Fill Out Your Satisfactory Note Sample Form

The Satisfactory Note Sample form serves as a crucial document in the cancellation and satisfaction of a promissory note, providing a structured approach for parties involved in financial transactions. It specifically outlines the cancellation of a promissory note with a designated principal amount, which is identified clearly within the form. After acknowledging the receipt of the agreed consideration, the undersigned party effectively releases and discharges the other party from any future claims related to the promissory note. This release covers a broad scope, ensuring that both known and unknown issues are addressed, which can prevent potential disputes from arising after the cancellation. Importantly, the form also includes space for the date of the agreement, as well as the signatures and printed names of the parties involved, which are essential for verifying the authenticity of the document and ensuring that all parties are in agreement. By employing this form, individuals and entities can safeguard their interests while navigating the complexities of financial obligations and liabilities.

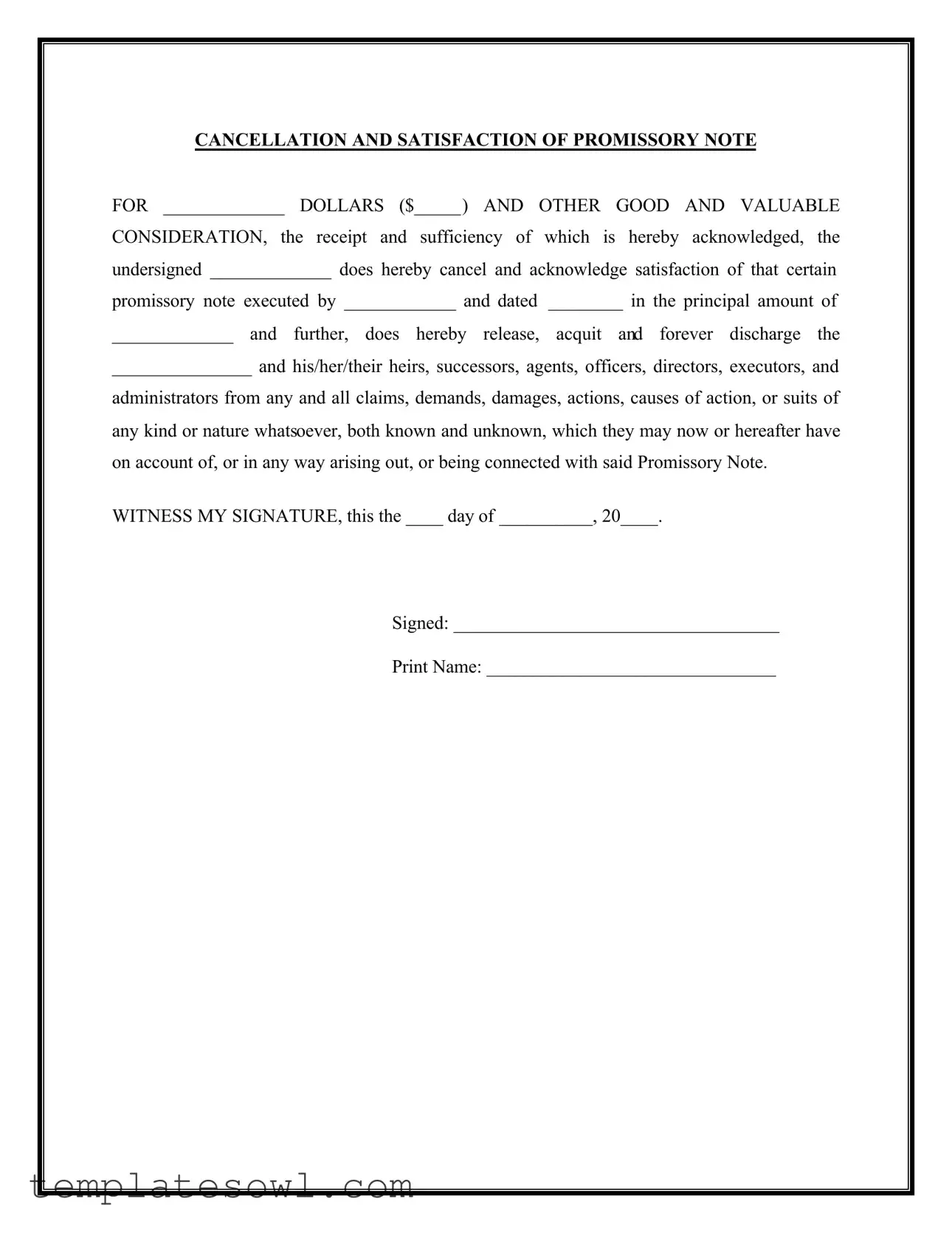

Satisfactory Note Sample Example

CANCELLATION AND SATISFACTION OF PROMISSORY NOTE

FOR _____________ DOLLARS ($_____) AND OTHER GOOD AND VALUABLE

CONSIDERATION, the receipt and sufficiency of which is hereby acknowledged, the undersigned _____________ does hereby cancel and acknowledge satisfaction of that certain

promissory note executed by ____________ and dated ________ in the principal amount of

_____________ and further, does hereby release, acquit and forever discharge the

_______________ and his/her/their heirs, successors, agents, officers, directors, executors, and

administrators from any and all claims, demands, damages, actions, causes of action, or suits of any kind or nature whatsoever, both known and unknown, which they may now or hereafter have on account of, or in any way arising out, or being connected with said Promissory Note.

WITNESS MY SIGNATURE, this the ____ day of __________, 20____.

Signed: ___________________________________

Print Name: _______________________________

Form Characteristics

| Fact Name | Details |

|---|---|

| Purpose | This form serves to officially cancel a promissory note and confirm its satisfaction, acknowledging that the debt has been paid or otherwise settled. |

| Parties Involved | The form requires signatures from the individual canceling the note (the undersigned) and provides spaces to fill in the names of the parties to the original promissory note. |

| Good and Valuable Consideration | The phrase indicates that the satisfaction of the note is in exchange for tangible consideration, which must be acknowledged by the undersigned. |

| Legal Release | The form includes a release clause, which prevents the undersigned from making future claims related to the promissory note, ensuring closure for all parties involved. |

| Date of Execution | The form requires the date on which the cancellation is acknowledged, establishing a clear timeline for the transaction. |

| Witness Requirement | While not always mandated, having a witness sign may strengthen the validity of the cancellation, especially in specific jurisdictions. |

| Governing Law | In some states, this form is governed by the Uniform Commercial Code (UCC) or state-specific legislation pertaining to secured transactions and promissory notes. |

| Signature Lines | The document provides designated areas for signatures and printed names, ensuring it can be properly executed and recorded. |

Guidelines on Utilizing Satisfactory Note Sample

Completing the Satisfactory Note Sample form is a critical step in officially canceling and acknowledging satisfaction of a promissory note. This process ensures all parties are aware that the debt has been settled, providing peace of mind and legal assurance moving forward.

- Title Section: At the top of the form, fill in the title "CANCELLATION AND SATISFACTION OF PROMISSORY NOTE FOR" followed by the amount in dollars, including the currency symbol (e.g., DOLLARS ($1000)).

- Debtor’s Information: In the space provided, write the name of the debtor (the individual or entity that originally signed the promissory note).

- Promissory Note Details: Specify the date of the promissory note in the provided space. Additionally, write the principal amount of the promissory note in the designated area.

- Release Clause: Fill in the name of the creditor (the individual or entity that lent the money) where prompted.

- Signature Section: Write the current date in the format of “____ day of __________, 20____” in the appropriate space. The date should reflect when you complete the form.

- Signature: Sign your name in the designated signature line.

- Print Name: Clearly print your name in the provided space, ensuring that it matches the signature.

Once you complete these steps, check that all information is correct and complete before submitting the form to ensure proper processing of the cancellation and satisfaction of the promissory note. This form serves to clarify that all obligations have been met and no further claims can be made regarding the original note.

What You Should Know About This Form

What is a Satisfactory Note Sample form?

A Satisfactory Note Sample form is a document used to officially cancel a promissory note. It serves as proof that the obligation to repay the loan associated with the note has been fulfilled. This form helps both parties ensure they are clear about the cancellation and the satisfaction of the note.

Why would I use this form?

You would use this form to formally acknowledge that a promissory note has been paid in full or otherwise satisfied. This is important for protecting your rights and interests, as it provides evidence that the note is no longer valid and that you cannot be held liable for repaying the debt.

What information do I need to fill out?

You will need to include the amount of the original promissory note, the names of the parties involved, the date the note was executed, and the date of cancellation. Additionally, signatures from both parties or their representatives are required.

Do both parties need to sign the form?

Yes, it is advisable for both parties to sign the form. This ensures that both the lender and borrower agree to the cancellation and release of any further obligations under the note.

What does the release clause mean?

The release clause in the form means that the borrower is releasing the lender from any future claims related to the promissory note. Essentially, the borrower cannot later bring a lawsuit or claim against the lender based on the note once it has been canceled and satisfied.

When should I create this document?

You should create this document once you have fulfilled the terms of the promissory note, whether by paying it off or through other agreements between the parties. This helps to provide clear documentation of the satisfaction at that time.

Is this form legally binding?

Yes, once properly filled out, signed, and dated, the form is legally binding. It acts as a formal agreement between the parties regarding the cancellation of the promissory note and serves as a legal safeguard for both parties.

Where should I keep this document?

It is a good idea to keep this document in a safe place, along with any other important financial paperwork. Both parties should keep a copy for their records to avoid disputes in the future.

Can I modify the form?

While you can modify the form to fit your specific situation, it is essential to ensure that any changes do not alter the intent of the agreement. If unsure, consult with a legal expert to ensure the modifications remain valid and enforceable.

What if I lose this document?

If you lose the document, it can lead to potential issues over the terms of the cancellation. To avoid complications, always maintain several copies in different locations. If lost, you might need to draft a new satisfactory note or seek legal assistance to resolve any disputes that arise.

Common mistakes

When filling out the Satisfactory Note Sample form, many individuals make common mistakes that can lead to delays or complications down the line. Understanding these errors can help ensure a smoother process.

One frequent mistake is leaving the amount field blank or incorrectly filled. Ensure that both the numeric and written amounts match perfectly. Clarity is key; discrepancies can create confusion and lead to potential disputes.

Another common oversight involves failing to use the correct names. Both the signer and the parties involved in the promissory note must be accurately identified. Incorrect names can complicate the cancellation process and may render the document void.

Also, many forget to fill in the date of the original promissory note. This date is crucial for establishing the timeline of the agreement. If this field is completed incorrectly, it could lead to misunderstandings regarding obligations and rights.

In addition, people often neglect to clearly indicate the recipient of the release. Ensure that all parties who are being released from obligations are correctly identified to prevent any potential liability concerns later.

Another aspect that is frequently overlooked is the signature line. It is essential that the person filling out the form signs it. Leaving this blank could invalidate the document, negating the intent to cancel the promissory note.

Many individuals also fail to provide an accurate date of execution for the cancellation. This date, too, must be included; both clarity and legal validity rely on having a complete and correctly filled document.

A lesser-known mistake involves not accounting for any attachments. If there are appendices or supporting documents mentioned that are not provided, this might lead to questions about the authority of the cancellation.

Additionally, participants sometimes overlook the need for witnesses or notaries, depending on state requirements. Without proper witnessing, the form might not hold up in legal situations.

Lastly, many people rush through the form, which leads to general errors like typos or omissions. Take the time to double-check all entries; clarity and accuracy are essential in legal documents.

A little attention to detail can make a significant difference when filling out the Satisfactory Note Sample form. Avoiding these pitfalls will help ensure that the cancellation process goes smoothly and legally.

Documents used along the form

The Satisfactory Note Sample form is essential for documenting the cancellation of a promissory note. When using this form, there are several other documents that can help clarify the agreement and protect the interests of all parties involved. Here are a few commonly used forms that often accompany it.

- Promissory Note - This document outlines the terms of the loan agreement, including the amount borrowed, interest rate, and repayment schedule. It serves as the original evidence of the debt before it is satisfied.

- Release of Liability - This form protects the borrower by releasing them from future claims related to the loan. It confirms that the lender cannot pursue further legal action once the note is satisfied.

- Notice of Cancellation - This document formally notifies all parties involved that the promissory note has been canceled. It can be useful for record-keeping and ensuring everyone is on the same page.

- Settlement Agreement - This agreement details the terms under which a debt is fully settled. It often includes any negotiated terms, such as reduced payments or other concessions made by the borrower.

Having these additional forms on hand can simplify the process and provide clarity for everyone involved. Each document plays a role in ensuring the transaction is properly documented and all parties are protected.

Similar forms

The Satisfactory Note Sample form serves a specific purpose in the realm of financial agreements, particularly concerning promissory notes. However, several other documents bear similarities in function and structure. Here are four such documents:

- Release of Liability Agreement: This document also aims to release one party from any future claims. Like the Satisfactory Note, it involves a party acknowledging receipt of consideration and agreeing not to hold the other party responsible for certain actions or results.

- Settlement Agreement: This document is typically used during negotiations to settle disputes. Similar to the Satisfactory Note, it outlines terms that clear up any outstanding issues or claims between parties involved in an agreement.

- Cancellation of Contract: This document serves to terminate an existing contract. It functions similarly to the Satisfactory Note, where acknowledgment of satisfaction and release from obligations is essential components of the cancellation process.

- Termination Agreement: Often used in employment and business contracts, this document makes clear that all obligations are effectively closed. Just like the Satisfactory Note, the Termination Agreement formally disconnects the parties from future claims and obligations regarding the original arrangement.

Dos and Don'ts

When filling out the Satisfactory Note Sample form, keep the following essential tips in mind:

- Do ensure that all relevant parties are accurately named. This includes the individual executing the note and the party to whom the note is being canceled. Precise identification helps prevent future disputes.

- Do clearly fill in the principal amount of the promissory note. Leaving this blank can lead to confusion about the amount being confirmed as satisfied.

- Don't overlook adding the date of the original promissory note. This information is crucial for historical context and for verifying the timeline of the transaction.

- Don't forget to include your signature at the bottom of the form. A signature is necessary to validate the cancellation and satisfaction of the note, ensuring it is legally binding.

By adhering to these guidelines, you can help secure a smooth and clear process in finalizing the cancellation and satisfaction of the promissory note.

Misconceptions

Understanding the nuances of legal forms is essential for ensuring that all parties are protected and agreements are properly documented. The Satisfactory Note Sample form is no exception. Here are seven common misconceptions surrounding this important document:

- It is the same as a promissory note. Many people confuse the Satisfactory Note with a promissory note. While the former indicates that a debt has been satisfied, the latter is a promise to pay a certain amount.

- It only needs to be signed by the borrower. This document must be signed by all parties involved, including the lender, to ensure that all claims are fully released.

- It is not legally binding. Some may think that informal agreements are sufficient. However, once signed, this form is legally binding and encapsulates the cancellation of the original note.

- Once it is completed, there is no need for further documentation. Although this form serves a specific purpose, it may be advisable to keep other related documents or agreements on hand for future reference.

- It can be completed without specific details. Omitting critical information like names, dates, and amounts can make this form invalid. Filling it out correctly is essential.

- It only pertains to monetary debts. While monetary debts are common, this form can also apply to other types of valuable consideration, broadening its usage.

- It eliminates all potential claims. The form aims to release parties from certain claims related to the promissory note, but other unrelated claims may still exist.

By debunking these misconceptions, it's easier to navigate the nuances of the Satisfactory Note Sample form and ensure all parties are adequately informed and protected.

Key takeaways

When filling out and using the Satisfactory Note Sample form, consider the following key points:

- Ensure you clearly specify the dollar amount and any relevant details in the blanks provided.

- Accurately identify the parties involved, including the issuer of the original promissory note.

- Verify that all dates are correct, especially the date of the original note and the date of cancellation.

- Make sure to write "Satisfactory Note" prominently to indicate the form's purpose.

- Understand that this form releases the debtor from further obligations related to the promissory note.

- Obtain signatures from all necessary parties to validate the cancellation.

- Keep a copy of the completed form for your records, as it serves as proof of satisfaction.

Browse Other Templates

Incident Form in Hospital - By completing this report, staff nurture a proactive approach to medication management.

How Do You Set Up Direct Deposit - Charlotte Metro Credit Union is committed to your financial needs.

Dmv Reg 256 - One part of the form requires the signature of the parent or legal guardian to validate the information provided by the minor.