Fill Out Your Rent Roll Form

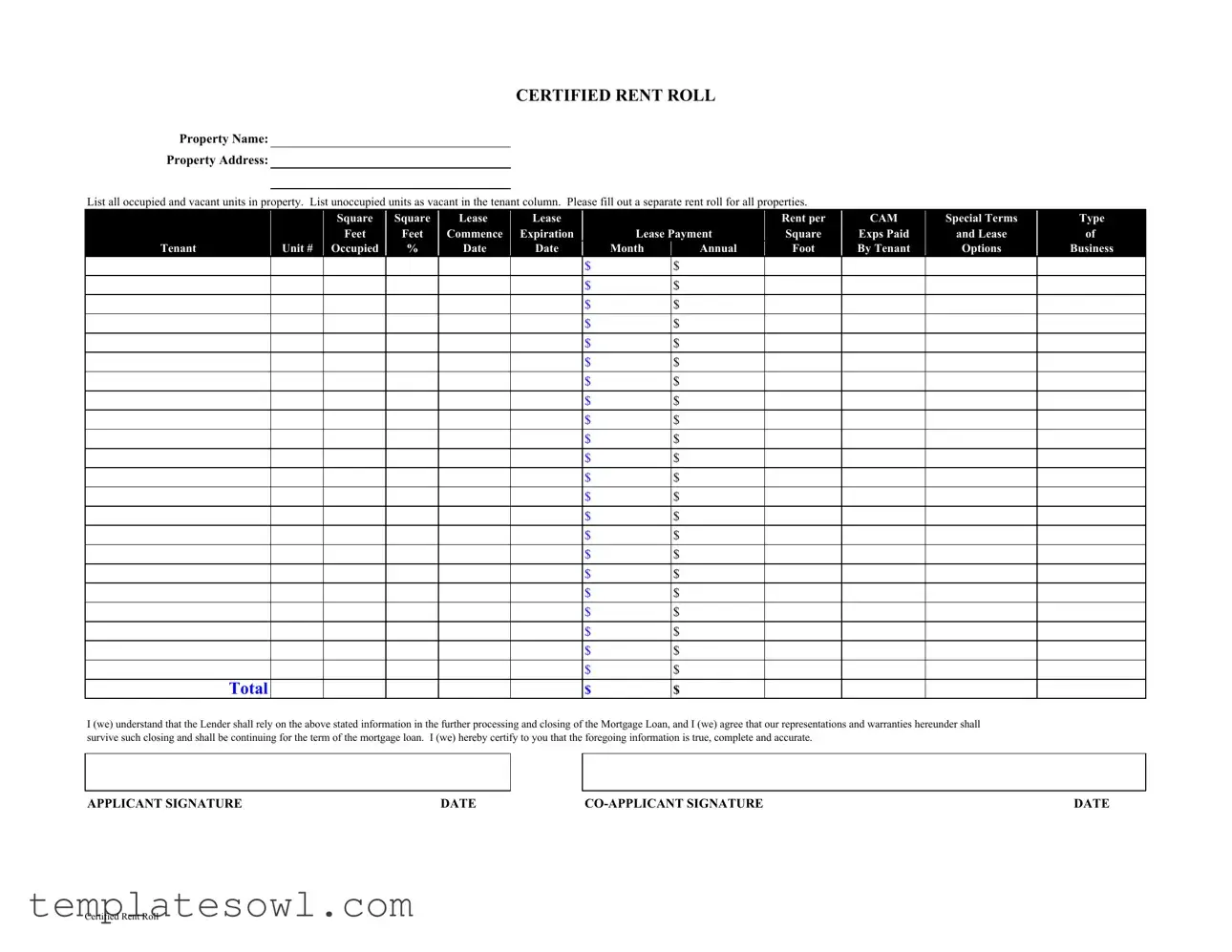

The Rent Roll form serves as a critical document for property management, especially in the context of securing financing. This form is a comprehensive ledger that captures details about all occupied and vacant units within a property. It demands information about each unit, such as its identification number, occupancy status, lease commencement and expiration dates, and the rent structure, including annual and monthly payments. Furthermore, it outlines any additional charges like common area maintenance (CAM). The form also requires a certification of accuracy from the property owner or manager, emphasizing that the lender will rely on the provided information during the mortgage loan process. Failure to furnish accurate data can have serious implications, potentially jeopardizing funding opportunities. Therefore, a meticulously completed Rent Roll is not just a regulatory requirement; it is a pivotal asset in managing property portfolios, enhancing financial visibility and facilitating informed decisions regarding real estate investments.

Rent Roll Example

CERTIFIED RENT ROLL

Property Name:

Property Address:

List all occupied and vacant units in property. List unoccupied units as vacant in the tenant column. Please fill out a separate rent roll for all properties.

|

|

|

Square |

Square |

Lease |

Lease |

|

|

Rent per |

CAM |

Special Terms |

Type |

|

|

|

|

Feet |

Feet |

Commence |

Expiration |

Lease Payment |

Square |

Exps Paid |

and Lease |

of |

||

Tenant |

|

Unit # Occupied |

% |

Date |

Date |

Month |

Annual |

Foot |

By Tenant |

Options |

Business |

||

|

|

|

|

|

|

|

$ |

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

$ |

|

|

|

|

|

|

|

|

|

|

|

$ |

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

$ |

|

|

|

|

|

|

|

|

|

|

|

$ |

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

$ |

|

|

|

|

|

|

|

|

|

|

|

$ |

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

$ |

|

|

|

|

|

|

|

|

|

|

|

$ |

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

$ |

|

|

|

|

|

|

|

|

|

|

|

$ |

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

$ |

|

|

|

|

|

|

|

|

|

|

|

$ |

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

|

|

|

|

|

$ |

|

$ |

|

|

|

|

I (we) understand that the Lender shall rely on the above stated information in the further processing and closing of the Mortgage Loan, and I (we) agree that our representations and warranties hereunder shall survive such closing and shall be continuing for the term of the mortgage loan. I (we) hereby certify to you that the foregoing information is true, complete and accurate.

APPLICANT SIGNATURE |

DATE |

DATE |

Certified Rent Roll

Certified Rent Roll

Form Characteristics

| Fact Name | Description |

|---|---|

| Property Identification | The Rent Roll form requires the property name and address. This information helps identify the specific property involved in a mortgage loan. |

| Occupancy Information | All occupied and vacant units must be listed in the form. Unoccupied units should be marked as vacant in the tenant column. |

| Unit Details | The form captures various details including square footage, lease commencement and expiration dates, and rent payment terms for each unit. |

| Legal Compliance | For state-specific forms, compliance with local landlord-tenant laws is necessary. Always consult the applicable governing laws in your state. |

| Certification Statement | A declaration stating that the information provided is true, complete, and accurate must be signed by the applicant and co-applicant. |

| Loan Processing Importance | The lender relies on the information provided in the Rent Roll for processing and closing the mortgage loan. This highlights the importance of accuracy. |

Guidelines on Utilizing Rent Roll

Completing the Rent Roll form is an essential step in providing accurate data for property management. The information collected will assist in various administrative and financial processes related to the property. Below are the steps to fill out the form properly.

- Begin by entering the Property Name at the top of the form.

- Below the property name, enter the Property Address.

- For each unit in the property, indicate if it is occupied or vacant. Include the unit number in the Tenant Unit # column.

- If a unit is unoccupied, list it as vacant in the corresponding row.

- Fill in the Lease Commencement Date and Lease Expiration Date for each occupied unit.

- Enter the Rent Payment amount and the CAM (Common Area Maintenance) expenses associated with each unit.

- Complete the Square Feet field, indicating the size of each unit.

- Document any Special Terms related to the lease in the designated area.

- For each occupied unit, specify any Lease Options available to the tenant.

- At the bottom of the form, calculate and enter the Total Rent and CAM expenses for all units listed.

- Finally, both the applicant and co-applicant must sign and date the form.

What You Should Know About This Form

What is a Rent Roll form?

A Rent Roll form is a comprehensive document listing all the units within a property, detailing which units are occupied and which are vacant. It includes information such as lease terms, rent amounts, and tenant details.

Why is a Rent Roll form important?

The Rent Roll form is crucial for both property management and financial institutions when assessing the rental income of a property. Lenders use this information to evaluate investment opportunities and manage risks associated with loans.

What information must be included on the Rent Roll form?

The form requires the property name, address, and a list of all units with their occupancy status. Additional details on square footage, lease dates, rent amounts, and any special terms should also be provided. This helps create a clear picture of the property's rental landscape.

How should I fill out the Rent Roll form for vacant units?

For vacant units, you should list them as "vacant" in the tenant column. Even if there are no current tenants, it's essential to document these units to provide a complete overview of the property.

Do I need to fill out a separate Rent Roll for each property?

Yes, a separate Rent Roll form must be completed for each property. This ensures that the information is accurate and specific to that particular property.

What happens to the information provided in the Rent Roll form?

Lenders rely on the information provided in the Rent Roll for processing and closing mortgage loans. The details you certify will inform their decisions and may affect future financing options.

Who needs to sign the Rent Roll form?

The Rent Roll must be signed by the applicant and co-applicant. This signature certifies that the information included in the form is true, complete, and accurate. It serves as a legal acknowledgment of the information presented.

What are the potential consequences of providing inaccurate information?

Providing inaccurate information can lead to complications in the loan approval process. Misrepresentation may result in denial of financing or legal implications down the line if the inaccuracies are discovered.

How often should I update the Rent Roll form?

It’s advisable to update the Rent Roll form regularly, particularly after tenant changes or lease renewals. Keeping the information current helps maintain accurate records for both management and lender purposes.

Can I use a digital version of the Rent Roll form?

Yes, digital versions of the Rent Roll form are acceptable as long as they capture all the required information. Ensure the format is easily accessible and can be printed if needed for submission to lenders.

Common mistakes

When completing the Rent Roll form, mistakes can lead to issues down the line. Here are six common errors people make that you should be aware of.

First, it’s crucial to list all occupied and vacant units accurately. Some people forget to include vacant units at all. Instead of another tenant's name, they might leave the column blank. This creates confusion and hampers effective management.

Second, failing to separate information for different properties often occurs. Each property needs its own Rent Roll form. It’s not acceptable to mix data from multiple properties on a single form. This mistake can lead to serious misunderstandings.

Another common error is not providing complete rent information. Every detail, including rent per square foot and any special terms, should be filled out. Omitting this information can affect how lenders evaluate the property's financial health.

People also often overlook the lease dates. Accurately recording commencement and expiration dates is essential. If these dates are wrong or missing, it can complicate lease negotiations or financial assessments.

Lastly, don’t forget to include signatures. Some individuals submit the form without signing it, which renders the document invalid. Both applicant and co-applicant must sign to certify the information is accurate.

By avoiding these mistakes, you’ll ensure that your Rent Roll is clear and trustworthy. This will facilitate smoother transactions and a better working relationship with lenders.

Documents used along the form

The Rent Roll form is a crucial document used in the management and evaluation of rental properties. Frequently, several other forms accompany it to provide a more comprehensive view of the property’s financial status and tenant agreements. Below is a list of related documents commonly used alongside the Rent Roll form, each serving a unique purpose.

- Lease Agreement: This is a legally binding contract between the property owner and the tenant, detailing the terms and conditions of the tenancy. It outlines the rent amount, payment due dates, security deposit requirements, and any rules governing the property.

- Tenant Application: Prospective tenants complete this form to provide their personal information, rental history, and financial background. Landlords use it to assess the suitability of applicants before leasing a unit.

- Property Management Agreement: This document outlines the relationship between the property owner and the property management company. It specifies the responsibilities of each party, including leasing, maintenance, and financial reporting duties.

- Move-In/Move-Out Inspection Form: This form is used to document the condition of a rental unit before a tenant moves in and after they move out. This helps establish a basis for any security deposit deductions for damages beyond normal wear and tear.

- Tenant Notice of Rent Increase: When a landlord decides to increase the rent, this notice informs tenants of the change. It typically includes the new rent amount, effective date, and any justifications for the increase.

- Maintenance Request Form: Tenants use this form to report issues requiring repairs or improvements in their units. This facilitates communication between tenants and property management, ensuring essential maintenance is addressed promptly.

- Security Deposit Agreement: This document specifies the amount of the security deposit collected from tenants, the conditions under which it may be withheld, and the timeframe for its return after the lease ends.

Each of these documents plays a vital role in property management and tenant relations. Together with the Rent Roll form, they contribute to a clearer understanding of both the operational and financial aspects of rental properties, promoting transparency and effective communication between landlords and tenants.

Similar forms

-

Lease Agreement: A Lease Agreement outlines the terms between a landlord and tenant, including the details of the rent, duration of tenancy, and obligations of both parties. Like the Rent Roll, it lists specific unit details and financial arrangements, ensuring clarity regarding occupancy and rental payments.

-

Tenant Ledger: A Tenant Ledger serves as a financial record for each unit, tracking rent payments, late fees, and any other charges. This document complements the Rent Roll by providing a detailed history of each tenant’s financial transactions, establishing a comprehensive overview of property income.

-

Property Management Report: A Property Management Report summarizes the overall performance of a property, including occupancy rates, maintenance issues, and financial outcomes. Similar to the Rent Roll, it includes data on occupied and vacant units, offering insights into the property's current status and financial health.

-

Occupancy Report: An Occupancy Report presents information on the percentage of rented versus available units while tracking tenant details and lease terms. This document, like the Rent Roll, focuses on occupancy metrics but may be less detailed regarding rental amounts and lease conditions.

Dos and Don'ts

When filling out the Rent Roll form, attention to detail is crucial. Here’s a list of dos and don’ts to ensure you complete the form correctly.

- Do include all occupied and vacant units in the property.

- Do list unoccupied units as vacant in the tenant column.

- Do fill out a separate rent roll for each property.

- Do ensure that all information is accurate and up to date.

- Don’t leave any sections blank unless specified. Provide as much detail as possible.

- Don’t provide false or misleading information, as this could lead to serious consequences.

- Don’t forget to sign and date the form before submission.

Completing this form diligently will not only speed up the process but also ensure accuracy in the lender's decision-making. Pay close attention to each section and verify the information you provide. Time is of the essence, so act promptly.

Misconceptions

Misconceptions about the Rent Roll form can lead to confusion for property owners and lenders alike. Here are four common misunderstandings:

- It's only for occupied units. Some believe the Rent Roll is solely for occupied units. In reality, it includes both occupied and vacant units. Vacant units should be listed clearly to provide a complete overview of the property.

- One Rent Roll is enough for multiple properties. A common mistake is to assume one Rent Roll suffices for several properties. Each property requires a separate Rent Roll to ensure accurate tracking of rental statuses and financial information for each location.

- Specific formatting is mandatory. People often think there's a rigid format for completing the Rent Roll. The key is to provide all necessary information accurately. While consistency is valuable, the specific layout may vary among different lenders.

- It is only a one-time submission. It’s a misunderstanding to think the Rent Roll is needed only during the loan process. The information on the Rent Roll must be updated regularly to reflect changes in occupancy and financial details, as this impacts loan servicing.

Key takeaways

Understanding the Rent Roll form is crucial for accurately documenting property lease information. The following key takeaways highlight important aspects of filling out and using this form:

- Property Identification: Clearly state the property name and address at the top of the form. This ensures that the information is linked to the correct property.

- Unit Tracking: List all units in the property, both occupied and vacant. For vacant units, specifically denote them as such in the tenant column.

- Separate Forms: Each property requires its own Rent Roll form. Using one form for multiple properties can lead to confusion and inaccuracies.

- Lease Details: Include comprehensive lease details for each tenant, such as lease commencement and expiration dates, rent amounts, and any special terms.

- Certification of Information: The form contains a certification statement that must be signed by the applicant and co-applicant. This statement affirms the accuracy of the provided information.

- Loan Reliance: Acknowledge that lenders will rely on the information provided in the Rent Roll for processing and closing the mortgage loan.

Browse Other Templates

Running Record Template - Educators can better guide students with informed observations.

When Do 1098 Forms Come Out - The layout and structure make it easy to review and understand crucial financial details.