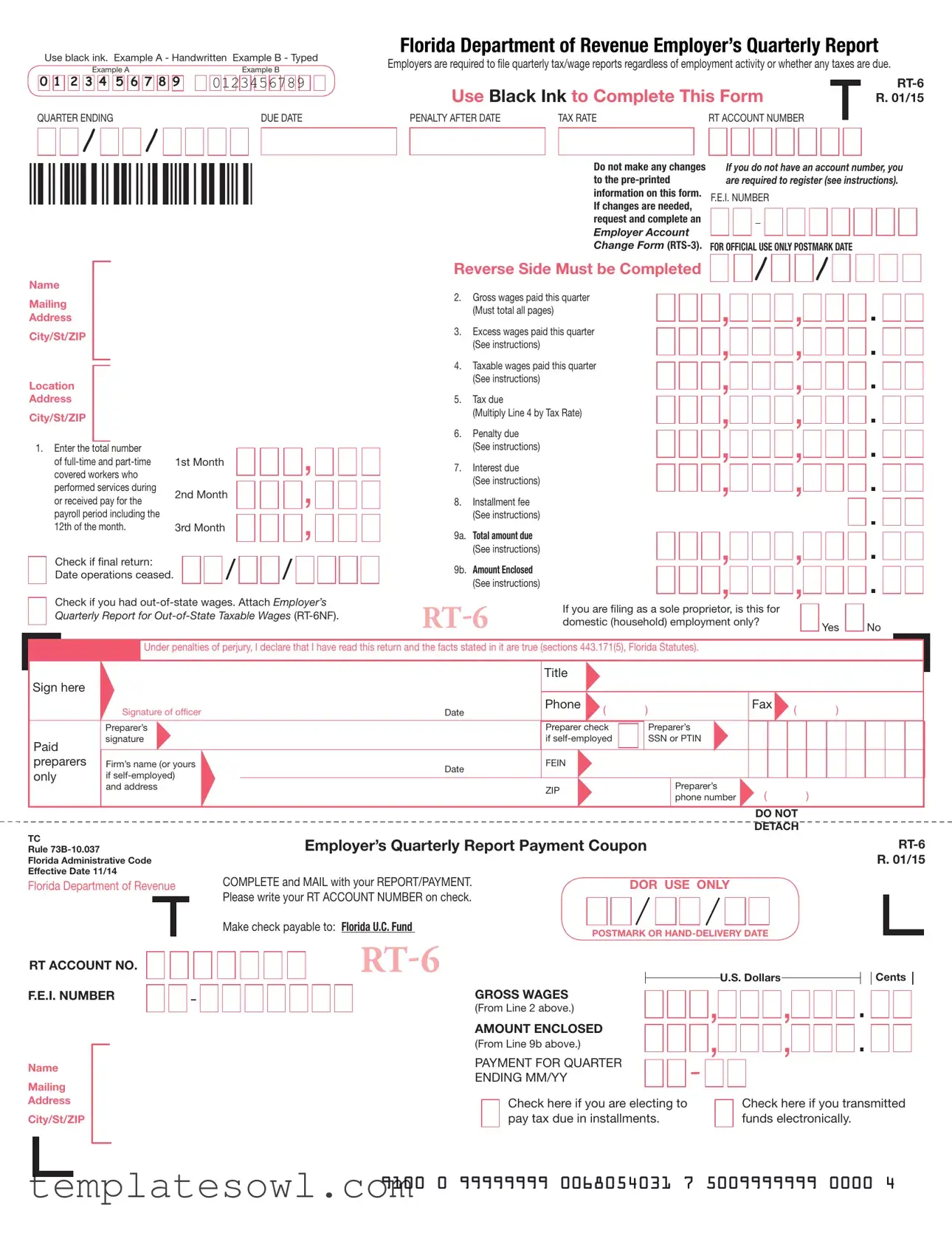

Fill Out Your Revenue Employers Report Form

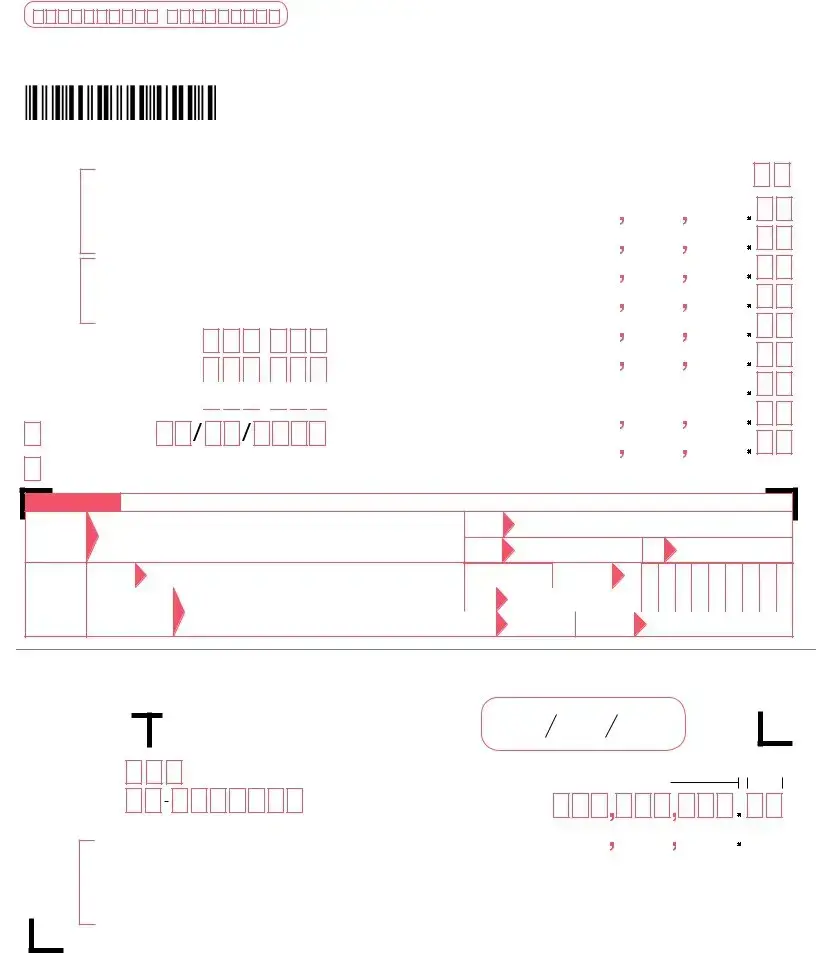

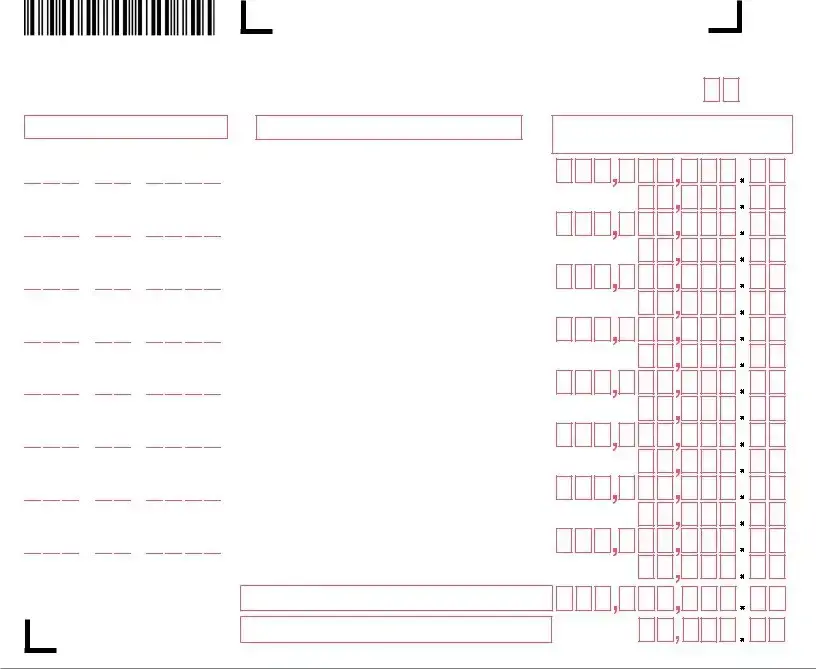

The Revenue Employers Report form is a critical tool for businesses operating in Florida, ensuring compliance with state tax requirements. Each employer must accurately report both tax and wage information on a quarterly basis, regardless of whether they have any actual employment activity or taxes due. Completing the form necessitates the use of black ink, and it requires detailed reporting of the number of full-time and part-time employees who worked during the payroll period, including the 12th of the month. Employers start by entering their account number, name, and address, followed by comprehensive data on gross wages, taxable wages, and any tax due. Calculation of these amounts is straightforward yet essential; the form guides employers through multiplying taxable wages by the appropriate tax rate to determine total taxes owed. Additionally, there are sections for penalties and interest that may apply, further emphasizing the importance of timely submission. Each report culminates with a declaration of accuracy and includes places for both employer and preparer signatures. Given its implications for payroll and regulatory compliance, understanding the nuances of the Revenue Employers Report is vital for any Florida employer.

Revenue Employers Report Example

Use black ink. Example A - Handwritten Example B - Typed |

|

Florida Department of Revenue Employer’s Quarterly Report |

|||||||||||||||||||||||||||||||||||||

Employers are required to file quarterly tax/wage reports regardless of employment activity or whether any taxes are due. |

|||||||||||||||||||||||||||||||||||||||

|

|

|

Example A |

|

|

|

|

|

Example B |

||||||||||||||||||||||||||||||

0 1 2 3 4 |

5 6 7 8 9 |

0123456789 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

Use Black Ink to Complete This Form |

|

||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

R. 01/15 |

||||||||||||||||||

QUARTER ENDING |

|

|

|

|

|

|

|

|

|

|

|

|

DUE DATE |

|

|

PENALTY AFTER DATE |

|

TAX RATE |

RT ACCOUNT NUMBER |

|

|

||||||||||||||||||

|

|

|

/ |

|

|

|

|

/ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Name

Mailing

Address

City/St/ZIP

Location

Address

City/St/ZIP

1.Enter the total number of

Check if final return: Date operations ceased.

1st Month

2nd Month

3rd Month

,

,

,

,

Do not make any changes |

If you do not have an account number, you |

||||||||||||||||||

to the |

are required to register (see instructions). |

||||||||||||||||||

information on this form. |

F.E.I. NUMBER |

||||||||||||||||||

If changes are needed, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

request and complete an |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Employer Account |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Change Form |

|

|||||||||||||||||||||||

Reverse Side Must be Completed |

|

|

|

|

|

/ |

|

|

|

|

|

/ |

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

2. |

Gross wages paid this quarter |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

(Must total all pages) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3. |

Excess wages paid this quarter |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

(See instructions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4. |

Taxable wages paid this quarter |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

(See instructions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5. |

Tax due |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

(Multiply Line 4 by Tax Rate) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6. |

Penalty due |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

(See instructions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7. |

Interest due |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

(See instructions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8. |

Installment fee |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

(See instructions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

9a. |

Total amount due |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

(See instructions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9b. |

Amount Enclosed |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

(See instructions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Check if you had

If you are filing as a sole |

proprietor, is this for |

|

Yes |

|

No |

|

|

|

|

|

|

||

|

domestic (household) employment only? |

|

|

|

|

|

|

|

|

|

|

|

|

Under penalties of perjury, I declare that I have read this return and the facts stated in it are true (sections 443.171(5), Florida Statutes). |

|

|

|

||||

Sign here |

|

Title |

|

|

|

|

|

|

|

|

|

|

|

|

|

Signature of officer |

Date |

Phone |

( |

) |

Fax |

( |

) |

|

|

||||||

|

Preparer’s |

|

Preparer check |

|

|

Preparer’s |

|

|

Paid |

signature |

|

if |

|

|

SSN or PTIN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

preparers |

Firm’s name (or yours |

Date |

FEIN |

|

|

|

|

|

only |

if |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

Preparer’s |

|

|

||

|

and address |

|

ZIP |

|

|

( |

) |

|

|

|

|

|

|

phone number |

|||

|

|

|

|

|

|

DO NOT

DETACH

TC

Rule

Florida Administrative Code

Effective Date 11/14

Florida Department of Revenue

RT ACCOUNT NO.

Employer’s Quarterly Report Payment Coupon

COMPLETE and MAIL with your REPORT/PAYMENT. |

|

|

DOR USE ONLY |

|||||||||||||||||||

Please write your RT ACCOUNT NUMBER on check. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

Make check payable to: Florida U.C. Fund |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

POSTMARK OR |

||||||||||||||||||||||

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

U.S. Dollars |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cents

F.E.I. NUMBER

GROSS WAGES

(From Line 2 above.)

Name

Mailing

Address

City/St/ZIP

AMOUNT ENCLOSED |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

(From Line 9b above.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

PAYMENT FOR QUARTER |

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

ENDING MM/YY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

Check here if you are electing to |

|

|

|

|

|

|

|

|

|

Check here if you transmitted |

|||||||||||||||||

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

pay tax due in installments. |

|

|

|

|

|

|

|

|

|

funds electronically. |

|||||||||||||||||

9100 0 99999999 0068054031 7 5009999999 0000 4

Florida Department of Revenue Employer’s Quarterly Report

Employers are required to file quarterly tax/wage reports regardless of employment activity or whether any taxes are due.

Use Black Ink to Complete This Form

QUARTER ENDING |

|

|

|

|

|

|

|

|

|

|

|

EMPLOYER’S NAME |

RT ACCOUNT NUMBER |

|||||||||||||

|

|

|

/ |

|

|

|

/ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

10. EMPLOYEE’S SOCIAL SECURITY NUMBER

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

11.EMPLOYEE’S NAME (please print first twelve characters of last name and first eight characters of first name in boxes)

Last |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12a. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

First |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Middle |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Initial |

|

|

12b. |

||

Last |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12a. |

First |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Middle |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Initial |

|

|

12b. |

||

Last |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12a. |

First |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Middle |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Initial |

|

|

12b. |

||

Last |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12a. |

First |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Middle |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Initial |

|

|

12b. |

||

Last |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12a. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

First |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Middle |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Initial |

|

|

12b. |

||

Last |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12a. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

First |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Middle |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Initial |

|

|

12b. |

||

Last |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12a. |

First |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Middle |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Initial |

|

|

12b. |

||

Last |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12a. |

First |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Middle |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Initial |

|

|

12b. |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12a. EMPLOYEE’S GROSS WAGES PAID THIS QUARTER

12b. EMPLOYEE’S TAXABLE WAGES PAID THIS QUARTER

Only the first $7,000 paid to each employee per calendar year is taxable.

13a. Total Gross Wages (add Lines 12a only). Total this page only. Include this and totals from additional pages in Line 2 on page 1.

13b. Total Taxable Wages (add Lines 12b only). Total this page only. Include this and totals from additional pages in Line 4 on page 1.

DO NOT

DETACH

Mail Reply To:

Reemployment Tax

Florida Department of Revenue

5050 W Tennessee St Bldg L

Tallahassee FL

Social security numbers (SSNs) are used by the Florida Department of Revenue as unique identifiers for the administration of Florida’s taxes. SSNs obtained for tax administration purposes are confidential under sections 213.053 and 119.071, Florida Statutes, and not subject to disclosure as public records. Collection of your SSN is authorized under state and federal law. Visit our website at floridarevenue.com and select “Privacy Notice” for more information regarding the state and federal law governing the collection, use, or release of SSNs, including authorized exceptions.

Please save your instructions!

Quarterly Report instructions

floridarevenue.com/forms

Form Characteristics

| Fact Name | Details |

|---|---|

| Filing Requirement | Employers must submit quarterly tax/wage reports, even if no tax is due or no employment has occurred during the quarter. |

| Filing Method | The form must be completed in black ink. Handwritten or typed entries are acceptable. |

| Quarterly Deadline | The due date for submission varies based on the quarter ending date. Employers need to be aware of these deadlines to avoid penalties. |

| Tax Calculation | Employers calculate taxes owed by multiplying taxable wages by the specified tax rate. |

| Penalties and Interest | Late submissions incur penalties and interest charges. Employers must follow the instructions to ascertain these amounts. |

| Out-of-State Wages | If applicable, employers must attach a separate report for out-of-state taxable wages (RT-6NF). |

| Employee Information | The form requires the reporting of gross wages and taxable wages for each employee, with limitations on taxable wages. |

| Confidentiality of SSNs | Social Security numbers (SSNs) collected for tax administration purposes are confidential and protected under state statutes. |

| Governing Laws | Florida Statutes sections 443.171(5) governs the filing of the Employer's Quarterly Report; additional sections on confidentiality include sections 213.053 and 119.071. |

Guidelines on Utilizing Revenue Employers Report

Completing the Revenue Employers Report form is a crucial part of fulfilling your tax obligations. Following these steps will help you accurately fill out the form and ensure timely submission.

- Begin by using black ink to fill out the form, whether you are handwriting or typing it.

- Enter the quarter ending date in the designated space.

- Locate your RT account number and write it at the top of the form.

- Provide your legal business name and mailing address, including city, state, and ZIP code.

- List the total number of employees who worked or received pay during the payroll period including the 12th of the month. Mark the checkbox if this is your final return.

- Fill in the gross wages paid for the quarter. Make sure to total all pages if applicable.

- Calculate and enter any excess wages paid during the quarter, following the provided instructions.

- Next, input the taxable wages paid this quarter, ensuring you adhere to the guidelines given.

- Multiply the taxable wages (from Line 4) by the tax rate, and write the result as the tax due.

- If applicable, calculate and include any penalties, interest, or installment fees and enter these amounts in their respective fields.

- At Line 9a, summarize the total amount due for the quarter. This amount may include all previous calculations.

- Indicate the amount enclosed by entering it in Line 9b.

- If you had out-of-state wages, check the corresponding box and ensure you attach the required report.

- Sign the form to verify that all information is true and complete. Include your title and the date.

- If someone else prepared the form, fill in their name, phone number, and other required details.

Once completed, review the filled form for accuracy before mailing it to the designated address. Make sure to keep copies for your records. Should you need assistance, refer to the instructions available on the Florida Department of Revenue's website.

What You Should Know About This Form

What is the Revenue Employers Report form?

The Revenue Employers Report form, known as RT-6, is a quarterly report that employers in Florida must file. This form details the wages paid to employees and calculates the taxes owed for those wages. All employers must file this report, even if they did not have any employees or are not liable for taxes during the quarter.

When is the Revenue Employers Report due?

This report is due quarterly. The specific due date will depend on the end of the quarter. It’s important to note that late filings can result in penalties.

How should the form be filled out?

When completing the RT-6 form, use black ink only. Make sure to fill in the required fields accurately. Do not alter any pre-printed information. If changes are necessary, request an Employer Account Change Form separately.

What information is required on the RT-6 form?

You need to provide your RT account number, the total number of employees, gross wages paid during the quarter, taxable wages, and tax calculations. Failure to provide complete and accurate information can lead to processing delays or penalties.

What happens if there are penalties or interest due?

If you file your report after the due date, you may incur penalties. Additionally, if there is an outstanding tax amount, interest may also accrue. Be sure to review the instructions closely for how to calculate any penalties or interest owed.

What if I had no employees during the quarter?

Even if you had no employees, you are still required to file the RT-6 form. Indicate that there were no workers during the payroll period, and provide any necessary explanations within the form.

Can I file and pay electronically for the RT-6?

Yes, employers have the option to file the RT-6 form and remit payment electronically. If you opt for electronic filing, check the box provided on the form to indicate this choice.

Where do I send the completed form?

Once completed, mail the RT-6 form and any payment to the Florida Department of Revenue at the specified address on the form. Ensure your RT account number is included on your payment check.

Common mistakes

Filling out the Revenue Employers Report form can feel daunting, but avoiding common mistakes can streamline the process and help ensure compliance. One frequent error is using a writing instrument other than black ink. The form explicitly states the need for black ink to maintain clarity and for the scanner to read the information accurately. A touch of color can lead to processing delays.

Another common mistake is neglecting to report the total number of covered workers. On the form, this total is crucial and must include all full-time and part-time employees who received pay for the payroll period that encompasses the 12th of the month. Omitting this information not only creates discrepancies but could also trigger penalties.

Many people also mistakenly alter the pre-printed information, such as the RT account number. It is essential to leave this data as it is presented on the form. Changes can lead to confusion and processing errors, thus complicating what should be a straightforward reporting process.

Calculating wages can be another area where errors occur. The gross wages paid during the quarter must be totaled, and this sum must match the amounts listed on all pages. Forgetting to double-check these calculations can result in underreporting or overreporting and can attract unwanted scrutiny from tax authorities.

One critical aspect of the form is accurately reporting taxable wages. Only the first $7,000 paid to each employee per calendar year is taxable. Misunderstanding this limit can cause a false impression of the overall tax liability, leading to incorrect filings and possible penalties.

Information about penalties and interest is often overlooked as well. Many individuals either fail to calculate these fees or do not reference the appropriate instructions for penalties and interest. This oversight can result in either underpaying and incurring additional fees or overpaying by miscalculating and including unnecessary amounts.

It is vital to check if there are any out-of-state wages accurately. If applicable, include the Employer’s Quarterly Report for Out-of-State Taxable Wages. Failing to report this can result in missing out on crucial information for tax calculations.

People sometimes forget to sign the form. This simple step is essential, as it verifies that the information provided is true and complete. Without a signature, the form could be considered incomplete and could be rejected, prolonging the filing process.

Lastly, providing contact information can be crucial for resolution purposes. Omitting your phone number or email address may make it challenging for the Department of Revenue to reach out in case of questions, leading to delayed responses or complications.

In summary, taking careful steps while filling out the Revenue Employers Report form can mitigate many of the obstacles that lead to confusion or penalties. By avoiding these common mistakes, you can ensure a smoother filing experience.

Documents used along the form

The Revenue Employers Report form is crucial for employers in fulfilling their quarterly tax obligations. It provides a snapshot of the number of employees, wages paid, and taxes due for a reporting period. However, several other forms and documents may accompany the Revenue Employers Report to ensure full compliance with tax regulations.

- Employer Account Change Form (RTS-3): This document is used when changes to an employer's account information are necessary. Reasons for filing this form could range from changes in business structure to updates in contact details. Proper completion ensures that the Florida Department of Revenue has the most accurate information.

- Employer's Quarterly Report for Out-of-State Taxable Wages (RT-6NF): Employers who pay wages to employees outside of Florida must file this form. It specifically addresses the wages that may be subject to different tax rules, ensuring compliance with both Florida and out-of-state regulations.

- Quarterly Report Instructions (RT-6N/RTS-3): This set of instructions is invaluable for understanding how to properly complete the Revenue Employers Report. Sent to new accounts or distributed when any changes occur, following these guidelines helps prevent any errors in reporting.

- Form W-2: Employers must provide each employee with a W-2 by the end of January for the previous taxable year. This form summarizes total earnings and taxes withheld, which employees use when filing their personal income taxes. The W-2 is not exclusively related to quarterly reports but is essential for compliance during the tax season.

Understanding these accompanying forms ensures that an employer is well-prepared to meet their tax obligations effectively. It also helps facilitate smoother interactions with tax authorities, reducing the risk of penalties or compliance issues.

Similar forms

- W-2 Form: Like the Revenue Employers Report, the W-2 form is used to report wages paid to employees and taxes withheld. Both forms require accurate reporting of wages and must be filed annually for employees.

- 1099-MISC Form: Similar to the Revenue Employers Report, the 1099-MISC is used to report payments made to independent contractors. It requires detailed reporting of amounts paid, though it focuses on contractors rather than employees.

- Form 941: This is the quarterly federal tax return that reports income taxes, social security tax, and Medicare tax withheld from employee’s paychecks. Both forms are filed quarterly, detailing compensation and associated taxes.

- Form 940: The Employer's Annual Federal Unemployment (FUTA) Tax Return conveys a similar purpose in reporting unemployment taxes. Like the Revenue Employers Report, it focuses on employer liability for taxes but on a federal level.

- State Unemployment Insurance (SUI) Report: This state-specific report is analogous, as it provides the state with information about payroll and unemployment liability, similar to the information submitted on the Revenue Employers Report.

- Payroll Records: Employers maintain payroll records that track employee hours, wages, and benefits. These records are essential for preparing tax reports and share similarities in data reporting required by the Revenue Employers Report.

- Form 944: This form is used by certain small employers to report annual federal payroll taxes rather than quarterly, yet it remains similar in purpose to the Revenue Employers Report in detailing wages and taxes.

- Employer’s Annual Reconciliation of Payroll Tax Liability: Like the Revenue Employers Report, this document summarizes wage totals and the corresponding tax liabilities for the year, ensuring compliance and accurate reporting to tax authorities.

Dos and Don'ts

When filling out the Revenue Employers Report form, follow these helpful guidelines:

- Use only black ink to complete the form.

- Ensure your handwriting is legible and clear.

- Always double-check the numbers for accuracy before submitting.

- Make sure to include all required information, such as the total number of employees.

- Complete both sides of the form as instructed.

- File your report by the due date to avoid penalties.

- Keep a copy of the completed form for your records.

- If your information changes, use the Employer Account Change Form.

- Don't leave pre-printed sections blank; fill them as needed.

- Avoid making errors that could result in delays or penalties.

Misconceptions

- Employers do not need to file if they have no employees. This is incorrect. All employers must file the Revenue Employers Report quarterly, even if there are no employees or no wages paid during the reporting period.

- Only large employers need to file quarterly reports. This is a misconception. All businesses, regardless of their size or number of employees, are required to file quarterly tax and wage reports.

- Penalties are only applied if money is owed. This statement is misleading. Penalties can be imposed for late or missing reports, regardless of whether any taxes are due for that quarter.

- Tax rates are the same for all employers. This is not accurate. Different employers may have different tax rates based on various factors, including the industry and the employer's experience rating.

- If an employer has an account number, they do not need to complete all sections of the report. This is incorrect. Even if an account number is issued, all sections of the form must still be completed accurately.

- Filing electronically is mandatory. This is not true. Employers have the option to file either electronically or by mail, depending on their preference.

Key takeaways

Understanding the Revenue Employers Report form is crucial for employers in Florida. Below are key takeaways to ensure compliance and accuracy when completing this form:

- Use black ink to fill out the form, whether handwritten or typed.

- Submit the form quarterly, regardless of whether any employees were paid or taxes are due.

- Review the due date for each quarter and submit the report on time to avoid penalties.

- Include the total number of full-time and part-time workers who were compensated during the quarter.

- Report all gross wages accurately, as this figure will impact your tax calculations.

- Only the first $7,000 paid to each employee per calendar year is considered taxable.

- If changes are needed on the form, do not alter pre-printed information; instead, complete an Employer Account Change Form.

- Be prepared to provide your F.E.I. number and RT account number to avoid confusion.

- Review and attach the Employer’s Quarterly Report for Out-of-State Taxable Wages if applicable.

- Retain a copy of the submitted form and instructions for your records, as they are essential for compliance.

Ensure that all sections are completed thoroughly to avoid delays or additional penalties. Accuracy and timeliness are imperative in filing the Revenue Employers Report form.

Browse Other Templates

Lds Food Order Form - Get white flour in a #10 can, available for 10 years of storage.

Va Form 10-7080 - Health care providers can request formal reviews if they disagree with decisions made.