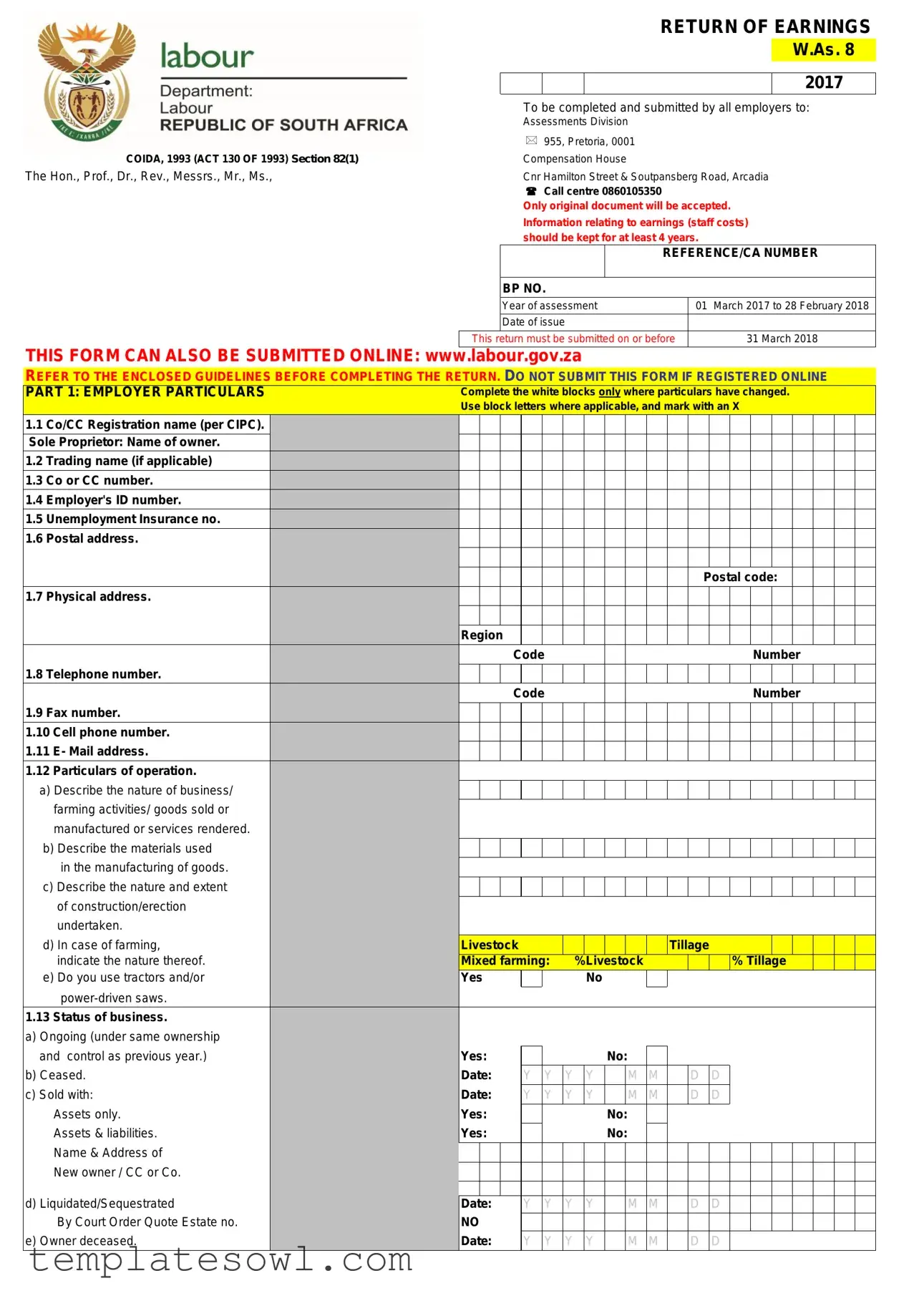

Fill Out Your Return Of Earnings Form

The Return of Earnings form, commonly known as the W.As. 8, plays a crucial role in the assessment of compensation fund contributions for employers. This mandatory form must be submitted annually by all employers to the Assessments Division of the Compensation Fund, as stipulated by the Compensation for Occupational Injuries and Diseases Act of 1993. The information captured within this document encompasses several important sections, starting with employer particulars, such as trading name and contact details, and extending to crucial employee details, including average employee numbers and total earnings disbursed during the specified assessment year. Employers need to accurately record total earnings for both permanent and temporary employees while also separate structures for director or member earnings to ensure comprehensive reporting. Furthermore, it’s vital for employers to note any substantial changes in employee counts or earnings compared to the previous year, as explanations may be necessary. Timeliness in submission cannot be overstated, as the form must reach the Compensation Fund by March 31 following the assessment year. Understanding each component of the Return of Earnings form is essential for compliance and enhances the accuracy of compensation assessments, ultimately fostering a transparent and accountable work environment.

Return Of Earnings Example

RETURN OF EARNINGS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

W.As. 8 |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2017 |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

To be completed and submitted by all employers to: |

||||||||||||||||||

|

|

|

|

|

|

Assessments Division |

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

COMPENSATION FUND |

|

|

|

* 955, Pretoria, 0001 |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

COIDA, 1993 (ACT 130 OF 1993) Section 82(1) |

|

|

|

Compensation House |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

The Hon., Prof., Dr., Rev., Messrs., Mr., Ms., |

|

|

|

Cnr Hamilton Street & Soutpansberg Road, Arcadia |

|||||||||||||||||||

|

|

|

|

|

|

( Call centre 0860105350 |

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

Only original document will be accepted. |

||||||||||||||||||

|

|

|

|

|

|

Information relating to earnings (staff costs) |

||||||||||||||||||

|

|

|

|

|

|

should be kept for at least 4 years. |

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

REFERENCE/CA NUMBER |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BP NO. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

Year of assessment |

|

|

|

01 March 2017 to 28 February 2018 |

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

Date of issue |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

This return must be submitted on or before |

|

|

|

31 March 2018 |

|||||||||||||||||

|

THIS FORM CAN ALSO BE SUBMITTED ONLINE: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

www.labour.gov.za |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

REFER TO THE ENCLOSED GUIDELINES BEFORE COMPLETING THE RETURN. DO NOT SUBMIT THIS FORM IF REGISTERED ONLINE |

|||||||||||||||||||||||

|

PART 1: EMPLOYER PARTICULARS |

Complete the white blocks only where particulars have changed. |

||||||||||||||||||||||

|

|

|

Use block letters where applicable, and mark with an X |

|||||||||||||||||||||

|

1.1 Co/CC Registration name (per CIPC). |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sole Proprietor: Name of owner. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1.2 Trading name (if applicable) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1.3 Co or CC number. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1.4 Employer's ID number. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1.5 Unemployment Insurance no. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1.6 Postal address. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Postal code: |

|

|

|

|

||||

|

1.7 Physical address. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Region |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

Code |

|

|

|

|

|

|

|

|

|

|

|

|

Number |

||||||

|

1.8 Telephone number. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Code |

|

|

|

|

|

|

|

|

|

|

|

|

Number |

||||||

|

1.9 Fax number. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1.10 Cell phone number. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1.11 E- Mail address. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1.12 Particulars of operation. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

a) Describe the nature of business/ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

farming activities/ goods sold or |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

manufactured or services rendered. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

b) Describe the materials used |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

in the manufacturing of goods. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

c) Describe the nature and extent |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

of construction/erection |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

undertaken. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

d) In case of farming, |

|

Livestock |

|

|

|

|

|

|

|

Tillage |

|

|

|

|

|

||||||||

|

indicate the nature thereof. |

|

Mixed farming: |

|

%Livestock |

|

|

|

|

|

% Tillage |

|

|

|

||||||||||

|

e) Do you use tractors and/or |

|

Yes |

|

|

|

|

|

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1.13 Status of business. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

a) Ongoing (under same ownership |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

and control as previous year.) |

|

Yes: |

|

|

|

|

|

|

No: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

b) Ceased. |

|

Date: |

|

Y |

Y |

Y |

|

Y |

|

M |

M |

|

D |

|

D |

|

|

|

|

|

|

|

|

|

c) Sold with: |

|

Date: |

|

Y |

Y |

Y |

|

Y |

|

M |

M |

|

D |

|

D |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Assets only. |

|

Yes: |

|

|

|

|

|

|

No: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Assets & liabilities. |

|

Yes: |

|

|

|

|

|

|

No: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

Name & Address of |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

New owner / CC or Co. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

d) Liquidated/Sequestrated |

|

Date: |

|

Y |

Y |

Y |

|

Y |

|

M |

M |

|

D |

|

D |

|

|

|

|

|

|

|

|

|

By Court Order Quote Estate no. |

|

NO |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e) Owner deceased. |

|

Date: |

|

Y |

Y |

Y |

|

Y |

|

M |

M |

|

D |

|

D |

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PART 2:

Reference number:

Declaration 01 March 2017 - 28 February 2018

I, the undersigned confirm that the number of employees and their earnings (staff costs/salaries & wages) for the 12 months ending 28/02/2018 are as follows:

|

Actual Earnings:01/03/2017 - 28/02/2018 |

|

Provisional Earnings:01/03/2018- 28/02/2019 |

|||||||

|

|

Number of employees and |

Number of directors/members |

|

Number of employees and |

Number of directors/members |

||||

|

|

amount of earnings (staff |

and amount of earnings (staff |

|

amount of earnings (staff |

and amount of earnings (staff |

||||

|

|

costs/salaries & wages) per |

costs/salaries & wages) per |

|

costs/salaries & wages) per |

costs/salaries & wages) per |

||||

|

|

month paid to all employees |

month paid to directors of a |

|

month expected to be paid to all |

month expected to be paid to |

||||

|

|

(excluding directors of a |

Company or members of a Close |

|

employees (excluding directors of |

directors of a Company or |

||||

Month |

|

Company or members of a close |

Corporation up to a maximum of |

|

a Company or members of a |

members of a Close Corporation |

||||

|

|

corporation) up to a maximum of |

R 403 500 per person for the |

|

close corporation) up to a |

up to a maximum of R 430 944 per |

||||

|

|

R 403 500 per person for the |

above period. |

|

maximum of R 430 944 per |

person for the above period. |

||||

|

|

above period. |

|

|

|

person for the above period. |

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

Number |

Earnings - |

Number |

Earnings - |

|

Number |

Earnings - |

Number |

Earnings - |

|

|

|

(Rands only) |

|

(Rands only) |

|

|

(Rands only) |

|

(Rands only) |

Mar |

|

|

|

|

|

|

|

|

|

|

Apr |

|

|

|

|

|

|

|

|

|

|

May |

|

|

|

|

|

|

|

|

|

|

Jun |

|

|

|

|

|

|

|

|

|

|

Jul |

|

|

|

|

|

|

|

|

|

|

Aug |

|

|

|

|

|

|

|

|

|

|

Sep |

|

|

|

|

|

|

|

|

|

|

Oct |

|

|

|

|

|

|

|

|

|

|

Nov |

|

|

|

|

|

|

|

|

|

|

Dec |

|

|

|

|

|

|

|

|

|

|

Jan |

|

|

|

|

|

|

|

|

|

|

Feb |

|

|

|

|

|

|

|

|

|

|

Total |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FINAL EARNINGS PAID |

|

ESTIMATED EARNINGS |

|

|

||

Total earnings of both employees |

|

|

|

|

|

|

|

|||

and Directors/Members: |

|

|

|

|

|

|

|

|||

Total cash value of free food and/ or |

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

||||

quarters. (if applicable) in Rands. |

|

|

|

|

|

|

|

|||

GRAND TOTAL OF EARNINGS |

|

|

|

|

|

|

|

|||

State in words the grand total of earnings: |

|

State in words the grand total of earnings: |

||||||||

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|||||

Give reason where earnings differ by 30% from the previous year: |

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Declaration by employer: |

|

|

|

Declaration by Agent/Payroll Administrator: |

||||||

Name: |

|

|

|

|

|

|

Name: |

|

|

|

Designation: |

|

|

|

Designation: |

|

|

||||

SIGNATURE: |

|

|

|

SIGNATURE: |

|

|

||||

Date: |

|

|

|

|

|

|

Date: |

|

|

|

Telephone No: |

|

|

|

Telephone No: |

|

|

||||

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|||

Company Banking Information: |

|

|

|

|

Office use only - Codified. |

|||||

Bank Name: |

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|||

Account No: |

|

|

|

|

|

|

|

|||

Branch Code: |

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|||

Branch Name: |

|

|

|

|

|

|

|

|||

Type of Acc: |

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

NB: IT IS THE RESPONSIBILITY OF THE EMPLOYER TO ENSURE THAT THE INFORMATION DECLARED IS ACCURATE AND CORRECT, THEREFORE NO REVISIONS WILL BE ENTERTAINED

IT IS COMPULSORY FOR BOTH EMPLOYER AND AGENT / PAYROLL ADMINISTRATOR TO SIGN THE DECLARATIONS ABOVE.

IT IS A SERIOUS OFFENCE TO MAKE A FALSE DECLARATION OR FAIL TO RENDER A RETURN WITHIN THE PRESCRIBED PERIOD.

THE ONUS IS ON THE EMPLOYER TO NOTIFY THE COMMISSIONER WITHIN 7 DAYS OF ANY CHANGES IN THE PARTICULARS SO FURNISHED (E.G NATURE OF BUSINESS OR CLOSURE OF BUSINESS, ETC)

In the event that more than one return is furnished for the same assessment period this office will accept the first return as final

Criminal proceedings will be instituted for misrepresentation of facts

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The Return of Earnings form is designed for employers to report the earnings of all employees for a specified assessment year. |

| Governing Law | This form is governed under the Compensation for Occupational Injuries and Diseases Act (COIDA) of 1993, specifically Section 82(1). |

| Submission Deadline | Employers must submit this form to the Assessments Division of the Compensation Fund on or before March 31 of the year following the assessment period. |

| Assessment Year | The assessment period for the relevant Return of Earnings form is from March 1, 2006, to February 28, 2007. |

| Employee Categories | The earnings reported must include all types of employees, such as permanent, temporary, and casual workers. |

| Earnings Cap | There's a maximum earnings cap of R189,840 per person for the assessment year indicated on the form. |

| Estimated Earnings | If actual earnings differ significantly from the previous year, employers should provide explanations on the form itself. |

| Submission Method | Faxed copies of the Return of Earnings form are not accepted; original submissions are required. |

| Accuracy Certification | Employers must certify the accuracy of the submitted information by signing and dating the form. |

Guidelines on Utilizing Return Of Earnings

Filling out the Return Of Earnings form is an important step in ensuring compliance with the Compensation Fund requirements. After submitting the completed form, you can expect to receive confirmation from the Assessments Division. This confirmation serves as proof of your filing. Below are the steps to follow as you complete the form.

- Obtain the Return Of Earnings form (W.As. 8 2006) from the Assessment Division or the website provided.

- Identify the correct year of assessment, which in this case is from 01 March 2006 to 28 February 2007.

- Fill out the Employer Particulars section, completing only the white blocks where details have changed. Use block letters when necessary.

- Provide your trading name, owner's name, Company/CC number, and Employer's ID number.

- Complete your postal address and physical address, including postal and area codes.

- Fill in your telephone, fax, and cell phone number as well as your email address.

- Describe your operation in the space provided, detailing goods manufactured or services rendered and materials used.

- Indicate any changes in your business status, such as ceasing operations or restructuring, and provide relevant dates if applicable.

- For Earnings of all employees, provide the average number of employees employed during the specified period.

- Document the total earnings paid to all employees for the assessment year, excluding directors or members.

- In cases where directors' or members' earnings apply, fill these in under the correct section.

- Calculate the total value of any included benefits, like free food and/or quarters.

- Sum all earnings to provide a TOTAL AMOUNT, adding earnings from previous entries.

- In the Expected Earnings section, provide estimated data for the upcoming assessment year.

- State any discrepancies in employee numbers or earnings compared to the previous year.

- Affirm the accuracy of your submitted information by signing and dating the document.

What You Should Know About This Form

What is the Return of Earnings form?

The Return of Earnings form is a document that employers in South Africa are required to complete and submit to the Assessments Division of the Compensation Fund. It collects information necessary for calculating contributions to the Compensation Fund, which provides benefits for employees who might be injured or become ill due to their work. This form must be filled out accurately and submitted on or before the specified deadline.

Who needs to submit the Return of Earnings form?

All employers, including those operating as companies or close corporations, are required to submit the Return of Earnings form. This includes employers with permanent, temporary, and casual employees. Failure to submit the form can lead to penalties and estimated assessments by the Compensation Fund.

What is the deadline for submitting the Return of Earnings form?

The Return of Earnings form must be submitted on or before March 31 each year for the preceding assessment year, which runs from March 1 to February 28 of the following year. It is important to ensure that the form is submitted on time to avoid any penalties.

What information is required on the Return of Earnings form?

The form requires detailed employer particulars, including the trading name, owner’s details, and addresses. Additionally, it requests information regarding the average number of employees and total earnings paid during the specified assessment year. Employers must also provide estimates for the upcoming assessment year.

What happens if the Return of Earnings form is not accurately completed?

If the form is not completed accurately, the Assessments Division may estimate the provisional earnings based on the declared figures plus a 10% increase. This can lead to higher contributions than warranted. It is crucial that employers provide precise and thorough information.

Can the Return of Earnings form be submitted by fax?

No, faxed copies of the Return of Earnings form are not accepted. Employers must submit the original document. This requirement underscores the importance of ensuring that the form is completed correctly and sent in the proper manner.

What are the consequences of failing to submit the Return of Earnings form?

Failure to submit the Return of Earnings form on time may lead to penalties imposed by the Compensation Fund. Furthermore, the consequence of late or non-submission includes potential assessments based on estimated earnings rather than actual figures. This can significantly affect the amount owed in contributions.

Whom should I contact for assistance with the Return of Earnings form?

For assistance regarding the Return of Earnings form, employers can contact the Compensation Fund's call center at 0860 105 350 or send an email to cf-info@labour.gov.za. Additional information is also available on their official website at http://www.labour.gov.za.

Common mistakes

Filling out the Return of Earnings form can be a straightforward process if approached with care. However, there are common mistakes that can impede this task. Individuals often overlook the importance of using the correct year of assessment, which in this case is from 01 March 2006 to 28 February 2007. Failure to align the reporting period correctly can lead to complications and possible rejections.

Providing inaccurate employer particulars represents another frequent error. Employers should fill in only the white blocks where changes have occurred, clearly using block letters. When changes are not properly marked, it leads to confusion and delays in processing the return.

One critical section is the earnings of employees. Many people fail to accurately calculate the total earnings paid to all employees. This figure must exclude directors or members of the company or close corporation and cannot exceed the specified maximum amount. Inadequate organization of this data results in audits or revised earnings estimates.

Neglecting to include the total cash value of free food and/or quarters also reflects a common oversight. If these amounts are omitted from the calculations, the totals reported will not represent the true expense incurred by the employer. Subsequently, this may affect the compensation fund's estimated liability.

Another potential mistake involves the failure to complete the estimated earnings section. Omitting this part of the form can automatically result in provisional earnings being calculated based on the prior year’s data, with an added 10%. This estimate may not accurately reflect current business operations, leading to inequities in contributions.

While providing reasons for differences in employee numbers or earnings compared to the previous year is optional, many neglect to do so when applicable. This explanation can clarify substantial discrepancies, avoiding unnecessary follow-up inquiries from the assessments division.

Finally, the method of submission can also lead to issues. It is critical not to submit faxed copies of the Return of Earnings form, as these are explicitly stated as unacceptable. A physical delivery or email submission, where specified, ensures compliance with the requirements and aids in maintaining accurate record-keeping.

Documents used along the form

Completing the Return of Earnings form often involves several other documents that provide additional information about the employer's workforce and compensation practices. The following is a list of common forms and documents that may accompany the Return of Earnings submission.

- Payroll Records: Employers must maintain accurate payroll records detailing the wages paid to each employee. This document provides the basis for the earnings reported in the Return of Earnings.

- Employee Contracts: These contracts outline the terms of employment for each employee, including roles, responsibilities, and compensation details. They serve as a reference to validate reported earnings.

- Workmen's Compensation Insurance Policy: Proof of existing workmen’s compensation insurance is often required to ensure that the employer is covered against work-related injuries and illnesses.

- Annual Financial Statements: These documents summarize the company’s financial performance over the year and may be requested to validate the accuracy of earnings reported in the Return of Earnings.

- Tax Returns: A copy of the employer’s tax returns may be necessary, as it reflects the overall financial health of the business and corroborates reported earnings.

- Staff Rosters: Detailed records of employee attendance and hours worked can support earnings calculations and provide a clearer picture of workforce changes throughout the assessment year.

Employers should prepare these documents in advance to ensure a complete and timely submission of the Return of Earnings. Maintaining accurate records and supporting documentation is crucial for compliance and to avoid potential penalties.

Similar forms

The Return of Earnings form is important for employers as it provides necessary information regarding employee earnings and assists in ensuring compliance with regulations. Several documents share similarities with the Return of Earnings form in terms of purpose and information required. These include:

- Employer's Quarterly Tax Return: Like the Return of Earnings form, this document details employee earnings over a specific period. It is also mandatory for employers to submit to the tax authorities, thus ensuring accurate reporting for tax purposes.

- Payroll Records: Payroll records contain information about individual employee earnings, making them similar in content. Both documents must capture earnings accurately to reflect liabilities and reporting obligations properly.

- Workers' Compensation Claims Form: This form is utilized when employees file claims for workplace injuries. Similar to the Return of Earnings, it involves reporting of earnings relevant to compensation calculations.

- Annual Income Statement: This document summarizes an employer’s total income and related tax obligations for the year. Both forms aim to document financial information regarding employees and contribute to overall compliance.

Dos and Don'ts

When filling out the Return Of Earnings form, adherence to specific guidelines can ensure accuracy and compliance. Below is a list of ten recommendations on what to do and what to avoid.

- Do ensure that all contact information is accurate and complete.

- Do double-check the earnings amounts for all employees prior to submitting the form.

- Do use block letters in the specified fields to promote clarity.

- Do provide the correct year of assessment as indicated on the form.

- Do refer to the enclosed guidelines before completing the return.

- Don't leave any fields blank unless specified; incomplete forms can lead to delays.

- Don't print or fax copies of the form, as originals are required.

- Don't underestimate the importance of providing reasons for significant changes in employee numbers or earnings.

- Don't forget to sign and date the form before submission.

- Don't mix permanent, temporary, and casual employee earnings without proper categorization.

Misconceptions

Misconceptions about the Return Of Earnings (ROE) form can lead to confusion and errors in submission. Here are six common misconceptions:

- Only large employers need to submit the ROE form. This is not true. All employers, regardless of size, must complete and submit the Return Of Earnings form to comply with legal requirements.

- The ROE form can be submitted anytime. In fact, there is a specific deadline to submit the form. Employers must submit it on or before March 31 each year for the previous assessment year.

- Deriving the earnings figure is simple and doesn't require documentation. This misconception can lead to mistakes. Accurate figures for earnings must be supported by thorough records of payments made to all employees, including casual and temporary workers.

- Directors' earnings are excluded from the ROE calculation. On the contrary, the ROE form requires employers to declare directors’ earnings separately, and a maximum cap applies.

- If business circumstances change, there's no need to update the ROE form. Any changes, such as cessation, ownership transfer, or changes in the number of employees, should be accurately reflected in the form.

- Fax submissions of the ROE form are acceptable. This is incorrect. Only original, printed forms can be submitted as faxed copies are not accepted.

Understanding these misconceptions can help ensure that employers comply with the requirements and avoid possible penalties.

Key takeaways

Filling out the Return Of Earnings (ROE) form is crucial for all employers. Here are key takeaways to keep in mind:

- Always submit the ROE by the deadline. For the 2006-2007 assessment year, that date is March 31, 2007.

- Use block letters for legibility. Only fill out the sections that have changed since last year.

- Provide accurate employer particulars. This includes trading name, postal address, and contact information.

- Detail the nature of your business operations. Be specific about goods or services offered and materials used.

- Report the total earnings paid to all employees. This includes permanent, temporary, and casual staff, excluding directors.

- For directors or members, report separate earnings. Ensure to follow maximum limits set for the assessment year.

- If there are changes in employee numbers or earnings, explain the reasons clearly on the form.

- Estimated earnings for the upcoming year must be realistic. If not correctly filled out, your earnings may be erroneously estimated.

- Remember that faxed copies of the ROE are not accepted. Submit the original document to avoid delays.

By following these guidelines, you can ensure compliance and streamline your reporting process.

Browse Other Templates

Fsis Form 7234-1 - The form serves as a communication tool between producers and the USDA.

Inspect Palpate Percuss Auscultate - Treatment frequencies and specific instructions regarding monitoring are detailed in the form.

Sysco Shop Portal - Submit social security numbers for various owners to verify identities.