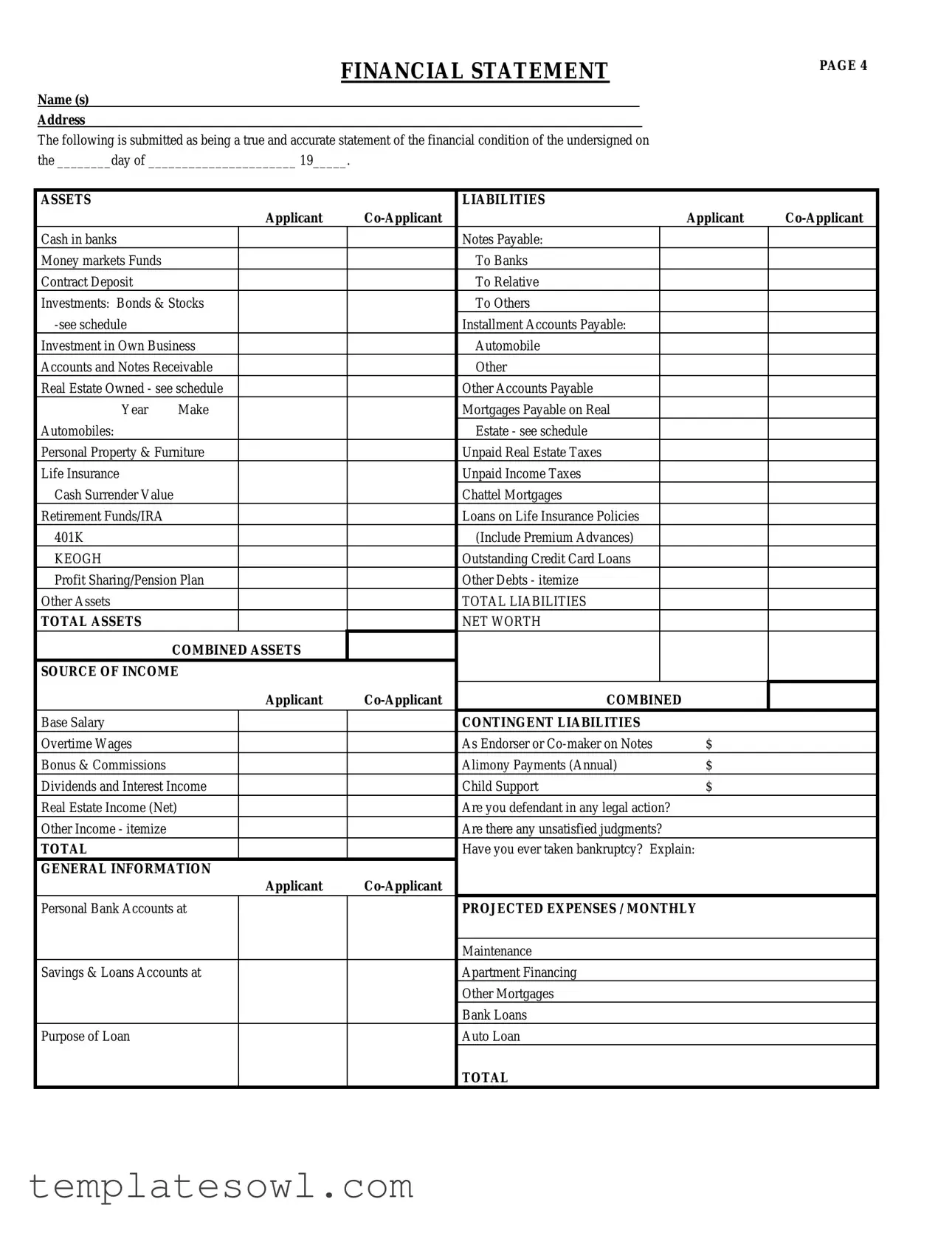

Fill Out Your Rebny Financial Statement Form

The Rebny Financial Statement form serves as a crucial tool for individuals seeking to provide a clear and organized picture of their financial health. It is designed for applicants and co-applicants to disclose essential financial details, including assets, liabilities, and sources of income. A user fills in various categories, such as cash in banks, investments, and real estate, allowing for a comprehensive overview of total assets. Conversely, liabilities cover items like notes payable, mortgages, and other debts, ensuring all financial obligations are accounted for. Additionally, the form addresses projected expenses and contingent liabilities, which may impact an applicant's financial stability. This thorough examination extends to general information, including bank accounts and ongoing legal matters. By capturing a complete financial snapshot, the Rebny Financial Statement form assists lenders in assessing creditworthiness and eligibility for loans or financing opportunities.

Rebny Financial Statement Example

FINANCIAL STATEMENT

PAGE 4

Name (s)

Address

The following is submitted as being a true and accurate statement of the financial condition of the undersigned on the ________day of ______________________ 19_____.

ASSETS |

|

|

|

LIABILITIES |

|

|

|

|

|

Applicant |

|

|

Applicant |

||

Cash in banks |

|

|

|

Notes Payable: |

|

|

|

Money markets Funds |

|

|

|

To Banks |

|

|

|

Contract Deposit |

|

|

|

To Relative |

|

|

|

Investments: Bonds & Stocks |

|

|

To Others |

|

|

|

|

|

|

|

Installment Accounts Payable: |

|

|

|

|

Investment in Own Business |

|

|

Automobile |

|

|

|

|

Accounts and Notes Receivable |

|

|

Other |

|

|

|

|

Real Estate Owned - see schedule |

|

|

Other Accounts Payable |

|

|

|

|

Year |

Make |

|

|

Mortgages Payable on Real |

|

|

|

Automobiles: |

|

|

|

Estate - see schedule |

|

|

|

Personal Property & Furniture |

|

|

Unpaid Real Estate Taxes |

|

|

|

|

Life Insurance |

|

|

|

Unpaid Income Taxes |

|

|

|

Cash Surrender Value |

|

|

|

Chattel Mortgages |

|

|

|

Retirement Funds/IRA |

|

|

|

Loans on Life Insurance Policies |

|

|

|

401K |

|

|

|

(Include Premium Advances) |

|

|

|

KEOGH |

|

|

|

Outstanding Credit Card Loans |

|

|

|

Profit Sharing/Pension Plan |

|

|

Other Debts - itemize |

|

|

|

|

Other Assets |

|

|

|

TOTAL LIABILITIES |

|

|

|

TOTAL ASSETS |

|

|

|

NET WORTH |

|

|

|

COMBINED ASSETS |

|

|

|

|

|

||

SOURCE OF INCOME |

|

|

|

|

|

||

|

|

Applicant |

COMBINED |

|

|

||

Base Salary |

|

|

|

CONTINGENT LIABILITIES |

|

|

|

Overtime Wages |

|

|

|

As Endorser or |

$ |

|

|

Bonus & Commissions |

|

|

|

Alimony Payments (Annual) |

$ |

|

|

Dividends and Interest Income |

|

|

Child Support |

$ |

|

||

Real Estate Income (Net) |

|

|

|

Are you defendant in any legal action? |

|

|

|

Other Income - itemize |

|

|

|

Are there any unsatisfied judgments? |

|

|

|

TOTAL |

|

|

|

Have you ever taken bankruptcy? Explain: |

|

||

GENERAL INFORMATION |

Applicant |

|

|

|

|

||

|

|

|

|

|

|

||

Personal Bank Accounts at |

|

|

PROJECTED EXPENSES / MONTHLY |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

Maintenance |

|

|

|

Savings & Loans Accounts at |

|

|

Apartment Financing |

|

|

||

|

|

|

|

Other Mortgages |

|

|

|

|

|

|

|

Bank Loans |

|

|

|

Purpose of Loan |

|

|

|

Auto Loan |

|

|

|

|

|

|

|

TOTAL |

|

|

|

SCHEDULE OF BONDS AND STOCKS

Amount of Shares |

Description (Extended Valuation in Column) |

Marketable Value |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SCHEDULE OF REAL ESTATE

Description and Location |

Cost |

Actual Value |

Mortgage Amount |

Maturity Date |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SCHEDULE OF NOTES PAYABLE

Specify any assets pledged as collateral, including the liabilities they secure:

To Whom Payable |

Date |

Amount |

Due |

Interest |

Pledged as Security |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The foregoing application (pages 1 through 5) has been carefully prepared, and the undersigned hereby solemnly declare(s) and certify(s) that all the information contained herein is true and correct.

Date |

|

19 |

|

Signature |

_ |

|

|

|

|

|

|

|

|

Date |

|

19 |

|

Signature |

|

|

|

|

|

|

|

|

|

Rev. May/01 |

|

|

|

|

|

|

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The Rebny Financial Statement form assesses an individual's financial condition. |

| Components | The form includes sections for assets, liabilities, and income sources. |

| Liabilities | Includes notes payable, mortgages, and various debts such as credit card loans. |

| Assets | Lists assets like cash, investments, real estate, and retirement accounts. |

| Net Worth Calculation | Net worth is determined by subtracting total liabilities from total assets. |

| Combined Income | The form requires combined income details from both applicant and co-applicant. |

| Projected Expenses | Monthly projected expenses must be documented to assess financial health. |

| Schedules Included | Includes schedules for bonds, stocks, real estate, and notes payable. |

| Certification | Applicants must certify that all provided information is accurate and true. |

| Legal Disclosure | Questions regarding bankruptcy and legal actions are included to evaluate risk. |

Guidelines on Utilizing Rebny Financial Statement

Filling out the Rebny Financial Statement form is crucial for providing a clear picture of your financial situation. This information will help the lender or the concerned party assess your financial health accurately. Here's how to fill it out step-by-step.

- Gather Necessary Documents: Collect documents like bank statements, tax returns, and any other financial statements you’ll need.

- Start with Personal Information: Fill in your name(s) and address at the top of the form.

- Complete the Assets Section: List your assets in the designated fields. Include cash in banks, investments, real estate, and personal items.

- List Liabilities: In the liabilities section, enter any debts such as loans, mortgages, and accounts payable.

- Calculate Total Assets and Liabilities: Add up all your assets and liabilities. This will help you determine your net worth.

- Source of Income: Provide information on your income sources. Include salaries, bonuses, dividends, and any other income you receive.

- Contingent Liabilities: If you are a co-signer on loans, list them here. Also include any alimony or child support obligations.

- General Information: Fill in details about your personal bank accounts and projected monthly expenses, including mortgages and loans.

- Schedules for Assets: Complete the schedules for bonds, stocks, and real estate. Provide details like description, value, and mortgage amounts.

- Signature and Date: Finally, sign and date the form to affirm that all provided information is true and correct.

What You Should Know About This Form

What is the purpose of the Rebny Financial Statement form?

The Rebny Financial Statement form is designed to provide a clear picture of an individual or household's financial situation. It collects detailed information about assets, liabilities, income, and expenses. This information is often needed for financial transactions, such as applying for loans or renting property. By submitting this form, applicants allow lenders or landlords to assess their financial stability and make informed decisions.

Who needs to complete the Rebny Financial Statement form?

This form is typically required from individuals applying for loans, mortgages, or rental agreements. Both the applicant and co-applicant (if applicable) should complete the form. Including financial details from both parties gives a comprehensive overview of the household's financial status. This is particularly important in evaluating creditworthiness and ability to meet financial obligations.

What information is required on the Rebny Financial Statement form?

The form requires various details, such as assets, which include cash, investments, real estate, and personal property. It also asks for liabilities, including loans, mortgages, and credit card debts. Additionally, individuals must provide information about their income sources and any contingent liabilities. The form includes both general information and specific schedules to ensure thorough documentation of financial conditions.

How is the information verified on the Rebny Financial Statement form?

What should I do if my financial situation changes after submitting the Rebny Financial Statement form?

If there are significant changes to your financial status after submission, it is crucial to inform the lender or property manager as soon as possible. Changes may include a new job, loss of income, increased debts, or substantial purchases. Transparent communication allows the involved parties to reassess the situation and, if necessary, make adjustments to loan terms or rental agreements.

Common mistakes

Filling out the Rebny Financial Statement form can feel daunting, but avoiding common mistakes is essential for presenting a clear and accurate financial picture. One frequent mistake occurs when individuals forget to fill in their personal information. This may seem trivial, but it’s vital to provide complete names and addresses. Omitting this may lead to processing delays or even rejections, as the form lacks essential identification details.

Another common error is in the section listing assets versus liabilities. People often overlook documenting all their liabilities, leading to a skewed net worth calculation. Each item, from credit card debts to mortgage balances, should be diligently noted. This information helps demonstrate the applicant's true financial obligations and provides a realistic overview of their financial health.

Additionally, rounding amounts can be tempting, but estimates can create problems. Rounding off figures, whether for income, expenses, or asset value, can seem easier, but presenting precise numbers is crucial. Accurate reporting of financial figures gives a clearer insight into one’s situation and mitigates the risk of being perceived as misleading.

In the income section, many individuals fail to itemize their income sources. Listing only a total income may overlook additional streams of income such as rental properties, dividends, or part-time jobs. Providing detailed information about each source can better support the financial request and illustrate a more comprehensive income profile.

Another frequent oversight is neglecting to check for contingent liabilities. These might include co-signing a loan or being responsible for alimony or child support payments. Not accounting for these obligations can misrepresent one’s financial standing, leading to incorrect conclusions about available resources.

It's also important that signers date their signatures correctly. Whether it’s the application date or the signature date, discrepancies can lead to questions about the validity of the application. A careful review can ensure that all dates align and are accurately completed.

Some applicants get so focused on reporting assets that they underestimate the value of their personal property. Furniture, electronics, and other possessions can add up, and every item should be documented to give a full depiction of one’s wealth. Leaving out valuables diminishes the overall asset total and could impact financial decisions.

Pitfalls can also arise in the expenses section, where people may forget to include all monthly expenditures. Routine payments such as utilities, groceries, and insurance should be noted. A thorough representation of monthly outflows helps paint a clearer financial picture and reveals potential gaps in budgeting.

Lastly, applicants should remember to answer all questions thoroughly. Many might skip queries that seem irrelevant or unimportant. Every question is designed to gather specific information that can augment or clarify circumstances. Responding fully helps avoid unnecessary complications later on in the process.

Documents used along the form

The Rebny Financial Statement form is an essential document commonly used in real estate transactions and financial assessments. Along with this form, several other documents often accompany it. Each document plays a vital role in providing a comprehensive snapshot of an applicant’s financial situation.

- Income Verification Letter: This letter, typically from an employer, confirms the applicant's current employment status and income details. It ensures that the financial information provided on the financial statement is accurate and reliable.

- Tax Returns: Applicants often submit their last two years of personal tax returns. These documents showcase a detailed overview of an individual’s income and financial history, allowing lenders to assess the applicant's stability over time.

- Credit Report: A comprehensive credit report provides a record of an individual's credit history. It includes information about credit accounts, payment history, and outstanding debts, helping lenders measure creditworthiness.

- Bank Statements: Typically, the last three months of bank statements are required to verify liquid assets. These statements reflect the applicant's cash flow and savings, essential for evaluating financial health.

- Business Financial Statements: For applicants who own businesses, recent financial statements, including profit and loss statements and balance sheets, can provide insight into the business's performance and reliability.

- Debt Schedule: A detailed list of the applicant's debts, including monthly payments and remaining balances, helps to assess overall financial obligations. This schedule reveals how much of the applicant’s income is committed to debt repayment.

- Asset Documentation: This includes appraisals, deeds, or ownership documents for significant assets, such as real estate or vehicles. Providing proof of ownership and value allows lenders to evaluate overall net worth.

These documents collectively contribute to understanding the financial landscape of the applicant, facilitating informed decision-making in lending or leasing processes. Having precise and complete information is crucial for both applicants and financial institutions.

Similar forms

- Personal Financial Statement: This document provides a detailed snapshot of an individual’s financial health, similar to the Rebny Financial Statement form. It includes assets, liabilities, and net worth, allowing lenders to assess financial stability.

- Profit and Loss Statement: Often used by businesses, this statement outlines income and expenses over a specific period. Like the Rebny form, it helps to evaluate financial standing and highlights sources of income.

- Cash Flow Statement: This document tracks the flow of cash in and out of an individual’s or business’ accounts. It mirrors the financial statement by identifying liquidity and helping assess the ability to pay debts.

- Loan Application: When applying for a loan, applicants often provide a summary of their financial status. Similar to the Rebny form, it requires details about income, debts, and assets to help lenders make informed decisions.

- Tax Return: Personal income tax returns show a comprehensive view of an individual's earnings and liabilities over the past year. This document can serve as supporting documentation for the information presented on the Rebny Financial Statement.

Dos and Don'ts

When filling out the REBNY Financial Statement form, attention to detail is essential. Below are some recommendations to guide you through this process smoothly.

- Do: Read the instructions thoroughly before starting to ensure you understand what is required.

- Do: Provide accurate and honest information. This builds trust and credibility.

- Do: Include all sources of income, as omitting even a small amount could affect your financial picture.

- Do: Organize your financial information before you begin. This makes the process more efficient.

- Do: Double-check your figures for accuracy. Mistakes can lead to misunderstandings or complications.

- Don't: Rush through the form. Taking your time helps prevent errors.

- Don't: Include misleading or false information. This can have serious legal repercussions.

- Don't: Leave any required fields blank. Incomplete forms may be rejected or delayed.

- Don't: Use jargon or technical terms. Clear language helps ensure everyone understands your submission.

- Don't: Forget to sign and date the form at the bottom. An unsigned form is not valid.

By following these guidelines, you can submit a thorough and accurate financial statement that represents your financial condition effectively.

Misconceptions

Here are ten common misconceptions about the Rebny Financial Statement form, along with clarifications for each.

- It is only for applicants seeking a mortgage. Many people believe this form is solely for mortgage applications. In reality, it can be used in various financial contexts, including personal loans and rental agreements.

- You must have a high income to fill it out. This is not true. All individuals, regardless of their income level, can complete the form to provide a comprehensive view of their financial status.

- Assets must be in cash only. Some think that only cash counts as assets. In fact, other forms of assets, such as stocks, bonds, real estate, and retirement accounts, should also be reported.

- Liabilities don’t need to be itemized. This is incorrect. It is essential to list all liabilities, including specific details about each one, to present an accurate financial picture.

- It’s not necessary to include contingent liabilities. Many assume they can ignore contingent liabilities. However, these potential debts play a significant role in assessing overall financial responsibility.

- Bankruptcy history must be disclosed only if it was recent. This is a misconception. Any past bankruptcy filings should be included, regardless of how long ago they occurred.

- The form is self-explanatory and requires no guidance. While the form has a clear structure, seeking help for any unclear sections is encouraged. Clarity ensures that all information is presented accurately.

- You cannot list multiple properties under “Other Real Estate Owned.” This is false. Multiple properties can be detailed, each with their respective values and liabilities.

- Personal information is not important for financial evaluation. This is misleading. Personal information, such as your financial history and income sources, is crucial for a complete assessment.

- The financial statement is confidential and only for the lender's eyes. While it is primarily used by lenders, it is important to note that others might review it as part of the financial evaluation process, such as real estate agents or financial advisors.

By understanding these misconceptions, you can navigate the Rebny Financial Statement form more effectively.

Key takeaways

Understanding the Rebny Financial Statement form is crucial for accurate financial reporting. Here are key takeaways to consider:

- The form requires personal information such as names and addresses of the applicant and co-applicant.

- Clearly distinguish between assets and liabilities. This separation helps in assessing financial stability.

- List all assets accurately. This includes cash, investments, real estate, and personal property.

- Be thorough when detailing liabilities. Include debts like loans, mortgages, and unpaid taxes.

- Disclose sources of income for both the applicant and co-applicant. Each income source needs to be itemized.

- Identify contingent liabilities, which may include co-signing on loans or legal judgments.

- Carefully complete the scheduled valuations for bonds, stocks, and real estate to measure true asset value.

- Keep in mind that honesty is essential. All details must be accurate to avoid potential legal issues.

- After filling out the form, sign and date it to certify authenticity. Both parties must do this.

- Review the form for any missing information before submission to ensure a smooth process.

Browse Other Templates

How Do I Get an Apostille in Ohio - Contact information for the Ohio Secretary of State is provided for inquiries regarding the process.

Cms 40b Form - Provide your current address and telephone number for communication purposes.