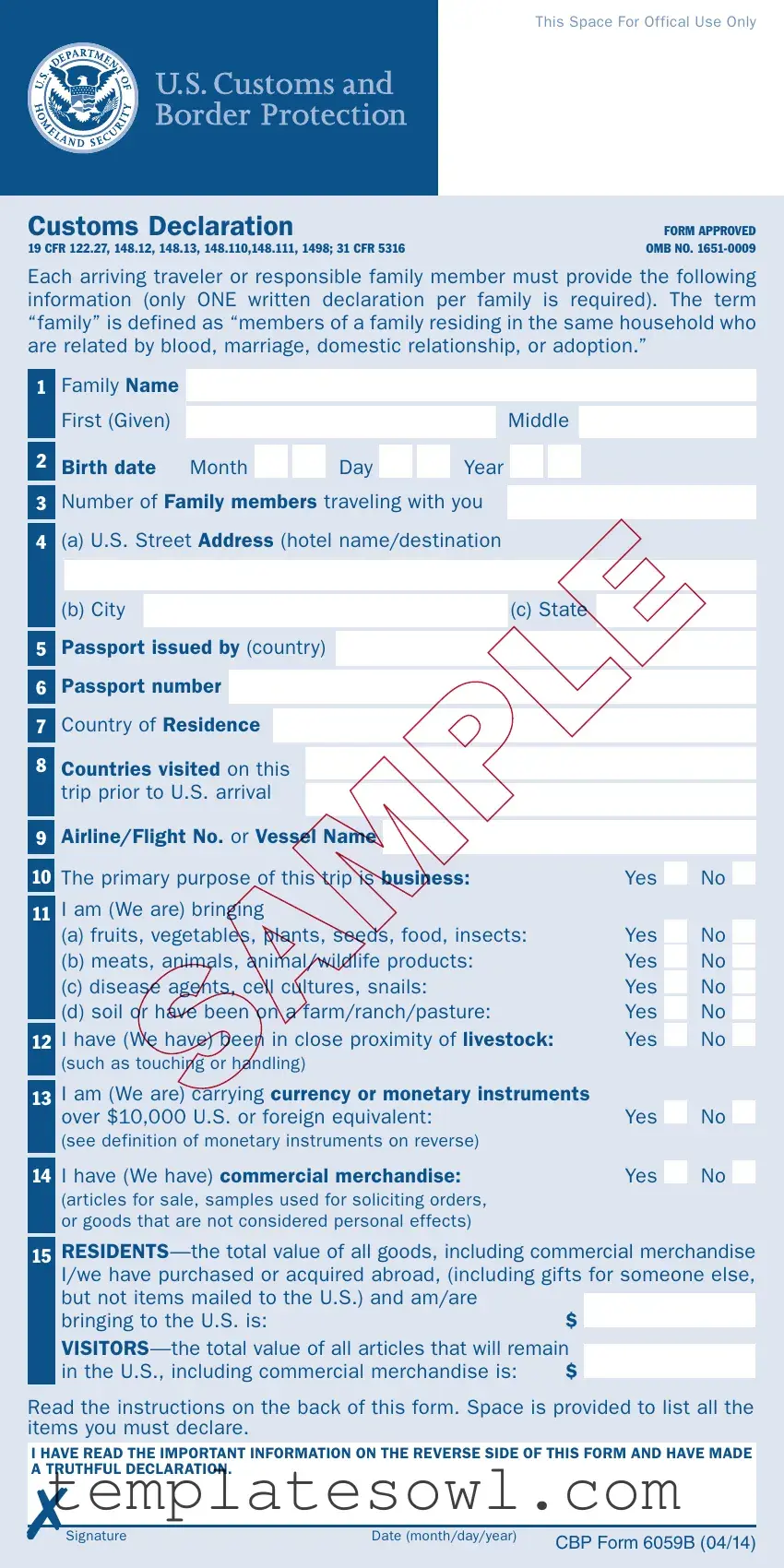

Fill Out Your Sample Us Customs Form

The Sample U.S. Customs form serves as an essential document for individuals arriving in the United States. This form, also known as CBP Form 6059B, is required for each traveler or a responsible family member to declare goods and personal effects. It contains several sections that gather crucial information, including family names, birthdates, United States address, and passport details. Travelers must indicate their countries of residence and list any countries visited prior to arriving in the U.S. The form also requires declaration of the primary purpose of the trip, along with any fruits, vegetables, meats, or other restricted items being brought into the country. Importantly, travelers are asked whether they carry currency or monetary instruments exceeding $10,000 and to specify the total value of goods purchased abroad. This provides the U.S. Customs and Border Protection (CBP) officers with necessary data to assess duty and ensure compliance with import regulations. Information regarding agricultural and wildlife restrictions, as well as penalties for non-compliance, is clearly stated. Signature and date sections confirm that travelers read and understood the instructions, promoting transparency in the customs process.

Sample Us Customs Example

This Space For Offical Use Only

Customs Declaration |

FORM APPROVED |

19 CFR 122.27, 148.12, 148.13, 148.110,148.111, 1498; 31 CFR 5316 |

OMB NO. |

Each arriving traveler or responsible family member must provide the following information (only ONE written declaration per family is required). The term “family” is defined as “members of a family residing in the same household who are related by blood, marriage, domestic relationship, or adoption.”

1Family Name

First (Given) |

Middle |

2Birth date Month

Day

Day

Year

Year

3 Number of Family members traveling with you

4(a) U.S. Street Address (hotel name/destination

(b) City |

(c) State |

5Passport issued by (country)

6Passport number

7Country of Residence

8Countries visited on this trip prior to U.S. arrival

9Airline/Flight No. or Vessel Name

10 |

The primary purpose of this trip is business: |

Yes |

|

No |

|

|

|

|

|

|

|

11 |

I am (We are) bringing |

|

|

|

|

|

|

|

|

||

|

(a) fruits, vegetables, plants, seeds, food, insects: |

Yes |

|

No |

|

|

(b) meats, animals, animal/wildlife products: |

Yes |

|

No |

|

|

(c) disease agents, cell cultures, snails: |

Yes |

|

No |

|

|

(d) soil or have been on a farm/ranch/pasture: |

Yes |

|

No |

|

|

|

|

|

|

|

12 |

I have (We have) been in close proximity of livestock: |

Yes |

|

No |

|

|

(such as touching or handling) |

|

|

|

|

|

|

|

|

|

|

13 |

I am (We are) carrying currency or monetary instruments |

|

|

|

|

|

|

|

|

||

|

over $10,000 U.S. or foreign equivalent: |

Yes |

|

No |

|

|

(see definition of monetary instruments on reverse) |

|

|

|

|

|

|

|

|

|

|

14 |

I have (We have) commercial merchandise: |

Yes |

|

No |

|

|

(articles for sale, samples used for soliciting orders, |

|

|

|

|

|

or goods that are not considered personal effects) |

|

|

|

|

|

|

|

|

|

|

15

bringing to the U.S. is:$

in the U.S., including commercial merchandise is: |

$ |

Read the instructions on the back of this form. Space is provided to list all the items you must declare.

I HAVE READ THE IMPORTANT INFORMATION ON THE REVERSE SIDE OF THIS FORM AND HAVE MADE A TRUTHFUL DECLARATION.

|

|

|

Signature |

Date (month/day/year) |

CBP FORM 6059B (04/14) |

|

|

U.S. Customs and Border Protection Welcomes You to the United States

U.S. Customs and Border Protection is responsible for protecting the United States against the illegal importation of prohibited items. CBP officers have the authority to question you and to examine you and your personal property. If you are one of the travelers selected for an examination, you will be treated in a courteous, professional, and dignified manner. CBP Supervisors and Passenger Service Representatives are available to answer your questions. Comment cards are available to compliment or provide feedback.

Important Information

U.S.

Visitors

Declare all articles on this declaration form and show the value in U.S. dollars. For gifts, please indicate the retail value.

Agricultural and Wildlife

Controlled substances, obscene articles, and toxic substances are generally prohibited entry.

The transportation of currency or monetary instruments, regardless of the amount, is legal. However, if you bring in to or take out of the United States more than $10,000 (U.S. or foreign equivalent, or a combination of both), you are required by law to file a report on FinCEN 105 (formerly Customs Form 4790) with U.S. Customs and Border Protection. Monetary instruments include coin, currency, travelers checks and bearer instruments such as personal or cashiers checks and stocks and bonds. If you have someone else carry the currency or monetary instrument for you, you must also file a report on FinCEN 105. Failure to file the required report or failure to report the total amount that you are carrying may lead to the seizure of all the currency or monetary instruments, and may subject you to civil penalties and/or criminal prosecution. SIGN ON THE OPPOSITE SIDE OF THIS FORM AFTER YOU HAVE READ THE IMPORTANT INFORMATION ABOVE AND MADE A TRUTHFUL DECLARATION.

Description of Articles |

|

|

CBP |

(List may continue on another CBP Form 6059B) |

|

Value |

Use Only |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

PAPERWORK REDUCTION ACT STATEMENT: An agency may not conduct or sponsor an information collection and a person is not required to respond to this information unless it displays a current valid OMB control number. The control number for this collection is

Form Characteristics

| Fact Name | Description |

|---|---|

| Official Use Only | This form is designated for official use by U.S. Customs and Border Protection (CBP). |

| Form Approval | The form is approved under 19 CFR 122.27 and other related regulations. |

| Family Definition | The term "family" includes members residing in the same household and related by various means. |

| Declaration Requirement | Only one declaration per family unit is required upon arrival in the U.S. |

| Currency Reporting | Travelers must report carrying over $10,000 in currency, requiring a FinCEN 105 report. |

| Duty Exemption | Residents can bring up to $800 duty-free; visitors may only bring $100 without duty. |

| Agricultural Restrictions | Certain items like fruits, vegetables, and live animals are restricted to prevent pest entry. |

| Signature Requirement | Travelers must sign the form after making a truthful declaration about their items. |

Guidelines on Utilizing Sample Us Customs

Filling out the Sample U.S. Customs form is an important step for travelers entering the United States. Adhering to the process outlined below will ensure that all necessary information is accurately provided. This form requires travelers to declare their purchased or acquired items and any specific details regarding their trip.

- Begin by filling in your family name, first name, and middle name in the designated fields.

- Enter your birth date using the format: Month / Day / Year.

- Indicate the number of family members traveling with you.

- Provide your U.S. street address, including the hotel name or final destination, followed by the city and state.

- State the country that issued your passport.

- Fill in your passport number.

- Indicate your country of residence.

- List all countries visited prior to your arrival in the U.S.

- Specify the airline/flight number or vessel name used for travel.

- Answer whether the primary purpose of your trip is business by marking “Yes” or “No.”

- Respond to the questions regarding items you are bringing into the U.S. about the following:

- Fruits, vegetables, plants, seeds, food, insects.

- Meats, animals, animal or wildlife products.

- Disease agents, cell cultures, snails.

- Soil or having been on a farm/ranch/pasture.

- Indicate if you have been in close proximity to livestock by marking “Yes” or “No.”

- Designate whether you are carrying currency or monetary instruments over $10,000 by selecting “Yes” or “No.”

- State if you have any commercial merchandise by marking “Yes” or “No.”

- Residents: Enter the total value of all goods you are bringing back to the U.S. Visitors: Note the total value of articles that will remain in the U.S.

- Read the instructions on the back of the form and ensure all necessary items are declared.

- Sign and date the form, confirming that you have read the information and made a truthful declaration.

What You Should Know About This Form

What is the purpose of the Sample US Customs form?

The Sample US Customs form is a declaration that travelers must complete upon entering the United States. It helps U.S. Customs and Border Protection (CBP) gather crucial information about what items travelers are bringing into the country. The form serves as a means to prevent the illegal importation of prohibited items and to assess any applicable duties on goods brought in from abroad.

Who is required to complete this form?

Every traveler arriving in the United States is required to provide a completed customs declaration form. This includes both U.S. residents and visitors. In the case of families traveling together, only one declaration form is necessary for the entire group, as long as it is filled out by a responsible family member.

What information do I need to provide on the form?

The form requires several pieces of information, including your family name, the number of family members traveling, your U.S. street address, your passport details, and countries visited before your arrival. Additionally, you'll need to declare the primary purpose of your trip and whether you are bringing certain items like fruits, meats, or cash over $10,000.

What should I do if I'm transporting gifts or purchases?

If you have gifts or purchases acquired abroad, you must declare their value on the form. For gifts, it's important to indicate the retail value. U.S. residents typically have a duty-free exemption of $800, while non-residents have a $100 exemption for the total value of items that will remain in the United States.

What are the penalties for not declaring items?

Failure to declare items can lead to serious consequences, including penalties or the seizure of goods. Prohibited items such as certain agricultural products, controlled substances, and wildlife can result in heightened scrutiny and enforcement actions. Therefore, it’s crucial to be honest and thorough in your declarations.

Is there a limit on the amount of cash I can bring into the U.S.?

You can legally transport any amount of currency or monetary instruments into the United States. However, if you’re carrying over $10,000, either in U.S. dollars or foreign equivalent, you must file a report (FinCEN 105) with CBP. This includes cash, travelers checks, and any other financial instruments considered monetary.

How does customs determine if I owe duty?

Duty is assessed by CBP officers based on the declarations made on the customs form. For U.S. residents, the duty-free exemption is typically $800, while visitors normally enjoy a $100 exemption. Any article valued above these exemptions may incur a duty charge, assessed at the current rate, on the amount over the exemption limit.

What should I do after completing the form?

After completing the Sample US Customs form, be sure to sign and date it. This confirms that you have read the information provided and made a truthful declaration. Present the form along with your passport and any other required documents as you go through customs. Being prepared can certainly streamline your experience.

Common mistakes

Filling out the Sample US Customs form is a crucial step in ensuring a smooth entry into the United States. However, many individuals often make mistakes that can lead to complications during the customs process. One common error is not understanding who qualifies as "family." The form states that only one declaration is needed per family. Yet, some travelers mistakenly think that they can file separate forms without realizing that this may cause confusion and delays. It’s essential to recognize that a family comprises members living in the same household and related by blood, marriage, or adoption.

Another frequent mistake involves underreporting the value of items brought into the country. Whether you are a resident or visitor, accurately declaring the total value of purchased goods is paramount. Some travelers may attempt to estimate values or omit certain items altogether, thinking it won’t be noticed. This could lead to penalties or even confiscation of the items. Always list all items clearly, including their retail values, to avoid potential issues. Transparency is key.

Additionally, many individuals ignore the section regarding agricultural and wildlife products. Failing to declare items such as fruits, vegetables, or certain meats can result in severe consequences. U.S. Customs and Border Protection (CBP) strictly regulates these products to safeguard against pests and diseases. When in doubt, it’s better to declare an item than to risk penalties for not doing so. Everyone should remember that the consequences of omission can be far worse than the inconvenience of declaring additional items.

Finally, a significant number of travelers neglect to report carrying currency or monetary instruments exceeding $10,000. This oversight stems from a misunderstanding of what constitutes “currency.” The law mandates that exceeding this limit requires notifying customs officials. Not only could failing to report result in seized funds, but it could also lead to potential legal ramifications. Awareness of your financial declarations and ensuring compliance with or without cash limits is vital.

Documents used along the form

When traveling internationally, it’s important to be prepared with the right forms and documentation. Along with the U.S. Customs Declaration Form, you may encounter several other forms that help streamline the customs process and ensure compliance with various regulations. Here’s a brief overview of some documents that are often used in conjunction with the Customs form:

- Form FinCEN 105: This form is required for travelers carrying more than $10,000 in currency or monetary instruments into or out of the U.S. It ensures that the source of large amounts of currency is properly documented, helping to prevent money laundering and other illegal activities.

- Form 8862: If you are claiming the Earned Income Tax Credit (EITC) after having had it denied in the past, this form is required. It provides the IRS with the information necessary to determine your eligibility for this credit when filing U.S. tax returns.

- Form CBP 7501: Also known as the Entry Summary form, this document is used for importing goods into the U.S. It provides detailed information about the shipment and is necessary for calculating duties and tariffs.

- Form I-94: This is the Arrival/Departure Record that details the immigration status of travelers entering the U.S. It records your arrival and departure dates and is essential for verifying your legal admission to the country.

- Form I-20: This form is issued to foreign students studying in the U.S. It certifies a student’s eligibility for a F-1 or M-1 visa, allowing them to enter the country for educational purposes.

- Form DS-160: Also known as the Online Nonimmigrant Visa Application, this form is essential for applying for a temporary visa to enter the U.S. It collects biographical information and details about your travel plans.

- Form CBP 6059D: The Customs Declaration for certain international travelers that provides information similar to the main Customs form but is specifically for travelers who do not need to submit a full declaration.

Having the correct forms ensures a smoother travel experience and compliance with customs regulations. Double-checking your documentation before traveling can ease your entry into the U.S. and minimize delays. Stay informed and organized to make your process as seamless as possible.

Similar forms

-

Customs Form 4790 (FinCEN 105): This form is used to report the transportation of monetary instruments exceeding $10,000. Similar to the Sample Us Customs form, it requires details about the currency being transported.

-

CBP Form 7501: This is the entry summary form used for goods imported into the U.S. It collects information about the description, quantity, and value of the goods, similar to the declaration of values in the customs form.

-

Form I-94: Issued to visitors arriving in the U.S., this form records entry and exit data. It requires personal information similar to the Sample Us Customs form but focuses on immigration status.

-

Declaration of Free Circulation (Form C): This document is used when importing goods into the European Union and includes detailed information about the goods. Like the Sample Us Customs form, it aims to classify and assess goods upon entry.

-

Customs Power of Attorney Form: This allows a designated person to act on behalf of another regarding customs transactions. It shares similarities with the customs declaration as both require personal information and intent related to customs clearance.

Dos and Don'ts

When completing the Sample U.S. Customs form, it is essential to adhere to certain guidelines to ensure accuracy and compliance. Below is a list of recommended actions and pitfalls to avoid during this process.

- Do: Provide truthful and complete information for all required fields.

- Do: Include all family members who are traveling with you in the declaration.

- Do: Declare all articles acquired abroad, specifying their value in U.S. dollars.

- Do: Check the appropriate boxes regarding your travel purpose and items you are bringing.

- Don't: Leave any fields blank; all sections must be filled in completely.

- Don't: Understate the value of goods; accurate value declaration is crucial.

Ensuring adherence to these guidelines will facilitate a smoother entry process into the United States.

Misconceptions

Understanding the U.S. Customs Declaration Form can prevent misunderstandings and ensure a smooth entry into the United States. Here are nine common misconceptions:

- Only Americans need to fill it out. Any traveler arriving in the U.S., regardless of nationality, must complete this form. It applies to both residents and visitors.

- I don't need to declare gifts. All items acquired abroad, including gifts, must be declared. This includes mentioning their retail value on the form.

- Submitting false information is harmless. Providing false information is not just unwise; it can lead to severe penalties, including fines or even criminal prosecution.

- There’s no limit on bringing in cash. While moving currency is legal, if you carry over $10,000, you must report it to Customs. Failure to do so can result in the seizure of your funds.

- All agricultural products are allowed. Many agricultural items, like fruits and vegetables, are restricted. Failure to declare these could result in penalties.

- I only need to declare items I purchased. You must declare all articles acquired abroad, even if they were gifts or free samples. This rule applies to both residents and visitors.

- Completing the form is optional. The form is mandatory for entry into the U.S. Ignoring this requirement can lead to delays or complications.

- The customs officers have no right to examine my belongings. Customs and Border Protection officers have the authority to examine both travelers and their property to ensure compliance with regulations.

- Duty fees are always charged. Duty fees apply only if the value of the goods exceeds established exemptions. U.S. residents typically have an $800 exemption, while visitors have a $100 exemption.

Clarifying these misconceptions can help travelers prepare properly and navigate customs with confidence.

Key takeaways

Filling out the Sample U.S. Customs form can be a straightforward process if you know what to expect. Here are some key takeaways to keep in mind:

- Only one declaration is needed per family, so ensure the family member responsible fills it out correctly.

- The term "family" covers those living in the same household who are related by blood, marriage, or adoption.

- Gather the essential information beforehand, including your family name, passport details, and U.S. destination address.

- Clearly declare all items you’re bringing into the U.S., including food, plants, and animals, as certain items are restricted.

- Pay attention to your duty exemptions; generally, U.S. residents can bring in up to $800 worth of items duty-free.

- It is essential to report if carrying over $10,000 in currency; this requires completing an additional form.

- Ensure that the declaration is truthful and comprehensive, as failure to do so can result in penalties.

- Signature and date are required at the end of the form to confirm that you have reviewed the information and understand the implications.

By following these tips, you can navigate the customs declaration process with confidence, ensuring a smoother entry into the United States.

Browse Other Templates

California Apartment Association - Applicants consent to renting terms upon approval and lease execution.

Handicap Application - Exhibitor parking is located conveniently off Greenfield Avenue.