Fill Out Your Rt 6 Form

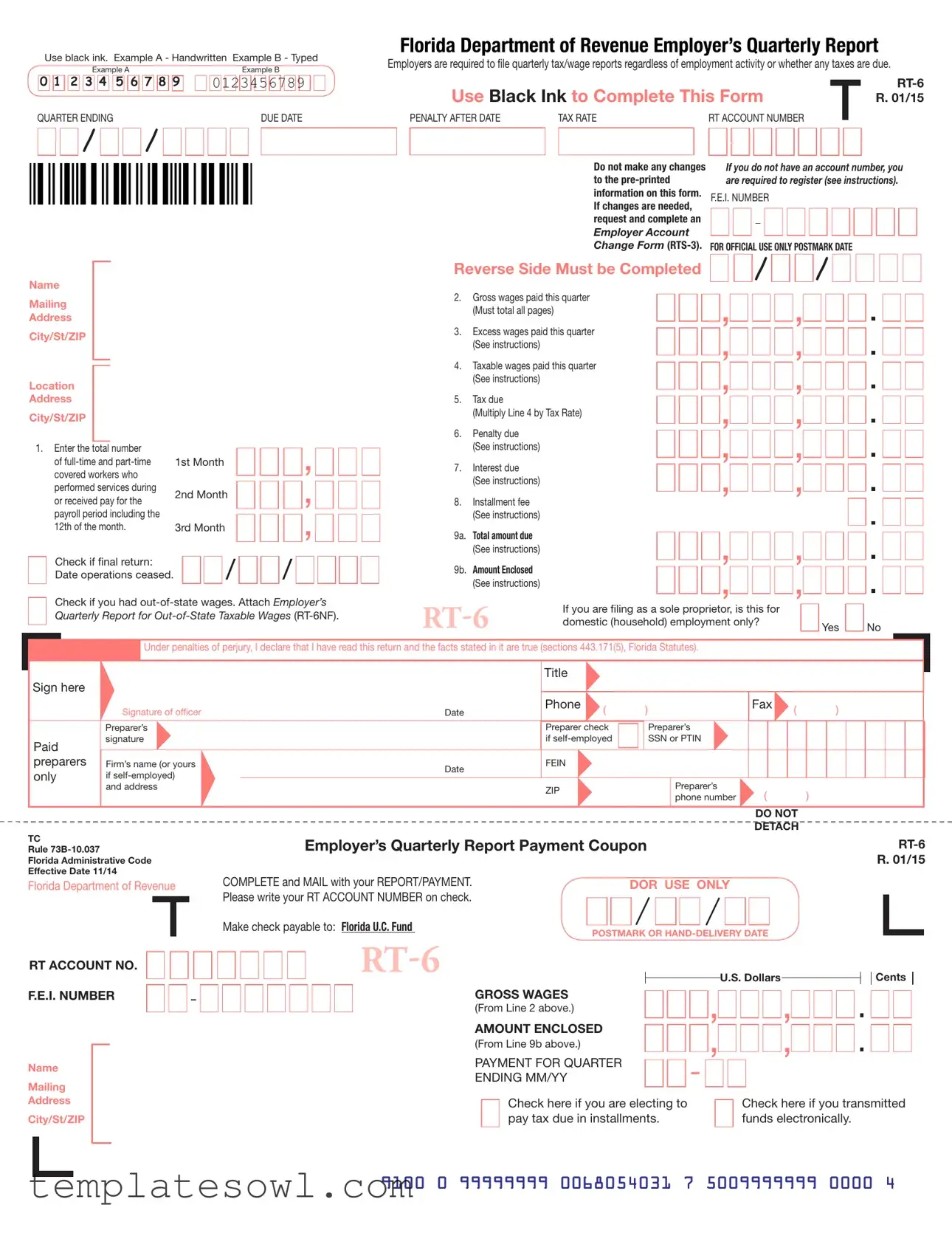

The RT-6 form, officially known as the Employer’s Quarterly Report, is a crucial document for employers operating in Florida. Each business must complete this form quarterly, irrespective of whether there are any employees or taxes due during the reporting period. Completed using black ink only, the RT-6 requires employers to report essential information such as gross wages paid, taxable wages, and the total tax liability for the quarter. Multiple sections within the form address specific requirements, including penalties for late submission and guidance for reporting employees’ wages. Employers must provide accurate details on the number of workers, the amounts paid, and the deadlines associated with submitting this document. Notably, changes to pre-printed information on the form are not allowed; any necessary updates must be handled through an Employer Account Change Form. Furthermore, if an employer operates out of state or pays employees outside Florida, separate documentation must be attached. Completing this form ensures employers fulfill their obligations under state laws and helps to maintain compliance with tax regulations.

Rt 6 Example

Use black ink. Example A - Handwritten Example B - Typed

|

Example A |

Example B |

|

0 1 |

2 3 4 |

5 6 7 8 9 |

0123456789 |

QUARTER ENDING |

DUE DATE |

/

/

/

Florida Department of Revenue Employer’s Quarterly Report

Employers are required to ile quarterly tax/wage reports regardless of employment activity or whether any taxes are due.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Use Black Ink to Complete This Form |

|

|

|||||||||||||||||

|

|

R. 01/15 |

|||||||||||||||||

PENALTY AFTER DATE |

|

TAX RATE |

RT ACCOUNT NUMBER |

|

|

|

|||||||||||||

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Do not make any changes If you do not have an account number, you

to the

information on this form. F.E.I. NUMBER If changes are needed,

request and complete an

Employer Account

Change Form

Name |

Mailing |

Address |

City/St/ZIP |

Location |

Address |

City/St/ZIP |

Reverse Side Must be Completed |

|

|

|

/ |

2.Gross wages paid this quarter (Must total all pages)

3.Excess wages paid this quarter (See instructions)

4.Taxable wages paid this quarter (See instructions)

5.Tax due

(Multiply Line 4 by Tax Rate)

/

1. Enter the total number |

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

of |

1st Month |

|

|

|

|

|

|

|

|

|

|||||

|

covered workers who |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

performed services during |

2nd Month |

|

|

|

|

|

|

|

, |

|

|

||||

|

|

|

|

|

|

|

|

|

|

|||||||

|

or received pay for the |

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

payroll period including the |

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

12th of the month. |

3rd Month |

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Check if inal return: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date operations ceased. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Check if you had

6.Penalty due (See instructions)

7.Interest due (See instructions)

8.Installment fee (See instructions)

9a. Total amount due (See instructions)

9b. Amount Enclosed

(See instructions)

If you are iling as a sole proprietor, is this for domestic (household) employment only?

Yes

Yes  No

No

Under penalties of perjury, I declare that I have read this return and the facts stated in it are true (sections 443.171(5), Florida Statutes). |

|

|

|

||||

|

|

Title |

|

|

|

|

|

Sign here |

|

|

|

|

|

|

|

Signature of oficer |

Date |

Phone |

( |

) |

Fax |

( |

) |

|

|

||||||

|

Preparer’s |

|

Preparer check |

|

Preparer’s |

|

|

|

Paid |

signature |

|

if |

|

SSN or PTIN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

preparers |

Firm’s name (or yours |

Date |

FEIN |

|

|

|

|

|

only |

if |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

and address |

|

ZIP |

|

|

Preparer’s |

( |

) |

|

|

|

|

|

phone number |

|||

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

DO NOT

DETACH

TC

Rule

Florida Administrative Code

Effective Date 11/14

Florida Department of Revenue

Employer’s Quarterly Report Payment Coupon |

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

R. 01/15 |

||

COMPLETE and MAIL with your REPORT/PAYMENT. |

|

|

DOR USE ONLY |

|

|

|

||||||||

Please write your RT ACCOUNT NUMBER on check. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Make check payable to: Florida U.C. Fund |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

POSTMARK OR |

|

|

|

|||||||||||

|

|

|

||||||||||||

|

|

|

|

|||||||||||

RT ACCOUNT NO.

F.E.I. NUMBER

GROSS WAGES

(From Line 2 above.)

U.S. Dollars

Cents

Name

Mailing Address

City/St/ZIP

AMOUNT ENCLOSED |

|

(From Line 9b above.) |

|

PAYMENT FOR QUARTER |

- |

ENDING MM/YY |

Check here if you are electing to pay tax due in installments.

Check here if you transmitted funds electronically.

9100 0 99999999 0068054031 7 5009999999 0000 4

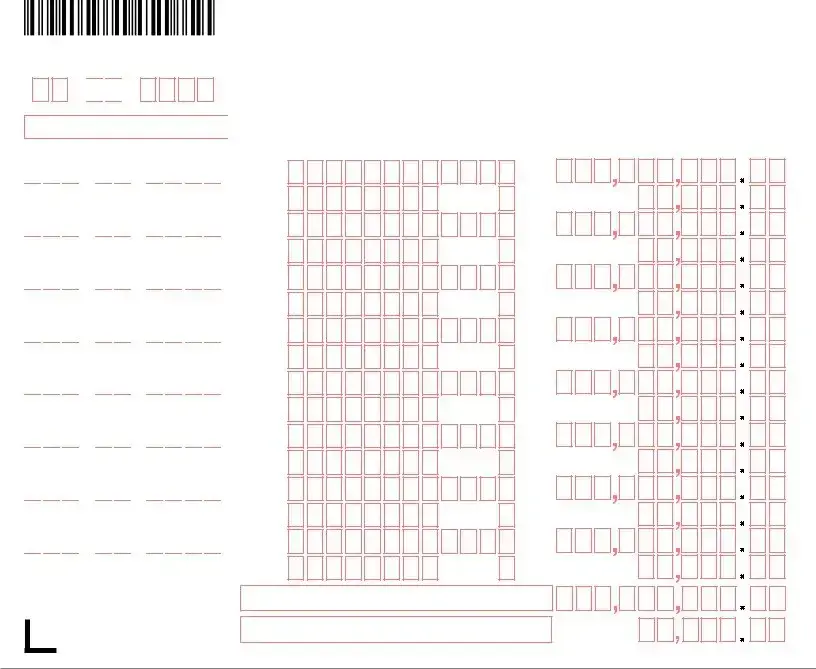

QUARTER ENDING

/

/

/

10. EMPLOYEE’S SOCIAL SECURITY NUMBER

|

|

|

|

|

Florida Department of Revenue Employer’s Quarterly Report |

|

|

|

||||||||||||||||

|

|

|

|

|

Employers are required to ile quarterly tax/wage reports regardless of employment activity or whether any taxes are due. |

|

|

R. 01/15 |

||||||||||||||||

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

Use Black Ink to Complete This Form |

|

|

|

|

|||||||||||||||

EMPLOYER’S NAME |

|

|

|

RT ACCOUNT NUMBER |

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

11. EMPLOYEE’S NAME (please print irst twelve characters of last name and irst |

|

12a. EMPLOYEE’S GROSS WAGES PAID THIS QUARTER |

|

|||||||||||||||||

|

|

|

|

eight characters of irst name in boxes) |

|

12b. EMPLOYEE’S TAXABLE WAGES PAID THIS QUARTER |

|

|||||||||||||||||

|

|

|

|

|

|

|

Only the irst $7,000 paid to each employee per calendar year is taxable. |

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

Last

Name

First

Name

Last

Name

First

Name

Last

Name

First

Name

Last

Name

First

Name

Last

Name

First

Name

Last

Name

First

Name

Last

Name

First

Name

Last

Name

First

Name

Middle Initial

Middle Initial

Middle Initial

Middle Initial

Middle Initial

Middle Initial

Middle Initial

Middle Initial

12a.

12b.

12a.

12b.

12a.

12b.

12a.

12b.

12a.

12b.

12a.

12b.

12a.

12b.

12a.

12b.

13a. Total Gross Wages (add Lines 12a only). Total this page only. Include this and totals from additional pages in Line 2 on page 1.

13b. Total Taxable Wages (add Lines 12b only). Total this page only. Include this and totals from additional pages in Line 4 on page 1.

DO NOT

DETACH

Mail Reply To:

Reemployment Tax

Florida Department of Revenue

5050 W Tennessee St Bldg L

Tallahassee FL

Social security numbers (SSNs) are used by the Florida Department of Revenue as unique identiiers for the administration of Florida’s taxes. SSNs obtained for tax administration purposes are conidential under sections 213.053 and 119.071, Florida Statutes, and not subject to disclosure as public records. Collection of your SSN is authorized under state and federal law. Visit our website at www.mylorida.com/dor and select “Privacy Notice” for more information regarding the state and federal law governing the collection, use, or release of SSNs, including authorized exceptions.

Please save your instructions!

Quarterly Report instructions

www.mylorida.com/dor

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | The RT-6 form is used by employers in Florida to report quarterly tax and wage information to the Department of Revenue. |

| Filing Frequency | Employers are required to file this form quarterly, regardless of whether they have employees or owe taxes. |

| Black Ink Requirement | All entries on the RT-6 form must be completed using black ink. |

| Taxable Wages Limit | Only the first $7,000 paid to each employee per calendar year is considered taxable. |

| Governing Laws | This form is governed by Florida Statutes, specifically section 443.171(5). |

| Electronic Payments | Employers can opt to transmit funds electronically for payment of taxes due. |

| Confidential Information | Social Security numbers used on the form are confidential under Florida Statutes sections 213.053 and 119.071. |

Guidelines on Utilizing Rt 6

Once you've gathered your information, it’s time to fill out the RT-6 form. This form must be completed accurately, as it reports quarterly tax and wage details to the Florida Department of Revenue. Follow each step carefully to ensure all required information is provided.

- Begin by using black ink to fill in the form.

- In the section marked "Quarter Ending," input the relevant quarter date.

- Enter the due date of the report next to the designated area.

- Fill in your RT Account Number; do not adjust pre-printed information.

- If applicable, provide your F.E.I. Number in the specified box.

- Indicate the number of full-time and part-time workers in the appropriate fields for the 1st, 2nd, and 3rd months.

- Record the gross wages paid this quarter, ensuring to total all pages.

- Input excess wages paid and taxable wages, referring to the instructions for guidance.

- Calculate the tax due by multiplying the taxable wages by the applicable tax rate.

- If there are any penalties or interest due, detail them in the respective areas.

- Total the amounts due in the section for "Total Amount Due" and specify the amount you are enclosing.

- Complete the section about your operations: check if this is a final return and if out-of-state wages were paid.

- Sign the form, ensuring it includes your title, date, and contact information.

- If self-employed, provide your signature and SSN or PTIN. Indicate your firm's name and address only if you are self-employed.

- Mail the completed report to the address specified on the form.

What You Should Know About This Form

What is the RT-6 form?

The RT-6 form, also known as the Employer's Quarterly Report, is a document required by the Florida Department of Revenue for employers. It is submitted every quarter, regardless of whether the employer had any employees or owed taxes. The form collects information about wages paid to employees and helps the state keep track of unemployment taxes. Completing the form accurately is essential to ensure compliance with state requirements.

Who needs to file the RT-6 form?

Any employer in Florida is required to file an RT-6 form if they pay wages to employees. This includes businesses of all sizes, as well as sole proprietors. It is crucial to file the form even if there are no employees or wages to report. Failure to do so may result in penalties. If you do not have an RT account number, you must first register with the Florida Department of Revenue before filing this report.

How do I complete the RT-6 form correctly?

Completing the RT-6 form requires careful attention. First, use black ink, either by hand or typed. Fill in the quarter ending date and the due date at the top of the form. Then, report the total number of employees and their wages in the specified sections. Be sure to add the figures from all pages if your report exceeds one page. Look for instruction notes in the form, as they explain how to calculate taxable wages and any penalties that might apply. Lastly, sign and date the form before submission to ensure it is valid.

What happens if I miss the deadline for filing the RT-6 form?

If the RT-6 form is not filed by the due date, penalties and interest may apply. Each month the form is late, additional fees may accumulate. Therefore, it's important to be proactive and submit the report on time to avoid unnecessary financial losses. Keeping track of your quarterly deadlines can help you stay compliant and avoid these pitfalls.

How can I submit the RT-6 form?

The completed RT-6 form can be submitted by mail or, for some employers, electronically via the Florida Department of Revenue's online portal. If mailing, ensure that it reaches the designated address—Reemployment Tax, Florida Department of Revenue, 5050 W Tennessee St Bldg L, Tallahassee, FL 32399-0180—before the postmark deadline. If you choose to file electronically, follow the instructions provided on the Florida Department of Revenue's website for electronic submissions.

Common mistakes

Completing the RT-6 form requires attention to detail, and many people make common mistakes that can lead to delays or penalties. Here are seven mistakes to avoid when filling out this important document.

First, using the wrong ink color can cause problems. Always use black ink when completing the RT-6 form. If you submit the form in any other color, it may not be processed properly. This requirement aims to ensure that your information is clearly visible and easy to read.

Another frequent error is altering the pre-printed information on the form. Do not make any changes to the information already printed on the RT-6. If you believe this information needs updating, you must fill out an Employer Account Change Form (RTS-3). Failure to follow this guideline can lead to incorrect filings and potential penalties.

Many individuals also forget to include all relevant wages. On Line 2, you'll need to total all gross wages paid during the quarter. Skipping this step or miscalculating the amount can cause issues. Always double-check your figures to ensure everything adds up correctly.

A common oversight centers around employee wage reporting. Some people fail to accurately report the taxable wages for each employee. Remember that only the first $7,000 paid to each employee per calendar year is taxable. It’s crucial to distinguish between gross wages and taxable wages on Lines 12a and 12b to avoid discrepancies.

Not including the correct tax calculations is another mistake that can lead to financial trouble. After determining your taxable wages, multiply them by the applicable tax rate to find out how much tax is due. Double-check your calculations to confirm that all amounts are accurate.

Submitting the form without checking for all required signatures can delay processing. Ensure that the individual responsible for filing the report has added their signature, along with a printed title and date. Missing a signature can result in the form being rejected or returned.

Lastly, do not forget to include your payment when sending in the form. If the total amount due is not enclosed with your report, it could lead to further delays and potential penalties. Always ensure you check off the appropriate boxes and write the RT account number on your check to facilitate processing.

Avoiding these mistakes can help you ensure that your RT-6 form is completed properly and submitted on time. Paying close attention to detail can save you from unnecessary headaches later on.

Documents used along the form

The RT-6 form is a key document for Florida employers, used for submitting quarterly tax and wage reports. However, there are several other forms and documents that play important roles in the process of tax compliance and employee reporting. Understanding these forms will help you navigate your responsibilities more effectively.

- RTS-3: Employer Account Change Form - Use this form to request changes to your employer account information, such as updates to business name, address, or ownership structure. Accurate information is crucial for compliance.

- RT-6NF: Employer’s Quarterly Report for Out-of-State Taxable Wages - This form is necessary if you have employees working out of state. It ensures you report the appropriate taxable wages, keeping your records complete.

- Form W-2 - Issued to employees, this form reports annual wages and the taxes withheld. Employers must provide this form to employees by January 31 each year, helping them fulfill their own tax duties.

- Form 941 - This IRS form is filed quarterly and reports income taxes, Social Security tax, or Medicare tax withheld from employee paychecks. It provides a federal perspective on employment taxes.

- Form 1099 - This document is used to report various types of income other than wages, salaries, and tips. Contractors receiving at least $600 in a year must receive this form by January 31.

- Unemployment Tax Returns - Employers may need to file specific unemployment tax returns depending on state regulations. This ensures contributions to state unemployment funds are properly reported.

- Form 1040 - While it’s primarily an individual income tax return form, employers may reference it for overall compliance, especially in relation to self-employment and contractor payments.

Being familiar with these forms and understanding their purposes can greatly ease the burden of compliance. Keeping accurate records and meeting reporting deadlines not only ensures you abide by the law but also fosters a trustworthy relationship with your employees and the government.

Similar forms

The Rt 6 form is part of reporting requirements for employers in Florida. Several other documents serve similar purposes in the realm of reporting tax and wage information. Each document has its specific focus and details, which are outlined below:

- Form 941: This is the Employer's QUARTERLY Federal Tax Return. Employers use it to report income taxes, Social Security tax, and Medicare tax withheld from employees' paychecks. Like the Rt 6, it is filed quarterly and includes information on wages and taxes due.

- Form 940: The Employer's Annual Federal Unemployment (FUTA) Tax Return is completed annually by employers to report their unemployment taxes. It complements the Rt 6, which also includes information pertinent to employee wages and payments, although it focuses on state unemployment taxes.

- Form W-2: This is the Wage and Tax Statement that employers must provide to employees at year-end. While it details annual earnings and tax withholdings, like the Rt 6, it ensures compliance with state and federal tax reporting requirements.

- Form W-3: This is the Transmittal of Wage and Tax Statements, filed alongside Form W-2. It provides a summary of all W-2 forms submitted by an employer, similar to how the Rt 6 summarizes quarterly employer tax information.

- Form RTS-3: This form is used for the Employer Account Change. If there are changes to the account information, employers must complete it, like the Rt 6, which has specific procedures for corrections.

- RT-6NF: This form is specifically for employers with out-of-state wages. It is an attachment to the Rt 6, designed to report additional taxable wages, ensuring accurate state compliance.

Dos and Don'ts

When filling out the RT-6 form, there are certain practices to follow and some to avoid to ensure accuracy and compliance. Below is a list of things you should and should not do.

- Use black ink for all entries on the form.

- Complete all required fields fully to prevent delays in processing.

- Double-check calculations to ensure accuracy in tax reporting.

- Include a signature to validate the document, as required.

- Attach any necessary documentation if applicable, such as additional reports.

- Do not make changes to pre-printed information on the form.

- Do not omit required information which may result in penalties.

- Do not forget to mail the form by the due date.

- Do not file without reviewing the instructions for accuracy.

- Do not fail to register if you do not have an account number.

Misconceptions

The RT-6 form is essential for employers in Florida, but several misconceptions exist about it. Here are some common misunderstandings:

- Employers only need to file if they owe taxes. In reality, employers must file quarterly tax reports regardless of whether they owe taxes or have employees.

- Black ink is optional for submission. Using black ink is a requirement when completing the form. This ensures that all information is clearly readable.

- Employers can make changes directly on the pre-printed information. This is incorrect. Employers should not alter any pre-printed information; changes must be requested through the Employer Account Change Form (RTS-3).

- Only full-time employees’ wages need to be reported. Both full-time and part-time employees’ wages must be reported, including those who received pay for the payroll period.

- If there are no employees, no form is required. Even if there are no employees, employers are still obligated to submit a report indicating no activity.

- The due date is flexible, depending on the employer’s preference. The due date for submitting the RT-6 form is specific and should be adhered to avoid penalties.

- Social Security numbers are publicly available. This is a misconception; SSNs provided on the RT-6 are confidential and protected by law, ensuring they are not disclosed as public records.

Understanding these points can help ensure compliance and avoid any unnecessary penalties or complications. Always refer to updated guidelines for further clarification.

Key takeaways

When filling out and using the RT-6 form for Florida's Employer’s Quarterly Report, it’s crucial to pay attention to several key points. Here are the main takeaways to help ensure accuracy and compliance.

- Use black ink when completing the form. This helps maintain readability and ensures your entries are legible.

- Report all employment activity, even if no wages are paid. Employers must submit this report quarterly, irrespective of payroll activity.

- Do not alter any pre-printed information on the form. If you need to make changes, you must complete a separate Employer Account Change Form (RTS-3).

- The total wages paid on Line 2 must include all employees who performed services or received pay during the quarter.

- Be aware that only the first $7,000 paid to each employee is taxable. This is significant for calculating taxable wages accurately.

- If applicable, attach the Employer’s Quarterly Report for Out-of-State Taxable Wages (RT-6NF) if you had any out-of-state wages.

- Pay attention to the due dates to avoid penalties and interest. Filing late could result in additional fees.

- Keep a copy of the report for your records. Documentation is vital for tax compliance and future reference.

Filling out the RT-6 form with care ensures that employers fulfill their reporting obligations accurately and efficiently. This helps avoid complications and ensures that tax records are maintained properly.

Browse Other Templates

When Can I Loan in Sss - This form may be downloaded from the official SSS website for convenience.

Workplace Investigation Report - Report findings help refine safety protocols and procedures.

Signs of Neglect - Reporting parties are afforded legal immunity from liability if acting in good faith.