Fill Out Your Reimbursement Ford Form

The Reimbursement Ford form serves as a crucial tool for retirees seeking reimbursement for qualified healthcare expenses. Upon submitting this form, individuals must provide concrete documentation proving that these expenses were incurred for themselves or their eligible dependents. Retirees need to ensure that the documentation includes essential details such as the date of the service, the names of those covered by health insurance, the provider's information, and the specific type of expense incurred, whether it’s for insurance, medical services, or medications. Different sections of the form cater to varying reimbursement requests. For example, retirees must utilize the specific section dealing with Social Security Administration-deducted premiums if they want reimbursement for Medicare premiums directly taken from their Social Security checks. Alternatively, if expenses were paid out-of-pocket after taxes, another section is dedicated to those claims. It's paramount that individuals fill out the form legibly and accurately, including their Social Security Numbers as appropriate for smoother processing. Furthermore, receipts must be preserved and clear copies submitted; otherwise, retirees may face complications or additional requests for resubmission. Understanding these fundamental components facilitates an efficient claims process, ultimately benefitting the financial well-being of Ford retirees navigating their healthcare expenses.

Reimbursement Ford Example

INSTRUCTIONS

(Do NOT FAX these instructions with your1 Claim)

PLEASE READ THIS BEFORE SUBMITTING YOUR RETIREE CLAIM FORM

The IRS requires you to substantiate all your claims with appropriate level of documentation in order to be reimbursed. Documentation in total must show that an eligible health care expense has been incurred by you or your eligible dependent. The documentation must show at a minimum

a)the date of coverage or expense

b)the individual covered by health coverage or the individual that incurred the expense

c)name of the provider, merchant, or insurance carrier

d)type of expense (insurance, or other eligible expense, such as medical service, prescription, over the counter medication, etc)

You will also be required to provide additional documentation for private health care premiums to show evidence of payment such as copy of the front and back of a cleared check along with the provider’s invoice or bill.

Tips for Completing the Ford HRA Retiree Pay Me Back Claim Form

XPrint, or write legibly.

XComplete a separate form for your Dependent, Spouse or Domestic Partner.

XMake sure you sign the form. If a person holding a Power of Attorney for the Retiree is signing, please make sure he or she signs the form in the following format “John Smith, Attorney in Fact for Jane Smith” [Make sure the Power of Attorney is either on file or submitted with the first claim.]

XThe account holder Name section should be completed with the Ford Retiree’s First and Last Name UNLESS you are a surviving spouse of a Ford Retiree where you will complete your name in the name field.

XIf you have a spouse, put your spouse’s Social Security Number (SSN) to better expedite your claim.

XKeep your original receipts, make copies — if your claim is incomplete, you will be required to resubmit the claim form and receipts. Send legible copies of your receipts.

XDo not submit premium expenses on this claim form for premiums paid to your health plan if you have elected the

1[As used on this form, “you,” “your” or “yours” refer to the Retiree.]

Page 1 of 3 |

Ford HRA Retiree Pay Me Back Claim Form Instructions

Section 1 – One Time Annual Request for Social Security Administration (SSA) Deduct Premiums (Medicare Part B, Medicare Part C – Medicare Advantage, Medicare Part D – Prescriptions)

XComplete this section if you are requesting reimbursement for a premium that is deducted from your Social Security Check.

XIn the “Service Start Date” boxes, enter the first of the month in which you are eligible for Medicare Part B, C or D for this year. In the “Service End Date” boxes, enter the last day of the year. (If eligible for Medicare Part B, C or D on January 1, this will be January 1 to December 31.)

XEnter the annual amount of your Medicare Part B, C or D expense (the monthly amount multiplied by the number of months of coverage.)

XInclude a copy of your Social Security “Cost of Living Statement” as proof of your expense (typically mailed starting in November the year before it becomes effective) or any other Medicare statement that clearly indicates your Medicare B, C or D premiums. If the cost is not deducted from your Social Security Check, please fill out Section 2 (Health Care Premiums Not Deducted from Your Social Security Check) on the claim form in order to be reimbursed.

XYou will be reimbursed on a

Section 2 – Health Care Premiums Not Deducted from Your Social Security Check

XComplete this section if you are requesting a lump sum reimbursement for Health Care premiums that:

-were not deducted from your Social Security Check, and

-you have paid to your health plan on an

XMake sure to provide documentation such as a statement from your insurance carrier, or a copy of the front and back of a cleared check that shows the premiums you have paid.

XThe Service Start and End Dates should represent the period of coverage you have paid for and are seeking reimbursement for. These dates should match the statement from your health plan indicating the coverage period you have paid for.

XKeep your original receipts and make copies to fax or mail to WageWorks.

XNote:

Page 2 of 3 |

Ford HRA Retiree Pay Me Back Claim Form Instructions

Section 3 – Other Expenses

XIf you are requesting reimbursement for other

XAcceptable forms of documentation to show the item was an eligible expense include a receipt or an explanation of benefits from your health plan.

XDocumentation should show the date of service, amount of the expense, and a description of the expense.

XWhen completing the claim form indicate who the expense was for.

XYou may add up more than one receipt or expenses incurred for several small eligible expenses and enter that amount on the claim form. When submitting several receipts or pieces of documentation please circle the expense amounts, date of service and description on each receipt or supporting documentation. Print the earliest service start date on the claim form if requesting reimbursement for several expenses. You will also need to indicate on the claim form who the expenses were for. (Self, Spouse, Dependent)

Page 3 of 3 |

Health Reimbursement Arrangement (HRA)

www.wageworks.com |

RETIREE Pay Me Back Claim Form |

Or, mail to: Claims Administrator, PO Box 14053, Lexington, KY 40512

DO NOT USE A FAX COVER SHEET

to ensure speedy processing.

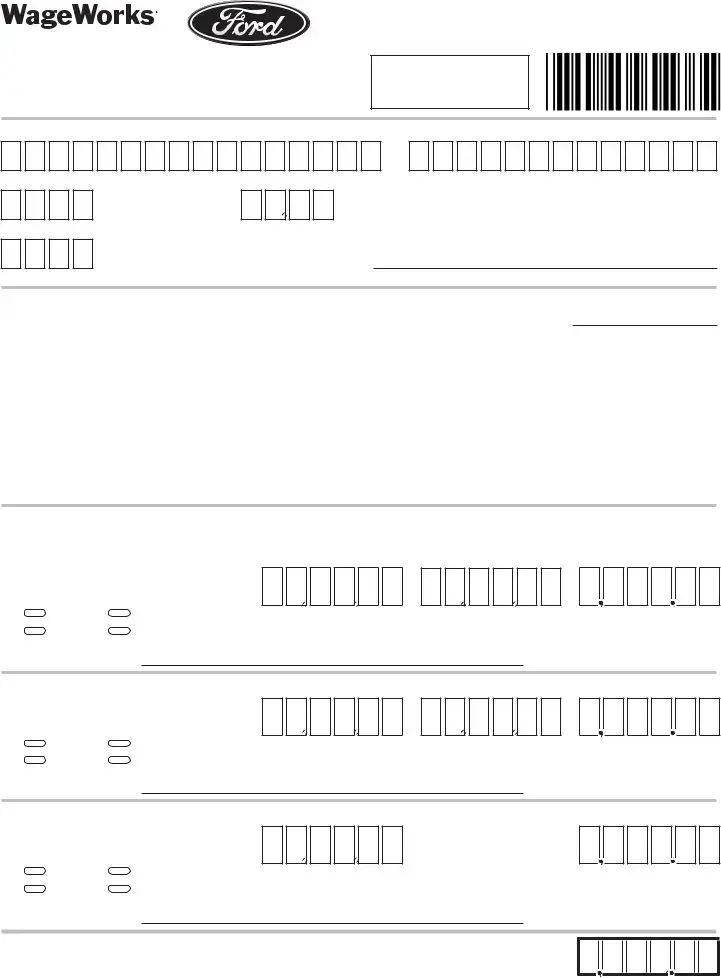

ACCOUNT HOLDER INFORMATION

Last Name

Ford Retiree SSN* (last 4 digits)

First Name

Retiree Birth Date (MM/DD)

Spouse/Survivor SSN* (last 4 digits) (if applicable) Email Address (complete only if new)

CERTIFICATION AND AUTHORIZATION

Signature of Account Holder X |

|

Date |

I certify that the information on this form is accurate and complete. I am requesting reimbursement for eligible expenses incurred by myself or an eligible dependent while I was a participant in the plan. (Patient & Relationship is assumed to be Self unless otherwise indicated.) I have already received these products and services and I have not/will not seek reimbursement of this expense from any other plan or party because I: 1) am required to pay for the premiums through withholding, 2) have paid for the premiums, 3) have already received these products and services. If I am covered under more than one health care account, reimbursement will be made according to the payment order determined by those plans and as stated on the WageWorks Web site. Use of this service indicates my acceptance of the WageWorks User Agreement at www.wageworks.com (available upon registration; enter user name and password or click on First Time User).

CLAIMS FOR

1.One Time Annual Request for Social Security Administration (SSA) Deducted Premiums (Medicare Part B, Medicare Part C – Medicare Advantage, Medicare Part D – Prescriptions)

Relationship to |

|

|

Account Holder |

|

|

Self |

Domestic Partner |

Service Start Date |

Spouse |

Dependent |

(MM/DD/YY) |

Patient’s Name

Service End Date

(MM/DD/YY)

$

Annual

Cost

2. Health Plan Premiums Not Deducted from Your Social Security Check

Relationship to

Account Holder

Self |

Domestic Partner |

Spouse |

Dependent |

Patient’s Name

Service Start Date

(MM/DD/YY)

Service End Date

(MM/DD/YY)

$

3.Other Expenses  Medical

Medical  Dental

Dental  Vision

Vision  Prescriptions

Prescriptions  Over-the-counter

Over-the-counter

Relationship to |

|

|

$ |

Account Holder |

|

||

|

|

||

Self |

Domestic Partner |

Service Date |

Total |

Spouse |

Dependent |

(MM/DD/YY) |

|

Patient’s Name

*The last 4 digits of the Social Security Number (SSN) is needed to assist us in identifying your account and to process your claim.

YOU MUST ATTACH A COPY OF APPROPRIATE PROOF OF SERVICE AND PAYMENT FOR EACH AMOUNT ABOVE.

$

TOTAL THIS FORM

Form Characteristics

| Fact Name | Description |

|---|---|

| Documentation Requirement | The IRS mandates that all claims submitted using the Reimbursement Ford form must be supported by appropriate documentation to confirm eligibility for reimbursement. |

| Minimum Documentation Criteria | Claims must include details such as the date of expense, the individual who incurred it, the provider's name, and the type of expense. |

| Separate Forms for Dependents | Submit a separate claim form for each dependent or spouse to ensure clarity and efficiency in processing. |

| Signature Requirement | A signature is essential for the claim to be valid. If signed by a Power of Attorney, it must clearly state the legal capacity of the signer. |

| Medicare Section | Section 1 of the form addresses reimbursement requests for premiums deducted from Social Security payments, and specific documentation is required. |

| Non-Deducted Premiums | Section 2 is dedicated to Health Care premiums not deducted from Social Security, allowing for lump sum reimbursement requests. |

| Out-of-Pocket Expenses | Section 3 allows for the submission of other medical expenses, including co-pays and over-the-counter items, alongside appropriate documentation. |

| Claim Processing | To expedite processing, send legible copies of documentation and maintain original receipts. Claims may need resubmission if incomplete. |

| Governing Law | This form is governed by IRS regulations as they pertain to Health Reimbursement Arrangements (HRAs) in the United States. |

Guidelines on Utilizing Reimbursement Ford

Completing the Reimbursement Ford form is an essential step for retirees looking to manage their healthcare expenses effectively. As you prepare to fill out this form, ensure you have all necessary documentation on hand to support your claims. Following precise steps will help to streamline your submission and expedite the reimbursement process.

- Gather documentation: Collect receipts, invoices, and any other requisite documents that show your eligible healthcare expenses, including dates and who incurred the costs.

- Identify appropriate sections: Determine if your claim falls under one-time annual requests for Social Security Administration deducted premiums, health care premiums not deducted from Social Security, or other eligible expenses.

- Complete Section 1: If applicable, fill in the service dates and annual costs for Medicare premiums. Attach a copy of the Social Security “Cost of Living Statement” or relevant Medicare documentation.

- Complete Section 2: If your health care premiums were not deducted from your Social Security, document the paid premiums along with coverage dates and required receipts.

- Complete Section 3: For claiming other expenses, list each and provide specific documentation, such as receipts or explanations of benefits, clearly showing eligibility.

- Fill in account holder information: Ensure to accurately enter your name, Social Security Number (last four digits), and other requested personal information.

- Sign and date: Before submission, provide your signature in the designated area, certifying that the information is accurate and complete. If someone with Power of Attorney signs, they should include their title.

- Make copies: Keep legible copies of all documents for your records before submitting the claim form and receipts.

- Submit the form: Send the completed form along with all necessary documents to the provided fax number or mailing address.

By carefully following these steps, you can ensure that your Reimbursement Ford form is well-prepared for submission. Remember to verify all information for accuracy to facilitate prompt processing.

What You Should Know About This Form

What is the Reimbursement Ford form and who should use it?

The Reimbursement Ford form is a claim form designed for Ford retirees to request reimbursement for eligible healthcare expenses incurred by themselves or their dependents. Retirees who have paid for healthcare services or premiums and who seek reimbursement through their Health Reimbursement Arrangement (HRA) should use this form.

What documentation do I need to submit with my claim?

To ensure your claim is processed, documentation must substantiate each expense. This includes details such as the date of the expense, the individual who incurred it, the name of the provider or merchant, and a description of the expense type. If you are claiming private health premiums, include a copy of a cleared check and the provider’s invoice. It is advisable to keep copies of all documents submitted for your records.

How do I fill out the claim form correctly?

Complete the form clearly, either by printing or writing legibly. Each dependent or spouse requires a separate form. Ensure you sign the claim. If a Power of Attorney is signing, they should write "Attorney in Fact" followed by the retiree’s name. Include the Ford retiree’s name in the account holder section unless you are the surviving spouse, in which case your name should be recorded.

What if I have not paid for my premiums through Social Security?

If your health care premiums are not deducted from your Social Security check, use the section for health care premiums not deducted. You must provide evidence of payment such as clear copies of checks or statements from your insurance carrier. Make sure the coverage dates align with the period for which you are claiming reimbursement.

Can I submit claims for other types of expenses?

Yes, you may request reimbursement for other out-of-pocket expenses such as co-pays, dental services, and eligible over-the-counter items. Documentation for these expenses must demonstrate the date, amount, and nature of the service. You can add up multiple expenses on the form, but you need to provide details for each expense submitted.

What should I do if my claim is incomplete?

If the claim is deemed incomplete after submission, you will need to resubmit both the claim form and the necessary receipts. For this reason, maintaining copies of your original receipts is crucial. Clear documentation is key to a smooth reimbursement process.

Is it necessary to submit anything for auto-reimbursement?

If you have chosen the auto-reimbursement option through Extend Health, do not submit premium expenses for reimbursement through this claim form. Instead, those expenses will be handled automatically through the selected program.

How will I receive the reimbursement once my claim is approved?

After your claim is approved, reimbursement will be processed based on the balance in your account. Funds will generally be disbursed on a pro-rated monthly basis, corresponding with the information you provided regarding the incurred expenses. Regular updates regarding your claims can be accessed through the WageWorks website.

Common mistakes

Filling out the Reimbursement Ford form can be a straightforward process, but many individuals make common mistakes that can delay their reimbursement or result in rejected claims. Understanding these pitfalls is essential.

One significant mistake is not providing proper documentation. The IRS mandates that every claim be substantiated with appropriate documentation, including the date of the expense, the individual covered, the name of the provider, and the type of expense. If this information is missing, your claim may not be processed.

Another common error involves submitting the wrong claim section. The form has distinct sections for different types of reimbursements, such as Social Security deducted premiums and other medical expenses. Failing to fill out the correct section can complicate your claim and lead to unnecessary wait times.

Legibility matters. Several claims are rejected each year because they are filled out in unclear handwriting or poorly printed. It's crucial to take the time to write or print legibly, ensuring that all information is easy to read.

Moreover, forgetting to sign the form can be a simple yet frustrating mistake. Your signature is a confirmation of accuracy and authenticity. Without it, the claims administrator may not process your request.

People often confuse the section for the account holder's name. It's essential to use the Ford retiree's first and last name, unless you are filling it out as a surviving spouse. Misidentification here can lead to processing errors.

Additionally, many forget to include Social Security numbers when applicable. Including your spouse's Social Security Number can expedite the claim process. Without it, delays may occur as the claims administrator may need to follow up for that information.

Keepsakes can be costly mistakes too. Some individuals submit original receipts rather than copies. Retaining the originals is crucial since you may need them for future claims. Always make sure to keep original receipts and submit only the copies.

Lastly, remember to submit all necessary paperwork at once. Incomplete submissions lead to requests for resubmission. This can chain delay your reimbursement. Ensure your forms and supporting documents are complete before sending them in.

Avoiding these common mistakes can lead to a smoother reimbursement experience. Before you submit your claim, double-check everything. Doing so can help you receive your reimbursement in a timely manner.

Documents used along the form

When submitting the Reimbursement Ford form, several other documents may also be necessary to ensure a smooth reimbursement process. These additional forms serve to validate claims, facilitate transactions, and confirm eligibility. Below is a list of key documents you might encounter alongside your reimbursement claim.

- Receipt for Medical Expenses: This document provides proof of purchase for medical services or supplies. It should include details such as the date of service, description of the service or item, and the amount paid.

- Explanation of Benefits (EOB): An EOB is sent by your health insurance provider after you receive medical care. This document explains what was covered, the amount billed, and what you may owe after insurance has paid.

- Medicare Premium Statement: This statement outlines the monthly Medicare premiums you are required to pay. It's essential for justifying reimbursement claims for Medicare-related expenses.

- Cleared Check Copy: A copy of a cleared check proves payment for health-related services or premiums. It should show both the front and back of the check to confirm that it has been processed by the bank.

- Provider Invoice or Bill: This is a formal request for payment from your healthcare provider detailing the services rendered and their associated costs. It should clearly indicate the dates of service and the patient’s name.

- Power of Attorney (if applicable): If someone else is submitting the claim on your behalf, a power of attorney document will be needed. This shows the authority granted to that individual to act for you in financial matters.

Gathering these documents prior to submission can streamline the claims process and help avoid delays in obtaining the reimbursements you deserve. Ensuring accuracy and completeness in your documentation will significantly enhance your chances of a successful claim outcome.

Similar forms

Understanding reimbursement forms can be essential for managing healthcare expenses effectively. The Reimbursement Ford form bears similarities to several other documents that serve similar purposes in tracking and requesting reimbursements for eligible healthcare costs. Here’s a concise overview of ten documents the Reimbursement Ford form is akin to:

- Expense Reimbursement Form: Like the Reimbursement Ford form, this document requests repayment for incurred expenditures, often requiring similar supporting documentation to verify the expense.

- Health Savings Account (HSA) Claim Form: This form allows individuals to request reimbursements from their HSA, detailing eligible medical expenses, much like the documentation requirements outlined in the Ford form.

- Flexible Spending Account (FSA) Claim Form: Similar in nature, an FSA claim form enables employees to request reimbursement for out-of-pocket health costs. It requires documentation, such as receipts, that validate the claim.

- Insurance Claim Form: Healthcare providers often use these forms to obtain payments from insurance companies. They share a need for detailed information concerning the service provided and any costs associated.

- Medicare Reimbursement Form: This form serves those seeking reimbursement from Medicare for covered medical expenses, aligning with requirements to provide proof of incurred costs.

- Tax Deduction Forms (Schedule A): Individuals claiming medical expenses as tax deductions must provide thorough documentation of healthcare-related costs, similar to the proof required for the Ford reimbursement claim.

- Provider Billing Statements: These statements outline the services received and costs owed, often serving as critical documentation for the reimbursement forms detailing eligible expenses.

- Dependent Care Expense Reimbursement Form: This form allows reimbursements for eligible dependent care costs. It shares similarities in documentation needs to validate expenses and eligibility.

- Out-of-Pocket Expense Report: Employees may compile this report to detail and reclaim costs incurred during employment, paralleling the Ford payment request procedure.

- Supplemental Insurance Claim Form: If utilizing supplemental insurance for healthcare expenses, this form outlines expenses and requests reimbursement, much like the process described in the Ford form.

Each of these documents serves a similar purpose: helping individuals recoup costs associated with healthcare. Familiarity with them can streamline the process of managing personal health finances.

Dos and Don'ts

- Print or write clearly when filling out the form.

- Complete a separate form for each dependent or spouse.

- Sign the form to validate your claim.

- Keep your original receipts; make copies for submission.

- Include your spouse’s Social Security Number to expedite the claim.

- Ensure all documentation matches the expenses claimed.

- Do not submit claims for premiums deducted from Social Security if enrolled in auto-reimbursement.

Do not overlook any required documentation as this can delay processing.

Do not combine claims for different types of expenses on one form.

Do not fax the instruction page along with your claim.

Do not provide pre-tax deductions, as they are ineligible for reimbursement.

Avoid use of a fax cover sheet; this ensures faster processing.

Do not forget to check that all dates and amounts are accurately entered.

Do not submit forms without your signature where indicated, as it invalidates the claim.

Misconceptions

Misconception 1: The Reimbursement Ford form can be submitted without documentation.

Many believe they can simply fill out the form and submit it. In reality, the IRS requires clear documentation for all claims. This means you need to provide proof showing that eligible expenses have been incurred, including the date, individuals involved, and the type of expense.

Misconception 2: Only health care premiums are eligible for reimbursement.

Some people think they can only claim health care premiums on this form. However, you can also seek reimbursement for various other eligible expenses, such as co-pays, dental services, and prescription costs, provided you have the appropriate documentation.

Misconception 3: Any document will suffice as proof for expenses.

This isn't the case. The documentation must be specific and show important details like the date of service and the nature of the expense. Generic invoices or unclear statements often lead to denial of the claim.

Misconception 4: You do not need to keep original receipts once submitted.

It's crucial to keep your original receipts. If your claim is incomplete, you might have to resubmit the entire claim, requiring you to produce those receipts again. Always retain copies for your records.

Misconception 5: The form can be completed by anyone on behalf of the retiree.

While another person can assist, the retiree must sign the form themselves, or a Power of Attorney must be noted clearly. Using the proper signature format is essential for processing the claim accurately.

Key takeaways

When filling out the Reimbursement Ford form, it's essential to follow certain guidelines to ensure a smooth process. Here are nine key takeaways:

- Document Everything: The IRS requires documentation to substantiate claims. This includes showing that an eligible health care expense was incurred, either by you or an eligible dependent.

- Required Information: Documentation must include the date of coverage or expense, the person covered, the provider's name, and the type of expense incurred.

- Additional Documentation: For private health care premiums, submit proof of payment, such as copies of cleared checks along with the provider’s invoice.

- Legible Completion: Whether typing or handwriting, ensure that all information is clear. Ambiguity may cause delays in processing.

- Separate Forms for Dependents: Complete a distinct form for any dependents, spouse, or domestic partner to ensure all claims are processed accurately.

- Signatures Matter: Remember to sign the form. A person holding a Power of Attorney should sign in a specific format to validate the claim.

- Keep Original Receipts: Always retain original receipts. If a claim is incomplete, you will need to resubmit receipts, which may cause delays.

- Avoid Auto-Reimbursement Confusion: Do not submit premium expenses for plans where you have chosen the auto-reimbursement process through Extend Health.

- Check for Accuracy: Ensure all information matches supporting documentation, especially in the start and end dates for service periods.

Adhering to these guidelines will help streamline the reimbursement process. Thorough preparation is key for a successful claim submission.

Browse Other Templates

What Is a Form 945 - Even if there are no employees or taxes due, employers are still required to submit this quarterly report.

Documents Update Rc Rushcard - Indicate the transaction you are disputing and why.

Photography Order Forms - Secure your spot for photography services by completing the form today.