Fill Out Your Rts 3 Form

The RTS-3 form is a crucial document for businesses in Florida that need to communicate changes regarding their reemployment tax accounts. This form captures significant updates such as changes in ownership, legal entity, and address updates. To ensure accurate handling, individuals must first identify their existing tax account by providing essential details like the account name, account number, and contact information. Additionally, the form allows users to specify the type of tax affected by the changes, primarily focusing on reemployment tax, while also offering the option to apply updates across various tax accounts including Corporate Income Tax and Sales and Use Tax. Those needing to update their address can select from different address types, ensuring that correspondence reaches the correct destination. Furthermore, the RTS-3 accommodates changes in account status, enabling businesses to inactivate, reactivate, or cancel their accounts as necessary. If there’s been a corporate name change, this information can also be recorded. For businesses that lease employees, sections dedicated to this aspect provide a straightforward way to report the leasing company’s details. Finally, certification of authority is required through a signature, ensuring that all reported changes are legitimate. The completed form must be submitted to the Florida Department of Revenue, which offers additional support and resources online.

Rts 3 Example

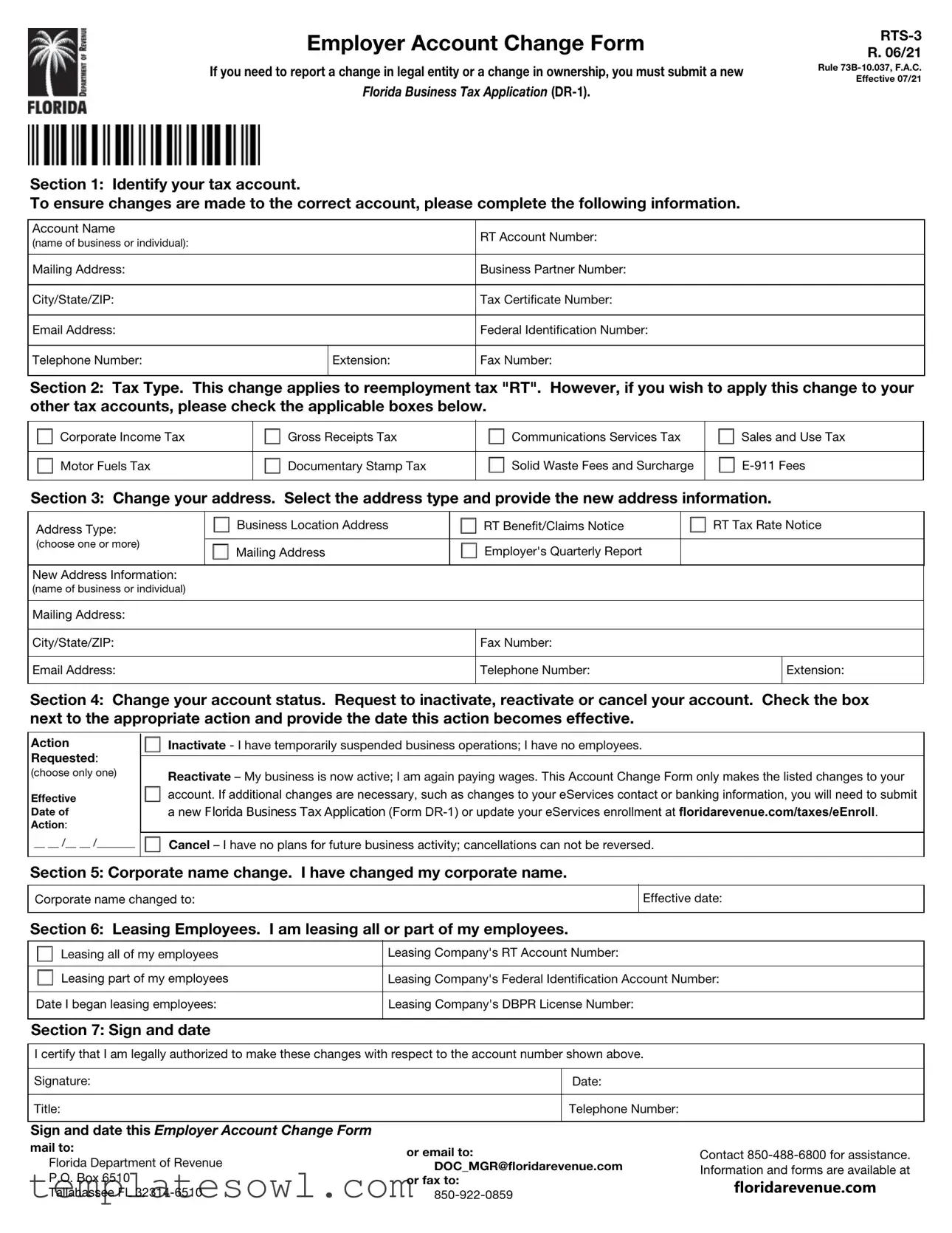

Employer Account Change Form

If you need to report a change in legal entity or a change in ownership, you must submit a new

Florida Business Tax Application

Section 1: Identify your tax account.

To ensure changes are made to the correct account, please complete the following information.

R. 06/21

Rule

Account Name |

|

RT Account Number: |

(name of business or individual): |

|

|

|

|

|

|

|

|

Mailing Address: |

|

Business Partner Number: |

|

|

|

City/State/ZIP: |

|

Tax Certificate Number: |

|

|

|

Email Address: |

|

Federal Identification Number: |

|

|

|

Telephone Number: |

Extension: |

Fax Number: |

|

|

|

Section 2: Tax Type. This change applies to reemployment tax "RT". However, if you wish to apply this change to your other tax accounts, please check the applicable boxes below.

|

|

Corporate Income Tax |

|

|

Gross Receipts Tax |

|

|

Communications Services Tax |

|

|

Sales and Use Tax |

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Motor Fuels Tax |

|

|

Documentary Stamp Tax |

|

|

Solid Waste Fees and Surcharge |

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

Section 3: Change your address. Select the address type and provide the new address information.

Address Type: |

|

|

Business Location Address |

|

|

RT Benefit/Claims Notice |

|

|

RT Tax Rate Notice |

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

(choose one or more) |

|

|

Mailing Address |

|

|

Employer's Quarterly Report |

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

New Address Information: |

|

|

|

|

|

|

|

|

|

|

(name of business or individual) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mailing Address: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City/State/ZIP: |

|

|

|

|

|

Fax Number: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Email Address: |

|

|

|

|

|

Telephone Number: |

|

|

|

Extension: |

|

|

|

|

|

|

|

|

|

|

|

Section 4: Change your account status. Request to inactivate, reactivate or cancel your account. Check the box next to the appropriate action and provide the date this action becomes effective.

Action

Requested:

(choose only one)

Effective

Date of

Action:

__ __ /__ __ /_______

Inactivate - I have temporarily suspended business operations; I have no employees.

Reactivate – My business is now active; I am again paying wages. This Account Change Form only makes the listed changes to your account. If additional changes are necessary, such as changes to your eServices contact or banking information, you will need to submit a new Florida Business Tax Application (Form

Cancel – I have no plans for future business activity; cancellations can not be reversed.

Section 5: Corporate name change. I have changed my corporate name.

Corporate name changed to:

Effective date:

Section 6: Leasing Employees. I am leasing all or part of my employees.

|

|

Leasing all of my employees |

Leasing Company's RT Account Number: |

|

|

||

|

|

|

|

|

|

Leasing part of my employees |

Leasing Company's Federal Identification Account Number: |

|

|

||

|

|

||

Date I began leasing employees: |

Leasing Company's DBPR License Number: |

||

|

|

|

|

Section 7: Sign and date

I certify that I am legally authorized to make these changes with respect to the account number shown above.

Signature:

Title:

Date:

Telephone Number:

Sign and date this Employer Account Change Form

mail to: |

or email to: |

Contact |

|

Florida Department of Revenue |

|||

DOC_MGR@floridarevenue.com |

Information and forms are available at |

||

P.O. Box 6510 |

or fax to: |

||

floridarevenue.com |

|||

Tallahassee FL |

Form Characteristics

| Fact Name | Details |

|---|---|

| Purpose | The RTS-3 form is used to report changes in an employer's account, including changes in legal entity or ownership. |

| Governing Law | The form is governed by Rule 73B-10.037 of the Florida Administrative Code. |

| Effective Date | The current version of the RTS-3 form became effective on October 17, 2017. |

| Account Identification | Completing the form requires information such as account name, account number, and tax certification number. |

| Tax Types | The form can apply to various tax types, including reemployment tax and other state taxes. |

| Address Changes | Sections accommodate updating various addresses, including business locations and mailing addresses. |

| Account Status Changes | Employers can request to inactivate, reactivate, or cancel their accounts through the form. |

| Corporate Name Change | Section for notifying of a change in corporate name, including the new name and effective date. |

| Leasing Employees | Employers can report if they are leasing employees, providing relevant leasing company information. |

Guidelines on Utilizing Rts 3

Completing the RTS-3 form is essential for updating your employer account with the Florida Department of Revenue. After filling it out, you will need to submit it either by mail or fax to ensure that the changes take effect promptly.

- Identify Your Tax Account: Fill in your account name, RT account number, mailing address, business partner number, city/state/ZIP code, tax certificate number, email address, federal identification number, and telephone number (including extension and fax number).

- Select Tax Type: Indicate that the change applies to reemployment tax “RT.” If applicable, check any additional tax types such as Corporate Income Tax, Sales and Use Tax, or others listed.

- Change Your Address: Choose the appropriate address type for the change (e.g., Business Location Address, Mailing Address). Then, provide the new address information along with the associated email address and telephone number.

- Change Your Account Status: Select one action: inactivate, reactivate, or cancel your account. Specify the effective date for this action.

- Corporate Name Change: If applicable, indicate the new corporate name and its effective date.

- Leasing Employees: If you are leasing employees, check the appropriate box and provide the necessary leasing company information, including their RT account number or federal identification number, the start date, and the leasing company's DBPR license number.

- Sign and Date: Confirm your authority to make these changes by signing and dating the form. Also, provide your title and telephone number.

Once the form is complete, mail or fax it to the Florida Department of Revenue. For assistance during the process, you can call 850-488-6800.

What You Should Know About This Form

What is the purpose of the RTS-3 form?

The RTS-3 form, or Employer Account Change Form, is designed for businesses in Florida to report changes related to their tax accounts. These changes could involve updating the business's legal entity status, ownership details, or contact information. It's important to complete this form accurately to ensure the Florida Department of Revenue can update your records correctly.

When should I submit an RTS-3 form?

You should submit the RTS-3 form whenever there is a change in your business's legal entity, ownership, or if you need to update your contact details such as mailing address or email. Additionally, if you need to inactivate, reactivate, or cancel your tax account due to changes in business operations, this form is essential. Remember, any significant change should be reported promptly to avoid complications with tax compliance.

How do I fill out the RTS-3 form?

To fill out the RTS-3 form, start by entering your account details in Section 1. Make sure to include the account name, account number, and contact information. In Section 2, specify the tax type this change applies to, particularly if it relates to reemployment tax. For changes of address or status, complete Sections 3 and 4 as needed. Be sure to provide all requested information clearly, as this helps expedite processing your request.

What if I am changing my corporate name?

If you're changing your corporate name, the RTS-3 form includes a dedicated section for this purpose. Simply indicate your old corporate name and provide the new name along with the effective date of this change. This ensures that your tax records reflect the most current information about your business identity.

What happens if I need to inactivate or cancel my account?

If you need to inactivate or cancel your tax account, the RTS-3 form allows you to request this action. It is important to choose only one option: inactivate, reactivate, or cancel. Provide the effective date for this action carefully, as cancellations cannot be reversed once processed. If you temporarily suspend operations but plan to reopen, consider inactivating rather than canceling.

How do I submit the RTS-3 form once it is completed?

After you have completed the RTS-3 form, sign and date it at the bottom to certify that you are authorized to make these changes. You can then mail the form to the Florida Department of Revenue at the address provided or fax it to the designated number. For assistance or if you have questions about the form, you can call the department directly at 850-488-6800.

Common mistakes

Filling out the RTS-3 form can be a straightforward process, but many people make common mistakes that can lead to delays or complications. One major error is failing to provide complete and accurate identification information. This includes the account name, RT account number, and Federal Identification Number. Missing or incorrect details can result in the form not being processed or being assigned to the wrong account.

Another frequent mistake is neglecting to select the correct tax type. The RTS-3 form specifically addresses reemployment tax. If individuals fail to check all applicable boxes for other tax accounts, they may inadvertently miss essential updates for those accounts. This oversight can create significant compliance issues down the line.

Address changes are often mismanaged on the RTS-3 form. Individuals must clearly indicate whether the new address is for a business location or another purpose. Furthermore, they should ensure that the new address is complete, including the city, state, and ZIP code. Incomplete addresses can lead to miscommunication and lost correspondence.

Lastly, the form requires a signature to authenticate the requests being made. People sometimes forget to sign or date the form, which invalidates the submission. Without an authorized signature, the Florida Department of Revenue cannot accept the changes, causing unnecessary delays. It is crucial to take a moment at the end of the form to verify that all required fields, especially the signature and date, are complete before mailing it in.

Documents used along the form

The RTS-3 form, officially titled the Employer Account Change Form, plays a crucial role in updating important information regarding your business's tax accounts. It helps ensure that the Florida Department of Revenue has the correct details for effective tax management. Other documents may accompany the RTS-3 form to facilitate various changes and ensure compliance. Below is a list of six commonly used forms that often complement the RTS-3.

- Florida Business Tax Application (DR-1): This application is necessary for registering new or existing businesses for state taxes. It needs to be submitted when there is a change in legal entity or ownership.

- Employer’s Quarterly Report (RT-6): This report provides the details of wages paid and taxes withheld for the quarter. It's essential for reconciling employer contributions accurately.

- Sales and Use Tax Return (DR-15): Businesses using the RTS-3 may also deal with sales tax. This return is filed to report sales tax collected from customers and remit it to the state.

- Corporate Income Tax Return (F-1120): If your business is structured as a corporation, this document reports your business's income, deductions, and credits. It’s vital for maintaining compliance with corporate tax regulations.

- Reemployment Tax Return (RT-1): This return is used to report reemployment tax owed by employers. It reflects the taxes due based on wages paid during a given period.

- Change of Address Form (DR-400): Necessary if your business moves. This form updates the address in the state’s records to ensure your tax documents reach you without any issues.

Understanding these forms and how they interconnect with the RTS-3 can make navigating the tax landscape easier. Keeping accurate records and submitting the right paperwork helps you avoid potential pitfalls and ensures smooth business operations.

Similar forms

The RTS 3 form is similar to several other documents used for different types of tax or account changes. Here is a list of six such documents and how they relate to the RTS 3 form:

- Florida Business Tax Application (DR-1) - This form is required when there is a change in legal entity or ownership, much like the RTS 3, which also addresses significant changes to a tax account.

- Employer Identification Number (EIN) Application (Form SS-4) - Both forms are used to identify changes in business status. The RTS 3 is focused on tax accounts, while the SS-4 is applied for obtaining a unique identifier for a business.

- Corporate Income Tax Return (Form F-1120) - Similar to the RTS 3, this document requires businesses to update their tax information regularly, including any changes in ownership or location.

- Sales Tax Registration Application (Form DR-1S) - This application, like the RTS 3, is necessary for businesses that need to report changes to their tax status or activities related to sales tax collection.

- Florida Unemployment Compensation (UC) Account Change Form - Both forms require businesses to report changes affecting their tax liabilities, specifically related to employment and tax contributions.

- Tax Exempt Certificate Application (Form DR-14) - Similar to the RTS 3, this document is utilized when a business needs to update or confirm its tax-exempt status and related information.

Dos and Don'ts

When filling out the RTS-3 form, it's essential to approach the process carefully to ensure accurate and timely updates. Here are some do's and don'ts to guide you:

- Do double-check your account information before submission to avoid errors.

- Do ensure that the contact information provided, especially your email and phone number, is up-to-date.

- Don't submit the form without signing it, as an unsigned form may be rejected.

- Don't forget to indicate the effective date of any changes. This step is crucial for proper processing.

Misconceptions

Misconception 1: The RTS-3 form is used exclusively for changing a business name.

The RTS-3 form allows for various types of changes, including changes in ownership, tax status, and address. It is not limited to name changes and serves multiple purposes related to employer accounts within the Florida Department of Revenue.

Misconception 2: Only large businesses need to file the RTS-3 form.

Any business, regardless of size, must complete the RTS-3 form if they experience any relevant changes, such as a change in ownership or status. It is crucial for all employers to ensure their tax account information remains accurate and up to date.

Misconception 3: The RTS-3 form can be submitted over the phone.

The RTS-3 form must be completed and submitted either by mail or fax. Telephone submissions are not accepted, and it is essential for businesses to follow the proper channels to ensure their requests are processed accurately.

Misconception 4: Submitting the RTS-3 form guarantees immediate updates to the account.

Key takeaways

Here are five key takeaways regarding the RTS-3 form for employer account changes in Florida:

- Thorough Identification Required: Ensure you provide your account name, account number, and other identifying details accurately to avoid processing errors.

- Tax Type Selection: Indicate the type of tax changes relevant to your situation, especially if it involves reemployment tax (RT). Other tax types may also be affected.

- Address Changes: Clearly specify if you are updating your business location, mailing, or notices addresses. New contact information is essential for communication.

- Account Status Actions: Decide on the appropriate action—whether to inactivate, reactivate, or cancel your account. Remember that cancellations cannot be reversed.

- Authentication Required: The form must be signed and dated by an authorized individual certifying their authority to make changes. This step is crucial for legitimacy.

Browse Other Templates

Cbp Form 3078 - Date of birth and place of birth details are essential for the application process.

Fidelity Self Employed 401k - The form includes sections for employer and contribution information.