Fill Out Your Reg 119 Form

The Reg 119 form, also known as the Certificate of Repossession, plays a crucial role in the process of reclaiming vehicles or vessels that have fallen into default under a conditional sale contract or a security interest agreement. This form is essential for legal owners, such as banks or finance companies, as it provides official documentation of the repossession and offers vital information about the specific vehicle or vessel involved. In it, the legal owner must detail the vehicle’s identification numbers, including the VIN or HIN, as well as utilize sections dedicated to outlining the circumstances of the repossession. Different scenarios surrounding the repossession can be addressed, whether it involved a licensed repossession agency, a voluntary surrender by the debtor, or an action taken directly by the legal owner. Furthermore, the form requires the legal owner to certify that all actions were taken lawfully and that proper notification was given to individuals liable under the contract. Ensuring compliance with regulations and timely notice is not merely good practice; it serves to uphold the rights of all parties involved in the transaction. The importance of accurately completing the Reg 119 form cannot be overstated, as it helps avoid potential disputes and legal challenges that may arise from improper repossession procedures.

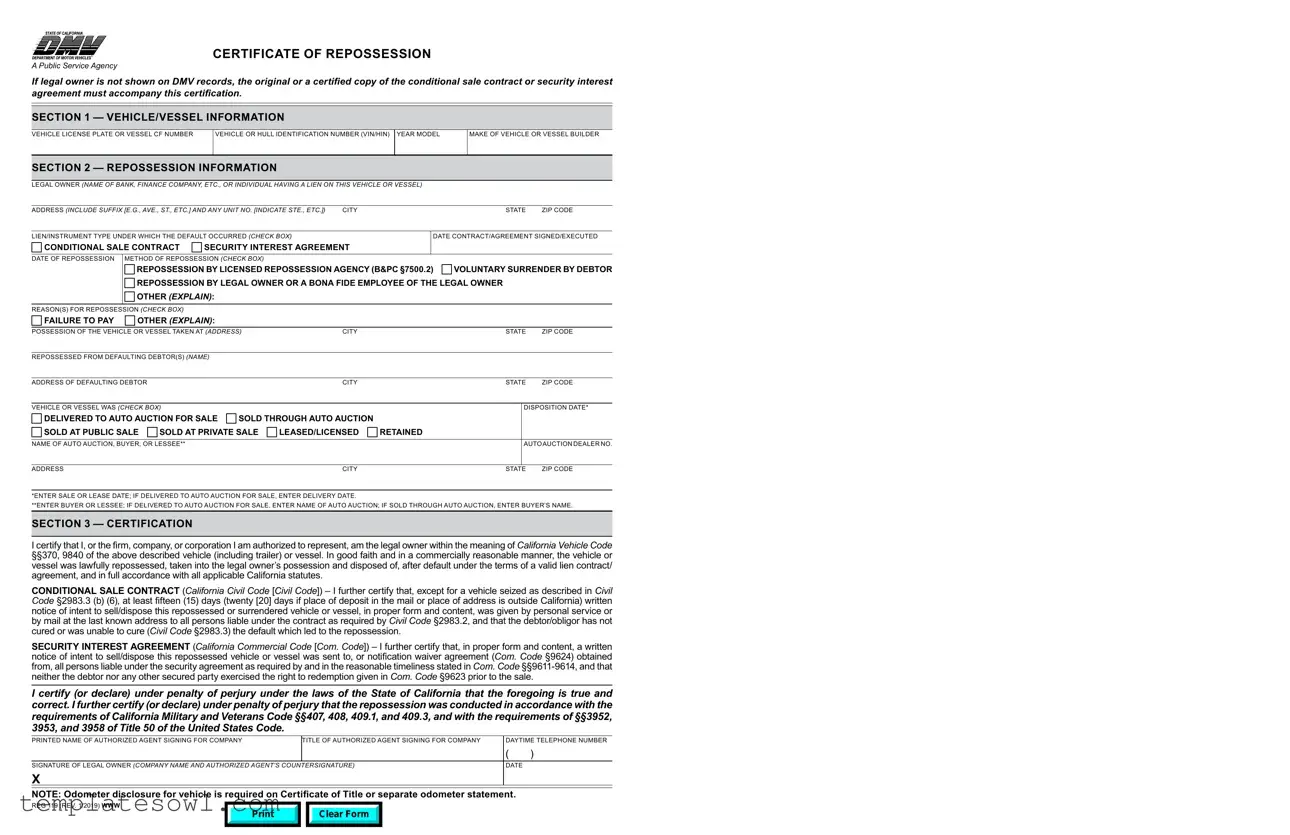

Reg 119 Example

CERTIFICATE OF REPOSSESSION

A Public Service Agency

If legal owner is not shown on DMV records, the original or a certified copy of the conditional sale contract or security interest agreement must accompany this certification.

SECTION 1 — VEHICLE/VESSEL INFORMATION

VEHICLE LICENSE PLATE OR VESSEL CF NUMBER

VEHICLE OR HULL IDENTIFICATION NUMBER (VIN/HIN)

YEAR MODEL

MAKE OF VEHICLE OR VESSEL BUILDER

SECTION 2 — REPOSSESSION INFORMATION

LEGAL OWNER (NAME OF BANK, FINANCE COMPANY, ETC., OR INDIVIDUAL HAVING A LIEN ON THIS VEHICLE OR VESSEL)

ADDRESS (INCLUDE SUFFIX [E.G., AVE., ST., ETC.] AND ANY UNIT NO. [INDICATE STE., ETC.]) |

CITY |

|

|

STATE |

ZIP CODE |

||||||

|

|

|

|

|

|

||||||

LIEN/INSTRUMENT TYPE UNDER WHICH THE DEFAULT OCCURRED (CHECK BOX) |

|

|

DATE CONTRACT/AGREEMENT SIGNED/EXECUTED |

||||||||

CONDITIONAL SALE CONTRACT |

SECURITY INTEREST AGREEMENT |

|

|

|

|

|

|||||

DATE OF REPOSSESSION |

METHOD OF REPOSSESSION (CHECK BOX) |

|

|

|

|

|

|

|

|||

|

REPOSSESSION BY LICENSED REPOSSESSION AGENCY (B&PC §7500.2) |

VOLUNTARY SURRENDER BY DEBTOR |

|||||||||

|

REPOSSESSION BY LEGAL OWNER OR A BONA FIDE EMPLOYEE OF THE LEGAL OWNER |

|

|||||||||

|

OTHER (EXPLAIN): |

|

|

|

|

|

|

|

|

||

REASON(S) FOR REPOSSESSION (CHECK BOX) |

|

|

|

|

|

|

|

|

|

||

FAILURE TO PAY |

OTHER (EXPLAIN): |

|

|

|

|

|

|

|

|

||

POSSESSION OF THE VEHICLE OR VESSEL TAKEN AT (ADDRESS) |

|

CITY |

|

|

STATE |

ZIP CODE |

|||||

|

|

|

|

|

|

|

|

|

|

||

REPOSSESSED FROM DEFAULTING DEBTOR(S) (NAME) |

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

ADDRESS OF DEFAULTING DEBTOR |

|

|

|

|

CITY |

|

|

STATE |

ZIP CODE |

||

|

|

|

|

|

|

|

|

|

|

||

VEHICLE OR VESSEL WAS (CHECK BOX) |

|

|

|

|

|

|

|

DISPOSITION DATE* |

|||

DELIVERED TO AUTO AUCTION FOR SALE |

SOLD THROUGH AUTO AUCTION |

|

|

|

|

|

|||||

SOLD AT PUBLIC SALE |

SOLD AT PRIVATE SALE |

LEASED/LICENSED |

RETAINED |

|

|

|

|||||

NAME OF AUTO AUCTION, BUYER, OR LESSEE** |

|

|

|

|

|

|

|

AUTOAUCTION DEALER NO. |

|||

|

|

|

|

|

|

|

|

|

|

|

|

ADDRESS |

|

|

|

|

|

CITY |

|

|

STATE |

ZIP CODE |

|

*ENTER SALE OR LEASE DATE; IF DELIVERED TO AUTO AUCTION FOR SALE, ENTER DELIVERY DATE.

**ENTER BUYER OR LESSEE; IF DELIVERED TO AUTO AUCTION FOR SALE, ENTER NAME OF AUTO AUCTION; IF SOLD THROUGH AUTO AUCTION, ENTER BUYER’S NAME.

SECTION 3 — CERTIFICATION

I certify that I, or the firm, company, or corporation I am authorized to represent, am the legal owner within the meaning of California Vehicle Code §§370, 9840 of the above described vehicle (including trailer) or vessel. In good faith and in a commercially reasonable manner, the vehicle or vessel was lawfully repossessed, taken into the legal owner’s possession and disposed of, after default under the terms of a valid lien contract/ agreement, and in full accordance with all applicable California statutes.

CONDITIONAL SALE CONTRACT (California Civil Code [Civil Code]) – I further certify that, except for a vehicle seized as described in Civil Code §2983.3 (b) (6), at least fifteen (15) days (twenty [20] days if place of deposit in the mail or place of address is outside California) written notice of intent to sell/dispose this repossessed or surrendered vehicle or vessel, in proper form and content, was given by personal service or by mail at the last known address to all persons liable under the contract as required by Civil Code §2983.2, and that the debtor/obligor has not cured or was unable to cure (Civil Code §2983.3) the default which led to the repossession.

SECURITY INTEREST AGREEMENT (California Commercial Code [Com. Code]) – I further certify that, in proper form and content, a written notice of intent to sell/dispose this repossessed vehicle or vessel was sent to, or notification waiver agreement (Com. Code §9624) obtained from, all persons liable under the security agreement as required by and in the reasonable timeliness stated in Com. Code

I certify (or declare) under penalty of perjury under the laws of the State of California that the foregoing is true and correct. I further certify (or declare) under penalty of perjury that the repossession was conducted in accordance with the requirements of California Military and Veterans Code §§407, 408, 409.1, and 409.3, and with the requirements of §§3952, 3953, and 3958 of Title 50 of the United States Code.

PRINTED NAME OF AUTHORIZED AGENT SIGNING FOR COMPANY |

TITLE OF AUTHORIZED AGENT SIGNING FOR COMPANY |

DAYTIME TELEPHONE NUMBER |

|||||

|

|

|

|

|

|

( |

) |

SIGNATURE OF LEGAL OWNER (COMPANY NAME AND AUTHORIZED AGENT’S COUNTERSIGNATURE) |

DATE |

|

|||||

X |

|

|

|

|

|

||

|

|

|

|

|

|

||

NOTE: Odometer disclosure for vehicle is required on Certificate of Title or separate odometer statement. |

|

||||||

REG 119 (REV. 1/2019) WWW |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Clear Form

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | The REG 119 form is used to certify the repossession of a vehicle or vessel by a legal owner or a designated agency. |

| Governing Law | This form is governed by California Vehicle Code §§370 and 9840, as well as specific provisions under the California Civil Code and Commercial Code. |

| Identification Requirements | When the legal owner is not documented with the DMV, the original or certified copy of the conditional sale contract or security interest agreement must accompany the REG 119. |

| Repossession Methods | There are several methods of repossession, including repossession by a licensed agency, voluntary surrender by the debtor, or repossession by the legal owner themselves. |

| Written Notice Requirement | Before selling or disposing of a repossessed vehicle, the legal owner must provide written notice to all liable parties as mandated by California Civil Code §2983.2. |

| Sale Timeline | A specific timeline for selling or disposing of the repossessed vehicle or vessel exists: at least 15 days notice is required, or 20 days if the debtor resides outside California. |

| Liability Disclosure | The REG 119 form requires detailed information about the defaulting debtor, including their name and address, to ensure clarity about the obligations involved. |

| Odometer Disclosure | For vehicles, an odometer disclosure must accompany the form, either on the Certificate of Title or a separate odometer statement. |

| Signature Requirements | The form must be signed by the legal owner, and can include the name of an authorized agent representing a company or financial institution. |

| Compliance with Military Codes | The repossession must comply with requirements set forth in California Military and Veterans Code, ensuring protections for military personnel. |

Guidelines on Utilizing Reg 119

Filling out the Reg 119 form is a necessary step in certifying a repossession. This form requires specific information about the vehicle or vessel being repossessed, the legal owner, and the circumstances surrounding the repossession. You will need to provide details like vehicle identification numbers, the date of repossession, and relevant agreements. It's important to ensure that all sections are completed accurately to avoid any delays.

- Gather all required information and documents. This includes the vehicle’s license plate number, vehicle identification number (VIN), and a copy of the conditional sale contract or security interest agreement if the legal owner is not listed in DMV records.

- Fill in Section 1 with vehicle or vessel information. Input the license plate or CF number, VIN or HIN, year, model, make, and builder of the vehicle or vessel.

- In Section 2, provide the legal owner’s information. This includes the name of the bank or individual with the lien, along with their complete address, city, state, and ZIP code.

- Select the type of lien or instrument associated with the default by checking the appropriate box. Include the date when the contract or agreement was signed or executed.

- Record the date of repossession, then check the box corresponding to the method of repossession (e.g., licensed agency, voluntary surrender, etc.).

- Indicate the reason for repossession by checking the appropriate box and provide the address where the vehicle was taken, including city, state, and ZIP code.

- Fill out the defaulting debtor's information: their name, address, city, state, and ZIP code.

- Complete the vehicle or vessel disposition details by checking the appropriate box that describes the method of disposition (such as delivered to auction or sold) and provide the name of the auction, buyer, or lessee as applicable.

- Proceed to Section 3 and provide your certification. Include your printed name, title, daytime telephone number, and signature, along with the date of signing.

After completing the form, review each section for accuracy. Once finalized, the form can be submitted through the appropriate channels. Ensure that any accompanying documents are also submitted as required.

What You Should Know About This Form

What is the purpose of the Reg 119 form?

The Reg 119 form, known as the Certificate of Repossession, is used to officially document the repossession of a vehicle or vessel. It serves as certification that the legal owner has taken possession due to default under the terms of a contract. Whether it relates to a secured loan or a sale agreement, this form establishes the legal basis for the repossession and indicates the manner in which it was conducted.

What information is required on the Reg 119 form?

The form requires detailed information about the vehicle or vessel, including its identification number, make, model, and year. Additionally, it necessitates the legal owner's information, the defaulting debtor's details, and specifics about the repossession process, including the method of repossession and reasons for it. Furthermore, the individual completing the form must certify that they have followed all relevant laws and notified all parties involved appropriately.

Who must complete the Reg 119 form?

What happens if the Reg 119 form is not filed?

If the Reg 119 form is not submitted, the repossession may not be recognized legally, potentially leaving the owner exposed to claims from the defaulting debtor. Failure to file could also impede the legal process for selling or disposing of the repossessed item. This might result in additional complications or legal challenges in future transactions.

Common mistakes

Completing the Reg 119 form can be a daunting task, and many individuals often overlook critical details. One common mistake involves failing to provide complete information about the vehicle or vessel. Section 1 requires specific entries such as the vehicle license plate number, vehicle identification number (VIN), and make and model. Missing any one of these details can lead to delays in processing the form and may result in a rejection.

Another frequent error occurs when individuals do not include the correct legal owner information. It is essential to accurately provide the name and address of the legal owner, which may be a bank, finance company, or an individual. Any discrepancies can cause complications in establishing ownership or retrieving the vehicle, particularly in cases of disputes.

People often neglect to check the appropriate method of repossession. In Section 2, it is necessary to select the correct repossession method. Whether it was conducted by a licensed repossession agency or through voluntary surrender, failing to accurately indicate the method can obscure the repossession's legitimacy.

Inadequate documentation is another mistake that can undermine the form's validity. For submissions where the legal owner is absent from DMV records, attaching the original or a certified copy of the conditional sale contract or security interest agreement is vital. Leaving out this documentation will not only delay the process but could also render the repossession invalid.

Many also forget to provide a clear reason for the repossession. Section 2 allows for the selection of reasons such as "failure to pay" or other valid explanations. Providing vague or insufficient reasoning can raise flags during processing, potentially leading to complications in status determination for the vehicle or vessel.

Lastly, individuals frequently overlook the certification section where the signer must declare under penalty of perjury that all information is accurate and complies with applicable California statutes. If this declaration is missing or improperly completed, it can result in significant consequences, including legal repercussions or denial of the repossession request.

Documents used along the form

The Reg 119 form, which serves as a Certificate of Repossession, may often be accompanied by various other forms and documents. Each of these documents plays a crucial role in ensuring that repossession and sale procedures are legally compliant and transparent. Here is a brief overview of these associated documents.

- Conditional Sale Contract: This document outlines the agreement between the buyer and seller regarding the sale terms. It often includes payment schedules and responsibilities. It is essential for confirming the terms under which the vehicle or vessel was sold.

- Security Interest Agreement: This agreement is crucial for establishing a creditor's legally enforceable interest in the property being repossessed. It details the conditions under which the lienholder can repossess the item due to default.

- Notification of Intent to Sell: Required by law, this document informs the debtor of the creditor's intention to sell the repossessed vehicle or vessel. Timely notification helps protect the rights of all parties involved.

- Odometer Disclosure Statement: This statement records the vehicle's mileage at the time of repossession. It is necessary for compliance with federal regulations that aim to prevent odometer fraud.

- Public Sale Notice: If the vehicle or vessel is to be sold at a public auction, this document provides details about the sale, including time, location, and terms. It ensures transparency in the sale process.

- Payment Receipt: This document serves as proof of payment from the buyer if the repossessed property is sold. It is an important record for both the seller and buyer, marking the completion of the transaction.

When dealing with repossession and related sales, it is important to ensure that all required documentation is complete and accurate. Having the right forms at hand can prevent legal complications and ensure a smooth process for all parties involved.

Similar forms

The REG 119 form, used for repossession documentation, shares similarities with several other documents commonly associated with liens and repossession processes. Each document serves a specific purpose in the context of vehicle or vessel ownership and recovery. Below is a list of seven documents that are similar to the REG 119 form:

- Title Transfer Document: This document indicates the change of ownership for a vehicle or vessel. Like the REG 119, it allows for the legal owner’s information to be recorded and provides proof of ownership transfer after repossession.

- Notice of Default: This written notification informs the debtor about their default status. Similar to the REG 119 form, it is a crucial step prior to taking action for repossession and outlines the reasons for the debt.

- Security Agreement: This document details the terms under which the lender can repossess the vehicle or vessel. Both this agreement and the REG 119 emphasize the legal rights of the lender concerning repossession.

- Conditional Sale Contract: This is a contract for the sale of a vehicle or vessel that includes terms for repossession if payments are not met. Like the REG 119, it establishes the legal framework for repo actions.

- Intent to Sell Notice: When a vehicle or vessel is repossessed, this notice must be sent to the debtor stating the lender's intention to sell. This document parallels the REG 119 by ensuring compliance with notification requirements before sale.

- Repo Order: Issued by a lender to a repossession agency, this document dictates the specifics of the repossession process. Similar to the REG 119, it confirms the legal authority for the agency to recover the vehicle.

- Vehicle/Vessel Registration Document: This document provides detailed information about the vehicle or vessel, including ownership details. The REG 119 requires some of this information as part of the repossession process, linking both documents' purposes.

Dos and Don'ts

When filling out the REG 119 form, ensure that you follow these guidelines for a smooth process.

- Review all sections carefully.

- Provide accurate vehicle and owner information.

- Attach necessary documents. Include the conditional sale contract or security interest agreement if the legal owner is not listed.

- Ensure all dates are correct, especially concerning repossession and contract execution.

- Sign and date the certification. This indicates your agreement with the statement.

Conversely, avoid these common pitfalls when completing the form.

- Do not leave any section blank if it applies to your situation.

- Refrain from using abbreviations or informal language that may confuse the reader.

- Don’t forget to check all relevant boxes related to repossession reasons and methods.

- Do not neglect to keep copies of the form and any accompanying documents for your records.

Misconceptions

- Misconception 1: The Reg 119 form is only for vehicles.

- Misconception 2: You don't need a certified copy of the sale contract.

- Misconception 3: The repossession process is straightforward and doesn’t require documentation.

- Misconception 4: Filing the Reg 119 form is optional.

- Misconception 5: No notice is needed prior to repossession.

Many people think the Reg 119 form applies solely to vehicles. However, this certification is also applicable to vessels. If you repossess a boat, you need to use this form as well.

Some believe that it's unnecessary to include the original or a certified copy of the conditional sale contract. In reality, if the legal owner is not listed on DMV records, attaching this document is essential.

It's a common thought that repossession is simple. However, proper documentation is crucial. You must provide evidence of the lien, the repossession method, and the circumstances surrounding the default.

Some assume that you can choose whether to submit the Reg 119 form. This is false. If you are the legal owner and have repossessed the vehicle or vessel, you are legally required to file this form.

Many people mistakenly think that repossession can occur without prior notification. In fact, you must notify the debtor of your intention to sell or dispose of the repossessed item, adhering to specific timeframes set by law.

Key takeaways

Here are some key takeaways about filling out and using the Reg 119 form:

- Understand the Purpose: The Reg 119 form serves as a Certificate of Repossession. It documents the retrieval of a vehicle or vessel after a borrower defaults on their obligations.

- Accurate Vehicle Information: Complete the vehicle or vessel information section accurately. This includes details like the license plate number, VIN or HIN, year, make, and model.

- Legal Owner Details: Input correct information for the legal owner, whether it’s an individual or a bank. Include the full address, ensuring it’s complete with any necessary suffix or unit numbers.

- Clear Repossession Reasons: Specify the reasons for repossession clearly. Options include failure to pay or other legitimate reasons, but be prepared to provide more detail if needed.

- Date and Method of Repossession: Clearly state the date of repossession and check the appropriate method used, such as voluntary surrender by the debtor or repossession by a licensed agency.

- Notice Requirements: Ensure compliance with notice requirements. A period of notice must be provided before sale or disposal of the repossessed property.

- Certification is Key: The form requires certification by the legal owner. This includes affirming that the repossession was conducted lawfully and in a commercially reasonable manner.

Browse Other Templates

Blank Bol Pdf - Carrier policies against rebate solicitations ensure legal compliance.

Sunlife Submit a Claim - The dentist must sign the verification section to confirm the services provided.

Subrogation Rights - Understanding the subrogation process is crucial for all parties involved in a claim.