Fill Out Your Sars Vat101 Form

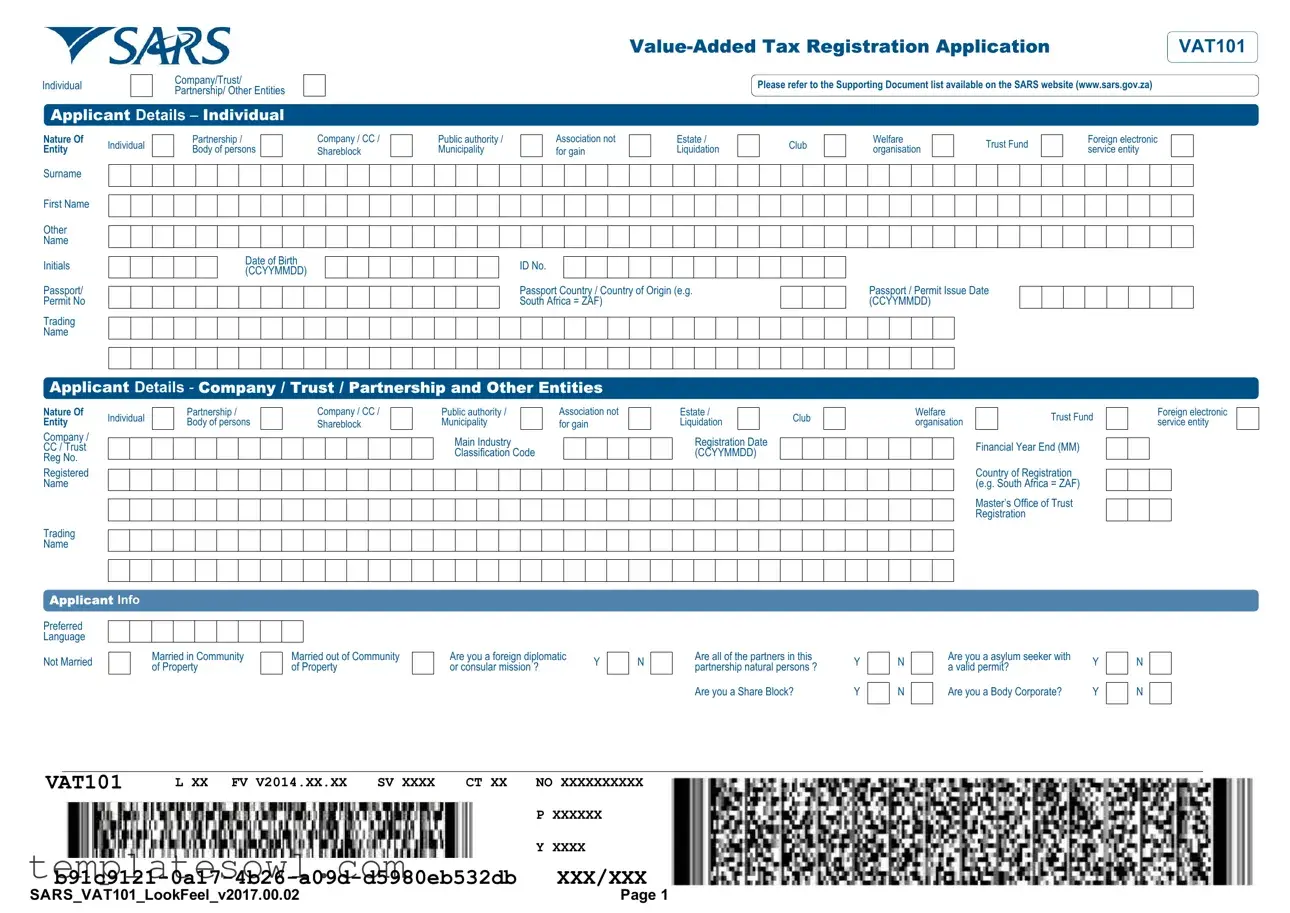

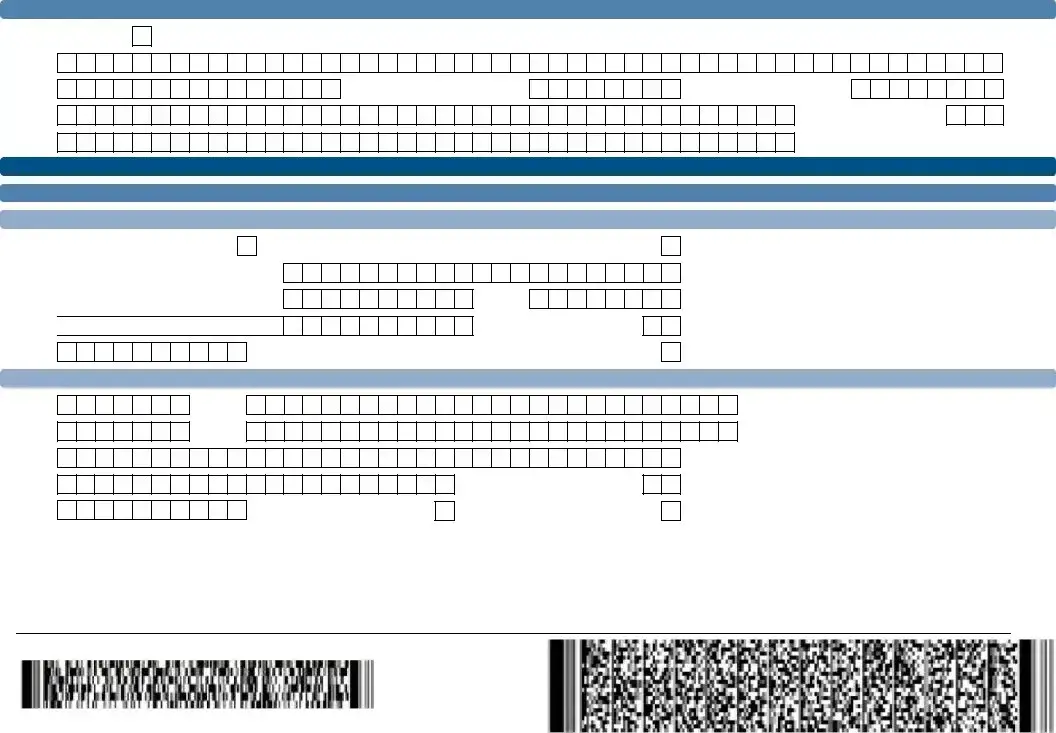

The SARS VAT101 form serves as a crucial document for registering for Value-Added Tax in South Africa. This form collects essential information from both individuals and entities, including partnerships, companies, trusts, and other organizations. Applicants must provide their personal details, such as name, ID or passport number, date of birth, and contact information. Specific categories must be selected, identifying the applicant as an individual, partnership, or a different entity type. The form also requires details about the business, including the registered name, trading name, registration date, and industry classification. Furthermore, applicants need to disclose their marital status, whether they have foreign diplomatic status, and if they are a body corporate. Address sections for both physical and postal details ensure that the South African Revenue Service (SARS) can communicate effectively with the applicant. Finally, the form includes banking information and declarations regarding the applicant’s financial setup, which helps SARS determine the tax obligations related to VAT registration.

Sars Vat101 Example

Individual

Company/Trust/ Partnership/ Other Entities

VAT101 |

Please refer to the Supporting Document list available on the SARS website (www.sars.gov.za)

Applicant Details – Individual

Nature Of |

Individual |

|

Partnership / |

|

Company / CC / |

Entity |

|

Body of persons |

|

Shareblock |

|

|

|

|

Public authority / Municipality

Association not for gain

Estate / Liquidation

Club

Welfare organisation

Trust Fund

Foreign electronic service entity

Surname

First Name

Other

Name

Initials

Passport/ Permit No

Trading

Name

Date of Birth (CCYYMMDD)

ID No.

Passport Country / Country of Origin (e.g. South Africa = ZAF)

Passport / Permit Issue Date (CCYYMMDD)

Applicant Details - Company / Trust / Partnership and Other Entities

Nature Of |

Individual |

|

Partnership / |

|

Company / CC / |

|

Public authority / |

|

Association not |

|

Estate / |

|

Club |

|

Welfare |

|

Trust Fund |

Entity |

|

Body of persons |

|

Shareblock |

|

Municipality |

|

for gain |

|

Liquidation |

|

|

organisation |

|

|||

|

|

|

|

|

|

|

|

|

|

|

Foreign electronic service entity

Company /

CC/ Trust

Reg No.

Registered Name

Trading

Name

Main Industry Classification Code

Registration Date (CCYYMMDD)

Financial Year End (MM)

Country of Registration (e.g. South Africa = ZAF)

Master’s Office of Trust

Registration

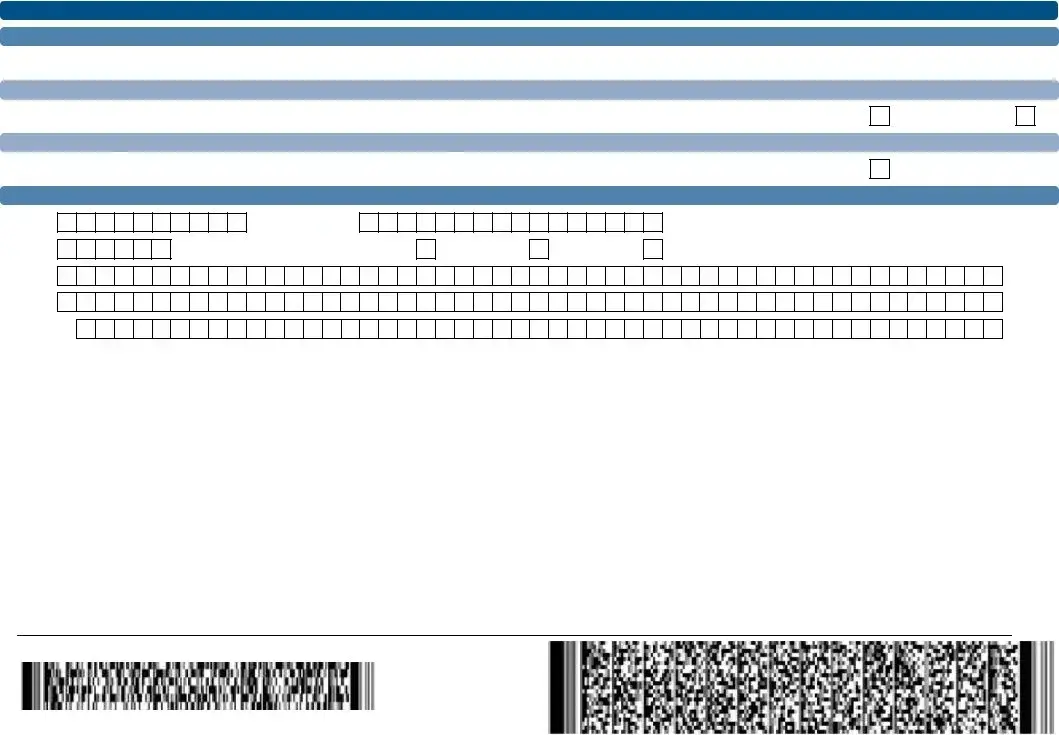

Applicant Info

Preferred

Language

Not Married |

|

Married in Community |

|

of Property |

|

|

|

Married out of Community of Property

Are you a foreign diplomatic |

Y |

|

or consular mission ? |

||

|

N

Are all of the partners in this |

Y |

|

partnership natural persons ? |

||

|

||

Are you a Share Block? |

Y |

N

N

Are you a asylum seeker with a valid permit?

Are you a Body Corporate?

Y

Y

N

N

VAT101 |

L XX FV V2014.XX.XX SV XXXX CT XX |

NO XXXXXXXXXX |

|

|

P XXXXXX |

|

|

Y XXXX |

XXX/XXX |

||

SARS_VAT101_LookFeel_v2017.00.02 |

Page 1 |

|

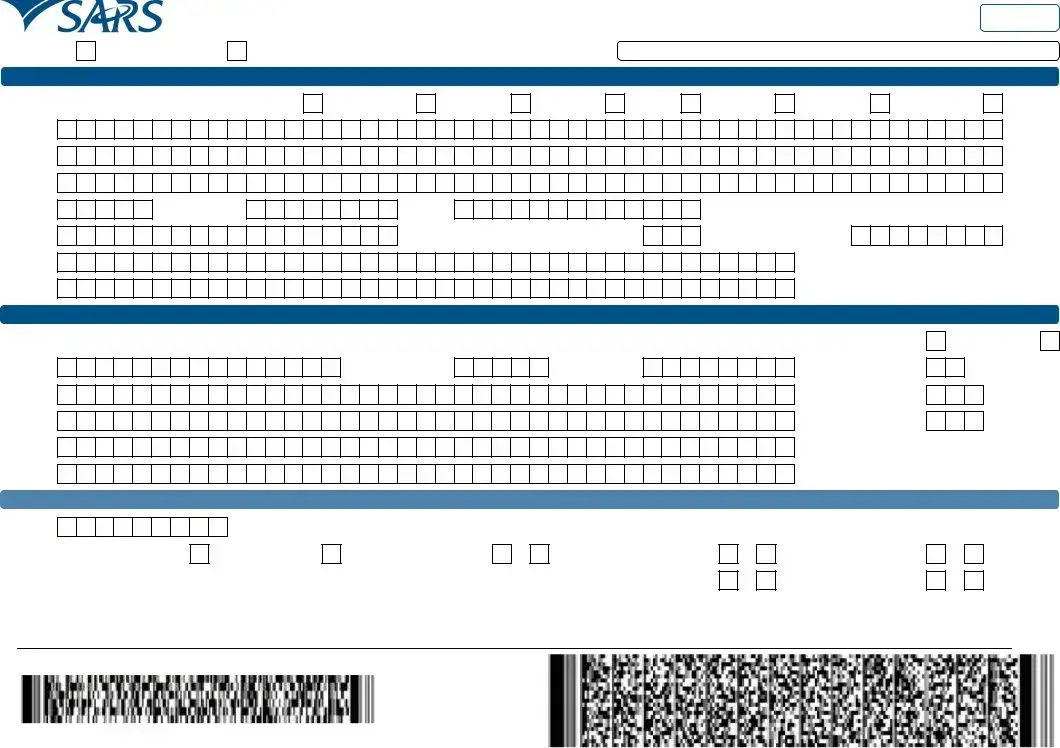

Contact Details

Home Tel No.

Cell No.

Mark here with an X if you declare that you do not have a Cell No.

Web

Address

Fax No.

Bus Tel No.

Mark here with an X if you declare that you do not have an Email address

Physical Address Details

Unit No. |

|

|

|

|

|

8 |

|

|

|

|

|

|

|

|

|

Street No.

Suburb /

District

Complex (if applicable)

Street / Farm Name

City / Town

Postal Code

Postal Address Details

Complete this part if postal address is a Postal Box

Country Code

Registered Physical Address

Mark here with an “X” if same as above or complete your Postal Address |

|

|

Is your Postal Address a Street Address? |

|

Y |

|

|

|

N |

|

|

|

|

Mark here with an “X” if this is a |

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

Care Of address |

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Postal Agency or Other |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PO Box |

|

|

Private Bag |

|

Other PO Special |

|

|

|

|

|

|

|

|

|

|

Number |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

Service (specify) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Post Office |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Country Code |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

Postal Code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Registered Postal Address |

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Complete this part if postal address is a Street Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

Unit No.

Street No.

Suburb / District

8

Complex (if applicable)

Street / Farm Name

City / Town

Country Code

Postal Code

Registered Postal Address

VAT101 L XX FV V2014.XX.XX SV XXXX CT XX NO XXXXXXXXXX

P XXXXXX

Y XXXX

SARS_VAT101_LookFeel_v2017.00.02 |

Page 2 |

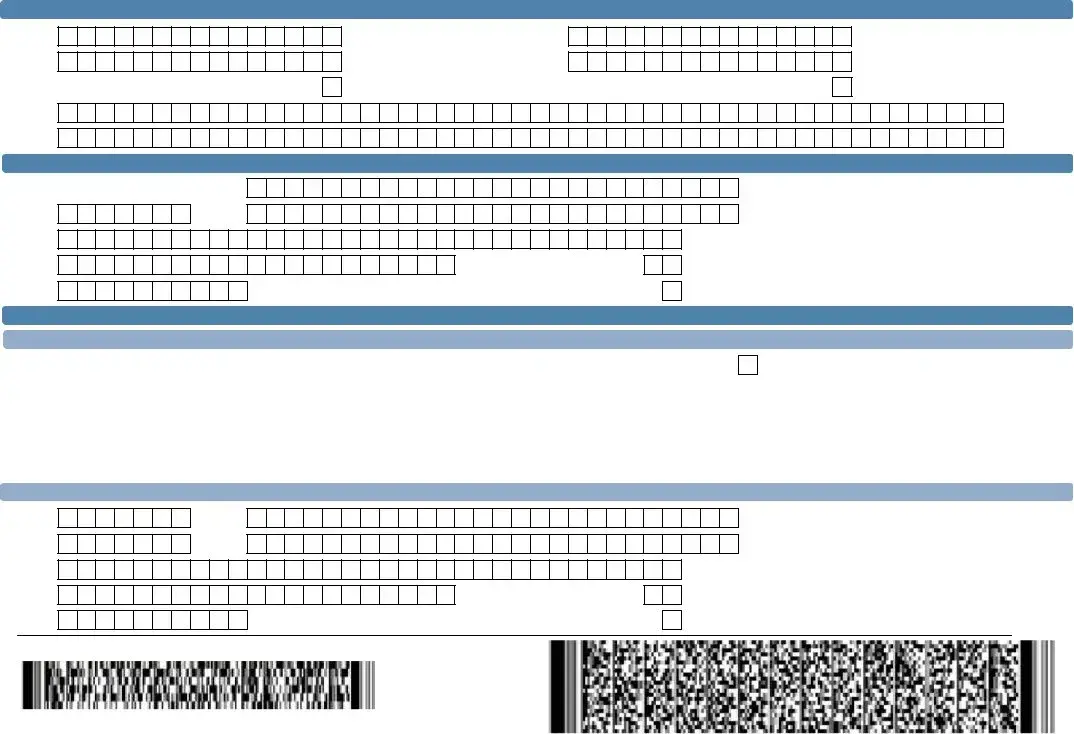

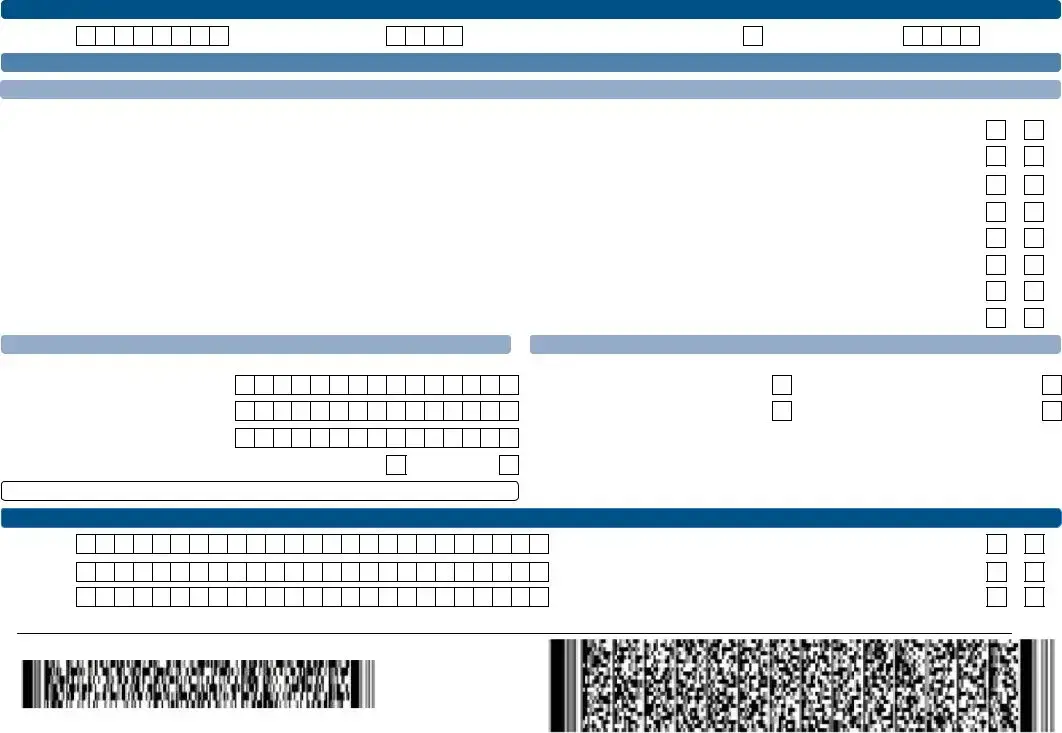

Particulars of Representative Taxpayer

Capacity: |

Treasurer |

|

Main Partner |

|

Main Trustee |

Nature Of |

Individual |

|

Partnership / |

|

Company / CC / |

|

|

||||

|

|

||||

Entity |

|

Body of persons |

|

Shareblock |

|

|

|

|

Public Officer

Public authority / Municipality

Main Member

Association not for gain

Parent / Guardian

Estate /

Liquidation

Accounting officer |

|

Curator / Liquidator / Executor / |

|

Administrator (Estates) |

|

|

|

Club |

|

Welfare |

|

Trust Fund |

|

Foreign electronic |

|

organisation |

|

|

service entity |

||

|

|

|

|

|

Surname |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

First Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Initials |

|

|

|

|

|

Date of Birth |

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

(CCYYMMDD) |

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Passport/ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Permit |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Relationship Marked for Termination

Date of Appointment (CCYYMMDD)

Passport Country (e.g. South Africa = ZAF)

ID No.

Passport Issue Date (CCYYMMDD)

Particulars of Members / Trustees / Beneficiaries / Partners / Directors etc.

Is this party a natural person ? |

Y |

|

N |

|

|

|

|

Particulars - Individual |

|

||

|

|

|

|

Capacity: |

Treasurer |

|

Partner |

|

|

|

Main Partner |

|

|

||

|

Director |

|

|

Nature Of |

Individual |

|

Partnership / |

|

|||

|

|||

Entity |

|

Body of persons |

|

|

|

||

Trustee

Main Trustee

Company / CC / Shareblock

Public Officer

Main Member

Public authority / Municipality

Member

Association not for gain

Parent / Guardian

Estate /

Liquidation

Accounting officer |

|

Curator / Liquidator / Executor / |

|

Administrator (Estates) |

|

|

|

Club |

|

Welfare |

|

Trust Fund |

|

Foreign electronic |

|

organisation |

|

|

service entity |

||

|

|

|

|

|

Surname |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

First Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Initials |

|

|

|

|

|

Date of Birth |

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

(CCYYMMDD) |

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Passport/ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Permit |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

No. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Relationship Marked for Termination

Date of Appointment (CCYYMMDD)

Passport Country (e.g. South Africa = ZAF)

8

ID No.

Passport Issue Date (CCYYMMDD)

VAT101 L XX FV V2014.XX.XX SV XXXX CT XX NO XXXXXXXXXX

P XXXXXX

Y XXXX

SARS_VAT101_LookFeel_v2017.00.02 |

Page 3 |

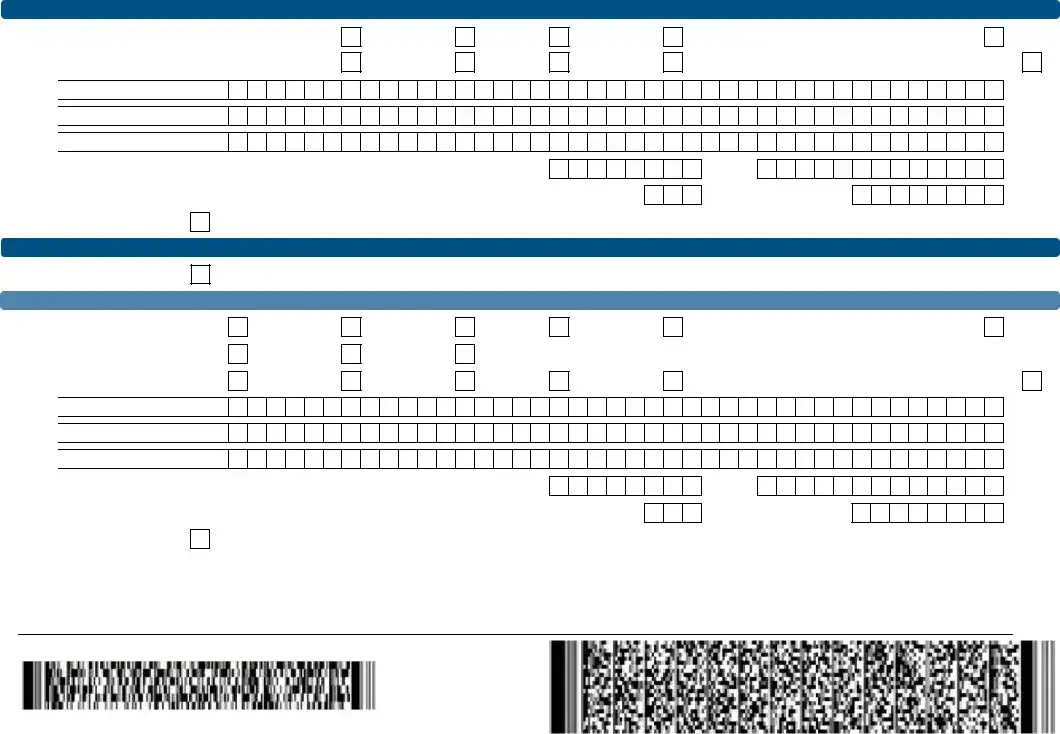

Particulars - Company / Trust / Partnership and Other Entities

Capacity: Partner

Nature of

Entity

Company /

CC/ Trust

Reg No.

Registered

Name

Date of Appointment (CCYYMMDD)

Registration Date (CCYYMMDD)

Country of Registration

(e.g. South Africa = ZAF)

My Addresses

Address Details (Used to add, edit and delete addresses at library level)

Complete this part if address is a Postal Box

Is your Postal Address a Street Address? |

Y |

|

N |

|

|

|

|

Postal Agency or Other

PO Box |

|

|

Private Bag |

|

Other PO Special |

||||||

|

|

|

Service (specify) |

||||||||

|

|

|

|

|

|

|

|

||||

Post Office |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mark here with an “X” if this is a Care Of address

Number

Country Code

Postal Code

Registered Postal Address

Complete this part if address is a Street Address

Unit No.

Street No.

Suburb / District

8

Complex (if applicable)

Street / Farm Name

City / Town

Country Code

Postal Code

Registered Postal Address

Registered Physical Address

VAT101 L XX FV V2014.XX.XX SV XXXX CT XX NO XXXXXXXXXX

P XXXXXX

Y XXXX

SARS_VAT101_LookFeel_v2017.00.02 |

Page 4 |

My Bank Accounts

Bank Account Holder Declaration

I use South African |

|

I use a South African Bank |

|

I declare that I have no |

|

|

|

|

|

|

bank accounts |

|

Account of a 3rd party |

|

South African bank account |

|

|

|

|

|

|

Reason for No Local / 3rd Party Bank Account – Individual |

|

|

|

|

|

|

||||

|

Insolvency / Curatorship |

|

Deceased Estate |

|

Shared Account |

|

Income below tax |

|

Statutory restrictions |

|

|

|

|

|

|

||||||

local bank account |

|

|

|

|

threshold / Impractical |

|

||||

|

|

|

|

|

|

|

|

|

||

Reason for No Local / 3rd Party Bank Account – Company / Trust / CC / Partnership / Government / Foreign Entity / Other Exempt Institutions etc.

|

Liquidation |

|

Company Deregistration |

|

Group Company Account |

|

Dormant |

|

Trust Administrator Account |

|

a local bank account |

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

Minor child

Bank Account Details

Bank Account

Status

Branch No.

Bank Name

Branch Name

Account Holder Name (Account name as registered at bank)

Account No.

Account Type: |

Cheque |

Savings

Transmission

VAT101 L XX FV V2014.XX.XX SV XXXX CT XX NO XXXXXXXXXX

P XXXXXX

Y XXXX

SARS_VAT101_LookFeel_v2017.00.02 |

Page 5 |

VAT

VAT Liability Date (CCYYMMDD)

Business Activity Code

Mark here if you derive farming income in addition to your main business activity income

Farming Activity Code

Financial PARTICULARS

Registration Options

Select one of the registration options below.

Taxable supplies exceeded R50 000.00 in the preceding 12 months

Taxable supplies did not exceed R50 000.00 in the preceding 12 months but are reasonably expected to exceed R50,000 in the following 12 months, based on one or more of the following situations:

The actual value of taxable supplies exceeded either an average of R4,200 per month for a minimum of 2 months and a maximum of 11 months immediately preceding the date of registration, or an actual value of R4200 in the month immediately preceding the date of registration

The actual value of taxable supplies were nil or did not exceed either an average of R4,200 per month for a minimum of 2 months and a maximum of 11 months immediately preceding the date of registration, or an actual value of R4200 in the month immediately preceding the date of registration, but either of the following exist

Written Contracts in terms of which a contractual obligation exists in writing, to make taxable supplies in excess of R50,000 in the following 12 months reckoned from the date of registration; or

Finance Agreements wherein the total repayments in terms of that financial, credit or other agreement will in the following 12 months reckoned from the date of registration exceed R 50,000 or

Expenditure incurred or to be incurred or capital goods acquired and payments made will in the following 12 months reckoned from the date of registrationexceed R 50,000

Goods or services are acquired directly in respect of the commencement of a continuous and regular activity and taxable supplies are expected to be made after a period of time

Y

Y

Y

Y

Y

Y

Y

Y

N

N

N

N

N

N

N

N

Value of Taxable Supplies

Furnish the actual / expected total value of taxable supplies for a period of 12 months as follows:

Standard rated supplies |

R |

|

R |

||

to other countries) |

||

|

Tax Periods

Please select one of the following:

Monthly tax period

Tax periods of two months

Tax periods of 6 months (Farming – only if taxable supplies for 12 months do not exceed R1.5 million)

Tax periods of 12 months ending on financial year end

Total value of taxable supplies |

R |

Accounting basis: |

Payment |

Invoice

Note: In the case of the purchase of a going concern, furnish the value of supplies made by the seller.

VAT - Diesel Refund Concession Options

On Land Status:

Off Shore Status:

Rail Status:

Would you like to register for diesel refunds – On land ? |

Y |

Would you like to register for diesel refunds – Off shore ? |

Y |

Would you like to register for diesel refunds – Rail ? |

Y |

N

N

N

VAT101 L XX FV V2014.XX.XX SV XXXX CT XX NO XXXXXXXXXX

P XXXXXX

Y XXXX

SARS_VAT101_LookFeel_v2017.00.02 |

Page 6 |

VAT – Diesel Refund

Concession Type – On Land

Liability Date (CCYYMMDD)

Major Division |

Forestry and Logging |

Estimated Diesel Purchases (litres

11

p/a) for Current Financial Year

Mining and Quarrying

Mining Sub - classification

Estimated Turnover for |

R |

|

|

|

|

|

|

|

|

|

|

|

||

Current Financial Year |

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|||

Farming |

|

|

Farming Sub - classification |

|

|

|

|

|||||||

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Concession Type – Offshore & Electricity Generating Plant

Liability Date |

|

|

|

|

|

|

|

|

Estimated Diesel Purchases (litres |

|

|

|

|

|

|

|

|

|

|

|

|

|

(CCYYMMDD) |

|

|

|

|

|

|

|

|

11 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

p/a) for Current Financial Year |

|

|

|

|

|

|

|

|

|

|

|

|

||

Major Division |

|

Coastal Shipping |

|

Offshore Mining |

|

|

Electricity Generating Plant |

|

|

|

|

|||||||||||

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Concession Type – Rail & Harbour Services

Estimated Turnover for |

R |

|

|

|

|

|

|

|

|

|

|

|

||

Current Financial Year |

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|||

NSRI |

|

|

Commercial Fishing |

|

|

|

|

|||||||

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Liability Date (CCYYMMDD)

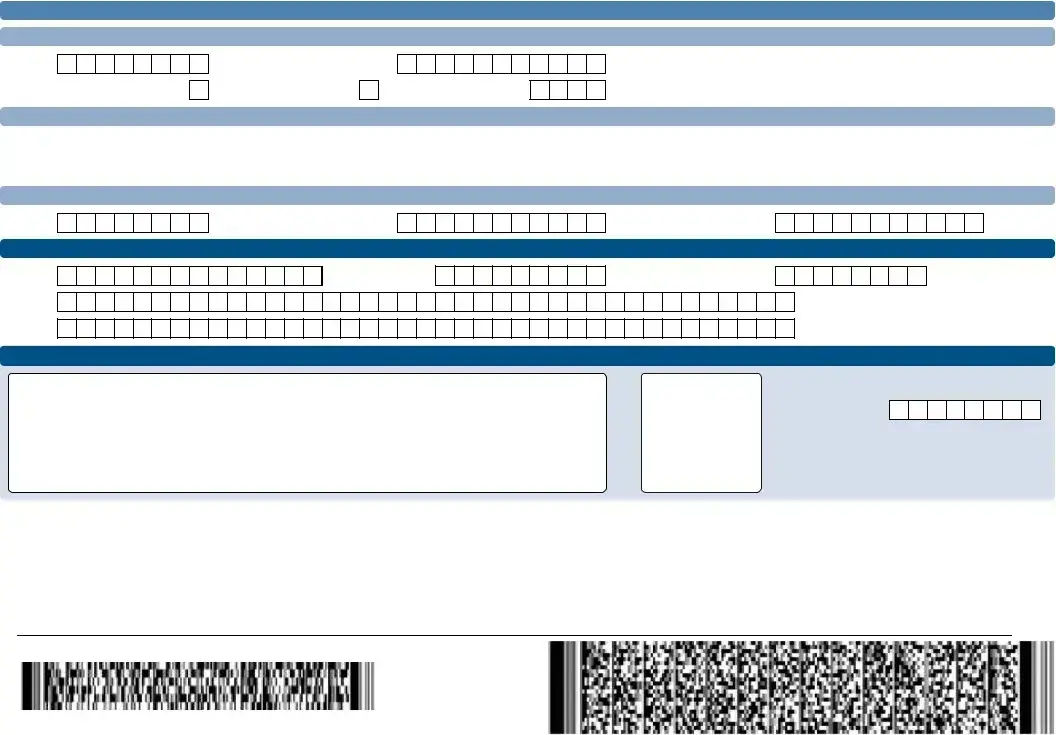

Tax Practitioner Details

Registration

Status

Controlling

Body

Estimated Diesel Purchases (litres p/a) for Current Financial Year

Registration No.

Estimated Turnover for |

R |

|

Current Financial Year |

||

|

||

Appointment Date(CCYYMMDD) |

||

Declaration

I, the undersigned (taxpayer/representative taxpayer) hereby indemnify the South African Revenue Service (SARS) against any loss which may occur due to any payment by SARS transferred to the above bank account nominated by me.

I declare that to the best of my knowledge the information in this form is true and correct and meets the requirements of any legislation as administered by SARS.

Date (CCYYMMDD)

For enquiries go to www.sars.gov.za or call 0800 00 SARS (7277)

Signature

VAT101 L XX FV V2014.XX.XX SV XXXX CT XX NO XXXXXXXXXX

P XXXXXX

Y XXXX

SARS_VAT101_LookFeel_v2017.00.02 |

Page 7 |

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose of VAT101 | The VAT101 form is used for registering a business or entity for Value-Added Tax (VAT) with the South African Revenue Service (SARS). |

| Applicable Entities | Individuals, companies, trusts, partnerships, and other entities can use this form for VAT registration. |

| Documentation Requirements | Applicants must submit various supporting documents, which can be found on the SARS official website. |

| Applicant Details | It's essential to provide accurate personal and business information, including ID numbers and contact details. |

| Bank Account Declaration | Applicants must declare their bank account status, confirming if they use a South African bank account or not. |

| Foreign Entities | Foreign entities providing electronic services are also required to register by submitting the VAT101 form. |

| Language Preference | Applicants can indicate their preferred language for correspondence with SARS. |

| Submission Process | Once completed, the VAT101 form must be submitted online or in person at a SARS office, following the guidelines provided by SARS. |

Guidelines on Utilizing Sars Vat101

Filling out the SARS VAT101 form is an essential step in registering for Value-Added Tax. Proper completion of this form ensures that your application is processed efficiently, and provides the necessary information for your business or entity. Below are the steps to guide you through the process:

- Start with the Applicant Details section. Choose whether you are an individual, company, trust, partnership, or another entity.

- Fill in your personal information, including your surname, first name, other names, and your identification number (ID No.).

- Provide your passport or permit number, along with the country of origin.

- Complete the trading name, date of birth (format: CCYYMMDD), and email address if applicable.

- On the Contact Details page, enter your phone numbers and other contact information. Make sure to indicate if you do not have a cell or email.

- Provide your physical address. Include details like unit number, street name, and postal code.

- Make sure to fill out the particulars of your representative, if applicable. This includes their personal details and capacity.

- Detail any partners or directors in the Particulars of Members section, confirming if each is a natural person.

- For bank account details, indicate your bank account status, provide the bank name, and ensure you list your account number.

- Finally, review all information for accuracy. Once you’ve confirmed that everything is correct, submit the form.

What You Should Know About This Form

What is the purpose of the VAT101 form?

The VAT101 form is used for registering for Value-Added Tax (VAT) in South Africa. Various entities, including individuals, companies, and trusts, must fill out this form to comply with local tax regulations. By completing this registration, entities can charge VAT on their goods and services, as well as claim back the VAT they have paid on business expenses.

Who needs to fill out the VAT101 form?

Any individual or entity, including partnerships, trusts, and companies, that meets the necessary criteria for VAT registration must complete the VAT101 form. Generally, if your business's taxable turnover exceeds the threshold set by SARS, you are required to register for VAT and submit this form.

What information is needed to complete the VAT101 form?

To complete the VAT101 form, you will need to provide personal details such as your name, ID number, and date of birth. For businesses, information like the registered company name, trading name, and registration number is required. You must also provide contact details, including your physical and postal addresses, and banking information if applicable.

What is the significance of the representative taxpayer details?

The representative taxpayer section of the VAT101 form is important if the business is structured as a partnership, trust, or any other type of entity where a representative is required. The representative taxpayer will have the authority to act on behalf of the entity concerning VAT matters, making this information essential for proper management and communication with SARS.

How should one submit the VAT101 form?

The VAT101 form can typically be submitted electronically through the SARS website or at a SARS branch. It is crucial to ensure all information is accurate and complete before submission to avoid delays in processing your VAT registration.

What happens after submitting the VAT101 form?

After you submit the VAT101 form, SARS will review your application. If approved, you will receive a VAT registration number, allowing you to start collecting VAT on your sales. If there are any issues or additional information needed, SARS will contact you directly to resolve them.

Where can I find more information or assistance regarding the VAT101 form?

For more detailed information, you can visit the SARS website, where you'll find resources and guides about the VAT101 form and VAT registration process. Additionally, you can contact SARS directly for assistance if you have specific questions or need help with your application.

Common mistakes

Filling out the SARS VAT101 form can be straightforward, but many make common mistakes that can delay the process. One frequent error is not providing complete applicant details. This includes leaving out critical information such as the full name, ID number, or the nature of the entity. Ensure that all fields are filled out accurately to avoid unnecessary complications.

Another mistake is incorrect completion of contact information. Missing or incorrect contact numbers can hinder communication from SARS. For example, failing to provide a valid email address or cell phone number could lead to missed notifications. It's essential to double-check this section and ensure all details are clear and accurate.

People often misclassify their entity type in the form. Choosing the wrong category, whether it be a partnership, company, or trust, can lead to confusion and processing delays. Take a moment to review your entity's classification carefully before submitting. This attention to detail ensures that your application can progress smoothly.

Additionally, individuals frequently skip over the financial details part of the form. Omitting information about the financial year-end or registration date can create red flags. Be thorough in entering financial data to present a complete picture of the entity’s status.

Finally, some applicants forget to provide supporting documents that are necessary for completing the VAT registration. The SARS website lists these requirements clearly. Ignoring these could result in your application being rejected or delayed. Always gather and attach all necessary paperwork for a more efficient processing experience.

Documents used along the form

The Sars Vat101 form is an essential document for registering for Value-Added Tax (VAT) in South Africa. To effectively process this registration, several supplementary documents may also be required. Below is a list of commonly used forms and documents that often accompany the VAT101.

- Proof of Identity: This can be a copy of the applicant's ID or passport. It verifies the identity of individuals or entities applying for VAT registration.

- Business Registration Documents: These documents include certificates of incorporation or registration, proving that the business is officially registered with relevant authorities.

- Bank Account Confirmation: A document from the bank confirming the business bank account. This is necessary for confirming the business’s financial activities.

- Address Verification: Bills or formal correspondence that confirm the physical address of the business. This is vital for ensuring correspondence reaches the right location.

- Financial Statements: Recent financial statements that provide insight into the business's financial health. These can be beneficial for understanding the nature of the business.

- Partnership Agreement: In cases where the entity is a partnership, this document outlines the nature of the partnership and the responsibilities of each partner.

- Tax Clearance Certificate: A certificate that confirms that the applicant is in good standing with South African tax obligations. This is often required to proceed with the registration.

- Power of Attorney: If someone is applying on behalf of the business, this document gives them authority to act. It clarifies who is managing the registration process.

- Member Confirmation: For partnerships or trusts, a document that lists key members or beneficiaries involved in the entity may be needed.

- Powers of Attorney for Trusts: For trust applications, powers of attorney documents establish who has authority to act on behalf of the trust. This ensures clarity in representation.

Gathering these documents can simplify the VAT registration process and enhance the likelihood of a smooth approval. Being prepared with the necessary paperwork ensures that there are no delays in getting your business registered for VAT.

Similar forms

The SARS VAT101 form is an important document for businesses and entities registering for Value-Added Tax (VAT) in South Africa. It shares similarities with several other key documents in the realm of tax registration and compliance. Below are four documents that bear resemblance to the VAT101 form:

- IRS Form SS-4: This form is used in the United States to apply for an Employer Identification Number (EIN). Like the VAT101, it requires specific details about the entity, such as name, address, and type of organization, to establish tax identity and registration.

- IRS Form 1065: This is the U.S. tax return for partnerships. Similar to the VAT101, it collects comprehensive information about the partnership structure, members, and financial activities, helping the IRS assess tax obligations.

- TT-1 (Taxpayer Registration Application): This document is utilized in some U.S. states for registering various business types with state revenue departments. It shares the VAT101's focus on identifying the nature of the entity along with its contact and ownership information.

- Form 940: This IRS form is for reporting annual Federal Unemployment Tax. Like the VAT101, it compels the entity to provide its identifying information, relevant dates, and structure, ensuring compliance with tax requirements.

Dos and Don'ts

When filling out the Sars VAT101 form, there are important guidelines to follow. Below is a list of dos and don’ts to ensure the application process runs smoothly.

- Do read the instructions carefully before starting the form.

- Do provide accurate information to avoid delays in processing.

- Do double-check all details entered, including dates and identification numbers.

- Do include all required supporting documents as listed on the SARS website.

- Do ensure that the form is signed in the appropriate section.

- Don’t leave any mandatory fields blank; this may result in the rejection of the application.

- Don’t use abbreviations or unclear terms that might confuse the reviewers.

- Don’t forget to indicate your preferred language for communications.

- Don’t wait until the last minute to submit the form; early submissions help avoid potential issues.

- Don’t falsify any information; doing so can result in penalties or legal repercussions.

Misconceptions

Misconception 1: The VAT101 form is only for individuals.

This form is actually for a variety of entities, not just individuals. Companies, trusts, partnerships, and other organizations can also apply for VAT registration using this form. It's vital to understand that the VAT101 accommodates many different business structures.

Misconception 2: You don't need supporting documents to submit the VAT101 form.

This is not true. An application will require a set of supporting documents, including identification and registration details. Missing these documents can delay or even prevent your application from being processed.

Misconception 3: The form can be filled out with vague or incomplete information.

Providing vague details is a common error. Fortunately, completing the VAT101 accurately is crucial for smooth processing. If you don't provide precise information, it could lead to complications or rejections.

Misconception 4: Any bank account can be used for VAT transactions.

Not every bank account is acceptable. The VAT101 form requires you to declare specific types of accounts, such as South African bank accounts. Understand which accounts qualify to avoid potential issues down the line.

Misconception 5: Once the form is submitted, no further action is needed.

Submitting the form is only the beginning. Monitoring the application status and responding to any queries from the tax authority is equally important. A proactive approach will enable you to address any issues swiftly and efficiently.

Key takeaways

When completing the SARS VAT101 form, ensure that you provide accurate personal or business details. Inaccuracies may lead to delays in processing your application.

The nature of the applicant is crucial. Clearly indicate whether you are an individual, partnership, company, or another entity type as this information dictates the subsequent requirements for your VAT registration.

Include all relevant contact details accurately. This includes your home and business telephone numbers, email address, and physical addresses. Failure to do so may hinder communication from SARS regarding your application.

Be mindful of any supporting documents required. Refer to the list on the SARS website to ensure completeness, as missing documents can result in application denial or processing delays.

Identify a representative taxpayer if applicable. The details of this person or entity must be correctly filled out, especially if they are acting on behalf of your partnership or company.

Review your form before submission. A thorough check can catch errors that might affect your VAT registration, thus saving you time and resources in the long run.

Browse Other Templates

How to Get Gun License in California 2023 - Applicants are encouraged to keep copies of all submitted documents for their records.

Lpcc Kentucky - By signing, you attest that all information is accurate and complete.