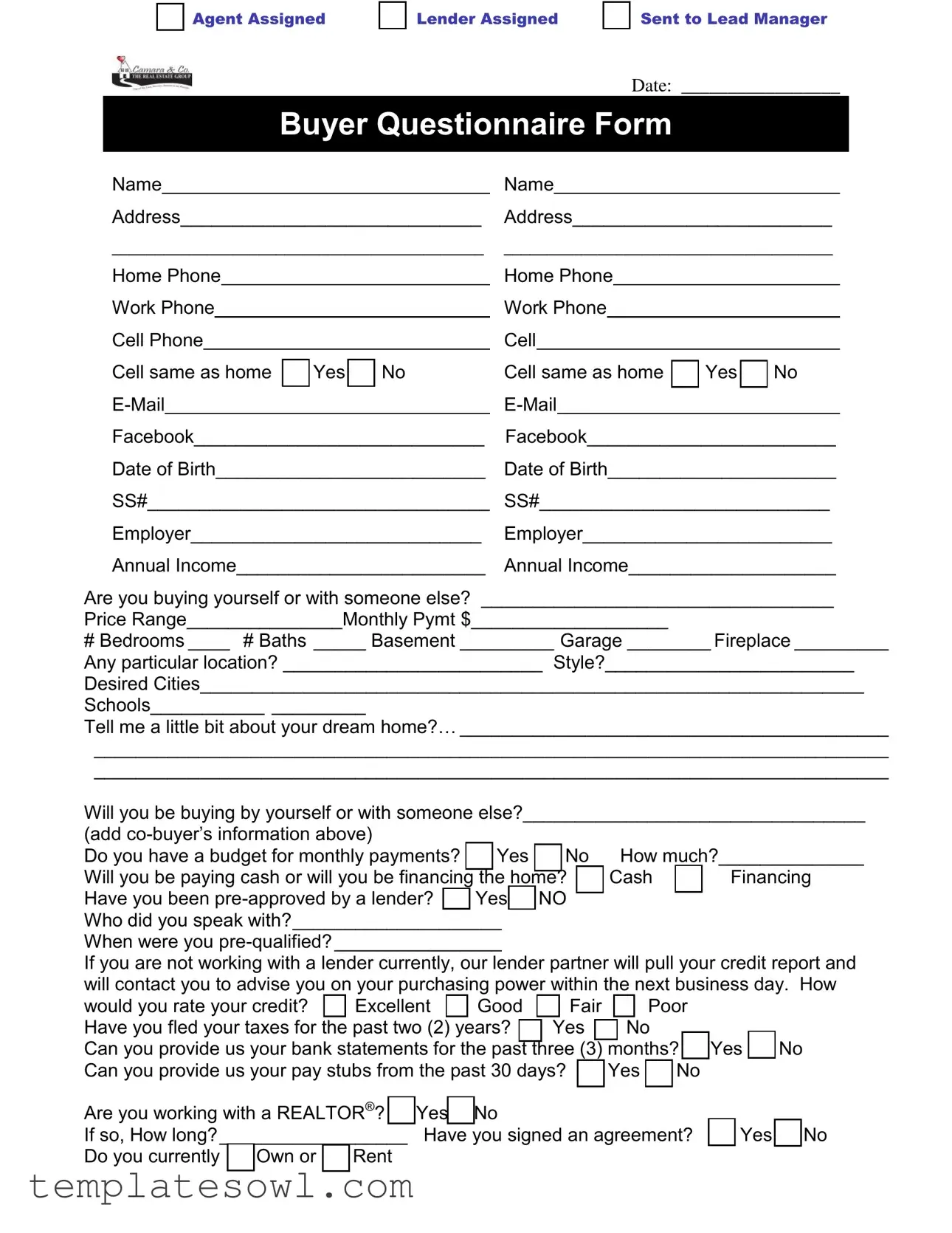

Fill Out Your Real Estate Questionnaire For Buyers Form

In the realm of real estate, effective communication is essential for understanding a buyer's needs and aspirations. The Real Estate Questionnaire For Buyers form serves as a vital tool in facilitating this dialogue. This document gathers crucial information about the prospective homebuyer, including personal details like name, current address, and contact information. Importantly, it assesses financial readiness by inquiring about income, credit rating, and whether the buyer has been pre-approved for financing. Beyond financial matters, the questionnaire delves into the buyer's preferences, seeking insights into desired locations, price ranges, and home features such as the number of bedrooms or the presence of a fireplace. Buyers are also prompted to share their motivations and any challenges they've faced in their purchasing journey. By detailing timelines, preferred communication methods, and current living situations—whether renting or owning—the form provides a comprehensive view of the buyer’s profile. This thorough approach not only enhances the agent's ability to assist but also empowers the buyer by clarifying their goals and expectations.

Real Estate Questionnaire For Buyers Example

Agent Assigned

Lender Assigned

Sent to Lead Manager

|

|

|

|

|

|

|

|

|

|

|

Date: _________________ |

|

||||

|

|

|

|

|

Buyer Questionnaire Form |

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name |

|

|

|

Name |

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Address_____________________________ |

Address_________________________ |

|

||||||||||||||

___________________________________________ |

______________________________________ |

|

||||||||||||||

Home Phone |

|

|

Home Phone |

|

|

|

|

|||||||||

Work Phone |

|

|

|

Work Phone |

|

|

|

|

|

|||||||

Cell Phone |

|

|

|

|

Cell |

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

||||||

Cell same as home |

Yes |

No |

Cell same as home |

|

Yes |

|

No |

|

||||||||

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

||||||||

Facebook____________________________ |

Facebook________________________ |

|

||||||||||||||

Date of Birth__________________________ |

Date of Birth______________________ |

|

||||||||||||||

SS#_________________________________ |

SS#____________________________ |

|

||||||||||||||

Employer____________________________ |

Employer________________________ |

|

||||||||||||||

Annual Income________________________ |

Annual Income____________________ |

|

||||||||||||||

Are you buying yourself or with someone else? __________________________________

Price Range_______________Monthly Pymt $___________________

# Bedrooms ____ # Baths _____ Basement _________ Garage ________ Fireplace _________

Any particular location? _________________________ Style?________________________

Desired Cities________________________________________________________________

Schools___________ _________

Tell me a little bit about your dream home?… _________________________________________

____________________________________________________________________________

____________________________________________________________________________

Will you be buying by yourself or with someone else?_________________________________

(add |

|

|

|

|

|

|

|

|

|

|

|

Do you have a budget for monthly payments? |

|

|

Yes |

|

No |

How much?______________ |

|||||

Will you be paying cash or will you be financing |

|

|

|

|

|

|

|

Cash |

|

Financing |

|

|

the home? |

|

|

|

|||||||

Have you been |

|

|

Yes |

|

NO |

|

|

|

|

||

|

|

|

|

||||||||

Who did you speak with?____________________ |

|

|

|

|

|

|

|||||

When were you

If you are not working with a lender currently, our lender partner will pull your credit report and will contact you to advise you on your purchasing power within the next business day. How

would you rate your credit? |

Excellent |

Good |

Fair |

|

Poor |

|

|

||||

Have you fled your taxes for the past two (2) years? |

Yes |

No |

|

|

|

|

|

||||

|

|

|

|

|

|||||||

Can you provide us your bank statements for the past three (3) months? |

|

Yes |

|

No |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

Can you provide us your pay stubs from the past 30 days? |

|

Yes |

|

No |

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

Are you working with a REALTOR®? |

Yes No |

If so, How long?__________________ |

Have you signed an agreement? |

Do you currently Own or Rent |

|

Yes

No

|

|

|

|

Date: _________________ |

|

|

|

|

|

If own, is your home currently on the market? |

|

Yes |

|

No |

If rent, when does your lease expire? _______________________________________________

How long have you been looking?__________________________________________________

Have you found anything you liked? ________________________________________________

What stopped you from buying it? __________________________________________________

How soon would you like to move? _________________________________________________

Just so I have a better idea of how to help and follow up with you, on a scale of 1 to 10 – 1 meaning you’re in no particular hurry an 10 meaning you want to buy a home this week – how

would you rate yourself?

1 |

|

2 |

|

3 |

|

4 |

|

5 |

|

6 |

|

7 |

|

8 |

|

9 |

|

10 |

What would it take to move you to a 10?_____________________________________________

When ready to move?

What times are best for you to look at homes? ________________________________

How would you like us to communicate? |

|

Phone |

|

|

|

|

|

|

|

Yes

No Investor

Yes

No

NOTES:_______________________________________________________________

______________________________________________________________________

______________________________________________________________________

______________________________________________________________________

Referred by:

Flyer

Craigslist

Harmon

Sign

Homes & Land Home Buyer Seminar

|

|

Trulia |

|

Zillow |

||||

|

|

Real Estate |

Book |

|

Internet |

|

Referral |

|

|

|

|

||||||

|

|

|

||||||

Other_______________________________

Invited to be a Friend on Facebook

Yes

No

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose of the Form | The Real Estate Questionnaire for Buyers is designed to collect essential information from potential home buyers. This information helps agents understand the buyers' needs, preferences, and financial situation. |

| Buyer Information | The form requires detailed personal information from the buyer, including name, contact information, and employment details. This allows for a comprehensive understanding of the buyer's profile. |

| Financial Assessment | Buyers must indicate their annual income and answer specific financial questions, such as whether they are paying cash or financing the home. This is crucial for determining buying capacity. |

| Preferences Section | The questionnaire includes sections where buyers can state their desired price range, number of bedrooms and baths, and other preferences, helping agents to tailor their search. |

| Credit Rating Inquiry | Buyers are asked to rate their creditworthiness on a scale from "Excellent" to "Poor." This information informs agents if pre-qualification is necessary before making offers. |

| Current Housing Situation | The form prompts buyers to specify whether they currently own or rent a home. If they own, they need to indicate if their property is on the market, influencing urgency and options. |

| Communication Preferences | Buyers can express how they would like to communicate with their agents, whether by phone or email. This helps establish a comfortable rapport for further interactions. |

| Referral Source | There is a section for noting how the buyer was referred to the real estate agent. Understanding referral sources can assist agents in evaluating their marketing effectiveness. |

Guidelines on Utilizing Real Estate Questionnaire For Buyers

Completing the Real Estate Questionnaire for Buyers is an important step in the home-buying process. This form gathers essential information that helps in tailoring the search for your dream home. To fill it out effectively, follow these clear and straightforward steps.

- Agent and Lender Information: Write down the names of the agent and lender assigned to you in the designated fields.

- Date: Fill in the current date in the space provided.

- Buyer Information: Enter your name and home address, along with any other contact details like phone numbers and email addresses. If your cell phone is the same as your home phone, mark that section appropriately.

- Birthdates and SSN: Provide both buyers’ dates of birth and Social Security numbers in the respective fields.

- Employer and Income: List the name of your employer and your annual income. If there's a co-buyer, include their information as well.

- Buying Context: Indicate whether you are buying by yourself or with someone else. Specify the price range, desired monthly payment, the number of bedrooms and bathrooms, basement, garage, and fireplace preferences.

- Location and Style: Share your preferred locations, style of home, and any particular features you desire.

- Financial Planning: Answer whether you have a budget for monthly payments, how you plan to finance the purchase, and if you have been pre-approved by a lender. Provide any additional lender details if applicable.

- Credit and Financial Documents: Rate your credit standing and confirm if you can provide tax returns, bank statements, and recent pay stubs.

- REALTOR® Information: State if you are working with a REALTOR®, how long you’ve been working together, and if you’ve signed an agreement.

- Current Living Situation: Indicate whether you currently own or rent a home, and provide relevant details about lease expiration or market presence.

- Searching for a Home: Mention how long you’ve been searching for a home and if you have identified any properties of interest. State reasons for not purchasing any homes you've liked.

- Urgency and Availability: Determine how quickly you want to move and what times work best for home viewings. You can also rate your urgency on a scale of 1 to 10.

- Communication Preferences: Specify how you prefer to communicate—via phone, email, or other means.

- First-time Buyer Status: Mark if you are a first-time homebuyer or an investor.

- Notes and Referrals: Use the notes section for any additional comments and indicate how you were referred to this process.

Once the questionnaire is fully completed, review all entries for accuracy to ensure that your preferences and details are correctly represented. This information will help guide your real estate search and streamline communication with your agent and lender.

What You Should Know About This Form

What is the purpose of the Real Estate Questionnaire For Buyers form?

The Real Estate Questionnaire For Buyers form is designed to collect essential information from potential homebuyers. This information helps real estate agents understand the needs and preferences of the buyers. By gathering details such as contact information, financial status, and housing preferences, the form aims to facilitate a smooth home-buying process. It ensures that agents can provide tailored assistance while helping buyers navigate their options effectively.

Who should complete the Real Estate Questionnaire For Buyers form?

This form should be completed by any individual or couple looking to purchase a home. If you are buying on your own, you will need to provide your information. If you are purchasing with someone else, both buyers must fill out their respective sections of the form. This ensures that all relevant parties are accounted for and can be considered in the home-buying process.

What kind of information is required on the form?

The form requests a variety of information, including personal details such as names, contact information, and dates of birth. Financial information, such as annual income and credit status, is also essential. Additionally, buyers are asked about their preferences regarding home features, price range, desired locations, and timelines for moving. This comprehensive approach allows for a clear understanding of the buyer's situation and desires.

What happens after the form is submitted?

Once the Real Estate Questionnaire For Buyers form is completed and submitted, a real estate agent will review the information provided. Based on the details shared, the agent may reach out to discuss the next steps. If financing is needed, the designated lender may also contact the buyer to discuss loan options and pre-approval processes. This initiates a collaborative relationship aimed at finding the best home for the buyer.

Common mistakes

Filling out the Real Estate Questionnaire For Buyers form is a crucial step in the home-buying process. Many people, however, make avoidable mistakes that can complicate matters down the line. One common mistake is providing inconsistent personal information. For instance, if the name or address is spelled differently in various parts of the form, it can create confusion and delay the process.

Another error is neglecting to accurately report financial details. Applicants sometimes underestimate their annual income or fail to disclose existing debts. This can lead to issues when it's time to secure financing. Being precise and honest about income sources ensures that lenders can assess your financial situation effectively.

Additionally, some buyers may overlook the importance of pre-approval. Many individuals fail to indicate whether they’ve been pre-approved by a lender or assume this information is less significant. Clarifying this status is essential, as it informs the real estate agent about your purchasing power and helps narrow down viable options.

Finally, forgetting to indicate specific preferences or requirements can be detrimental. Items such as the desired number of bedrooms, baths, or specific locations should not be neglected. Providing detailed information about your dream home helps agents tailor their search to better suit your needs. Remember, every detail counts when embarking on the journey to find your ideal home.

Documents used along the form

The Real Estate Questionnaire For Buyers form is an essential document that starts the home buying process. It helps gather crucial information about potential buyers, their preferences, and their financial situation. Other forms may complement this questionnaire, providing further details or assisting in the transaction process.

- Buyer Representation Agreement: This document outlines the relationship between the buyer and the real estate agent. It details the agent's responsibilities and the commission structure while securing the buyer's rights during the home purchase process.

- Pre-Approval Letter: A pre-approval letter from a lender indicates that a buyer has been evaluated for creditworthiness. This document helps buyers understand their budget and strengthens their position when making an offer.

- Disclosure Statements: These forms provide important information about the property being purchased. Sellers must disclose any known issues or defects, ensuring buyers are fully informed before making a commitment.

- Purchase Agreement: This is a legally binding contract between the buyer and seller. It outlines the terms of the sale, including the purchase price, contingencies, and closing details, providing protection for both parties involved.

These documents play a vital role in simplifying the home buying experience. Having all necessary forms in order ensures a smoother process and helps protect the interests of both buyers and sellers.

Similar forms

- Buyer Representation Agreement: A Buyer Representation Agreement lays out the relationship between the buyer and the real estate agent. Similarly to the Real Estate Questionnaire for Buyers, it collects essential details about the buyer's preferences, financial status, and intent to purchase, thus ensuring both parties are aligned from the start.

- Loan Application: A Loan Application form gathers relevant financial information to assess a buyer's eligibility for financing. Like the Real Estate Questionnaire, it delves into income, employment, and credit history, providing a comprehensive picture for lenders to understand the buyer's financial readiness.

- Property Wish List: Buyers often create a Property Wish List to outline their ideal features in a home. This document, much like the Real Estate Questionnaire, focuses on specifics like the number of bedrooms, desired locations, and other preferences, helping agents in their search for suitable properties.

- Pre-Qualification Form: A Pre-Qualification Form is used to determine how much a buyer can afford before seriously shopping for a home. Both this form and the Real Estate Questionnaire assess financial capabilities, highlighting budget constraints and expectations for monthly payments.

- Homebuyer Needs Assessment: A Homebuyer Needs Assessment is a detailed document outlining a buyer's needs and preferences in a home. Like the Real Estate Questionnaire, it aims to capture the buyer’s visions, expectations, and specific circumstances relevant to their home search.

- Financial Disclosure Statement: A Financial Disclosure Statement provides a thorough account of a buyer’s financial status, including debts and assets. It parallels the Real Estate Questionnaire by requiring buyers to present their financial background, which is crucial for evaluating their purchasing power.

- Rental Application (if applicable): For buyers who are currently renting, a Rental Application may be necessary. This document collects similar information—such as employment details and rental history—as the Real Estate Questionnaire, helping assess the buyer’s stability and commitment to a new home purchase.

Dos and Don'ts

When filling out the Real Estate Questionnaire for Buyers form, keep the following guidelines in mind:

- Do provide accurate personal information, including your name, address, and contact details.

- Do specify whether you are buying alone or with someone else.

- Do clearly outline your price range and desired monthly payment.

- Don't leave any required fields blank; incomplete forms can delay the process.

- Don't guess your credit rating; provide the most honest assessment based on your knowledge.

- Don't forget to discuss your dream home in detail; this helps agents find suitable properties.

Misconceptions

- Misconception 1: The form is overly complicated.

- Misconception 2: It is only for first-time homebuyers.

- Misconception 3: Providing personal information is optional.

- Misconception 4: The questionnaire is just a formality.

- Misconception 5: It is not important to truthfully answer financial questions.

- Misconception 6: I can complete the form the day of my home search.

- Misconception 7: The form is only necessary if financing.

- Misconception 8: My agent will know what I want without the questionnaire.

- Misconception 9: It’s not necessary to consider future plans.

- Misconception 10: Privacy concerns are valid.

Some buyers feel the Real Estate Questionnaire for Buyers is complex. However, it is designed to gather essential information in a straightforward manner to facilitate the home-buying process.

This form can be used by anyone looking to purchase a home. Whether it's a first-time buyer or an investor, all potential buyers can benefit from its structure.

While some sections may seem optional, providing complete information helps agents serve buyers more effectively. Incomplete data can result in missed opportunities.

While it may seem like a formality, the responses guide agents in understanding buyers’ needs and preferences. This information is crucial for finding suitable properties.

Honest answers regarding finances are vital. Accurate financial information helps determine appropriate properties and ensures buyers stay within their budget.

Completing the questionnaire prior to viewing homes streamlines the process. This allows agents to prepare specific options that meet the buyer's criteria from the outset.

Even cash buyers should complete the questionnaire. It provides agents with a better understanding of the buyer’s needs and aids in the search for the right property.

While agents do listen to clients, the questionnaire ensures nothing is overlooked. It allows bankers and agents to have a clear picture of individual preferences.

Considering future plans is essential, as it can affect the type of home selected. Discussing timelines and needs can prevent purchasing a home that doesn't fit long-term goals.

While privacy concerns are important, safeguarding this information is a priority for real estate professionals. Data is utilized solely to assist in the home-buying journey.

Key takeaways

Completing the Real Estate Questionnaire for Buyers is a crucial step in the home-buying process. Below are key takeaways to keep in mind when utilizing this form:

- Personal Information is Essential: Accurate entries such as name, address, and contact details ensure effective communication between buyers and real estate agents.

- Financial Readiness: It's important to include information about income, credit rating, and pre-approval status. This data helps assess purchasing power and financing options.

- Preferences Matter: Specifying the desired price range, number of bedrooms and bathrooms, and preferred locations provides agents with insights to tailor home searches accordingly.

- Timeframe Clarification: Indicating how soon buyers wish to move informs agents of urgency and helps prioritize suitable properties.

- Effective Communication: Buyers should indicate their preferred communication method. Clear communication preferences facilitate better follow-up and service quality.

Browse Other Templates

Sample Loan Application Application Application Form Application Cars Finance - Your certification of information accuracy supports the integrity of the application process.

Fillable Da Form 638 - It includes sections for intermediate authorities to review and make recommendations on awards.