Fill Out Your Rev 1605 Form

The Rev 1605 form serves a vital function within the corporate governance framework, specifically designed to manage updates regarding corporate officers associated with existing corporate tax accounts. This form is crucial for ensuring that the Pennsylvania Department of Revenue has accurate and current information about a corporation's officers, as it is required to forward this information to the Pennsylvania Department of State for public record purposes. The Rev 1605 form consists of several sections where corporations must provide essential details, including the business name, employer identification number (EIN), and specific addresses. Noteworthy is the requirement for documentation of the names and roles of corporate officers, including their Social Security Numbers. This ensures compliance with state regulations while maintaining transparency. An affirmation section is present, in which the authorized representative attests to the accuracy of the information provided. Submissions can be made electronically or via traditional methods like fax or email, allowing for convenience and efficiency in keeping corporate records updated.

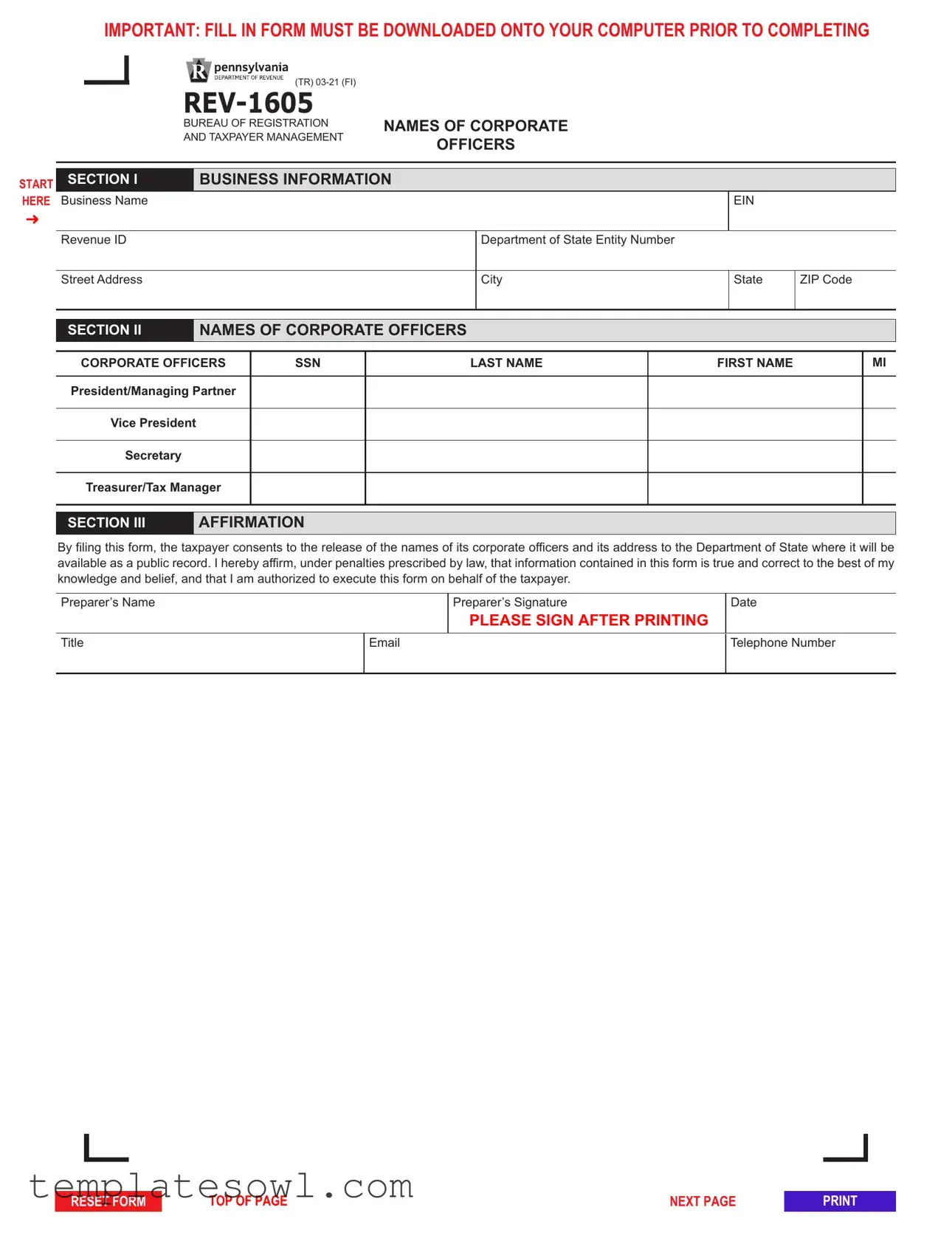

Rev 1605 Example

IMPORTANT: FILL IN FORM MUST BE DOWNLOADED ONTO YOUR COMPUTER PRIOR TO COMPLETING

(TR)

(TR)

AND TAXPAYER MANAGEMENT

NAMES OF CORPORATE

OFFICERS

START

HERE

➜

SECTION I |

BUSINESS INFORMATION |

|

|

|

Business Name |

|

|

EIN |

|

|

|

|

|

|

Revenue ID |

|

Department of State Entity Number |

|

|

|

|

|

|

|

Street Address |

|

City |

State |

ZIP Code |

|

|

|

|

|

SECTION II |

|

NAMES OF CORPORATE OFFICERS |

|

|

|

||

|

|

|

|

|

|

||

CORPORATE OFFICERS |

SSN |

|

LAST NAME |

FIRST NAME |

MI |

||

|

|

|

|

|

|

||

President/Managing Partner |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

Vice President |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Secretary |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Treasurer/Tax Manager |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SECTION III |

|

AFFIRMATION |

|

|

|

||

By filing this form, the taxpayer consents to the release of the names of its corporate officers and its address to the Department of State where it will be available as a public record. I hereby affirm, under penalties prescribed by law, that information contained in this form is true and correct to the best of my knowledge and belief, and that I am authorized to execute this form on behalf of the taxpayer.

Preparer’s Name

Title

|

Preparer’s Signature |

Date |

|

PLEASE SIGN AFTER PRINTING |

|

Telephone Number |

||

|

|

|

RESET FORM

TOP OF PAGE |

NEXT PAGE |

Instructions for

Names of Corporate Officers

GENERAL INFORMATION

PURPOSE OF

Use the Names of Corporate Officers,

The Department of Revenue is required to forward the names of corporate officers received with tax reports to the PA Department of State for inclusion in the public records of the corporation. This information is provided from the corporate officer section of the

NOTE: Corporations may update names of corporate officers electronically through

www.etides.state.pa.us.

FORM INSTRUCTIONS

SECTION I

BUSINESS INFORMATION

Provide the business name, federal entity identification number (EIN), revenue ID, Department of State entity number and business address.

IMPORTANT: The Department of State Entity Number must be provided in order for the updates to be made

to the Department of State.

SECTION II

NAMES OF CORPORATE OFFICERS

Complete all fields for each corporate officer.

SECTION III

AFFIRMATION

An officer or a representative of the corporation must complete and sign the form.

HOW TO FILE

Submit the completed and signed form by fax or email to: Fax:

Email:

www.revenue.pa.gov |

|

RETURN TO FORM |

|

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The REV-1605 form is used to add or change corporate officer information for an existing corporate tax account. |

| Mandatory Fields | Section I requires the business name, EIN, Revenue ID, Department of State Entity Number, and business address. |

| Corporate Officer Information | Section II must be completed with SSN, last name, first name, and MI for each corporate officer. |

| Affirmation Requirement | Section III requires a signature affirming the information's accuracy and authorization to file the form. |

| Governing Law | This form falls under Pennsylvania state law, specifically relating to corporate tax reporting. |

| Public Record | Filing this form permits the release of corporate officer names and addresses as public records via the Department of State. |

| Filing Method | Submit the completed form via fax or email to the appropriate Pennsylvania Department of Revenue contact. |

Guidelines on Utilizing Rev 1605

After downloading the Rev 1605 form to your computer, you're ready to proceed. This form is used to update or change the names of corporate officers associated with an existing tax account. The information will be submitted to the relevant state department for public record. Follow these steps to complete the form accurately.

- Locate the downloaded Rev 1605 form on your computer.

- Open the form and navigate to SECTION I: BUSINESS INFORMATION.

- Enter the following details:

- Business Name

- Employer Identification Number (EIN)

- Revenue ID

- Department of State Entity Number

- Street Address

- City

- State

- ZIP Code

- Proceed to SECTION II: NAMES OF CORPORATE OFFICERS.

- Fill in all fields for each corporate officer, including:

- Social Security Number (SSN)

- Last Name

- First Name

- Middle Initial (MI)

- Title (e.g., President, Vice President, Secretary, Treasurer/Tax Manager)

- Next, move to SECTION III: AFFIRMATION.

- Have an authorized officer or representative of the corporation sign the form, providing their Preparer’s Name, Title, Signature, and Date.

- Include the Email and Telephone Number of the preparer.

- Check all entered information for accuracy before proceeding.

- Sign the form after printing it out.

- Submit the completed form by fax or email to the designated contact:

- Fax: 717-787-3708

- Email: RA-BTFTREGISFAX@PA.GOV

What You Should Know About This Form

What is the purpose of the Rev 1605 form?

The Rev 1605 form is used to add or update the corporate officer information in an existing corporate tax account. The Department of Revenue shares the names of these officers with the Pennsylvania Department of State, thereby allowing this information to be included in public corporate records. Any corporation can complete this form to ensure its records are current and accurate.

How do I obtain the Rev 1605 form?

You can download the Rev 1605 form from the Pennsylvania Department of Revenue’s website. It is important to remember that you need to download the form to your computer before you can complete it.

What information do I need to provide in Section I?

In Section I, you need to fill in your business name, federal employer identification number (EIN), revenue ID, Department of State entity number, and your business address, including city, state, and ZIP code. Providing the Department of State entity number is crucial for the updates to be processed.

Who needs to sign the Rev 1605 form?

The form must be completed and signed by an officer of the corporation or a representative who is authorized to act on behalf of the taxpayer. This ensures that the information is verified for accuracy.

How can I submit the Rev 1605 form once it’s completed?

You may submit the completed form by either fax or email. The fax number is 717-787-3708, and the email address is RA-BTFTREGISFAX@PA.GOV. Make sure to double-check that all information is filled out correctly before submission.

Can I update corporate officer information electronically?

Yes, corporations can update the names of their corporate officers electronically through the e-Tides system at www.etides.state.pa.us. This option may provide a more efficient way to make updates compared to using a paper form.

What happens after I submit the Rev 1605 form?

Once you submit the Rev 1605 form, the Department of Revenue will process your request and forward the updated corporate officer information to the Pennsylvania Department of State. The information will then become part of the public records for your corporation.

Is the information submitted on the Rev 1605 form public?

Yes, by filing this form, you consent to the release of the names of corporate officers and your business address. This means that the information will be available to the public as part of the corporate records maintained by the Department of State.

What should I do if I need assistance with filling out the Rev 1605 form?

If you need help filling out the Rev 1605 form, you may contact the Pennsylvania Department of Revenue for assistance. They can provide guidance on how to correctly complete the form and answer any additional questions you may have.

What legal penalties are associated with the Rev 1605 form?

By signing the Rev 1605 form, the person submitting the information affirms that the details provided are true and accurate to the best of their knowledge. Providing false information can lead to legal penalties, which could include fines or other sanctions as prescribed by law.

Common mistakes

Filling out the Rev 1605 form can seem straightforward, but it's important to pay attention to details. One common mistake people make is ignoring the instruction to download the form onto their computer before completing it. Skipping this step can result in lost data or incomplete submissions, causing frustration and delays in processing.

Another frequent error is neglecting to provide the Department of State Entity Number. This piece of information is crucial for the form to be valid. Without it, the updates cannot be made, and you may find yourself having to start over. Make sure to double-check that this number is included in Section I alongside other business details.

Incorrectly filling out the names and information for the corporate officers is also a pitfall. It's essential to complete all fields for each officer in Section II. Omitting any details, such as a middle initial or incorrect Social Security Number, can lead to issues down the line. Each entry should be accurate to avoid complications with official records.

Some people overlook the importance of the affirmation section. It’s not just a formality; an authorized officer or representative must sign the form attesting that the information provided is true and correct. Failing to include this signature can render the form incomplete and invalid. This additional step ensures accountability and integrity in the submission process.

After completing the form, individuals often make the mistake of not confirming their submission method. Whether you choose to fax or email the completed form, it’s vital to verify that the information is sent to the correct address. For example, using an incorrect email address can lead to missed updates and unnecessary delays.

Finally, many individuals forget to keep a copy of the completed form for their records. Having this reference can be valuable for tracking any future updates or communications. Always make a quick photocopy or save a digital version before sending it off to ensure you have your own record of what was submitted.

Documents used along the form

The REV-1605 form is a crucial document for corporations in Pennsylvania that need to update or add their corporate officer information. When filing this form, businesses often use additional documents to ensure compliance and clarity. Below are several forms commonly used alongside the REV-1605.

- RCT-101, Corporate Net Income Tax Report: This report is essential for corporations to file their income tax returns. It includes financial details that will relate directly to the corporate officers listed on the REV-1605 form, such as profit and loss statements and overall revenue information.

- Form 941, Employer's Quarterly Federal Tax Return: This form reports employee wages, tips, and other compensation, as well as federal income tax withheld. Submission of this form complements the REV-1605 by ensuring that the corporation meets federal tax obligations related to its officers.

- Form 990, Return of Organization Exempt From Income Tax: Nonprofit organizations may file this form to report their annual financial information. It includes details about corporate officers and is essential for maintaining tax-exempt status, working alongside the REV-1605 for accurate public records.

- Articles of Incorporation: This foundational document establishes the corporation. It details the initial corporate officers and structure. Keeping this document updated is vital when changes are made, such as those documented in the REV-1605 form.

Using these additional forms can help maintain accurate public records and keep your corporation compliant with both state and federal regulations. Proper documentation ensures that your business operates smoothly and that any updates, such as changes to corporate officers, are legally recognized.

Similar forms

- Form SS-4: This form is used to apply for an Employer Identification Number (EIN) from the IRS. Like the Rev 1605, it requires information about the business and its officers. Both documents are essential for the proper tax identification of a corporation.

- Form 2553: This form enables businesses to elect S corporation status for tax purposes. Similar to Rev 1605, it involves details about corporate officers and requires signatures to verify the information provided.

- Form RCT-101: This is the Corporate Net Income Tax Report where corporations report their income and pay taxes. The officer information provided on this form is also reported to the Department of State, paralleling the process outlined in Rev 1605.

- Form 1065: Used by partnerships to report income, deductions, and profits. Both this form and Rev 1605 require disclosure of the primary individuals involved in the business and serve tax reporting purposes.

- Form 990: Nonprofit organizations use this form to report their annual information. Similar to Rev 1605, it contains details on officers and directors, ensuring transparency in governance.

- Form 1023: This form is necessary for organizations applying for federal tax-exempt status. Like Rev 1605, it asks for information about the organization’s officers and requires affirmations regarding the truth of the submitted details.

Dos and Don'ts

Things You Should Do:

- Download the Rev 1605 form onto your computer before filling it out.

- Provide complete and accurate information for each corporate officer.

- Include your Department of State Entity Number to ensure updates are processed.

- Sign the form after printing it to confirm your affirmation.

- Submit the completed form via fax or the specified email address.

Things You Shouldn't Do:

- Do not skip any sections; all fields must be filled out.

- Avoid providing incorrect or outdated information to prevent delays.

- Do not forget to include your fax number or email for confirmation.

- Never submit an unsigned form as it may be rejected.

- Do not attempt to change corporate officer information without using this form.

Misconceptions

Misconception 1: The REV-1605 form can be completed in a web browser.

This is incorrect. You must download the form onto your computer to fill it out. Web browsers may not support all functionalities of the form.

Misconception 2: You only need to submit the form once, and you are done.

This is misleading. Corporations must also update officer information and submit the REV-1605 form whenever there are changes. Keeping records current is essential.

Misconception 3: You can skip providing the Department of State Entity Number.

This is not allowed. The Department of State Entity Number is mandatory for updates to be processed. Without it, the submission will likely be rejected.

Misconception 4: Only the corporate president needs to sign the form.

Actually, any officer or authorized representative must sign the form. This ensures that the submission is valid and recognized by the authorities.

Misconception 5: Email submissions are not accepted.

This is false. You can submit the completed form via email or fax. Ensure all information is accurate before sending to avoid delays.

Misconception 6: The names of corporate officers are confidential information.

This is not true. Once submitted, the names and address become public records. The filing of this form confirms consent for this information to be shared.

Key takeaways

Here are key takeaways about filling out and using the Rev 1605 form:

- Download the form onto your computer before filling it out to ensure all features function properly.

- Provide accurate information in Section I, including the business name, EIN, Revenue ID, and Department of State entity number.

- Complete all fields in Section II for each corporate officer to avoid processing delays.

- Remember that the Department of State entity number is essential for any updates to be recognized.

- Sign and date the form in Section III to confirm the information is true and that you are authorized to submit it.

- You can submit the form via fax or email for quick processing by the Department of Revenue.

Browse Other Templates

Print Form - Prior addresses for the past five years should be included if applicable.

Tobacco Use Declaration,Smoke-Free Commitment Form,Tobacco Status Verification,Nicotine Usage Affidavit,Cessation Participation Agreement,Tobacco-Free Compliance Form,Health Commitment Statement,Tobacco Usage Disclosure,Smoke-Free Affidavit,Nicotine- - It is crucial for employees to accurately report their tobacco status.