Fill Out Your Sample Undertaking Form

The Sample Undertaking form is an essential document designed for individuals and entities engaging in foreign exchange transactions under the jurisdiction of the Foreign Exchange Management Act (FEMA) of 1999. This form plays a crucial role in ensuring compliance with regulatory requirements by requiring the declarant to affirm that the specified transaction is not meant to contravene any provisions of FEMA or related regulations. By filling out this form, the applicant commits to providing all necessary information and documentation to validate the transaction and uphold the requirements outlined in the declaration. It is important to note that failure to furnish satisfactory compliance may lead to the refusal of the transaction by the Bank, which could escalate to reporting the matter to the Reserve Bank of India if there’s suspicion of non-compliance. Additionally, only authorized personnel can sign this declaration on behalf of an organization, ensuring that all representations made are legitimate and backed by proper authority. The form also includes sections for detailing the nature and purpose of the foreign exchange transaction, as well as other essential elements such as the transaction amount and beneficiary information, making it a comprehensive tool for regulatory adherence.

Sample Undertaking Example

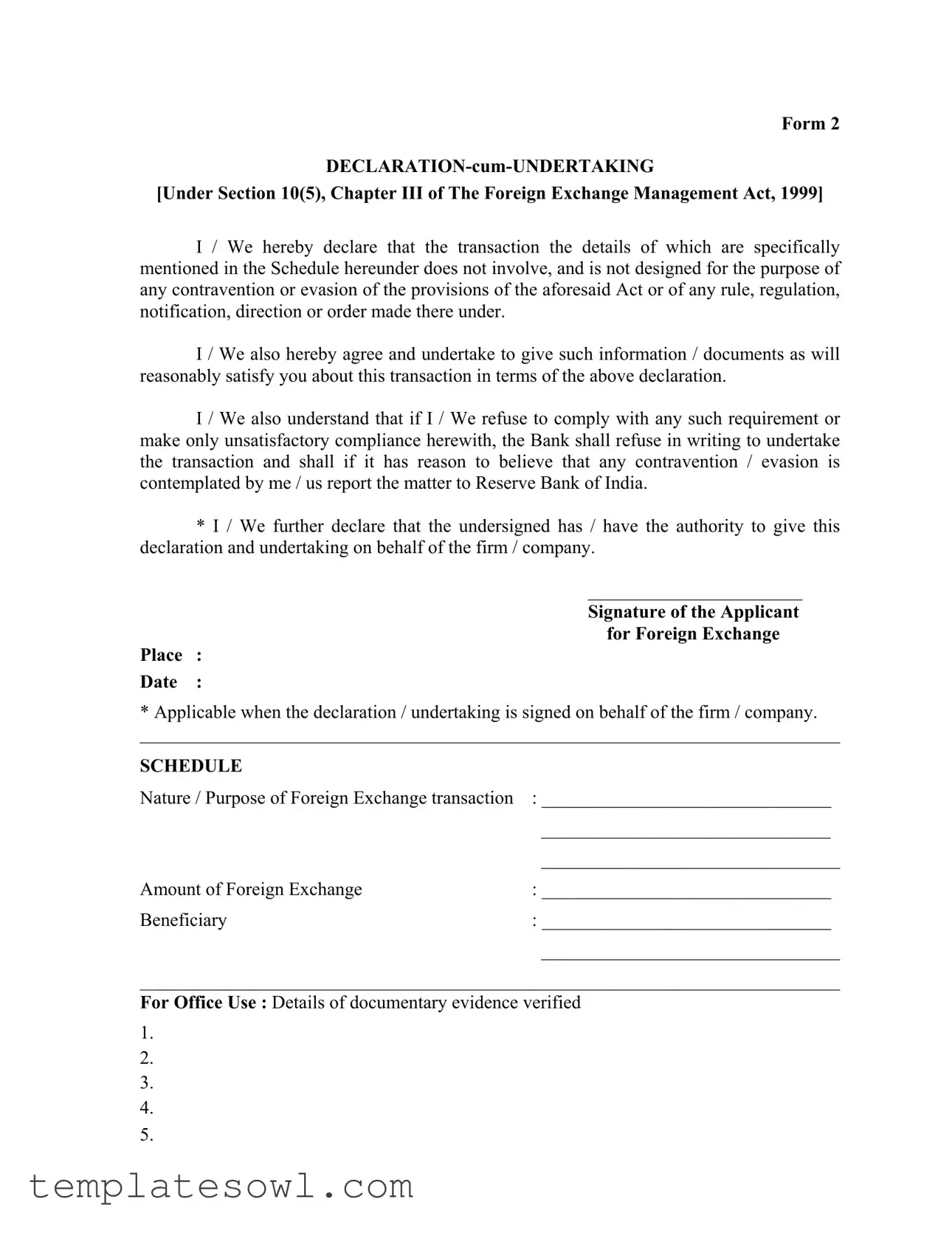

Form 2

[Under Section 10(5), Chapter III of The Foreign Exchange Management Act, 1999]

I / We hereby declare that the transaction the details of which are specifically mentioned in the Schedule hereunder does not involve, and is not designed for the purpose of any contravention or evasion of the provisions of the aforesaid Act or of any rule, regulation, notification, direction or order made there under.

I / We also hereby agree and undertake to give such information / documents as will reasonably satisfy you about this transaction in terms of the above declaration.

I / We also understand that if I / We refuse to comply with any such requirement or make only unsatisfactory compliance herewith, the Bank shall refuse in writing to undertake the transaction and shall if it has reason to believe that any contravention / evasion is contemplated by me / us report the matter to Reserve Bank of India.

*I / We further declare that the undersigned has / have the authority to give this declaration and undertaking on behalf of the firm / company.

_______________________

Signature of the Applicant

for Foreign Exchange

Place :

Date :

*Applicable when the declaration / undertaking is signed on behalf of the firm / company.

___________________________________________________________________________

SCHEDULE |

|

Nature / Purpose of Foreign Exchange transaction |

: _______________________________ |

|

_______________________________ |

|

________________________________ |

Amount of Foreign Exchange |

: _______________________________ |

Beneficiary |

: _______________________________ |

|

________________________________ |

___________________________________________________________________________

For Office Use : Details of documentary evidence verified

1.

2.

3.

4.

5.

Form Characteristics

| Fact Name | Detail |

|---|---|

| Governing Law | The Sample Undertaking form is governed by the Foreign Exchange Management Act, 1999. |

| Purpose | This form is a declaration and undertaking related to foreign exchange transactions. |

| Details Required | Applicants must specify the nature or purpose of the foreign exchange transaction. |

| Authority | Signatories must have the authority to act on behalf of their firm or company. |

| Verification | Documentary evidence must be verified by the bank to process the transaction. |

| Compliance | Failure to provide requested information may result in refusal to undertake the transaction. |

| Reporting Obligations | Bank must report any suspected contravention to the Reserve Bank of India. |

| Signature Requirement | The form must be signed by the applicant to validate the declaration and undertaking. |

Guidelines on Utilizing Sample Undertaking

Completing the Sample Undertaking form is an essential step in fulfilling the legal requirements under the Foreign Exchange Management Act. It’s important to provide accurate information and ensure that all necessary details are included to avoid delays in processing your transaction.

- Download the Form: Obtain the Sample Undertaking form from the designated source, ensuring you have all the correct versions and updates.

- Read the Instructions: Carefully review any accompanying instructions to understand what information is needed.

- Fill in Your Information: Begin by entering your name or the name of your company at the top of the form. If applicable, include details of any authorized signatories.

- Provide Transaction Details: In the designated SCHEDULE section, clearly state the nature or purpose of the foreign exchange transaction you are undertaking.

- Include the Amount: Specify the amount of foreign exchange involved in the transaction. Ensure that this is accurate to avoid complications.

- Identify the Beneficiary: Fill in the name of the beneficiary receiving the foreign exchange and any additional required details.

- Sign the Form: The applicant for foreign exchange must sign the form. If the declaration is made on behalf of a firm or company, ensure that the designated signatory has the authority to do so.

- Provide Date and Place: Include the date and place where the form is being completed.

- Review for Accuracy: Before submission, double-check the completed form for any mistakes or omissions.

- Submit the Form: Once everything is filled out and verified, submit the completed form to the appropriate bank or financial institution.

After submitting the form, be prepared to provide any additional documentation or information that might be requested. Compliance with these requirements will help facilitate your transaction effectively.

What You Should Know About This Form

What is the purpose of the Sample Undertaking form?

The Sample Undertaking form serves as a declaration by individuals or firms, confirming that their foreign exchange transactions comply with the Foreign Exchange Management Act, 1999. It ensures that transactions do not contravene any related laws or regulations.

Who needs to fill out the Sample Undertaking form?

Any individual or firm engaging in foreign exchange transactions must complete the Sample Undertaking form. This includes businesses and organizations that require foreign exchange services from a bank.

What information is required in the Schedule section of the form?

The Schedule section requires details about the nature or purpose of the transaction, the amount of foreign exchange involved, and the beneficiary's information. Providing accurate details is essential for compliance and verification purposes.

What happens if I refuse to provide requested documentation?

If you refuse to provide the necessary documentation or if your compliance is deemed unsatisfactory, the bank will deny the transaction in writing. In such cases, the bank may also report the matter to the Reserve Bank of India if it suspects any potential contravention of laws.

Is there a specific format for signing the form?

The form must be signed by the applicant seeking foreign exchange. If it is signed on behalf of a firm or company, the signatory must have the authority to act on behalf of that entity. Additionally, the place and date of signing are also required.

What should I do if I need assistance while filling out the form?

If you need assistance while completing the Sample Undertaking form, consider reaching out to your bank's customer service or a financial advisor. They can provide guidance on correctly filling out the form and ensuring compliance with relevant regulations.

Are there any consequences for making false declarations?

Yes, making false declarations on the Sample Undertaking form can lead to severe consequences. This may include legal actions, penalties, and difficulties in executing future transactions, as the bank may report discrepancies to regulatory authorities.

How does the bank verify the information provided in the form?

The bank reviews the information on the Sample Undertaking form against documentary evidence submitted. This includes checking transaction details and ensuring that all requirements are met to satisfy regulatory conditions.

Can I edit the form after submitting it?

Once the Sample Undertaking form is submitted, changes cannot be made without proper procedures. If an error is noticed after submission, contact your bank to discuss how to rectify the situation as soon as possible.

Is the Sample Undertaking form mandatory for all foreign exchange transactions?

Yes, the Sample Undertaking form is generally mandatory for the majority of foreign exchange transactions as it ensures compliance with the Foreign Exchange Management Act, 1999. This ensures that all parties adhere to regulatory requirements.

Common mistakes

Filling out the Sample Undertaking form can be a complex task, and it's easy to make mistakes if you're not careful. One of the most common errors is failing to include specific details in the Schedule section. Without clear information about the nature and purpose of the transaction, your form may be deemed incomplete, leading to delays in the process.

Another frequent mistake is not accurately stating the amount of foreign exchange. This number must be precise. Inaccuracies can result in confusion and may even cause the application to be rejected outright. Double-check that the amount matches your intended transaction.

Many applicants overlook the importance of providing complete information about the beneficiary. Missing or incorrect beneficiary details can complicate matters significantly. Always ensure that this section is filled out accurately and in full.

Some people fail to sign the form or overlook the necessity of including the correct signature. This can lead to unnecessary rejections. Be sure both the signature and the capacity in which you're signing are clear. If you're signing on behalf of a firm or company, this must be clearly indicated.

The date is often forgotten or misplaced. An incomplete or missing date can make the form invalid. Double-check that you record the date of submission accurately, as it is essential for processing.

Inadequate compliance with additional information requests can also lead to failure. If the bank asks for further documentation, you must respond adequately and swiftly. Ignoring these requests could result in your transaction being halted.

Not understanding and adhering to the Foreign Exchange Management Act can place applicants in a tough spot. Many individuals fill out the form without awareness of the legal implications surrounding it. Knowledge of this act is crucial in ensuring compliance and avoiding potential issues.

Another mistake is failing to keep copies of your filed form. Always retain a copy of the submitted document for your records. This can serve as proof of what was declared in case disputes arise later.

Finally, many underestimate the prospect of errors during the review process. If a bank official highlights an error, addressing it quickly and effectively is vital. Being proactive is key to preventing delays in your transaction.

By being aware of these common mistakes, you can fill out the Sample Undertaking form correctly and efficiently. Ensuring the accuracy and completeness of your submission is vital for a smooth and timely process.

Documents used along the form

When engaging in foreign exchange transactions, several essential forms and documents often accompany the Sample Undertaking form. Each of these documents serves a specific purpose and ensures compliance with regulatory requirements. Understanding these documents can streamline the process and mitigate potential issues.

- Foreign Exchange Application Form: This form initiates the request for foreign exchange and provides basic details about the applicant and the transaction.

- KYC Documents: Know Your Customer (KYC) documents verify the identity and address of the applicant. These may include government-issued identification, address proof, and recent photographs.

- Transaction Details Form: This document outlines the specific details of the foreign exchange transaction, including purpose, currency type, and amount. It substantiates the application made.

- Letter of Credit: A financial document from a bank guaranteeing payment to the seller upon fulfilling certain terms. This is often used in international trade.

- Tax Compliance Certificate: A certificate ensuring that the applicant complies with local tax regulations, confirming that all applicable taxes related to the transaction have been duly paid.

- Endorsement Letter: This letter is used to approve any required endorsements or confirmations related to the transaction by relevant parties, such as suppliers or banks.

- Power of Attorney: If an agent is acting on behalf of the applicant, this legal document grants them the authority to complete the necessary transactions and forms.

- Foreign Inward Remittance Certificate: This certificate is generated when foreign funds are received. It details the amount and source of the remittance, validating the transaction.

- Compliance Undertaking: This document reinforces the applicant's understanding of regulatory requirements and their commitment to adhere to them throughout the transaction.

Each of these documents plays a pivotal role in ensuring that foreign exchange transactions adhere to legal and regulatory frameworks. Proper understanding and preparation of these forms can enhance compliance and facilitate smoother transactions.

Similar forms

The Sample Undertaking form serves an important function within the context of regulatory compliance in foreign exchange transactions. There are various other documents that share similarities with this form, impacting how individuals and companies conduct their business. Each of these documents typically assures compliance and provides necessary declarations or commitments. Below is a list of ten documents that resemble the Sample Undertaking form:

- Letter of Undertaking: Like the Sample Undertaking, this letter provides assurance regarding specific commitments or obligations, often tied to financial agreements. Recipients can rely on it to understand the commitments made.

- Affidavit: An affidavit also serves as a sworn statement, confirming the truth of information provided, similar to how the Sample Undertaking declares compliance with regulations.

- Compliance Certificate: This document certifies that a company or individual adheres to relevant laws and regulations, much like the undertaking that assures of compliance with the Foreign Exchange Management Act.

- Indemnity Agreement: An indemnity agreement offers protection against potential losses, paralleling the assurance given in the Sample Undertaking regarding the legality of transactions.

- Power of Attorney: This document grants authority to act on someone else's behalf, similar to how the Sample Undertaking requires a declaration of authority by the signatory on behalf of a firm or company.

- Secured Loan Agreement: Much like the Sample Undertaking, this agreement outlines specific commitments and conditions for a loan, ensuring compliance with financial regulations.

- Bank Guaranty: A bank guaranty assures that a bank will meet a financial obligation if the principal party fails. This is analogous to the assurances given in the Sample Undertaking about compliance.

- Certificate of Good Standing: This document affirms that a business is authorized to conduct operations, which bears resemblance to the declarations made in the Sample Undertaking about compliance with relevant laws.

- Disclosure Statement: Similar to the undertaking, this statement provides necessary disclosures about financial operations, emphasizing transparency and adherence to legal obligations.

- Transaction Declaration: A transaction declaration outlines the specifics of a financial transaction and assures its lawful nature, akin to the declaration of compliance within the Sample Undertaking.

Understanding these documents can significantly streamline processes involving regulatory compliance, ensuring that all parties are fully aware of their obligations and responsibilities.

Dos and Don'ts

When filling out the Sample Undertaking form, there are important guidelines to follow for a smooth process. Below are seven things you should and shouldn't do:

- Do read the form thoroughly before you start filling it out.

- Don't leave any sections blank, unless specifically instructed to do so.

- Do provide accurate and detailed information about the transaction.

- Don't use vague language; be clear and specific in your descriptions.

- Do check for any required signatures and ensure they are included.

- Don't forget to date the form in the designated area.

- Do keep a copy of the completed form for your records.

Misconceptions

Misconceptions about the Sample Undertaking form can lead to confusion for individuals and organizations interacting with foreign exchange regulations. The following list outlines seven common misconceptions along with explanations to clarify them.

- The form is optional. Many believe that submitting the Sample Undertaking form is optional. However, it is mandatory for transactions covered under the Foreign Exchange Management Act (FEMA) when applicable.

- It guarantees approval of the transaction. A common misconception is that completing the form guarantees that the transaction will be approved. In reality, the form serves as a declaration, but approval depends on compliance with all regulations and the bank’s discretion.

- Only the applicant needs to sign. Some assume that only the individual applying for the foreign exchange needs to sign the form. If the application is made on behalf of a firm or company, additional signatures from authorized personnel may be required.

- The bank will not report any issues. There is a belief that if problems arise, the bank will not take action. In fact, if the bank suspects any contravention or evasion, it is obligated to report the matter to the Reserve Bank of India.

- Information on the form is not scrutinized. Many think that the data provided in the Sample Undertaking form is not carefully reviewed. In contrast, banks are responsible for verifying the information and may request additional documentation to confirm legitimacy.

- Completing the form is enough to satisfy regulations. Some believe that merely filling out the form fulfills all regulatory requirements. However, providing proper documentation and additional information is essential to fully comply with the law.

- The purpose of the transaction is irrelevant. A misconception exists that the nature or purpose of the transaction does not matter. In reality, clearly stating the purpose is crucial as it helps assess compliance with FEMA and related regulations.

Key takeaways

When filling out and using the Sample Undertaking form, keep the following key takeaways in mind:

- Understand the purpose: This form serves as a declaration that your foreign exchange transaction complies with the Foreign Exchange Management Act.

- Be accurate: Fill in all details accurately and completely in the schedule provided. This includes the nature of the transaction and the amount involved.

- Authority to sign: Ensure that the person signing the form has the proper authority to do so on behalf of the firm or company.

- Provide supporting documents: Be prepared to provide any requested information or documents that support your declaration.

- Know the implications: Understand that failing to comply with requirements may result in the bank refusing to process your transaction.

- Bank's responsibility: The bank has the right to report any suspected contravention to the Reserve Bank of India.

- Record verification: Keep track of the details provided for office use; this includes the verifying of documentary evidence.

Browse Other Templates

Therapy Templates - This form collects essential personal information for your first psychotherapy session.

Tesco Pet Insurance Uk - If your pet was referred, include details of the referring vet.

Pa Duplicate Title - Understanding the requirements of the MV-38D is essential for all registered vehicle dealers in Pennsylvania.