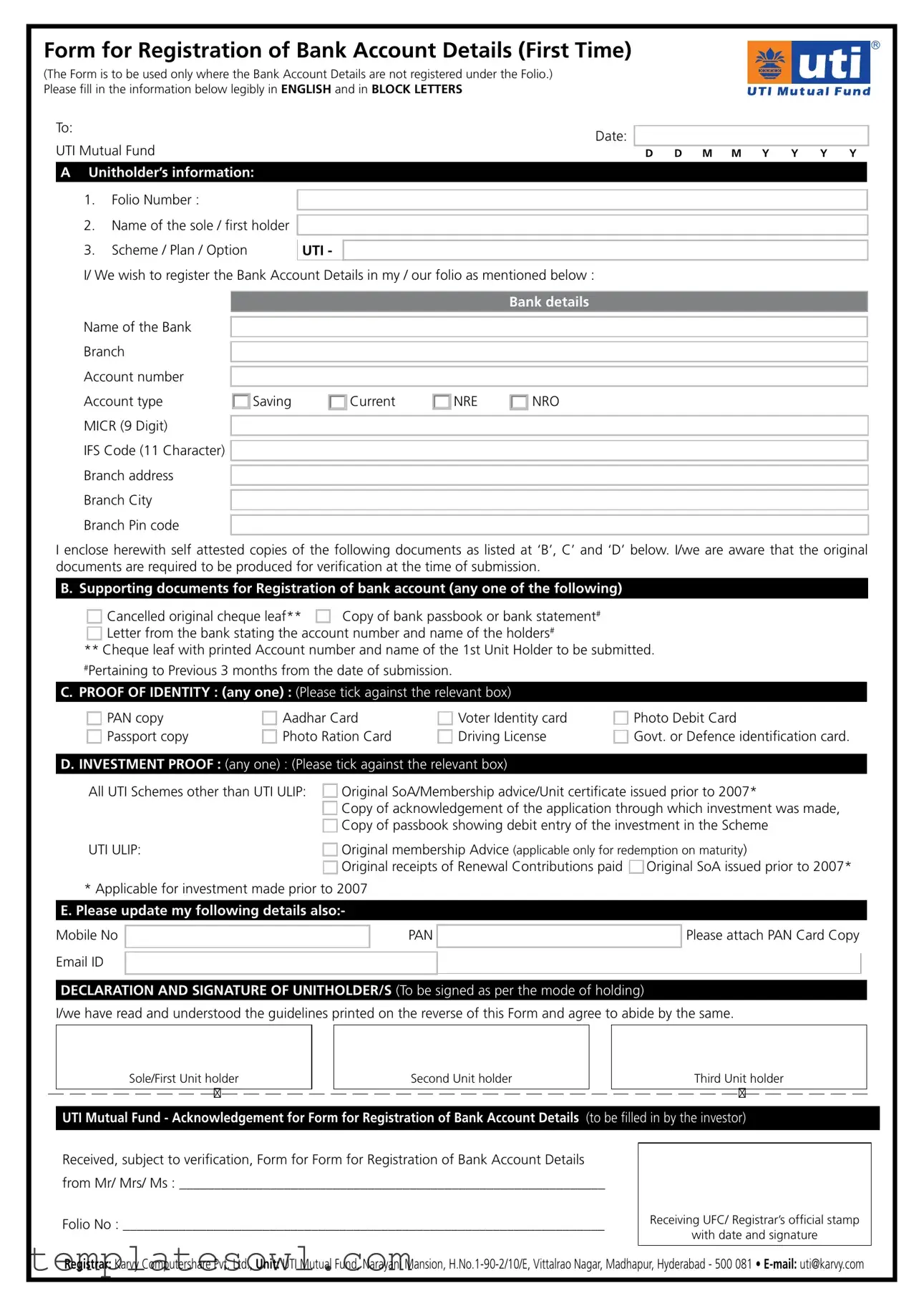

Fill Out Your Registration Bank Form

When investing in mutual funds, ensuring that your bank account details are registered accurately can streamline transactions and enhance your overall experience. The Registration Bank form serves as an essential tool for unitholders aiming to link their bank account with their investment portfolio, particularly for those whose bank information is not already on file. This form requires specific details, including the name of the bank branch, account number, and account type, as well as unique identifiers like the MICR and IFS code. Additionally, unitholders must provide supporting documentation, such as a cancelled cheque or bank statement, to verify their account. Identification proof is also necessary; options range from a PAN card to a voter identity card. Finally, applicants are prompted to include investment proof that demonstrates their association with the respective mutual fund schemes. By meticulously completing this form and attaching the necessary documents, investors can facilitate the registration of their bank account efficiently, paving the way for smooth transactions in the future.

Registration Bank Example

D D M M Y Y Y Y

Cancelled original cheque leaf** Copy of bank passbook or bank statement#

Letter from the bank stating the account number and name of the holders#

**Cheque leaf with printed Account number and name of the 1st Unit Holder to be submitted.

#Pertaining to Previous 3 months from the date of submission.

C.PROOF OF IDENTITY : (any one) : (Please tick against the relevant box)

|

PAN copy |

|

Aadhar Card |

|

Voter Identity card |

|

|

|

|

|

|

|

Passport copy |

|

Photo Ration Card |

|

Driving License |

D. INVESTMENT PROOF : (any one) : (Please tick against the relevant box)

|

Photo Debit Card |

|

Govt. or Defence identification card. |

All UTI Schemes other than UTI ULIP: Original SoA/Membership advice/Unit certificate issued prior to 2007*

Copy of acknowledgement of the application through which investment was made,

Copy of passbook showing debit entry of the investment in the Scheme

UTI ULIP: |

|

Original membership Advice (applicable only for redemption on maturity) |

Original receipts of Renewal Contributions paid Original SoA issued prior to 2007* * Applicable for investment made prior to 2007

E. Please update my following details also:-

Mobile No

Email ID

PAN  Please attach PAN Card Copy

Please attach PAN Card Copy

DECLARATION AND SIGNATURE OF UNITHOLDER/S (To be signed as per the mode of holding)

I/we have read and understood the guidelines printed on the reverse of this Form and agree to abide by the same.

Sole/First Unit holder |

|

Second Unit holder |

|

Third Unit holder |

|

|

|

|

|

|

|

UTI Mutual Fund - Acknowledgement for Form for Registration of Bank Account Details (to be filled in by the investor)

Received, subject to verification, Form for Form for Registration of Bank Account Details from Mr/ Mrs/ Ms : _____________________________________________________________

Folio No : _____________________________________________________________________

Receiving UFC/ Registrar’s official stamp

with date and signature

Registrar: Karvy Computershare Pvt. Ltd., Unit: UTI Mutual Fund, Narayani Mansion,

Guidelines

1.The Form for Registration of Bank Account Details is to be used only by those Unitholders whose bank details are not registered in their folio [if the bank details are not printed on the Statement of Account (SoA)]

2.In order to protect the interest of the investors, following documents are requested for Registration of Bank Account Details:

A] |

Proof of Bank Account (Please refer to Para B of the Form on the reverse) |

B] |

Proof of identity (Please refer to Para C of the Form on the reverse) |

C] |

Proof of Investment (Please refer to Para D of the Form on the reverse) |

3.Please carry the original documents of the copies you wish to submit towards the proof. The original will be returned to you after verification, across the counter.

4.Please fill in the Form in CAPITAL LETTERS.

5.The change of bank account details will be processed subject to verification of signature and subject to receipt of all the required documents.

6.In case you wish to register more than one bank account (upto 5), please fill up “Multiple Bank Account Registration Form”.

7.In case of any assistance, please contact nearest UTI Financial centre.

Check list

The Form is complete in all respects

The form is signed by the holders as per the holding basis Copy of proof of Bank Account is attached

Copy of proof of identity is attached. Copy of proof of Investment is attached

*********

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | This form is used for registering bank account details for UTI Mutual Fund investments. |

| Governing Laws | The form complies with mutual fund regulations under the Securities and Exchange Board of India (SEBI). |

| Required Documents | Supportive documents must include proof of bank account, identity, and investment. |

| Format Requirements | Information on the form must be filled in capital letters and in English. |

| Document Verification | Original documents should be presented for verification at the time of submission. |

| Number of Bank Accounts | Investors can register up to five bank accounts using this form. |

| Submission Acknowledgment | A confirmation will be provided, subject to document verification, when the form is submitted. |

Guidelines on Utilizing Registration Bank

Once you have gathered all necessary documents, you can proceed to fill out the Registration Bank form. This form is essential for registering your bank details within your investment folio if they are not already recorded. Follow the steps below to ensure that you complete the form accurately and thoroughly.

- Begin by entering the Name of the Bank in the designated field.

- Provide the Branch of your bank clearly.

- Fill in your Account number. Ensure there are no typos.

- Select your Account type by checking one of the options available (NRO, Current, NRE, or Saving).

- Write down the MICR (9 Digit) code applicable to your bank account.

- Input the IFS Code (11 characters) accurately.

- Fill in the Branch address and ensure that it is complete and correct.

- Enter the Branch City in the following space.

- Complete the Branch Pin code as needed.

- Tick off the necessary supporting documents you are enclosing from sections B, C, and D, indicating which of them is included.

- Write the Date and ensure it follows the format D D M M Y Y Y Y.

- If you are submitting a Cancelled original cheque leaf, ensure it is attached.

- Attach either a copy of your bank passbook or bank statement that covers the previous three months.

- If applicable, include a letter from your bank stating your account number and the names of the account holders.

- For Proof of Identity, tick one of the boxes for documents like PAN, Aadhar Card, Voter ID, Passport, Photo Ration Card, or Driving License.

- Under Investment Proof, check one of the relevant boxes for documentation ranging from a Photo Debit Card to original SoA issued prior to 2007, depending on your circumstances.

- If you wish to update your Mobile No, Email ID, or PAN, include that information as well.

- Sign the declaration and provide your signature as per the mode of holding. Make sure all unit holders sign if there is more than one.

With the form completely filled out and all necessary documents attached, you can now submit it at your nearest UTI Financial Centre for verification. Be sure to keep copies of everything for your records.

What You Should Know About This Form

What is the purpose of the Registration Bank form?

The Registration Bank form is designed for UTI Mutual Fund unit holders who need to register their bank account details for the first time. This is essential for processing any transactions, such as redemptions or dividends, directly into their bank accounts. Without these details, transactions may be delayed or returned.

What information do I need to provide in the Registration Bank form?

When filling out the form, you need to include details such as the name of the bank, branch address, account number, account type, and MICR as well as IFS codes. Additionally, you'll have to check various boxes to indicate the types of supporting documents you are submitting. This ensures that all required information is documented clearly and accurately.

What supporting documents are required for registration?

You must submit a proof of bank account, proof of identity, and proof of investment. Depending on your situation, this can include a cancelled cheque, bank statement, PAN card, or an identification document. Ensure that the originals of these documents are available, as they will need to be verified in person during the submission.

How do I ensure my form is complete before submission?

Before submitting the form, check the checklist provided in the guidelines. Make sure all sections are filled out, your signatures are present according to your holding basis, and all required copies of documents are attached. Omitting information or signatures can lead to delays in processing.

What happens after I submit the Registration Bank form?

After you submit the form, it will be subject to verification. You will receive an acknowledgment indicating that your form has been received. The processing of your request will depend on the verification of your documents and signatures. If everything is in order, the bank details will be registered to your folio.

Can I register multiple bank accounts with this form?

This form is intended for the registration of a single bank account. If you wish to register up to five bank accounts, you will need to complete a separate "Multiple Bank Account Registration Form." This helps keep the documentation organized and ensures that each account is processed accurately.

Common mistakes

Filling out the Registration Bank form can be straightforward, yet many individuals overlook critical details that may lead to delays or outright rejection of their application. One common mistake is inadequate attention to detail when providing the bank branch name and account number. Missing or incorrect information in these sections can complicate the verification process and may ultimately hinder the registration of the bank account.

Another frequent error occurs in the selection of account types. Applicants sometimes check the wrong box or fail to indicate their account type altogether. Such oversights can lead to confusion, making it difficult for the financial institution to process requests. It is essential to verify the accuracy of these choices to avoid unnecessary rework.

The MICR code and IFS code are also areas where mistakes often occur. These codes must be precisely filled out; a minor digit error can misdirect funds and create significant issues in banking transactions. Therefore, ensuring that both codes are correct and noted legibly is key to successful registration.

Moreover, some applicants neglect the importance of attaching the necessary supporting documents outlined in sections B, C, and D of the form. Failing to include these documents can result in an incomplete application, which the bank may reject. It is vital to double-check that all required documentation is submitted in accordance with the outlined criteria.

One of the most underestimated yet critical components is the signature. Individuals often forget to sign the form or sign it incorrectly based on the mode of holding. The absence of the proper signature can render the application invalid, thus prolonging the process unnecessarily.

Lastly, incomplete contact information, such as not providing a mobile number or email ID, can create barriers in communication between the applicant and the financial institution. Should further information be required, inadequate contact details can prevent timely follow-up. Individuals should be meticulous about including complete and accurate personal information.

Documents used along the form

The Registration Bank form is an essential document used for recording bank account details in investment portfolios, particularly for those holding units in UTI Mutual Funds. When submitting this form, it's common to accompany it with various supporting documents. Each document serves a vital role in ensuring that the registration process is secure and compliant.

- Cancelled Original Cheque Leaf: This document provides proof of the bank account number and the name of the account holder. It should be a cheque with the bank's printed details.

- Copy of Bank Passbook or Statement: A recent statement or a copy of a passbook that verifies account ownership and activity, ideally from within the last three months.

- Letter from the Bank: A formal letter from the bank confirming the account number and the names of the account holders, further ensuring account verification.

- Proof of Identity: Any one form of identification such as a PAN card, Aadhar card, voter ID, passport, photo ration card, or driving license is required to verify the identity of the applicant.

- Proof of Investment: Documentation that proves investment in UTI schemes, such as an original Statement of Account, membership advice, or other relevant forms specific to UTI ULIP or traditional investment schemes.

- Mobile Number and Email ID Updates: It’s important to provide updated contact information, often required to ensure effective communication.

- PAN Card Copy: Attaching a copy of the PAN card helps in tax verification and serves as a formal identification document.

- Multiple Bank Account Registration Form: If an investor wishes to register more than one bank account, this form is necessary to facilitate that process.

- Acknowledgment Receipt: Upon submission, an acknowledgment is provided, documenting that the submission has been received for further verification.

Collectively, these documents strengthen the integrity of the registration process, protecting both the investor and the financial institution involved. Properly compiling and submitting these forms ensures a smooth and effective registration of bank details within investment portfolios.

Similar forms

-

Bank Account Opening Form: Similar to the Registration Bank form, a Bank Account Opening Form gathers essential details regarding the bank institution, account type, and personal identification of the account holder. It also requires proof of identity and typically asks for documents like a government-issued ID or a utility bill for address verification.

-

Mutual Fund Application Form: The Mutual Fund Application Form, like the Registration Bank form, collects information about the investor and their investment details. It often requires proof of identity and may ask for banking information to facilitate transactions. This form aims to establish the investor's profile and account management preferences.

-

Loan Application Form: Like the Registration Bank form, a Loan Application Form necessitates personal and financial details from the applicant. It usually requires identification proof, employment information, and financial documentation. Both forms facilitate the verification of the applicant's financial background and help the institution determine eligibility.

-

Investment Account Registration Form: This form is also similar to the Registration Bank form, as it collects information on the investor’s financial background and fund allocation preferences. Both require supporting documentation to authenticate the identity and banking details, ensuring that investment transactions are secure and efficient.

Dos and Don'ts

Things to Do When Filling Out the Registration Bank Form:

- Fill out the form in capital letters to ensure readability.

- Provide accurate bank account details as they appear on your documents.

- Include all required supporting documents for verification.

- Ensure that the form is signed by all account holders as per the holding basis.

- Attach copies of proof of identity and proof of investment.

- Enclose a cancelled original cheque leaf or a bank statement from the last three months.

- Keep the original documents handy for verification during submission.

Things Not to Do When Filling Out the Registration Bank Form:

- Do not submit the form without ensuring all fields are complete.

- Avoid using non-legible handwriting or mixed case letters.

- Do not provide inaccurate information, as it may lead to processing delays.

- Do not forget to include a copy of the PAN card if applicable.

- Avoid submitting documents that are outdated or irrelevant.

- Do not leave out signatures from any of the holders when required.

- Do not attempt to submit the form without the necessary supporting documents.

Misconceptions

- Misconception 1: The Registration Bank form is only for new investors.

- Misconception 2: You can submit any document for proof of identity.

- Misconception 3: Once you submit the form, your bank details are automatically updated.

- Misconception 4: Copies of documents are sufficient; original documents are not needed.

- Misconception 5: You can register multiple bank accounts using a single form.

- Misconception 6: The form does not require a signature.

- Misconception 7: Any type of bank statement can be submitted as proof.

- Misconception 8: The Registration Bank form is the same for all UTI schemes.

Misconception 1: The Registration Bank form is only for new investors. In reality, this form is meant for all unitholders whose bank details are not yet registered in their folio, regardless of their investment history.

Misconception 2: You can submit any document for proof of identity. Actually, specific forms of identity proof are required, such as a PAN card or passport. Ensure you choose from the provided options.

Misconception 3: Once you submit the form, your bank details are automatically updated. This is incorrect, as the changes are subject to verification before being processed.

Misconception 4: Copies of documents are sufficient; original documents are not needed. This is misleading. You must present the original documents for verification at the time of submission.

Misconception 5: You can register multiple bank accounts using a single form. However, if you wish to register more than one bank account, you must complete a separate Multiple Bank Account Registration Form.

Misconception 6: The form does not require a signature. This is false. Signatures are mandatory to validate the request, and they must match the mode of holding.

Misconception 7: Any type of bank statement can be submitted as proof. In fact, only specific documents, such as a bank statement from the previous three months, are acceptable.

Misconception 8: The Registration Bank form is the same for all UTI schemes. This is incorrect; the requirements may vary between different UTI schemes, making it crucial to follow the specific guidelines provided.

Key takeaways

When filling out the Registration Bank form, keeping a few key points in mind can simplify the process immensely. Here’s what to remember:

- Fill Out Clearly: Ensure you complete the form in block letters and legibly. This practice helps avoid any misunderstandings regarding your bank account details.

- Provide Accurate Documentation: Include self-attested copies of all required documents. These include proof of your bank account, identity, and investment. Originals should also be brought for verification.

- Signature Matters: Make sure to sign the form according to how your account is held. Each unit holder must sign to ensure the request is valid.

- Contact Information: Update your mobile number and email address on the form. Having current contact information is essential for any follow-up communications.

Following these guidelines can help ensure a smooth processing of your bank account registration. If assistance is needed, reaching out to your nearest UTI Financial Centre can provide valuable support along the way.

Browse Other Templates

Cmsnet - Ensure cooperation with the security requirements outlined by CMS.

How to Dissolve Llc in Texas - The option for electronic waiver reflects evolving filing requirements.