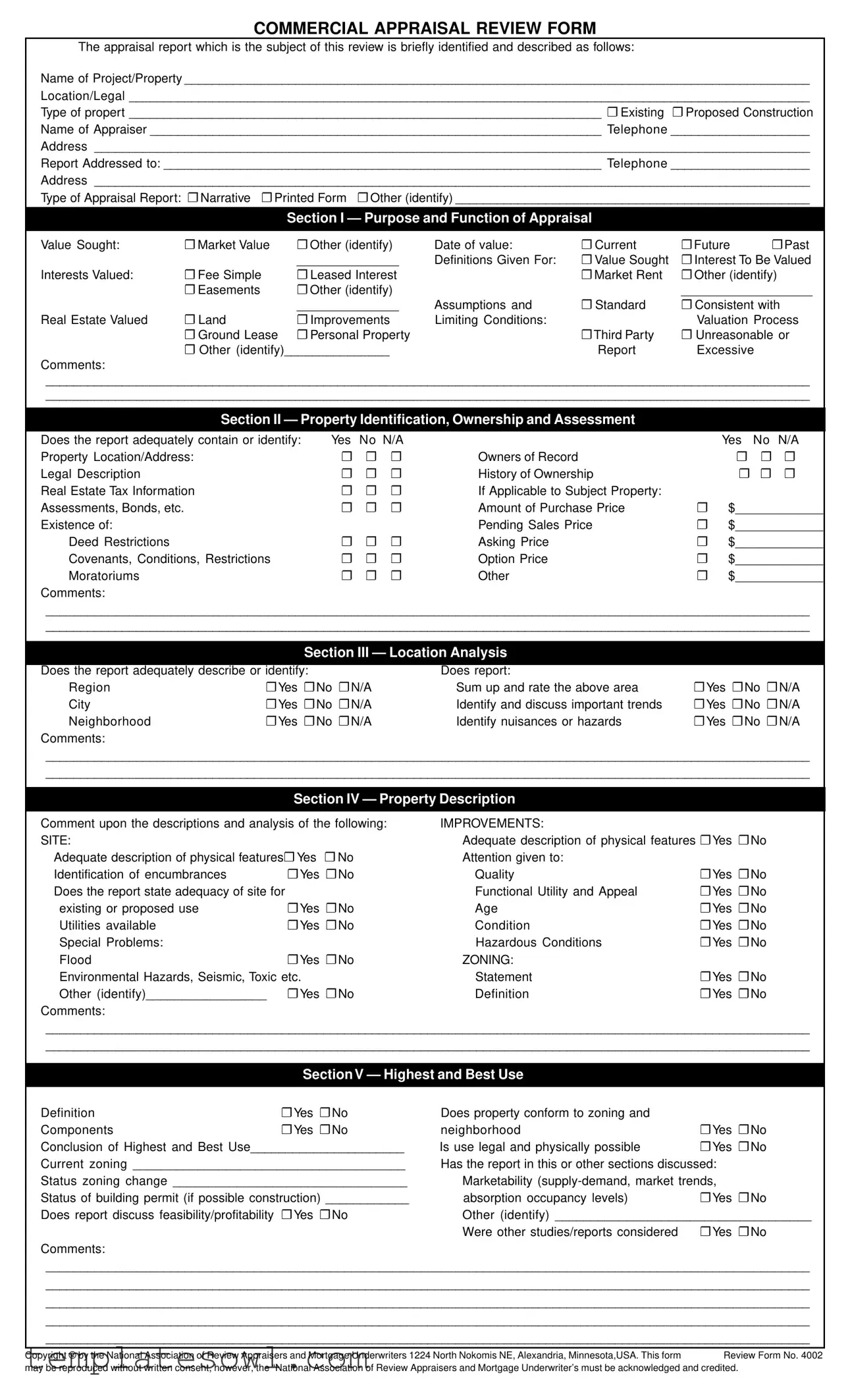

Fill Out Your Review Commercial Appraisal Form

The Review Commercial Appraisal form is an essential tool in the appraisal process, providing a structured means to evaluate the thoroughness and accuracy of an appraisal report. This form begins by gathering fundamental details about the property, including its name, location, and whether it is existing or proposed construction. It also lists important player information, like the appraiser's name and contact details. The form then focuses on the purpose of the appraisal, such as determining market value, and identifies the specific interests being valued. This section ensures clarity on the valuation process and any assumptions or limiting conditions that may affect the report. In addition, it thoroughly investigates the property identification, ownership history, and tax information, which are crucial in establishing its legitimacy and value. Another important aspect is the location analysis, where various factors—such as regional trends and neighborhood nuisances—are assessed. The form also requires detailed property descriptions, including improvements, physical features, and zoning considerations. Ultimately, it offers a mechanism for reviewers to express their conclusions and recommendations, ensuring the appraisal's soundness and reliability. As a vital piece of documentation, this form plays a crucial role in safeguarding the integrity and accuracy of commercial appraisals, thus aiding stakeholders in making informed decisions.

Review Commercial Appraisal Example

COMMERCIAL APPRAISAL REVIEW FORM

The appraisal report which is the subject of this review is briefly identified and described as follows:

Name of Project/Property __________________________________________________________________________________________

Location/Legal __________________________________________________________________________________________________

Type of propert ____________________________________________________________________ ❐ Existing ❐ Proposed Construction

Name of Appraiser _________________________________________________________________ Telephone ____________________

Address |

_______________________________________________________________________________________________________ |

Report Addressed to: _______________________________________________________________ Telephone ____________________ |

|

Address |

_______________________________________________________________________________________________________ |

Type of Appraisal Report: ❐ Narrative ❐ Printed Form ❐ Other (identify) ___________________________________________________ |

|

Section I — Purpose and Function of Appraisal

Value Sought: |

❐ Market Value |

❐ Other (identify) |

Date of value: |

❐ Current |

❐ Future |

❐ Past |

|

|

______________ |

Definitions Given For: |

❐ Value Sought |

❐ Interest To Be Valued |

|

Interests Valued: |

❐ Fee Simple |

❐ Leased Interest |

|

❐ Market Rent |

❐ Other (identify) |

|

|

❐ Easements |

❐ Other (identify) |

|

|

__________________ |

|

|

|

______________ |

Assumptions and |

❐ Standard |

❐ Consistent with |

|

Real Estate Valued |

❐ Land |

❐ Improvements |

Limiting Conditions: |

|

Valuation Process |

|

|

❐ Ground Lease |

❐ Personal Property |

|

❐ Third Party |

❐ Unreasonable or |

|

|

❐ Other (identify)_______________ |

|

Report |

Excessive |

|

|

Comments: |

|

|

|

|

|

|

______________________________________________________________________________________________________________

______________________________________________________________________________________________________________

Section II — Property Identification, Ownership and Assessment

Does the report adequately contain or identify: |

Yes |

No |

N/A |

|

|

Yes |

No N/A |

|

Property Location/Address: |

❐ |

❐ |

❐ |

Owners of Record |

|

❐ |

❐ |

❐ |

Legal Description |

❐ |

❐ |

❐ |

History of Ownership |

|

|

|

|

Real Estate Tax Information |

❐ |

❐ |

❐ |

If Applicable to Subject Property: |

|

|

|

|

Assessments, Bonds, etc. |

❐ |

❐ |

❐ |

Amount of Purchase Price |

❐ |

$____________ |

||

Existence of: |

|

|

|

Pending Sales Price |

❐ |

$____________ |

||

Deed Restrictions |

❐ |

❐ |

❐ |

Asking Price |

❐ |

$____________ |

||

Covenants, Conditions, Restrictions |

❐ |

❐ |

❐ |

Option Price |

❐ |

$____________ |

||

Moratoriums |

❐ |

❐ |

❐ |

Other |

❐ |

$____________ |

||

Comments: |

|

|

|

|

|

|

|

|

______________________________________________________________________________________________________________

______________________________________________________________________________________________________________

Section III — Location Analysis

Does the report adequately describe or identify: |

Does report: |

|

|

Region |

❐ Yes ❐ No ❐ N/A |

Sum up and rate the above area |

❐ Yes ❐ No ❐ N/A |

City |

❐ Yes ❐ No ❐ N/A |

Identify and discuss important trends |

❐ Yes ❐ No ❐ N/A |

Neighborhood |

❐ Yes ❐ No ❐ N/A |

Identify nuisances or hazards |

❐ Yes ❐ No ❐ N/A |

Comments: |

|

|

|

______________________________________________________________________________________________________________

______________________________________________________________________________________________________________

Section IV — Property Description

Comment upon the descriptions and analysis of the following: |

IMPROVEMENTS: |

|

|

SITE: |

|

Adequate description of physical features ❐ Yes ❐ No |

|

Adequate description of physical features❐ Yes ❐ No |

Attention given to: |

|

|

Identification of encumbrances |

❐Yes ❐ No |

Quality |

❐ Yes ❐ No |

Does the report state adequacy of site for |

|

Functional Utility and Appeal |

❐ Yes ❐ No |

existing or proposed use |

❐Yes ❐ No |

Age |

❐ Yes ❐ No |

Utilities available |

❐Yes ❐ No |

Condition |

❐ Yes ❐ No |

Special Problems: |

|

Hazardous Conditions |

❐ Yes ❐ No |

Flood |

❐Yes ❐ No |

ZONING: |

|

Environmental Hazards, Seismic, Toxic etc. |

Statement |

❐ Yes ❐ No |

|

Other (identify)_________________ |

❐Yes ❐ No |

Definition |

❐ Yes ❐ No |

Comments: |

|

|

|

______________________________________________________________________________________________________________

______________________________________________________________________________________________________________

Section V — Highest and Best Use

Definition |

❐ Yes ❐ No |

Does property conform to zoning and |

|

Components |

❐ Yes ❐ No |

neighborhood |

❐ Yes ❐ No |

Conclusion of Highest and Best Use______________________ |

Is use legal and physically possible |

❐ Yes ❐ No |

|

Current zoning ______________________________________ |

Has the report in this or other sections discussed: |

||

Status zoning change _________________________________ |

Marketability |

||

Status of building permit (if possible construction) ____________ |

absorption occupancy levels) |

❐ Yes ❐ No |

|

Does report discuss feasibility/profitability |

❐ Yes ❐ No |

Other (identify) ____________________________________ |

|

|

|

Were other studies/reports considered |

❐ Yes ❐No |

Comments: |

|

|

|

______________________________________________________________________________________________________________

______________________________________________________________________________________________________________

______________________________________________________________________________________________________________

______________________________________________________________________________________________________________

______________________________________________________________________________________________________________

Copyright © by the National Association of Review Appraisers and Mortgage Underwriters 1224 North Nokomis NE, Alexandria, Minnesota,USA. This formReview Form No. 4002 may be reproduced without written consent, however, the “National Association of Review Appraisers and Mortgage Underwriter’s must be acknowledged and credited.

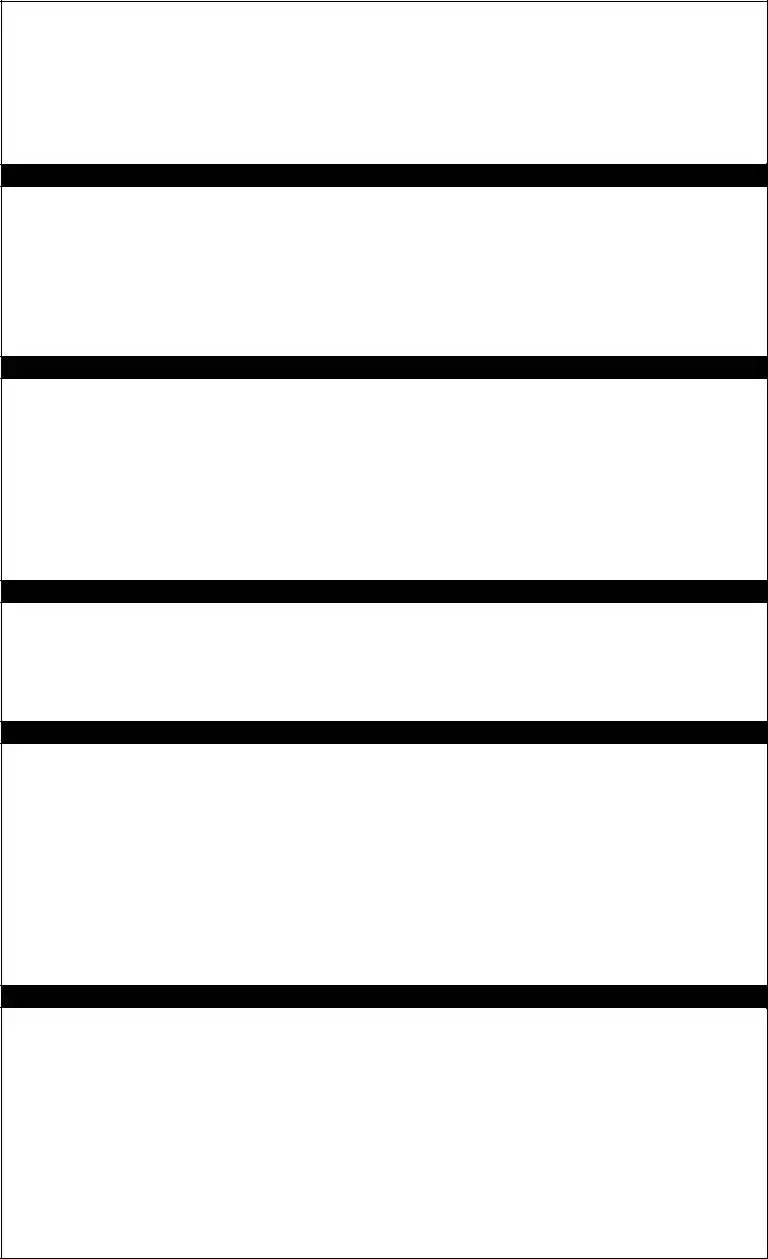

SECTION VI — Property Valuation

Comment and rate the approaches to value: |

|

|

|

|

||

COST APPROACH: |

Satisfactory |

Unsatisfactory |

DISCOUNTED CASH FLOW ANALYSIS (DCF) |

|

||

Format |

|

❐ |

❐ |

|

Satisfactory |

Unsatisfactory |

Adequacy of data |

|

❐ |

❐ |

Format |

❐ |

❐ |

Source of costs |

|

❐ |

❐ |

Adequacy of data and support for: |

|

|

Land value estimate |

|

❐ |

❐ |

Holding Period |

❐ |

❐ |

Estimated cost new |

|

❐ |

❐ |

Growth Rates |

❐ |

❐ |

Depreciation estimate |

|

❐ |

❐ |

Discount Rate |

❐ |

❐ |

SALES COMPARISON APPROACH: |

|

Development of Cash Flow Estimates ❐ |

❐ |

|||

Format |

|

❐ |

❐ |

Reversionary Value |

❐ |

❐ |

Adequacy of data |

|

❐ |

❐ |

Other Methods of Processing Income |

|

|

Sources of data |

|

❐ |

❐ |

Stream (Mortgage Equity, Band of |

|

|

Summary of sales table |

|

❐ |

❐ |

Investments, etc.) |

❐ |

❐ |

Use of adjustment grid table |

❐ |

❐ |

RECONCILIATION: |

|

|

|

Comparative analysis of sales |

❐ |

❐ |

Indicated values are: |

|

|

|

INCOME CAPITALIZATION APPROACH: |

|

Cost Approach |

$ __________ |

|

||

Format |

|

❐ |

❐ |

Sales Comparison Approach |

$ __________ |

|

Selection of proper capitalization |

|

Income Approach |

$ __________ |

|

||

method |

|

❐ |

❐ |

DCF Analysis |

$ __________ |

|

Adequacy of data and support for: |

|

|

Other (Pending Sale, etc.) |

|

|

|

Comparable Rentals |

|

❐ |

❐ |

Value Conclusion |

|

$ ________ |

Vacancy and Loss Factor |

|

❐ |

❐ |

Allocation as Follows: |

|

|

Operating History |

|

❐ |

❐ |

Land |

$ __________ |

|

Rent Roll |

|

❐ |

❐ |

Improvements |

$ __________ |

|

Income Estimate |

|

❐ |

❐ |

Personal Property |

$ __________ |

|

Expense Estimate |

|

❐ |

❐ |

Other |

$ __________ |

|

Net Operating Income |

|

❐ |

❐ |

Total Value |

|

$ ________ |

Capitalization Rate |

|

❐ |

❐ |

|

|

|

Comments:

______________________________________________________________________________________________________________

______________________________________________________________________________________________________________

______________________________________________________________________________________________________________

______________________________________________________________________________________________________________

Section VII — Other Report Requirements

Does the report contain a certification ❐ Yes |

❐ No |

Does the principal appraiser make |

|

|

|

Is the report |

❐ Yes |

❐ No |

statement of concurrence with value |

|

|

Did the principal appraiser sign the |

|

conclusion |

❐ Yes |

❐ No |

|

report |

❐ Yes |

❐ No |

Does the report contain appraiser(s) |

|

|

Did the principal appraiser personally |

|

qualifications |

❐ Yes |

❐ No |

|

inspect subject property |

❐ Yes |

❐ No |

|

|

|

|

|

|

|

||

|

Section VIII — Final Rating of Appraisal |

|

|

||

|

|

|

|

|

|

|

Acceptable |

Unacceptable |

|

Acceptable |

Unacceptable |

Report Format |

|

|

Property Valuation: |

|

|

Readability and neatness |

❐ |

❐ |

Feasibility/Profitability |

❐ |

❐ |

Mathematical accuracy |

❐ |

❐ |

Market Trends |

❐ |

❐ |

Exhibits (Photos, Maps, etc.) |

❐ |

❐ |

Cost Approach |

❐ |

❐ |

Appraiser’s analytical ability |

❐ |

❐ |

Sales Comparison Approach |

❐ |

❐ |

Purpose and function of appraisal ❐ |

❐ |

Income Approach |

❐ |

❐ |

|

Property identification |

❐ |

❐ |

DCF |

❐ |

❐ |

Locational analysis |

❐ |

❐ |

Reconciliation |

❐ |

❐ |

Property Description |

❐ |

❐ |

Date of Appraisal |

❐ |

❐ |

Site |

❐ |

❐ |

Overall Rating of Appraisal |

|

|

Improvements |

❐ |

❐ |

|

|

|

Highest and Best Use |

❐ |

❐ |

|

|

|

Brief Comments on Unacceptable Ratings:

______________________________________________________________________________________________________________

______________________________________________________________________________________________________________

______________________________________________________________________________________________________________

______________________________________________________________________________________________________________

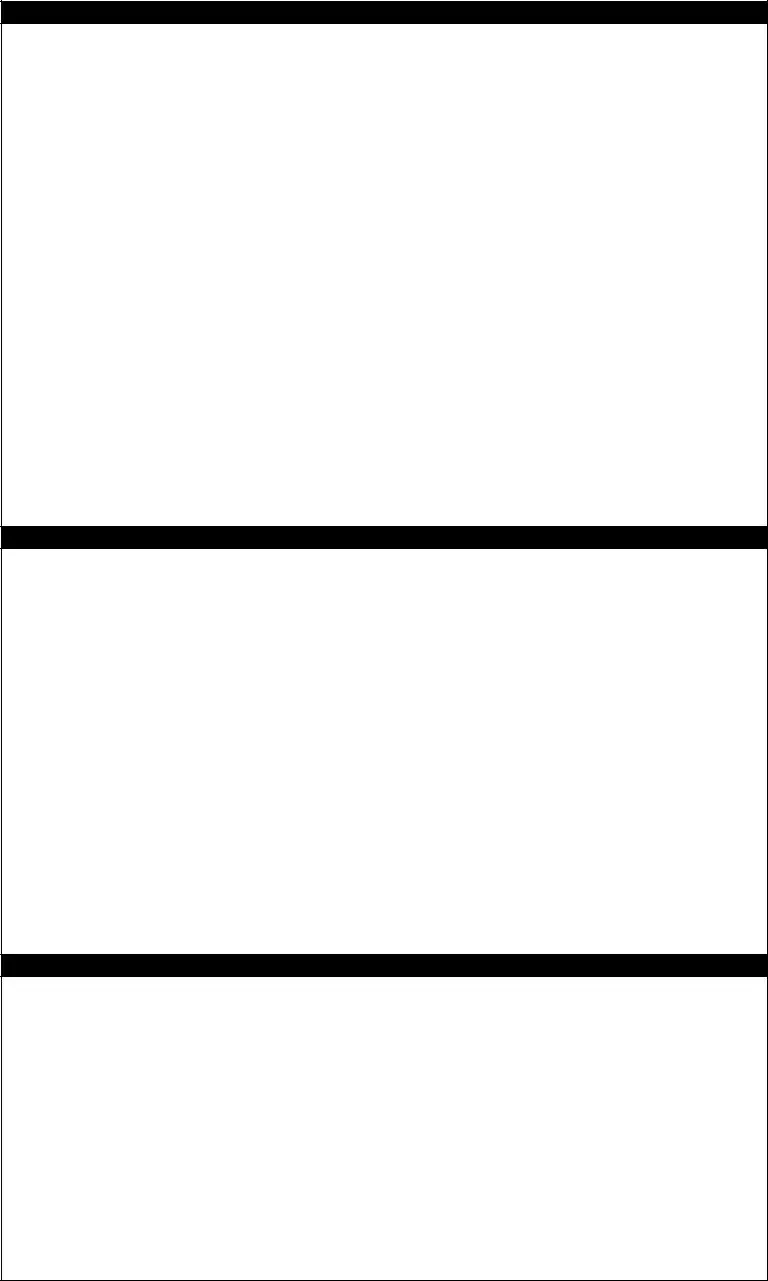

Section IX — Reviewer’s Conclusions — Recommendations

Scope of Review: |

|

|

If reviewer does not concur with the soundness if conclusion, then |

Read report |

❐ Yes |

❐ No |

what is the recommended action: |

Interviewed appraiser |

❐ Yes |

❐ No |

❐ Totally reject appraisal |

Field Review |

❐ Yes |

❐ No |

❐ Have appraiser rework, revise, update the appraisal |

Does the Reviewer concur with |

|

|

❐ Have another appraisal prepared by someone else |

the soundness of conclusion: |

❐ Yes |

❐ No |

❐ Other |

Concluding Comments:

______________________________________________________________________________________________________________

______________________________________________________________________________________________________________

______________________________________________________________________________________________________________

______________________________________________________________________________________________________________

______________________________________________________________________________________________________________

______________________________________________________________________________________________________________

Reviewer’s Signature _____________________________________________________________________________________________

Name of Reviewer __________________________________________________________________ Date ________________________

Position ___________________________________________________________________________ Department __________________

Address __________________________________________________________________________ Telephone ___________________

City, State, Zip __________________________________________________________________________________________________

Copyright © by the National Association of Review Appraisers and Mortgage Underwriters P.O. Box 879, Palm Springs, California, 92263 USA. This form |

Review Form No. 4002 |

may be reproduced without written consent, however, the “National Association of Review Appraisers and Mortgage Underwriter’s must be acknowledged and credited. |

|

Form Characteristics

| Fact Name | Detail |

|---|---|

| Purpose | The Review Commercial Appraisal form is designed to evaluate the adequacy and accuracy of a commercial appraisal report. It helps assess whether the appraisal meets industry standards and provides relevant information for decision-making. |

| Property Types | The form covers both existing properties and proposed constructions, allowing for a comprehensive review across different types of commercial real estate. |

| Data Requirements | It requires detailed information including the location, legal description, ownership history, and property tax data, ensuring that all relevant factors are documented for thorough analysis. |

| Governing Law | This form adheres to the guidelines set forth by the Uniform Standards of Professional Appraisal Practice (USPAP) and various state laws related to real estate appraisal processes. |

| Final Rating | The form concludes with a section for the reviewer to rate the appraisal report’s overall acceptability, covering aspects such as report format, property identification, and accuracy of the valuation methods used. |

Guidelines on Utilizing Review Commercial Appraisal

Filling out the Review Commercial Appraisal form is an essential step in the appraisal review process. Completing this form accurately ensures that all necessary information about the appraisal report is properly documented. This clarity aids in making informed decisions based on the assessment of property value and its implications.

- Begin by filling in the Name of Project/Property section with the name of the property being appraised.

- Provide the Location/Legal information accurately, including any necessary legal identifiers.

- Select the Type of Property by checking the appropriate box for either “Existing” or “Proposed Construction.”

- Input the Name of Appraiser along with their Telephone number and Address.

- Similarly, record the Report Addressed to, their Telephone number, and Address.

- Check the Type of Appraisal Report that pertains to the report you are reviewing.

- For Section I, indicate the Value Sought and the corresponding Date of Value.

- Detail the Interests Valued by checking all relevant boxes.

- Document any Assumptions and Limiting Conditions pertinent to the appraisal.

- In Section II, answer whether the report adequately contains information on Property Location/Address, Owners of Record, and any Real Estate Tax Information.

- Continue filling out Section III by answering whether the report adequately describes the Location Analysis.

- Proceed to Section IV, where you comment on the Property Description and analyze the improvements and site features.

- In Section V, confirm whether the property conforms to zoning and legal definitions.

- Evaluate the contents in Section VI, focusing on various valuation approaches such as the Cost Approach and Sales Comparison Approach.

- Check for certifications and signatures in Section VII to ensure compliance.

- Complete the Final Rating of Appraisal in Section VIII by marking the relevant criteria as acceptable or unacceptable.

- Lastly, in Section IX, provide your conclusions, recommendations, and signature as the reviewer.

Ensure that each section is completed thoroughly before submitting the form. This diligence not only reflects professionalism but also enhances the understanding of the valuation process.

What You Should Know About This Form

What is the purpose of the Review Commercial Appraisal form?

The Review Commercial Appraisal form serves as a tool to evaluate the quality and reliability of commercial appraisal reports. It helps reviewers assess whether important aspects of the appraisal have been adequately addressed, such as property identification, valuation methods, and compliance with applicable standards. This structured approach ensures nuanced evaluations, promoting fairness and transparency in real estate transactions.

Who should complete the Review Commercial Appraisal form?

The form should be filled out by qualified professionals trained in commercial real estate appraisals. Typically, these reviewers can be individuals like certified appraisers, mortgage underwriters, or anyone with relevant experience in property valuation. Their insights are crucial to ensure that the appraisal meets industry standards and accurately reflects the property's value.

What information is required about the property on the form?

Reviewers must provide specific details about the property, including its name, location, and type—whether it is an existing structure or a proposed construction project. Additionally, they need to note the owners of record, the legal description, and relevant tax information. This information ensures the review process is rooted in accurate, identifiable data related to the property being appraised.

How does the form address the quality of the appraisal report?

The form contains detailed sections that help reviewers rate the quality of the appraisal report. Sections evaluate key components like the valuation methods used, the level of detail in the property description, and the assumptions made in the report. By giving a structured rating, the form highlights areas of strength and points out any weaknesses in the appraisal, facilitating a balanced critique.

What should a reviewer do if they find discrepancies in the appraisal?

If discrepancies are found, the reviewer can suggest appropriate actions on the form, such as having the appraiser rework or revise the report, or even conducting a completely new appraisal by another qualified professional. This recommendation process ensures that any significant issues are clearly communicated and addressed, promoting the integrity of the appraisal process.

What is meant by “highest and best use” in the review process?

“Highest and best use” refers to the most profitable legal use of a property, considering its physical attributes, zoning, and market conditions. Reviewers will assess if the appraisal adequately discusses the property’s potential and whether it aligns with current zoning regulations. This evaluation helps ensure that the appraisal reflects realistic expectations for value based on how the property can best be utilized.

Can the Review Commercial Appraisal form be modified?

While the form is standardized, it may be tailored for specific needs of different organizations or situations. However, any modifications should retain the essential elements that ensure comprehensive reviews. It's essential to maintain the integrity and effectiveness of the original form to fulfill its intended purpose.

What happens after the form is completed?

Once the Review Commercial Appraisal form is filled out, it serves as documentation of the review process. It may be used to support decisions regarding financing, sales, or other real estate transactions. Additionally, it provides a clear account of evaluations and recommendations, which can be beneficial for all parties involved in the appraisal process.

Common mistakes

When filling out the Review Commercial Appraisal form, many individuals inadvertently make mistakes that can significantly impact the review process. One common error is neglecting to provide complete property identification details. Without accurate descriptions of the property's name, location, and legal information, it becomes challenging for reviewers to assess the appraisal effectively. A well-defined property location is essential; thus, leaving this section incomplete is a misstep that should be avoided.

Another frequent mistake occurs in the definition of value sought. Reviewers often encounter vague or undefined terms when it comes to indicating if the intended value is market value or another type. Failing to clearly identify the value sought can lead to misinterpretations of the appraisal's purpose. Moreover, the date of value should also be specified accurately. If an appraisal references an incorrect date, it could invalidate the report's relevance to current market conditions.

Inadequate attention to the assumptions and limiting conditions section is yet another pitfall. Reviewers rely on clearly stated assumptions to understand the context of the appraisal. Missing or misleading assumptions might result in a skewed evaluation, leading to poor decision-making. Furthermore, accurately identifying all interests to be valued, such as fee simple or leased interests, is critical. People often overlook this aspect, leading to confusion about what the appraisal encompasses.

Location analysis holds a particular importance in appraisal reviews, yet many users fall short here. A thorough evaluation of the region, city, and neighborhood characteristics—including economic trends or significant nuisances—must be included. Omitting these discussions can obscure issues that might affect property value, ultimately complicating the review process.

When describing the property and its improvements, comprehensiveness is key. Reviewers report that vague descriptions of physical features, such as the condition of the site and available utilities, diminish their ability to assess the necessary factors accurately. Areas like zoning and environmental hazards must be discussed in-depth. Failing to include findings related to zoning can lead to complications later on.

Additionally, the highest and best use section is often mismanaged. Incorrect conclusions about the property’s use or failure to discuss relevant zoning changes can be detrimental. In this section, it’s vital to connect zoning laws to marketability aspects like supply and demand. Reviewers also appreciate comments pertaining to any feasibility studies conducted, and neglecting to include previous reports can raise red flags.

A final common error lies in the overall completeness of the report. Missing signatures or qualifications of the appraiser can undermine the credibility of the appraisal. Always ensure that the report is co-signed and includes the principal appraiser's qualifications. This documentation is crucial for establishing trust in the evaluation being conducted.

In summary, taking care to provide accurate details, clear definitions, and thorough analyses throughout the Review Commercial Appraisal form is essential for an effective and reliable review process. By steering clear of these common mistakes, individuals can contribute to a smoother evaluation and support better decision-making.

Documents used along the form

The Review Commercial Appraisal form plays a crucial role in the evaluation of real estate projects. However, it is often utilized alongside several other documents that enhance the appraisal process. Understanding these supporting documents is essential for a comprehensive review and accurate valuation.

- Appraisal Report: This is the primary document that outlines the details of the property being appraised. It includes methodology, valuation approaches, and conclusions reached by the appraiser regarding the property's market value.

- Comparable Sales Analysis: This document compares the property in question to similar properties that have recently sold. It informs the appraisal by providing real market data that can validate the appraised value.

- Property Disclosure Statement: Often prepared by the property owner, this statement reveals important information about the condition, history, and any known issues related to the property. This transparency can significantly impact the appraisal outcome.

- Market Analysis Report: This report examines current market trends, economic conditions, and demographic information relevant to the property. It helps assess the viability and investment potential of the property within its market.

- Zoning Documentation: Zoning regulations determine how a property can be used. This documentation provides critical information about zoning classifications, permissible uses, and any restrictions that may affect property value.

In summary, various forms and documents are essential in the appraisal process. Each serves a distinct purpose while contributing to a thorough understanding of the property being evaluated. Together, they enhance the accuracy and integrity of the appraisal review process.

Similar forms

- Commercial Property Appraisal Report: Both documents assess the value of a commercial property. While the Review Commercial Appraisal form focuses on evaluating the appraisal report's soundness, the appraisal report itself establishes the property's market value based on various methods.

- Residential Appraisal Review Form: Similar to the Review Commercial Appraisal form, this document reviews the findings of a residential appraisal. It examines location, property condition, and market trends to confirm the accuracy of the residential appraisal process.

- Market Analysis Report: A Market Analysis Report provides insights into current market conditions, just as the Review Commercial Appraisal form assesses the property's market context and its highest and best use based on market demand.

- Bank Loan Review Document: This document reviews appraisal findings for loan approval. Like the Review form, it ensures that the property value aligns with lending criteria, safeguarding the lender’s interests.

- Property Condition Assessment Report: Both the Property Condition Assessment and the Review Commercial Appraisal form focus on the physical aspects of a property. They analyze structural integrity and maintenance, thereby influencing overall valuation.

- Investment Analysis Report: In an Investment Analysis Report, various financial metrics are evaluated to determine potential returns on investment. Similarly, the Review form assesses financial viability and profitability of the property being reviewed.

Dos and Don'ts

When filling out the Review Commercial Appraisal form, it is important to follow specific guidelines to ensure accuracy and efficiency. Here are some key points to consider:

- DO complete all required fields clearly and accurately.

- DO double-check the property location and legal descriptions for correctness.

- DO review the appraisal report thoroughly to understand its content.

- DO ensure that any assumptions or limitations are clearly stated.

- DON'T leave any sections incomplete without a valid reason.

- DON'T use abbreviations or shortcuts that may lead to confusion.

- DON'T modify the form's layout or structure.

- DON'T forget to include your signature and date at the end of the form.

Misconceptions

Misconceptions about the Review Commercial Appraisal form can lead to confusion and misinterpretation. Here are five common misunderstandings, explained clearly.

- The form is only for existing properties. This is incorrect. The Review Commercial Appraisal form accommodates both existing and proposed construction, which means it can be used for a wide range of property types.

- It’s only necessary for high-value properties. Many believe that only expensive properties require a formal appraisal review. However, any commercial property, regardless of its value, can benefit from a careful appraisal review to ensure accuracy and fairness.

- The purpose of the review is solely to dispute an existing appraisal. While challenging an appraisal can be one reason for using the form, it also serves a broader purpose. The review can enhance understanding of market conditions, validate assessments, and ensure that the appraisal aligns with appraisal standards.

- You don’t need to include property descriptions. Some people assume that the form does not require detailed property descriptions. In reality, providing thorough and accurate descriptions is critical for understanding the property’s context and value.

- Only licensed appraisers can complete the form. This is a common misconception. While it is important for the reviewer to understand appraisal principles, individuals with relevant knowledge and experience can also work with the form to analyze appraisal reports effectively.

Key takeaways

1. Identify Key Information: Ensure the project/property name, location, and type are clearly noted at the beginning of the form.

2. Define Purpose: Clearly state the purpose of the appraisal by selecting the value sought, which may include market value or other specific types.

3. Confirm Property Details: Provide accurate property ownership details, including owners of record and any legal descriptions.

4. Location Analysis: Evaluate the surrounding area, considering regional, city, and neighborhood elements that could affect property value.

5. Assess Property Descriptions: Carefully review the adequacy of descriptions related to both site and improvements, including any special problems or zoning issues.

6. Highest and Best Use: Determine if the property conforms to existing zoning laws and whether the proposed use is legal and feasible.

7. Valuation Methods: Assess all approaches to valuing the property, including cost approach and income capitalization, and check their adequacies and formats.

8. Reporting Requirements: Confirm if the report includes necessary certifications, and ensure that the principal appraiser has provided a statement of concurrence with the valuation conclusion.

9. Review Conclusions: After evaluating the appraisal, state whether the conclusion is acceptable or unacceptable, and provide clear recommendations on next steps if needed.

Browse Other Templates

Warrant Quashed - This process helps maintain the integrity of the judicial system.

Letter to Tenant to Move Out - It highlights the importance of communication during the moving process.

Export Value Declaration Form - Exporters are encouraged to review the "Correct Way to Fill Out the Shipper’s Export Declaration" guide.