Fill Out Your Retail Installment Sale Contract Form

The Retail Installment Sale Contract (RISC) is an essential document used in the financing of retail purchases, especially for vehicles. This contract allows consumers to buy goods while paying for them over time, typically through monthly payments. It contains several critical components, including the sale price, down payment, and financing details such as interest rates and terms. Additionally, the contract outlines consequences for late payments, including potential late fees and arbitration processes in case of disputes. Different states may have their specific acceptable RISC forms, reflecting local laws and practices. For instance, forms may differ based on whether they include a simple interest calculation or pre-computed interest. As consumers consider financing options, understanding the elements of this contract is fundamental to making informed decisions and ensuring protection throughout the purchasing process.

Retail Installment Sale Contract Example

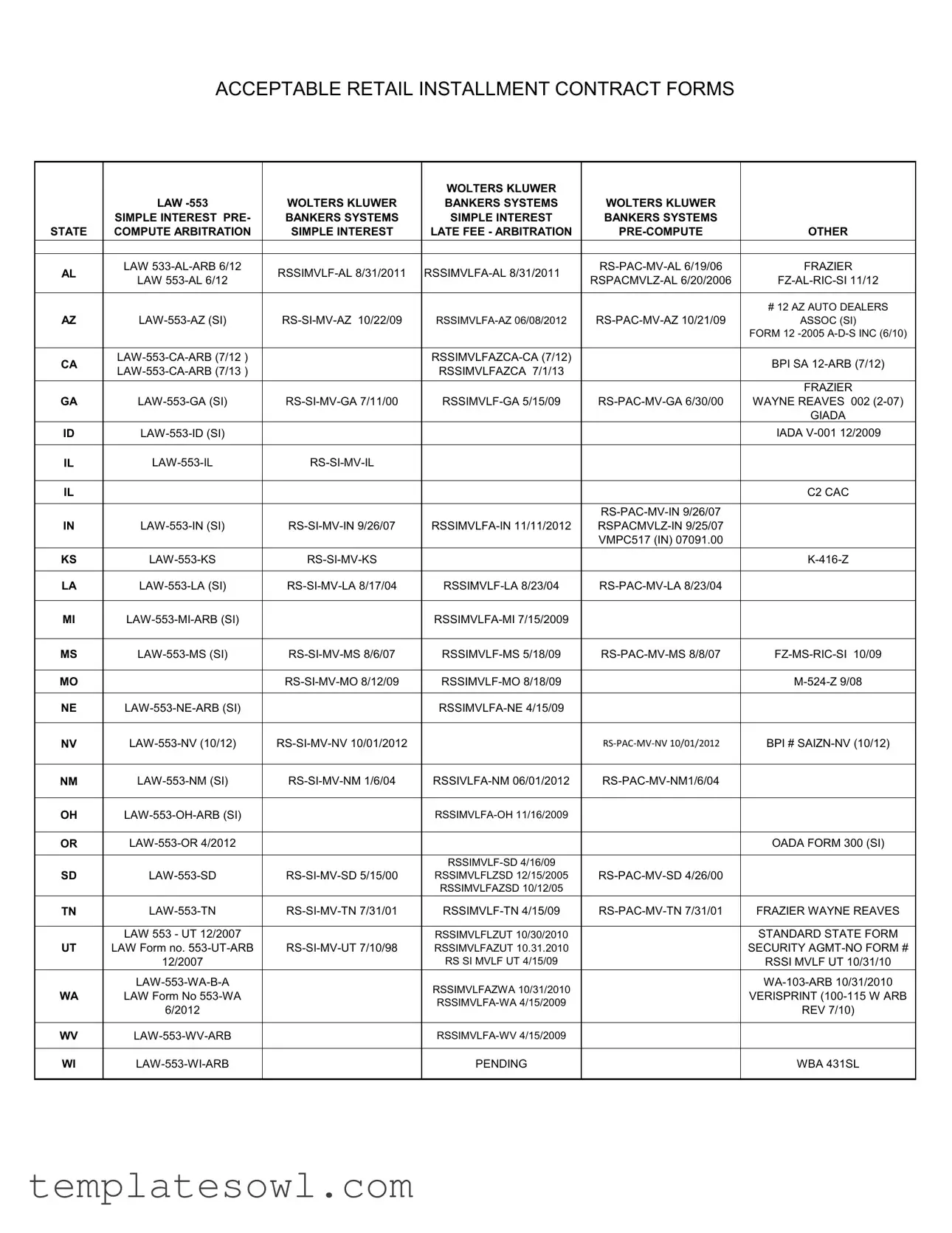

ACCEPTABLE RETAIL INSTALLMENT CONTRACT FORMS

|

|

|

WOLTERS KLUWER |

|

|

|

|

LAW |

WOLTERS KLUWER |

BANKERS SYSTEMS |

WOLTERS KLUWER |

|

|

|

SIMPLE INTEREST PRE- |

BANKERS SYSTEMS |

SIMPLE INTEREST |

BANKERS SYSTEMS |

|

|

STATE |

COMPUTE ARBITRATION |

SIMPLE INTEREST |

LATE FEE - ARBITRATION |

OTHER |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AL |

LAW |

FRAZIER |

||||

LAW |

||||||

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

# 12 AZ AUTO DEALERS |

|

AZ |

ASSOC (SI) |

|||||

|

|

|

|

|

FORM 12 |

|

|

|

|

|

|

|

|

CA |

|

|

BPI SA |

|||

|

RSSIMVLFAZCA 7/1/13 |

|

||||

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

FRAZIER |

|

GA |

WAYNE REAVES 002 |

|||||

|

|

|

|

|

GIADA |

|

ID |

|

|

|

IADA |

||

|

|

|

|

|

|

|

IL |

|

|

|

|||

|

|

|

|

|

|

|

IL |

|

|

|

|

C2 CAC |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

IN |

|

|||||

|

|

|

|

VMPC517 (IN) 07091.00 |

|

|

|

|

|

|

|

|

|

KS |

|

|

||||

|

|

|

|

|

|

|

LA |

|

|||||

|

|

|

|

|

|

|

MI |

|

|

|

|||

|

|

|

|

|

|

|

MS |

||||||

|

|

|

|

|

|

|

MO |

|

|

||||

|

|

|

|

|

|

|

NE |

|

|

|

|||

|

|

|

|

|

|

|

NV |

|

BPI # |

||||

|

|

|

|

|

|

|

NM |

|

|||||

|

|

|

|

|

|

|

OH |

|

|

|

|||

|

|

|

|

|

|

|

OR |

|

|

|

OADA FORM 300 (SI) |

||

|

|

|

|

|

|

|

|

|

|

|

|

||

SD |

RSSIMVLFLZSD 12/15/2005 |

|

||||

|

|

|

RSSIMVLFAZSD 10/12/05 |

|

|

|

TN |

FRAZIER WAYNE REAVES |

|||||

|

|

|

|

|

|

|

|

LAW 553 - UT 12/2007 |

|

RSSIMVLFLZUT 10/30/2010 |

|

STANDARD STATE FORM |

|

UT |

LAW FORM NO. |

RSSIMVLFAZUT 10.31.2010 |

|

SECURITY |

||

|

12/2007 |

|

RS SI MVLF UT 4/15/09 |

|

RSSI MVLF UT 10/31/10 |

|

|

|

RSSIMVLFAZWA 10/31/2010 |

|

|||

WA |

LAW FORM NO |

|

|

VERISPRINT |

||

|

|

|||||

|

6/2012 |

|

|

REV 7/10) |

||

|

|

|

|

|||

|

|

|

|

|

|

|

WV |

|

|

|

|||

|

|

|

|

|

|

|

WI |

|

PENDING |

|

WBA 431SL |

||

|

|

|

|

|

|

Form Characteristics

| Fact Name | Description |

|---|---|

| Acceptable Forms | The Retail Installment Sale Contract must be one of the acceptable forms from specified providers, such as Wolters Kluwer and Bankers Systems. |

| State-Specific Variations | Each state may have distinct versions of the contract, governed by its own laws, such as Alabama Law 533-AL-ARB. |

| Interest Calculation | The forms may contain provisions for simple interest calculations, including Pre-Compute and Other options. |

| Late Fees | Some contracts include specific clauses regarding late fees, which must be clearly outlined to avoid confusion. |

| Governing Law | The contracts comply with state-specific laws, ensuring that all terms are legally enforceable. |

| Arbitration Clauses | Certain forms may have arbitration clauses to resolve disputes outside of court, as per governing state laws. |

| Form Updates | Many forms are updated periodically. The version date is critical to ensure compliance with the latest legal requirements. |

| Standardization | There are efforts to standardize the Retail Installment Sale contracts across states to promote fairness and clarity for consumers. |

Guidelines on Utilizing Retail Installment Sale Contract

Filling out the Retail Installment Sale Contract form is a straightforward task that requires careful attention to detail. Follow each step to ensure accuracy and completeness, as this contract is essential for both the buyer and seller in a retail transaction. After completing the form, it will need to be signed and dated by both parties to finalize the agreement.

- Title of the Contract: At the top of the form, clearly write "Retail Installment Sale Contract."

- Seller Information: Fill in the seller's name and contact details, including address and phone number.

- Buyer Information: Enter the buyer's name, address, and contact information in the designated section.

- Item Description: Provide a detailed description of the item(s) being sold, including make, model, and any serial numbers.

- Sale Price: State the total sale price for the item(s), including any applicable taxes and fees.

- Down Payment: Indicate the amount of the down payment made by the buyer.

- Financing Terms: Outline the financing terms, including interest rate, payment schedule, and total repayment amount.

- Late Fees: Specify any late fees that will apply if payments are not made on time.

- Signatures: Both parties should sign and date the form at the bottom to indicate their agreement to the terms.

What You Should Know About This Form

What is a Retail Installment Sale Contract?

A Retail Installment Sale Contract is an agreement between a buyer and a seller that allows the buyer to purchase goods or services and pay for them over time. It typically outlines the terms of the sale, including the price, repayment schedule, and any interest or fees that may apply.

What should I look for in a Retail Installment Sale Contract?

When reviewing a Retail Installment Sale Contract, it is important to check the total price, the down payment required, and the interest rate. Ensure the payment schedule is clear and that any fees for late payments or early payoffs are disclosed. Always read the fine print for any additional terms that may impact your purchase.

Are there different types of Retail Installment Sale Contract forms for different states?

Yes, Retail Installment Sale Contracts come in various forms tailored to meet the legal requirements of different states. For example, the forms in Alabama, California, and Michigan exhibit specific provisions in accordance with each state’s regulations. Be sure to use the form that aligns with your location to ensure compliance.

Can I negotiate terms in the Retail Installment Sale Contract?

Yes, negotiation is possible. Many aspects of the contract, such as the interest rate, down payment, and fees, may be negotiable. Approach this discussion openly and be prepared to explain your reasons for requesting changes.

What happens if I miss a payment on my Retail Installment Sale Contract?

Missing a payment can lead to late fees as specified in the contract. It may also affect your credit score and could result in legal actions if left unresolved. Always communicate with your seller immediately if you anticipate difficulty making a payment.

Is the Retail Installment Sale Contract legally binding?

Yes, once signed, the Retail Installment Sale Contract becomes a legally binding agreement. Both parties are expected to adhere to the outlined terms. Consult with a legal expert if you have any concerns regarding the enforceability of the contract.

Can I cancel a Retail Installment Sale Contract?

Cancellation policies vary depending on state laws and the terms specified in the contract. Some contracts may allow a brief period of cancellation without penalty, while others may not. Review your contract closely and reach out to the seller for clarification if needed.

What types of goods or services can I purchase with a Retail Installment Sale Contract?

Typically, these contracts are used for significant purchases such as vehicles, appliances, and furniture. However, the specific goods or services may vary by seller, so verify with the retailer to understand their offerings.

What should I do if I don't understand something in my Retail Installment Sale Contract?

If any part of the contract is unclear, it's important to seek clarification. You can ask the seller for an explanation or consult with a professional who specializes in contracts. Understanding each term is essential to avoid issues later on.

How do I obtain a Retail Installment Sale Contract form?

You can typically obtain a Retail Installment Sale Contract form directly from a retailer or dealer providing the goods or services. Additionally, various legal or automotive websites offer standard forms tailored for each state. Ensure you are using the most current version for your state's regulations.

Common mistakes

Completing the Retail Installment Sale Contract form can be a straightforward process, but several common mistakes can lead to challenges later on. One of the most frequent errors occurs when individuals fail to carefully check the accuracy of personal information such as names, addresses, and social security numbers. Any mistakes in this critical data might lead to identity verification issues in the future, hindering the transaction process.

Another common mistake is neglecting to read the terms and conditions outlined in the contract. Many people overlook details regarding interest rates, payment schedules, and late fees. Failure to fully understand these terms can result in unexpected financial obligations that individuals may not have anticipated. It is essential to take the time to read through each section thoroughly.

Additionally, people often forget to assess the total cost of the purchase, which includes not only the base price of the item being financed but also any additional fees or charges. If these costs are not calculated correctly, buyers may be unaware of the true financial impact of the contract. A comprehensive look at the total cost can help prevent financial strain in the future.

Incorrectly identifying the purchase type is also a prevalent oversight. It is crucial to select the proper category for the item being financed, whether it be a vehicle, furniture, or another category. This affects not only the terms of the contract but also the applicable state regulations. Misclassifying the purchase can complicate compliance with local laws.

Lastly, many individuals fail to consult with a trusted advisor or legal expert before signing the document. Engaging with a knowledgeable third party can provide additional insights and recommendations that may not be apparent to the signer. Taking this step can often prevent costly mistakes and lead to a more informed and confident signing experience.

Documents used along the form

The Retail Installment Sale Contract is often accompanied by various other forms and documents that help facilitate the sale and financing process. Each of these documents serves a specific purpose, contributing to the clarity and legality of the transaction between the buyer and seller. Below is a list of commonly used forms along with brief descriptions of their functions.

- Disclosure Statement: This document outlines important details regarding the terms of the sale, including interest rates, payment schedules, and any fees. It ensures that buyers are fully informed before entering into the contract.

- Security Agreement: This agreement specifies the collateral used to secure the loan. It grants the seller or lender a legal claim to the item being financed in case of default.

- Credit Application: A form completed by the buyer to request financing. It collects personal and financial information to assess the buyer's creditworthiness.

- Truth in Lending Statement: This document provides a summary of the credit terms, including the annual percentage rate (APR) and total finance charges, helping buyers understand the costs associated with their loan.

- Purchase Order: This form is used to confirm the buyer's intent to purchase and outlines the specifics of the transaction, including the item, price, and any conditions of sale.

- Installment Payment Schedule: This document details the payment amounts, due dates, and total number of payments. It serves as a roadmap for the buyer's obligation over the life of the loan.

- Sales Tax Agreement: This form outlines the sales tax applicable to the purchase. It ensures compliance with state and local tax regulations.

- Insurance Verification Form: This document is used to confirm that the buyer has obtained the necessary insurance coverage for the financed item, often a vehicle.

- Assignment Agreement: This form allows the seller to transfer the rights of the contract to a third party, typically a financing company, outlining the terms of the assignment.

Utilizing these forms and documents together with the Retail Installment Sale Contract enhances the overall transparency and security of the transaction. Each document plays a critical role in establishing the rights and responsibilities of the parties involved, ultimately supporting a smoother purchasing experience.

Similar forms

Retail Lease Agreement: This document outlines the terms under which one party agrees to rent property owned by another party. Similar to a Retail Installment Sale Contract, it specifies payment terms, including amounts due and due dates.

Purchase Agreement: A Purchase Agreement is a contract that details the sale of goods or services between a buyer and seller. Like the Retail Installment Sale Contract, it requires agreement on the total price, terms of payment, and delivery conditions.

Loan Agreement: This contract formalizes the borrower's promise to repay a loan under specified terms. Both agreements include provisions for interest rates and payment schedules, although one is for retail products and the other for cash loans.

Conditional Sales Agreement: This document allows a seller to keep ownership of an item until the buyer pays the full purchase price. While similar to a Retail Installment Sale Contract, it may involve different conditions regarding ownership transfer.

Financing Agreement: This contract provides detailed descriptions of the financing terms for a purchase, including interest rates and payment methods. It mirrors the Retail Installment Sale Contract in its objective to outline payment arrangements.

Credit Agreement: A Credit Agreement defines the terms under which credit can be extended to a consumer. Like the Retail Installment Sale Contract, it sets terms for repayment, fees, and penalties.

Service Agreement: This contract outlines the terms for services provided, detailing costs, payment schedules, and deliverables. While not a sale of goods, the structure regarding payment cycles can be akin to a Retail Installment Sale Contract.

Timeshare Agreement: A Timeshare Agreement allows multiple parties to share ownership of a property. It includes payment terms similar to the Retail Installment Sale Contract, particularly regarding installment payments over time.

Lease-Purchase Agreement: This hybrid contract combines elements of a lease and a purchase agreement, allowing a tenant to buy the property they are renting. Terms detailing future payments reflect those found in a Retail Installment Sale Contract.

Automobile Financing Agreement: Specifically for vehicle purchases, this document lays out the terms for financing a car. Similar to the Retail Installment Sale Contract, it delineates payment schedules and interest rates.

Dos and Don'ts

- Do read the entire contract carefully before starting.

- Do ensure all personal information is complete and accurate.

- Do verify the terms of sale, including interest rates and payment schedules.

- Do ask questions if any terms are unclear or confusing.

- Don't leave any sections blank; every field must be filled out.

- Don't rush through the form; take your time to avoid errors.

- Don't sign the contract until you fully understand all obligations.

Ensuring accuracy and clarity in filling out the Retail Installment Sale Contract is crucial. This not only protects your rights but also helps prevent unexpected complications down the line.

Misconceptions

- Misconception 1: The Retail Installment Sale Contract is only used for automobiles.

- Misconception 2: All Retail Installment Sale Contracts are the same.

- Misconception 3: The contract can be changed at any time without notice.

- Misconception 4: Signing the contract means the buyer has given up all rights.

- Misconception 5: The Retail Installment Sale Contract does not require disclosures.

- Misconception 6: A higher interest rate always means a better deal.

- Misconception 7: The Retail Installment Sale Contract is only for new products.

- Misconception 8: A Retail Installment Sale Contract guarantees financing.

- Misconception 9: The contract is irrelevant once the purchase is complete.

This form can be used for various retail transactions, not just auto sales. It covers the sale of goods and services, making it versatile.

The forms can vary by state and by lender. Different provisions may apply, including interest rates and terms, depending on local laws.

Changes to the contract require agreement from both parties and must comply with applicable laws. Unilateral changes are generally not permitted.

Consumers still have rights even after signing. These rights include the ability to dispute charges and pursue remedies for breaches of contract.

The law mandates certain disclosures, such as the total cost of the sale and the terms of repayment. Sellers must provide this information to the buyer.

A higher interest rate can indicate a more costly loan. It's essential to consider the total cost over the loan term rather than just the interest rate.

This contract can also be used for used products. The seller must specify in the agreement whether the item is new or used.

Signing the contract does not guarantee financing. Approval may depend on credit checks and the lender's policies.

The contract remains important post-purchase. It serves as a legal document outlining payment obligations and can be referenced in case of disputes.

Key takeaways

When filling out and using a Retail Installment Sale Contract form, it is essential to keep a few key points in mind to ensure that everything is done correctly and fairly.

- Choose the Correct Form: There are various acceptable Retail Installment Sale Contract forms. Make sure to select the form that complies with your state’s laws.

- Provide Accurate Information: All details regarding the buyer, seller, and the terms of the sale must be filled out accurately. Errors can lead to misunderstandings and potential legal issues.

- Understand the Terms: Familiarize yourself with the terms of the sale, including interest rates, payment schedules, and total cost. Both you and the buyer should fully understand what is being agreed upon.

- Include Necessary Disclosures: Certain information must be disclosed to the buyer, such as any fees, penalties for late payments, and the rights of both parties under the contract.

- Signatures are Key: Ensure that both the buyer and seller sign the contract where indicated. This establishes that both parties agree to the terms outlined.

- Keep Copies: After the contract is signed, both parties should retain a copy for their records. This serves as proof of the agreement and can be referenced in case of disputes.

By following these guidelines, both parties can approach the sale with confidence and clarity, ensuring a smoother transaction.

Browse Other Templates

Charitable Registration Document,Nonprofit Registration Form,Illinois Charity Registration,Charitable Organization Registration,Charitable Trust Registration Statement,Solicitation for Charity Form,Fundraising Registration Statement,Illinois Charitab - Organizations must adhere to specific deadlines for submitting the registration form.

Registrar Famu - Students should take care to provide all necessary information for a timely review.

What Is a Da Form 1059 Used for - The evaluations completed on this form are retained as part of the soldier's official record.