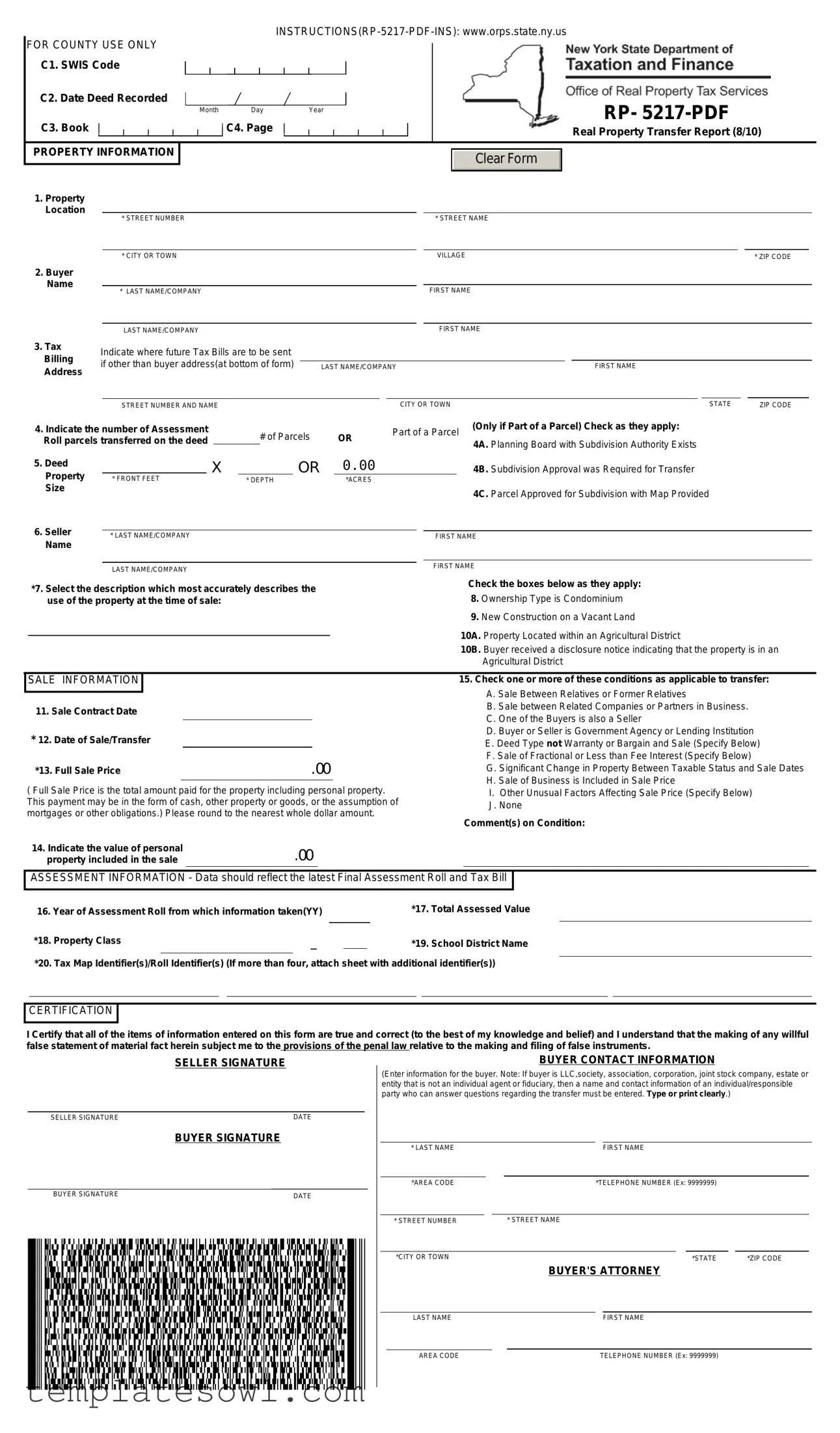

Fill Out Your Rp 5217 Form

The RP 5217 form serves as an essential document in the real estate transaction process within New York State. This form, officially termed the Real Property Transfer Report, collects vital information regarding the transfer of real property between parties. When completing the RP 5217, individuals must provide details about the property location, including the street number, street name, city or town, and ZIP code. Key participants in the transaction are also highlighted, with sections for both the buyer's and seller's names, addresses, and relevant contact information. The form requires the assessment number and property class, which helps local authorities maintain accurate tax records. Additionally, it addresses the sale information by querying the sale conditions, including whether the transaction involves relatives or related companies, the date of sale, and the full sale price. This information creates a comprehensive record that is crucial for tax assessment and legal purposes, ensuring transparency and accountability in property sales. Furthermore, the form also mandates certification by the seller and buyer, confirming the accuracy of the information provided, which carries significant legal weight. Completing the RP 5217 accurately and thoroughly is vital for all parties involved to prevent future disputes or issues related to the property transfer.

Rp 5217 Example

FOR COUNTY USE ONLY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

C1. SWIS Code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

C2. Date Deed Recorded |

|

|

|

|

|

|

|

|

|

|

|

|

|

RP- |

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

Month |

|

Day |

Year |

|

|

|

|||||||||||

C3. Book |

C4. Page |

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

Real Property Transfer Report (8/10) |

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PROPERTY INFORMATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Clear Form |

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. Property |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

Location |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

* STREET NUMBER |

|

|

|

|

|

|

|

|

|

* STREET NAME |

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

* CITY OR TOWN |

|

|

|

|

|

|

|

|

|

VILLAGE |

|

|

* ZIP CODE |

|

||||||||

2. Buyer |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

* LAST NAME/COMPANY |

|

|

|

|

|

|

|

|

FIRST NAME |

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

LAST NAME/COMPANY |

|

|

|

|

|

|

|

|

|

FIRST NAME |

|

|

|

|

|

|||||||

3. Tax |

Indicate where future Tax Bills are to be sent |

|

Billing |

||

if other than buyer address(at bottom of form) |

||

Address |

||

|

LAST NAME/COMPANY |

|

FIRST NAME |

|

|

STREET NUMBER AND NAME |

|

|

|

|

|

|

|

|

|

|

|

|

CITY OR TOWN |

|

|

|

|

|

STATE |

|

|

ZIP CODE |

|

|

||||||||||

|

4. Indicate the number of Assessment |

# of Parcels |

OR |

Part of a Parcel |

|

(Only if Part of a Parcel) Check as they apply: |

|

|

|

|||||||||||||||||||||||||||

|

Roll parcels transferred on the deed |

|

|

|

|

|

|

4A. Planning Board with Subdivision Authority Exists |

|

|

|

|||||||||||||||||||||||||

|

5. Deed |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0.00 |

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

X |

|

|

OR |

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4B. Subdivision Approval was Required for Transfer |

|

|

|

||||||||||||||||||

|

Property |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

* FRONT FEET |

* DEPTH |

|

*ACRES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

Size |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4C. Parcel Approved for Subdivision with Map Provided |

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

6. Seller |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

* LAST NAME/COMPANY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FIRST NAME |

|

|

|

||||||||||||||||||

|

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FIRST NAME |

|

|

|

|||||||||

|

|

LAST NAME/COMPANY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

*7. Select the description which most accurately describes the |

|

|

|

|

|

|

|

|

|

|

Check the boxes below as they apply: |

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

8. Ownership Type is Condominium |

|

|

|

||||||||||||||||||||||

|

use of the property at the time of sale: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9. New Construction on a Vacant Land |

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10A. Property Located within an Agricultural District |

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10B. Buyer received a disclosure notice indicating that the property is in an |

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Agricultural District |

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

SALE INFORMATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

15. Check one or more of these conditions as applicable to transfer: |

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A. Sale Between Relatives or Former Relatives |

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

11. Sale Contract Date |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

B. Sale between Related Companies or Partners in Business. |

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C. One of the Buyers is also a Seller |

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

* 12. Date of Sale/Transfer |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

D. Buyer or Seller is Government Agency or Lending Institution |

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

E. Deed Type not Warranty or Bargain and Sale (Specify Below) |

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

F. Sale of Fractional or Less than Fee Interest (Specify Below) |

|

|

|

|||||||||||

|

*13. Full Sale Price |

|

|

|

|

|

|

|

|

|

|

|

G. Significant Change in Property Between Taxable Status and Sale Dates |

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

H. Sale of Business is Included in Sale Price |

|

|

|

||||||

( Full Sale Price is the total amount paid for the property including personal property. |

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||

|

|

|

|

|

I. Other Unusual Factors Affecting Sale Price (Specify Below) |

|

|

|

||||||||||||||||||||||||||||

This payment may be in the form of cash, other property or goods, or the assumption of |

|

J. None |

|

|

|

|||||||||||||||||||||||||||||||

mortgages or other obligations.) Please round to the nearest whole dollar amount. |

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

|

|

|

|

|

Comment(s) on Condition: |

|

|

|

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

14. Indicate the value of personal |

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

property included in the sale |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

ASSESSMENT INFORMATION - Data should reflect the latest Final Assessment Roll and Tax Bill |

|

|

|

|

|||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

16. Year of Assessment Roll from which information taken(YY) |

|

|

|

|

|

*17. Total Assessed Value |

|

|

|

||||||||||||||||||||||||||

|

*18. Property Class |

_ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

*19. School District Name |

|

|

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*20. Tax Map Identifier(s)/Roll Identifier(s) (If more than four, attach sheet with additional identifier(s))

CERTIFICATION

I Certify that all of the items of information entered on this form are true and correct (to the best of my knowledge and belief) and I understand that the making of any willful false statement of material fact herein subject me to the provisions of the penal law relative to the making and filing of false instruments.

|

SELLER SIGNATURE |

|

|

|

|

SELLER SIGNATURE |

|

DATE |

|

BUYER SIGNATURE |

|

|

|

|

BUYER SIGNATURE |

|

DATE |

BUYER CONTACT INFORMATION

(Enter information for the buyer. Note: If buyer is LLC,society, association, corporation, joint stock company, estate or entity that is not an individual agent or fiduciary, then a name and contact information of an individual/responsible party who can answer questions regarding the transfer must be entered. Type or print clearly.)

* LAST NAME |

|

|

|

|

FIRST NAME |

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

*AREA CODE |

|

|

|

*TELEPHONE NUMBER (Ex: 9999999) |

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

* STREET NUMBER |

|

|

* STREET NAME |

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

*CITY OR TOWN |

|

|

|

|

|

|

*STATE |

*ZIP CODE |

|||

BUYER'S ATTORNEY

|

LAST NAME |

|

FIRST NAME |

||

|

|

|

|

|

|

|

AREA CODE |

TELEPHONE NUMBER (Ex: 9999999) |

|||

Form Characteristics

| Fact Name | Fact Description |

|---|---|

| Form Purpose | The RP-5217 form is used for reporting the transfer of real property in New York State. |

| Governing Law | This form is governed by New York State Real Property Law. |

| Required Information | Important details, such as property information, buyer and seller names, and sale conditions are required on the form. |

| Certification Statement | Sellers and buyers must certify that all information provided is true and correct, subjecting them to penalties for false statements. |

Guidelines on Utilizing Rp 5217

Filling out the Rp 5217 form requires attention to detail. Completing it accurately is essential for processing your property transfer smoothly. Once you have filled it out, you will need to submit it according to your county's requirements.

- Begin with the County Use Only section, filling in the following fields: SWIS Code, Date Deed Recorded (Month, Day, Year), Book, and Page.

- For Property Information, provide the address including Street Number, Street Name, City or Town, Village, and ZIP Code.

- Fill in the Buyer Name section with Last Name/Company and First Name for each buyer. This applies if there are multiple buyers.

- In the Tax Billing section, indicate where future tax bills should be sent if it's different from the buyer's address. Include Last Name/Company, First Name, Street Number, Street Name, City or Town, State, and ZIP Code.

- Specify the number of parcels transferred and check the applicable boxes regarding subdivision authority and approval.

- Provide details about the Seller using Last Name/Company and First Name.

- Indicate the Ownership Type and check the boxes that describe the use of the property during the sale.

- Provide the Date of Sale and the Full Sale Price, ensuring the latter is rounded to the nearest whole dollar.

- Indicate if personal property is included in the sale and its value.

- Insert information about the Assessment, including Year of Assessment Roll, Total Assessed Value, Property Class, School District Name, and Tax Map Identifier(s).

- Complete the Certification section by signing and dating for all parties involved: Seller(s) and Buyer(s).

- Lastly, provide Buyer Contact Information, ensuring you include all necessary details for which individual can answer questions about the transfer. Include your Attorney's contact if applicable.

What You Should Know About This Form

What is the RP-5217 form used for?

The RP-5217 form, also known as the Real Property Transfer Report, is utilized in New York State to document the details of a real estate transaction. This form is mandatory when property ownership changes hands and provides essential information about the property, including its location, the parties involved, and the sale details. Local authorities use the data submitted to update property records and assess property taxes accordingly.

Who is responsible for filling out the RP-5217 form?

The responsibility for completing the RP-5217 form typically falls on the seller or their designated representative, such as a real estate agent or attorney. It is crucial that the information provided is accurate, as any discrepancies can lead to issues with the property transfer, tax assessments, or legal complications.

What information is required on the RP-5217 form?

Several pieces of information need to be included in the RP-5217 form. This includes the property's location, buyer and seller names, tax billing address, assessment details, property classification, and the sale price. Additionally, any special conditions affecting the sale, such as it being between relatives or involving a government agency, should also be indicated. Providing complete and accurate information helps ensure a smooth transaction process.

Where can I find the RP-5217 form?

The RP-5217 form can be accessed through the New York State Office of Real Property Services website. The form is available for download in PDF format, and it’s advisable to refer to the specific instructions provided on the website to complete the form correctly. It’s essential to keep updated with any changes to the form or its requirements to ensure compliance.

What happens if the RP-5217 form is not submitted?

If the RP-5217 form is not submitted upon the transfer of property, it can lead to complications. Local authorities may be unable to update tax records or assess property taxes properly, which can result in future tax liabilities for owners. Furthermore, the transaction may be considered incomplete, which can have legal ramifications for both buyers and sellers. Timely submission of the form is crucial to avoid such issues.

Common mistakes

Filling out the RP-5217 form is a crucial step in real estate transactions, yet many individuals make common mistakes that can delay the process or lead to complications. One significant error is not completing the property location section accurately. Specific details like the street number and street name must be correct; even a small typo may result in confusion or misappropriation.

Another frequent mistake occurs in the buyer's name section. When entering names, people may inadvertently place an individual's last name in the company field or omit essential information altogether. This can cause legal complications later, especially if the property is held in different ownership formats. Clearly delineating between individuals and entities is key.

Property assessment information requires attention too. Individuals often overlook the importance of ensuring that the total assessed value and property class are correctly stated. Discrepancies here could lead to issues with taxes or the eligibility for tax exemptions, which can be financially detrimental.

Some fail to double-check the chosen options on the ownership type and property use descriptions. Users sometimes neglect to determine the most accurate descriptions of their property at the time of sale. Saying a property is a condominium when it's not can lead to various misunderstandings and potential legal ramifications.

Many individuals forget to round off the full sale price to the nearest whole dollar. Although it seems minor, this oversight can interrupt processing. Rounding consistently throughout helps maintain clarity in the form and avoids unnecessary questions from the authorities.

When it comes to indicating who will receive future tax bills, a common pitfall is providing inaccurate billing addresses. Not specifying the appropriate name and address can create chaos when tax bills are sent to the wrong person. Ensuring this section is filled out correctly is essential for avoiding issues with tax payments in the future.

Participants often overlook the certification section, which is vital for the integrity of the form. The failure to sign or provide dates on signatures can render the document incomplete. It is important to take this step seriously and ensure that all parties involved acknowledge the information being submitted.

Additionally, buyers sometimes neglect to include contact information for representatives, such as lawyers or agents. This can lead to confusion during the transaction if questions arise and no one is available to provide clarity.

Lastly, failing to read the form thoroughly before submitting it invites mistakes. Some individuals rush to complete it, resulting in overlooked details and misstatements. Taking a moment to review every section can save time and trouble later on.

Documents used along the form

The Real Property Transfer Report, known as the RP-5217 form, is a vital document used during the transfer of real estate in New York. Along with this form, there are several other documents that facilitate the transfer process. Each form serves a specific purpose, ensuring that both the buyer and seller are fully informed and compliant with legal requirements. Below is a list of commonly used forms that accompany the RP-5217 form in real estate transactions.

- Deed: This document formally transfers property ownership from the seller to the buyer. It typically includes information about the property’s legal description, the parties involved, and any conditions of the transfer. A properly executed deed is essential for the transaction to be valid.

- Seller's Disclosure Statement: This form requires sellers to disclose any known issues or defects related to the property. This can include problems such as structural damage, plumbing issues, or pest infestations. It helps buyers make informed decisions regarding the property.

- Mortgage Documents: If the buyer is financing the purchase through a mortgage, various documents are involved, including the loan application, promissory note, and mortgage agreement. These documents outline the terms of the loan and the buyer's repayment obligations.

- Tax Forms: Different tax forms may be necessary to report the sale and establish tax liability. These can include forms related to capital gains taxes, property taxes, and other local or state requirements. Accurate reporting is crucial to avoid potential penalties.

- Closing Statement: Also known as the settlement statement, this document outlines all the financial transactions and costs related to the sale. It includes details such as the purchase price, closing costs, and any adjustments for taxes or repairs. Both the buyer and seller review and sign this document during the closing process.

Each of these documents plays an important role in ensuring that the real estate transaction proceeds smoothly and transparently. Properly completing and understanding these forms can greatly assist in reducing misunderstandings or disputes in the future. This cooperative approach fosters mutual trust and clarity between all parties involved in the transaction.

Similar forms

Form RP-5217-NY: Similar to the RP-5217 form, this form also documents property transfers in New York State. It requires similar information about buyers, sellers, and property details.

Form RP-5218: This form is used for reporting exemptions on property transfers, which shares key details about property assessment and ownership, aligning with the information captured in RP-5217.

Form RP-5216: Used for property transfers involving estate sales, this form requires similar seller and buyer information, as well as property assessment details, mirroring components of the RP-5217.

Form NYS-IT-2663: This form covers withholding on New York State real estate sales by nonresidents. It gathers essential buyer and seller data, echoing the structure found in the RP-5217.

Form TP-584: The Real Estate Transfer Tax form shares similarities in capturing essential property transaction information, including the parties involved and property details, like the RP-5217.

Form RP-5217-A: Primarily used for reports on multiple parcel transfers, this form captures buyer and seller details in a manner comparable to the RP-5217.

Form U.S. Treasury Form 8300: This document is used to report cash transactions exceeding $10,000 in real estate sales. Like the RP-5217, it includes identifying information about the parties involved.

Form HUD-1: The Settlement Statement contains detailed information about the sale of real estate, including buyer and seller data and property specifics, resonating with the RP-5217 form.

Form ALTA Settlement Statement: This statement is used during real estate transactions to summarize the closing details. Its information requirements closely mirror those of the RP-5217.

Dos and Don'ts

When filling out the RP 5217 form, attention to detail is crucial. Here are essential dos and don'ts to keep in mind:

- Do ensure all required fields are completed accurately, including names and property details.

- Do use clear and legible handwriting or type to avoid any misinterpretations.

- Do indicate where future tax bills should be sent, particularly if it differs from the buyer's address.

- Do verify the total assessed value and property class reflect the latest assessment roll.

- Don't leave any necessary fields blank; incomplete forms can lead to delays.

- Don't forget to round the full sale price to the nearest whole dollar amount.

- Don't provide false information on the form; this can have legal ramifications.

- Don't neglect to sign and date the form where indicated, as missing signatures can render the document invalid.

Misconceptions

Misconceptions about the RP-5217 form can lead to confusion during property transactions. It's important to clarify these common misunderstandings:

- The RP-5217 form is only for residential properties. This is false. The form applies to all types of real property transfers, including commercial and industrial properties.

- You don’t need to file the RP-5217 form if you are not a professional. In reality, anyone involved in a property transfer, whether a homeowner or a business, must complete this form.

- Submitting the RP-5217 form is optional. This is incorrect. Filing the form is mandatory for real estate transactions to ensure accurate records for tax assessments.

- Only the buyer needs to fill out the RP-5217 form. This misconception overlooks the fact that both the seller and buyer must provide information to complete the form accurately.

- The form must be filled out by an attorney only. While many prefer to have a lawyer assist them, individuals can complete the form themselves as long as they understand the requirements.

- The RP-5217 form is the same as a property deed. This is misleading. The form is a transfer report that supplements the deed but does not replace it.

- You can file the RP-5217 form any time after the sale. In fact, it must be submitted promptly after the transfer to ensure timely updates to property tax records.

- The information on the RP-5217 form is not shared publicly. This is inaccurate. Certain details from the form, like the sale price and property assessments, can be accessed by the public.

- Filing the RP-5217 form guarantees a tax break. This is not true. While the form aids in determining property taxes, it does not automatically grant any tax exemptions or reductions.

- The RP-5217 form is only needed during residential sales. This is incorrect, as the form is required for all real estate transactions, regardless of the type of property involved.

Understanding these clarifications can help ensure a smoother property transaction process. Always consider consulting a professional when navigating legal forms and property transfers.

Key takeaways

Here are nine key takeaways about filling out and using the RP-5217 form:

- Accuracy is Crucial: Ensure that all information entered is correct and true to avoid potential legal issues.

- Provide Complete Property Information: Include details such as the property location, parcel size, and existing assessments to facilitate processing.

- Multiple Buyers: If there are multiple buyers, list all names clearly to prevent confusion during the transaction.

- Tax Billing Addresses: Specify the tax billing address if it differs from the buyer's address to ensure proper delivery of tax bills.

- Indicate Property Use: Correctly categorize the property use by selecting the appropriate ownership type and descriptor boxes.

- Full Sale Price: Report the complete sale price accurately, including any personal property and adjustments, rounding to the nearest dollar.

- Certification Requirement: The form must be signed by both the buyer and seller, confirming that all information is truthful.

- Timing Matters: Fill out and submit the form promptly after the transfer to comply with local regulations.

- Seek Legal Guidance: Consulting an attorney may help navigate any complexities that arise during the filling out of this form.

Browse Other Templates

Louisiana Resale Certificate - The R 1042 is designed to reduce the financial burden during the purchasing phase for businesses focused on resale.

File a Claim With Allianz - Payment options include cash and cheque, with specific details needed for cheque payments.