Fill Out Your Sample Profit Loss For Taxi Form

The Sample Profit & Loss for Taxi form serves as a crucial financial document for taxi businesses, whether independently operated or contracted to drivers. This form provides a comprehensive breakdown of all income streams, including taxi fares and tips received from passengers. It captures various operating and non-operating income, allowing business owners to monitor their financial performance effectively. Additionally, expenses related to fuel, maintenance, LTA fees, and depreciation are meticulously detailed, giving a clear picture of operating costs. Several key sections highlight total income and total expenses, ultimately leading to the calculation of net profit before tax. This form also differentiates between personal and business expenses, ensuring that private use of the taxi is accounted for appropriately. Overall, the Sample Profit & Loss for Taxi form is designed to facilitate the tracking and management of finances in the taxi industry, providing invaluable insights for owners and stakeholders alike.

Sample Profit Loss For Taxi Example

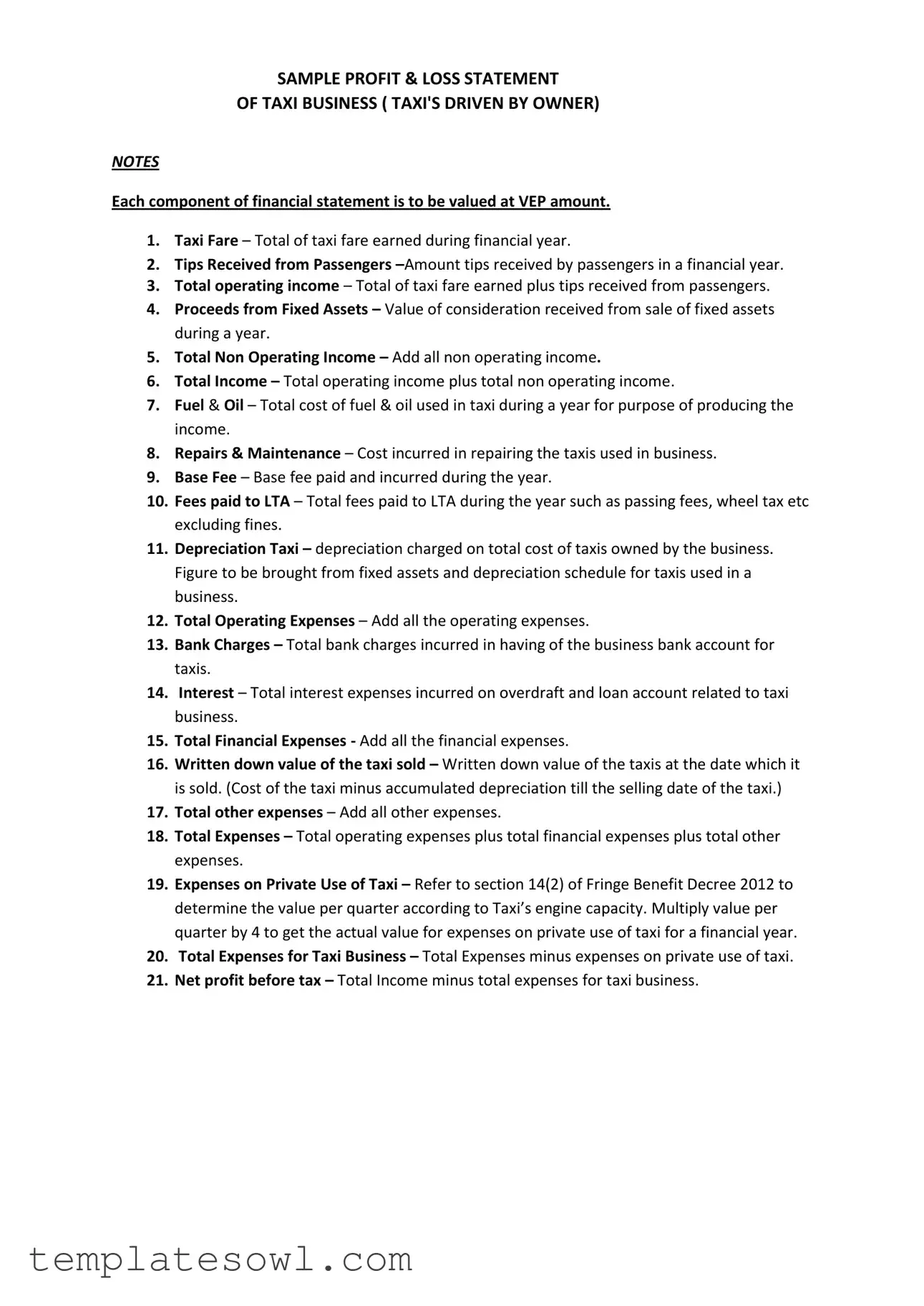

SAMPLE PROFIT & LOSS STATEMENT

OF TAXI BUSINESS ( TAXI'S DRIVEN BY OWNER)

NOTES

Each component of financial statement is to be valued at VEP amount.

1.Taxi Fare – Total of taxi fare earned during financial year.

2.Tips Received from Passengers

3.Total operating income – Total of taxi fare earned plus tips received from passengers.

4.Proceeds from Fixed Assets – Value of consideration received from sale of fixed assets during a year.

5.Total Non Operating Income – Add all non operating income.

6.Total Income – Total operating income plus total non operating income.

7.Fuel & Oil – Total cost of fuel & oil used in taxi during a year for purpose of producing the income.

8.Repairs & Maintenance – Cost incurred in repairing the taxis used in business.

9.Base Fee – Base fee paid and incurred during the year.

10.Fees paid to LTA – Total fees paid to LTA during the year such as passing fees, wheel tax etc excluding fines.

11.Depreciation Taxi – depreciation charged on total cost of taxis owned by the business. Figure to be brought from fixed assets and depreciation schedule for taxis used in a business.

12.Total Operating Expenses – Add all the operating expenses.

13.Bank Charges – Total bank charges incurred in having of the business bank account for taxis.

14.Interest – Total interest expenses incurred on overdraft and loan account related to taxi business.

15.Total Financial Expenses - Add all the financial expenses.

16.Written down value of the taxi sold – Written down value of the taxis at the date which it is sold. (Cost of the taxi minus accumulated depreciation till the selling date of the taxi.)

17.Total other expenses – Add all other expenses.

18.Total Expenses – Total operating expenses plus total financial expenses plus total other expenses.

19.Expenses on Private Use of Taxi – Refer to section 14(2) of Fringe Benefit Decree 2012 to

dete i e the value pe ua te acco di g to Ta i’s e gi e capacit . Multiply value per quarter by 4 to get the actual value for expenses on private use of taxi for a financial year.

20.Total Expenses for Taxi Business – Total Expenses minus expenses on private use of taxi.

21.Net profit before tax – Total Income minus total expenses for taxi business.

SAMPLE PROFIT & LOSS STATEMENT

OF TAXI BUSINESS (CONTRACTED TO DRIVER)

NOTES

Each component of financial statement is to be valued at VEP amount.

1.Taxi Income – Total taxi income received from drivers during the financial year.

2.Proceeds from Fixed Assets – Value of consideration received from sale of fixed assets during a year.

3.Total Non Operating Income – Add all non operating income.

4.Total Income – Total operating income plus total non operating income.

5.Repairs & Maintenance – Cost incurred in repairing the taxi used in business.

6.Base Fee – Base fee paid and incurred during the year.

7.Fees paid to LTA – Total fees paid to LTA during the year such as passing fees etc excluding fines.

8.Depreciation Taxi – depreciation charged on total cost of taxis owned by the business. Figure to be brought from fixed assets and depreciation schedule for taxis used in a business.

9.Total Operating Expenses – Add all the operating expenses.

10.Bank Charges – Total bank charges incurred in having of the business bank account for taxis.

11.Interest – Total interest expenses incurred on overdraft and loan account related to taxi business.

12.Total Financial Expenses - Add all the financial expenses.

13.Written down value of the taxi sold – Written down value of the taxis at the date which it is sold. (Cost of the taxi minus accumulated depreciation till the selling date of the taxi.)

14.Total other expenses – Add all other expenses.

15.Total Expenses – Total operating expenses plus total financial expenses plus total other expenses.

16.Expenses on Private Use of Taxi – Refer to section 14(2) of Fringe Benefit Decree 2012 to

dete i e the value pe ua te acco di g to Ta i’s e gi e capacit . Multipl value pe

quarter by 4 to get the actual value for expenses on private use of taxi for a financial year.

17.Total Expenses for Taxi Business – Total Expenses minus expenses on private use of taxi.

18.Net profit before tax – Total Income minus total expenses for taxi business.

SAMPLE BALANCE SHEET

OF TAXI BUSINESS

NOTES

Each component of financial statement is to be valued at VEP amount.

1.Cash at Bank - This closing bank balance of a year from the bank reconciliation or bank statement which is ending balance as at 31st December.

2.Cash on Hands - Ending balance, as at 31 December of cash held on hand.

3.Debtors – Amount of money owed to your business by individual or organisation as at end of current financial year.

4.Insurance in advance – Amount of insurance expenses paid in advance for taxi insurance before it has been incurred.

5.Total Current Assets - Add all current assets.

6.Taxi

7.Accumulated Depreciation - Total depreciation on taxis from date of acquisition till year end date.

8.Cost of taxis less accumulated depreciation on taxis (Written down Value).

9.Land – Historical cost of land owned by you or your business.

10.Building – Value of building owned by you for personal use.

11.Accumulated Depreciation - Total depreciation on building from date of acquisition till year end date.

12.Value of building less accumulated depreciation on building (Written down Value).

13.Motor Vehicle – Value of all motor vehicles owned you for personal use valued at purchase price.

14.Accumulated Depreciation - Total depreciation on motor vehicle from date of acquisition till year end date.

15.Purchase price of motor vehicle less accumulated depreciation on motor vehicle (Written down Value).

16.Total Fixed Assets – Total of written down value of all assets plus value of land.

17.Total Assets – Current assets plus fixed assets.

18.Creditors – Total amount of money owed by you or your business to individuals (including friends and relatives) and organization which can be paid within 12 months period.

19.Total Current Liabilities - Total amount of all current liabilities.

20.Loan payable – Amount of loan is to be paid as at end of the year either payable to financial institution or any other party (including friends and relatives).

21.Taxi loan payable – Amount of loan to be paid for taxi as at end of the year either payable to financial institution or any other party (including friends and relatives).

22.Total Long Term Liabilities – Add all long term liabilities.

23.Total Liabilities – Total current liabilities plus total long term liabilities.

24.Net Assets – Total assets minus total liabilities.

25.Beginning Capital – Amount of capital at the start of this financial year (closing capital of last financial year).

26.Net Profit after income tax – Net profit of the current year after income tax has been subjected to it.

27.Beginning capital plus net profit after income tax.

28.Drawings – Total value of cash taken by owner from the business for personal use during the year.

29.Closing Equity – Beginning capital plus net profit after income tax minus drawings.

Form Characteristics

| Fact Name | Description |

|---|---|

| Taxi Fare | This represents the total taxi fare earned during the financial year. It is crucial for assessing revenue generation. |

| Total Operating Income | The sum of taxi fare and tips received from passengers, indicating overall income from operations. |

| Total Non-Operating Income | This includes any income not generated from regular taxi operations, reflecting additional revenue streams. |

| Total Income | Calculated by adding total operating income and total non-operating income, this figure shows overall financial performance. |

| Total Operating Expenses | The sum of all expenses incurred in running the taxi business, essential for assessing profitability. |

| Net Profit Before Tax | This figure is derived from total income minus total expenses, indicating the profitability available before taxation. |

| Private Use Expense Calculation | The value for expenses on private use is determined by section 14(2) of the Fringe Benefit Decree 2012, which impacts tax considerations. |

| Governing Laws | For state-specific forms, regulations, such as local tax laws and operational mandates, must be observed in financial reports. |

Guidelines on Utilizing Sample Profit Loss For Taxi

Filling out the Sample Profit Loss for Taxi form requires a careful approach to ensure accurate reporting of your taxi business finances. Completing this form will help reveal your financial performance over the year, providing insights into your income and expenses. Here’s a step-by-step guide on how to fill it out effectively.

- Gather your financial data for the fiscal year, including taxi fare earnings, tips, operating income, and expense records.

- Start with Taxi Fare section: Enter the total amount earned from taxi fares during the year.

- Next, input the Tips Received: Record the total amount of tips received from passengers.

- Add these two amounts together for your Total Operating Income.

- Include Proceeds from Fixed Assets: If you sold any fixed assets, document the income received from those sales.

- Sum the non-operating income for Total Non Operating Income.

- Calculate Total Income by adding the Total Operating Income and Total Non Operating Income together.

- Document the costs under Fuel & Oil: Enter your total fuel and oil expenses for the year.

- Include Repairs & Maintenance costs for any repairs made to your taxis during the year.

- Record the Base Fee incurred during the year.

- List Fees paid to LTA, including any passing fees or wheel tax, excluding fines.

- Document Depreciation Taxi using the figures from your depreciation schedule.

- Add all operating expenses together to find your Total Operating Expenses.

- Document Bank Charges associated with maintaining your business bank account.

- Input the Interest incurred on any loans or overdrafts related to your taxi business.

- Sum all financial expenses to determine Total Financial Expenses.

- Calculate the Written Down Value of the Taxi Sold by subtracting accumulated depreciation from the sale price of any taxis sold.

- Add any Total Other Expenses incurred throughout the business year.

- Add up all expenses to find the Total Expenses.

- Reference section 14(2) of the Fringe Benefit Decree 2012 to determine Expenses on Private Use of Taxi, and adjust your totals accordingly.

- Calculate Total Expenses for Taxi Business by subtracting expenses on private use from Total Expenses.

- Finally, calculate your Net Profit Before Tax by subtracting Total Expenses for Taxi Business from Total Income.

What You Should Know About This Form

What is a Sample Profit Loss For Taxi form?

The Sample Profit Loss For Taxi form is a financial statement that summarizes the income and expenses of a taxi business owned by an individual or contracted to a driver. This document provides insight into the financial health of the business, helping owners track earnings, operating costs, and ultimately calculate the net profit before tax for the year.

How do I calculate Total Operating Income?

Total Operating Income is calculated by summing all taxi fares earned during the financial year and the tips received from passengers. This figure offers a clear picture of the revenue generated from operations before any expenses are deducted.

What expenses are included in Total Operating Expenses?

Total Operating Expenses consists of all the costs related to running the taxi business. These typically include costs for fuel and oil, repairs and maintenance, base fees, and fees paid to the Local Transport Authority (LTA). By understanding these expenses, owners can identify areas for potential savings or efficiency improvements.

How is Depreciation on the taxi calculated?

Depreciation is calculated based on the total cost of each taxi owned by the business and reduces this amount over time to reflect the wear and tear on the vehicle. Owners typically refer to their fixed assets and depreciation schedule to determine the correct figure for each financial year.

What does the term 'Net profit before tax' mean?

Net profit before tax represents the difference between total income and total expenses for the taxi business. This value indicates the operational success of the business before accounting for tax obligations, allowing owners to gauge profitability.

How should I handle Expenses on Private Use of Taxi?

To determine the expenses related to private use of the taxi, refer to the applicable regulations, such as the Fringe Benefit Decree. Multiply the value per quarter by four to arrive at the full annual amount. It's crucial to accurately account for these costs, as they can affect your taxable income.

What documentation should I keep in order to support my Profit Loss statement?

Maintaining detailed and accurate documentation is essential. Keep records of all taxi fares, tips, invoices for repairs and maintenance, receipts for fuel purchases, and any fees paid to authorities. This documentation provides concrete evidence for the figures reported on the Profit Loss statement and aids in compliance with tax regulations.

Common mistakes

Filling out the Sample Profit Loss for Taxi form can be challenging, and errors can have significant consequences for your financial reporting. One common mistake is failing to include all sources of income. It’s essential to report not just the taxi fares, but also any tips received and proceeds from fixed assets. If you overlook tips or sales from old taxi vehicles, your total income will not accurately reflect your business's performance.

Another frequent error is miscalculating total expenses. People might add up their fuel and oil costs but forget to include other operating expenses, such as repairs, maintenance, and base fees. It's crucial to ensure that every single expense is accounted for to avoid overstating profits or underestimating expenses.

Many also struggle with the depreciation calculations. Depreciation must be consistently and accurately computed for all vehicles owned. Failing to do so can lead to errors in both total expenses and net profit before tax. Maintaining detailed depreciation schedules will help in getting accurate figures and will support your financial statements.

Incorrectly categorizing expenses is another mistake people often make. For instance, some might mislabel personal use expenses as business expenses. This can lead to complications if the IRS questions your filings, leading to potential audits or penalties. Always refer to the appropriate guidelines for categorizing your expenses accurately.

Additionally, individuals sometimes skip the calculation for private use of the taxi. It's critical to follow the prescribed method to ascertain the value of expenses related to personal use. This step ensures that you’re compliant with tax regulations and that your business remains transparent in its financial dealings.

People frequently overlook the importance of reviewing their forms before submission. Small errors, such as transposing numbers or mathematical mistakes, can lead to significant inaccuracies in your financial reports. A comprehensive review process can help catch these mistakes before they cause issues down the road.

Lastly, many individuals fail to keep accurate records throughout the year. Instead of waiting until the end of the financial year to gather information, maintaining organized records on an ongoing basis simplifies the process significantly. Good record-keeping makes filling out the Profit Loss form much less daunting and increases the reliability of your financial reports.

Documents used along the form

The management of a taxi business involves careful financial tracking and documentation. Along with the Sample Profit & Loss for Taxi form, several other forms and documents play critical roles in providing a comprehensive view of the business's financial health. Here’s a brief overview of these essential documents.

- Balance Sheet - This document summarizes the business's assets, liabilities, and equity at a specific point in time. It helps gauge the financial stability and liquidity of the taxi operation.

- Income Statement - This provides a detailed look at revenue and expenses over a specific period, further elaborating on the business's profitability, just like the profit and loss statement.

- Cash Flow Statement - It illustrates how cash moves in and out of the business, showing how funds are generated and spent over time. This is crucial for managing day-to-day operations.

- Driver Contracts - These agreements outline the terms between taxi owners and drivers, including pay rates, responsibilities, and expectations, helping in legal compliance and operational efficiency.

- Taxi Maintenance Records - Documenting repairs and maintenance ensures accountability and helps maintain the vehicles in optimal condition, impacting operational reliability.

- Insurance Policies - These documents outline coverage details, premium payments, and claims procedures, protecting the business from unforeseen liabilities.

- Tax Returns - The filed returns provide a comprehensive view of the income earned and taxes owed, which is crucial for compliance and financial planning.

- Asset Depreciation Schedules - They track the depreciation of each taxi and related assets, giving insight into asset value and tax implications over time.

- Bank Statements - Monthly statements from the financial institution validate transactions and cash balances, supporting financial accuracy.

- Expense Receipts - Keeping receipts for all business-related expenses helps in tracking costs accurately, necessary for expense reporting and tax deductions.

In summary, using these documents alongside the Sample Profit & Loss for Taxi form contributes to a well-rounded financial management strategy. Proper documentation is essential for operational success, compliance, and informed decision-making in the taxicab industry.

Similar forms

Here are four documents that the Sample Profit & Loss for Taxi form is similar to, along with specific comparisons:

- Sample Profit & Loss Statement of Other Businesses: Much like the taxi form, this document outlines income and expenses, providing a clear overview of financial performance over a specific period. It details operating income, non-operating income, and total expenses, just like the taxi statement.

- Sample Cash Flow Statement: Similar to the taxi profit and loss form, a cash flow statement tracks the flow of cash in and out of a business. It separates operating, investing, and financing activities, which helps in understanding how cash is generated and used, mirroring the income and expenses concept.

- Sample Income Statement for Rental Properties: This document shares similarities by listing income sources, like rents received, alongside detailed expenses such as maintenance and repairs. Both aim to calculate net income, providing essential insights into profitability.

- Sample Budget Report: A budget report serves as a plan for future income and expenses. It resembles the taxi profit and loss statement by projecting revenues from fares and expenses like fuel and maintenance, helping in managing financial expectations effectively.

Dos and Don'ts

When filling out the Sample Profit & Loss for Taxi form, keep these things in mind:

- Do provide accurate figures for all income and expenses. Ensure that your totals reflect the actual amounts earned and spent.

- Do separate business from personal expenses. Clearly identify and only include taxi-related costs.

- Do double-check all calculations. Errors in addition or subtraction can significantly affect your financial picture.

- Do maintain proper documentation. Keep receipts and records as proof of income and expenses for future reference.

- Don't forget to include all income sources. This includes fare earnings, tips, and any non-operating income.

- Don't estimate expenses. Provide actual figures based on your records instead of approximations.

- Don't neglect applicable fees. Ensure you include all fees paid to the LTA and any other mandatory expenses.

- Don't ignore depreciation. Accurately calculate and include depreciation for all vehicles owned.

Misconceptions

Misconceptions about the Sample Profit Loss Form for a taxi business can lead to confusion and misinterpretation of financial performance. Here are six common misunderstandings, along with clarifications:

- 1. All income is considered operational. Many people think that any income generated counts as operational income. In reality, non-operating income, like proceeds from fixed assets, is included separately and should not be mixed with operational income.

- 2. Tips are not significant in profit-loss calculations. Some taxi operators underestimate the impact of tips on their overall income. However, tips received from passengers contribute significantly to total operating income and should not be overlooked.

- 3. Private use expenses are irrelevant. There's a misconception that expenses for private use of a taxi don't matter in profit-loss statements. In fact, these expenses must be accounted for to determine the true profitability of the taxi business.

- 4. Depreciation only relates to fixed assets. Many believe that depreciation only applies to physical assets like taxis or buildings. However, depreciation should also be carefully calculated and included for all applicable assets, impacting the total profit or loss.

- 5. Total Expenses equals operational costs plus fixed costs only. A common mistake is assuming Total Expenses merely combines operating costs and fixed costs. Total Expenses actually encompass all operational, financial, and other related expenses, leading to a complete picture of business expenditure.

- 6. Calculating Net Profit is simple addition and subtraction. Some assume that calculating Net Profit before tax is straightforward. It involves more than just subtracting total expenses from total income; it requires considering various elements such as depreciation and private use costs.

Understanding these misconceptions is crucial for effectively managing and evaluating a taxi business's financial health. Addressing these points can help ensure that operators maintain accurate and insightful financial records.

Key takeaways

When completing the Sample Profit Loss Form for your taxi business, there are some essential points to remember. These takeaways will help ensure that you fill out the form accurately and use it effectively.

- Accurate Revenue Reporting: Report all income items accurately. This includes taxi fare earned, tips received, and any proceeds from fixed assets. Sum these to get the total operating income.

- Total Expenses Counting: Be sure to document all relevant expenses. This includes costs like fuel, maintenance, and fees paid to the Local Transport Authority (LTA). Remember to differentiate between operating expenses and financial expenses.

- Non-Operating Income: Don’t overlook non-operating income. Include any additional income sources when calculating your total income, as they contribute to the overall profitability of your taxi operation.

- Net Profit Calculation: After listing all income and expenses, calculate your net profit before tax. This is a significant indicator of your taxi business’s financial health and will guide future decisions.

- Expenses on Private Use: Keep track of the expenses associated with any private use of the taxi. Ensure you refer to the regulations to fairly assess these costs, as they will factor into your total business expenses.

By following these key takeaways, you will create a clear financial picture of your taxi business. This approach ultimately lays the groundwork for informed decision-making and financial planning.

Browse Other Templates

What Is a Salvaged Car Title - The MV-426B allows for customization requests, reflecting the unique nature of street rods and collectibles.

Az New Hire - Secure handling of personal information is prioritized in the reporting process.

Gonzaga Admission Requirements - This form is essential for requesting your Gonzaga University transcripts.