Fill Out Your Salvation Army Tax Receipt Form

The Salvation Army Tax Receipt Form serves as a crucial tool for individuals who wish to contribute to the charity while availing themselves of potential tax benefits. This form allows donors to clearly specify the type of contribution they are making, whether it be a one-time general donation, a monthly installment, or a donation made in memory or honor of someone special. The form requires essential donor information, including name, address, and contact details, thus ensuring that the organization can recognize and thank donors for their generosity. Moreover, it provides various options for the donation amount, allowing flexibility and ease in choosing the desired contribution. Significantly, donors are informed that contributions of $10.00 or more are eligible for tax receipts, which can also be requested in situations where the donation falls below this threshold. In cases of memorial or honorary contributions, the form offers an option for sending an acknowledgment card, which adds a personal touch to the donation process. Lastly, the Salvation Army is dedicated to protecting the privacy of its donors, as outlined in their privacy policy. This dedication helps build a sense of trust and community between the organization and its supporters.

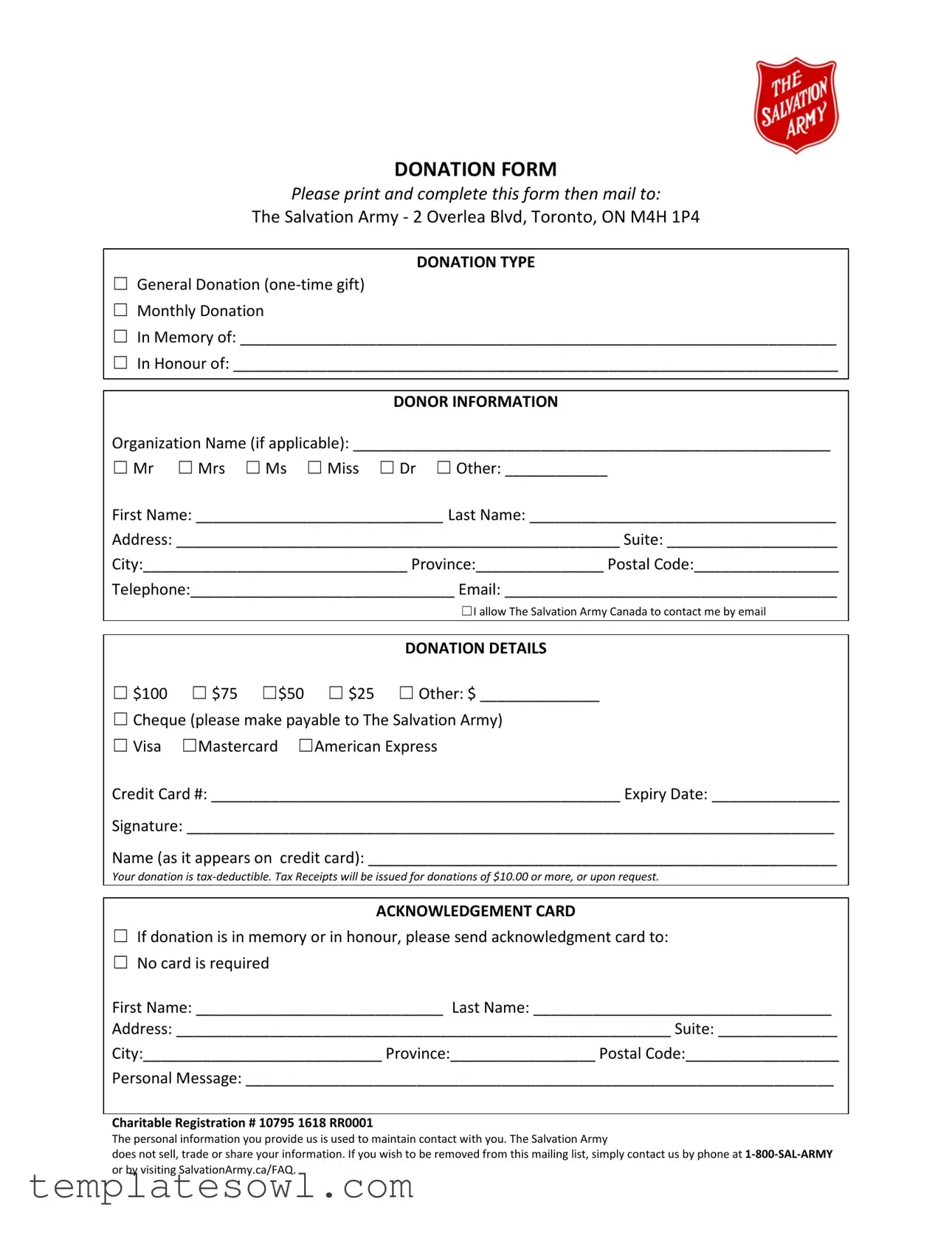

Salvation Army Tax Receipt Example

DONATION FORM

Please print and complete this form then mail to:

The Salvation Army - 2 Overlea Blvd, Toronto, ON M4H 1P4

DONATION TYPE

☐General Donation

☐Monthly Donation

☐In Memory of: ______________________________________________________________________

☐In Honour of: _______________________________________________________________________

DONOR INFORMATION

Organization Name (if applicable): ________________________________________________________

☐ Mr ☐ Mrs ☐ Ms ☐ Miss ☐ Dr ☐ Other: ____________

First Name: _____________________________ Last Name: ____________________________________

Address: ____________________________________________________ Suite: ____________________

City:_______________________________ Province:_______________ Postal Code:_________________

Telephone:_______________________________ Email: _______________________________________

☐I allow The Salvation Army Canada to contact me by email

DONATION DETAILS

☐ $100 ☐ $75 ☐$50 ☐ $25 ☐ Other: $ ______________

☐Cheque (please make payable to The Salvation Army)

☐Visa ☐Mastercard ☐American Express

Credit Card #: ________________________________________________ Expiry Date: _______________

Signature: ____________________________________________________________________________

Name (as it appears on credit card): _______________________________________________________

Your donation is

ACKNOWLEDGEMENT CARD

☐If donation is in memory or in honour, please send acknowledgment card to:

☐No card is required

First Name: _____________________________ Last Name: ___________________________________

Address: __________________________________________________________ Suite: ______________

City:____________________________ Province:_________________ Postal Code:__________________

Personal Message: _____________________________________________________________________

Charitable Registration # 10795 1618 RR0001

The personal information you provide us is used to maintain contact with you. The Salvation Army

does not sell, trade or share your information. If you wish to be removed from this mailing list, simply contact us by phone at

Form Characteristics

| Fact Name | Details |

|---|---|

| Tax-Deductibility | Your donation is tax-deductible, which means you can reduce your taxable income by the amount you contributed. |

| Minimum Donation Amount | Tax receipts will be issued for any donation of $10.00 or more, or you may request one for smaller amounts. |

| Acknowledgment for Memorial Gifts | If you donate in memory or in honor of someone, you have the option to request an acknowledgment card to be sent to the designated person. |

| Personal Information Security | The Salvation Army commits to protecting your personal information and assures that it does not sell or trade your data. |

| Payment Options | You may choose to donate via cheque or credit card, including Visa, MasterCard, and American Express. |

| Contact Permission | You have the option to allow The Salvation Army to contact you via email for updates and information. |

| Charitable Registration Number | The Salvation Army is a registered charity in Canada, with the registration number 10795 1618 RR0001 for tax purposes. |

| Mailing Address for Donations | Donations must be mailed to The Salvation Army - 2 Overlea Blvd, Toronto, ON M4H 1P4 for processing. |

Guidelines on Utilizing Salvation Army Tax Receipt

After completing the Salvation Army Tax Receipt form, you will need to mail it to the designated address to ensure your donation is processed. Make sure all required sections are filled out correctly to avoid any delays. Below are the steps you should follow.

- Begin by selecting the Donation Type. Check the appropriate box for a general donation, monthly donation, or if the donation is in memory or in honour of someone.

- If applicable, enter the Donor Information for your organization. If not, proceed to provide your personal information.

- Choose your title from the options given (Mr, Mrs, Ms, Miss, Dr, or Other) and fill in your first and last name.

- Complete your mailing Address, including suite number, city, province, and postal code.

- Provide your Telephone number and email address. Consider checking the box if you wish to be contacted by email.

- In the Donation Details section, select the amount you wish to donate by checking the corresponding box. If you choose 'Other,' specify the amount.

- Select your payment method: cheque, Visa, Mastercard, or American Express. If using a credit card, enter the credit card number and expiry date.

- Sign the form where indicated, and include the name as it appears on the credit card if that payment method is selected.

- If your donation is in memory or in honour of someone, fill out the Acknowledgement Card section, providing the recipient's information and a personal message. If no card is required, check that option.

- Review all information for accuracy before mailing the completed form to The Salvation Army at the address provided.

What You Should Know About This Form

What should I include when completing the Salvation Army Tax Receipt form?

You should provide all relevant donor information, including your name, address, and contact details. Specify your donation type, whether it is a general donation, a monthly donation, or in memory or honor of someone. Also, indicate the donation amount and payment method. If you opted to send an acknowledgment card, include the recipient's information and your personal message.

How can I receive a tax receipt for my donation?

Tax receipts are issued for donations of $10.00 or more. If you require a receipt, it will automatically be included when you submit your donation form. You may also request a receipt if your donation is below $10.00, but this must be specified at the time of donation.

What payment methods are acceptable?

You can make your donation using a cheque or a credit card. Acceptable credit cards include Visa, MasterCard, and American Express. Ensure that you provide the correct credit card number and expiry date when filling out the donation form to avoid processing delays.

Can I donate anonymously?

The form does not specifically require names for donations unless you choose to indicate a donation in memory or in honor of someone. If anonymity is important, consider completing the donation without including your personal information, although this may affect the receipt issuance.

How is my personal information handled?

The Salvation Army keeps your personal information confidential and does not sell, trade, or share it with others. The information collected is used solely for maintaining contact and processing your donations. If you wish to be removed from their mailing list, you can contact them directly.

Where should I send the completed donation form?

You should mail your completed donation form to The Salvation Army at this address: 2 Overlea Blvd, Toronto, ON M4H 1P4. Be sure to use a secure method of postage to ensure your donation reaches them safely.

Common mistakes

When filling out the Salvation Army Tax Receipt form, individuals often make a few common mistakes. These can lead to delays in processing donations or even prevent donors from receiving their tax receipts. Understanding these pitfalls can help ensure that your donation gets the recognition it deserves.

One frequent error is leaving the donor information section incomplete. It's crucial to provide all requested details, including your name, address, and contact information. Incomplete forms can lead to challenges in issuing receipts, especially if the Salvation Army needs to reach you.

Another common mistake is neglecting to indicate the donation type. Whether you're making a one-time donation, a monthly contribution, or donating in memory or honor of someone, selecting the correct option helps the organization categorize your gift properly. Forgetting this detail can complicate record-keeping.

Many people forget to double-check the amount of their donation. This can be a simple oversight, such as missing the "Other" box when specifying a custom donation amount. Ensuring clarity about the total amount helps avoid any confusion later on regarding how much was donated.

Another typical error involves the payment details. Individuals sometimes forget to provide complete credit card information or omit the expiry date. It is essential to fill out these fields accurately to ensure the donation processes smoothly.

Some donors fail to sign the form. Omitting a signature might not seem significant, but it is a critical element of approving the donation, particularly for credit card transactions. A missing signature can create substantial delays in processing.

Many also neglect to specify that they want to receive an acknowledgment card for memory or honor donations. This small detail can mean a lot to those who are being remembered or honored. By indicating whether an acknowledgment card is needed, you ensure that your intent is communicated clearly to the Salvation Army.

Lastly, being unmindful of your personal message can result in a missed opportunity to personalize your donation. If you're dedicating a donation to someone special, a thoughtful message can enhance the impact of your gesture. Always take a moment to include a personal note.

By paying attention to these common mistakes, you can help streamline the donation process and ensure that your generosity is recognized appropriately. Remember, accuracy is key!

Documents used along the form

The Salvation Army Tax Receipt form is a vital document for both donors and the organization, ensuring that contributions are properly recorded and acknowledged for tax purposes. Alongside this form, several other documents frequently accompany it, helping enhance the donation experience and provide necessary information. Here’s a closer look at these forms and their importance in the donation process.

- Donation Acknowledgment Letter: This letter confirms the receipt of the donation and may include a personalized message. It serves as an additional record for donors and reaffirms their generosity.

- Direct Deposit Form: This form enables donors to set up automatic donations directly from their bank accounts. It simplifies the giving process, making regular contributions more manageable for those who choose to give monthly.

- Event Registration Form: When participating in fundraising events sponsored by The Salvation Army, this form collects important information about attendees, helping organize events more effectively and ensure that everyone is accounted for.

- Volunteer Application Form: For those looking to get involved beyond monetary donations, this form allows individuals to volunteer their time and skills. It supports the organization by mobilizing community members to assist in various capacities.

- Charitable Impact Report: Often provided to donors, this report details how their contributions have made a difference. It provides insight into the organization’s projects and financial transparency, reinforcing trust and encouraging future donations.

Each of these documents plays a crucial role in enhancing the donation experience, fostering communication, and ensuring transparency between The Salvation Army and its supporters. By understanding these forms, donors can navigate the process more easily and feel confident in their contributions.

Similar forms

- Donation Receipt: Similar to the Salvation Army Tax Receipt, a donation receipt functions as proof of a charitable contribution made to a nonprofit organization. It typically includes the donor's name, amount donated, and the organization's details.

- Charitable Contribution Statement: This document summarizes all donations made during a specific period. Like the tax receipt, it provides essential details and can be used for tax purposes.

- End-of-Year Tax Summary: This summary may include all contributions made over a year, allowing donors to compile their charitable giving for tax deductions. It serves a purpose similar to that of the Salvation Army Tax Receipt.

- Tax Deduction Statement: This statement outlines the amounts that can be deducted from taxable income due to charitable donations. It gives the same benefit of tax reduction as the Salvation Army Tax Receipt.

- Gift Aid Declaration (UK): While different in geographic context, this document allows contributors to increase the value of their donations through tax refunds. Its purpose aligns with that of the Salvation Army Tax Receipt in terms of tax benefits.

- Itemized Deduction Worksheet: This worksheet helps individuals track various deductible expenses, including charitable contributions. It serves as a comprehensive tool similar to the tax receipt by ensuring all donations are accounted for.

- Volunteer Hours Form: Though focused on time rather than money, this form can sometimes be used to calculate financial equivalents of volunteer contributions for tax purposes. It represents a different type of giving that aligns with the spirit of charitable donations, like those documented on the Salvation Army Tax Receipt.

Dos and Don'ts

When filling out the Salvation Army Tax Receipt form, keep these important tips in mind:

- Do print clearly to ensure your information is easily readable.

- Do include your full address to avoid any delays in processing your receipt.

- Don't forget to sign the form; an unsigned form may not be processed.

- Don't leave any required fields blank; this could prevent your donation from being acknowledged.

Misconceptions

Understanding the Salvation Army Tax Receipt form is essential for donors. Below are some common misconceptions about this form:

- Donations are not tax-deductible. Many people believe that their donations to the Salvation Army are not tax-deductible. In fact, donations of $10 or more qualify for tax receipts.

- Only large donations receive tax receipts. Some think only significant contributions receive tax receipts. The truth is that receipts are issued for donations of $10 or more.

- Tax receipts are automatically sent for every donation. It’s a common misconception that tax receipts are automatically sent. You must request a receipt for donations under $10.

- I can't donate in memory or in honor of someone. Some donors feel they cannot dedicate their gifts. However, the form offers the option to donate in memory or honor of a loved one.

- Online donations can't be tracked. Donors often worry that online contributions go unrecognized. The Salvation Army maintains records of all donations made through their website.

- Credit card donations are not secure. Some are concerned about the safety of their information. The Salvation Army uses secure payment methods to protect donor data.

- Your personal information will be shared. There’s a belief that the organization sells donor information. In reality, the Salvation Army does not share or trade your personal details.

- Tax receipts cannot be reissued. Many individuals think that if a receipt is lost, it cannot be replaced. However, the Salvation Army can reissue tax receipts upon request.

- I must give a specific amount to donate. Some donors believe they are required to contribute set amounts. In reality, you can select the "Other" option to donate any desired amount.

By clarifying these misconceptions, donors can more confidently support the Salvation Army and understand the benefits of their contributions.

Key takeaways

Understanding how to fill out and use the Salvation Army Tax Receipt form can significantly enhance your donation experience. Here are some key takeaways to keep in mind:

- Choose the Right Donation Type: Select the donation type that best fits your intention, whether it’s a one-time gift, a monthly commitment, or a donation made in memory or honor of someone.

- Provide Accurate Donor Information: Fill out your details completely, including your name, address, and contact information. This will ensure you receive your tax receipt and any communications from The Salvation Army.

- Tax Deductibility: Donations of $10 or more are tax-deductible, meaning you can claim this amount on your tax return, potentially reducing your taxable income.

- Requesting an Acknowledgment Card: If your donation is made in memory or honor of someone special, consider opting for an acknowledgment card. This personal touch can mean a lot to recipients.

- Payment Method Options: Choose your payment method wisely. You have the option of paying by cheque or credit card. Be sure to fill out the corresponding sections accurately.

- Keep a Copy: Always keep a copy of the completed donation form for your records. This can be useful for reference when it comes time to file your taxes.

Being mindful of these points can make your contribution to The Salvation Army more impactful and ensure you maximize the benefits of your generosity.

Browse Other Templates

Checklist of Labor Law Requirements - Each section of the checklist corresponds to specific regulatory requirements.

Pediatric Care Plan - The overall performance indicates areas of strength as well as those needing improvement.

Prealgebra Worksheets - Key tool for preparing for higher-level math courses.