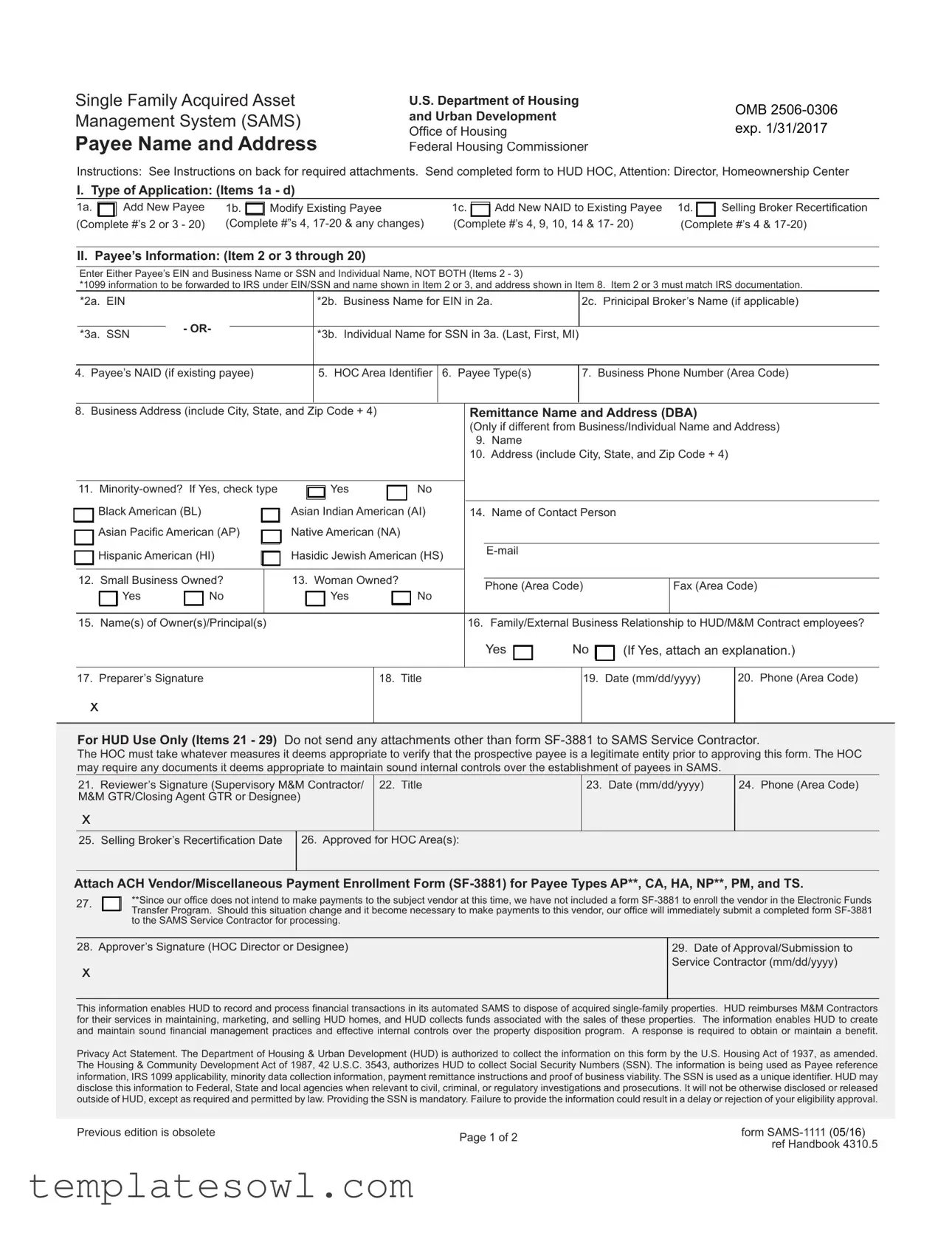

Fill Out Your Sams 1111 Form

The Sams 1111 form is an essential document used by the U.S. Department of Housing and Urban Development (HUD) to manage payees involved in the acquisition and disposition of single-family homes. This form serves multiple purposes, including adding a new payee, modifying an existing one, or recertifying a selling broker. Various sections of the form require specific details about the payee, such as their name, address, and taxpayer identification number, to ensure accurate financial transactions and compliance with IRS regulations. Additionally, the form collects information regarding the payee's minority status and ownership structure, which supports HUD's commitment to promoting diversity in its procurement practices. Proper completion of the Sams 1111 form facilitates the processing of financial transactions tied to HUD's acquired properties, allowing contractors to receive timely reimbursements for their services. Attachments, like IRS documentation and business licenses, are mandatory to validate the payee's legitimacy. Understanding the key elements of the Sams 1111 form helps streamline HUD's property disposition processes and maintain effective internal controls.

Sams 1111 Example

Single Family Acquired Asset Management System (SAMS)

Payee Name and Address

U.S. Department of Housing

and Urban Development

Offi ce of Housing

Federal Housing Commissioner

OMB

Instructions: See Instructions on back for required attachments. Send completed form to HUD HOC, Attention: Director, Homeownership Center

I. Type of Application: (Items 1a - d)

1a. |

|

Add New Payee |

1b. |

|

Modify Existing Payee |

1c. |

|

Add New NAID to Existing Payee |

1d. |

|

Selling Broker Recertifi cation |

(Complete #’s 2 or 3 - 20) |

(Complete #”s 4, |

(Complete #’s 4, 9, 10, 14 & 17- 20) |

(Complete #’s 4 & |

||||||||

II. Payee’s Information: (Item 2 or 3 through 20)

Enter Either Payee’s EIN and Business Name or SSN and Individual Name, NOT BOTH (Items 2 - 3)

*1099 information to be forwarded to IRS under EIN/SSN and name shown in Item 2 or 3, and address shown in Item 8. Item 2 or 3 must match IRS documentation.

*2a. |

EIN |

|

|

|

|

- OR- |

|

*3a. |

SSN |

||

|

*2b. Business Name for EIN in 2a. |

2c. Prinicipal Broker’s Name (if applicable) |

|

|

*3b. Individual Name for SSN in 3a. (Last, First, MI)

4. Payee’s NAID (if existing payee)

5. HOC Area Identifi er

6. Payee Type(s)

7. Business Phone Number (Area Code)

8. Business Address (include City, State, and Zip Code + 4) |

|

|

Remittance Name and Address (DBA) |

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Only if different from Business/Individual Name and Address) |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9. |

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10. |

Address (include City, State, and Zip Code + 4) |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11. |

|

|

If Yes, check type |

|

|

|

Yes |

|

|

|

No |

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Black American (BL) |

|

|

|

Asian Indian American (AI) |

14. |

Name of Contact Person |

|

|

||||||||||||||

|

|

|

|

|

|

||||||||||||||||||||

|

|

Asian Pacifi c American (AP) |

|

|

|

Native American (NA) |

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Hispanic American (HI) |

|

|

|

Hasidic Jewish American (HS) |

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12. Small Business Owned? |

|

|

13. Woman Owned? |

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

Phone (Area Code) |

|

Fax (Area Code) |

||||||||||||||||||||

|

|

|

|

Yes |

|

No |

|

|

|

|

Yes |

|

|

No |

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

15. |

|

Name(s) of Owner(s)/Principal(s) |

|

|

|

|

|

|

|

|

16. Family/External Business Relationship to HUD/M&M Contract employees? |

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

|

No |

|

|

(If Yes, attach an explanation.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

17. Preparer’s Signature

18. Title

19. Date (mm/dd/yyyy)

20. Phone (Area Code)

x

For HUD Use Only (Items 21 - 29) Do not send any attachments other than form

The HOC must take whatever measures it deems appropriate to verify that the prospective payee is a legitimate entity prior to approving this form . The HOC may require any documents it deems appropriate to maintain sound internal controls over the establishment of payees in SAMS.

21.Reviewer’s Signature (Supervisory M&M Contractor/ M&M GTR/Closing Agent GTR or Designee)

x

22. Title

23. Date (mm/dd/yyyy)

24. Phone (Area Code)

25. Selling Broker’s Recertifi cation Date

26. Approved for HOC Area(s):

Attach ACH Vendor/Miscellaneous Payment Enrollment Form

27.

**Since our offi ce does not intend to make payments to the subject vendor at this time, we have not included a form

28. Approver’s Signature (HOC Director or Designee)

x

29.Date of Approval/Submission to Service Contractor (mm/dd/yyyy)

This information enables HUD to record and process fi nancial transactions in its automated SAMS to dispose of acquired

Privacy Act Statement. The Department of Housing & Urban Development (HUD) is authorized to collect the information on this form by the U.S. Housing Act of 1937, as amended. The Housing & Community Development Act of 1987, 42 U.S.C. 3543, authorizes HUD to collect Social Security Numbers (SSN). The information is being used as Payee reference

information, IRS 1099 applicability, minority data collection information, payment remittance instructions and proof of business viability. The SSN is used as a unique identifi er. HUD may disclose this information to Federal, State and local agencies when relevant to civil, criminal, or regulatory investigations and prosecutions. It will not be otherwise disclosed or released

outside of HUD, except as required and permitted by law. Providing the SSN is mandatory. Failure to provide the information could result in a delay or rejection of your eligibility approval.

Previous edition is obsolete |

Page 1 of 2 |

form |

|

ref Handbook 4310.5 |

|

|

|

Instructions for Completing Form

Preparer: Complete Items 1 and 2 or 3, and 7 thru 20 legibly in ink or type.

HUD Office Staff: Complete Items 4 thru 6, and 21 thru 29 legibly in ink or type. Sign Items 21 and 28 in ink.

1a. Add New Payee: Check if new payee and complete items 2 or 3 through 20.

1b. Modfiy Existing Payee: Check if modifying information for an existing payee. Items 4 and 17 - 20 and any changes must be completed.

1c. Add New NAID for Existing Payee: Check if linking a new NAID to an existing payee. Items 4, 9, 10 &

1d. Selling Broker Recertification: Check if recertifying selling broker. Items 4 &

2a. EIN: Enter the Employer Identifi cation Number for the business.

2b. Business Name: Enter the name of the business as it should appear on checks or IRS form

2c. Principal Broker’s Name: Enter the name of the principal broker as it should appear on checks or IRS Form

3a. SSN: Enter the individual’s Social Security Number.

3b. Individual Name: Enter the name of the individual as it should appear on checks and IRS Form

4.For HUD Use Only. Payee’s NAID: Enter the Name/Address Identifi er(NAID) if existing payee.

5.For HUD Use Only. Enter the HOC Area Identifi er (e.g., PA for Philadelphia Area A).

6.For HUD Use Only. Payee Type: Enter type code from below:

AP=Appraiser |

NP=Nonprofi t organization |

CA=Closing Agent |

PM=M&M Contractor |

GT=Local/State Government |

SB=Selling Broker |

HA =Homeowner Association |

TS=Trade/Service Vendor |

NB |

|

7.Business Phone Number: Enter the area code and telephone number.

8.Business Address: Enter complete mailing address of the company or individual named in item 2b or 3b above.

9 - 10. Remittance Name and Address: Enter the Name and Address for remittance of compensation only if different from Business/Individual Name and Address. This is typically the Doing Business As (DBA) Name.

11.

12.Small Business Owned?: Check “Yes” if the company qualifi es as a small business. Check “No” if not.

13.Woman Owned? : Check “Yes” if the company qualifi es as a woman owned business. Check “No” if not.

14.Contact Person: Enter the name, telephone number, fax number, and email address of the contact person.

15.Names of Owners/Principals: Enter the name(s) of the company’s owner(s) or principal(s). Continue on separate page if necessary.

16.Related Parties: Enter “Yes” if the payee has either a family relationship or an external business relationship with any HUD/M&M Contract employee.

Attach explanation. Enter “No” if no such relationship exits.

17

For HUD Use Only.

21 - 24. Reviewer’s Signature: Enter legible signature, title, date, and phone number of individual reviewing the form.

25.Selling Broker’s Recertification Date: Date of next scheduled recertifi cation by HUD Offi ce. Enter month and year.

26.Approved for HOC Areas. Enter the HOC area(s) in which the Payee is approved for work.

27.Check if vendor will never receive a payment from HUD.

28 - 29. Approver’s Signature: Enter legible signature of the HOC Director or designee approving form and date form is approved and submitted to the Service Contractor.

Note: 48 CFR 2426 sets forth the Department of Housing and Urban Development’s policy to promote Minority Business Enterprise participation in its procurement program. Executive Orders 11625 and 12432 require monitoring and evaluation of performance and reporting to Congress and the President. While completion of this data is not mandatory, we strongly encourage your cooperation. This data will be used only for reporting purposes. A minority business enterprise is a business which is at least 51 percent owned by one or more minority group members; or, in case of a

Attachments that must accompany this form to establish a new payee. When modifying an existing payee, attach applicable documentation relating to modification, e.g., change of banking institution, attach new Form

|

AP |

||

For All Payees: |

|

√ |

|

Internal Revenue Service (IRS) documentation showing Business Name/Individual Name and |

|

||

Tax Identifi cation Number (TIN). Examples include IRS Form 147C, Tax Return with preprinted |

|

|

|

label, IRS payment coupon. State issued forms are not acceptable. |

|

|

|

In addition, for Payees not under formal contract with HUD: |

|

|

|

Copy of Driver’s License |

|

√ |

|

Copy of fi rst page of a recent telephone bill, utility bill, or bank statement |

|

√ |

|

Copy of Local or State business license for payee’s trade, if applicable |

|

√ |

|

Copy of State Real Estate Broker’s license |

|

|

|

Completed Form |

√* |

||

Completed Form |

|

|

|

IRS Ruling/Determination Letter |

|

|

|

|

|

|

|

In addition, for Payees under formal contract with HUD: |

|

|

|

Copy of fi rst page of your signed contract with HUD |

|

√ |

|

Copy of fi rst page of a recent telephone bill, utility bill, or bank statement |

|

√ |

|

CA

√

√

√

√

√

√

√

GT

√

Payee Type

HA NB NP

√ √ √

√√*

√**

PM

√

√

√

√

√

√

√

SB

√

√

√

√

√

TS

√

√

√

√

√

√

√

*If the HOC Area Office does not intend to make payments to the vendor, check box in Item 27 and do not include Form

**If nonprofit organization cannot show proof of

Previous edition is obsolete |

Page 2 of 2 |

form |

|

|

ref Handbook 4310.5 |

Form Characteristics

| Fact Name | Details |

|---|---|

| Purpose | The SAMS 1111 form is used by individuals and organizations to apply for participation in the HUD Single Family Acquired Asset Management System. |

| Governing Law | The form is authorized under the U.S. Housing Act of 1937 and the Housing & Community Development Act of 1987. |

| Required Information | Applicants must provide either an Employer Identification Number (EIN) or Social Security Number (SSN), business name, and address. Both cannot be submitted at the same time. |

| Forms Attachment | Along with the SAMS 1111, applicants may need to attach additional documents such as IRS certification and a business license. |

| Verification Process | The HOC must verify the legitimacy of the prospective payee and may require various documents to maintain internal controls. |

| Minority Business Reporting | A part of the form collects data on minority ownership, which supports HUD's commitment to promote Minority Business Enterprise participation. |

| E-Filing Requirement | Providing the SSN is mandatory for electronic processing and compliance with IRS regulations. |

Guidelines on Utilizing Sams 1111

Completing the SAMS 1111 form is essential for establishing or updating the necessary financial information with the U.S. Department of Housing and Urban Development (HUD). The following instructions will guide you through the required steps to ensure accurate submission of this form.

- Determine the type of application you are submitting by checking the appropriate box in Section I (Items 1a - 1d).

- In Section II, fill out either Items 2 or 3 with the Payee's EIN (Employer Identification Number) and Business Name, or SSN (Social Security Number) and Individual Name. Do not enter both.

- Complete all applicable fields from Items 2 through 20. This includes payee's NAID, area identifier, contact information, and ownership details.

- If applicable, indicate whether the business is minority-owned, small business owned, or woman-owned by checking 'Yes' or 'No' in Items 11-13.

- Provide the name and contact information for a designated contact person in Item 14, and include names of owners/principals in Item 15.

- Address any potential family or business relationships to HUD employees in Item 16. If there is a relationship, attach a brief explanation.

- Sign and date the form in Items 17-20, ensuring the preparer's information is legible.

- Once completed, submit the form to HUD's Homeownership Center (HOC), along with any required attachments.

After submitting the form, the HUD will review the application and determine if additional actions or documents are necessary to complete the process. Keep an eye on any correspondence for confirmation or additional requirements.

What You Should Know About This Form

What is the purpose of the SAMS 1111 form?

The SAMS 1111 form is utilized by the U.S. Department of Housing and Urban Development (HUD) to manage financial transactions related to single-family acquired properties. This form allows payees to register or update their information, ensuring that HUD can process payments and maintain accurate records. It supports functions such as adding a new payee, modifying existing payee information, or recertifying a selling broker.

Who needs to fill out the SAMS 1111 form?

This form must be completed by individuals or businesses looking to become a payee for HUD related transactions. It applies to various types of payees, including appraisers, closing agents, M&M contractors, and other entities involved in the sale and management of HUD properties. Existing payees may also need to submit the form to make changes to their current information.

What information is required on the SAMS 1111 form?

To effectively complete the SAMS 1111 form, one must provide identifying information such as the tax identification number (either an EIN for businesses or SSN for individuals), contact details, and the business address. Additionally, the form requires information about business ownership, such as minority or woman-owned status, and contact information for a representative. Clear and accurate data in these fields is essential for proper processing by HUD.

What should be included with the completed SAMS 1111 form?

Along with the completed SAMS 1111 form, applicants must include various attachments. This includes IRS documentation to verify the business name and tax identification number, proof of identity such as a driver's license, a recent bank statement or utility bill, and a local or state business license if applicable. For payees already under contract with HUD, attaching the first page of the signed contract is required as well.

What happens if the information on the SAMS 1111 form is incorrect?

Submitting incorrect information on the SAMS 1111 form may lead to delays or rejections in processing the application. Careful attention should be given to ensure that all details are accurate and match the documentation provided. In case of any discrepancies or required updates, the payee may be asked to resubmit the form along with the necessary corrections to avoid payment processing issues.

Common mistakes

Filling out the SAMS 1111 form incorrectly can lead to delays or rejection of processing. One common mistake is the failure to choose the correct type of application. The form has specific options listed, and selecting the wrong type can create confusion and necessitate resubmission.

Another frequent error occurs with the identification numbers. When filling out item 2 or 3, applicants often provide both the Employer Identification Number (EIN) and Social Security Number (SSN). It is important to use either the EIN or the SSN, but not both, as this can lead to inconsistencies with IRS documentation.

Inaccuracies in the business name or individual name are also prevalent. Item 2b and 3b require attention, as names provided must exactly match what appears on IRS forms. Discrepancies in these names can result in the form being returned for correction.

Another mistake involves the remittance address. If the remittance name and address differ from the business/individual name and address, applicants must fill out items 9 and 10 appropriately. Failure to indicate this can complicate payment processing.

Omitting required attachments is an issue that many encounter as well. For example, the IRS documentation showing the business or individual name and Tax Identification Number is mandatory. Any missing documentation during submission can lead to rejection of the application.

Additionally, applicants sometimes overlook the certification regarding minority ownership and business ownership. Item 11 requires specific selection based on the company’s status. An incorrect answer may call into question the authenticity of the information presented.

Signing the form correctly is critical. Often, preparers neglect to provide a legible signature and necessary contact information in items 17, 21, or 28. This can create issues regarding the validity of the submitted form.

Incomplete contact information is another common oversight. Providing the business phone number or details of the contact person is crucial. Missing this information may hinder future communications regarding the submitted application.

Misunderstanding the requirements related to family and external business relationships with HUD/M&M employees frequently leads to errors as well. If this applies, a clear explanation must be attached; otherwise, selecting “No” without considering the implications could result in compliance issues.

Lastly, adhering strictly to the deadlines is essential. Some applicants fail to resubmit or update their information before the set timeline. Maintaining organization and tracking submission dates will help mitigate this problem.

Documents used along the form

The SAMS 1111 form, used in the management of acquired single-family assets by the U.S. Department of Housing and Urban Development (HUD), often necessitates the submission of additional forms and documents to ensure proper processing of applications. Here are several accompanying documents that may be required.

- Form SF-3881: This document, known as the ACH Vendor/Miscellaneous Payment Enrollment Form, collects banking information necessary for electronic payments. It is essential for any payee type receiving payments from HUD.

- IRS Form 147C: This IRS documentation serves as proof of a business name and Tax Identification Number (TIN). It is commonly requested to confirm the identity of the payee.

- IRS Tax Return: A tax return, featuring preprinted labels, can verify the business name and TIN. This document is crucial for establishing the legitimacy of a payee.

- Driver’s License: A copy of the driver's license is often needed to authenticate the identity of individual payees. This is particularly important when a new payee is being added or an existing payee's details are modified.

- Utility Bill or Bank Statement: The first page of a recent utility bill or bank statement may be required to provide proof of address. This helps confirm the payee's location.

- Local or State Business License: For businesses, a copy of the applicable local or state business license is often requested. This document demonstrates that the entity is authorized to operate legally.

- Contract with HUD: If the payee is under a formal contract with HUD, a copy of the first page of that signed contract is necessary to validate the relationship between the parties.

- Form SAMS-1111A: This Selling Broker Certification form is required for selling brokers and is utilized to verify their qualifications and eligibility to participate in sales on behalf of HUD.

Submitting these documents alongside the SAMS 1111 form assists in facilitating a robust verification process. This process helps maintain compliance with HUD's internal controls while ensuring that payees are properly qualified for transactions related to acquired properties.

Similar forms

- W-9 Form: The W-9 form is used to request the taxpayer identification number and certification of individuals or businesses. Similar to SAMS 1111, it gathers basic information for tax reporting purposes and ensures that payee details are accurate for IRS purposes.

- SF-3881: This form is an ACH Vendor/Miscellaneous Payment Enrollment Form. Like SAMS 1111, it facilitates electronic payments and collects important payee information necessary for processing payments effectively.

- 1099-MISC Form: The IRS Form 1099-MISC reports various types of income other than wages and salaries. It shares common ground with SAMS 1111 as both involve collecting details for income reporting related to payees.

- Form 1040: The individual income tax return Form 1040 captures personal income details. SAMS 1111 often collects similar individual identification information, such as Social Security Numbers (SSNs), for compliance with tax obligations.

- Business License Application: This document registers businesses with state or local authorities. SAMS 1111 also verifies the legitimacy of business entities before approving payee status for HUD transactions.

- Minority Business Enterprise (MBE) Certification Form: This form certifies businesses that meet minority ownership criteria. Within SAMS 1111, applicants specify whether they are minority-owned, ensuring accurate tracking for affirmative action reporting.

- Contractor Registration Form: This form registers contractors for business, often including similar information about legal structure and ownership. SAMS 1111 verifies business validity before allowing participation in HUD contracts.

- IRS Form 147C: Issued by the IRS, this form verifies the official name and tax identification number of a business. SAMS 1111 parallels this by requiring verification of the payee’s EIN or SSN for accurate record-keeping.

Dos and Don'ts

When filling out the SAMS 1111 form, there's a right way and a wrong way to do things. Here are nine essential dos and don'ts to help you navigate the process smoothly.

- Do complete all required sections legibly.

- Don't submit attachments other than the specified form SF-3881.

- Do check your entries for accuracy to avoid delays.

- Don't leave any mandatory fields blank.

- Do ensure your Tax Identification Number matches IRS records.

- Don't use both EIN and SSN; choose one and stick with it.

- Do sign the form in ink when completing it.

- Don't forget to include the phone number and email for a contact person.

- Do notify the HUD office if you have a family or external business relationship with HUD employees.

Following these tips can significantly improve your experience with the SAMS 1111 form. Take your time, double-check your work, and you’ll be on your way to a successful submission.

Misconceptions

- Misconception 1: The SAMS 1111 form is only for new payee applications.

- Misconception 2: Completing the SAMS 1111 form is optional.

- Misconception 3: The SAMS 1111 form does not require supporting documents.

- Misconception 4: Only businesses can apply through the SAMS 1111 form.

This is inaccurate. While the form does allow for adding new payees, it also serves multiple functions. Users can modify existing payees, add new NAIDs to current payees, or recertify selling brokers, indicating its versatility.

This is misleading. Submission of the SAMS 1111 form is mandatory for any payee seeking to engage with HUD. This requirement ensures that proper records and controls are established for financial transactions.

This claim is false. Several attachments must accompany the form, particularly for new payees or those modifying existing information. For instance, IRS documentation and proof of business operations are crucial for validation.

This is incorrect. The form is designed for both businesses and individuals. It accommodates different payee types, including minority-owned and woman-owned businesses, as well as individual contractors. This broad applicability furthers HUD's mission to support diverse participation.

Key takeaways

When filling out the SAMS 1111 form, the following key takeaways are essential for ensuring accuracy and compliance:

- Purpose of the Form: This form is utilized primarily to add new payees, modify existing ones, or recertify selling brokers for transactions related to HUD’s single-family properties.

- Information Requirement: It is crucial to provide either the Employer Identification Number (EIN) or Social Security Number (SSN), but not both. These details must match IRS documentation.

- Contact Details: Comprehensive information about the payee, including business name, contact person, and address, is necessary for proper identification and communication.

- Certification: For payees that are minority-owned or small businesses, specific checkboxes must be selected, along with the relevant type identified according to HUD’s definitions.

- Attachments: Certain documents are mandatory, including IRS documentation showing the business name and Tax Identification Number, particularly for setting up new payees.

- Review Process: The completion of this form requires both a preparer and a reviewer’s signature, reinforcing the importance of internal controls and verification of the payee's legitimacy.

- Compliance with Regulations: Providing the SSN is mandatory under current regulations, and failure to do so may delay or reject eligibility for approval.

Browse Other Templates

Boiler Operator Job Description - Be proactive in managing your licensure and avoid potential penalties.

Comed Customer Service - The form clearly states that it does not admit liability on ComEd's part.

UMWA Address Change Form,Address Update Request Form,Change of Residence Application,Miner's Address Modification Form,Widow's Address Adjustment Request,Health and Retirement Funds Address Notification,Miner/Widow Information Update Form,Address Cor - Follow all instructions to ensure successful processing.