Fill Out Your Rental Property Expenses Form

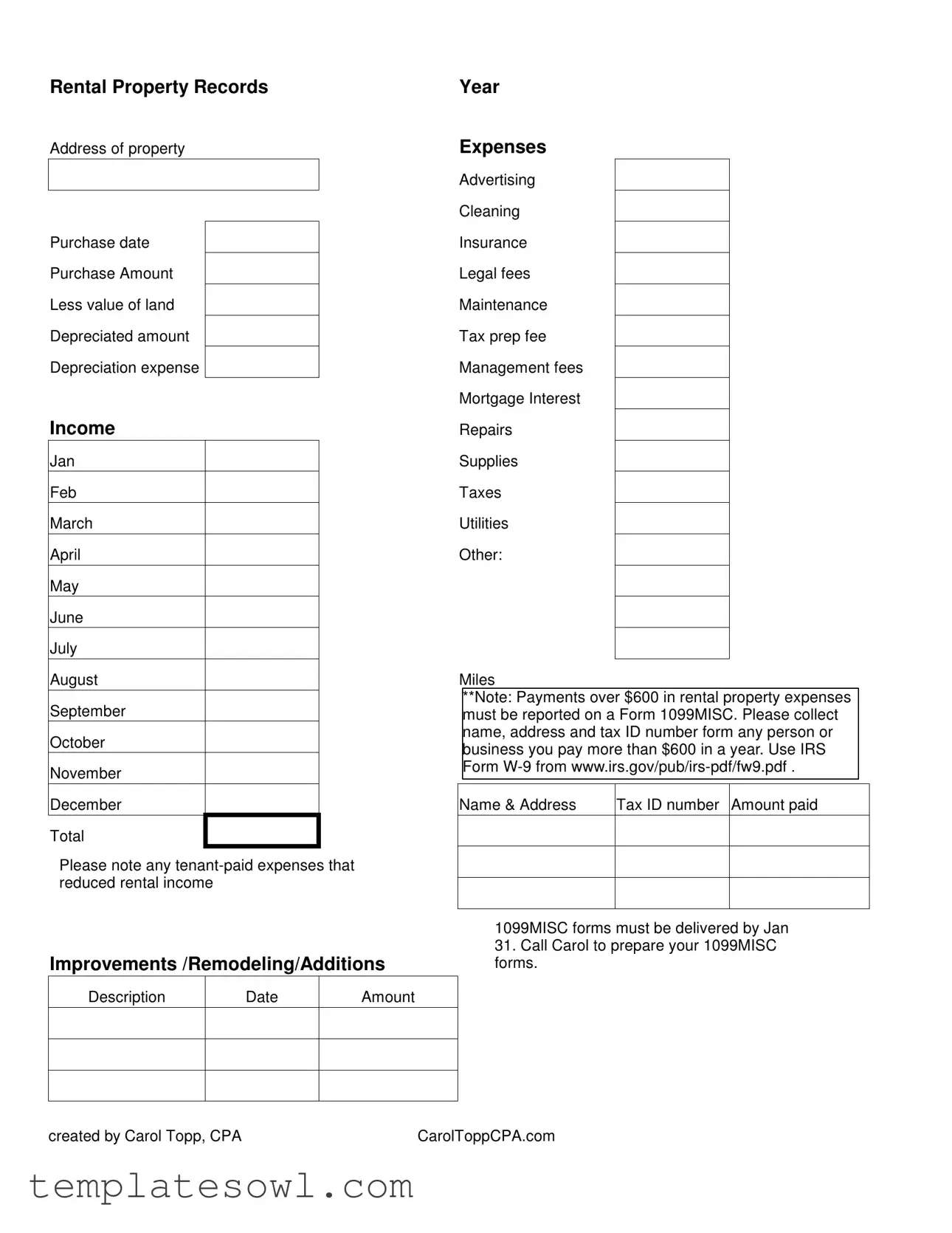

The Rental Property Expenses form serves as a vital tool for landlords managing various costs associated with their rental properties. This form captures essential information such as the property address, purchase date, and initial purchase amount while also accounting for the value of land, which is not depreciable. A section is dedicated to the recording of depreciation expenses throughout the year, offering insights into the wear and tear of the property. Monthly income figures spanning from January to December ensure that landlords can easily track their earnings, while a space is allocated for noting tenant-paid expenses that might offset rental income. Additionally, this form encompasses a comprehensive array of expenses, including but not limited to advertising, maintenance, and utilities, allowing for a thorough financial overview. Landlords must also be diligent about reporting any payments exceeding $600 to contractors or service providers on a Form 1099MISC, thus keeping meticulous records, including the payee's name, address, and tax ID number. This form not only aids in financial organization but also reinforces compliance with IRS regulations, prompting landlords to collect necessary documentation, such as the IRS Form W-9. For added convenience, reminders for submitting 1099MISC forms by January 31 are included, emphasizing the importance of timely and accurate reporting in the realm of rental property management.

Rental Property Expenses Example

Rental Property Records

Address of property

Purchase date

Purchase Amount

Less value of land

Depreciated amount

Depreciation expense

Income

Jan

Feb

March

April

May

June

July

August

September

October

November

December

Total

Please note any

Improvements /Remodeling/Additions

Description |

Date |

Amount |

|

|

|

|

|

|

|

|

|

Year

Expenses

Advertising

Cleaning

Insurance

Legal fees

Maintenance

Tax prep fee

Management fees

Mortgage Interest

Repairs

Supplies

Taxes

Utilities

Other:

Miles

**Note: Payments over $600 in rental property expenses must be reported on a Form 1099MISC. Please collect name, address and tax ID number form any person or business you pay more than $600 in a year. Use IRS Form

Name & Address |

Tax ID number |

Amount paid |

|

|

|

1099MISC forms must be delivered by Jan

31.Call Carol to prepare your 1099MISC forms.

created by Carol Topp, CPA |

CarolToppCPA.com |

Form Characteristics

| Fact Name | Details |

|---|---|

| Property Address | The rental property's address must be accurately recorded on the form to ensure proper identification and compliance with local regulations. |

| Purchase Information | Include the purchase date and purchase amount. This information helps track the investment history and informs depreciation calculations. |

| Depreciation Expense | Depreciation allows property owners to account for the property's reduced value over time. Make sure to calculate the depreciated amount correctly. |

| Monthly Income Tracking | Income should be tracked monthly, indicating how much rent is received throughout the year. This section provides a clear picture of annual earnings. |

| Tenant-Paid Expenses | Note any expenses covered by tenants that reduce rental income. Transparency in finances is crucial for accurate income reporting. |

| Reporting Requirements | Payments exceeding $600 to any individual or business must be reported using Form 1099-MISC. Ensure proper information is collected, including name and Tax ID. |

Guidelines on Utilizing Rental Property Expenses

Completing the Rental Property Expenses form requires careful attention to detail. The information you provide will help in tracking your expenses, which is essential for accurately reporting your rental income and expenses for tax purposes. Follow these steps to ensure that your form is filled out correctly.

- Start by entering the address of the rental property at the top of the form.

- Fill in the purchase date of the property.

- Provide the purchase amount for the property.

- Next, subtract the value of the land and enter the less value of land.

- Input the depreciated amount for the property.

- Calculate and enter the depreciation expense.

- Record the rental income on a monthly basis from January to December. Calculate the total rental income at the end of this section.

- Identify any tenant-paid expenses that reduced your rental income and note these in the designated section.

- List additional expenses in the categories provided—advertising, cleaning, insurance, legal fees, maintenance, tax prep fees, management fees, mortgage interest, repairs, supplies, taxes, and utilities.

- Include any other expenses not listed in the categories provided.

- Keep track of your mileage related to the rental property in the given section.

- For any payments over $600, gather the names, addresses, and tax ID numbers of the payees. You will need to report these payments on a Form 1099MISC.

- Use the IRS Form W-9 to collect the necessary information from any payee.

- Ensure all 1099MISC forms are delivered by January 31. If needed, contact Carol to assist with preparing these forms.

What You Should Know About This Form

What is the purpose of the Rental Property Expenses form?

This form helps landlords and property owners keep track of their rental property expenses. It outlines various costs related to the property, including advertising, maintenance, and repairs. By documenting these expenses, property owners can accurately report income and file their taxes efficiently.

What information do I need to provide about my rental property?

You will need to include the address of the property, the purchase date, and the purchase amount. Additionally, you should note the value of the land separately, since that value is not depreciated. Providing this information allows for a clear understanding of your property’s financial situation.

How do I calculate depreciation for my rental property?

To calculate depreciation, subtract the land value from the purchase amount, then apply the applicable depreciation method over the useful life of the property. This amount is often listed annually and can be documented on the form under “Depreciated amount.” It is important to consult IRS guidelines for specifics on calculations based on your unique situation.

What types of expenses can I deduct using this form?

You can deduct various expenses such as advertising costs, cleaning fees, insurance, legal fees, maintenance costs, tax preparation fees, management fees, mortgage interest, repairs, supplies, property taxes, and utility expenses. If there are other expenses, you can document them in the "Other" section.

What should I include in the 'tenant-paid expenses' section?

If tenants pay certain expenses that reduce your rental income, note these in this section. Examples include utility costs paid directly by tenants or any fees that are payable on their behalf. Including this information provides a clearer picture of your rental income.

What is the significance of the $600 threshold for reporting on Form 1099MISC?

The $600 threshold indicates that any individual or business you pay more than $600 in rental property expenses in a year must be reported to the IRS using Form 1099MISC. This requirement ensures compliance with tax rules and helps maintain accurate records of payments.

What information do I need from someone I pay over $600?

For any person or business receiving payment over the $600 threshold, you must collect their name, address, and tax ID number. This information is essential for accurate reporting on Form 1099MISC and can be obtained using IRS Form W-9.

When do I need to submit the 1099MISC forms?

All 1099MISC forms must be delivered by January 31 of the following tax year. Timely submission helps you stay compliant with tax regulations and avoids potential delays in payment processing or penalties.

Who can assist me with preparing 1099MISC forms?

You can reach out to Carol, as indicated in the form, for assistance with preparing your 1099MISC forms. Her expertise can help ensure that your filings are completed accurately and on time.

Common mistakes

When filling out the Rental Property Expenses form, it’s easy to overlook important details that can impact your tax filings. One common mistake is neglecting to accurately report the address of the property. Ensure the address is correct and complete, as this information helps clearly identify your rental property for all tax purposes.

Another frequent error occurs with the purchase date and amount. When entering these figures, be careful to provide the exact date of acquisition and the total purchase price without the land value. This clarity is vital for calculating depreciation accurately and understanding your investment’s performance over time.

People often miss a crucial step by failing to properly calculate the depreciated amount. This figure should reflect the value of the property after deducting the land value. When left blank or filled out incorrectly, it can lead to significant discrepancies in your depreciation expense.

Additionally, it's important to document all relevant tenant-paid expenses that can reduce your rental income. Forgetting to note these expenses can result in paying more taxes than necessary. Keeping thorough records of these transactions will allow for more accurate financial reporting.

Another common mistake is related to payments over $600. If you make a payment exceeding this amount to a service provider or contractor, you must report it using a Form 1099MISC. Many individuals forget to collect the required information, which includes the provider's name, address, and tax identification number. This oversight can lead to penalties later on.

Lastly, it’s vital not to overlook the delivery deadline for 1099MISC forms. They must be sent out by January 31 each year. Missing this timeline can have consequences, such as fines or extended scrutiny from the IRS. By being aware of these common mistakes and taking steps to avoid them, you can navigate your rental property expenses smoothly.

Documents used along the form

The Rental Property Expenses form is an essential document for landlords and property owners to track their financial activities related to rental properties. Several other forms also play a critical role in managing and reporting rental property finances effectively. Below is a list of related documents that are commonly used in conjunction with the Rental Property Expenses form.

- Form 1099-MISC: This form is used to report payments made to independent contractors and service providers. If payments exceed $600 in a calendar year, you must file this form to comply with IRS regulations.

- Form W-9: This form collects the name, address, and tax identification number of individuals or entities from whom you have requested services or products. Utilize it to maintain accurate records for issuing Form 1099-MISC when necessary.

- Property Management Agreement: This document outlines the terms and conditions between a property owner and a property management company. It details the services provided, management fees, and the responsibilities of each party regarding the management of the rental property.

- Lease Agreement: The lease agreement is a legally binding contract between the landlord and tenant. It specifies the rental terms, including the rental amount, duration of lease, and obligations of both parties. This document is crucial for clarifying expectations and ensuring compliance with rental laws.

Using these forms and documents alongside the Rental Property Expenses form will help streamline record-keeping and ensure compliance with financial regulations. Proper organization of these documents can help you navigate the complexities of rental property management more efficiently.

Similar forms

The Rental Property Expenses form shares similarities with several other documents used in real estate and accounting. Each of these documents serves a specific purpose but commonly revolves around tracking income and expenses related to properties.

- Profit and Loss Statement: This document summarizes the income, costs, and expenses for a specific period, similar to how the Rental Property Expenses form outlines monthly income and various expenditures.

- Schedule E (Form 1040): Used for reporting rental income and expenses for tax purposes, this form captures details about rental properties much like the Rental Property Expenses form.

- Form 1099-MISC: This form is utilized to report payments made to non-employees, especially when payments exceed $600, mirroring the need for careful documentation of significant expenses in the Rental Property Expenses form.

- W-9 Form: Required to collect taxpayer information for payments made, similar to the information collection highlighted in the Rental Property Expenses form for anyone paid over $600.

- Depreciation Schedule: It reflects the depreciation of property over time, much like the depreciation expense listed in the Rental Property Expenses form.

- Annual Tax Return: The overall summary of an individual's financial activity for the year, which includes rental income and deductions that relate directly to the details collected in the Rental Property Expenses form.

- Account Statement: Issued by a bank or financial institution, detailing all transactions, similar to how the Rental Property Expenses form outlines specific expenses related to rental properties.

- Cash Flow Statement: This document focuses on the inflow and outflow of cash, akin to tracking rental income and expenses on the Rental Property Expenses form.

- Investment Analysis Report: Used to evaluate the performance of rental properties, including income and expenses, reflecting the comprehensive financial overview provided by the Rental Property Expenses form.

Understanding these documents can enhance the management of rental properties and ensure compliance with tax obligations.

Dos and Don'ts

When filling out the Rental Property Expenses form, there are several best practices and pitfalls to avoid. Here’s a concise list of dos and don’ts:

- Do: Carefully enter the address of the property to ensure accuracy.

- Do: Note all tenant-paid expenses that affect your rental income.

- Do: Maintain a record of payments over $600 for reporting on a Form 1099MISC.

- Do: Collect the name, address, and tax ID number of any person or business for payments exceeding $600 in a year.

- Do: Submit 1099MISC forms by January 31 to comply with regulations.

- Don’t: Forget to include improvements and remodeling costs, as these impact your overall expenses.

- Don’t: Leave out the depreciated amount which is crucial for tax purposes.

- Don’t: Overlook utility costs and other recurring expenses that can be deducted.

- Don’t: Submit incomplete forms; ensure each section is filled out correctly.

- Don’t: Ignore the importance of keeping receipts for all expenses claimed.

Misconceptions

Here are nine common misconceptions about the Rental Property Expenses form:

- Only property owners need to fill it out. Many landlords who rent properties may not own them but still need to report rental income and expenses.

- All expenses are deductible. Not every expense related to the rental property qualifies for a tax deduction. It's essential to know which costs are eligible.

- Only cash payments count as expenses. Non-cash expenses, like depreciation, must also be documented and reported.

- Tenant-paid expenses don't need to be recorded. Any expenses that impact the rental income, including those paid by tenants, should be noted on the form.

- It's fine to ignore the $600 rule. Payments exceeding $600 to any service provider must be reported using Form 1099MISC. This requirement should not be overlooked.

- Filling out the form is optional. Properly documenting income and expenses is crucial for tax compliance, making this form mandatory for many property owners.

- You can report expenses anytime during the year. Accurate record-keeping throughout the year is important. Year-end reporting can lead to missed deductions.

- All miles driven for property maintenance are deductible. Only business-related miles qualify as deductions, so it is important to track them accurately.

- Help isn’t available if needed. Resources, including consultative services from accountants and tax professionals, are often available to assist owners with rental property expenses.

Key takeaways

Here are some key takeaways regarding the Rental Property Expenses form:

- Property Information: Always include the property address, purchase date, and purchase amount accurately. This information is crucial for tax reporting.

- Value Adjustments: Subtract the value of the land from the purchase amount to determine the depreciated amount. This is important for calculating depreciation expenses.

- Monthly Income Tracking: Keep a detailed record of the rental income for each month. This helps in accurately assessing total income for the year.

- Record Tenant-Paid Expenses: Note any expenses paid by tenants that might affect rental income. This can include utilities or repairs they covered.

- Expense Documentation: Maintain thorough records for all expenses related to rental property management, including advertising, cleaning, and maintenance fees.

- 1099-MISC Reporting: Payments over $600 to contractors or service providers must be reported on Form 1099-MISC. Collect their name, address, and tax ID number for accurate reporting.

- Submission Deadline: Ensure 1099-MISC forms are submitted by January 31. To prepare these forms, you can contact Carol, who handles this process.

Browse Other Templates

Medicare Abn 2024 - The CMS R 131 Advance ABN form provides beneficiaries with important information regarding Medicare's potential noncoverage of specific services.

Form Dr 0104 - Individuals must calculate and enter their total income from all applicable federal forms before determining Colorado-specific income.