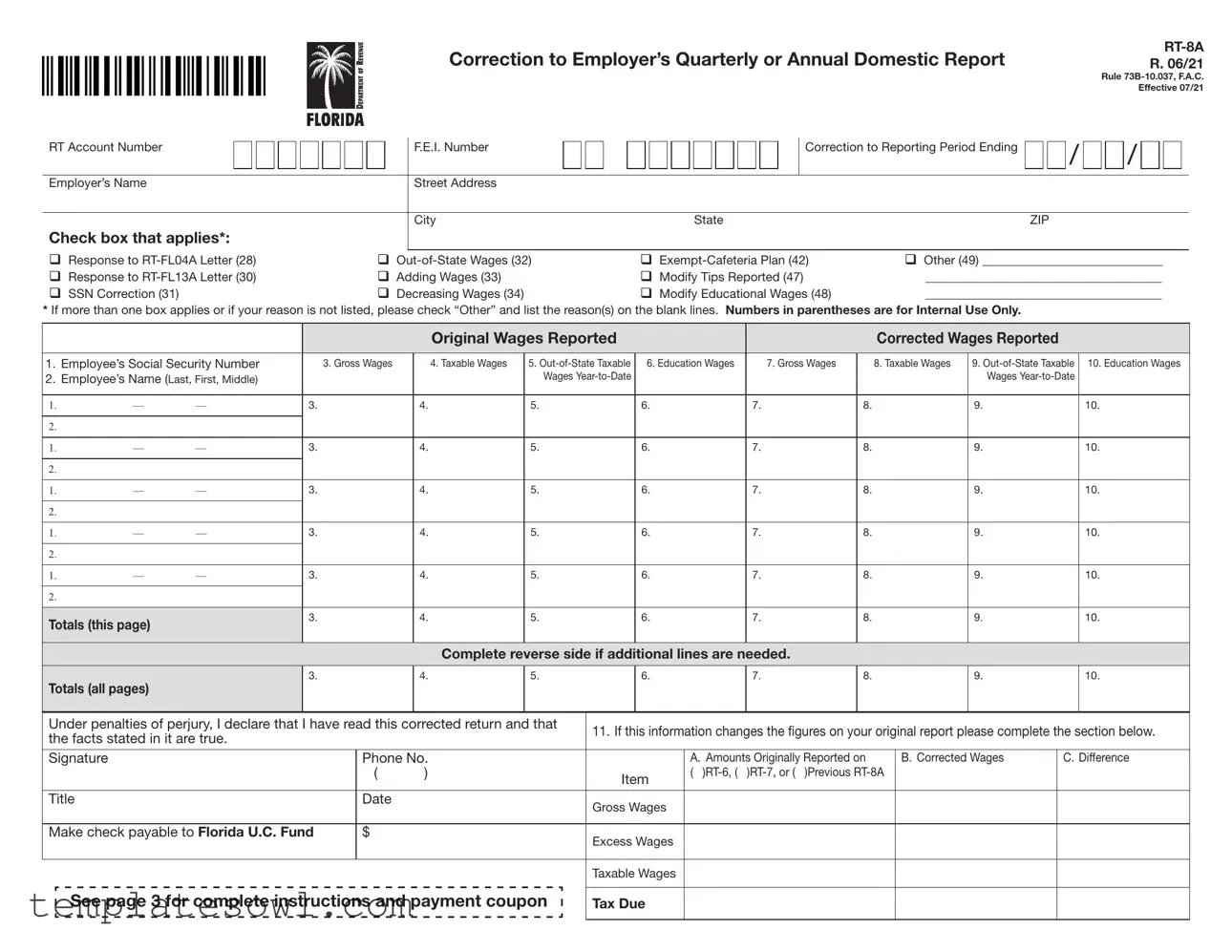

Fill Out Your Rt 8A Form

The RT-8A form serves an essential function for employers who need to correct any inaccuracies found in previously submitted employment reports. This form is specifically designed to amend details in the Employer’s Quarterly Report (RT-6), the Quarterly Report for Out-of-State Taxable Wages (RT-6NF), and the Annual Report for Employers of Domestic Employees Only (RT-7), among others. Employers are required to complete this form when there are discrepancies in reported wages, including changes to employee names or social security numbers, adjustments in gross or taxable wages, and modifications to out-of-state or educational wages. The form facilitates categorizing the reason for the corrections by providing checkboxes, while also allowing for detailed entry of the original and corrected wage amounts. Understanding how to accurately fill out the RT-8A, including reporting totals, is crucial for compliance with state regulations. It also ensures that any overpayments or underpayments of taxes can be properly addressed. By adhering to the instructions on this form, employers can maintain the integrity of their reporting and ensure that their tax obligations are met in a timely manner.

Rt 8A Example

Correction to Employer’s Quarterly or Annual Domestic Report

R. 06/21

Rule

RT Account Number |

F.E.I. Number |

|

Correction to Reporting Period Ending |

Employer’s Name |

Street Address |

|

|

|

City |

State |

ZIP |

Check box that applies*: |

|

|

|

q Response to |

q |

q |

q Other (49) _____________________________ |

q Response to |

q Adding Wages (33) |

q Modify Tips Reported (47) |

______________________________________ |

q SSN Correction (31) |

q Decreasing Wages (34) |

q Modify Educational Wages (48) |

______________________________________ |

*If more than one box applies or if your reason is not listed, please check “Other” and list the reason(s) on the blank lines. Numbers in parentheses are for Internal Use Only.

|

|

|

|

Original Wages Reported |

|

|

Corrected Wages Reported |

|

||

|

|

|

|

|

|

|

|

|

||

1. Employee’s Social Security Number |

3. Gross Wages |

4. Taxable Wages |

5. |

6. Education Wages |

7. Gross Wages |

8. Taxable Wages |

9. |

10. Education Wages |

||

2. Employee’s Name (Last, First, Middle) |

|

|

Wages |

|

|

|

Wages |

|

||

|

|

|

|

|

|

|

|

|

|

|

1. |

— |

— |

3. |

4. |

5. |

6. |

7. |

8. |

9. |

10. |

|

|

|

|

|

|

|

|

|

|

|

2. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. |

— |

— |

3. |

4. |

5. |

6. |

7. |

8. |

9. |

10. |

|

|

|

|

|

|

|

|

|

|

|

2. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. |

— |

— |

3. |

4. |

5. |

6. |

7. |

8. |

9. |

10. |

|

|

|

|

|

|

|

|

|

|

|

2. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. |

— |

— |

3. |

4. |

5. |

6. |

7. |

8. |

9. |

10. |

|

|

|

|

|

|

|

|

|

|

|

2. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. |

— |

— |

3. |

4. |

5. |

6. |

7. |

8. |

9. |

10. |

|

|

|

|

|

|

|

|

|

|

|

2. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Totals (this page) |

|

3. |

4. |

5. |

6. |

7. |

8. |

9. |

10. |

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

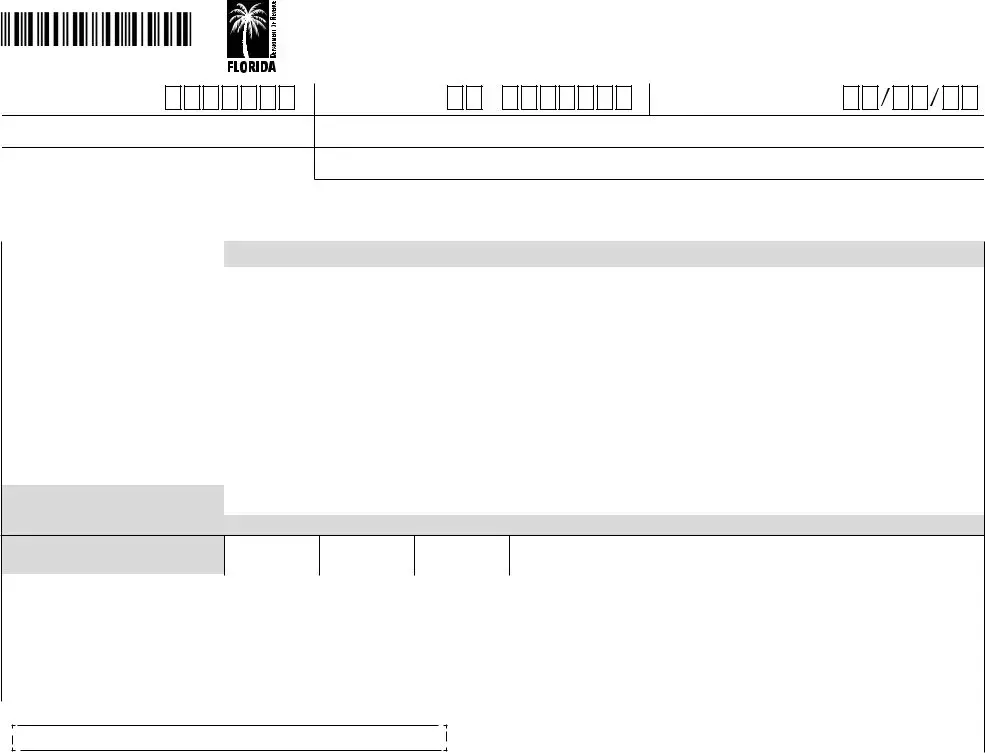

Complete reverse side if additional lines are needed.

Totals (all pages)

3.

4.

5.

6. |

7. |

8. |

9. |

10. |

|

|

|

|

|

Under penalties of perjury, I declare that I have read this corrected return and that |

11. If this information changes the figures on your original report please complete the section below. |

|||||

the facts stated in it are true. |

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Signature |

Phone No. |

|

A. Amounts Originally Reported on |

B. Corrected Wages |

C. Difference |

|

|

( |

) |

Item |

( |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title |

Date |

|

Gross Wages |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Make check payable to Florida U.C. Fund |

$ |

|

Excess Wages |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Taxable Wages |

|

|

|

See page 3 for complete instructions and payment coupon |

|

|

|

|

||

Tax Due |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

R. 06/21 |

|

|

|

|

|

|

|

|

|

|

Page 2 |

|

|

|

|

|

|

|

|

|

||

|

|

|

|

Original Wages Reported |

|

|

Corrected Wages Reported |

|

||

|

|

|

|

|

|

|

|

|

||

1. Employee’s Social Security Number |

3. Gross Wages |

4. Taxable Wages |

5. |

6. Education Wages |

7. Gross Wages |

8. Taxable Wages |

9. |

10. Education Wages |

||

2. Employee’s Name (Last, First, Middle) |

|

|

Wages |

|

|

|

Wages |

|

||

|

|

|

|

|

|

|

|

|

|

|

1. |

— |

— |

3. |

4. |

5. |

6. |

7. |

8. |

9. |

10. |

|

|

|

|

|

|

|

|

|

|

|

2. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. |

— |

— |

3. |

4. |

5. |

6. |

7. |

8. |

9. |

10. |

|

|

|

|

|

|

|

|

|

|

|

2. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. |

— |

— |

3. |

4. |

5. |

6. |

7. |

8. |

9. |

10. |

|

|

|

|

|

|

|

|

|

|

|

2. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. |

— |

— |

3. |

4. |

5. |

6. |

7. |

8. |

9. |

10. |

|

|

|

|

|

|

|

|

|

|

|

2. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. |

— |

— |

3. |

4. |

5. |

6. |

7. |

8. |

9. |

10. |

|

|

|

|

|

|

|

|

|

|

|

2. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. |

— |

— |

3. |

4. |

5. |

6. |

7. |

8. |

9. |

10. |

|

|

|

|

|

|

|

|

|

|

|

2. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. |

— |

— |

3. |

4. |

5. |

6. |

7. |

8. |

9. |

10. |

|

|

|

|

|

|

|

|

|

|

|

2. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. |

— |

— |

3. |

4. |

5. |

6. |

7. |

8. |

9. |

10. |

|

|

|

|

|

|

|

|

|

|

|

2. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. |

— |

— |

3. |

4. |

5. |

6. |

7. |

8. |

9. |

10. |

|

|

|

|

|

|

|

|

|

|

|

2. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. |

— |

— |

3. |

4. |

5. |

6. |

7. |

8. |

9. |

10. |

|

|

|

|

|

|

|

|

|

|

|

2. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. |

— |

— |

3. |

4. |

5. |

6. |

7. |

8. |

9. |

10. |

|

|

|

|

|

|

|

|

|

|

|

2. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. |

— |

— |

3. |

4. |

5. |

6. |

7. |

8. |

9. |

10. |

|

|

|

|

|

|

|

|

|

|

|

2. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Totals (this page) |

|

3. |

4. |

5. |

6. |

7. |

8. |

9. |

10. |

|

Totals from this page should be included in

Totals (all pages) on page 1.

Social security numbers (SSNs) are used by the Florida Department of Revenue as unique identifiers for the administration of Florida’s taxes. SSNs obtained for tax administration purposes are confidential under sections 213.053 and 119.071, Florida Statutes, and not subject to disclosure as public records. Collection of your SSN is authorized under state and federal law. Visit our Internet site at floridarevenue.com/privacy for more information regarding the state and federal law governing the collection, use, or release of SSNs, including authorized exceptions.

Correction to Employer’s Quarterly or Annual Domestic Report Instructions

R.06/21 Page 3

This form

•Employer’s Quarterly Report

•Quarterly Report for

•Annual Report for Employers of Domestic Employees Only

•Employer’s Quarterly Report for Employees Contracted to Governmental or Nonprofit Educational Institutions(Form

Annual filers will need to complete one

Corrections to an Employer’s Quarterly Report may be made online by using the Department’s File and Pay webpage. If you are required to file and pay reemployment tax electronically, you are also required to correct your prior returns electronically and should not submit this form.

Please complete the information at the top of page 1 and check the box that states your reason(s) for making the correction. If more than one box applies or if your reason is not listed, please check “Other” and list the reason(s) on the blank lines.

Items 1 and 2 – Enter the social security number (SSN) and name as reported on the original report,

Correcting employee SSN or name – If you are correcting the employee SSN or name:

•include the exact information from the original report,

•indicate on the next line that this is a “SSN change” or “name change”, and

•list the corrected information on the line below.

Item 3 – Enter the employee Gross Wages as reported on the original

Item 4 – Enter the employee Taxable Wages as reported on the original

Item 5 – Enter the employee

Item 6 – Enter the employee Education Wages as entered on the original

Item 7 – Enter the employee corrected Gross Wages as it should be on the

Item 8 – Enter the employee corrected Taxable Wages as it should be on the

Item 9 – Enter the employee corrected

Item 10 – Enter the employee corrected Education Wages as it should be on the

Item 11 –

Column A - Amounts Originally Reported on

Column B - Corrected Amounts for

gross wages, excess wages, taxable wages, and tax due as it should be recorded for the reporting quarter being corrected.

Column C - Difference, is the net change to the total gross wages, excess wages, taxable wages, and tax due between the corrected amount (Column B) and what was originally reported (Column A). The column will also indicate either the amount of the credit or the amount of additional tax due.

Payment Coupon Completion Instructions –

Complete the payment coupon even if you do not owe any additional tax.

Write the

Enter the federal employer identification number in the “F.E.I. Number” box. Enter the employer’s legal entity name and mailing address in the space provided.

Enter the additional tax due in the “Amount Enclosed” field. If the individual wage corrections result in a credit, any applicable refund will be sent to you.

Enter the

Month |

|

|

Year |

|

|

March 31 |

= |

03 |

2018 |

= |

18 |

June 30 |

= |

06 |

2017 |

= |

17 |

September 30 |

= |

09 |

2016 |

= |

16 |

December 31 |

= |

12 |

2015 |

= |

15 |

|

|

|

|

|

|

Make check payable to Florida U.C. Fund.

Mail the original completed form and coupon along with any remittance due to:

Florida Department of Revenue 5050 W Tennessee Street Tallahassee FL

Need Assistance? To speak with a Department of Revenue representative, call Taxpayer Services, Monday through Friday, excluding holidays, at

IMPORTANT

Complete pages 1 and 2 for corrections to the Employer’s Quarterly or Annual Domestic Report. Return completed form and coupon, even if you don’t owe any additional tax, to the Department.

|

DO NOT |

|

DETACH |

Correction to Employer’s Quarterly or Annual Domestic Report |

|

Payment Coupon |

R. 06/21 |

Florida Department of Revenue COMPLETE and MAIL with your REPORT/PAYMENT. Please write ACCOUNT NUMBER on your check.

Be sure to SIGN YOUR CHECK.

Make check payable to: Florida U.C. Fund

DOR USE ONLY

POSTMARK OR HAND DELIVERY DATE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ACCOUNT NO. |

|

|

|

|

|

1234567 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

F.E.I. NUMBER |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

1 |

2 |

|

|

3 |

|

4 |

|

5 |

|

6 |

|

7 |

|

8 |

|

9 |

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name |

Mailing Address 1 |

|||||||||||||||||||||||||||||||

Mailing Address 2 |

||||||||||||||||||||||||||||||||

Address |

||||||||||||||||||||||||||||||||

City/St/ZIP |

Mailing Address 3 |

|||||||||||||||||||||||||||||||

|

Mailing Address 4 |

|||||||||||||||||||||||||||||||

|

Mailing Address 5 |

|||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

91002 |

|||||||||||||||||||||||||

|

|

|

|

|

|

|

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

US Dollars |

|

|

|

|

|

|

|

Cents |

|

|||||

AMOUNT ENCLOSED |

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PAYMENT FOR QUARTER |

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

Q |

Y |

Y |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

ENDING MM/YY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Check here if you transmitted |

|

||||||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

funds electronically. |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

0 99999999 0068054049 2 5009999999 0000 4

Form Characteristics

| Fact Name | Fact Description |

|---|---|

| Form Purpose | The RT-8A form is used to correct errors in previously submitted Employer’s Quarterly or Annual Domestic Reports. |

| Effective Date | The RT-8A form became effective in July 2021, as noted by the form’s revision date. |

| Governing Rules | The form is governed by Rule 73B-10.037 of the Florida Administrative Code. |

| Required Information | Employers must provide their RT Account Number and F.E.I. Number on the form for proper identification. |

| Corrections | Employers can correct wages, SSN, and names as part of their submission on this form. |

| Multiple Corrections | If multiple corrections apply, the form allows for checking more than one box under the reason for correction. |

| Year-to-Date Wages | Year-to-date wages need to be reported for all employees being corrected. |

| Submission Instructions | The completed RT-8A form must be mailed to the Florida Department of Revenue along with any payment due. |

| Confidentiality of SSN | Social Security Numbers collected on the RT-8A are confidential and are protected under Florida law. |

Guidelines on Utilizing Rt 8A

Successfully completing the RT-8A form is crucial for addressing any errors in your previously submitted reports. Follow these steps carefully to ensure your corrections are processed seamlessly.

- Begin by locating the RT Account Number and F.E.I. Number. Enter these at the top of the form.

- Specify the Correction to Reporting Period Ending and fill in your Employer’s Name, Street Address, City, State, and ZIP Code.

- Check the appropriate box that applies to your correction. If multiple reasons apply, select Other and provide details.

- In Item 1, enter the Employee’s Social Security Number as originally reported.

- In Item 2, input the Employee’s Name (Last, First, Middle) exactly as it appeared on the original report.

- For Items 3-6, list the Gross Wages, Taxable Wages, Out-of-State Taxable, and Education Wages as reported previously.

- Proceed to Items 7-10 to enter the corrected values for Gross Wages, Taxable Wages, Out-of-State Taxable, and Education Wages.

- In Item 11, complete Column A with amounts originally reported, Column B with corrected amounts, and Column C with the differences.

- Fill out the payment coupon at the bottom of the form, including your Account No. and F.E.I. Number.

- Make a payment if there is additional tax due, and write your check payable to Florida U.C. Fund.

- Once completed, mail the original form and payment coupon to the Florida Department of Revenue.

After submitting the RT-8A form, you may want to keep a copy for your records. If you have further questions or uncertainties about the process, contacting the Department of Revenue's Taxpayer Services can provide additional clarity and assistance.

What You Should Know About This Form

What is the RT-8A form used for?

The RT-8A form is utilized to correct errors made in previously submitted Employer’s Quarterly or Annual Domestic Reports. These reports include the Employer’s Quarterly Report (RT-6), Quarterly Report for Out-of-State Taxable Wages (RT-6NF), Annual Report for Employers of Domestic Employees Only (RT-7), and the Employer’s Quarterly Report for Employees Contracted to Governmental or Nonprofit Educational Institutions (Form RT-6EW). It allows employers to rectify discrepancies and ensure accurate reporting of wages and taxes.

Who should file the RT-8A form?

Any employer who has identified errors in their prior submissions related to employee wages, taxes, or other reporting details should file the RT-8A form. It is critical for maintaining compliance with Florida tax regulations and prevents potential penalties associated with incorrect reporting.

When should the RT-8A form be submitted?

The RT-8A form should be submitted as soon as an error is discovered. Timely corrections help to mitigate the risks of penalties and interest that may accrue due to incorrect reporting. If you are required to file and pay reemployment tax electronically, you must correct your prior returns electronically and refrain from using this form.

What information is needed to complete the RT-8A form?

To complete the RT-8A form, you will need the employee's Social Security Number (SSN), their name, and the specific details regarding the wages that were originally reported and the corrected figures. Additionally, you must indicate the reason for the correction by checking the relevant boxes at the top of the form.

Can multiple corrections be included in one RT-8A form?

Yes, if multiple corrections apply, you can check more than one box indicating the reasons for correction. If your specific situation is not listed, you may select "Other" and provide an explanation. It is recommended to retain clarity and organization for accurate processing.

What happens if I need to correct an SSN or name?

If you need to correct an employee’s SSN or name, ensure you include the original information from the previous report and specify that a "SSN change" or "name change" is occurring. Then, list the corrected information clearly on the lines provided. This helps to prevent any confusion in processing your amendments.

How do I determine the tax due after corrections?

The tax due can be calculated by comparing the originally reported amounts with the corrected amounts. The RT-8A form provides columns where you will enter the original amounts, corrected amounts, and the difference. This will allow you to see if additional tax is owed or if a credit is applicable due to errors in original reporting.

Where should I send the completed RT-8A form?

The completed RT-8A form, along with any applicable payment, should be mailed to the Florida Department of Revenue at 5050 W Tennessee Street, Tallahassee, FL 32399-0180. Ensure that all information is accurate and that you sign the payment if applicable, including your RT account number on the check.

What if I need assistance with the RT-8A form?

If you require assistance while completing the RT-8A form or have questions regarding the process, you can contact Taxpayer Services at the Florida Department of Revenue by calling 850-488-6800. They are available Monday through Friday, excluding holidays, to provide the support you need.

Common mistakes

Filling out the RT-8A form can be a straightforward process, but many people inadvertently make mistakes that could delay their corrections or even lead to penalties. Here are six common errors to watch out for when completing this important form.

One frequent mistake involves checking the wrong box at the beginning of the form. Individuals should carefully review the options available, such as "Response to RT-FL04A Letter" or "Adding Wages." If the appropriate box is not selected, the Department may misinterpret the purpose of the correction, resulting in further complications. Always ensure that the selected checkbox accurately reflects your situation.

Another common error relates to the accuracy of Social Security Numbers (SSNs). When correcting SSNs or employee names, it is essential to include the exact information as reported in the original filing. Oftentimes, people mistakenly enter a new SSN without indicating that a change has occurred. This can lead to confusion and rejection of the form. Always clearly identify any changes to SSNs or employee names.

A third mistake involves failing to complete all necessary sections of the form. Each area requiring information about gross wages, taxable wages, and out-of-state taxable wages should be filled out accurately. Omitting even one number could result in an incomplete application. Make it a habit to double-check that every required field is complete and correct.

Some may overlook the significance of the totals section. It’s crucial to ensure that the totals from all pages match the figures listed at the start of the form. If there is a discrepancy, it can raise red flags and lead to delays. Always verify that the figures are consistent before submitting.

Another common pitfall occurs with payment errors. When sending in a payment along with the RT-8A form, individuals sometimes forget to sign their checks or include the correct account number. This seemingly minor oversight can cause unnecessary delays in processing. Always ensure that your check is signed and the account number is written clearly on the payment.

Finally, many do not pay attention to deadlines. Submitting the RT-8A form promptly is essential for correcting any reported wages before penalties apply. Be aware of the specific time frames required by the Department of Revenue, and plan accordingly so your corrections are handled in a timely manner.

Documents used along the form

The following forms and documents are commonly used alongside the RT-8A form. These documents facilitate corrections and provide necessary details regarding employee wages and tax obligations. Understanding these forms will help ensure compliance and accurate reporting.

- Employer’s Quarterly Report (RT-6): This report details the wages paid to employees during the quarter and the corresponding taxes withheld. It serves as the primary report for employers to fulfill their reemployment tax obligations.

- Quarterly Report for Out-of-State Taxable Wages (RT-6NF): This form is specifically for reporting wages earned by employees who worked out of state. It ensures accurate recording and taxation of these wages.

- Annual Report for Employers of Domestic Employees Only (RT-7): Employers with domestic employees submit this report annually. It summarizes the total wages paid throughout the year and the associated tax liabilities.

- Employer’s Quarterly Report for Employees Contracted to Governmental or Nonprofit Educational Institutions (RT-6EW): This specialized report is required for employers working with federal, state, or local government agencies, as well as non-profit educational organizations. It collects necessary wage information related to specific contracts.

Using these forms correctly ensures that all corrections are made promptly and accurately. This helps support compliance with tax legislation while avoiding potential penalties or discrepancies in employee wage reporting.

Similar forms

The RT-8A form is primarily used for correcting errors in previously submitted employment reports. Several other documents serve similar functions. Here’s a look at eight documents that are akin to the RT-8A form and how they relate:

- Employer’s Quarterly Report (RT-6): This form is used to report employment and wage information on a quarterly basis. The RT-8A is utilized to make corrections to errors found in the RT-6 submissions.

- Quarterly Report for Out-of-State Taxable Wages (RT-6NF): Similar to the RT-6, this report focuses specifically on wages that are taxable for out-of-state employees. Corrections for inaccuracies in this report can be submitted via the RT-8A.

- Annual Report for Employers of Domestic Employees Only (RT-7): Used for providing annual wage and tax information for domestic employees, the RT-8A allows employers to correct any mistakes in this report.

- Employer’s Quarterly Report for Employees Contracted to Governmental or Nonprofit Educational Institutions (Form RT-6EW): This form addresses employment details for specific types of employees. Just like the RT-6, any errors in this report can be rectified using the RT-8A.

- Response to RT-FL04A Letter: This letter serves as a communication from the Florida Department of Revenue regarding issues with submitted reports. The RT-8A can be used to address the points raised in this letter.

- Response to RT-FL13A Letter: Similar to the RT-FL04A, this letter provides feedback on discrepancies found in reports. Corrections prompted by this letter can also be managed through the RT-8A.

- Adding Wages (Form RT-6): If wages need to be added to employee records, the RT-8A can be a vehicle for making those adjustments. It helps ensure that all wage reports accurately reflect employee earnings.

- Modify Tips Reported (Form RT-6): Where tips reported may have been incorrectly stated, the RT-8A is the proper form for making necessary modifications to ensure accurate wage reporting.

Each of these documents plays a vital role in maintaining accurate employment and wage records, ensuring compliance with reporting obligations. Utilizing the RT-8A helps to ensure that any corrections to previous submissions are made clearly and efficiently.

Dos and Don'ts

Dos and Don'ts for Filling Out the RT-8A Form

- Do: Ensure all information is accurate, including names and Social Security numbers.

- Do: Check the appropriate box that explains the reason for the correction.

- Do: Use the exact information as reported on the original submission for corrections.

- Do: Complete the payment coupon even if you do not owe additional tax.

- Do: Sign the form to confirm the accuracy of your information.

- Don't: Submit the form without checking for typographical errors.

- Don't: Leave any boxes blank; complete all necessary sections.

- Don't: Forget to include the amounts originally reported when making corrections.

- Don't: Detach any parts of the form; submit it as a whole.

- Don't: Use outdated information; ensure you are using the most recent version of the form.

Misconceptions

- Misconception: The RT-8A form is only for correcting errors made by employers.

- Misconception: All corrections can be made online, eliminating the need for the RT-8A form.

- Misconception: The RT-8A can only be submitted once a year.

- Misconception: The RT-8A can be filed with any type of tax correction.

- Misconception: Employers can ignore corrections if they believe the error is minor.

- Misconception: It's unnecessary to include a reason for the correction on the RT-8A.

- Misconception: Completing the RT-8A takes an excessive amount of time and effort.

- Misconception: The RT-8A must be sent in paper format and cannot be submitted electronically at all.

This is not entirely accurate. While employers frequently use the RT-8A to correct their own errors, it can also be used to report accurate information if changes originate from employee feedback. For instance, if an employee discovers a mistake in their reported wages, the employer can use this form to amend those records.

Although many corrections may be filed electronically, certain situations require the RT-8A form, particularly when dealing with specific corrections related to employee information. Employers need to be aware of the nuances in their reporting requirements.

This is incorrect. If multiple corrections are necessary, employers can submit the RT-8A for each corresponding quarter. This means that if mistakes occurred across different reporting periods, multiple forms could be necessary.

The RT-8A is specifically designed for corrections related to the employer’s quarterly or annual domestic reports. Other types of tax corrections may require different forms or procedures, so it’s essential to ensure the right form is used for specific corrections.

In fact, providing a reason helps clarify the nature of the correction. This can streamline the process for the tax authorities and ensure that the submitted corrections are processed accurately and efficiently.

This isn't necessarily true. Once you understand the required information and how to gather it, filling out the RT-8A can be relatively straightforward. Some employers may find that investing a little time in properly managing their reports can save them considerable effort down the line.

The RT-8A form can be printed and mailed, but many employers can also make corrections electronically through specific platforms offered by the Department of Revenue. Understanding the available options can make the process much more manageable.

Key takeaways

When filling out the RT-8A form for correcting errors in employer reports, keep these key points in mind:

- Understand the purpose of the RT-8A form. It is specifically designed to correct mistakes on previously submitted reports related to domestic employee wages.

- Ensure that you select the appropriate checkbox at the top of the form. Multiple reasons can be noted by checking "Other" and providing additional details.

- Accurately enter the employee's Social Security Number (SSN) and name exactly as they appeared in the original report. Indicate if you are making a correction for SSN or name changes.

- Report both the original and corrected amounts for wages in the designated sections. This includes gross wages, taxable wages, out-of-state taxable wages, and education wages.

- Double-check the totals after filling in the correction details. Accurate calculations are important to ensure compliance and avoid further discrepancies.

- When correcting multiple quarters, a separate RT-8A form is required for each quarter. Annual filers must complete one for each quarter that has errors.

- Submit the form along with any payment due, even if the adjustments result in no additional tax owed. This can help prevent issues with record-keeping.

- If you have questions or need assistance, don't hesitate to contact the Florida Department of Revenue's Taxpayer Services for guidance.

Browse Other Templates

Oro Step Application - By providing clear and precise information, you contribute to a well-documented registry that aids future educational initiatives.

Mv3617 Order for Ignition Interlock Exemptions - Defendants should keep a copy of the submitted form for personal records.

How Long Does It Take for an Llc to Be Approved in Ohio - Expedited services are available if you need faster processing of your filing.