Fill Out Your Receipt Security Deposit Form

When renting a property, securing a lease often begins with a financial commitment in the form of a security deposit. The Receipt Security Deposit form is a vital document in this process, providing a written acknowledgment that a landlord or agent has received the deposit from a tenant. This form includes essential details such as the date the deposit was made, the specific property address, and the names of all tenants involved. Importantly, it specifies the amount received, and it may also indicate any balance due, ensuring transparency about financial obligations. Furthermore, the mode of payment—whether made by cash, check, money order, credit card, or cashier's check—is clearly noted. All these elements come together to create a record that protects both the tenant and the landlord, outlining the terms related to the lease period and the security deposit itself.

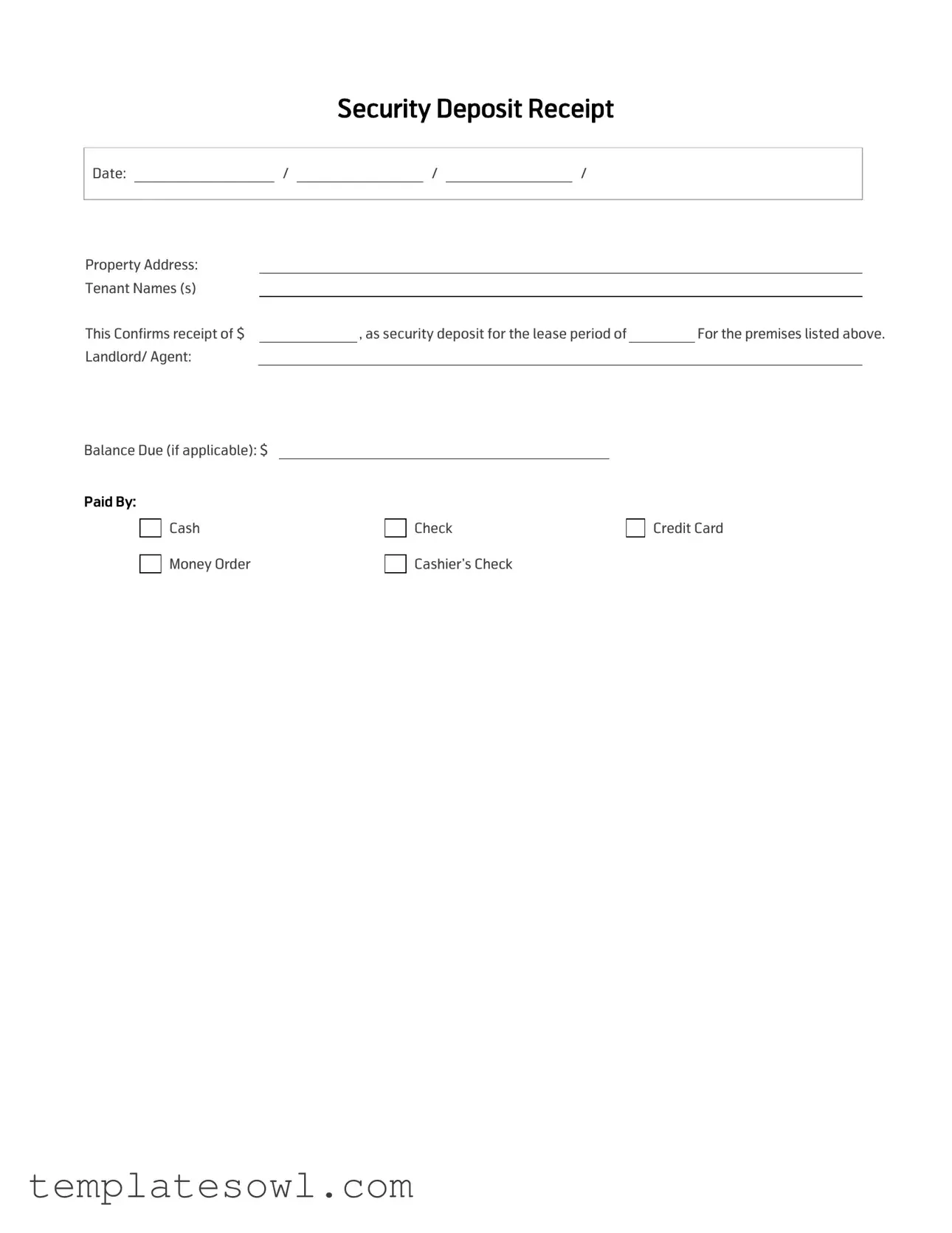

Receipt Security Deposit Example

-

Security Deposit Receipt

Date: |

/ |

/ |

/ |

|||

|

|

|

|

|

|

|

Property Address:

Tenant Names (s)

This Confirms receipt of $ Landlord/ Agent:

Balance Due (if applicable): $

Paid By:

□

Cash

Cash

□

Money Order

Money Order

, as security deposit for the lease period of |

|

For the premises listed above. |

□ Check |

□ Credit Card |

□ Cashier’s Check |

|

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | This form serves as a receipt for the security deposit paid by a tenant to a landlord or agent. |

| Receipt Date | The receipt must include the date on which the security deposit payment was made. |

| Property Address | The address of the rental property must be clearly stated on the form. |

| Tenant Information | The names of the tenant(s) making the payment should be documented in the receipt. |

| Deposit Amount | The exact amount of money received as a security deposit must be recorded. |

| Landlord/Agent Details | The name of the landlord or the agent managing the property must be clearly noted. |

| Balance Due | If applicable, any remaining balance that the tenant owes should be indicated. |

| Payment Method | The form provides options for various payment methods like cash, money order, check, credit card, or cashier’s check. |

| Lease Period | The specific lease period for which the security deposit covers should be included in the form. |

| State Regulations | In many states, including California and New York, security deposit requirements and procedures are outlined in landlord-tenant laws. |

Guidelines on Utilizing Receipt Security Deposit

After gathering the necessary information, you can proceed to fill out the Receipt Security Deposit form. This document serves as an acknowledgment of the funds received for the rental property. Ensure all fields are complete and accurate before submitting the form to avoid any discrepancies.

- Locate the date field at the top of the form. Enter the security deposit receipt date in the format: MM/DD/YYYY.

- Find the property address section and write down the complete address of the rental property.

- In the tenant names section, list the names of all tenants involved in the lease agreement.

- Record the amount of the security deposit received. Insert the numerical value in the space provided.

- Indicate the name of the landlord or agent receiving the deposit in the designated area.

- If applicable, note any balance due in the balance due field, also using numerical values.

- Choose the method of payment by marking the appropriate box: Cash, Money Order, Check, Credit Card, or Cashier’s Check.

- Specify the lease period for which the security deposit is being held. Include relevant dates or duration as required.

What You Should Know About This Form

What is a Receipt Security Deposit form?

A Receipt Security Deposit form is a document that acknowledges the receipt of a security deposit from a tenant to a landlord or property manager. This form typically includes details such as the date the deposit was received, the property address, the names of the tenants involved, and the amount of the deposit. It serves as proof for both parties that the landlord has received the security deposit, which is usually held to cover potential damages or unpaid rent during the lease period.

What information do I need to provide on the form?

To complete the Receipt Security Deposit form, you will need to provide several key pieces of information. This includes the date the deposit is received, the property address, and the names of the tenants who will be renting the property. You'll also need to specify the amount of the security deposit and check the payment method used—cash, money order, check, credit card, or cashier’s check. If there is a balance due, that amount should also be recorded.

Why is it important to have a Receipt Security Deposit form?

Having a Receipt Security Deposit form is crucial for both tenants and landlords. For tenants, it provides documented proof that they paid a security deposit, which may be needed when disputing charges at the end of a lease. For landlords, it serves as a record that can be referred back to if there are any questions or issues concerning the security deposit throughout the lease period. This documentation can help prevent misunderstandings and protect both parties in case of legal disputes.

Can I use a digital version of the Receipt Security Deposit form?

Yes, a digital version of the Receipt Security Deposit form is perfectly acceptable, as long as it includes all the necessary information. Many landlords and property managers now utilize electronic documents for efficiency. Just ensure that both the tenant and the landlord or agent receive copies of the completed form, either digitally or in printed format, to maintain a clear record of the transaction.

What should I do if there is a dispute over the security deposit?

If a dispute arises concerning the security deposit, the Receipt Security Deposit form can serve as a vital piece of evidence. Both parties should refer to the document for clarity on what was agreed upon. Communication between the tenant and landlord is key. If no resolution can be found, consider seeking help from a mediator or reviewing local tenant-landlord laws, as well as possibly involving legal professionals if necessary.

Common mistakes

Completing a Receipt Security Deposit form is a straightforward process, but it’s easy to overlook crucial details. One common mistake people make is failing to include the correct date on the form. The date of the transaction is important for record-keeping and can impact both landlords and tenants. Without it, disputes over when the deposit was paid can arise, leading to unnecessary tension.

Another frequent error is neglecting to accurately fill out the property address. This oversight might seem innocuous, but it can create confusion and complicate future transactions. Each property has its distinct legal considerations, and without clarity on the address, tracking deposit details can become problematic.

Missing tenant names is also a mistake that occurs often. The form should list all tenants committing to the lease. Leaving out one or more names can raise issues around the return of the security deposit. Each tenant should see their name on the document to confirm their agreement to the terms outlined.

People sometimes forget to accurately state the amount of the security deposit. This figure should be clear and correct, as any discrepancies can impact the return of the funds at the end of the lease. Staying precise ensures everyone involved is on the same page regarding financial commitments.

It’s essential to mark how the payment was made. Some individuals overlook this section and fail to check the appropriate box, whether it was by cash, money order, check, credit card, or cashier’s check. This information provides critical context and helps maintain an accurate record of the transaction.

Another mistake is not noting any balance due. If there is an amount remaining to be paid, indicating this on the form clarifies the tenant’s financial obligations. Failing to include this detail may lead to misunderstandings down the line.

Lastly, people sometimes forget to sign the form. Whether it’s the landlord or agent, the signature is a necessary affirmation of the agreement. Without it, the form is incomplete and could be disputed by either party, which can lead to complications when it's time to process the return of the deposit.

Documents used along the form

When renting a property, several documents complement the Receipt Security Deposit form to ensure clarity and protect the rights of both landlords and tenants. Understanding these documents can facilitate a smoother rental experience.

- Lease Agreement: This is the formal contract that outlines the terms of the rental arrangement, including rent amount, duration, responsibilities for repairs, and rules for behavior in common areas.

- Walk-Through Checklist: This document is used before the tenant moves in to document the condition of the property. It helps both parties agree on what is acceptable wear and tear versus damage.

- Move-In Inspection Report: Similar to the walk-through checklist, this report is completed during a property inspection. It provides a detailed account of the property's condition at the time of occupancy, which can be referred back to upon move-out.

- Lease Addendum: This is an additional document that modifies or adds to the original lease agreement. It can cover specific rules or policies that were not included in the initial lease.

- Notice to Evict: If issues arise, this formal notice is given to the tenant indicating the landlord's intent to terminate the lease. It typically outlines reasons for eviction and provides a timeline for the tenant to vacate the property.

- Security Deposit Agreement: This document outlines the terms surrounding the security deposit, including how it can be used and the conditions under which it may be withheld after the tenant moves out.

- Rent Receipt: This is a record given to tenants after they pay rent. It serves as proof of payment and includes details such as the date of the payment and the amount.

- Maintenance Request Form: Tenants use this form to formally request repairs or maintenance for issues that arise during their tenancy, allowing landlords to track issues and respond appropriately.

- Move-Out Notice: Tenants typically submit this form at least 30 days before vacating the property. It gives the landlord official notice of the tenant's intent to leave the rental.

Being familiar with these documents can help both landlords and tenants navigate their rental responsibilities and rights effectively. Clear communication and documentation play crucial roles in ensuring a positive rental experience for everyone involved.

Similar forms

- Lease Agreement: A lease agreement outlines the terms and conditions between the landlord and tenant regarding the rental of property. Like the security deposit receipt, it serves as a formal record of the commitment between the parties, specifying the duration of the lease and financial obligations.

- Rental Application: This document collects important information about potential tenants. It often includes details on employment, rental history, and references. Similar to the security deposit receipt, it reflects a step in the process of securing a rental agreement.

- Move-In Checklist: A move-in checklist details the condition of the rental property at the start of a tenancy. Both the checklist and security deposit receipt aim to document the state of the property, helping to protect against disputes at the lease's end.

- Security Deposit Agreement: This agreement specifically details how the security deposit will be handled, including conditions for its return. It shares similarities with the receipt, as both confirm the deposit amount and terms surrounding it.

- Rent Payment Receipt: A rent receipt, given upon payment of rent, serves as proof of the transaction. Like the security deposit receipt, it confirms that a payment has been made and illustrates the financial relationship between the tenant and landlord.

- Property Inspection Report: This report documents the condition of the property during inspections. Both documents aim to protect parties by providing evidence of property condition, which can impact the return of any security deposit.

- Lease Renewal Agreement: This document formalizes the renewal of a lease, including any updated terms or modification of security deposits. It aligns with the security deposit receipt in that they both reference the ongoing financial agreement between tenant and landlord.

- Eviction Notice: An eviction notice informs a tenant of lease violations or non-payment. Though more formal and potentially adversarial, it highlights the importance of tenant obligations, similar to how the security deposit receipt serves as a reminder of financial commitments.

Dos and Don'ts

When completing the Receipt Security Deposit form, it’s essential to ensure accuracy and clarity. Here’s a handy list of dos and don’ts to guide you through the process:

- Do make sure to fill out the form completely, including all required fields.

- Do double-check the security deposit amount to ensure it matches what you are paying.

- Do clearly state the date of the receipt to provide a timeline for payment.

- Do include all tenant names, as this ensures that everyone involved is documented.

- Don't forget to sign the form; your signature confirms the transaction.

- Don't leave any fields blank; incomplete forms can lead to misunderstandings later.

- Don't ignore the payment method box; specify whether you paid by cash, check, or another method.

- Don't underestimate the importance of keeping a copy of this receipt for your records.

By following these guidelines, you can navigate the process of filling out your Receipt Security Deposit form smoothly and effectively.

Misconceptions

Misconceptions about the Receipt Security Deposit form can lead to confusion for both landlords and tenants. Here are four common myths, clarified for better understanding:

- Myth 1: The form is optional and not required by law.

- Myth 2: The receipt does not need to specify payment method.

- Myth 3: Tenants do not need to keep a copy of the receipt.

- Myth 4: The amount of the security deposit is flexible and can be changed later.

Fact: While not every state mandates a specific form, providing a receipt for the security deposit is essential. It serves as proof of payment and protects both parties in case of disputes.

Fact: It is crucial to indicate how the payment was made, whether by cash, check, or credit card. This specificity can help clarify any future disagreements over the deposit.

Fact: Tenants should always retain a copy of the receipt for their records. This documentation is vital when seeking the return of the security deposit at the end of the lease.

Fact: The amount specified in the receipt is the legal binding figure unless both parties agree to a change in writing. Clarity at the start avoids problems later.

Key takeaways

Here are some key takeaways regarding the Receipt Security Deposit form:

- Proper Completion is Crucial: Ensure all fields are filled out accurately. This includes the receipt date, property address, and tenant names.

- Confirmation of Payment: The form serves as proof that the landlord or agent received the security deposit. This is vital for both parties in case of any future disputes.

- Payment Methods Matter: Clearly indicate how the deposit was paid—options include cash, check, or credit card. This documentation supports transparency.

- Balance Due Section: If there’s a balance due on the security deposit, make sure to note this clearly on the form.

- Lease Period Identification: Specify the lease period for which the deposit is being held. This helps clarify the timeframe associated with the security deposit.

- Keep Copies: Both the landlord and tenant should retain a copy of the completed form. This serves as a safeguard for both parties.

Browse Other Templates

Az Nursing Board - Nursing assistant training program requirements are defined in the document.

Observation Hours Physical Therapy - The PT must provide a thoughtful assessment of the applicant's abilities.