Fill Out Your Sample Of 850 Petition Form

The Sample Of 850 Petition form serves as a crucial tool for individuals involved in trust administration under California Probate Code. It allows a trustee or any interested person to seek a court order regarding property that may not have been formally transferred to a trust but is still believed to be part of it. The petition can be initiated when there is a dispute about ownership, possession, or claims related to real or personal property. In particular, Probate Code §850(a)(3) offers specific grounds for filing this petition, allowing you to contest claims of ownership or address issues concerning creditors of the trust settlor. Furthermore, the petition can include related civil action claims, which broadens its applicability. Essential details such as factual basis for the claim, names and addresses of interested parties, and specific property descriptions must be clearly stated. The court hearing is set by the clerk, following statutory notice requirements. Importantly, this form encapsulates the legal standards established by landmark cases, ensuring that even properties not formally transferred can still be recognized as trust assets. Overall, the Sample Of 850 Petition form is a fundamental mechanism in navigating trust-related legal challenges effectively.

Sample Of 850 Petition Example

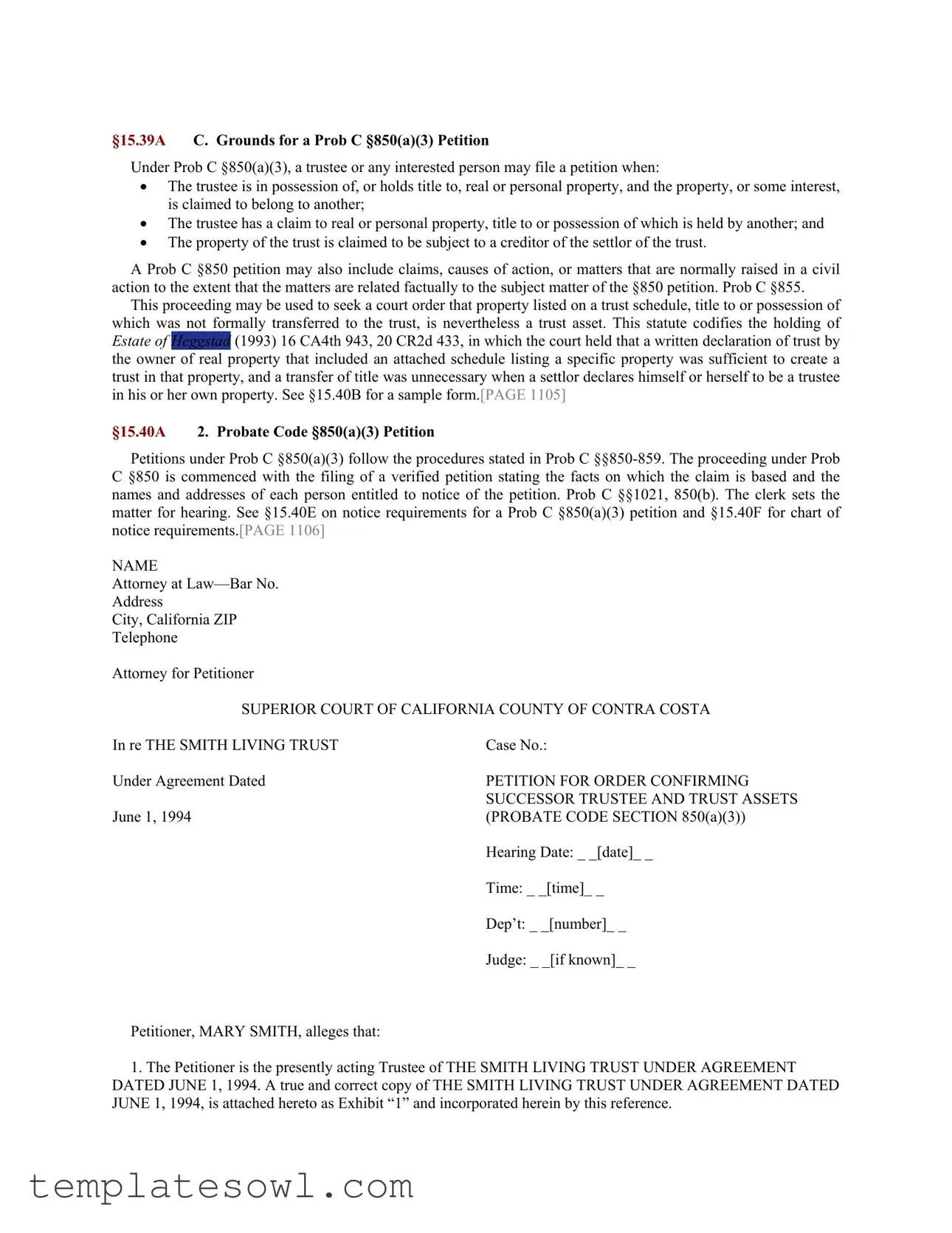

§15.39A C. GROUNDS FOR A PROB C §850(A)(3) PETITION

Under Prob C §850(a)(3), a trustee or any interested person may file a petition when:

•The trustee is in possession of, or holds title to, real or personal property, and the property, or some interest, is claimed to belong to another;

•The trustee has a claim to real or personal property, title to or possession of which is held by another; and

•The property of the trust is claimed to be subject to a creditor of the settlor of the trust.

A Prob C §850 petition may also include claims, causes of action, or matters that are normally raised in a civil action to the extent that the matters are related factually to the subject matter of the §850 petition. Prob C §855.

This proceeding may be used to seek a court order that property listed on a trust schedule, title to or possession of which was not formally transferred to the trust, is nevertheless a trust asset. This statute codifies the holding of Estate of Heggstad (1993) 16 CA4th 943, 20 CR2d 433, in which the court held that a written declaration of trust by the owner of real property that included an attached schedule listing a specific property was sufficient to create a trust in that property, and a transfer of title was unnecessary when a settlor declares himself or herself to be a trustee in his or her own property. See §15.40B for a sample form.[PAGE 1105]

§15.40A 2. PROBATE CODE §850(A)(3) PETITION

Petitions under Prob C §850(a)(3) follow the procedures stated in Prob C

NAME

Attorney at

Address

City, California ZIP

Telephone

Attorney for Petitioner

SUPERIOR COURT OF CALIFORNIA COUNTY OF CONTRA COSTA

In re THE SMITH LIVING TRUST |

Case No.: |

Under Agreement Dated |

PETITION FOR ORDER CONFIRMING |

|

SUCCESSOR TRUSTEE AND TRUST ASSETS |

June 1, 1994 |

(PROBATE CODE SECTION 850(a)(3)) |

|

Hearing Date: _ _[date]_ _ |

|

Time: _ _[time]_ _ |

|

Dep’t: _ _[number]_ _ |

|

Judge: _ _[if known]_ _ |

Petitioner, MARY SMITH, alleges that:

1.The Petitioner is the presently acting Trustee of THE SMITH LIVING TRUST UNDER AGREEMENT DATED JUNE 1, 1994. A true and correct copy of THE SMITH LIVING TRUST UNDER AGREEMENT DATED JUNE 1, 1994, is attached hereto as Exhibit “1” and incorporated herein by this reference.

2.JOHN SMITH died on January 1, 1995. Before his death, JOHN SMITH and his spouse, MARY SMITH,

were in the process of transferring title of all their assets into the Trust. On or about June 15, 1994, John Smith wrote to Peter Principle, his stockbroker at Merrill Lynch, and indicated they wished their account title changed into the name of the Trust. A copy of the June 15, 1994, letter to Peter Principle is attached hereto as Exhibit “2” and incorporated here by this reference.

3.Petitioner believes that the trust declaration under which she has been acting trustee is valid.

4.At Paragraph 1.03 of the trust instrument the Settlors, JOHN SMITH and MARY SMITH, declared that the property described in Schedule A, which is attached to the Trust Agreement at Page 18, is transferred in trust under the terms of the Agreement. The Schedule A lists, among other items, the Merrill Lynch brokerage account. In addition to signing the Trust Agreement both in their capacity as Settlors and as initial Cotrustees, JOHN SMITH and MARY SMITH also executed a document entitled “General Transfer and Assignment” on June 1, 1994. A true and correct copy of the General Transfer and Assignment is attached hereto as Exhibit “3” and incorporated herein by reference. Under the Assignment, the Settlors attempted to transfer and assign to the Cotrustees all of the Settlors’ interest in all tangible and intangible personal property of whatever nature and wherever situated. The general transfer was intended to specifically include stocks, bonds, mutual funds, and limited partnerships as set forth in Paragraph 2 on Page 1 of the General Transfer and Assignment.

5.Petitioner requests this Court confirm that the assets set forth in Exhibit “3” attached hereto be deemed to be assets subject to THE SMITH LIVING TRUST UNDER AGREEMENT DATED JUNE 1, 1994, and under the control of MARY SMITH as Successor Trustee. Petitioner believes that the assets described in Exhibit “3” are subject to her control as Trustee either under Schedule A attached to the Trust Agreement as part of the trust declaration or as validly transferred and assigned under the General Transfer and Assignment.

6.Settlor JOHN SMITH was gravely ill and dying from cancer at the time he implemented his estate plan. On June 1, 1994, the Settlors signed the Transfer and Assignment document and on June 15, 1994, Settlor JOHN SMITH instructed his stockbroker to transfer the account to the Trust. Settlor JOHN SMITH died before he could officially change the title to his Merrill Lynch account. Petitioner is informed and believes that it was the Settlors’ intention and understanding that the Settlors’ interest in the stocks, bonds, mutual funds, and partnership interests were intended to be in the trust under the General Transfer and Assignment and Schedule A of the Trust Agreement.

7.Settlor JOHN SMITH was a resident of Contra Costa County, California, at the time of his death. A true and correct copy of his death certificate is attached hereto as Exhibit “4” and incorporated herein by reference. The Successor Trustee, MARY SMITH, is a resident of Contra Costa County. The principal place of trust administration is in Contra Costa County.

8.Article Five, Paragraph 5.08 of THE SMITH LIVING TRUST UNDER AGREEMENT DATED JUNE 1, 1994, expressly provides that if one of the initial Cotrustees for any reason fails to qualify or ceases to act as Trustee, then the surviving Cotrustee should act as Successor Trustee. On January 5, 1995, the named Successor Trustee, MARY SMITH, executed an Acceptance of Trust by Successor Trustee, a copy of which is attached hereto as Exhibit “5.” Petitioner requests that the Court confirm the appointment of MARY SMITH as Successor Trustee. The Trust Agreement states that no bond is required of any Trustee (Article Five, Paragraph 5.03).

9.The names, addresses, and ages of the beneficiaries of THE SMITH LIVING TRUST UNDER AGREEMENT DATED JUNE 1, 1994, as well as their relationship to the Settlors are set forth below:

Mary Smith, Surviving Spouse 123 Main Street Anytown, CA

John Smith, Jr., Adult Son 1925 Sandy Rose Court Anytown, CA

Nancy Doe, Adult Daughter 1940 Sandy Rose Court Anytown, CA

Peter Smith, Adult Son 3421 Santa Maria Avenue Anytown, CA

WHEREFORE, Petitioner prays for an Order of this Court that:

1.THE SMITH LIVING TRUST UNDER AGREEMENT DATED JUNE 1, 1994, is valid;

2.The assets set forth on Exhibit “3” are assets subject to the management and control of MARY SMITH, as Successor Trustee of THE SMITH LIVING TRUST UNDER AGREEMENT DATED JUNE 1, 1994, under the General Transfer and Assignment document or under Schedule A of the Trust Agreement; and

3.Such other orders as the Court deems just and proper.

Dated: _ _[date]_ _

________________________ MARY SMITH, Trustee of The

Smith Living Trust Under Agreement Dated June 1, 1994

Form Characteristics

| Fact Name | Detail |

|---|---|

| Governing Law | The Petition form is governed by Probate Code §850(a)(3) and related sections (§850-859). |

| Eligibility to File | Trustees or any interested person can file a §850 petition when disputes regarding property ownership arise. |

| Purpose of the Petition | The petition seeks a court order to confirm property as part of a trust, which was not formally transferred. |

| Relation to Civil Action | Claims in a §850 petition can include matters typically addressed in civil actions if related to the petition's facts. |

| Example Case | The holding in Estate of Heggstad (1993) established that a trust can be recognized even without formal property transfer. |

Guidelines on Utilizing Sample Of 850 Petition

Completing the Sample of 850 Petition form is a crucial process for managing the assets within a trust. This form needs to be filled out accurately to ensure that all relevant information is presented to the court for consideration. Below are structured steps to guide you through this process.

- Obtain the Form: Acquire the Sample of 850 Petition form from a reliable source, such as the court's website or your attorney.

- Fill in Your Information: At the top of the form, write your name, address, and telephone number. This information identifies who is filing the petition.

- Enter Attorney Details: If you are being represented by an attorney, include their name, address, bar number, and contact details just below your information.

- Specify the Court: Indicate the name of the court, such as "SUPERIOR COURT OF CALIFORNIA," and the "COUNTY OF CONTRA COSTA."

- Case Details: In the designated section, write "In re THE SMITH LIVING TRUST" followed by the case number and relevant dates.

- Petition Content: Start detailing your allegations in the form, reaffirming your role, and referencing the attached exhibits, such as the trust document and any transfer assignments.

- Summarize Key Points: Clearly outline the reasons why you are filing the petition. Use concise statements regarding the appointment of a successor trustee, the validity of the trust, and the management of trust assets.

- Beneficiary Information: Fill in the names, addresses, ages, and relationships of the beneficiaries of the trust as required on the form.

- Signature: Conclude by signing the form and dating it, confirming that all information provided is correct to the best of your knowledge.

- Attach Exhibits: Ensure you include all referenced exhibits, such as the trust agreement and death certificate, as attachments.

- Review the Form: Before submitting, review the completed petition for any errors or missing information.

- File the Petition: Submit the completed form at the court clerk's office, along with any required filing fees.

Once you have submitted the petition, the clerk will set a hearing date. It is essential to comply with notification requirements to inform all interested parties regarding the hearing. This ensures that the petition proceeds smoothly through the court system.

What You Should Know About This Form

What is the purpose of the Probate Code §850(a)(3) petition?

The purpose of a Probate Code §850(a)(3) petition is to clarify the ownership and control of property that is claimed to be part of a trust. A trustee or any interested person can file this petition when there are disputes about who holds title to real or personal property related to the trust. This could involve situations where the trustee possesses property that someone else claims as theirs, or where property belonging to the trust is claimed by a creditor of the trust's settlor. The petition helps to resolve these claims in court.

Who can file a §850 petition?

A §850 petition can be filed by a trustee or any interested person. This might include beneficiaries or other individuals who have a legal interest in figuring out the rightful ownership of trust property. If you believe you have a stake in the property in question, you may have the right to file such a petition.

What types of property can be included in a §850 petition?

Any type of property that is related to the trust can be included in a §850 petition. This includes real property like land or buildings, as well as personal property such as bank accounts, stocks, and bonds. If there are specific claims about whether certain assets are indeed part of the trust, these can be addressed directly through the petition.

What information must be included in the petition?

The petition must include verified facts that support your claim, such as the names and addresses of individuals entitled to notice, and a clear explanation of your basis for the petition. The court needs to understand the relationship of the parties involved and the specifics of the property dispute. This ensures that any interested parties are informed of the proceedings and have a chance to respond.

How does the hearing process work once a §850 petition is filed?

Once the §850 petition is filed, the clerk of the court sets a date for the hearing. During this hearing, the court will examine the petition details, hear arguments from both parties, and make a decision about the claims made. It is essential for all relevant parties to be notified about this hearing, as it allows for a fair and just resolution of the matter.

What is the significance of the Estate of Heggstad case in relation to a §850 petition?

The Estate of Heggstad case is significant because it established that a trust could be recognized even if the title of the property was not formally transferred into the trust before the settlor's death. This means that a written declaration of trust, supported by a clear listing of the assets, can suffices to establish ownership. The §850 petition allows interested parties to seek confirmation of such assets, ensuring they are correctly recognized under the trust, even if there have been complications with formal transfers.

Common mistakes

When completing the Sample of 850 Petition form, individuals often make several common mistakes that can delay their case or lead to legal complications. Awareness of these pitfalls can facilitate a smoother submission process, ensuring all necessary details are correctly provided.

Missing Required Information is a frequent error. Petitions must include specific details such as the names and addresses of all parties entitled to notice. Omitting any of this information can lead to the court rejecting the petition, as proper notification is essential for judicial proceedings.

Another mistake involves incomplete or incorrect documentation. Every petition must reference supporting documents and include verified copies of essential items, like trust agreements and death certificates. If the required attachments are missing or not correctly cited, this can sabotage the petition’s legitimacy.

People also often fail to provide adequate background information. The court requires a clear explanation of the circumstances behind the petition. This includes detailing the trustee's claims and the relevance of the property in question. Inadequate context may lead to misunderstandings or a lack of clarity regarding the petition's intent.

Moreover, some petitioners neglect to address jurisdictional requirements. It's crucial to confirm that the petition is filed in the correct court, as jurisdiction plays a vital role in the validity of the proceedings. Filing in the wrong jurisdiction can result in unnecessary delays and additional expenses.

Lastly, submitting the form without a clear legal basis often leads to unnecessary complications. It’s important to articulate the grounds upon which the petition is based, as the court needs to understand why the request is being made. Without a compelling rationale, the petition may be dismissed or require further amendments.

Documents used along the form

The Sample of 850 Petition form is a significant document used in certain probate proceedings. It often works alongside various other forms and documents to provide a comprehensive legal approach. Below is a list of related documents that may commonly accompany the Petition for Order Confirming Successor Trustee and Trust Assets.

- Trust Declarations: This document outlines the formation and terms of the trust. It includes details about the trust's beneficiaries, trustees, and the property held within the trust.

- General Transfer and Assignment: This document serves as a formal agreement transferring assets into the trust. It typically covers various types of property, both tangible and intangible, and signifies the intent to assign these assets to the trustees.

- Death Certificate: A certified copy of the death certificate of the settlor or individual connected to the trust. This document proves the settlor's death, which is important for the trust's administration.

- Acceptance of Trust: This document is executed by the successor trustee and signifies their acceptance of the role. It confirms that the successor trustee agrees to manage the trust's assets according to its terms.

- Schedule A: A schedule of the assets that are included in the trust. This list is essential for the court to understand what property should be managed under the trust agreement.

- Proof of Notice: This document demonstrates that all interested parties have been notified of the probate proceedings. It typically details the manner and timing of the notice provided to beneficiaries and other relevant individuals.

- Petitioner’s Declaration: A statement from the petitioner (the person filing the petition) outlining their belief in the validity of the trust and their entitlements under it. This document adds personal context and support to the petition.

- Court Order: A formal order issued by the court that confirms the contents of the petition. This document is crucial for carrying out any actions directed by the court.

- Beneficiary Information: A document detailing the names, addresses, and relationships of each beneficiary. This information helps ensure that all parties have been considered in the proceedings.

Each of these documents plays a role in establishing the legitimacy of the trust and ensures that the proceedings comply with applicable laws. They work together to streamline the process and provide clarity to all parties involved.

Similar forms

- Probate Code §850(d) Petition: Similar to the Sample of 850 Petition, this document addresses claims related to property transactions involving trusts. It allows individuals to seek judicial confirmation regarding the validity of trust-related assets.

- Probate Code §17200 Petition: This type of petition is used to request the court's intervention in trust administration. Much like the Sample of 850 Petition, it can involve disputes over trust property and the duties of trustees.

- Will Contest Petition: This document allows interested parties to contest the validity of a will. Similar to the Sample of 850 Petition, it engages the court to clarify ownership and intentions regarding property distribution.

- Petition for Instructions: This petition is used when a trustee requires guidance on how to proceed with trust management. Like the Sample of 850 Petition, it seeks a court’s directive on matters related to trust assets.

- Petition for Accounting: Individuals use this document to request an accounting of trust assets from a trustee. It serves a similar purpose as the Sample of 850 Petition by ensuring transparency and accuracy in trust management.

- Transfer of Property Petition: This petition is filed to seek approval for the transfer of property into a trust. As with the Sample of 850 Petition, it aims for judicial confirmation regarding property ownership under trust rules.

- Petition for Removal of Trustee: This document allows beneficiaries to request the removal of a trustee. Like the Sample of 850 Petition, it addresses issues of trust property and fiduciary responsibility.

- Petition for Modification of Trust: Individuals can modify trust terms via this petition. Similarly, the Sample of 850 Petition addresses changes and clarifications related to trust assets and their management.

- Civil Action Complaint: While more general, this complaint can be filed for disputes similar to those in trust petitions. Both seek judicial intervention regarding property and rightful ownership.

- Petition for Settlement of Accounts: This petition is aimed at resolving disputes over an estate's financial accounts. In the same vein as the Sample of 850 Petition, it ensures proper estate management and accountability.

Dos and Don'ts

When filling out the Sample Of 850 Petition form, it is crucial to follow certain guidelines to ensure the process goes smoothly. Below is a list of dos and don’ts to keep in mind.

Things You Should Do:

- Carefully read the instructions provided with the petition form to understand the requirements.

- Double-check all personal and contact information for accuracy before submitting the form.

- Clearly state the grounds for your petition, ensuring they align with the Probate Code §850(a)(3).

- Attach all necessary documents such as the trust declaration and death certificate to support your petition.

Things You Shouldn't Do:

- Do not skip any sections of the form, as incomplete forms can lead to delays and complications.

- Avoid using unclear or vague language in your statements; clarity is key.

- Do not submit the petition without making copies of all documents for your records.

- Never forget to check the court's deadlines for filing your petition to avoid missing important dates.

Misconceptions

- Misconception 1: Only lawyers can file a §850 petition.

- Misconception 2: The §850 petition is only for disputes over property.

- Misconception 3: The assets listed in a trust automatically become trust property.

- Misconception 4: A §850 petition is a lengthy and complicated process.

While legal representation can be helpful, anyone who meets the criteria outlined in the petition can file it. Interested persons, like beneficiaries or trustees, have the right to submit the petition themselves.

This petition can address a variety of issues. It may include claims related to property or even causes of action typically seen in civil cases, as long as they connect to the primary subject matter of the petition.

This isn’t always the case. If specific titles or assets have not been formally transferred to the trust, a §850 petition may be required for the court to determine that those assets count as part of the trust.

Though it might seem daunting, understanding the steps can simplify the process. Filing a verified petition and gathering necessary documentation is manageable, especially if you stay organized and follow the outlined procedures.

Key takeaways

- Understand the purpose: The Sample Of 850 Petition form addresses claims about property belonging to a trust.

- Identify eligibility: A trustee or any interested individual can file this petition.

- Review grounds for filing: The petition can state that a trustee holds property claimed by another or that trust property is subject to a creditor of the settlor.

- Include related claims: This petition allows for the inclusion of civil claims related to the trust's property.

- File a verified petition: Start the process by submitting a petition verifying the facts and including parties that need notice.

- Set a hearing date: The court clerk schedules a hearing date once the petition is filed.

- Present documentation: Attach relevant documents like the trust agreement and any transfer assignments as exhibits.

- Confirm trustee status: The petition can request the court to confirm the appointment of a successor trustee.

- Detail beneficiaries: Clearly list all beneficiaries, including their relationships to the settlor.

Browse Other Templates

Where to Get Pay Stubs - Your paycheck stub is easily accessible online with ePayStub.

Head to Toe Assessment Form - Recognize the importance of each key skill listed.