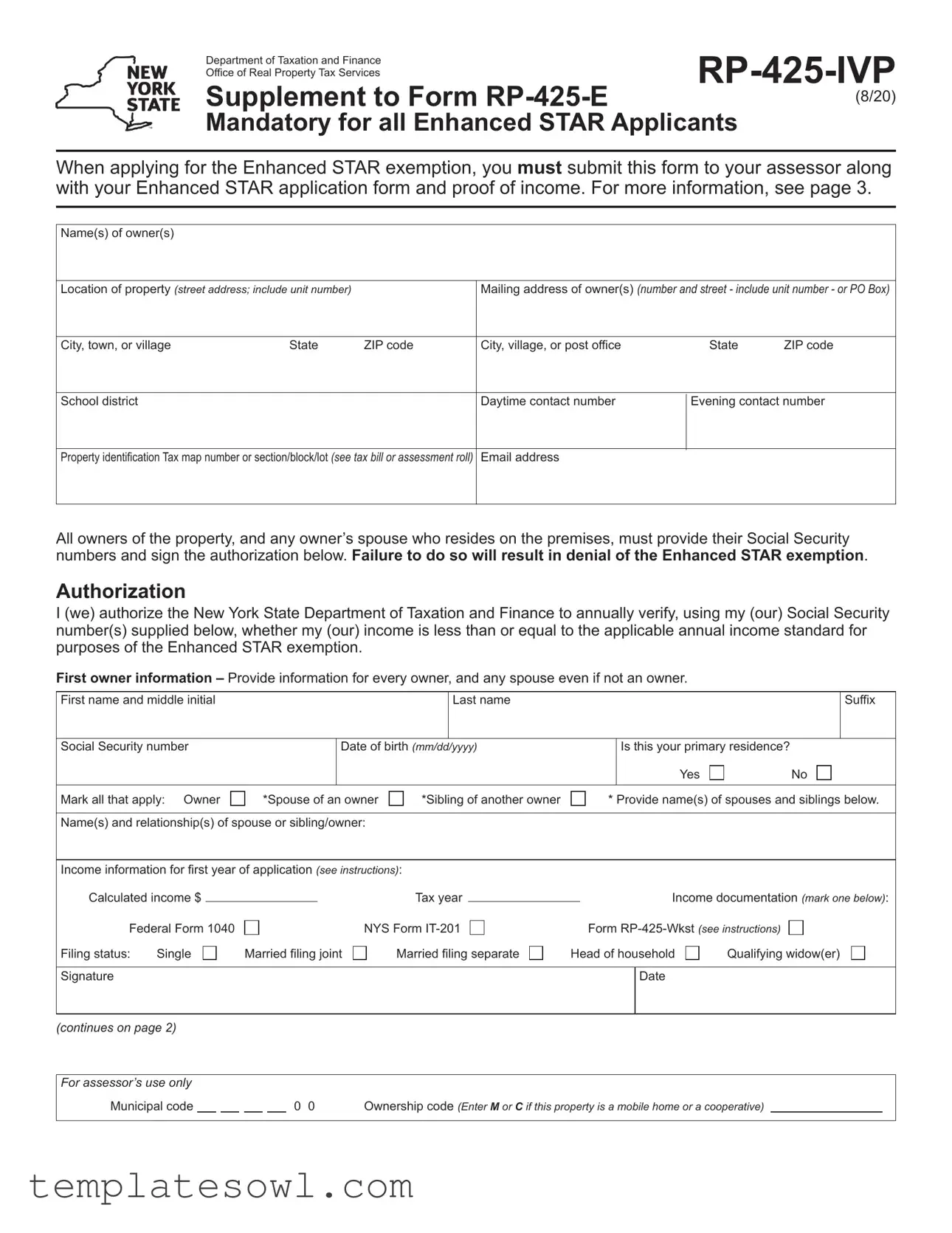

Fill Out Your Rp 425 Ivp Form

The RP-425 IVP form is a critical document for homeowners seeking the Enhanced STAR exemption, a valuable benefit designed to reduce school property taxes for eligible residents. This form must be submitted alongside the Enhanced STAR application and proof of income to the local assessor. It collects detailed owner information, including names, addresses, and contact details, while requiring Social Security numbers from all property owners and their spouses residing on the premises. This information allows for an annual verification of income eligibility, a process that simplifies future applications. Additionally, the form mandates disclosure of calculated income and the tax year relevant to the application. Specific documentation, such as Federal Form 1040 or NYS Form IT-201, must be provided to support the income claims. Importantly, the form includes measures to protect personal information and ensures that the applicant's income will only be used for eligibility verification, not disclosed to the assessor. Proper completion of the RP-425 IVP form is essential for taking advantage of this property tax relief program, highlighting its role in protecting the financial interests of homeowners across the state.

Rp 425 Ivp Example

Department of Taxation and Finance |

|

Office of Real Property Tax Services |

|

Supplement to Form |

(8/20) |

Mandatory for all Enhanced STAR Applicants

When applying for the Enhanced STAR exemption, you must submit this form to your assessor along with your Enhanced STAR application form and proof of income. For more information, see page 3.

Name(s) of owner(s) |

|

|

|

|

|

|

|

|

|

||

Location of property (street address; include unit number) |

|

Mailing address of owner(s) (number and street - include unit number - or PO Box) |

|||

|

|

|

|

|

|

City, town, or village |

State |

ZIP code |

City, village, or post office |

State |

ZIP code |

|

|

|

|

|

|

School district |

|

|

Daytime contact number |

Evening contact number |

|

|

|

|

|

||

Property identification Tax map number or section/block/lot (see tax bill or assessment roll) |

Email address |

|

|

||

|

|

|

|

|

|

All owners of the property, and any owner’s spouse who resides on the premises, must provide their Social Security numbers and sign the authorization below. Failure to do so will result in denial of the Enhanced STAR exemption.

Authorization

I (we) authorize the New York State Department of Taxation and Finance to annually verify, using my (our) Social Security number(s) supplied below, whether my (our) income is less than or equal to the applicable annual income standard for purposes of the Enhanced STAR exemption.

First owner information – Provide information for every owner, and any spouse even if not an owner.

First name and middle initial |

|

|

|

|

|

|

|

|

|

Last name |

|

|

|

|

|

|

Suffix |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

Social Security number |

|

|

|

|

|

|

Date of birth (mm/dd/yyyy) |

|

|

Is this your primary residence? |

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

|

No |

||

Mark all that apply: Owner |

|

|

*Spouse of an owner |

*Sibling of another owner |

|

* Provide name(s) of spouses and siblings below. |

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

Name(s) and relationship(s) of spouse or sibling/owner: |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

Income information for first year of application (see instructions): |

|

|

|

|

|

|

|

|

||||||||||||||||

Calculated income $ |

|

|

|

|

|

|

|

|

|

Tax year |

|

|

|

|

Income documentation (mark one below): |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

Federal Form 1040 |

|

|

|

|

|

|

|

NYS Form |

|

Form |

||||||||||||||

Filing status: |

Single |

|

Married filing joint |

|

Married filing separate |

Head of household |

Qualifying widow(er) |

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Signature |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

(continues on page 2) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For assessor’s use only |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Municipal code |

0 0 |

|

|

Ownership code (Enter M or C if this property is a mobile home or a cooperative) |

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Additional owner or spouse information – Provide information for every owner, and any spouse even if not an owner.

First name and middle initial |

|

|

|

|

Last name |

|

|

|

|

|

Suffix |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|||

Social Security number |

|

|

Date of birth (mm/dd/yyyy) |

|

|

Is this your primary residence? |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Mark all that apply: Owner |

*Spouse of an owner |

*Sibling of another owner |

|

* Provide name(s) of spouses and siblings below. |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Name(s) and relationship(s) of spouse or sibling/owner: |

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|||

Income information for first year of application (see instructions): |

|

|

|

|

|

|

||||||||

Calculated income $ |

|

|

|

|

Tax year |

|

|

|

|

Income documentation (mark one below): |

||||

|

|

|

|

|

|

|

|

|||||||

Federal Form 1040 |

|

|

NYS Form |

|

Form |

|||||||||

Filing status: |

Single |

Married filing joint |

Married filing separate |

Head of household |

Qualifying widow(er) |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Signature |

|

|

|

|

|

|

|

|

|

|

|

Date |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Additional owner or spouse information – Provide information for every owner, and any spouse even if not an owner.

First name and middle initial |

|

|

|

|

Last name |

|

|

|

|

|

Suffix |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|||

Social Security number |

|

|

Date of birth (mm/dd/yyyy) |

|

|

Is this your primary residence? |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

No |

|

Mark all that apply: Owner |

*Spouse of an owner |

*Sibling of another owner |

|

* Provide name(s) of spouses and siblings below. |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Name(s) and relationship(s) of spouse or sibling/owner: |

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|||

Income information for first year of application (see instructions): |

|

|

|

|

|

|

||||||||

Calculated income $ |

|

|

|

|

Tax year |

|

|

|

|

Income documentation (mark one below): |

||||

|

|

|

|

|

|

|

|

|||||||

Federal Form 1040 |

|

|

NYS Form |

|

Form |

|||||||||

Filing status: |

Single |

Married filing joint |

Married filing separate |

Head of household |

Qualifying widow(er) |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Signature |

|

|

|

|

|

|

|

|

|

|

|

Date |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Additional owner or spouse information – Provide information for every owner, and any spouse even if not an owner.

First name and middle initial |

|

|

|

|

Last name |

|

|

|

|

|

Suffix |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|||

Social Security number |

|

|

Date of birth (mm/dd/yyyy) |

|

|

Is this your primary residence? |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Mark all that apply: Owner |

*Spouse of an owner |

*Sibling of another owner |

|

* Provide name(s) of spouses and siblings below. |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Name(s) and relationship(s) of spouse or sibling/owner: |

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|||

Income information for first year of application (see instructions): |

|

|

|

|

|

|

||||||||

Calculated income $ |

|

|

|

|

Tax year |

|

|

|

|

Income documentation (mark one below): |

||||

|

|

|

|

|

|

|

|

|||||||

Federal Form 1040 |

|

|

NYS Form |

|

Form |

|||||||||

Filing status: |

Single |

Married filing joint |

Married filing separate |

Head of household |

Qualifying widow(er) |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Signature |

|

|

|

|

|

|

|

|

|

|

|

Date |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Page 3 of 3

Instructions

You must include this form when applying or reapplying for the Enhanced STAR exemption.

General information

To apply for the Enhanced STAR exemption, submit this application and Form

You must also provide proof of income as described on the above forms.

When submitting this form, you must supply the Social Security numbers of all owners of the property and of any owner’s spouse who resides on the premises.

In the first year, the assessor will verify your eligibility based on the income information you provide. (See Income information.) In the following years, the New York State Department of Taxation and Finance will verify your income eligibility. You will not need to reapply for the exemption or provide copies of your tax returns to your local assessor.

The Tax Department will not disclose your income to the assessor. It will only disclose whether or not your income is below the applicable income standard.

Nassau County homeowners: Complete

Form

which is available at Nassau County’s website at www.nassaucountyny.gov (search: STAR). Submit both forms to the address on page 2 of Nassau County’s application.

Income information

This is the income that the assessor will use to verify your eligibility in your first year of applying for the Enhanced STAR exemption.

•Calculated income – Refer to Proof of income for STAR purposes on page 3 of Form

•Tax year – Income is based on the tax year two years prior to the year for which you are applying for an exemption. For example, if you are applying for an

Enhanced STAR exemption for the

•Income documentation – Indicate the income tax form that was used to document income. If you did not file a Federal or New York State income tax return for the required year, complete Form

Form

Privacy notification

The Privacy Act of 1974 requires us to advise you that the law which allows us to ask for your Social Security numbers is New York Real Property Tax Law section 425 (4)(b). It is mandatory that you furnish your Social Security numbers. Once you furnish them, they will be forwarded to the New York State Department of Taxation and Finance, which will use them to verify, or

attempt to verify, whether your income is greater than the applicable income standard for purposes of the Enhanced STAR exemption. If you do not furnish your Social

Security numbers, you will be unable to receive an Enhanced STAR exemption.

Form Characteristics

| Fact Name | Fact Detail |

|---|---|

| Form Purpose | The RP-425-IVP form is mandatory for all Enhanced STAR applicants to submit alongside their Enhanced STAR application and proof of income. |

| Governing Law | This form adheres to New York Real Property Tax Law, specifically section 425. |

| Social Security Requirement | All property owners and any spouse residing on the premises must provide their Social Security numbers. |

| Income Verification | The New York State Department of Taxation and Finance uses the provided Social Security numbers to verify income eligibility for the Enhanced STAR exemption. |

| First Year Income Documentation | Applicants must supply income information from the tax year two years prior to the exemption year. |

| Contact Information | Applicants are required to provide daytime and evening contact numbers for communication. |

| Additional Owner Information | The form requests detailed information for all owners and their spouses, even if not property owners. |

| Primary Residence Status | Applicants must indicate whether the property is their primary residence, an essential criterion for exemption. |

| Signature Requirement | The form must be signed by all parties providing information, confirming the accuracy of the submitted data. |

| Submission Process | In Nassau County, the RP-425-IVP must be submitted with the county’s Enhanced STAR Property Tax Exemption Application. |

Guidelines on Utilizing Rp 425 Ivp

Filling out the RP-425 IVP form is a crucial step when applying for the Enhanced STAR exemption. Ensure that you provide complete and accurate information on the form to avoid any delays or rejections in the application process. Gather the necessary documentation before you start, such as your Social Security number, income information, and any other required details.

- Begin by writing your name(s) in the designated field for owner(s).

- Fill in the location of the property including the street address and unit number.

- Provide the mailing address of the owner(s), ensuring you include the street address, unit number, or PO Box.

- Complete the city, town, or village field, followed by the state and ZIP code.

- Indicate the school district for the property.

- List your daytime and evening contact numbers.

- Include the property identification number or tax map number as it appears on your tax bill or assessment roll.

- Provide your email address for any communication regarding your application.

- All property owners and any co-owners’ spouses must input their Social Security numbers and sign the authorization section. Make sure to do this accurately to avoid issues with your application.

- In the section for the first owner, enter their first name, middle initial, last name, and any suffix.

- Input the Social Security number and date of birth in the required format (mm/dd/yyyy).

- Indicate if this property is their primary residence by checking 'Yes' or 'No'.

- Mark all applicable statuses regarding ownership, including if they are a sibling of another owner.

- Provide the names and relationships of any spouse or sibling if applicable.

- Fill out the calculated income for the first year of application and the tax year for this income.

- Select the appropriate income documentation form from the choices given.

- Indicate the filing status from the options provided (e.g., Single, Married filing joint, etc.).

- Ensure that the first owner or spouse signs and dates the form at the bottom.

- If there are additional owners or spouses, repeat the necessary fields for each one, ensuring you provide complete information as stated in the form.

- After filling out all required sections, review the form for accuracy before submission.

What You Should Know About This Form

What is the RP-425 IVP form?

The RP-425 IVP form is a mandatory document for applicants seeking the Enhanced STAR exemption in New York. This form must be submitted along with the Enhanced STAR application and proof of income to your local assessor.

Who needs to fill out the RP-425 IVP form?

All owners of the property, as well as any owner’s spouse who resides on the premises, must provide their information and Social Security numbers on this form. Failure to provide this information will result in denial of the Enhanced STAR exemption.

What information is required on the form?

The form requires the names of the owners, property location, mailing address, school district, contact numbers, and email address. Additionally, it asks for Social Security numbers and income details for each owner and spouse.

What happens if I do not provide my Social Security number?

If you do not provide your Social Security number, you will not be eligible for the Enhanced STAR exemption. The law mandates that this information is necessary for income verification.

How is income verified by the Department of Taxation and Finance?

In the first year of your application, the assessor will verify your income based on the information you provide. In subsequent years, the New York State Department of Taxation and Finance will automatically verify your income using the Social Security numbers you supplied.

When do I need to reapply for the Enhanced STAR exemption?

You will not need to reapply for the Enhanced STAR exemption once it has been granted. You should only submit the RP-425 IVP form and your Enhanced STAR application once every year you are eligible.

What if I did not file a Federal or New York State income tax return?

If you did not file a return, you must complete Form RP-425-Wkst, the Income for STAR Purposes Worksheet, to document your income. Submit this worksheet along with both the Enhanced STAR application and the RP-425 IVP form.

Where should I submit the RP-425 IVP form?

This form should be submitted to your local assessor's office along with your Enhanced STAR application. If you are a homeowner in Nassau County, also complete the county's Enhanced STAR Property Tax Exemption Application and submit both forms as instructed.

Common mistakes

When completing the RP-425 IVP form for the Enhanced STAR exemption, people often encounter several common mistakes that may hinder their application. First, many applicants overlook the necessity of including the Social Security numbers for all owners and their spouses who reside on the premises. Omitting this essential information will lead to automatic denial of the exemption. Understanding the requirement for Social Security numbers should be a priority for all applicants.

Second, individuals frequently provide incomplete or incorrect property identification details. The form requires accurate property identification, such as the tax map number or section/block/lot information. Failing to double-check these details can delay the processing of the application, potentially resulting in other complications.

Another prevalent error is miscalculating or failing to document the calculated income for the first year of the application. The law mandates that this income must meet specific criteria, and applicants should ensure they have recorded the correct figures and the appropriate tax year. Inaccuracies in income calculations can undermine the entire application process.

Additionally, some applicants neglect to mark their filing status correctly. The RP-425 IVP form requires an indication of whether individuals are filing as single, married filing jointly, married filing separately, head of household, or qualifying widow(er). Misrepresentation of this status could raise questions and lead to denial or rejection of the application.

Furthermore, many applicants do not pay sufficient attention to the submission of supporting documentation. Applicants must not only provide the RP-425 IVP form but also submit the Enhanced STAR application form and proof of income. Skipping any of these required documents jeopardizes the overall application.

Errors occur, too, when applicants submit a form that is not signed or dated. The RP-425 IVP form requires a signature from all owners and their spouses. In situations where this step is overlooked, the application becomes incomplete, leading to unnecessary delays.

Moreover, applicants sometimes confuse the definitions of ‘primary residence’ versus secondary residences. It is crucial to properly understand and accurately indicate whether the property in question is truly the primary residence of the owner. Incorrectly answering this question could affect eligibility.

Lastly, failing to follow up after submitting the form can lead to misunderstandings regarding application status. Applicants should proactively check in with their local assessor's office to ensure they meet all deadlines and understand their application’s progress. Awareness of these common mistakes can greatly improve the likelihood of a successful Enhanced STAR exemption application.

Documents used along the form

When applying for the Enhanced STAR exemption in New York, several important forms complement the RP-425 IVP form. Each of these documents plays a vital role in ensuring the application process functions smoothly and that all necessary information is collected for the assessment. Below is a brief overview of key forms that are typically used together with the RP-425 IVP.

- Form RP-425-E: This is the main application form for the Enhanced STAR exemption. It requires basic information about the property and the owners, along with detailed income information necessary for eligibility evaluation.

- Form RP-425-Wkst: Also known as the Income for STAR Purposes Worksheet, this form is utilized when applicants have not filed a Federal or New York State income tax return. It allows applicants to declare their income to establish eligibility for the Enhanced STAR exemption.

- Form IT-201: This is the New York State Resident Income Tax Return form. Many applicants must submit this document as proof of income when applying for the Enhanced STAR exemption.

- Form 1040: The Federal Individual Income Tax Return is another income documentation option that applicants can submit. It presents the applicant's financial situation and is employed to verify their eligibility for the exemption.

- Nassau County Enhanced STAR Property Tax Exemption Application: Homeowners in Nassau County must complete this specific application in conjunction with the RP-425 IVP form when applying for the Enhanced STAR exemption.

- Proof of Income Documentation: While not a form per se, providing accurate proof of income documentation is crucial. This could include IRS tax returns or other financial records that verify the applicant’s income for the relevant tax year.

- Authorization Form: Although often integrated within the RP-425 IVP, this form requires applicants to provide consent for the New York State Department of Taxation and Finance to verify income using Social Security numbers. This authorization is mandatory for processing the Enhanced STAR exemption.

In preparation for applying for the Enhanced STAR exemption, it is essential to gather these documents and forms. By completing and submitting the necessary paperwork, applicants can ensure that their request for tax relief is processed efficiently and meets all required guidelines.

Similar forms

The RP-425 IVP form is an important document in the application process for the Enhanced STAR exemption in New York State. Several other documents share similarities with the RP-425 IVP in terms of their purpose, requirements, and the information they collect. Below is a list of six such documents:

- Form RP-425-E (Application for the Enhanced STAR Exemption): This form is the primary application needed to apply for the Enhanced STAR exemption. Like the RP-425 IVP, it requires personal details of the property owners and proof of income documentation.

- Form RP-425-Wkst (Income for STAR Purposes Worksheet): Used to supplement income details when tax returns are not available. It gathers similar income information and supporting details, making it essential for some applicants.

- NYS Form IT-201 (Resident Income Tax Return): This tax return form provides a comprehensive overview of a taxpayer’s income. It is required for income verification, just as the RP-425 IVP uses income declarations to qualify for the exemption.

- Federal Form 1040 (U.S. Individual Income Tax Return): Similar to the NYS Form IT-201, this federal document outlines income details for individuals. Both forms are accepted as proof of income in the Enhanced STAR application process.

- Form RP-425-NL (Application for the Additional School Tax Relief Exemption): This form is similar in its function to RP-425 IVP. It requires information on the property owner’s income and property, aiming to reduce school taxes for eligible applicants.

- Form RP-487 (Application for Exemption from Real Property Taxes): This application seeks similar personal and financial details for various property tax exemptions, paralleling the structure and necessity of the RP-425 IVP form in claiming the Enhanced STAR exemption.

In summary, these forms share a common goal: to ensure that applicants provide necessary personal and income information to qualify for exemptions or benefits related to property taxes.

Dos and Don'ts

When filling out the RP-425 IVP form, consider the following guidelines:

- Do: Include Social Security numbers for all property owners and their spouses residing on the premises.

- Do: Submit this form alongside the Enhanced STAR application and proof of income to your assessor.

- Do: Provide accurate and complete information for every property owner and any spouse, even if not an owner.

- Do: Mark whether the property is your primary residence and check all applicable boxes regarding ownership.

- Do: Keep a copy of all submitted documents for your records.

- Don’t: Omit any required information, as this may lead to denial of the exemption.

- Don’t: Provide false information or documentation; this could result in penalties or loss of benefits.

- Don’t: Forget to sign and date the form; an unsigned form will be considered incomplete.

- Don’t: Leave any sections blank that apply to you; make sure to answer all relevant questions.

- Don’t: Ignore instructions regarding income documentation; ensure you include the correct tax forms.

Misconceptions

Misconceptions about the RP-425 IVP form can create confusion for applicants seeking the Enhanced STAR exemption. Here are nine common misunderstandings along with clarifications:

- Only the property owner needs to provide information. All owners and any spouse residing on the premises must provide their information and Social Security numbers.

- You don’t need to submit the form every year. While reapplication isn’t required, initial submission is mandatory. Ensure your eligibility is verified based on income each year.

- Income verification is solely the responsibility of the local assessor. The New York State Department of Taxation and Finance verifies income eligibility using the information provided on this form.

- The form is optional if you have submitted other documents. The RP-425 IVP form must be submitted alongside Form RP-425-E to apply for the Enhanced STAR exemption.

- Social Security numbers are not necessary. It is mandatory to furnish Social Security numbers for all owners and any spouse living in the property. Failure to do so could lead to denial of the exemption.

- You can use any year’s income for calculation. Income is determined based on the tax year two years prior to your application year. Be sure to reference the correct year when calculating income.

- Tax documentation isn’t important if I have proof of income. It’s crucial to provide the appropriate tax documentation specified in the form to substantiate your income claims.

- The information provided can be shared with other agencies. The Tax Department does not disclose your income details to the local assessor. Only the verification of whether your income meets the standard is communicated.

- Nassau County homeowners have different requirements. Homeowners in Nassau County must complete additional forms along with the RP-425 IVP, which can be found on the county’s website.

Understanding these points can help streamline the application process for the Enhanced STAR exemption and ensure that applicants provide the necessary information and documentation.

Key takeaways

The RP-425-IVP form is an essential document for homeowners applying for the Enhanced STAR exemption in New York. Here are some key takeaways to help you navigate the form effectively:

- Mandatory Submission: All applicants must submit this form along with the Enhanced STAR application and proof of income.

- Owner Information: The form requires detailed information about all property owners and their spouses, including Social Security numbers.

- Income Verification: The New York State Department of Taxation and Finance uses the social security numbers provided to verify income eligibility annually.

- Primary Residence: Confirm whether the property in question is your primary residence, as this affects eligibility.

- Income Documentation: You must provide evidence of income, which may include Federal Form 1040, NYS Form IT-201, or Form RP-425-Wkst.

- Calculation of Income: Ensure that you calculate your income according to the guidelines outlined in the instructions; this is crucial for your eligibility.

- Submission for Nassau County: Homeowners in Nassau County need to combine this form with the county’s Enhanced STAR Property Tax Exemption Application.

- Two-Year Rule: The income used for eligibility is based on the tax year two years prior to the application year.

- Privacy Requirements: Be aware that your Social Security information is required by law under New York Real Property Tax Law, and not providing it will result in denial of the exemption.

Completing and submitting the RP-425-IVP form accurately is vital for securing the Enhanced STAR exemption, so ensure all information is thorough and correct.

Browse Other Templates

Njtr1 - The form allows for clear injury classification, from minor complaints to severe physical trauma.

Weiser Security Services - Detail your military service and type of discharge received.

Florida Lottery Winner Redemption Form,Prize Claim Request Form,Lottery Prize Collection Form,Winning Ticket Claim Application,Lottery Payout Claim Form,Jackpot Winner Submission Form,Lottery Reward Application,Claimant Prize Submission Form,Florida - To protect your ticket, store it safely until you're ready to claim it.