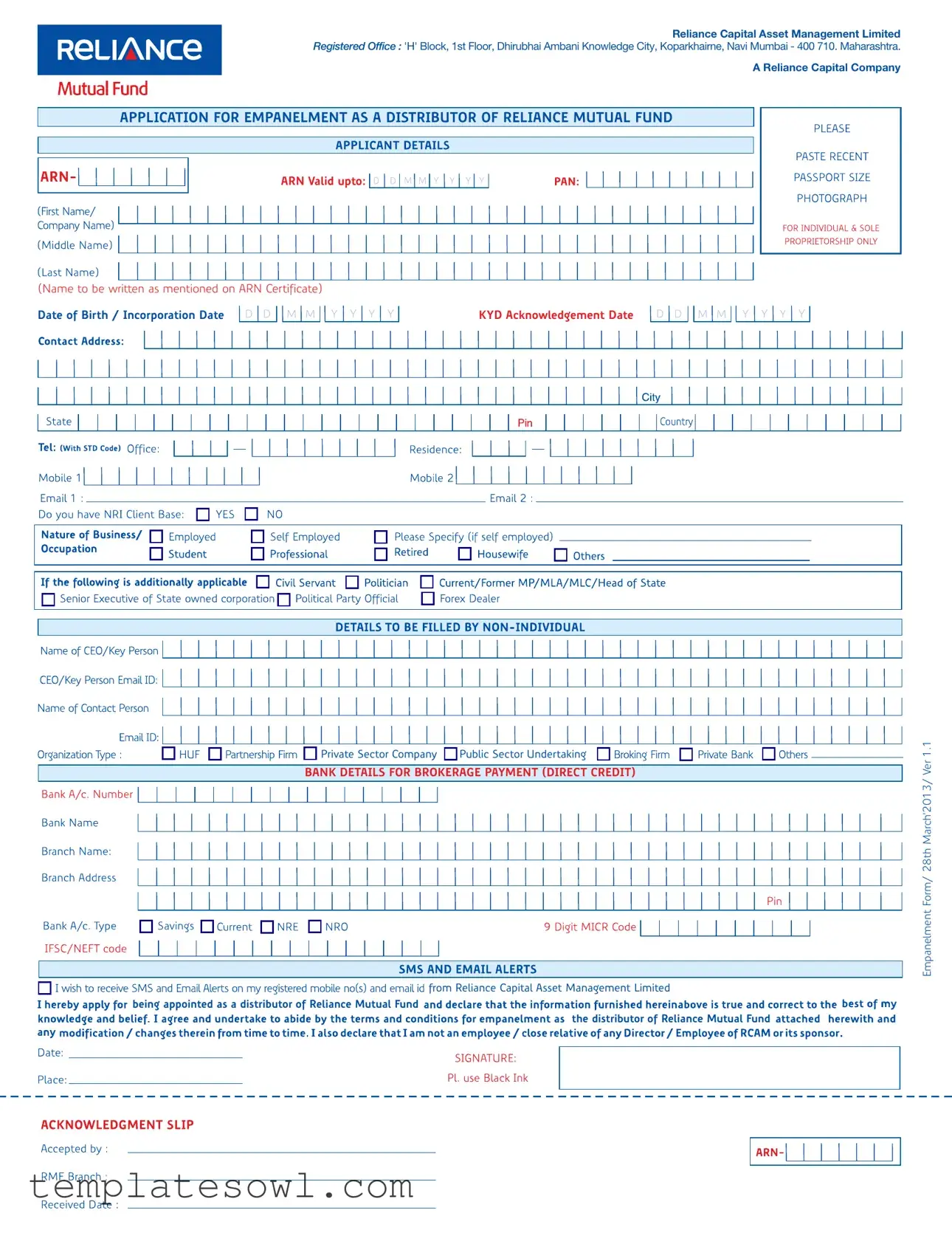

Fill Out Your Reliance Empanelment Form

The Reliance Empanelment Form serves as a crucial application for individuals and enterprises seeking to become distributors of Reliance Mutual Fund. This document requires essential personal information, such as the applicant's name as it appears on their ARN certificate, date of birth or incorporation, and Know Your Distributor (KYD) details. Proposed distributors must specify whether they fall under the category of a private sector company or a public sector undertaking. The form further mandates the completion of nominee details for individual proprietorships, ensuring a clear line of succession in the event of unforeseen circumstances. Notably, it includes bank details for direct credit of brokerage payments, which is a vital aspect for recipients of commissions associated with fund distributions. Furthermore, the form outlines the critical obligations and terms of engagement, emphasizing the importance of adhering to the regulatory framework established by the Association of Mutual Funds in India (AMFI) and the Securities and Exchange Board of India (SEBI). Applicants must understand their responsibilities, which include maintaining confidentiality and complying with ethical sales practices. Overall, the Reliance Empanelment Form is more than a document; it is an entryway into the mutual fund distribution landscape, setting the foundation for a relationship built on trust, compliance, and mutual benefit.

Reliance Empanelment Example

Reliance Capital Asset Management Limited

Registered Office : 'H' Block, 1st Floor, Dhirubhai Ambani Knowledge City, Koparkhairne, Navi Mumbai - 400 710. Maharashtra.

A Reliance Capital Company

APPLICATION FOR EMPANELMENT AS A DISTRIBUTOR OF RELIANCE MUTUAL FUND

ARN Valid upto:

(Name to be written as mentioned on ARN Certificate)

Date of Birth / Incorporation Date

KYD Acknowledgement Date

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Private Sector Company |

Public Sector Undertaking |

|

||||||||||||

|

|

|

|

|

||||||||||||||||||||

BANK DETAILS FOR BROKERAGE PAYMENT (DIRECT CREDIT)

from Reliance Capital Asset Management Limited

being appointed as a distributor of Reliance Mutual Fund

being appointed as a distributor of Reliance Mutual Fund

the distributor of Reliance Mutual Fund

the distributor of Reliance Mutual Fund

Empanelment Form/ 28th March'2013/ Ver 1.1

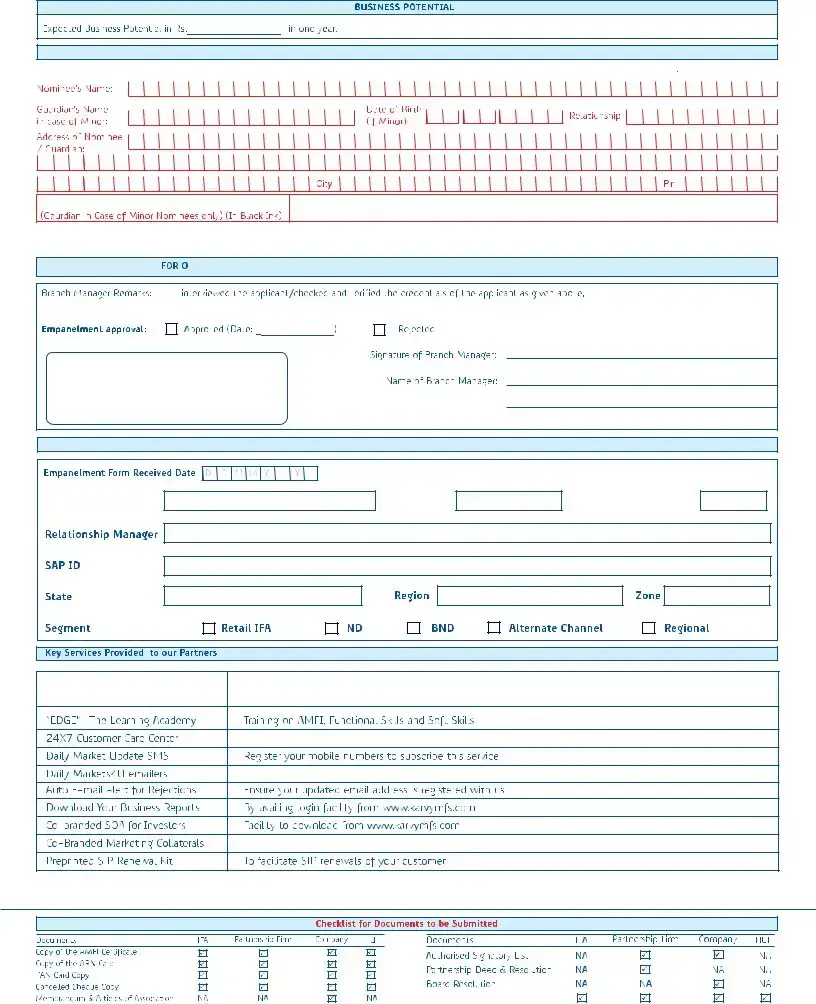

NOMINEE DETAILS : (Mandatory - Incase of Individual/Proprietorship Firm Only.)

(including trail brokerage)

(including trail brokerage)

of Nominee

of Nominee

Referred by: ARN- |

|

(If you have been referred by any distributor of Reliance Mutual Fund then kindly mention the ARN code of referred person) |

|

|

|

by Reliance Capital Asset Management Limited Branch/Regional Manager

by Reliance Capital Asset Management Limited Branch/Regional Manager

Have |

I recommend and approve/do not |

recommend and disapprove empanelment of the applicant as a distributor. |

|

|

(Date:______________) |

RCAM Branch Seal |

|

|

Sap ID of Branch Manager: |

For Reliance Capital Asset Management Limited Branch Use

Branch Name |

Branch Code |

Distributor City Category |

Direct Credit of Brokerage Facility |

AXIS, Bank of Baroda, CITI BANK, HDFC, ICICI, IDBI, Punjab National Bank & State Bank of India. |

in given Banks |

For other Banks we process the brokerage through NEFT. |

Just dial

Subscribe on www.reliancemutual.com for latest updates

Avail Marketing Collaterals from www.reliancemutual.com

Empanelment Form/ 28th March'2013/ Ver 1.1

KYD Acknowledgement

For Empanelment as Distributor of Reliance Mutual Fund

These Terms and Conditions of Empanelment as a Distributor of Reliance Mutual Fund are a binding contract between yourself and Reliance Capital Asset Management Limited ('RCAM') (as asset manager of Reliance Mutual Fund ('RMF')) for your appointment as a distributor of Reliance Mutual Fund. Please read these Terms and Conditions carefully. By signing these Terms and Conditions you acknowledge that you have read, understood and agree to be legally bound by them.

OBLIGATIONS OF THE DISTRIBUTOR:

1.The Distributor and its employees who will be involved in the distribution of the units of the schemes of RMF represent and warrant that they are authorised to act as a distributor of mutual fund product(s) and have passed the Association of Mutual Funds of India ('AMFI') Certification Test (Advisor Module) and a copy of the AMFI Registration Number (ARN) shall be submitted to RCAM for its verification and records.

2.In terms of Circular No. 35P/

3.The Distributor and its employees who will be involved in distribution of units of the schemes of RMF must carry out such directions and instructions as may be issued by RCAM from time to time and shall, at all times, comply with all the extant applicable laws, rules, regulations, guidelines, directions, etc.

4.The Distributor must carefully read and understand the Scheme Information Document ('SID') of the scheme(s) of RMF and Statement of Additional Information ('SAI') and explain to the investors, the investment objectives, features of the schemes and risks associated therein. The Distributor must not make any representation concerning RMF or any scheme of RMF except those contained in relevant SID, SAI, the Key Information Memorandum ('KIM') and / or the marketing material issued by RCAM.

5.The Distributor shall use only the SID, SAI, KIM and marketing material as is provided to him by RCAM and the Distributor shall not design his own marketing material in respect of any scheme of RMF unless he has obtained prior written approval of RCAM for the same.

6.The Distributor shall at all times conduct himself with propriety and decorum and in a manner which is not prejudicial to the interest of RCAM / RMF.

7.The Distributor must not use any unethical means to sell, distribute, market, solicit or induce any investor to undertake any transaction pertaining to the units of any scheme of RMF.

8.The Distributor shall, at all times, comply with and adhere to the code of conduct for Distributors (enclosed herewith as Annexure), including any amendments thereto from time to time.

9.The Distributor shall comply with the provisions of the Securities and Exchange Board of India (Mutual Funds) Regulations, 1996 and guidelines issued by Securities and Exchange Board of India ('SEBI') / AMFI from time to time pertaining to mutual funds with specific focus on regulations / guidelines on advertisements, sales literature and code of conduct.

10.The Distributor is not permitted to accept / receive cash towards investment in units of any scheme of RMF or otherwise on behalf of RCAM. The Distributor cannot, on behalf of RCAM, issue receipt of any application form(s), cheque(s), demand draft(s), etc. received towards subscription or any transaction in the units of any scheme of RMF.

11.The Distributor shall help RCAM/ RMF in complying with the relevant extant statutory and other applicable regulatory requirements relating to anti money laundering and know your client.

12.The Distributor shall be responsible for providing the foreign inward remittance certificate or the certificate evidencing the subscription by way of debit to the NRE/ FCNR account of any

13.The Distributor shall not in any way pledge or have any lien or charge on the properties of the RCAM, RMF, the trustee company of RMF ('RCTC') or any investor, that are in its possession, towards the fees payable to the Distributor for the services rendered herein.

14.RCAM shall have a right to call upon the Distributor to furnish any information or statistics including but not limiting to his business with respect to other mutual fund(s), which the Distributor shall be bound to furnish.

15.The Distributor shall neither use nor display the name, logo, mark or any intellectual property of RCAM (or any things identical thereto) in any manner whatsoever, except as permitted by RCAM.

16.RCAM shall furnish to the Distributor through email, the copies of notices, addendums and all other documents as may be related to the schemes of RMF. The Distributor undertakes to:

(a)properly display such documents in its places of business;

(b)provide his email address to RCAM and keep RCAM informed about the changes thereto;

(c)provide legible hard copies of such documents to investors/potential investors of RMF.

FEES AND CHARGES PAYABLE TO THE DISTRIBUTOR:

17.The Distributor shall be eligible for a fee, on the amount of subscriptions sourced by him towards investment in any scheme of RMF, at the rates prescribed by RCAM from time to time. The rate(s) of fee are subject to revision, from time to time, at the sole discretion of RCAM and the Distributor shall be bound by such revisions. The fee payable by RCAM shall be inclusive of all taxes, service tax, costs, charges and expenses incurred by the Distributor in connection with his rendering of the services herein.

18.In case the Distributor receives any fee which is not due or payable to the Distributor, RCAM / RMF shall be entitled to recover or adjust all such wrongly paid amounts from the amounts due to the Distributor.

19.RCAM will directly credit the fee payable to the Distributor in his bank account, as per the details provided by him from time to time, or through such means as may be deemed appropriate by RCAM.

20.In case any fee is paid to the Distributor, in advance, in respect of proposed subscriptions by any investor, RCAM shall have a right to recover such amount of advance fees, as is paid to the Distributor in respect of any subscriptions which are not made by the investor.

21.The Distributor shall be entitled to only the fee specified herein above for the services rendered by him in terms of this agreement.

INDEMNITY:

22. The Distributor hereby declares and covenants to defend, indemnify and hold RCAM and its directors, affiliates, promoters, employees, successors in interest and permitted assigns harmless from and against all claims, liabilities, costs, charges, damages or assertions of liability of any kind or nature resulting from:

a.Any breach of terms, covenants and conditions or other provisions hereof, or any SID(s) / SAI or any actions or omissions there under;

b.Any failure to comply with all applicable legislation, statutes, ordinances, regulations, administrative rulings or requirements of law;

c.The misfeasance, malfeasance, negligence, defaults, misconduct or fraudulent acts of & by the Distributor or its representatives, employees, directors, agents, representatives; and

d.Any and all actions, suits, proceedings, assessments, settlement, arbitration judgments, cost and expenses, including attorneys' fees, resulting from any of the matters set forth herein above.

TERM AND TERMINATION:

23.The appointment of the Distributor shall continue to remain in full force and effect unless terminated by RCAM or the Distributor, in accordance with the provisions contained herein. RCAM shall be entitled to terminate the engagement of the Distributor forthwith, if:

a.the Distributor is found to be a minor or adjudicated as an insolvent or found to be of unsound mind by a court of competent jurisdiction;

b.it is found that the Distributor has knowingly participated in or connived in any fraud, dishonesty or misrepresentation against RCAM / RMF or any unitholder of RMF.

c.any statement made by the Distributor in the Distributor Empanelment Form is found to be false or misleading or intended to mislead.

d.the Distributor conducts or acts in any manner, which is deemed prejudicial to the interest of RCAM / RMF;

e.the Distributor does not comply with all applicable legislations, statutes, ordinances, regulations, administrative rulings or requirements.

f.the Distributor remains inactive in business with RCAM for a considerable period of time, as decided by RCAM from time to time. RCAM also reserves the right to suspend brokerage under such cases.

Reliance Capital Asset Management Limited

Registered Office : 'H' Block, 1st Floor, Dhirubhai Ambani Knowledge City, Koparkhairne, Navi Mumbai - 400 710. Maharashtra.

A Reliance Capital Company

Empanelment Form/ 28th March'2013/ Ver 1.1

24.Further, RCAM shall have the right to terminate the appointment of the Distributor, without any cause, at any time by giving 10 (ten) days notice to the Distributor. The Distributor may also terminate his engagement with RCAM at any time by giving 10 days notice to RCAM.

25.The engagement of Distributor shall stand automatically terminated, without notice from RCAM, upon disqualification or withdrawal of necessary authorisation(s) of the Distributor.

26.Upon any termination, the distributor shall forthwith return to RCAM all documents, papers and material pertaining to and / or belonging to RCAM / RMF.

CONFIDENTIALITY :

27.The Distributor undertakes that the Distributor, its directors, affiliates, promoters, employees and representatives shall at all times maintain strict confidentiality with regard to all matters, documents, information or data already exchanged or to be exchanged in future by RCAM relating to RCAM/ RMF/ RCTC, any investor, any scheme of RMF and issues raised by the RCAM from time to time and shall not be disclosed, divulged, or allowed or caused to be divulged by any of them without prior written consent of RCAM, to any third party nor used for any purpose other than for the performance of their obligations hereunder.

MISCELLANEOUS :

28.RCAM reserves the sole right and discretion to change the status category of the Distributor.

29.The empanelment of the Distributor as a distributor of RMF shall be on a

30.The Distributor shall not have any claim against RCAM / RMF for any loss, actual or notional, incurred by him on account of any revision in the rate(s) of fee by RCAM.

31.In respect of all disputes arising under this engagement, the courts at Mumbai alone shall have jurisdiction, in accordance with the laws of India.

32.The Distributor shall be entitled to register a nominee with RCAM, which nominee shall, in case of the demise of the Distributor, be entitled to receive trail commissions on the business done by the Distributor before his demise, provided the Distributor has complied with these Terms and Conditions. RCAM reserves the right to ascertain the identity of the nominee at any time.

33.The statements and declarations made by the Distributor herein are the basis of his empanelment as a Distributor.

34.The empanelment of the Distributor as an distributor of RMF is subject to written confirmation from RCAM.

I HEREBY CONFIRM AND DECLARE THAT I HAVE READ AND UNDERSTOOD THESE 'TERMS AND CONDITIONS OF EMPLANEMENT AS DISTRIBUTOR AND AGREE TO ABIDE BY THE SAME.

Signature :

ARN Name :

ARN Code :

ANNEXURE

SEBI's Code Of Conduct (For Intermediaries of Mutual Funds)

(To be complied with by the Distributor at all times)

1.Take necessary steps to ensure that the client's interest is protected;

2.Adhere to SEBI (Mutual Fund) Regulations, 1996, as amended, and the guidelines related to selling, distribution and advertising practices. Be fully conversant with the key provisions of the SID / SAI as well as the operational requirements of various schemes of RMF.

3.Provide full and latest information in respect of schemes of RMF to investors in the form of offer documents, performance reports, fact sheets, portfolio disclosures and brochures, and recommend schemes appropriate for the client's situation and needs.

4.Highlight risk factors of each scheme, avoid misrepresentation and exaggeration, and urge investors to go through SID / SAI / KIM before deciding to make investments.

5.Disclose all material information related to the schemes/plans while canvassing for business.

6.Abstain from indicating or assuring returns in any type of scheme, unless the SID is explicit in this regard.

7.Maintain necessary infrastructure to support RCAM in maintaining high service standards to investors, and ensure that critical operations such as forwarding forms and cheques to RCAM/ RCAM's registrar and despatch of statement of account and redemption cheques to investors are done within the time frame prescribed in the SID / SAI and SEBI Mutual Fund Regulations.

8.Not colluding with clients in faulty business practices such as bouncing cheques, wrong claiming of dividend/redemption cheques, etc.

9.Not undertake commission driven malpractices such as:

(a)recommending inappropriate products solely because the intermediary is getting higher commissions therefrom.

(b)encouraging over transacting and churning of mutual fund investments to earn higher commissions, even if they mean higher transaction costs and tax for investors.

10. Not make negative statements about RCAM or any scheme of RMF and ensure that comparisons, if any, are made with similar and comparable products.

11. Ensure that all investor related statutory communications (such as changes in fundamental attributes, exit/entry load, exit options, and other material aspects) are sent to investors reliably and on time.

12. Maintain confidentiality of all investor deals and transactions.

13. When marketing various schemes, remember that a client's interest and suitability to their financial needs is paramount, and that extra commission or incentive earned should never form the basis for recommending a scheme to the client.

14. Not rebate commission back to investors and not attract clients through temptation of rebate/gifts etc.

15. A focus on financial planning and advisory services ensures correct selling, and also reduces the trend towards investors asking for passback of commission.

16. All your employees engaged in sales and marketing should obtain AMFI certification. Employees in other functional areas should also be encouraged to obtain the same certification

I /We, having read the above, agree and undertake to abide by aforesaid SEBI's code of conduct.

Empanelment Form/ 28th March'2013/ Ver 1.1

|

|

Signature : |

Place: |

|

ARN Name : |

Date: |

|

ARN Code : |

Reliance Capital Asset Management Limited

Registered Office : 'H' Block, 1st Floor, Dhirubhai Ambani Knowledge City, Koparkhairne, Navi Mumbai - 400 710. Maharashtra.

A Reliance Capital Company

Form Characteristics

| Fact Name | Description |

|---|---|

| Company Name | Reliance Capital Asset Management Limited is the entity responsible for the Empanelment Form. |

| Purpose of Form | This form is intended for individuals or firms wishing to become distributors of Reliance Mutual Fund. |

| Mandatory Details | Nominee details must be provided if the applicant is an individual or proprietorship firm. |

| Bank Details | The form requires bank information for direct credit of brokerage payments. |

| Compliance Requirements | Distributors must adhere to AMFI regulations and ensure compliance with all applicable laws. |

| Terms and Conditions | By signing the form, applicants agree to adhere to the stated terms and conditions. |

| Indemnity Clause | Distributors must indemnify Reliance Capital against any claims resulting from their actions. |

| Governing Laws | All disputes will be governed by the laws of India, with jurisdiction in Mumbai. |

Guidelines on Utilizing Reliance Empanelment

Completing the Reliance Empanelment form is a critical step for those wishing to become a distributor of Reliance Mutual Fund. Ensuring that all required information is filled out accurately will expedite the processing of your application. Follow these steps carefully to complete the form.

- Begin by writing your name exactly as it appears on your ARN Certificate.

- Add your Date of Birth or Incorporation Date.

- Provide the KYD Acknowledgement Date.

- Select your business type: Private Sector Company or Public Sector Undertaking.

- Fill in your bank details for brokerage payment, ensuring you include a valid account number for direct credit.

- Complete the Nominee Details section (mandatory for individuals or proprietorship firms).

- If referred by another distributor, include their ARN code.

- Obtain the approval of the Branch/Regional Manager and include the date of approval in the specified area.

- Provide the Branch Seal and the SAP ID of the Branch Manager.

- In the 'For Reliance Capital Asset Management Limited Branch Use' section, complete the information for Branch Name and Branch Code.

- Indicate your Distributor City and Category.

- Submit the completed form as per the specified process outlined on the form.

Once you complete and submit the form, it will be reviewed for approval. Stay informed about the progress of your application and prepare for any follow-up communications from Reliance Capital Asset Management Limited.

What You Should Know About This Form

What is the Reliance Empanelment form used for?

The Reliance Empanelment form is used to apply for becoming a distributor of Reliance Mutual Fund. By filling out this form, you express your intent to market and sell Reliance Mutual Fund products to potential investors. This allows you to earn fees for the subscriptions that you facilitate.

Who can apply to be a distributor through this form?

The application is open to individuals or firms in both the private and public sectors who meet the necessary qualifications. You'll need to provide your ARN (AMFI Registration Number) and demonstrate your capability to comply with the regulations related to mutual funds.

What are the requirements to fill out the form?

You must provide your personal information, including your date of birth or incorporation date. Also, you need to include bank details for direct credit of brokerage payments and any details related to a nominee if applicable. Additionally, you must have passed the AMFI Certification Test.

Are there any fees involved with the application?

No fees are required for submitting the Empanelment form itself. However, there are fee structures associated with the commissions earned by successfully sourcing investments for Reliance Mutual Fund. These fees can change over time, and you’ll be informed of such changes as they occur.

What happens after I submit the form?

Your application will be reviewed, and you’ll receive communication regarding its status. The Reliance Capital Asset Management Limited reserves the right to verify the provided information. If your application is approved, you’ll be officially empaneled as a distributor.

What are my responsibilities as a distributor?

As a distributor, you are expected to provide accurate and relevant information about the mutual fund schemes. You must ensure that you adhere to applicable laws, maintain confidentiality, and operate ethically. Compliance with the SEBI guidelines and the code of conduct is mandatory.

Can I choose any bank for direct credit of payments?

You can choose from a list of specified banks for the direct credit of brokerage payments. These include major banks like HDFC, ICICI, and State Bank of India. For other banks, payments are processed using NEFT.

How will my performance as a distributor be monitored?

Your performance may be evaluated by the Reliance Capital Asset Management Limited based on the subscriptions you secure. They have the right to request information regarding your business activities to ensure compliance with their standards and guidelines.

What if I want to terminate my distributorship agreement?

You can terminate your engagement with Reliance Capital Asset Management Limited by providing a 10-day notice. Additionally, RCAM can also terminate the agreement under various conditions, ensuring that there are processes in place for both parties.

Common mistakes

Completing the Reliance Empanelment form requires careful attention to detail. Here are seven common mistakes individuals often make during this process.

1. Incorrect Name Format: One frequent error is writing the name differently than it appears on the ARN certificate. The form specifically requires the name to be identical. A mismatch may lead to delays or even rejection of the application.

2. Missing Mandatory Information: Many overlook the mandatory fields, especially in the nominee details section. Individuals filling out the form must ensure that all required information is included, as omitting even a small detail can cause complications.

3. Incorrect Date Entries: Filling in incorrect dates for birth or incorporation is another common mistake. These dates must match the supporting documents exactly to avoid confusion or verification issues.

4. Ignoring Bank Details: Providing incomplete or incorrect bank account information for brokerage payments is a critical error. Ensuring accuracy here is essential, as mistakes could prevent timely processing of payments.

5. Not Having Recommendation Notes: Failing to include the ARN code when referred by another distributor is a missed opportunity. This can limit the chances of a smoother application process and reflects poorly on the form’s completeness.

6. Inadequate Signature and Date: The form must be signed and dated appropriately at the end. Incomplete or absent signatures can result in immediate rejection, thereby extending the time to complete the empanelment process.

7. Not Reading Terms and Conditions: Lastly, many applicants rush through the terms and conditions. It is essential to read and understand them, as signing without comprehension can lead to binding commitments unknowingly.

Awareness of these mistakes can facilitate a smoother application process and enhance the likelihood of successful empanelment as a distributor of Reliance Mutual Fund.

Documents used along the form

In the process of becoming a distributor for Reliance Mutual Fund, several forms and documents are crucial to ensure compliance and streamline operations. Among these, the Reliance Empanelment Form stands out. However, it is often accompanied by various other documents that serve distinct purposes. Below is a list of these important forms and documents along with a brief description of what each entails.

- AMFI Registration Number (ARN) Certificate: This document validates that the distributor has passed the Association of Mutual Funds in India (AMFI) Certification Test. It certifies the distributor's ability to operate within the mutual fund industry.

- Know Your Distributor (KYD) Acknowledgement: This acknowledgment is proof that the distributor has complied with necessary identification requirements, ensuring that they have undergone the proper background checks.

- Bank Account Details Form: This form provides the necessary bank details to facilitate direct credit of brokerage payments. It ensures that all financial transactions are conducted smoothly and securely.

- Nominee Declaration Form: A vital document for individual and sole proprietorship distributors, this form allows the distributor to appoint a nominee who will inherit any future commissions in the event of their demise.

- Code of Conduct Agreement: This agreement outlines the ethical standards and practices distributors must follow. It ensures accountability and promotes responsible behavior in dealings with clients and the company.

- Provisional Certification of Compliance: This document acts as a temporary certification, confirming that the distributor is working towards fulfilling all necessary regulatory compliance requirements before being fully accredited.

Each of these documents plays a vital role in establishing eligibility and facilitating a trustworthy partnership between the distributor and Reliance Mutual Fund. Understanding the purpose of each document is key to ensuring a smooth application process and adherence to the industry standards.

Similar forms

- Application for Employment: This document often requires personal information, similar to the empanelment form. Both request identification details and verification of qualifications.

- Vendor Registration Form: Like the empanelment form, this document is used to gather essential information about the entity seeking to establish a working relationship, including bank details and compliance confirmations.

- Mutual Fund Distributor Registration Application: This document shares similarities with the empanelment form, as both have sections on terms and conditions that govern the distributor’s responsibilities and rights.

- KYC Documents: Both forms necessitate Know Your Customer (KYC) compliance. They require personal identification and verification to protect against fraud.

- Partnership Agreement: Similar to the obligations laid out in the empanelment form, this document outlines the duties and responsibilities of involved parties, ensuring transparency in roles.

- Sales and Marketing Agreement: This document and the empanelment form both highlight rules regarding conduct and ethics, ensuring that all parties adhere to regulatory standards in their operations.

- Compliance Certification: Like the obligations in the empanelment form, compliance certification requires acknowledgment of adherence to certain regulations and laws, reinforcing responsibility.

The above documents demonstrate how the Reliance Empanelment form connects with various business and regulatory practices. Each plays a role in ensuring compliance and proper conduct in the respective fields.

Dos and Don'ts

When filling out the Reliance Empanelment form, there are some important points to keep in mind. Below is a list of do's and don'ts to help simplify the process.

- Do carefully read all instructions. Familiarize yourself with every section of the form to ensure accurate completion.

- Do provide accurate information. Make sure that names and details match official documents to avoid delays.

- Do check for required documents. Ensure you have all necessary attachments before submission.

- Do understand the terms and conditions. Knowing what you are agreeing to is essential for a smooth process.

- Don't rush through the form. Take your time to prevent mistakes that could lead to rejection.

- Don't use incomplete or ambiguous information. Clarity is crucial in every response.

- Don't ignore the confidentiality requirement. Protect sensitive information throughout the application process.

- Don't assume prior knowledge. If unsure about something, seek clarification instead of guessing.

Misconceptions

Misconception 1: The Reliance Empanelment form is just a formality.

Many people think that filling out the Empanelment form is merely a formality and does not need serious attention. In reality, this form is a critical step for anyone looking to operate as a distributor for Reliance Mutual Fund. It comes with important implications and responsibilities, such as compliance with various regulatory requirements and maintaining ethical standards in all dealings.

Misconception 2: You don't need prior experience in mutual funds to apply.

Some individuals may believe that prior experience in mutual funds is not necessary for filling out the form. However, the distributor must be knowledgeable about mutual fund products and must have passed the Association of Mutual Funds of India (AMFI) Certification Test. This ensures that only qualified individuals represent the financial interests of investors.

Misconception 3: The Empanelment process is quick and easy.

Many prospective distributors underestimate the time commitment involved in the Empanelment process. While filling out the form may seem straightforward, the evaluation and approval process require thorough verification and due diligence. This takes time, and applicants must be prepared for a thorough review of their qualifications, background, and adherence to various terms and conditions.

Misconception 4: Once approved, there are no ongoing obligations.

Another common misunderstanding is that approval as a distributor means no further obligations. In fact, distributors must continuously comply with a range of regulations and maintain high standards of conduct. This includes updating knowledge of relevant laws and regulations, adhering to SEBI guidelines, and ensuring that they act in the best interest of clients at all times.

Key takeaways

Filling out the Reliance Empanelment form is a crucial step for those looking to become a distributor of Reliance Mutual Fund. Here are some key takeaways that can help streamline the process:

- Mandatory Information: Ensure that all required fields, such as your name, date of birth or incorporation date, and ARN certificate details, are accurately filled in. This information is essential for your application to be processed.

- Bank Details: Provide complete and correct bank details for direct credit of your brokerage payments. If you choose a bank not listed, understand that payments will be made through NEFT, which may add delays.

- Know Your Distributor (KYD): Familiarize yourself with the KYD regulations. You must comply with these requirements and verify that all employees involved in distribution also meet the necessary certifications.

- Compliance with Regulations: Read the Terms and Conditions carefully. Understanding your obligations, including adhering to the Securities and Exchange Board of India (SEBI) regulations and the code of conduct, is vital for maintaining your distributor status.

- Confidentiality Commitment: As a distributor, you are required to maintain confidentiality regarding all information exchanged during the distribution process. This includes not disclosing client data without consent.

These factors play a significant role in ensuring not only your successful application but also your ongoing relationship with Reliance Capital Asset Management Limited. Taking the time to review and follow these guidelines can greatly enhance the effectiveness of your application and future operations.

Browse Other Templates

Af Form 910 Blank - The AF 707 form is used for Officer Performance Reports from Lieutenant to Colonel.

Roas - The application is a reflection of you; fill it out thoughtfully and completely.

Atm Card Request Letter - Make sure to fill in all required fields to avoid delays in processing your request.