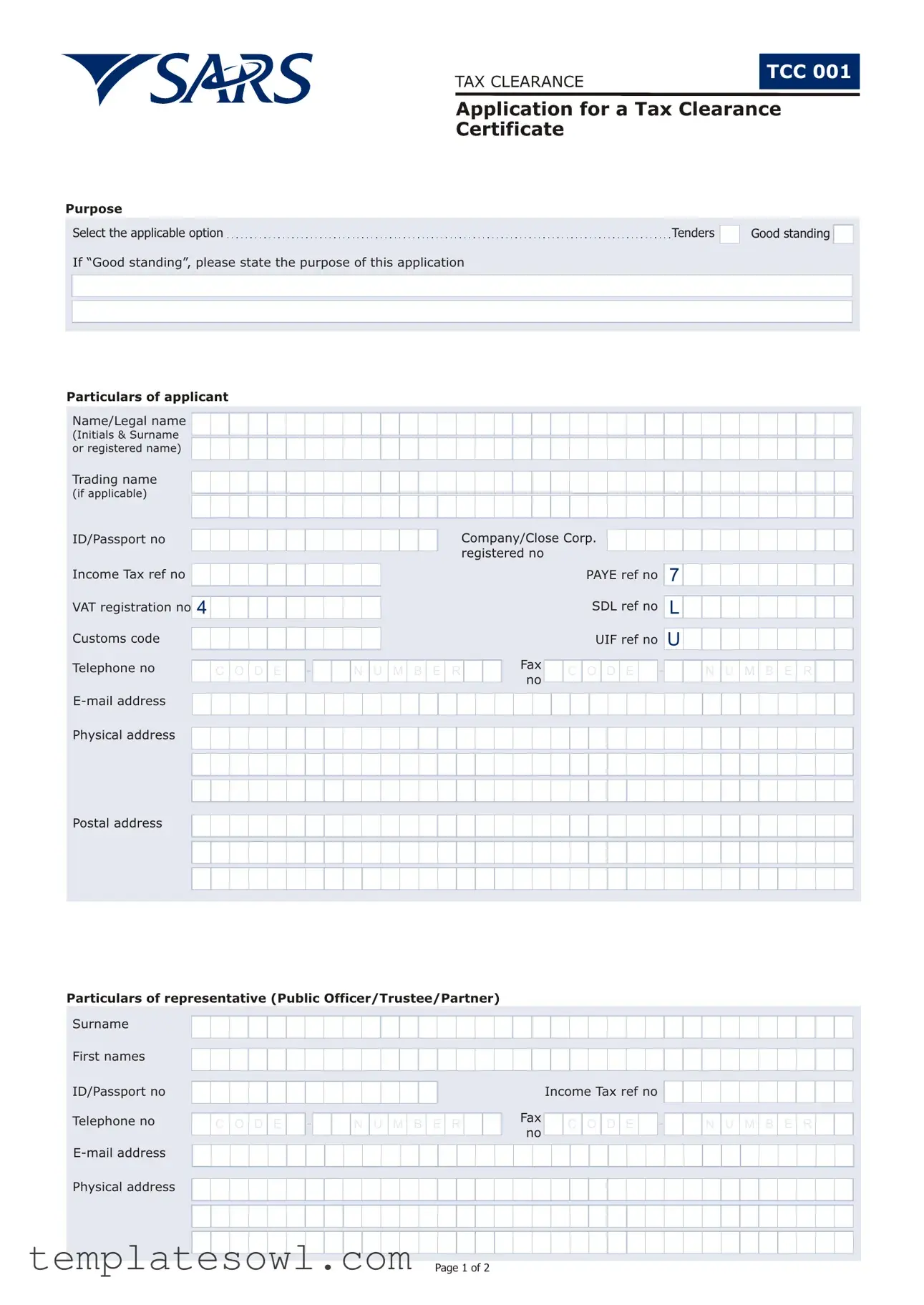

Fill Out Your Sars Tcc 001 Form

The Sars Tcc 001 form plays a crucial role for individuals and businesses seeking a Tax Clearance Certificate in South Africa. This application form is designed for those applying for a certificate either for tender submissions or to verify good standing with the South African Revenue Service (SARS). In filling out this form, applicants must provide key details such as their legal name, trading name if applicable, various registration numbers—including income tax and VAT—and their contact information. Sections for tender particulars allow the applicant to specify tender numbers, estimated amounts, and the duration of contracts previously awarded. Moreover, the form requires information on whether the applicant is under audit investigation, underscoring the importance of transparent disclosures. By appointing a representative or agent through a signed power of attorney, individuals can ensure that their applications are processed efficiently. It is essential for applicants to provide accurate information, as false declarations can lead to severe penalties. Notably, a Tax Clearance Certificate will only be issued after SARS has received the completed application alongside appropriate identification documentation, further reinforcing the integrity of the tax clearance process.

Sars Tcc 001 Example

TAX CLEARANCE

TCC 001

Application for a Tax Clearance

Certificate

Purpose |

|

|

Select the applicable option |

Tenders |

Good standing |

If “Good standing”, please state the purpose of this application

Particulars of applicant

Name/Legal name

(Initials & Surname or registered name)

Trading name

(if applicable)

ID/Passport no

Company/Close Corp. registered no

Income Tax ref no |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PAYE ref no |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

VAT registration no |

|

|

4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SDL ref no |

|||||||

Customs code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

UIF ref no |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

Telephone no |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fax |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

C |

O |

D |

E |

|

|

|

|

|

|

N |

U |

M |

B |

E |

R |

|

|

|

|

|

|

C |

O |

D |

E |

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

no |

|

|

|

|

|

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Physical address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Postal address

7

L

U

U

N U M B E R

N U M B E R

Particulars of representative (Public Officer/Trustee/Partner)

Surname

First names

ID/Passport no

Telephone no

Income Tax ref no

|

C |

O |

D |

E |

|

|

|

|

|

|

N |

U |

M |

B |

E |

R |

|

|

|

|

|

Fax |

|

|

C |

O |

D |

E |

|

|

|

|

|

N |

U |

M |

B |

E |

R |

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

no |

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Physical address

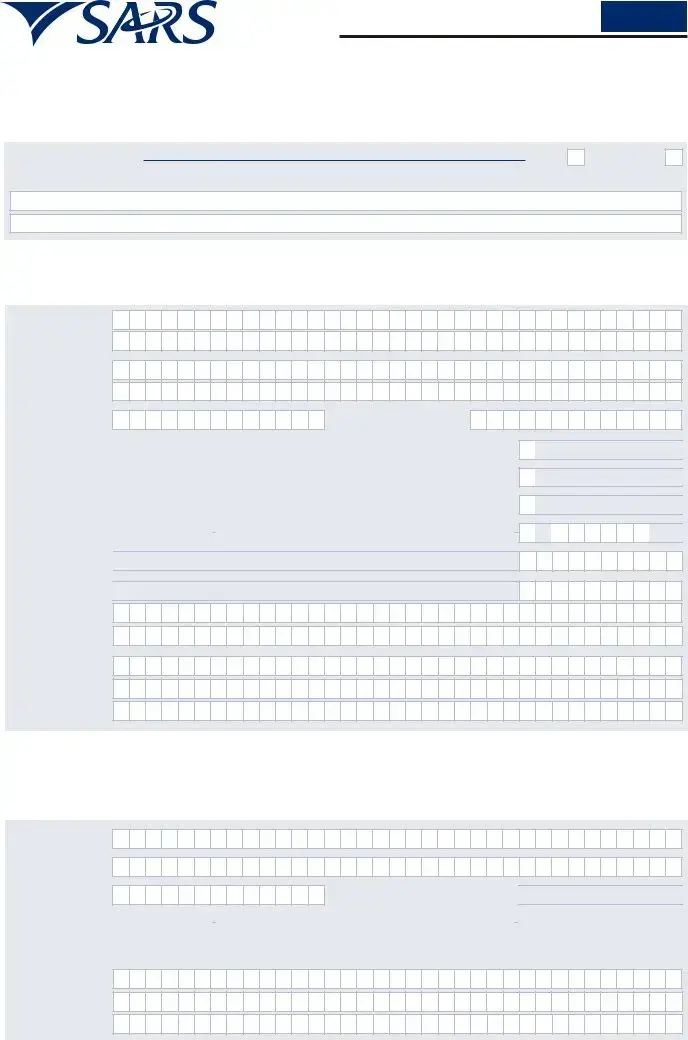

Page 1 of 2

Particulars of tender (If applicable)

Tender number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Estimated Tender |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

R |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

amount |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Expected duration |

|

|

|

|

|

|

year(s) |

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

of the tender |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

,

,

Particulars of the 3 largest contracts previously awarded |

|

|

|

||

Date started |

Date finalised |

Principal |

Contact person |

Telephone number |

Amount |

Audit

Are you currently aware of any Audit investigation against you/the company? If “YES” provide details

YES

NO

Appointment of representative/agent (Power of Attorney)

I the undersigned confirm that I require a Tax Clearance Certificate in respect of Tenders

I hereby authorise and instruct

SARS the applicable Tax Clearance Certificate on my/our behalf.

SARS the applicable Tax Clearance Certificate on my/our behalf.

Signature of representative/agent

Name of representative/ agent

or Goodstanding.

to apply to and receive from

CC Y Y

M M

M M

D D Date

D D Date

Declaration

I declare that the information furnished in this application as well as any supporting documents is true and correct in every respect.

C

Signature of applicant/Public Officer

Name of applicant/

Public Officer

C

Y

Y

M M

M M

D

D

Date

D

Notes:

1.It is a serious offence to make a false declaration.

2.Section 75 of the Income Tax Act, 1962, states: Any person who

(a)fails or neglects to furnish, file or submit any return or document as and when required by or under this Act; or

(b)without just cause shown by him, refuses or neglects to-

(i)furnish, produce or make available any information, documents or things;

(ii)reply to or answer truly and fully, any questions put to him ...

As and when required in terms of this Act ... shall be guilty of an offence ...

3.SARS will, under no circumstances, issue a Tax Clearance Certificate unless this form is completed in full.

4.Your Tax Clearance Certificate will only be issued on presentation of your South African Identity Document or Passport (Foreigners only) as applicable.

Page 2 of 2

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose of Form | The Sars Tcc 001 form is used for applying for a Tax Clearance Certificate, which may indicate good standing or be necessary for tenders. |

| Applicant Information | Applicants must provide details such as their legal name, trading name, and various identification numbers (ID, Company Registration, etc.). |

| Declaration Requirement | The applicant must declare that all information provided in the application, along with any supporting documents, is accurate and true. |

| Serious Offence | Falsifying information on the application may lead to legal repercussions, as stated under Section 75 of the Income Tax Act, 1962. |

| Documentation Needed | The issuance of the Tax Clearance Certificate is contingent upon the applicant presenting a valid South African ID or Passport, applicable to foreigners. |

Guidelines on Utilizing Sars Tcc 001

Filling out the SARS TCC 001 form accurately is essential for obtaining a Tax Clearance Certificate. This certificate is necessary for various purposes, particularly when dealing with tenders or proving good standing with SARS. Follow these steps to complete the form correctly.

- Select the purpose of the application: either Tenders or Good Standing. If you choose Good Standing, specify the purpose of this application.

- Enter the particulars of the applicant:

- Name/Legal name (Initials & Surname or registered name)

- Trading name (if applicable)

- ID/Passport number

- Company/Close Corporation registered number

- Income Tax reference number

- PAYE reference number

- VAT registration number

- SDL reference number

- Customs code

- UIF reference number

- Telephone number

- Fax number

- E-mail address

- Physical address

- Postal address

- Provide the particulars of the representative (Public Officer/Trustee/Partner):

- Surname

- First names

- ID/Passport number

- Telephone number

- E-mail address

- Income Tax reference number

- Fax number

- Physical address

- If applicable, enter the particulars of the tender:

- Tender number

- Estimated Tender amount

- Expected duration (in years) of the tender

- List the particulars of the 3 largest contracts previously awarded:

- Date started

- Date finalized

- Principal contact person

- Telephone number

- Amount

- Indicate if you are currently aware of any audit investigation against you or the company. If "YES," provide details.

- Complete the appointment of representative/agent section by confirming you authorize SARS to apply for the Tax Clearance Certificate on your behalf. Include:

- Signature of representative/agent

- Name of representative/agent

- Date

- Declare that the information provided is true and correct by signing in the designated area. Include:

- Signature of the applicant/Public Officer

- Name of the applicant/Public Officer

- Date

Ensure all sections of the form are completed. Missing information can delay the issuance of your Tax Clearance Certificate. Always present your South African Identity Document or Passport along with the completed form for processing.

What You Should Know About This Form

What is the purpose of the SARS TCC 001 form?

The SARS TCC 001 form is primarily utilized to apply for a Tax Clearance Certificate. This certificate serves as proof that an individual or company is in good standing with tax obligations. Whether you are applying for a tender or simply wishing to demonstrate compliance, this form is essential.

Who needs to fill out the TCC 001 form?

This form must be completed by individuals or entities seeking a Tax Clearance Certificate. This includes individuals applying for government tenders or businesses that need to verify their tax status for any other official purpose. If your organization operates in South Africa, it’s crucial to ensure that your tax matters are in order.

What information is required on the TCC 001 form?

When filling out the TCC 001 form, a variety of details are necessary. Applicants need to provide their name or legal name, trading name, ID or passport number, and relevant tax reference numbers (Income Tax, PAYE, VAT, SDL, etc.). Additionally, contact information such as telephone number and email address is required. Transparency in this information is paramount for a successful application.

Can someone else submit the TCC 001 form on my behalf?

Yes, you can appoint a representative or agent to complete and submit the TCC 001 form on your behalf. By signing the authorization section included in the form, you allow your appointed individual to apply for the Tax Clearance Certificate for you. Ensure that your chosen representative is trustworthy and fully informed about your tax status.

What happens if there is an ongoing audit?

If you are currently under audit investigation, it is crucial to disclose this information on the TCC 001 form. This may influence the processing of your Tax Clearance Certificate application. Transparency during this process helps prevent issues later on, especially if you are applying for a tender or financial aid.

What should I do if I misplace my Tax Clearance Certificate?

In the event of misplacing your Tax Clearance Certificate, you may need to reapply using the TCC 001 form. It's advisable to keep multiple copies of important documents to avoid complications. Always ensure that your information is up to date and correctly filed in case you need to obtain another certificate.

What are the consequences of providing false information on the TCC 001 form?

Providing false information on the TCC 001 form is a serious matter. It can lead to legal penalties, including fines or other repercussions stipulated under the Income Tax Act. The trustworthiness of your application is vital, and it’s always best to provide accurate and honest information to avoid any issues with the South African Revenue Service.

Common mistakes

Completing the Sars Tcc 001 form can be a straightforward process, yet many individuals encounter common pitfalls that can delay or jeopardize their application. One frequent mistake is failing to select the applicable option for the purpose of the application. Applicants must clearly specify whether they are applying for a Tax Clearance Certificate for tenders or for being in good standing. A missed selection can result in unnecessary processing delays.

Another error involves entering incorrect personal or business details. Accuracy is key when filling out sections like the name, ID/Passport number, and registration numbers. Typos or mismatched information can lead to complications. Double-checking details before submission is essential to ensure everything aligns with official records.

Some applicants forget to provide a valid and current email address. This contact information is crucial as it enables communication regarding the application status. Providing an outdated or incorrect email can result in missed notifications or requests for additional information.

Applicants often neglect to include their physical as well as postal addresses. Omitting this information can hinder the processing of the application, causing unnecessary delays. It’s important to provide both addresses to facilitate communication and documentation delivery.

In the case of companies or close corporations, failing to designate a representative or public officer can be problematic. The application must include the name and details of the person responsible for the submission. Without this information, SARS may question the validity of the application, potentially leading to further issues.

Many people overlook the importance of declaring any ongoing audit investigations. If the applicant is aware of an audit, stating this clearly is crucial. Ignoring this requirement can lead to significant complications, including potential legal ramifications.

Furthermore, not signing the declaration can invalidate the application. It is vital that the applicant or public officer signs the form to affirm that all information provided is accurate. A missed signature can result in outright rejection of the application.

Lastly, applicants sometimes underestimate the necessary documentation for the certification process. Presenting your South African Identity Document or a Passport when applying is mandatory. Without these documents, the Tax Clearance Certificate won’t be issued, making it imperative to have everything prepared prior to submission.

Documents used along the form

The SARS TCC 001 form is crucial for obtaining a Tax Clearance Certificate, essential for various business dealings in South Africa. Along with this form, several other documents may be required for a complete submission. Below is a list of commonly associated forms and documents that complement the TCC 001. Each entry offers a brief description to help you understand their significance.

- ID Document or Passport: This serves as proof of identity for South African citizens or foreign applicants. It is essential for verifying the details provided in the TCC 001 form.

- Proof of Address: A recent utility bill or bank statement confirming the applicant’s physical address. This document helps SARS validate the application against provided details.

- Company Registration Certificate: This certificate documents the legal incorporation of a business and proves its existence. It typically includes the company number and registration date.

- Tax Compliance Status Letter: This letter indicates that the business is compliant with tax requirements. It may be needed to accompany the TCC application for additional verification.

- PAYE Registration Document: This documentation confirms the registration for Pay As You Earn (PAYE) tax. It demonstrates the company's tax responsibilities regarding employee salaries.

- VAT Registration Certificate: This certificate proves that your business is registered for Value Added Tax (VAT). It is crucial for businesses involved in taxable activities.

- SDL Registration Document: The Skills Development Levy (SDL) registration document verifies that the company is compliant with contributions aimed at skills development.

- Financial Statements: Recent financial statements may be required to evaluate the applicant's financial health. These documents can provide insights into the company's operations and profitability.

Completing the TCC 001 form and gathering the associated documents ensures a smoother application process. Having the necessary paperwork readily available not only helps expedite the approval but also aids in achieving better compliance with tax regulations.

Similar forms

The SARS TCC 001 form, used to apply for a Tax Clearance Certificate, shares similarities with several other important documents in the realm of taxation and business compliance. Below is a breakdown of five such documents and how they relate to the TCC 001 form.

- IRS Form 4506-T: This form allows taxpayers to request a transcript of their tax return. Like the TCC 001, it helps confirm an individual’s or business’s tax compliance status. Both documents resonate with the need for transparency in tax dealings.

- W-9 Form: The Request for Taxpayer Identification Number and Certification is essential for U.S. businesses. It collects information about a business’s tax status. Just as the TCC 001 identifies the taxpayer and their obligations, the W-9 identifies U.S. entities for accurate reporting.

- Certificate of Good Standing: This certificate verifies that a business is authorized to operate and is in compliance with state regulations. Similar to how the TCC 001 asserts that an entity can engage in tenders by proving its tax compliance, this certificate attests to overall business legitimacy.

- Form 8850: This document is used to request certification for the Work Opportunity Tax Credit. Both this form and the TCC 001 serve a purpose in facilitating business activities and ensuring compliance with relevant laws, showcasing the importance of meeting eligibility requirements.

- State Tax Clearance Certificate: Issued by state tax authorities, this document confirms that a business has met state tax obligations. Much like the TCC 001, it emphasizes the importance of being tax-compliant before participating in certain business opportunities, particularly government contracts.

Understanding these documents will help businesses navigate their tax obligations more effectively. Each plays a crucial role, ensuring compliance and promoting trust in business relationships.

Dos and Don'ts

When filling out the Sars Tcc 001 form, attention to detail is crucial. Here’s a list of dos and don’ts to guide you:

- Do clearly state the purpose of your application, whether it’s for tenders or good standing.

- Do provide accurate personal and company information including your ID number and contact details.

- Do ensure all required fields are completed to avoid delays in processing.

- Do verify that contact details for your representative are correct.

- Do declare any ongoing audit investigations truthfully.

- Don’t leave any sections blank; incomplete forms will be rejected.

- Don’t submit false information; this is considered a serious offence.

- Don’t forget to provide supporting documents where required.

- Don’t neglect to confirm that your identity document or passport is available for submission.

- Don’t rush through the application; take your time to ensure accuracy.

Misconceptions

- Misconception 1: The Sars Tcc 001 form is only for companies.

- Misconception 2: You can submit the form without complete information.

- Misconception 3: A Tax Clearance Certificate is automatically granted after submitting the form.

- Misconception 4: The form can be submitted without proper identification.

- Misconception 5: It's unnecessary to keep a copy of the completed form.

This form is applicable to individuals, businesses, and organizations alike. Everyone can apply for a Tax Clearance Certificate, whether they operate as a sole proprietor or have a registered company. The process is designed to accommodate a wide variety of applicants.

Many believe that they can submit the Sars Tcc 001 form even if it's incomplete. However, a full and accurate application is crucial. Submitting the form without all required details can lead to delays or rejection of your application. Always ensure that every section is filled out completely.

Submitting the form doesn’t guarantee approval. The application will undergo a review by SARS, which may involve additional checks. If any discrepancies arise or if additional information is needed, it could delay the issuance of your certificate.

Identification is a critical requirement when applying. Applicants must provide either a South African Identity Document or a passport if they are foreigners. Without appropriate identification, your application will not be processed.

Retaining a copy of your submitted form can be incredibly beneficial. It serves as a record of what you provided to SARS and may assist in future applications or inquiries. Always keep a copy of any official document for your records.

Key takeaways

When filling out and using the Sars Tcc 001 form, consider the following key takeaways:

- Understand the Purpose: Clearly identify whether you are applying for a Tax Clearance Certificate for tenders or good standing. This will guide your completion of the form.

- Accurate Information: Ensure that the information you provide, such as names, identification numbers, and contact details, is correct. Providing false information can lead to legal issues.

- Include All Necessary Details: Fill in every required section of the form. Incomplete forms will not be processed, which may delay the issuance of your Tax Clearance Certificate.

- Authorization: If you are appointing a representative or agent to act on your behalf, make sure their details are included and that you sign the authorization section correctly.

- Representatives’ Information: If applicable, include information about the public officer or trustee. This person will be accountable for the application.

- Read the Declaration: Before signing, carefully review the declaration stating that all information is true and correct. A false declaration is a serious offense.

- Document Presentation: Prepare to present your South African Identity Document or passport upon application submission. This is mandatory for the issuance of your Tax Clearance Certificate.

Browse Other Templates

Air Balance Hvac - An emphasis on thorough documentation supports accountability within the process.

Ds-261 Form Pdf - Auto clearing house (ACH) can be chosen as a payment method.