Fill Out Your Release Of Lien Texas Form

The Release Of Lien Texas form plays a crucial role in the process of extinguishing a lien on a property in Texas. When a borrower pays off a loan, this form serves as a formal acknowledgment from the lender, often referred to as the holder of the note, that the debt has been fulfilled. Key details such as the date of the original note, the borrower's name, and the property description will be included in the document. This form not only signifies the satisfaction of the outstanding debt but also releases the property from any associated liens held by the lender, eliminating any claims they once had against it. Furthermore, it explicitly states that the lender waives any rights to enforce the lien in the future, providing much-needed clarity and peace of mind to the borrower. It is important to note that the form must be duly notarized and recorded with the appropriate local authorities to ensure its legal standing. Understanding the nuances of this document can help borrowers navigate the complexities of debt resolution and property ownership in Texas, ultimately fostering more secure real estate transactions.

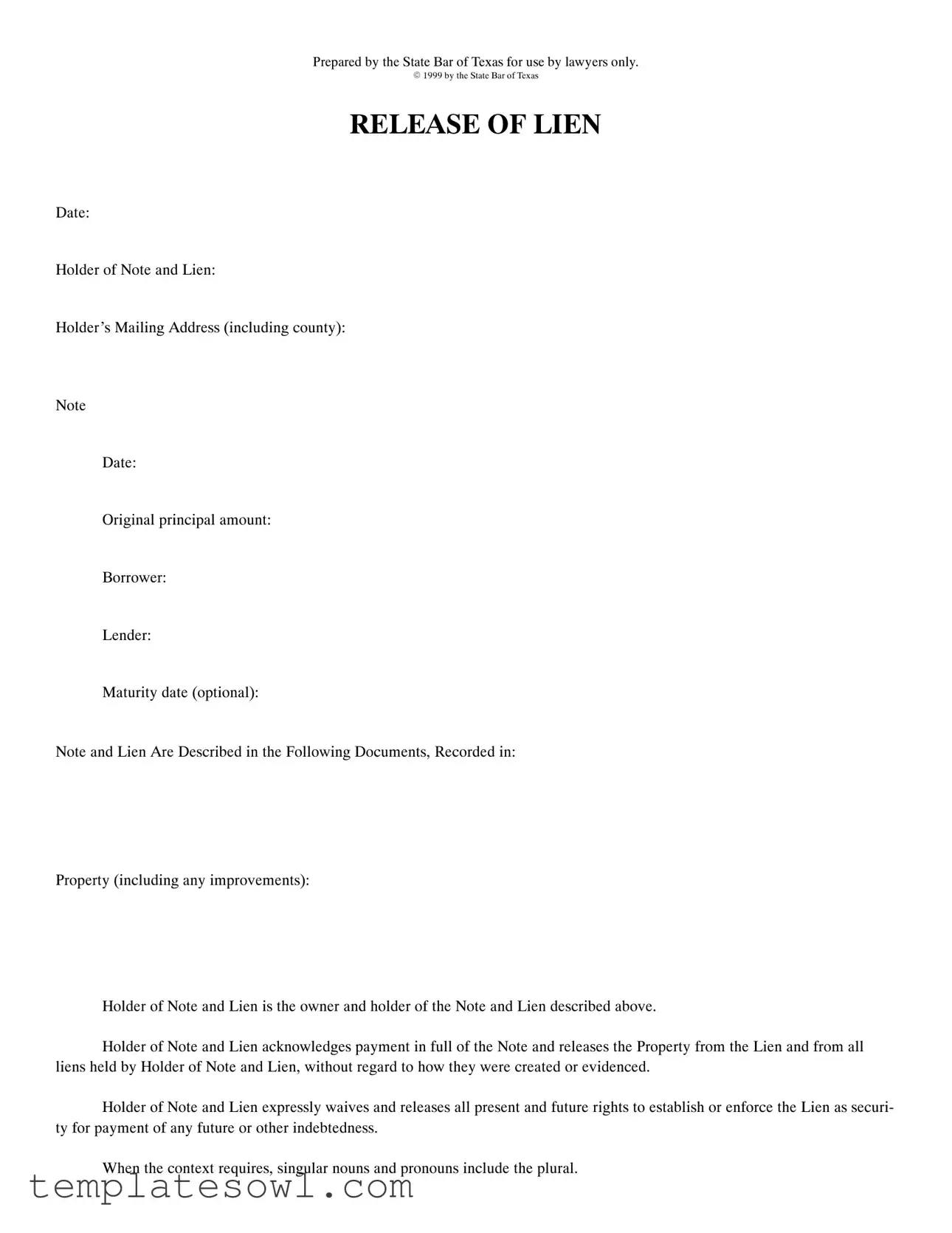

Release Of Lien Texas Example

Prepared by the State Bar of Texas for use by lawyers only.

E 1999 by the State Bar of Texas

RELEASE OF LIEN

Date:

Holder of Note and Lien:

Holder’s Mailing Address (including county):

Note

Date:

Original principal amount:

Borrower:

Lender:

Maturity date (optional):

Note and Lien Are Described in the Following Documents, Recorded in:

Property (including any improvements):

Holder of Note and Lien is the owner and holder of the Note and Lien described above.

Holder of Note and Lien acknowledges payment in full of the Note and releases the Property from the Lien and from all liens held by Holder of Note and Lien, without regard to how they were created or evidenced.

Holder of Note and Lien expressly waives and releases all present and future rights to establish or enforce the Lien as securi- ty for payment of any future or other indebtedness.

When the context requires, singular nouns and pronouns include the plural.

|

(Acknowledgment) |

|

STATE OF TEXAS |

|

|

COUNTY OF |

|

|

This instrument was acknowledged before me on |

, |

|

by |

. |

|

|

|

|

|

Notary Public, State of Texas |

|

|

Notary’s name (printed): |

|

|

Notary’s commission expires: |

|

|

(Corporate Acknowledgment) |

|

STATE OF TEXAS |

|

|

COUNTY OF |

|

|

This instrument was acknowledged before me on |

, |

|

by |

, |

|

of |

|

|

a |

|

corporation, on behalf of said corporation. |

|

|

|

|

Notary Public, State of Texas |

|

|

Notary’s name (printed): |

|

|

Notary’s commission expires: |

|

AFTER RECORDING RETURN TO: |

PREPARED IN THE LAW OFFICE OF: |

Form Characteristics

| Fact Name | Details |

|---|---|

| Document Purpose | The Release of Lien form is used to formally release a lien against a property once a debt has been paid in full. |

| Governing Law | This form is governed by Texas Property Code §§ 51.003 and 52.001. |

| Prepared By | This form was prepared by the State Bar of Texas specifically for use by lawyers. |

| Notary Requirement | A notary public must acknowledge the instrument before it becomes valid. |

| Components | The form includes sections for information such as the holder of the note, borrower's details, and the original principal amount. |

| Waiver of Rights | The holder waives the right to enforce the lien for any future indebtedness. |

| Transaction Date | A specific date must be entered on the form to indicate when the lien is being released. |

| Return Instructions | After recording, the document should be returned to the law office indicated at the bottom of the form. |

| Document Expiry | The notary's commission must be clearly stated, including when it expires, ensuring that the acknowledgment is valid. |

Guidelines on Utilizing Release Of Lien Texas

Once the Release of Lien form is completed and signed, it should be filed with the appropriate local government office, usually the county clerk's office, to officially release the lien on the property. This process ensures that the lien is removed from public records, clarifying the ownership of the property and the absence of any claims against it.

- Header: Write the date at the top of the form.

- Holder of the Note and Lien: Provide the full name of the individual or entity holding the note and lien.

- Holder’s Mailing Address: Fill in the complete mailing address, including the county.

- Note Date: Enter the date when the original note was signed.

- Original Principal Amount: Specify the amount of money originally borrowed.

- Borrower: Include the name of the person or entity that borrowed the money.

- Lender: Fill in the name of the entity or individual who lent the money.

- Maturity Date (optional): Provide the date when the loan was due, if applicable.

- Documents Description: Describe the documents that detail the note and lien, including where they are recorded.

- Property Description: Clearly describe the property, including any improvements made to it.

- Acknowledgment Statement: Confirm that the holder acknowledges payment in full and agrees to release the property from the lien.

- Notary Section: Have the document acknowledged by a notary public, including filling out the notary’s name and commission expiration date.

- Corporate Acknowledgment (if applicable): If a corporation is involved, complete the corporate acknowledgment section similarly with the notary’s information.

- Return Address: Specify where the document should be returned after recording, usually the law office preparing it.

What You Should Know About This Form

What is a Release of Lien Texas form?

The Release of Lien Texas form is a legal document used to confirm that a lien on a property has been satisfied and is no longer in effect. This form marks the formal acknowledgment from the holder of the lien that they have received full payment or have otherwise agreed to release the lien. It's crucial for property owners who want to clear their titles.

Who needs a Release of Lien?

Anyone who has had a lien placed against their property in Texas may need a Release of Lien. This typically includes borrowers who have paid off their mortgage or any other debts secured by a lien. Additionally, lenders or lien holders should provide this document once outstanding obligations have been fulfilled.

How do I obtain a Release of Lien?

The document can often be prepared by a lawyer or legal professional familiar with Texas property law. The holders of the lien may also create the document themselves, provided they follow the correct format and include all necessary details, such as the original loan amount and property description.

What information is required to complete the Release of Lien?

You will need to provide several details. This includes the date of the release, the holder of the note and lien, their mailing address, the original principal amount of the loan, the borrower’s name, and a description of the property. The document should clearly indicate that the lien has been released.

Is the Release of Lien legally binding?

Yes, once properly completed and signed, the Release of Lien is legally binding. It serves as official proof that the lien has been released. To ensure its effectiveness, the document should be recorded with the county clerk's office where the property is located.

What happens if the Release of Lien is not filed?

If the Release of Lien is not filed after a debt is paid, the lien may remain on public record. This can complicate future property sales or refinancing because potential buyers or lenders may see the lien as a barrier. Filing the release is crucial for clearing the record.

Is there a fee associated with recording the Release of Lien?

Yes, there is typically a fee charged by the county clerk’s office to record the Release of Lien. Fees can vary depending on the county. It's advisable to check with the local office for the exact amount prior to submission.

Can I revoke a Release of Lien?

Once a Release of Lien has been recorded, it generally cannot be revoked. The property is thereby cleared of the lien permanently. If there are issues or disputes regarding the lien's release, it may require legal action to address the situation.

What should I do after obtaining a Release of Lien?

After obtaining a Release of Lien, make sure to thoroughly review the document to ensure all information is accurate. It's essential to file it with the appropriate county clerk's office. Keep a copy for your records, as it is proof that the lien has been released.

Common mistakes

When filling out the Release Of Lien Texas form, individuals often overlook key details that can lead to complications. One common mistake is failing to clearly write the date of the document. This date is essential as it establishes when the lien was officially released. Without a proper date, the form could be questioned, potentially causing delays in the release process.

Another frequent error involves incorrect identification of the Holder of Note and Lien. It is important that the name provided accurately reflects the current holder. If the wrong name is listed, it can result in confusion and may invalidate the release. Ensuring that this information matches official records is crucial.

Many people forget to include the Holder’s Mailing Address, which should contain a complete address, including the county. Omitting this information can create difficulties for future correspondence and could hinder the processing of the lien release.

Also, individuals sometimes neglect to indicate the Original Principal Amount of the note. This detail is necessary to confirm the amount that was secured by the lien. Leaving this blank might lead to disputes regarding the lien’s validity.

Another common mistake arises when borrowers do not properly identify themselves. The section labeled Borrower must include the full name of the individual or entity responsible for the debt. Errors here can complicate matters if a dispute regarding the lien arises later.

Omitting the Maturity Date, though optional, can also be a misstep. This date indicates when the loan is supposed to be repaid. While it may not be mandatory, including it can help clarify any misunderstandings about the loan terms.

Some individuals fail to adequately describe the Property associated with the lien. It is vital to provide a thorough description, including any improvements. This ensures that there is no confusion about what property the lien release pertains to.

Inaccurate documentation of how the lien and note are described in recorded documents can lead to issues. Individuals should take care to specify the correct documents. Misidentifying these can render the release ineffective.

Additionally, many forget to seek notarization. The Acknowledgment section must be properly completed and signed in front of a notary public. Failure to do this means the release may not be legally enforceable, which could undermine its purpose.

Finally, returning the completed form correctly is essential. After recording, the document should be sent to the designated return address, which is often overlooked. Attention to these details can ensure a smoother process in the release of liens, avoiding unnecessary complications.

Documents used along the form

When dealing with the Release Of Lien Texas form, several other documents may be necessary to ensure that all legal aspects surrounding the lien are completely addressed. Each of these documents serves a unique purpose and can streamline the process of releasing a lien effectively.

- Affidavit of Release: This document serves as a sworn statement from the lienholder confirming that all debts have been satisfied and the lien is no longer valid.

- Deed of Trust: Often used in conjunction with a lien, this document outlines the terms under which property is secured, including the responsibilities of the borrower.

- Notice of Default: This form notifies the borrower that they are in default on their obligations and may be at risk of losing their property.

- Mortgage Payment History: Providing a detailed record of all payments made towards the loan, this document can help verify the satisfaction of the debt associated with the lien.

- Tax Certification: It proves that all property taxes have been paid and clears any potential liens related to tax delinquency.

- Release of Judgment Lien: If a judgment lien is involved, this document explicitly states that the lien has been released and is no longer enforceable.

- Acknowledgment of Satisfaction of Debt: This formal acknowledgment from the lender confirms that the debt has been fully paid, paving the way for the lien release.

- Quitclaim Deed: Should there be any transfer of ownership involved, a quitclaim deed can be utilized to relinquish any claims to the property.

- Final Payment Receipt: This serves as proof that the last payment has been made, reinforcing the release of the lien.

Understanding these associated documents can greatly enhance communication between parties and facilitate a smoother transaction when addressing lien releases. Proper documentation ensures that all parties are clear about their rights and obligations, ultimately helping to avoid any confusion or disputes in the future.

Similar forms

Release of Mortgage: Similar to a Release of Lien, this document formally removes the mortgage holder's claim against the property once the mortgage is paid in full. Both documents serve to clarify that the borrower has satisfied their obligation to the lender.

Deed of Trust Release: This document signifies the release of a deed of trust, which is a secured transaction that involves real estate. Like the Release of Lien, it indicates that the debt has been paid and that the lender no longer has a claim on the property.

Subordination Agreement: This document alters the priority of liens on a property. While it doesn't release a lien outright, like the Release of Lien, it modifies the lender's rights concerning other claims against the property.

Partial Lien Release: This document releases part of the property from a lien while maintaining the lien on the remainder. It is similar to the Release of Lien in that it removes some of the encumbrances on a property.

Affidavit of Release: Often used to confirm the satisfaction of a debt, this document serves to verify that a lien has been released or that the loan has been paid off, resembling the function of a Release of Lien.

UCC-3 Financing Statement Amendment: This form is used to amend or terminate a UCC-1 financing statement. While it primarily deals with secured transactions not specifically tied to real estate, it shares similarities in terms of releasing claims on collateral.

Dos and Don'ts

When filling out the Release of Lien form in Texas, it’s essential to approach the task carefully and thoroughly. Here’s a list of best practices and common pitfalls to avoid.

- Do ensure all information is accurate. Double-check names, addresses, and dates to avoid any mistakes that could lead to misunderstandings.

- Don't leave any required fields blank. Each section needs to be completed; failing to provide necessary information can cause delays.

- Do review the terms of the lien. Make sure you understand the implications of releasing a lien, as it may affect your financial obligations.

- Don't forget to include signatures. The holder of the note must sign the document to validate the release.

- Do utilize the appropriate notary services. Ensuring that the signatures are notarized properly is vital for the document's acceptance.

- Don't neglect to file the document. After completing the form, submit it to the appropriate county office to make it official.

Being mindful of these do’s and don’ts can help streamline the process and protect your interests as you fill out the Release of Lien form in Texas. Always remember that attention to detail pays off!

Misconceptions

When dealing with the Release Of Lien Texas form, misunderstandings can lead to complications. Below are four common misconceptions, along with clarifications.

- Misconception 1: The Release of Lien form is only for homeowners.

- Misconception 2: Once the form is filed, it cannot be rescinded.

- Misconception 3: The form does not require notarization.

- Misconception 4: The Release of Lien is only valid if recorded immediately.

This form is not limited to any specific type of property owner. It is intended for various scenarios involving any holder of a lien or note, whether they are individuals, businesses, or corporations. Anyone with a lien on a piece of property can utilize this form upon receiving full payment.

While the release is a formal acknowledgment of payment and clearance of the lien, it does not mean that the rights to collect future debts are entirely relinquished. In certain cases, agreements or disputes can allow for negotiations to revisit the terms, but this typically requires legal guidance.

Notarization is a crucial step in validating the Release of Lien. It ensures that the document is executed properly and can be upheld in legal settings. A notary public's acknowledgment confirms the identity of the parties involved, adding a layer of protection for all stakeholders.

While it is best practice to record the release as soon as possible to maintain a clear title, the validity of the lien release does not actually hinge on immediate recording. The acknowledgment of payment and release of the lien is valid once the form is properly completed and signed, regardless of recording timing.

Key takeaways

When filling out and using the Release of Lien Texas form, keep these key points in mind:

- The form is primarily designed for use by lawyers. Ensure that you are following the proper procedures.

- Complete all required fields accurately, including the holder of the note, lien details, and borrower information.

- Include the mailing address of the holder and specify the county to avoid any confusion.

- Make sure to state the original principal amount and maturity date, if applicable.

- Clearly describe the property involved, including any improvements to ensure it is correctly identified.

- Once filled, the holder of the note must acknowledge that payment has been made in full and release the lien accordingly.

- Seek notarization to validate the document; this adds an extra layer of authenticity.

- Record the completed form with the appropriate local authority to officially release the lien.

Pay attention to detail throughout the process to ensure a smooth release of the lien. Proper documentation prevents future disputes and secures the interests of all parties involved.

Browse Other Templates

Form Fl-155 - Use clear and concise entries when filling out FL-155 to avoid confusion.

Goodwill Vouchers Near Me - Vouchers can only be redeemed at selected Goodwill locations specified in the form.