Fill Out Your Real Estate Tax Deduction Form

The Real Estate Tax Deduction form, specifically designed for realtors, serves as a vital tool in managing and organizing tax-deductible business expenses. Understanding how to effectively utilize this form can significantly impact your overall tax situation. It captures various categories of expenses, ranging from advertising and signage to professional fees and educational costs. To qualify for deduction, the expenses must meet the criteria of being "ordinary and necessary" for your real estate operations. This means that each expense should be directly associated with your business activities. Notably, reimbursable expenses are excluded, ensuring clarity and focus on genuine business costs. Familiarizing yourself with the sections for supplies, travel, and continuing education can streamline the deduction process considerably and help you maximize your savings. Should you have questions or specific concerns, reaching out to a certified professional can provide tailored guidance.

Real Estate Tax Deduction Example

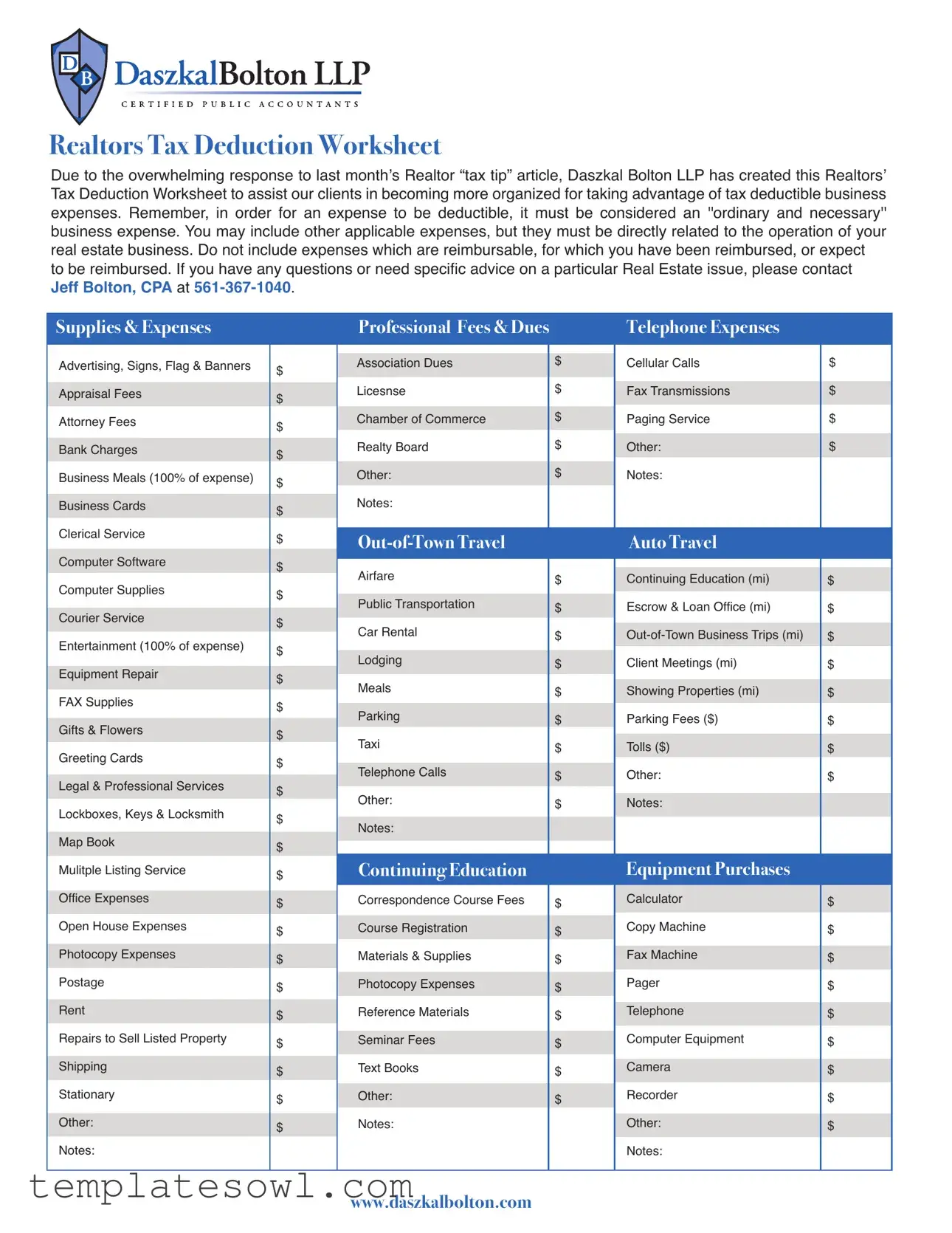

Realtors Tax Deduction Worksheet

Due to the overwhelming response to last month’s Realtor “tax tip” article, Daszkal Bolton LLP has created this Realtors’ Tax Deduction Worksheet to assist our clients in becoming more organized for taking advantage of tax deductible business expenses. Remember, in order for an expense to be deductible, it must be considered an ''ordinary and necessary'' business expense. You may include other applicable expenses, but they must be directly related to the operation of your real estate business. Do not include expenses which are reimbursable, for which you have been reimbursed, or expect to be reimbursed. If you have any questions or need specific advice on a particular Real Estate issue, please contact JEFF BOLTON, CPA at

Supplies & Expenses

Advertising, Signs, Flag & Banners Appraisal Fees

Attorney Fees

Bank Charges

Business Meals (100% of expense) Business Cards

Clerical Service

Computer Software

Computer Supplies Courier Service Entertainment (100% of expense) Equipment Repair

FAX Supplies

Gifts & Flowers

Greeting Cards

Legal & Professional Services

Lockboxes, Keys & Locksmith

Map Book

Mulitple Listing Service

Office Expenses

Open House Expenses

Photocopy Expenses

Postage

Rent

Repairs to Sell Listed Property

Shipping

Stationary

Other:

Notes:

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

Professional Fees & Dues

Association Dues |

$ |

|

|

Licesnse |

$ |

|

|

Chamber of Commerce |

$ |

Realty Board |

$ |

|

|

Other: |

$ |

Notes: |

|

|

|

|

|

Airfare |

$ |

|

|

|

|

Public Transportation |

$ |

|

|

Car Rental |

$ |

|

|

|

|

Lodging |

$ |

|

|

Meals |

$ |

|

|

|

|

Parking |

$ |

Taxi |

$ |

|

|

|

|

Telephone Calls |

$ |

|

|

Other: |

$ |

|

|

|

|

Notes: |

|

|

|

|

|

Continuing Education |

|

Correspondence Course Fees |

$ |

|

|

|

|

Course Registration |

$ |

Materials & Supplies |

$ |

|

|

|

|

Photocopy Expenses |

$ |

|

|

Reference Materials |

$ |

|

|

|

|

Seminar Fees |

$ |

|

|

Text Books |

$ |

|

|

|

|

Other: |

$ |

Notes: |

|

|

|

Telephone Expenses

Cellular Calls

Fax Transmissions

Paging Service

Other:

Notes:

Auto Travel

Continuing Education (mi)

Escrow & Loan Office (mi)

Client Meetings (mi)

Showing Properties (mi)

Parking Fees ($)

Tolls ($)

Other:

Notes:

Equipment Purchases

Calculator

Copy Machine

Fax Machine

Pager

Telephone

Computer Equipment

Camera

Recorder

Other:

Notes:

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

www.daszkalbolton.com

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The Realtors Tax Deduction Worksheet helps real estate professionals organize their deductible business expenses for tax purposes. |

| Ordinary and Necessary | To qualify for a deduction, expenses must be considered “ordinary and necessary” for the real estate business. |

| Non-Reimbursable Expenses | Expenses that have been reimbursed or are expected to be reimbursed cannot be included in the worksheet. |

| Professional Help | If there are specific questions related to real estate tax issues, individuals are encouraged to contact Jeff Bolton, CPA. |

| Available Deductions | The worksheet outlines several categories of deductible expenses, including supplies, professional fees, travel, and continuing education. |

| Meal Deductions | Business meals and entertainment costs may be fully deductible, provided they are directly related to business activities. |

| State-Specific Laws | Real estate tax deduction laws can vary by state, so it is important to consult state-specific regulations or a tax professional. |

| Record-Keeping | Keeping organized records of all applicable expenses is crucial for maximizing deductions and supporting claims during tax filing. |

Guidelines on Utilizing Real Estate Tax Deduction

Completing the Real Estate Tax Deduction form requires attention to detail and accurate record-keeping. Following the steps outlined below will help ensure that all information is submitted correctly, which is essential for optimizing tax deductions related to your real estate business.

- Gather all necessary documentation, including receipts and invoices for business-related expenses.

- Start with the section titled Supplies & Expenses. List all applicable expenses in the spaces provided, beginning with advertising and marketing costs.

- Proceed to enter expenses for professional fees and dues, ensuring that all memberships and licenses are recorded accurately.

- In the Out-of-Town Travel section, detail all relevant travel expenses. This includes airfare, lodging, and transportation costs.

- Fill out the Continuing Education section by noting all expenses associated with professional development, such as course fees and materials.

- Document telephone expenses in the corresponding section, listing any business-related cellular calls and other telecommunications costs.

- Record auto travel by detailing each trip's purpose, along with the mileage for each category, including client meetings and property showings.

- For any equipment purchases, list items with their total costs. Ensure that all purchases relate directly to your business operations.

- Review your entries for completeness and accuracy. Verify that the total amounts correspond to your receipts.

- Finally, submit the form as per the instructions provided by your tax advisor or local tax authority.

What You Should Know About This Form

What is the Realtors Tax Deduction Worksheet?

The Realtors Tax Deduction Worksheet is a tool created to help real estate professionals organize their expenses for tax purposes. It outlines various categories of deductible expenses and serves as a guide to ensure that taxpayers can effectively track and claim ordinary and necessary expenses related to their real estate business.

What expenses can I deduct using this worksheet?

You can deduct numerous expenses directly associated with the operation of your real estate business. These include supplies, advertising costs, appraisal fees, professional fees, office expenses, and expenses related to continuing education. Remember, any expense claimed must be essential to your business operations and not reimbursable.

How do I determine if an expense is "ordinary and necessary"?

An expense is considered "ordinary" if it is common and accepted in your industry. It is "necessary" if it contributes to the success of your business. Use your best judgment, and if in doubt, consider reaching out to a tax professional for guidance on specific expenses.

Can I include my home office expenses?

If you have a designated home office used exclusively for your real estate business activities, you may be able to deduct related expenses. This includes a portion of your rent or mortgage, utility bills, and other related costs. Make sure to maintain accurate records to calculate your deductions correctly.

Are meals for clients fully deductible?

Currently, meals for business purposes are typically deductible up to 50% of the total cost. However, as noted on the worksheet, certain entertainment expenses can be deductible up to 100%, provided they are directly related to your business. Always check current IRS guidelines for updates.

What should I do if I get reimbursed for an expense?

If you have been reimbursed for an expense, you cannot deduct that expense on your taxes. It's essential to be careful about tracking which expenses have been reimbursed to avoid redundant claims.

How do I keep track of my mileage for business-related travel?

You should maintain a detailed log of your business-related mileage. Include trips taken for client meetings, showing properties, and travel for educational purposes. Be diligent about noting the date, destination, and purpose of each trip to ensure accurate reporting.

Can I include continuing education expenses?

Yes, expenses related to continuing education, such as registration fees, course materials, and textbooks, can typically be deducted. Keeping good records of these expenses will help support your claims during tax filing.

Who should I contact for more specific tax advice?

If you have particular tax questions or need tailored advice, it’s best to consult a professional. You can reach out to Jeff Bolton, CPA, at 561-367-1040 for personalized guidance regarding your real estate tax deductions.

What if I have additional expenses that aren't listed on the worksheet?

You can include other applicable expenses not explicitly mentioned in the worksheet, provided they are directly related to your operation as a real estate professional. Document them thoroughly and ensure they meet the ordinary and necessary criteria for deductibility.

Common mistakes

Filling out the Real Estate Tax Deduction form can be a straightforward task if approached methodically. However, several common mistakes can lead to discrepancies or missed deductions. Awareness of these errors can help real estate professionals ensure they maximize their benefits.

One prevalent mistake is forgetting to distinguish between personal and business expenses. Many individuals assume that expenses incurred while conducting business are automatically deductible. However, only expenses that are both ordinary and necessary for the business qualify. Items purchased for personal use should be excluded, as including them can trigger scrutiny from tax authorities.

Another common error is not keeping detailed records of business expenses. Receipts and documentation are crucial. Real estate professionals often fail to maintain adequate records, assuming that their memory will suffice. In doing so, they risk losing out on legitimate deductions. It is essential to keep items categorized and organized to substantiate the claims made on the form.

Inaccurate reporting of expenses is yet another significant error. Careless math and misplaced decimals can lead to incorrect totals. Moreover, some people forget to list every relevant expense or might include expenses that should not be on the form. Double-checking figures can prevent these costly mistakes.

Additionally, failing to report business-related travel accurately can undermine efforts to claim deductions. Travel expenses, such as airfare, lodging, and meals, must be documented clearly. Missing receipts or muddled notes about what was spent can complicate matters later. Being thorough in this aspect is critical for supporting claims.

Another hurdle is the failure to recognize what constitutes a deductible expense. Some individuals may overlook business meals, entertainment, or fees associated with continuing education. Understanding the eligibility of such expenses can make a noticeable difference. Educating oneself about what can and cannot be included ensures no potential deduction is left unclaimed.

Lastly, the timing of the expenses can cause confusion. Some individuals wait to submit their deductions until the end of the tax year, causing them to miss certain eligible expenses that may have occurred earlier. Keeping a running record throughout the year is essential for maintaining accuracy. The right timing can help secure all relevant deductions.

Documents used along the form

When filing for the Real Estate Tax Deduction, several other forms and documents often accompany this process. Each of these documents serves a specific purpose and can make the overall tax filing smoother and more accurate. Below are common forms that may be necessary alongside the Real Estate Tax Deduction form.

- Schedule A (Form 1040): This form is used to report itemized deductions, including state and local taxes, mortgage interest, and charitable contributions. Although it’s not exclusively for real estate, it is essential for claiming the Real Estate Tax Deduction.

- Form 1098: This document is provided by mortgage lenders to report the amount of mortgage interest paid, which can be deductible. It is an important tool for assisting taxpayers in minimizing their tax liability related to homeownership.

- Property Tax Bill: A copy of the latest property tax bill is necessary to substantiate the amount of real estate taxes paid during the year. This document verifies the taxpayer's eligibility for the deduction.

- Proof of Payment: This can include bank statements or receipts showing payment of real estate taxes. Providing this documentation enhances credibility during the tax filing process.

- Schedule C (Form 1040): For real estate professionals who operate their businesses as sole proprietors, Schedule C is necessary to report income and expenses associated with business activities, including real estate sales.

- Business Expense Receipts: Keeping receipts for various business-related expenses is crucial. These documents support the claims made in the Realtors Tax Deduction Worksheet and help ensure all deductibles are accounted for.

- Continuing Education Records: If the taxpayer has incurred expenses for continuing education required by their profession, records of such expenses can contribute to eligibility for deductions related to professional development.

Incorporating these forms and documentation into the filing process can help real estate professionals maximize their deductions and ensure compliance with tax regulations. By maintaining thorough records and using the appropriate tools, taxpayers can navigate the complexities of real estate tax deductions more effectively.

Similar forms

-

Schedule A (Form 1040): This form is used by taxpayers to itemize deductions, which includes real estate taxes. Similar to the Real Estate Tax Deduction form, it requires documentation of the expenses incurred, including property tax payments, to reduce taxable income.

-

Form 4562: This document is filed for depreciation and amortization. Like the Real Estate Tax Deduction form, it allows taxpayers to claim deductions related to property. Both require detailed record-keeping and justification for expenses related to property use.

-

Schedule E (Form 1040): Used for rental income and expenses, Schedule E allows individuals to deduct expenses associated with rental properties. Both documents help clarify expenses that reduce overall taxable income related to property management.

-

Form 8829: This form is designed for calculating expenses for business use of your home. Similar to the Real Estate Tax Deduction form, it requires proof of expenses, including prorated real estate taxes, to ensure deductions are legitimate.

-

Form 1065: Partnerships use this form to report income and deductions. It similarly emphasizes tracking and reporting real estate-related expenses, allowing the business to claim its share of applicable deductions, including taxes.

-

Form 1098: This is the Mortgage Interest Statement that lenders provide, detailing mortgage interest and real estate taxes. As with the Real Estate Tax Deduction form, it serves as proof for taxpayers to claim eligible deductions when filing taxes.

-

Form 2120: This form is applicable for reporting the income of certain partnerships, which often includes real estate transactions. Both forms require detailed disclosure of income and expenses related to property dealings.

-

State Tax Return Forms: Many states have their own specific forms for reporting real estate taxes and other deductions. Like the Real Estate Tax Deduction form, these documents require clarity and transparency regarding property-related expenses.

-

Form 8825: This form is for reporting rental real estate income and expenses for partnerships or S corporations. It parallels the Real Estate Tax Deduction form in its emphasis on detailed record-keeping and expensing for real estate-related income.

Dos and Don'ts

When filling out the Real Estate Tax Deduction form, there are some key points to keep in mind. This list will help you stay on track and avoid common pitfalls.

- DO keep receipts for all expenses. Documentation will support your claims and help if you're audited.

- DON'T include expenses for which you’ve been reimbursed or expect to be reimbursed.

- DO categorize your expenses clearly. This will make it easier to calculate deductions.

- DON'T mix personal expenses with business expenses. Keep them separate to avoid complications.

- DO consult a tax professional if you have questions. They can provide guidance tailored to your situation.

- DON'T overlook "ordinary and necessary" criteria for deductions. Make sure your expenses fit these definitions.

- DO stay organized. Use a system to track expenses throughout the year for smoother filing.

By following these dos and don'ts, you can make the process of filling out your tax deduction form more manageable and effective.

Misconceptions

- Real Estate Agents Can Deduct All Expenses: Not every expense is deductible. The IRS only allows deductions for costs that are ordinary and necessary for business. Personal expenses or those that don't directly relate to the real estate business won’t qualify.

- Each Business Expense Is Automatically Deductible: Just because an expense is business-related doesn’t mean it can be deducted. Ensure that it fits the criteria of being ordinary and necessary to your profession.

- Reimbursed Expenses Are Tax Deductible: If you receive reimbursement for an expense, you cannot claim it as a deduction. This applies to any costs that have already been paid back through another party or service.

- All Meals and Entertainment Expenses Are Deductible: With the IRS, not all meals and entertainment qualify for deduction. While some expenses may currently be fully deductible, many are subject to limits. Always double-check the current guidelines.

- Professional Fees Can Be Ignored: Professional fees such as attorney or accounting services can be significant, and these can absolutely qualify as deductibles. Keeping track of these fees is essential.

- Travel Expenses Are Not Deductible: This misconception is far off the mark. Travel expenses like airfare or lodging can often be deducted if they are directly related to business activities. However, always maintain clear records.

- Only Direct Costs Are Deductible: While direct costs are often deductible, don't overlook indirect expenses that support your business, such as a portion of your home office or related resources.

- Continuing Education Expenses Can’t Be Deduced: This is incorrect. Costs associated with continuing education, like course registration or materials, are typically fully deductible as they enhance your skills in the business.

- You Don’t Need to Keep Records: Some believe that they can deduct expenses without documentation. In reality, maintaining an organized record of receipts and expenses is crucial for substantiating your claims.

Key takeaways

Filling out and using the Real Estate Tax Deduction form can be straightforward when you know the essentials. Here are key takeaways to help you navigate the process effectively:

- Track Your Business Expenses: Make sure every deduction you claim qualifies as an “ordinary and necessary” expense related to running your real estate business.

- Avoid Reimbursed Costs: Do not include any expenses that you have already been reimbursed for or expect to be reimbursed. Only report out-of-pocket costs.

- Organize Your Receipts: Keep accurate records of all related expenses, from advertising to continuing education. This documentation will support your claims during tax filing.

- Utilize the Worksheet: Take advantage of the Realtors’ Tax Deduction Worksheet to categorize and sum up your deductions. This tool assists in keeping your finances organized.

- Consult a Professional: If you have questions about specific items or how to maximize your deductions, consider reaching out to a tax professional for guidance.

By keeping these points in mind, you can make the most out of the Real Estate Tax Deduction form and ensure that you're not leaving potential deductions on the table.

Browse Other Templates

Can You Get a Moving Permit Online - Permits ensure that vehicle owners can move their vehicles without the delays of traditional registration processing.

How to Fill Out Affidavit for Collection of Personal Property California - This form provides essential legal protection for claimants against fraudulent claims to the decedent's property.