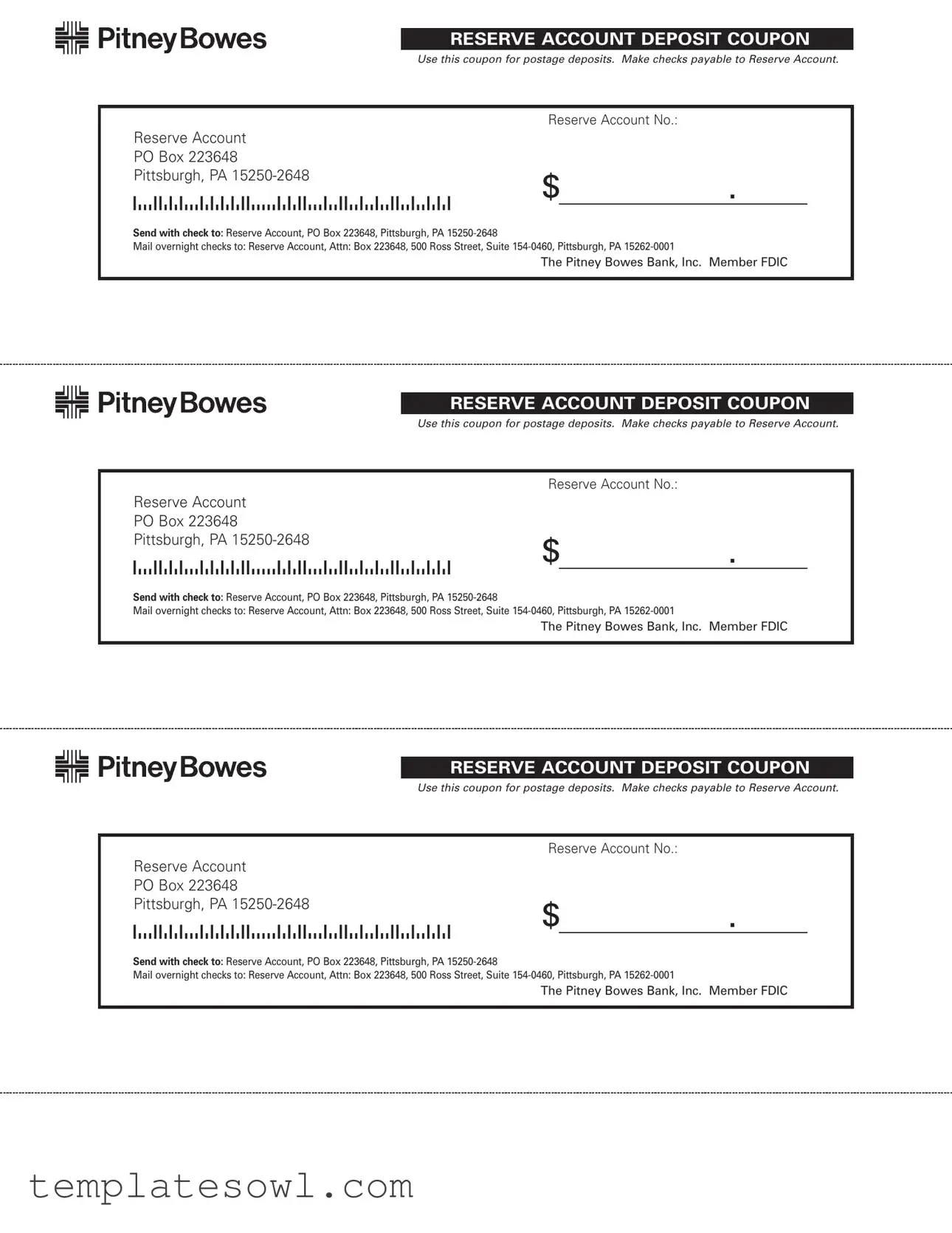

Fill Out Your Reserve Account Deposit Slip Form

The Reserve Account Deposit Slip form plays a crucial role in facilitating the process of making deposits into a reserve account, particularly for postage needs. This form is specifically designed to ensure that funds are allocated accurately and efficiently. It provides space for essential information, such as the Reserve Account number and the amount being deposited. Users must also make checks payable to the Reserve Account and follow the specified mailing instructions to ensure prompt processing. The mailing address for standard deposits is straightforward, with all checks directed to the Reserve Account at a designated P.O. Box in Pittsburgh, Pennsylvania. For those needing expedited service, there's an alternative address for overnight deliveries. Importantly, deposits are handled by The Pitney Bowes Bank, Inc., which is a member of the FDIC, providing an added layer of security for your funds. Understanding how to properly complete and submit this form is key to ensuring seamless transactions and maintaining an effective reserve account.

Reserve Account Deposit Slip Example

RESERVE ACCOUNT DEPOSIT COUPON

Use this coupon for postage deposits. Make checks payable to Reserve Account.

|

Reserve Account No.: |

|

||

Reserve Account |

|

|

|

|

PO Box 223648 |

|

|

|

|

Pittsburgh, PA |

$ |

. |

||

/152502648485/ |

||||

|

|

|

||

SEND WITH CHECK TO: Reserve Account, PO Box 223648, Pittsburgh, PA

Mail overnight checks to: Reserve Account, Attn: Box 223648, 500 Ross Street, Suite

The Pitney Bowes Bank, Inc. Member FDIC

RESERVE ACCOUNT DEPOSIT COUPON

Use this coupon for postage deposits. Make checks payable to Reserve Account.

|

Reserve Account No.: |

|

||

Reserve Account |

|

|

|

|

PO Box 223648 |

|

|

|

|

Pittsburgh, PA |

$ |

. |

||

/152502648485/ |

||||

|

|

|

||

SEND WITH CHECK TO: Reserve Account, PO Box 223648, Pittsburgh, PA

Mail overnight checks to: Reserve Account, Attn: Box 223648, 500 Ross Street, Suite

The Pitney Bowes Bank, Inc. Member FDIC

RESERVE ACCOUNT DEPOSIT COUPON

Use this coupon for postage deposits. Make checks payable to Reserve Account.

|

Reserve Account No.: |

|

||

Reserve Account |

|

|

|

|

PO Box 223648 |

|

|

|

|

Pittsburgh, PA |

$ |

. |

||

/152502648485/ |

||||

|

|

|

||

SEND WITH CHECK TO: Reserve Account, PO Box 223648, Pittsburgh, PA

Mail overnight checks to: Reserve Account, Attn: Box 223648, 500 Ross Street, Suite

The Pitney Bowes Bank, Inc. Member FDIC

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | This form is used for making deposits into a Reserve Account. |

| Check Payable | Checks must be made payable to "Reserve Account". |

| Mailing Address | Deposits should be sent to: Reserve Account, PO Box 223648, Pittsburgh, PA 15250-2648. |

| Overnight Delivery | For overnight checks, send to: Reserve Account, Attn: Box 223648, 500 Ross Street, Suite 154-0460, Pittsburgh, PA 15262-0001. |

| Account Number | The form includes a field for the Reserve Account number. |

| Bank Affiliation | The Reserve Account is affiliated with The Pitney Bowes Bank, Inc., a Member FDIC. |

| State Regulations | Federal regulations govern the use of banks and accounts, including those involved in the Reserve Account. |

| Identification | Each deposit must include the reserve account number for proper processing. |

| Deposit Amount | Depositors must specify the amount to be deposited on the form. |

| Repetition | The form is repetitive to ensure clarity and ease of understanding for all users. |

Guidelines on Utilizing Reserve Account Deposit Slip

Once you have the Reserve Account Deposit Slip form ready, it's time to fill it out accurately to ensure your deposit is processed without any issues. Follow the simple steps outlined below to make the process seamless.

- Locate the section labeled Reserve Account No. on the form. Enter your unique reserve account number in the designated space.

- Find the area marked with a dollar sign ($). Here, write the amount you wish to deposit, ensuring the decimal point is included for cents.

- After entering the deposit amount, double-check your entries for accuracy. This helps prevent any delays in processing your deposit.

- Prepare a check made out to Reserve Account. Ensure that the check's amount matches what you wrote on the deposit slip.

- Place the completed deposit slip along with your check into an envelope.

- Address the envelope to Reserve Account, PO Box 223648, Pittsburgh, PA 15250-2648.

- If you prefer faster processing, use the overnight mailing address: Reserve Account, Attn: Box 223648, 500 Ross Street, Suite 154-0460, Pittsburgh, PA 15262-0001.

- Seal the envelope securely and take it to your local postal service or courier for delivery.

What You Should Know About This Form

What is the purpose of the Reserve Account Deposit Slip?

The Reserve Account Deposit Slip is used to facilitate postage deposits into a Reserve Account. It provides a convenient way to submit check payments, ensuring they are correctly attributed to the intended reserve fund.

How should I fill out the Reserve Account Deposit Slip?

When completing the deposit slip, you should write your Reserve Account number prominently on the slip. Next, indicate the amount of the deposit clearly. Ensure that all information is legible to avoid processing delays.

Who should I make checks payable to?

Checks should be made payable to “Reserve Account.” This ensures that the funds are directed to the correct account upon receipt.

Where do I send the completed deposit slip and check?

Your completed deposit slip and check should be sent to the following address: Reserve Account, PO Box 223648, Pittsburgh, PA 15250-2648. For faster processing, overnight checks should be sent to: Reserve Account, Attn: Box 223648, 500 Ross Street, Suite 154-0460, Pittsburgh, PA 15262-0001.

Is there a specific bank associated with the Reserve Account?

Yes, the Reserve Account is associated with The Pitney Bowes Bank, Inc., which is a member of the FDIC. This affiliation provides an added layer of security for your deposits.

What should I do if I have questions about my deposit?

If you have inquiries regarding your deposit or need assistance, it is advisable to contact the customer service department associated with the Reserve Account. They can provide further guidance tailored to your concerns.

Common mistakes

Filling out the Reserve Account Deposit Slip form can seem straightforward, but there are common mistakes that many people make. One frequent error is leaving the Reserve Account Number section blank. This number is essential for processing your deposit correctly. Without it, your funds may be misplaced, leading to unnecessary delays.

Another mistake often involves not properly filling out the dollar amount. Some individuals neglect to complete the dollar amount or mistakenly add extra zeros. Make sure to write the amount clearly in the designated area to avoid confusion.

In many cases, people write checks payable to the wrong entity. Ensure your checks are made out specifically to Reserve Account. Writing to another name will result in a non-processing of your deposit.

Another common oversight is failing to sign the check. It might seem trivial, but a blank or missing signature can lead to the return of your deposit. Always double-check that your check is signed before sending it off.

While mailing the deposit, inadequate addressing becomes a problem. Ensure that you have the correct address: Reserve Account, PO Box 223648, Pittsburgh, PA 15250-2648. Any mistakes here can lead to significant delays or loss of the check.

Some may opt to send their deposits without considering the mailing method. Not clearly marking the envelope for expedited service can result in missed deadlines. For faster processing, use overnight mail as stated in the instructions.

Ignoring the mailing instructions can lead to errors as well. Always refer back to the specific mailing addresses provided for regular versus overnight deposits, ensuring that your package is sent to the right location.

Moreover, not taking the time to confirm your mailing details can cause issues. A quick review of your filled-out slip can save you from mistakes that may complicate the deposit process.

A significant mistake that is often overlooked is not keeping copies of your deposit slip and check. Having a record allows you to track your deposit if any issues arise. Documentation is key to resolving potential problems.

Lastly, forgetting to verify that your deposit has been correctly processed can lead to larger issues down the line. Always follow up with your Reserve Account balance to confirm that the deposit appears as expected. This proactive step will help ensure everything is in order.

Documents used along the form

The Reserve Account Deposit Slip is an essential document for making deposits into a reserve account. Along with this slip, there are several other forms and documents that may be necessary depending on the specific circumstances. The following list outlines key documents that often accompany the Reserve Account Deposit Slip.

- Check for Deposit - A check made payable to the Reserve Account, which is the primary method of funding the reserve account. It must include the correct amount and, ideally, reference the account number associated with the deposit.

- Deposit Confirmation Form - This form serves as a record of the deposit made. It can document the date, amount, and method of deposit, providing a reference for future inquiries or audits.

- Account Statement - A statement from the Reserve Account, detailing recent transactions, including deposits and withdrawals. It helps account holders track their activity and confirm that their deposits have been processed.

- Authorization Form - If someone other than the account holder is making the deposit, an authorization form may be required to grant permission for that individual to conduct the transaction.

- W-9 Form - This form is used to provide taxpayer identification information. It may be needed for tax reporting purposes, especially when interest accrues on the reserve account.

- Overnight Delivery Receipt - If sending a deposit via overnight delivery, a receipt from the delivery service serves as proof of shipping and may include tracking information to confirm timely delivery to the Reserve Account.

- Postage Rate Sheet - A document outlining current postal rates may be necessary when determining how much to deposit into the reserve account for postage expenses.

- Customer Service Contact Information - A prepared document containing essential contact details helps account holders quickly reach out for assistance or to resolve any issues regarding their account.

By understanding these various documents and their purposes, one can ensure a seamless process when managing deposits and transactions through the Reserve Account. Each document plays a role in maintaining clarity and efficiency in financial management.

Similar forms

- Deposit Slip - A standard deposit slip allows individuals to deposit funds directly into their bank account. Similar to the Reserve Account Deposit Slip, it includes account details and the amount to deposit.

- Withdrawal Slip - This document is used to request the removal of funds from an account. It requires the account information and specifies the amount, much like the reserve deposit form outlines the deposit amount.

- Money Order - A money order serves as a prepaid payment method. It includes information about the payer and payee, akin to how the Reserve Account Deposit Slip specifies who to make the check payable to.

- Check Deposit Envelope - This envelope is used for submitting checks when making deposits. Similar to the deposit slip, it ensures the funds are sent to the correct account.

- Electronic Funds Transfer Request Form - This form authorizes the transfer of funds electronically. Like the deposit slip, it collects necessary account information and the amount to be transferred.

- Direct Deposit Authorization Form - This form allows individuals to authorize regular payments, such as paychecks, to be deposited directly into their bank account. It contains similar account details necessary for proper fund allocation.

- Certificate of Deposit (CD) Application - This application is used to open a CD at a bank. While it pertains to saving rather than depositing, it must provide account details and initial investment amounts.

- Bank Transfer Form - This document facilitates the transfer of funds between accounts within the same bank or to another bank. It ensures the transfer complies with the specified account information.

- Cash Deposit Receipt - When cash is deposited, this receipt serves as proof of the transaction. It similarly documents the amount deposited, maintaining detailed record-keeping akin to the Reserve Account Deposit Slip.

Dos and Don'ts

When filling out the Reserve Account Deposit Slip form, following a few simple guidelines can make the process smoother. Here are some essential dos and don’ts to keep in mind:

- Do ensure you have the correct Reserve Account number before sending your deposit.

- Do double-check the amount you intend to deposit is clearly written and correct.

- Do use a blue or black ink pen to fill out the form, as this makes the information more readable.

- Do securely attach your check to the deposit slip to avoid it getting lost during transit.

- Do keep a copy of the completed deposit slip for your records.

- Don’t leave any sections blank; even small details matter and can delay processing.

- Don’t forget to sign your check. A missing signature could result in your deposit being rejected.

- Don’t send cash with your deposit slip; always use a check to ensure security.

- Don’t mail your deposit to an incorrect address; always refer to the instructions for the specific mailing address.

Misconceptions

When it comes to understanding the Reserve Account Deposit Slip form, several misconceptions can create confusion. Here are four common misunderstandings, clarified for better comprehension.

- Misconception 1: The form is only for large deposits.

- Misconception 2: It is necessary to include additional documentation with the form.

- Misconception 3: Overnight mail requires a different form.

- Misconception 4: The form must be filled out perfectly or it will be rejected.

Many people believe that the Reserve Account Deposit Slip is meant solely for significant transactions. In reality, this form can be used for any amount, making it accessible for both minor and major postal deposits.

Some individuals think that they must attach extra paperwork to the Deposit Slip. However, the form itself serves as the primary document for the transaction, simplifying the deposit process without requiring additional documents.

There is a belief that using overnight shipping necessitates a separate kind of slip. This is not the case. The same Reserve Account Deposit Slip can be used, regardless of mailing speed, as long as it is sent to the correct address.

Some may worry that any mistake on the form will lead to rejection. While accuracy is important, minor errors are often correctable. The crucial part is to provide the required information clearly, allowing your deposit to be processed smoothly.

Key takeaways

Here are key takeaways for filling out and using the Reserve Account Deposit Slip form:

- Purpose: This form is specifically designed for making postage deposits to the Reserve Account.

- Payment Details: Always make checks payable to "Reserve Account" to ensure proper processing.

- Account Number: Enter the Reserve Account number clearly on the slip to avoid confusion.

- Mailing Address: Send the completed deposit slip along with the check to PO Box 223648, Pittsburgh, PA 15250-2648.

- Overnight Delivery: For overnight deliveries, address the envelope to "Attn: Box 223648" at 500 Ross Street, Suite 154-0460, Pittsburgh, PA 15262-0001.

- FDIC Member: The Reserve Account is managed by The Pitney Bowes Bank, Inc., which is a member of the FDIC.

- Clarity: Fill out the dollar amount clearly on the form to minimize errors.

- Duplicate Copies: It is advisable to keep a copy of the filled-out deposit slip for your records.

- Regular Use: Utilize this form regularly to maintain adequate postage funds in your Reserve Account.

Browse Other Templates

Texas Franchise Tax Declaration,Texas Annual Tax Reporting Form,Texas Franchise Tax Filing Sheet,Texas Business Tax Summary,Texas Corporate Tax Report,Texas Revenue and Margin Report,Texas Taxpayer Disclosure Form,Annual Texas Business Tax Statement, - The reporting process is designed to be straightforward for taxpayers.

8804 - Copy D is for the withholding agent to maintain for their records.