Fill Out Your Rush Card Dispute Form

The Rush Card Dispute form serves as a crucial tool for customers experiencing issues with transactions made using their Rush Card. This form is designed to help users articulate and formalize disputes regarding fraudulent charges or inaccuracies in transaction amounts. Within a tight timeframe of ten business days, consumers must complete and submit the form to ensure their grievances are addressed promptly. The form requires essential personal information, including the disputant's name, contact details, and details about the specific transaction in question, including date, amount, and merchant name. Additionally, users must select the type of error affecting their account, such as incorrect transaction amounts or failure to receive cash from an ATM. Documentation such as receipts may be required to support the claim. The form encourages individuals to outline efforts made to resolve the dispute directly with the merchant prior to submission. This process not only facilitates a clearer understanding of the issue at hand but also aids in a more efficient resolution pathway for those seeking redress for disputed transactions.

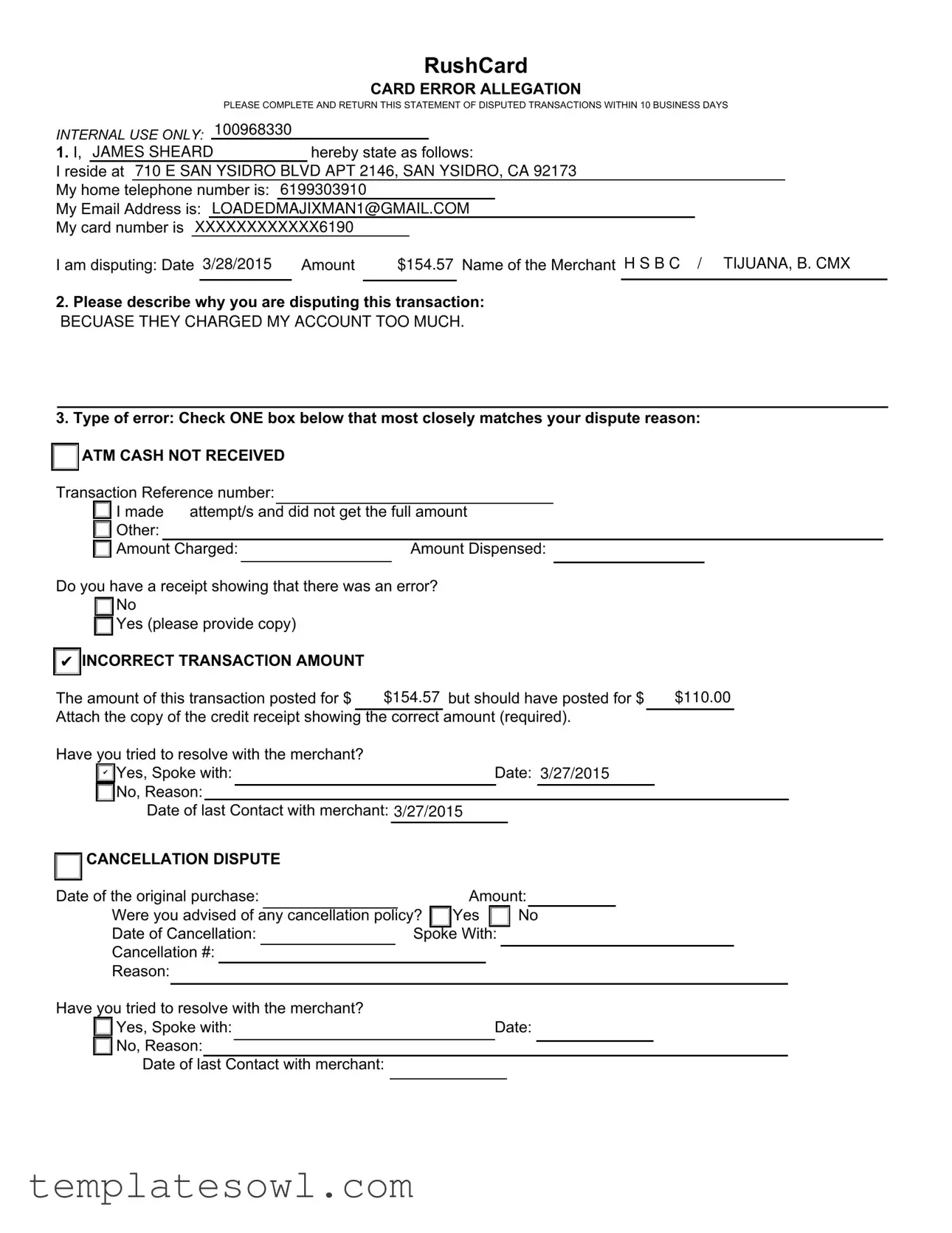

Rush Card Dispute Example

|

|

|

|

|

RushCard |

|

|

|

|

|

|

CARD ERROR ALLEGATION |

|

|

|

|

|

PLEASE COMPLETE AND RETURN THIS STATEMENT OF DISPUTED TRANSACTIONS WITHIN 10 BUSINESS DAYS |

||

INTERNAL USE ONLY: |

|

100968330 |

|

|

||

1. I, JAMES SHEARD |

|

hereby state as follows: |

||||

|

|

|

||||

I reside at 710 E SAN YSIDRO BLVD APT 2146, SAN YSIDRO, CA 92173 |

||||||

|

|

|

|

|

|

|

My home telephone number is: 6199303910

My Email Address is: LOADEDMAJIXMAN1@GMAIL.COM

My card number is XXXXXXXXXXXX6190

I am disputing: Date 3/28/2015 Amount |

$154.57 Name of the Merchant H S B C / TIJUANA, B. CMX |

||||

|

|

|

|

|

|

2.Please describe why you are disputing this transaction:

BECUASE THEY CHARGED MY ACCOUNT TOO MUCH.

3.Type of error: Check ONE box below that most closely matches your dispute reason:

ATM CASH NOT RECEIVED

ATM CASH NOT RECEIVED

Transaction Reference number:

I made attempt/s and did not get the full amount

I made attempt/s and did not get the full amount

Other:

Other:

|

|

|

|

|

|

Amount Charged: |

|

Amount Dispensed: |

|||

|

|

|

|

|

|

Do you have a receipt showing that there was an error?

No

No

Yes (please provide copy)

Yes (please provide copy)

✔INCORRECT TRANSACTION AMOUNT

The amount of this transaction posted for $ |

|

$154.57 but should have posted for $ |

$110.00 |

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

Attach the copy of the credit receipt showing the correct amount (required). |

|

|

||||||||||||||||||||||||

Have you tried to resolve with the merchant? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

✔ Yes, Spoke with: |

|

|

|

|

|

|

Date: 3/27/2015 |

|

|

||||||||||||||||

|

No, Reason: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

Date of last Contact with merchant: 3/27/2015 |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

CANCELLATION DISPUTE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

Date of the original purchase: |

|

|

|

|

Amount: |

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Were you advised of |

any cancellation policy? |

Yes |

|

|

|

|

No |

|

|

||||||||||||||||

|

Date of Cancellation: |

|

|

|

|

Spoke With: |

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

Cancellation #: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

Reason: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Have you tried to resolve with the merchant? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

Yes, Spoke with: |

|

|

|

|

|

|

Date: |

|

|

||||||||||||||||

|

No, Reason: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

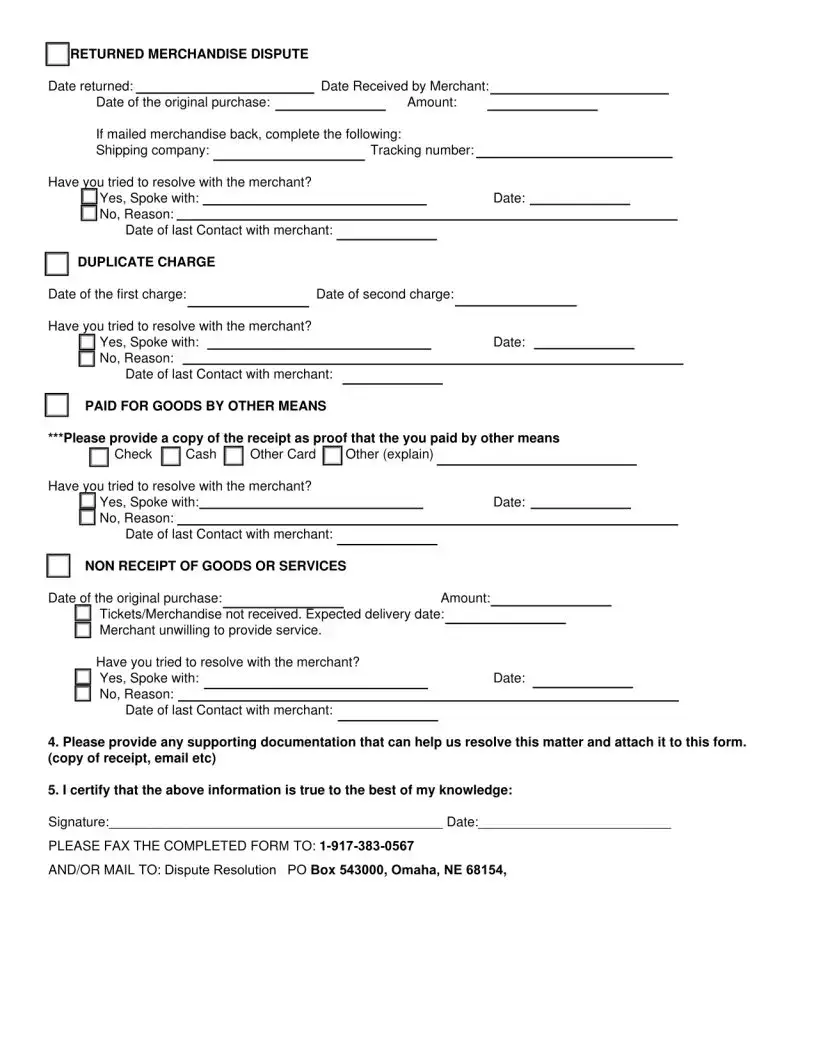

Date of last Contact with merchant:

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | The Rush Card Dispute form is meant for customers to report discrepancies in transaction amounts related to their Rush Card. |

| Submission Timeline | Customers must submit the form within 10 business days from the date of the disputed transaction for proper processing. |

| Customer Information | The form requires the customer's full name, address, telephone number, email address, and the last four digits of the card number. |

| Disputed Transaction Details | Information such as the transaction date, amount, and merchant name is required to facilitate the dispute process. |

| Error Description | Customers must explain the reason for the dispute, including selecting the type of error from provided options. |

| Document Requirements | A copy of the credit receipt showing the correct transaction amount must be attached to the form to support the claim. |

| Merchant Resolution | The form asks whether the customer has attempted to resolve the issue directly with the merchant, requiring details of that interaction. |

| Governing Law | This form is governed by California consumer protection laws, ensuring that disputes are handled in accordance with local regulations. |

Guidelines on Utilizing Rush Card Dispute

After completing the Rush Card Dispute form, it is important to submit it within the specified timeframe for processing. Ensure all information is accurate. Accurate submissions speed up the dispute resolution process.

- Begin by entering your full name at the top of the form. Use the format: I, [Your Full Name]. For example, I, JAMES SHEARD.

- Provide your current residence address. Include the street, apartment number (if applicable), city, state, and zip code.

- Input your home telephone number in the designated space.

- Enter your email address clearly to ensure communication.

- Fill in your Rush Card number by replacing it with the appropriate digits, except for the last four numbers.

- Identify the transaction you are disputing by providing the date, amount, and the name of the merchant. For example: Date: 3/28/2015, Amount: $154.57, Name of Merchant: H S B C / TIJUANA, B. CMX.

- Describe the reason for your dispute. Be clear and concise.

- Select the type of error that matches your situation. Only check one box.

- If applicable, note the transaction reference number.

- Indicate whether you have a receipt showing the error. Check either Yes or No.

- Provide details about the incorrect transaction amount. Include the amount charged and the correct amount.

- Attach a copy of the credit receipt that supports your claim, if required.

- State whether you have tried to resolve the issue with the merchant. Check Yes or No, and provide details of your communication.

- Include the date of your last contact with the merchant or any additional information requested in the form.

What You Should Know About This Form

What is the purpose of the Rush Card Dispute form?

The Rush Card Dispute form serves as a means for cardholders to formally dispute transactions that they believe were processed incorrectly. By completing this form, individuals can provide specific details about the disputed charge, including the transaction amount, the merchant involved, and the reason for the dispute. This documentation helps Rush Card manage and address any discrepancies, ensuring that issues are resolved in a fair and timely manner.

What information do I need to provide when filling out the Rush Card Dispute form?

When completing the Rush Card Dispute form, it is essential to provide accurate information. Begin with your personal details, including your full name, address, and contact information. You need to include the card number related to the disputed transaction, the date of the transaction, the amount charged, and the name of the merchant. Additionally, describe clearly why you are disputing the charge. If applicable, indicate if you have any supporting documentation, such as receipts, that can substantiate your claim.

What should I do if I have already attempted to resolve the issue with the merchant?

If you have already contacted the merchant regarding the disputed transaction, you should indicate this on the form. Provide the name of the person you spoke with and the date of that communication. If there was no resolution, elaborate on any reasons provided by the merchant. It is crucial to show that you made an effort to address the situation prior to filing the dispute, as this can impact the review process by the Rush Card team.

How long will it take to resolve my dispute after submitting the form?

The timeline for resolving a dispute can vary depending on individual circumstances and the nature of the dispute itself. Once the Rush Card Dispute form is submitted, the review process typically begins promptly. Cardholders can generally expect an initial response within a few business days. However, resolving the dispute may take longer, especially if further investigation or communication with the merchant is necessary. It is recommended to keep track of the timeline and follow up if you have not received an update after a reasonable period.

Common mistakes

When filling out the Rush Card Dispute form, individuals often overlook crucial details that can hinder the processing of their disputes. One common mistake is incomplete contact information. It's vital to provide accurate personal details, including a complete address, phone number, and email. Any missing or incorrect information can lead to delays in communication. Ensure that everything is double-checked for accuracy before submission to avoid this pitfall.

Another frequent error is the lack of clarity in explaining the dispute. The form requests a description of the reason for the dispute, and vague statements can lead to complications. Phrases like "they charged my account too much" do not provide enough context. Being specific about the nature of the error is essential. Instead of generalizing, indicate precisely how much was charged and the correct amount, if known.

People often neglect to check the appropriate error type. The form asks for a selection that best corresponds to the error, and failing to do so can result in misclassification of the dispute. Each category has specific requirements and implications. Therefore, carefully review all options and select the one that most accurately represents the situation.

Additionally, many submit the form without the necessary documentation. If there’s a receipt or other proof of the correct transaction amount, including a copy is mandatory. Disregarding this request can result in the dispute being denied or delayed. Ensure to include all required attachments right from the start to facilitate a smoother process.

Finally, individuals sometimes forget to indicate whether they have attempted to resolve the issue with the merchant. This part of the form is critical for demonstrating that you have made an effort to address the issue before escalating it. Specify who you spoke with, the date of contact, and any relevant details regarding the conversation. Providing this information helps establish a clear record and can aid in expediting the dispute resolution process.

Documents used along the form

The Rush Card Dispute form is an essential document for reporting issues with transactions on your Rush Card. To effectively manage your dispute, you may also need several other forms and documents. Each document serves a specific purpose in providing necessary information or supporting evidence.

- Transaction Receipt: This document proves the details of the original transaction, including the date, amount, and merchant. It's essential for verifying your claim.

- Customer Service Communication Record: Documenting any conversations with the merchant or customer service representatives helps establish your efforts to resolve the issue before filing a dispute.

- Merchant Cancellation Policy: If your dispute involves a cancellation, including a copy of the merchant’s cancellation policy shows whether the terms were met during the transaction.

- ATM Withdrawal Receipt: If your dispute concerns an ATM error, providing the receipt can support your claim of insufficient cash dispensed compared to what was requested.

- Proof of Address: This document may be required to confirm your identity and residence, particularly if your name or address has changed since opening the card account.

- Affidavit of Dispute: Some cases might require a signed statement confirming that you are disputing the transaction and asserting that the information provided is true to the best of your knowledge.

Collecting these documents not only supports your dispute but also helps streamline the process. It ensures that you have everything needed to resolve the matter efficiently and effectively.

Similar forms

- Credit Card Dispute Form: This document allows consumers to challenge unauthorized or incorrect charges on their credit card statements. Similar to the Rush Card Dispute form, it requires personal information, details of the disputed transaction, and an explanation of why the charge is being contested.

- Bank Error Resolution Form: Customers use this form to report errors related to transactions, such as unauthorized withdrawals. Like the Rush Card form, it demands a clear description of the error and may include necessary transaction documentation.

- Chargeback Request Form: Utilizing this document, consumers can initiate a chargeback with their bank for disputed transactions. It shares similarities with the Rush Card Dispute form in terms of outlining transaction specifics and providing a reason for the chargeback.

- Fraudulent Activity Report: This report is used to notify a bank about suspicious transactions. Similar to the Rush Card Dispute form, it requires details of the transaction and reasons why it is believed to be fraudulent.

- Merchant Return/Refund Request Form: Shoppers submit this form when requesting a refund for returned merchandise. It parallels the Rush Card form by requiring transaction details, an explanation for the return, and may necessitate supporting documents for the claim.

Dos and Don'ts

When filling out the Rush Card Dispute form, it's essential to follow proper guidelines to ensure your dispute is processed efficiently. Here’s a list of things you should and shouldn’t do:

- Do provide all required personal information, including your name, address, and contact details.

- Do clearly describe the reason for your dispute, making sure to be concise and specific.

- Do indicate the type of error by checking the appropriate box; this helps to categorize your issue accurately.

- Do include any supporting documentation, such as a receipt showing the correct amount for the disputed transaction.

- Don’t leave any sections blank. Incomplete forms can lead to delays in processing your dispute.

- Don’t exaggerate or provide false information. Accuracy is crucial for a successful resolution.

By following these guidelines, you can strengthen your position in resolving your dispute efficiently.

Misconceptions

- Misconception 1: All disputes are resolved in the same timeframe.

- Misconception 2: I don't need to provide supporting documents.

- Misconception 3: I need to contact the merchant to resolve everything first.

- Misconception 4: Disputing a charge will negatively impact my credit.

This is not true. Each dispute varies based on the complexity and the response time of the involved parties. While a prompt resolution is often possible, delays can occur.

Supporting documents, such as receipts, are often essential for verifying the dispute. Without them, the resolution process may take longer or may not be resolved in your favor.

While it's beneficial to try resolving the issue with the merchant directly, it’s not always required. You can submit a dispute form even if you haven't resolved it with the merchant.

Filing a dispute does not harm your credit score. It's a consumer right to dispute inaccurate charges. Your credit report remains unaffected during the dispute process.

Key takeaways

Filling out the Rush Card Dispute form accurately is essential to ensure swift resolution. Below are key takeaways to guide you through the process:

- Complete All Required Fields: Ensure that all sections of the form are filled out completely. Missing information can delay the processing of your dispute.

- Be Specific About Your Dispute: Clearly describe why you are disputing the transaction. This should include the exact nature of the charge and any relevant details.

- Provide Documentation: Attach a copy of any receipts or evidence that support your claim. This documentation is often necessary for verifying your dispute.

- Confirm Merchant Communication: Indicate whether you have contacted the merchant regarding your dispute. If you have, provide the name of the person you spoke to and the date of the communication.

- Submit Within Deadline: Ensure that the completed form is submitted within 10 business days of the transaction date. Timely submission is crucial to process your dispute effectively.

Browse Other Templates

Carrier Packet Example - Ethnic background information may be needed for diversity programs.

California Repo Affidavit - The Affidavit of Repossession facilitates smooth transactions for sold repossessed vehicles.