Fill Out Your Rural Health Clinic Billing Cheat Form

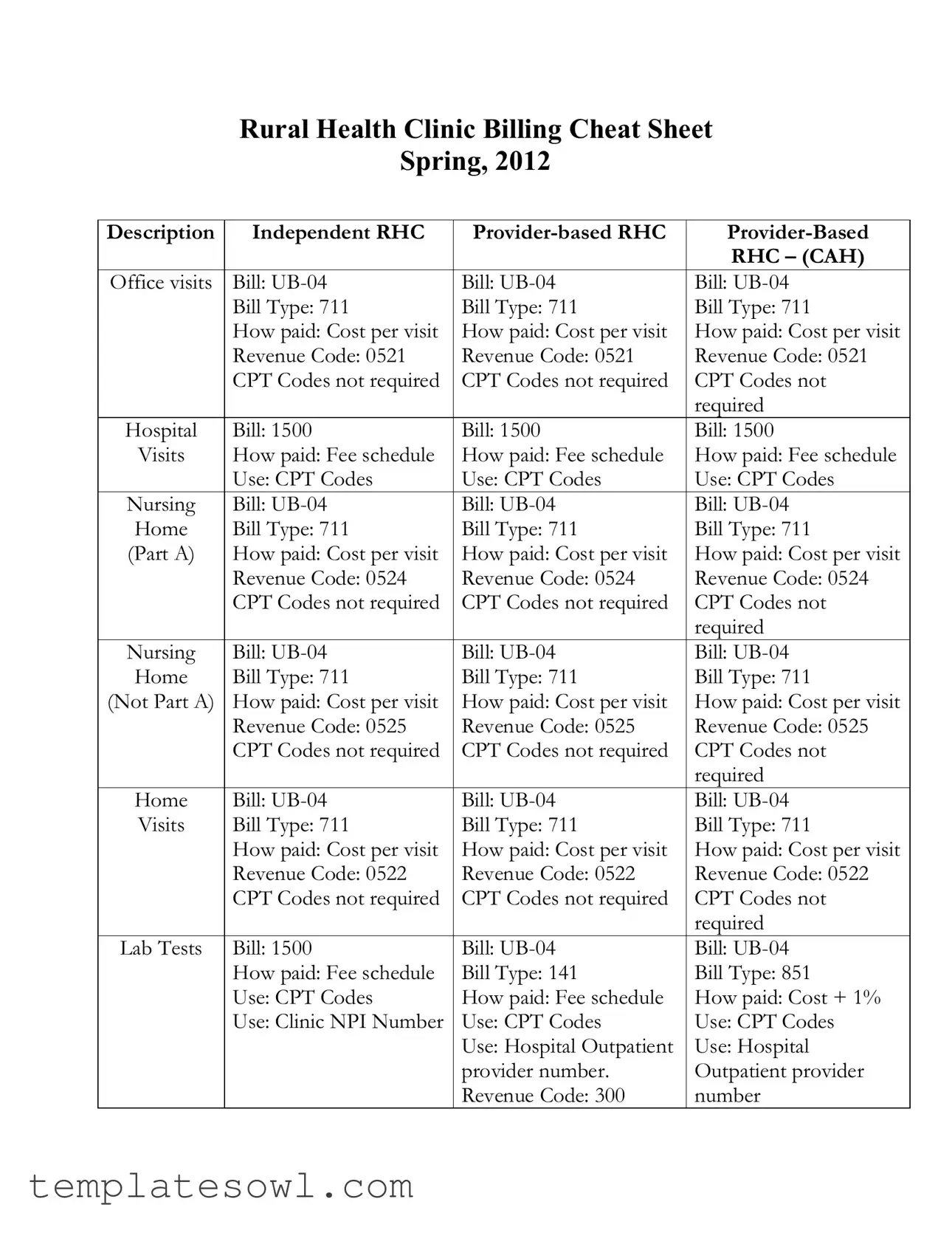

The Rural Health Clinic (RHC) Billing Cheat form serves as a vital resource for understanding the billing processes associated with different types of RHCs, including independent RHCs, provider-based RHCs, and provider-based RHCs that are Critical Access Hospitals (CAH). It succinctly outlines key billing components such as the bill types, payment methods, revenue codes, and the use of CPT codes. The cheat sheet details the billing procedures for various services, including office visits, nursing services, lab tests, diagnostic tests, and more. Each section clarifies how visits are billed — typically using UB-04 or 1500 forms — and specifies how payments are calculated, whether through cost-per-visit models or fee schedules. Additionally, it highlights the importance of using specific modifiers in certain situations, such as when billing evaluation and management codes. Clear guidance is provided on bundling injections and office procedures, ensuring that healthcare providers accurately represent their services and comply with billing requirements. The form illustrates the processes that healthcare professionals must follow to avoid errors and streamline revenue cycles, making it essential for effective administrative management in rural health settings.

Rural Health Clinic Billing Cheat Example

Rural Health Clinic Billing Cheat Sheet

Spring, 2012

Description |

Independent RHC |

||

|

|

|

RHC – (CAH) |

Office visits |

Bill: |

Bill: |

Bill: |

|

Bill Type: 711 |

Bill Type: 711 |

Bill Type: 711 |

|

How paid: Cost per visit |

How paid: Cost per visit |

How paid: Cost per visit |

|

Revenue Code: 0521 |

Revenue Code: 0521 |

Revenue Code: 0521 |

|

CPT Codes not required |

CPT Codes not required |

CPT Codes not |

|

|

|

required |

Hospital |

Bill: 1500 |

Bill: 1500 |

Bill: 1500 |

Visits |

How paid: Fee schedule |

How paid: Fee schedule |

How paid: Fee schedule |

|

Use: CPT Codes |

Use: CPT Codes |

Use: CPT Codes |

Nursing |

Bill: |

Bill: |

Bill: |

Home |

Bill Type: 711 |

Bill Type: 711 |

Bill Type: 711 |

(Part A) |

How paid: Cost per visit |

How paid: Cost per visit |

How paid: Cost per visit |

|

Revenue Code: 0524 |

Revenue Code: 0524 |

Revenue Code: 0524 |

|

CPT Codes not required |

CPT Codes not required |

CPT Codes not |

|

|

|

required |

Nursing |

Bill: |

Bill: |

Bill: |

Home |

Bill Type: 711 |

Bill Type: 711 |

Bill Type: 711 |

(Not Part A) |

How paid: Cost per visit |

How paid: Cost per visit |

How paid: Cost per visit |

|

Revenue Code: 0525 |

Revenue Code: 0525 |

Revenue Code: 0525 |

|

CPT Codes not required |

CPT Codes not required |

CPT Codes not |

|

|

|

required |

Home |

Bill: |

Bill: |

Bill: |

Visits |

Bill Type: 711 |

Bill Type: 711 |

Bill Type: 711 |

|

How paid: Cost per visit |

How paid: Cost per visit |

How paid: Cost per visit |

|

Revenue Code: 0522 |

Revenue Code: 0522 |

Revenue Code: 0522 |

|

CPT Codes not required |

CPT Codes not required |

CPT Codes not |

|

|

|

required |

Lab Tests |

Bill: 1500 |

Bill: |

Bill: |

|

How paid: Fee schedule |

Bill Type: 141 |

Bill Type: 851 |

|

Use: CPT Codes |

How paid: Fee schedule |

How paid: Cost + 1% |

|

Use: Clinic NPI Number |

Use: CPT Codes |

Use: CPT Codes |

|

|

Use: Hospital Outpatient |

Use: Hospital |

|

|

provider number. |

Outpatient provider |

|

|

Revenue Code: 300 |

number |

Description |

Independent RHC |

||

|

|

|

RHC – (CAH) |

Technical |

Bill: 1500 |

Bill: |

Bill: |

Components |

How paid: Fee schedule |

Bill Type: 131 |

Bill Type: 851 |

of |

Use: CPT Codes |

How paid: Fee schedule |

How paid: Fee schedule |

Diagnostic |

Use: Clinic NPI Number |

Use: CPT Codes |

Use: CPT Codes |

Tests |

|

Use: Hospital Outpatient |

Use: Hospital |

|

|

provider number |

Outpatient provider |

|

|

|

number |

Flu and |

Log flu and pnuem. |

Log flu and pnuem. |

Log flu and pnuem. |

Pnuem. |

Shots and include on the |

Shots and include on the |

Shots and include on |

Injections |

cost report. |

cost report. |

the cost report. |

All other |

Bundle with the office |

Bundle with the office |

Bundle with the office |

Injections |

visit on the |

visit on the |

visit on the |

|

revenue code 0521. Will |

revenue code 0521. Will |

revenue code 0521. Will |

|

increase charges that are |

increase charges that are |

increase charges that are |

|

bundled into 0521. |

bundled into 0521. |

bundled into 0521. |

Office |

Bundle with the office |

Bundle with the office |

Bundle with the office |

Procedures |

visit on the |

visit on the |

visit on the |

|

revenue code 0521. Will |

revenue code 0521. Will |

revenue code 0521. Will |

|

increase charges. If you |

increase charges. If you |

increase charges. If you |

|

bill an E and M code use |

bill an E and M code use |

bill an E and M code |

|

modifier 25. |

modifier 25. |

use modifier 25. |

EKGs |

Bill the Professional |

Bill the Professional |

Bill the Professional |

|

component on |

component on |

component on |

|

(93010) and bill the |

(93010) and bill the |

(93010) and bill the |

|

technical component |

technical component |

technical component |

|

(tracing 93015) on the |

(tracing 93015) on the |

(tracing 93015) on the |

|

1500. |

on the |

|

|

|

Type and 730 Revenue |

851 Bill Type and 730 |

|

|

code. |

Revenue code. |

Homecare |

During the initial period |

During the initial period |

During the initial period |

Plan |

when a face to face |

when a face to face |

when a face to face |

Oversight |

encounter is required, |

encounter is required, bill |

encounter is required, |

|

bill this code on the UB- |

this code on the |

bill this code on the |

|

04, Revenue Code 521) |

Revenue Code 521) |

|

|

Thereafter, since there is |

Thereafter, since there is |

521) |

|

not face to face, do not |

not face to face, do not |

Thereafter, since there |

|

bill for the service. |

bill for the service. |

is not face to face, do |

|

|

|

not bill for the service. |

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Title | This is the Rural Health Clinic Billing Cheat Sheet, Spring 2012 edition. |

| Independent RHC Billing | Independent RHCs use UB-04 forms for office visits and bill at Type 711. |

| Cost Payment Model | All visits are paid based on cost per visit for independent and provider-based RHCs. |

| Revenue Codes | The revenue codes include 0521, 0524, 0525, and 0522 for different visit types. |

| CPT Codes Requirement | CPT Codes are not required for billing office visits for any RHC type. |

| Lab Tests Billing | For lab tests, use code 300 on the UB-04 or 1500 forms; payment is based on a fee schedule. |

| Injections Procedure | All injections can be billed using revenue code 0521 and should be bundled with office visit charges. |

| Homecare Billing | Bill homecare services on the UB-04 with revenue code 521 when a face-to-face encounter occurs. |

Guidelines on Utilizing Rural Health Clinic Billing Cheat

Filling out the Rural Health Clinic Billing Cheat form requires attention to specific details relevant to your clinic's billing practices. Completing the form accurately ensures compliance with billing requirements and facilitates timely reimbursement. Follow the steps outlined below to ensure all necessary information is included.

- Gather all necessary documentation related to the services provided, including visit types, CPT codes, and revenue codes.

- Identify the type of Rural Health Clinic (RHC) you are billing for: Independent RHC, Provider-based RHC, or Provider-Based RHC – CAH.

- Determine the appropriate billing method based on service type and RHC category:

- For office visits, select 'UB-04' and 'Bill Type 711' for cost per visit under Revenue Code 0521.

- For lab tests, use '1500' or 'UB-04' with the respective Bill Types and Revenue Codes.

- For nursing home visits, choose 'UB-04' with Bill Type 711 under Revenue Codes 0524 or 0525, based on Part A status.

- Fill in the billing form with details from your documentation, ensuring to use 'CPT Codes' where required and appropriate NPI or provider numbers.

- Review the completed form for accuracy to avoid billing rejections or delays.

- Submit the billing form to the appropriate payer following your clinic's established procedures.

Following these steps will assist in efficiently completing the Rural Health Clinic Billing Cheat form, ensuring all required components are addressed and facilitating the billing process.

What You Should Know About This Form

What is the Rural Health Clinic Bill Type for office visits?

For all types of Rural Health Clinics, including Independent RHCs and both Provider-based RHCs, the Bill Type to use for office visits is 711. This is applicable whether you're billing UB-04 or 1500 forms. The payment method for these visits is generally based on a cost-per-visit model, utilizing Revenue Code 0521, and CPT codes are not required for these visits, simplifying the billing process.

How are lab tests billed in Rural Health Clinics?

When billing for lab tests, Independent RHCs should use the 1500 form with a Bill Type of 141. Provider-based RHCs will typically use the UB-04 form along with a Bill Type of 851. Payment is made based on a fee schedule for both, and it's essential to use CPT codes correctly in these cases. Make sure to also include the Clinic NPI number for Independent RHCs and the Hospital Outpatient provider number for Provider-based RHCs.

What should be included when billing for injections and flu shots?

Injections such as flu and pneumonia shots should be aggregated with the office visit when billed. You'll report these on the UB-04 using Revenue Code 0521. It's important to note that these will increase the charges that are bundled into that specific code. Include these procedures on your cost report to ensure accurate billing and reimbursement.

Are there any specific codes needed for EKG billing?

Yes, when billing for EKGs, you need to separately account for both the professional and technical components. The professional component is reported on the UB-04 using the CPT code (93010), while the technical component (tracing 93015) should be billed on the 1500 form. Ensure to use the correct Bill Types: 131 for the UB-04 and 730 for the 1500, to streamline the billing and payment process.

How should home care services be billed in a Rural Health Clinic?

For home care services, during the initial period when a face-to-face encounter is required, you should bill the appropriate code on the UB-04 using Revenue Code 521. However, once the face-to-face encounter requirement is no longer applicable, do not bill for the service. This distinction is crucial to avoid unnecessary charges and ensure compliance with billing policies.

Common mistakes

Filling out the Rural Health Clinic Billing Cheat form can seem daunting, and errors can lead to reimbursement issues. One common mistake is failing to use the correct bill type for the services rendered. Different types of clinics require specific billing codes. For instance, independent RHCs and provider-based RHCs may all utilize the UB-04 form, but they each have designated bill types such as 711 or 1500. Not checking the specifics can result in delays or denials in payment.

Another frequent error is not adhering to the appropriate revenue codes. Each service has a specific revenue code associated with it, like 0521 for office visits or 0524 for home services. When these codes are either overlooked or mismatched, the claim may be flagged as inaccurate. Therefore, always double-check that the revenue codes align with the corresponding services provided.

Additionally, many individuals forget that for certain services, CPT codes are not required. This applies to various types of visits. Ignoring this fact can lead to unnecessary complications in the billing process. If the cheat sheet indicates that CPT codes are not needed, it's essential to follow that instruction to streamline the submission.

Some people also mistakenly include charges that should be bundled with others. For example, when billing for office procedures, it is crucial to bundle certain injections using revenue code 0521. Not doing so might inflate charges incorrectly, impacting both the clinic’s profitability and compliance with billing regulations.

Lastly, many fail to apply the correct modifiers, particularly when billing E and M codes. The modifier 25 must be used if an E and M code is being billed alongside other services. Neglecting to do this not only jeopardizes the claim but also raises questions during audits.

Being aware of these common mistakes can help ensure that billing processes run smoothly, leading to consistency in revenue flow for rural health clinics.

Documents used along the form

The Rural Health Clinic (RHC) Billing Cheat Sheet serves as a quick reference for healthcare providers to facilitate accurate billing processes within rural health clinics. Along with this cheat sheet, several other forms and documents are frequently utilized. Each of these documents plays a crucial role in ensuring compliance with billing regulations and optimizing reimbursement for services rendered.

- UB-04 Claim Form: This form is used by facilities such as hospitals and outpatient clinics to bill Medicare, Medicaid, and other insurers for inpatient and outpatient services. It captures essential service details and billing codes necessary for payment processing.

- CMS-1500 Form: A standard form for billing professional services. Independent providers utilize this document to claim reimbursement for medical services rendered to patients under various government health programs and managed care plans.

- Reimbursement Policy Documents: These documents outline the billing and reimbursement guidelines set by insurers and government programs. Providers refer to them to ensure compliance with current policies and reimbursements specific to rural health clinic services.

- Encounter Forms: Also known as charge slips or superbills, these forms summarize services provided during a patient visit. They are essential for healthcare providers to track patient encounters, codes for billing, and ensure accurate documentation for insurance claims.

These forms and documents, in conjunction with the Rural Health Clinic Billing Cheat Sheet, enhance the ability of healthcare providers to navigate the complexities of medical billing and reimbursement effectively. By maintaining clear and compliant records, RHCs can improve their financial viability while continuing to deliver essential services to rural communities.

Similar forms

The Rural Health Clinic Billing Cheat form serves as a critical reference for billing procedures within different healthcare settings. Several other documents are similar in their approach to detailing billing processes and categories. Each can be summarized as follows:

- CMS 1500 Form: This is primarily used for outpatient billing. Like the RHC Billing Cheat form, it outlines how to use CPT codes, especially for office visits and professional services. It is crucial for independent clinics.

- UB-04 Form: Frequently employed for institutional billing, the UB-04 form mirrors the RHC form by providing classifications for services rendered, including revenue codes and billing types. Both documents optimize claims submission for various healthcare services.

- Medicare Billing Guidelines: These guidelines detail the payment structures and required documentation needed for billing Medicare. Much like the RHC form, they emphasize the use of specific billing codes and payment methods based on service type.

- State Medicaid Billing Manuals: Each state has unique billing manuals for Medicaid that share a similar layout to the RHC Billing Cheat form. They typically include billing cycles, rates, and service codes, fostering consistency in billing practices across state lines.

- ICD-10 Code Guidelines: While focused on diagnosis coding, these guidelines relate closely to the RHC form by emphasizing the necessity of accurate coding in claims submissions, ensuring proper reimbursements for healthcare providers.

- Provider Enrollment Application: The documents required for enrolling providers generally include a detailed breakdown of services and billing examples. Similar to the RHC form, they highlight the necessary billing information that contributes to a provider's legitimacy and reimbursement eligibility.

Dos and Don'ts

When filling out the Rural Health Clinic Billing Cheat form, follow these guidelines carefully.

- DO ensure you use the correct Bill Type, like UB-04 or 1500, according to the service being billed.

- DO include the appropriate Revenue Codes, such as 0521 for office visits, to avoid billing errors.

- DO clearly indicate the use of CPT Codes where required, for services like office procedures and diagnostics.

- DO keep documentation thorough and accurate, as it supports your billing claims.

- DON'T forget to use modifier 25 when billing an E and M code if relevant, as this clarifies the services rendered.

- DON'T mix up billing forms or types between independent RHC and provider-based RHC services; maintain specificity.

- DON'T submit claims without verifying if a face-to-face encounter is required; this is crucial for homecare services.

- DON'T bundle office visit charges incorrectly; always follow the established guidelines for billing procedures.

Misconceptions

Misconceptions about the Rural Health Clinic Billing Cheat Form can lead to confusion and errors in billing practices. Understanding these misconceptions is essential for healthcare providers. Below are eight common misconceptions along with explanations for each.

- CPT Codes Are Always Required: Many believe that CPT codes must be used for all billing situations. However, for certain services under the Rural Health Clinic (RHC) billing structure, CPT codes are not required.

- Only Hospital-Based Clinics Can Bill Using UB-04: There is a misconception that only hospital-based clinics can use the UB-04 billing form. In reality, both independent RHCs and provider-based RHCs can use the UB-04 for billing.

- Homecare Services Always Require Billing: Some think that every homecare service must be billed. However, if a face-to-face encounter has not occurred, billing should not take place for those services.

- Revenue Codes Are the Same for All Services: It's often assumed that revenue codes do not vary. Yet, each service type comes with specific revenue codes that must be correctly applied during billing.

- Injections Can Be Billed Separately: There's a belief that injections can be billed as standalone services. In actuality, injections need to be bundled with the office visit using the appropriate revenue code.

- Modifiers Are Optional: Some providers think modifiers can be left out when billing. This is not the case; using the correct modifiers, such as the modifier 25 for Evaluation and Management (E&M) codes, is essential for accurate claims.

- Technical and Professional Components Are Billed Similarly: People may assume that technical and professional components of tests can be billed using the same forms. However, these components require different billing forms and codes.

- The Billing Process Is the Same for All RHC Types: There is a prevailing myth that billing processes are uniform across all RHCs. This is incorrect, as independent and provider-based RHCs follow distinct billing protocols.

Clarifying these misconceptions can significantly enhance the efficiency and accuracy of billing practices within Rural Health Clinics. Accurate billing not only ensures proper reimbursement but also maintains compliance with healthcare regulations.

Key takeaways

Filling out and using the Rural Health Clinic Billing Cheat form effectively can streamline your billing process. Here are some key takeaways to consider:

- Independent and Provider-Based RHC: Understand the differences in billing for independent and provider-based Rural Health Clinics (RHC).

- Forms Used: Utilize the UB-04 form for facility billing and the 1500 form for professional services.

- Bill Type: Use Bill Type 711 consistently for most RHC visits and services.

- Cost Per Visit: Know that payment is generally based on cost per visit for RHC services.

- Revenue Codes: Familiarize yourself with specific revenue codes like 0521 for office visits and 0522 for home visits.

- CPT Codes: CPT codes are typically not required for payment on UB-04 bills, but are essential on 1500 forms.

- Lab Tests: For lab tests, use 1500 for the professional component and UB-04 for technical services.

- Modifiers: Remember to use modifier 25 when billing an Evaluation and Management (E&M) code for office visits.

- Home Health Services: Bill for home care services on UB-04, ensuring to differentiate between initial and subsequent visits.

- Injections and Shots: Include vaccines and injections in the cost report, bundling these with office visits to optimize reimbursement.

By adhering to these guidelines, you will enhance accuracy in the billing process and potentially increase reimbursements for services rendered.

Browse Other Templates

Erate Bear Form - Any address changes must be reported to both DRS and the Statewide Grievance Committee.

2022 Tax Checklist - Unreimbursed job-related expenses can help reduce taxable income for employees.