Fill Out Your Refunding Bond And Release Form

The Refunding Bond and Release form plays a crucial role in estate management, particularly after a loved one has passed away. This document is essentially a promise made by the Obligor, who is usually a beneficiary of the estate, to repay a specified amount to the Obligee, typically the executor or administrator of the estate. The Obligor acknowledges receiving either their full or partial share of the estate, confirming that all debts of the estate have been settled and that any remaining balances have been properly distributed among heirs. By signing this form, the Obligor also relinquishes any future claims against the Obligee regarding the estate. This safeguard ensures that if any debts arise later, or if it becomes evident that additional funds are required to cover unpaid obligations, the Obligor agrees to reimburse the Obligee from their allocated share. The document serves not only as a legal assurance for the Obligee but also as a protective measure for the Obligor, establishing clear boundaries about debts and claims related to the estate of the deceased. Understanding the importance and implications of the Refunding Bond and Release form can help beneficiaries feel more secure in their dealings following a loss.

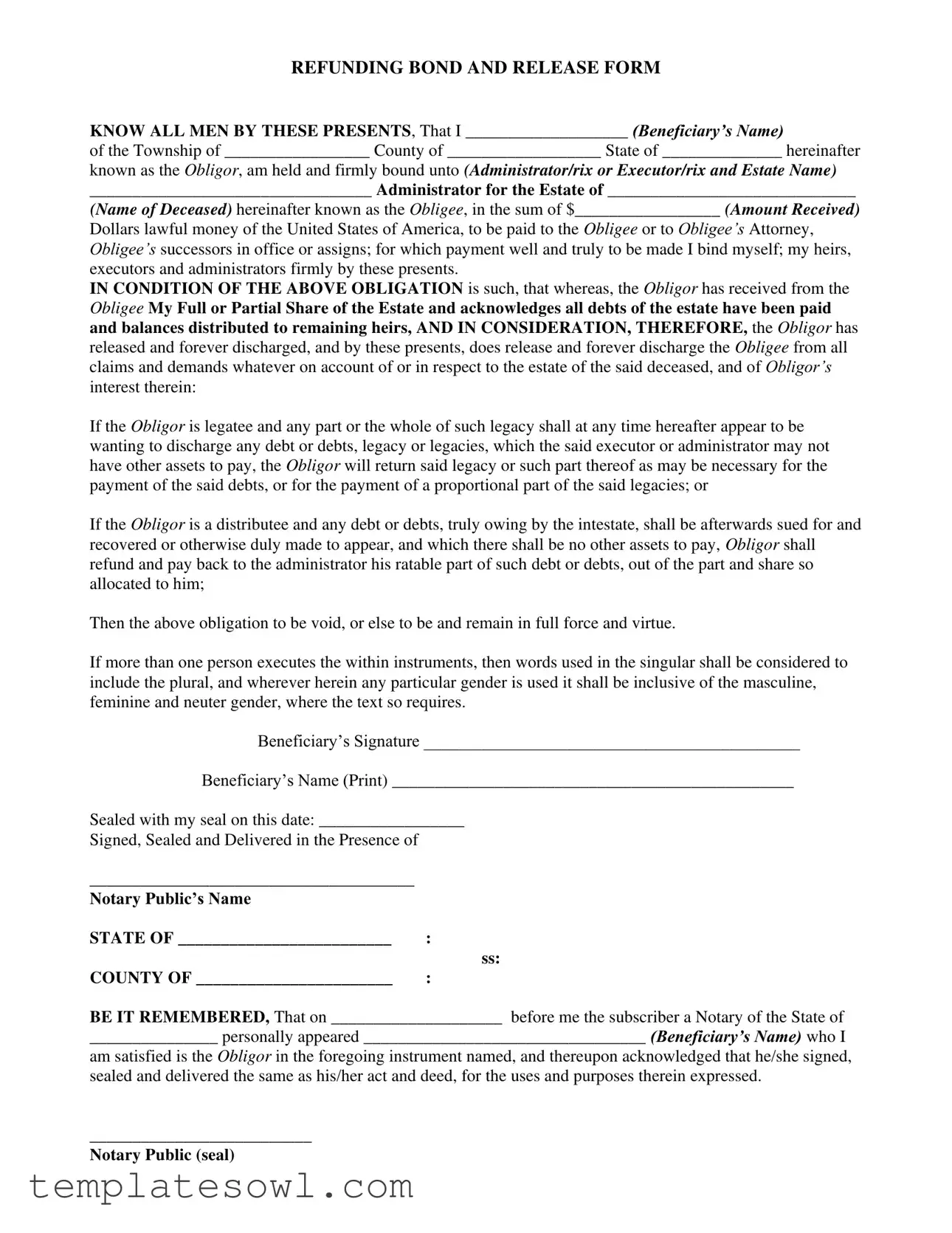

Refunding Bond And Release Example

REFUNDING BOND AND RELEASE FORM

KNOW ALL MEN BY THESE PRESENTS, That I ___________________ (Beneficiary’s Name)

of the Township of _________________ County of __________________ State of ______________ hereinafter

known as the Obligor, am held and firmly bound unto (ADMINISTRATOR/RIX OR EXECUTOR/RIX AND ESTATE NAME)

_________________________________ Administrator for the Estate of _____________________________

(NAME OF DECEASED) hereinafter known as the Obligee, in the sum of $_________________ (AMOUNT RECEIVED)

Dollars lawful money of the United States of America, to be paid to the Obligee or to Obligee’s Attorney, Obligee’s successors in office or assigns; for which payment well and truly to be made I bind myself; my heirs,

executors and administrators firmly by these presents.

IN CONDITION OF THE ABOVE OBLIGATION is such, that whereas, the Obligor has received from the Obligee My Full or Partial Share of the Estate and acknowledges all debts of the estate have been paid and balances distributed to remaining heirs, AND IN CONSIDERATION, THEREFORE, the Obligor has

released and forever discharged, and by these presents, does release and forever discharge the Obligee from all claims and demands whatever on account of or in respect to the estate of the said deceased, and of Obligor’s

interest therein:

If the Obligor is legatee and any part or the whole of such legacy shall at any time hereafter appear to be wanting to discharge any debt or debts, legacy or legacies, which the said executor or administrator may not have other assets to pay, the Obligor will return said legacy or such part thereof as may be necessary for the payment of the said debts, or for the payment of a proportional part of the said legacies; or

If the Obligor is a distributee and any debt or debts, truly owing by the intestate, shall be afterwards sued for and recovered or otherwise duly made to appear, and which there shall be no other assets to pay, Obligor shall refund and pay back to the administrator his ratable part of such debt or debts, out of the part and share so allocated to him;

Then the above obligation to be void, or else to be and remain in full force and virtue.

If more than one person executes the within instruments, then words used in the singular shall be considered to include the plural, and wherever herein any particular gender is used it shall be inclusive of the masculine, feminine and neuter gender, where the text so requires.

Beneficiary’s Signature ____________________________________________

Beneficiary’s Name (Print) _______________________________________________

Sealed with my seal on this date: _________________

Signed, Sealed and Delivered in the Presence of

______________________________________

Notary Public’s Name

STATE OF _________________________ |

: |

|

ss: |

COUNTY OF _______________________ |

: |

BE IT REMEMBERED, That on ____________________ before me the subscriber a Notary of the State of

_______________ personally appeared _________________________________ (Beneficiary’s Name) who I

am satisfied is the Obligor in the foregoing instrument named, and thereupon acknowledged that he/she signed, sealed and delivered the same as his/her act and deed, for the uses and purposes therein expressed.

__________________________

Notary Public (seal)

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The Refunding Bond and Release form is designed to protect the Obligee by ensuring that the Obligor acknowledges receipt of their share of an estate and releases any claims against it. |

| Parties Involved | This form involves three key parties: the Obligor (Beneficiary), the Obligee (Administrator or Executor), and the estate of the deceased. |

| Legal Authority | The use of this form is governed by state probate laws, which vary by location. It’s essential to check local regulations. |

| Importance of Notary | Execution of the form requires a notary public to affirm the identity of the Obligor, adding a layer of legal validation to the document. |

| Liability Clause | The form includes a clause that holds the Obligor liable for refunding any portion of their legacy if debts arise later that cannot be covered by the estate’s assets. |

Guidelines on Utilizing Refunding Bond And Release

After completing the Refunding Bond and Release form, it is essential to ensure that all signatures are appropriately witnessed and notarized to give the document legal force. Following this, you can proceed with submitting the form to the relevant administrator or executor as outlined in your estate arrangements.

- Begin by filling in the blank spaces at the top of the form with the beneficiary's name, township, county, and state. Make sure this information is accurate.

- Next, enter the name of the administrator or executor and the estate name of the deceased individual, ensuring the information matches other official documents.

- In the designated area, write the amount of money received in lawful dollars. This figure should correspond to the agreed-upon amount discussed with the administrator or executor.

- Locate the section titled "Beneficiary's Signature" and sign your name as the obligor, clearly indicating your acceptance of the terms.

- Print your name in the next available space directly below your signature for clarity.

- Fill in the date on which you are signing the document. This is crucial for record-keeping purposes.

- In the next area, find the line for the notary public's name and make sure a notary public observes your signing of the document.

- Once a notary public is present, they will complete their section indicating that they witnessed your signature. They may give you a seal or stamp, which is typically necessary for the document to be valid.

What You Should Know About This Form

What is a Refunding Bond And Release form?

The Refunding Bond And Release form is an important legal document used in estate matters. It serves to confirm that a beneficiary, referred to as the Obligor, has received their share of an estate and releases the estate administrator from any future claims regarding that share. This form is crucial in settling accounts after a loved one's passing and ensures all parties are clear about their rights and responsibilities.

Who completes the Refunding Bond And Release form?

The Obligor, who is typically a beneficiary of the estate, fills out this form. They acknowledge receipt of their share and express their intention to release the administrator or executor from any further claims. It is important that this form is filled out accurately to avoid any confusion or legal issues later on.

What information is required when filling out the form?

When completing the form, the Obligor must provide their full name, the name of the township, county, and state, as well as the estate administrator’s name and the name of the deceased. Additionally, the amount received by the Obligor should be specified. This information is essential for creating a clear record of the transaction and the parties involved.

What happens if debts arise after signing this form?

If any estate debts surface after the Obligor has signed the form, the Obligor remains responsible for refunding their proportional share of those debts. This situation is addressed in the form itself. Therefore, the Obligor should be aware that, despite releasing the administrator from claims, they may still face obligations related to the estate's debts.

Is a notary public required for this form?

Yes, the form must be signed in the presence of a notary public. This step is crucial as it adds an official layer of validation to the document. The notary verifies the identity of the Obligor and confirms that they willingly signed the document, ensuring that the form has legal weight and can be upheld in a court of law if necessary.

How long is the Refunding Bond And Release form valid?

The validity of the Refunding Bond And Release form is generally tied to the finalization of estate matters related to the specific deceased individual. Once all claims and debts associated with the estate have been settled, the obligation outlined in the form becomes void. However, the Obligor should keep a copy of the signed document for their records, as it serves as proof of their release from further claims concerning the estate.

Common mistakes

When filling out the Refunding Bond and Release form, many individuals inadvertently make mistakes that can lead to complications down the road. One common error is failing to provide accurate personal information. The form requires the beneficiary’s name and details about the township, county, and state. Omitting this information or providing incorrect data can delay the processing of the document and create confusion regarding the parties involved.

Another mistake often seen is neglecting to specify the amount to be refunded. The line designated for “AMOUNT RECEIVED” must be filled out completely. If this section is left blank, it may raise questions later, prompting additional steps for clarification. Likewise, indicating an incorrect amount can lead to disputes or an invalid form, which could hinder the beneficiary's interests.

Not adhering to the signing requirements is yet another frequent issue. The form must be signed in the presence of a notary public. Failing to obtain a notarization or not having all necessary parties sign the document can lead to it being legally unenforceable. It's crucial to follow every detail regarding signatures and witness requirements to ensure the bond is valid.

Lastly, individuals sometimes misunderstand their obligations as outlined in the form. For instance, failing to acknowledge that the release is final can create misunderstandings later. Beneficiaries should fully comprehend the implications of signing the release, including their commitment to refund any legacy if financial liabilities arise in the future. This misunderstanding can lead to legal challenges and dissatisfaction among heirs or estate representatives.

Documents used along the form

In the context of estate management, several forms and documents may accompany the Refunding Bond And Release form. These documents serve to clarify responsibilities, confirm claims, and address the distribution of assets. Each document plays a specific role in ensuring a smooth transition and completion of estate matters.

- Last Will and Testament: This document outlines the wishes of the deceased regarding the distribution of their assets upon death. It identifies beneficiaries and specifies bequests, ensuring that the decedent's intentions are honored.

- Administrator’s Account: This record details the financial activities related to the estate, including income, expenses, and distributions. It provides transparency for beneficiaries about how the estate has been managed and what has been paid out.

- Release of Claims: This form is typically signed by beneficiaries to confirm that they have received their share of the estate. By signing this document, beneficiaries waive any future claims against the estate, providing closure to the estate administration process.

- Inventory of Estate Assets: This document lists all assets belonging to the estate at the time of the decedent's death. It includes real property, bank accounts, personal items, and more, helping to facilitate fair distribution among beneficiaries.

- Affidavit of Heirship: This sworn statement identifies heirs and their relationship to the deceased. It is particularly useful in situations where a will is missing or disputed, helping to establish rightful claimants to the estate.

- Notice to Creditors: This document notifies potential creditors of the estate, giving them the opportunity to present any claims. It helps ensure all debts are addressed before finalizing the distribution of assets.

These documents collectively support the overall process of estate administration. They help protect the interests of all parties involved, ensuring that the obligations and rights are respected. Careful attention to each form can prevent misunderstandings and promote harmony among beneficiaries.

Similar forms

- Release of Liability Form: This document frees one party from any legal claims by another party, similar to how the Refunding Bond and Release relieves the Obligee from claims regarding the estate.

- Settlement Agreement: A settlement agreement resolves disputes outside of court, akin to the Refunding Bond, which finalizes financial obligations between the Obligor and Obligee.

- Indemnity Agreement: This contract obligates one party to compensate another for certain damages or losses, paralleling the repayment obligations outlined in the Refunding Bond.

- Promissory Note: A formal promise to pay a specified amount, similar to the financial commitments made by the Obligor in the Refunding Bond.

- Release of Lien Document: This document removes a claim against property, much like the Refunding Bond releases the Obligee from future claims related to the estate.

- Quitclaim Deed: This deed transfers rights or interests in real estate without guaranteeing title, similar to how the Refunding Bond conveys that the Obligor has no further claims on the estate.

- Waiver Agreement: A waiver relinquishes a known right, paralleling the Obligor's waiver of further claims against the Obligee in the context of estate settlement.

Dos and Don'ts

When filling out the Refunding Bond And Release form, it’s essential to follow specific guidelines to ensure accuracy and compliance. Below are four things you should and shouldn’t do:

- Do double-check all entries for spelling and accuracy, especially names and amounts.

- Do ensure that all required fields are completed before submitting the form, including the signature and date.

- Don’t use abbreviations or informal language; maintain a formal tone throughout the document.

- Don’t forget to have the document notarized as required; this adds an essential layer of validity.

Misconceptions

Misconception 1: The Refunding Bond and Release form is only necessary for large estates.

This form is useful regardless of the size of the estate. Whether it’s a small amount or a significant sum, if you’ve received your share, this form helps document the agreement.

Misconception 2: Signing the form means you waive all rights to any future claims.

While the form releases the administrator from current claims against the estate, it doesn't prevent you from making legitimate claims in the future if new issues arise.

Misconception 3: You can only use this form if you are the sole beneficiary.

This form can also be used if there are multiple beneficiaries. It clearly states your rights and obligations even when others are involved.

Misconception 4: A notary public is not necessary for the form to be valid.

A notary public is required to verify the identity of the signer and ensure the document is legally binding. Without this step, the document may not be enforceable.

Misconception 5: Once the form is signed, you are permanently liable for any estate debts.

The obligation to refund only applies if the estate faces debts that cannot be covered by other assets. You aren't liable for debts that have already been settled.

Misconception 6: The Refunding Bond and Release form cannot be modified after signing.

While the original signed document is binding, it is possible to create amendments or new agreements if all parties involved consent to the changes and follow legal protocols.

Key takeaways

Understanding and properly utilizing the Refunding Bond and Release form is essential for ensuring clarity in estate handling. Here are some key takeaways to consider:

- Purpose of the Form: This form serves to acknowledge that the beneficiary, referred to as the Obligor, has received their share from an estate and releases the administrator from further claims related to that estate.

- Parties Involved: The form involves two main parties: the Obligor (beneficiary) and the Obligee (administrator of the estate). Clear identification of both parties is crucial.

- Financial Obligations: The Obligor must state the exact amount received. This ensures transparency regarding the financial transactions relating to the estate.

- Release of Claims: By signing the form, the Obligor releases the Obligee from any future claims or demands concerning the beneficiaries' interest in the estate.

- Repayment Conditions: The form outlines specific scenarios wherein the Obligor might need to refund portions of the received estate share if debts arise that cannot be covered by the estate's remaining assets.

- Witnessing Requirement: The form must be signed in the presence of a notary public. This adds a layer of verification that the signatures are legitimate and the form was executed correctly.

Completing this form accurately can help avoid disputes and facilitate a smoother estate settlement process.

Browse Other Templates

Seating Expansion Evaluation Form,DBPR Restaurant Seating Assessment,Florida Food Service Seating Change Form,Public Service Establishment Capacity Approval Form,Restaurant Seating Capacity Evaluation,DBPR HR Seating Compliance Form,Seating Capacity - Compliance with this form can strengthen an establishment's operational integrity.

Purdue Patient Portal - Tuberculosis testing is mandatory for international students upon arrival in the U.S.