Fill Out Your Resale Certificate Maryland Form

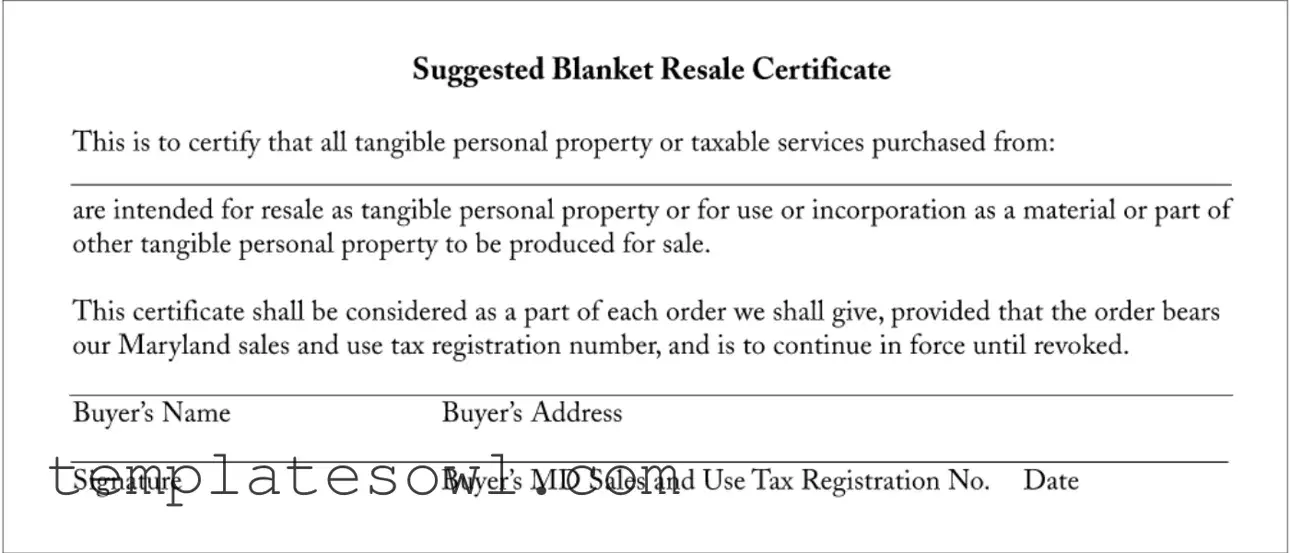

The Resale Certificate Maryland form plays a crucial role in the state's sales tax environment, specifically for businesses involved in the retail and wholesale of tangible goods. This document allows purchasers to buy items for resale without incurring sales tax at the point of purchase. Emphasizing its importance, the form serves as a certification that the tangible personal property or taxable services acquired will not be used for personal consumption but rather be resold to end consumers. Furthermore, this certificate acts as a blanket authorization for ongoing transactions, provided that each order includes the buyer's Maryland sales and use tax registration number. This ensures that all future purchases made under this certificate remain exempt until it is explicitly revoked. Essential details, such as the buyer's name, signature, address, and the registration number, must be clearly stated. Understanding how the Resale Certificate Maryland form functions can greatly benefit business owners by allowing them to streamline their purchasing processes while ensuring compliance with state tax regulations.

Resale Certificate Maryland Example

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The Resale Certificate allows purchasers to buy tangible personal property or taxable services tax-free when they intend to resell them. |

| Form Type | This is a suggested blanket resale certificate, which can be used for multiple purchases. |

| Registration Requirement | The certificate must include the buyer's Maryland sales and use tax registration number for validation. |

| Continuous Validity | The certificate remains effective until revoked by the buyer. |

| Applicable Law | This form complies with Maryland Sales and Use Tax laws. |

| Signatory | The buyer must sign the certificate, confirming the legitimacy of the intended resale. |

| Date Requirement | A date must be provided to document when the certificate was signed. |

| Intended Use | The property purchased under this certificate must be intended for resale or incorporated into products for sale. |

| Future Orders | The certificate applies to all future orders made by the buyer, as long as the orders reference the certificate. |

Guidelines on Utilizing Resale Certificate Maryland

To complete the Resale Certificate Maryland form, you will need to provide specific information that identifies your business and indicates your intention to purchase items for resale. Once this form is filled out accurately, it can be used for multiple transactions. Below are the steps necessary to fill out the form correctly.

- Begin with the Buyer’s Name: Write the complete name of your business or you as the buyer at the top of the form.

- Provide the Buyer’s Address: Enter the full address of your business where you will receive the items being purchased.

- Fill in the Maryland Sales and Use Tax Registration Number: This number is essential as it identifies your business for tax purposes. Make sure it is accurate.

- Sign the Form: The buyer or an authorized representative must sign the document to validate it. This signature confirms that the purchase is intended for resale.

- Insert the Date: Write the date when you are filling out the form. This will serve as a record of when the certificate was issued.

After completing these steps, retain a copy for your records. Present the completed form to the vendor when making a purchase, allowing you to avoid paying sales tax on items intended for resale.

What You Should Know About This Form

What is a Resale Certificate in Maryland?

A Resale Certificate in Maryland is a document that allows businesses to purchase items without paying sales tax, as long as those items are intended for resale. This certificate is utilized by retailers when acquiring inventory that they plan to sell to customers. It certifies that the buyer is registered for sales and use tax in the state of Maryland.

Who needs a Resale Certificate?

Any business in Maryland that plans to resell tangible personal property or taxable services can benefit from a Resale Certificate. This includes retailers, wholesalers, and any other entities that deal in the sale of goods. The buyer must possess a valid Maryland sales and use tax registration number to use this certificate.

How does a business obtain a Resale Certificate?

Businesses can obtain a Resale Certificate by registering for a sales and use tax license with the Maryland Comptroller's office. Once registered, the business will receive a sales and use tax registration number, which can then be included on the Resale Certificate when making purchases.

What information is needed on the Resale Certificate?

The Resale Certificate should include crucial details such as the buyer's name, signature, address, and Maryland sales and use tax registration number. Additionally, it’s essential for the certificate to state that the items purchased are for resale or to be incorporated into products for resale.

Is the Resale Certificate valid for all types of purchases?

No, the Resale Certificate is only valid for purchases intended for resale or for items that will be part of a product that will be resold. It cannot be used to purchase items for personal use or consumption. Misuse of the certificate can result in penalties or fines.

How long does a Resale Certificate remain valid?

A Resale Certificate remains valid until it is revoked by the buyer. Businesses can indicate that the certificate is ongoing by stating that it applies to all future purchases until they decide to revoke it. It is advisable for buyers to keep their certificate updated and notify sellers if there are changes.

What should be done if a Resale Certificate is no longer needed?

If a business no longer requires the Resale Certificate, it should formally revoke it. This can be done by notifying all sellers who have received the certificate. It ensures compliance with tax regulations and prevents any accidental misuse in the future.

Common mistakes

Completing the Resale Certificate Maryland form accurately is important for ensuring proper tax compliance. However, individuals often make several common mistakes that can lead to complications. Understanding these pitfalls can help streamline the process.

One common mistake is leaving out the Buyer's Name. This section is critical, as it identifies who is making the purchase. Without this information, the form can be deemed invalid, causing potential disputes during audits.

Another frequent error occurs when purchasers fail to provide their Maryland sales and use tax registration number. It is essential to include this registration number to establish that the buyer is authorized to make tax-exempt purchases. Omitting this detail can lead to the denial of the resale certificate.

In some cases, buyers forget to sign the form. A signature signifies agreement and acknowledgment of the terms outlined in the certificate. Without a signature, the form lacks validity and may result in back taxes or fines.

Additionally, people often do not provide a date on the resale certificate. This omission can create confusion about when the certificate is effective. Including the date ensures all parties are aware of the timeline for the certificate’s validity.

Another mistake is failing to mention the specific vendor from whom the goods are purchased. Without declaring who the supplier is, it can be challenging to track transactions and verify that items are intended for resale.

Occasionally, buyers forget that the resale certificate is valid only for tangible personal property or taxable services intended for resale. Misunderstanding this rule can lead to misuse of the certificate for items that are not eligible, resulting in potential penalties.

Lastly, some individuals mistakenly think that the resale certificate is a blanket exemption for all purchases. While it covers purchases intended for resale, it does not exempt all transactions. It is crucial to be aware of the limitations of the resale certificate to avoid unintended consequences.

Documents used along the form

The Resale Certificate Maryland form is a crucial document for businesses engaged in purchasing goods for resale. Alongside it, there are several other forms and documents that streamline transactions and clarify tax responsibilities. Here’s a list of common documents that often accompany the Resale Certificate in Maryland.

- Sales and Use Tax Registration Certificate: This certificate confirms that a business is registered to collect sales tax in Maryland. It is essential for businesses to display this number on the Resale Certificate.

- Purchase Order: A purchase order is a commercial document issued by a buyer to a seller, detailing products or services being ordered. It serves as an official record of the transaction.

- Vendor Agreement: This agreement outlines the terms and conditions of the relationship between a vendor and a purchaser. It often includes pricing, delivery, and payment timelines.

- Business License: A business license is a permit issued by the government to legally operate a business. It may be requested by some suppliers to verify legitimacy before completing a sale.

- Certificate of Exemption: This document allows a buyer to purchase products without paying sales tax in specific scenarios, such as nonprofits or government entities.

- Invoice: An invoice lists goods sold or services rendered and indicates the total amount due. It often references the Resale Certificate when applicable.

- Shipping Manifest: A shipping manifest outlines what goods are being shipped and includes details such as quantities and descriptions. It's important for tracking inventory and verifying orders.

- Returns Policy: This document outlines the vendor's policy on product returns, refunds, and exchanges. It is vital for both buyer and seller to understand their rights and responsibilities.

- Affidavit for Tax Exemption: This affidavit is used by purchasers to affirm their tax-exempt status when making purchases for resale, adding another layer of protection against sales tax liability.

- Internal Record Keeping Documents: These may include spreadsheets or databases used by the purchaser to track inventory and sales. Good recordkeeping is key for tax compliance and overall business management.

Understanding these additional forms and documents will help ensure smooth business operations and compliance with Maryland tax regulations. Keeping your records organized can prevent issues down the line, allowing you to focus on growing your business.

Similar forms

The Resale Certificate Maryland form serves as a vital tool in sales transactions, particularly for businesses that buy goods for resale. Similar documents exist in various states and contexts, each serving a purpose akin to the Resale Certificate. Below are ten documents similar in function and intent, detailing their specific uses:

- California Resale Certificate: Like the Maryland version, this certificate allows businesses in California to purchase goods without paying sales tax when those goods are intended for resale. It must include the seller's name and address, along with the buyer's tax registration number.

- Texas Sales and Use Tax Resale Certificate: This document serves a similar function in Texas. It certifies that goods purchased are meant for resale, thus exempting the buyer from sales tax at the point of purchase. The form must include the buyer’s details and an affirmation of their intent to resell.

- New York Resale Certificate: In New York, this certificate allows businesses to avoid sales tax on goods purchased for resale. It must be provided to the seller and should include the buyer’s sales tax ID number, aligning it closely with the Maryland form.

- Florida Annual Resale Certificate for Sales Tax: This document enables Florida businesses to make tax-exempt purchases throughout the year. It operates under similar principles as the Maryland Resale Certificate, covering a broad range of purchased goods intended for resale.

- Virginia Resale Certificate: This Virginia-specific form allows for tax-exempt purchases on items intended for resale. Buyers in Virginia must provide evidence of their resale intent, like their sales tax number, mirroring requirements from the Maryland form.

- Illinois Resale Certificate: In Illinois, a resale certificate enables businesses to buy items without incurring sales tax for the purpose of reselling. The format and details required are quite similar to those found in the Maryland Resale Certificate.

- Pennsylvania Resale Certificate: This certificate grants Pennsylvania businesses the ability to purchase goods for resale without payment of sales tax. Like Maryland’s form, it requires specific buyer details and a declaration regarding resale intent.

- Georgia Sales Tax Resale Certificate: Similar to the Maryland form, this certificate allows buyers in Georgia to make tax-exempt purchases intended for resale. Details needed include the seller’s information and the buyer's tax registration number.

- Arizona Resale Certificate: In Arizona, this certificate functions similarly by allowing businesses to buy goods for resale without sales tax. The necessary information aligns closely with that required in the Maryland Resale Certificate.

- Ohio Resale Certificate: This Ohio document certifies that purchased items will be resold, thus exempting the buyer from sales tax. The requirements for validating resale intent are comparable to those in Maryland’s Resale Certificate.

Understanding these similar documents can help business owners navigate sales tax exemptions more effectively across different states.

Dos and Don'ts

When filling out the Resale Certificate Maryland form, it's important to get it right to avoid any issues. Here’s a list of dos and don’ts that can help you navigate the process effectively.

- Do ensure that all fields are filled out completely and accurately.

- Do include your Maryland sales and use tax registration number.

- Do sign and date the form to validate it.

- Do check that the buyer's name matches the name on the registration number.

- Do use the certificate for tangible personal property or taxable services intended for resale.

- Don't forget to double-check for any typos or omissions.

- Don't use the form for items not intended for resale.

- Don't submit the form without a signature.

- Don't assume the certificate is valid indefinitely; remember it needs to be revoked if no longer applicable.

- Don't provide false information, as this could lead to penalties.

Misconceptions

Misconceptions can often lead to confusion about the usage of the Resale Certificate in Maryland. Here are some common misunderstandings:

- Misconception 1: A resale certificate is necessary for every purchase.

- Misconception 2: All purchases can be made tax-free with a resale certificate.

- Misconception 3: The certificate must be renewed frequently.

- Misconception 4: A physical copy of the certificate is always required.

Many believe that a resale certificate must be presented for each individual purchase. In reality, a resale certificate can be used as a blanket statement, covering multiple transactions as long as it is part of the buyer's order.

Some people think that using a resale certificate allows them to purchase any item without paying sales tax. However, it only applies to tangible personal property or taxable services intended for resale. If the items will not be resold, sales tax must be paid.

There is a belief that resale certificates expire frequently. In Maryland, as long as the seller has the buyer's current sales and use tax registration number, the certificate remains valid until it is revoked by the buyer.

Some assume that a hard copy of the resale certificate is mandatory for each transaction. While a physical copy is helpful, the key requirement is that the certificate information is provided with the order, which can also include digital formats.

Key takeaways

When filling out and utilizing the Resale Certificate in Maryland, there are several essential points to keep in mind:

- Purpose of the Certificate: The Resale Certificate serves to prove that goods or services purchased are intended for resale, not for personal use.

- Required Information: The form must include the buyer's name, address, Maryland sales and use tax registration number, and the date of completion.

- Tax Registration Number: Ensure that the Maryland sales and use tax registration number is accurate. This number validates the certificate and the buyer's legitimacy.

- Continuity of Validity: This certificate remains in effect for all future orders until the buyer revokes it. Clearly state the intention to utilize it on each order.

- Signature Requirement: The buyer must sign the certificate. A signature indicates acknowledgment of the terms laid out in the form.

- Vendor Awareness: Sellers should keep a copy of the certificate on file for their records to support tax-exempt sales.

- Revocation Process: Buyers have the right to revoke the certificate at any time. Ensure that any revocation is documented to maintain clear records.

Browse Other Templates

Form 941 Irs - Caution is encouraged, as errors may delay processing or incur penalties.

Truck Driver Write Offs - Record expenses incurred while traveling out of town for work purposes.