Fill Out Your Sb 13100 Probate Form

Navigating the aftermath of a loved one’s passing can be overwhelming, especially when it comes to handling their personal belongings. The California SB 13100 Probate form simplifies this process for those who qualify. Designed for the collection of personal property without the need for formal probate proceedings, this affidavit is particularly useful when the total value of an estate does not exceed $166,250. With clear provisions laid out, it allows individuals to claim assets after at least 40 days have passed since the decedent's death. Along with essential information regarding the decedent and their estate, the form requires specific declarations about consent from personal representatives or the absence of ongoing probate actions. Moreover, it ensures that the rights of all successors are duly acknowledged. By facilitating the transfer of assets, SB 13100 helps people move forward in a time of grief, allowing them to focus on remembrance rather than red tape.

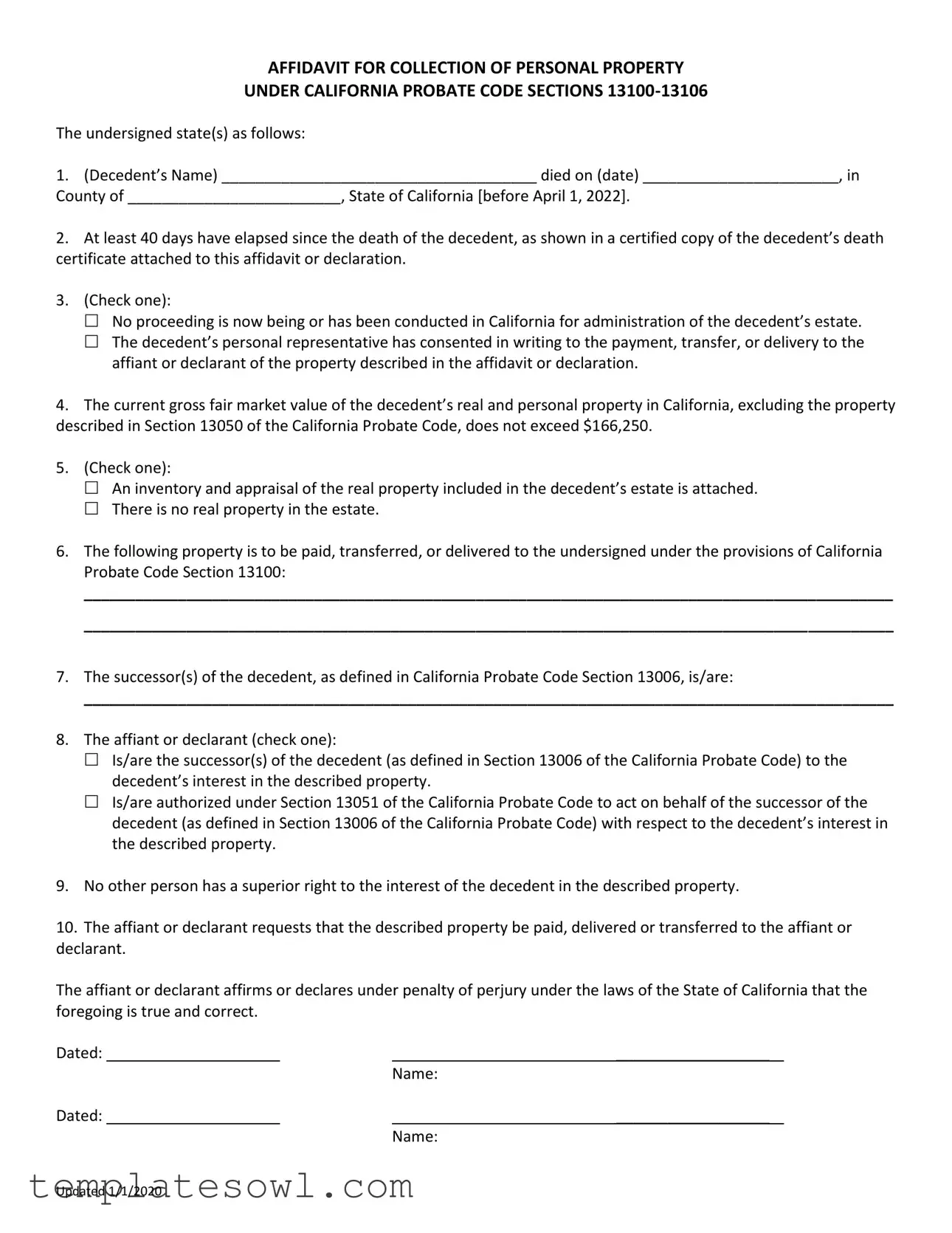

Sb 13100 Probate Example

AFFIDAVIT FOR COLLECTION OF PERSONAL PROPERTY

UNDER CALIFORNIA PROBATE CODE SECTIONS

The undersigned state(s) as follows:

1.(Decedent’s Name) _____________________________________ died on (date) _______________________, in County of _________________________, State of California [before April 1, 2022].

2.At least 40 days have elapsed since the death of the decedent, as shown in a certified copy of the decedent’s death certificate attached to this affidavit or declaration.

3.(Check one):

No proceeding is now being or has been conducted in California for administration of the decedent’s estate.

The decedent’s personal representative has consented in writing to the payment, transfer, or delivery to the affiant or declarant of the property described in the affidavit or declaration.

4.The current gross fair market value of the decedent’s real and personal property in California, excluding the property described in Section 13050 of the California Probate Code, does not exceed $166,250.

5.(Check one):

An inventory and appraisal of the real property included in the decedent’s estate is attached.

There is no real property in the estate.

6.The following property is to be paid, transferred, or delivered to the undersigned under the provisions of California Probate Code Section 13100:

_______________________________________________________________________________________________

_______________________________________________________________________________________________

7.The successor(s) of the decedent, as defined in California Probate Code Section 13006, is/are:

_______________________________________________________________________________________________

8.The affiant or declarant (check one):

Is/are the successor(s) of the decedent (as defined in Section 13006 of the California Probate Code) to the decedent’s interest in the described property.

Is/are authorized under Section 13051 of the California Probate Code to act on behalf of the successor of the decedent (as defined in Section 13006 of the California Probate Code) with respect to the decedent’s interest in the described property.

9.No other person has a superior right to the interest of the decedent in the described property.

10.The affiant or declarant requests that the described property be paid, delivered or transferred to the affiant or declarant.

The affiant or declarant affirms or declares under penalty of perjury under the laws of the State of California that the foregoing is true and correct.

Dated: |

__________________ |

||

|

|

|

Name: |

Dated: |

__________________ |

||

|

|

|

Name: |

Updated 1/1/2020

ACKNOWLEDGEMENT

A notary public or other officer completing this certificate verifies only the identity of the individual who signed the document to which this certificate is attached, and not the truthfulness, accuracy, or validity of that document.

STATE OF CALIFORNIA

COUNTY OF MENDOCINO

On ____________________ before me, ________________________________, personally

appeared _____________________________________, proved to me on the basis of

satisfactory evidence to be the person whose name is subscribed to the within instrument and acknowledged to me that he/she executed the same in his/her authorized capacity, and that by his/her signature on the instrument the person executed the instrument.

I certify under PENALTY OF PERJURY under the laws of the State of California that the foregoing paragraph is true and correct.

WITNESS my hand and official seal.

________________________________________ (Seal)

Signature of Notary Public

Updated 1/1/2020

Form Characteristics

| Fact Name | Detail |

|---|---|

| Purpose | The SB 13100 form is an affidavit used for the collection of personal property belonging to a deceased person. |

| Governing Law | This form is governed by the California Probate Code Sections 13100-13106. |

| Eligibility | At least 40 days must pass since the decedent's death before this affidavit can be submitted. |

| Property Value Limit | The total value of the decedent’s property, excluding certain assets, must not exceed $166,250. |

| Signatory Requirement | The form must be signed by the affiant or declarant, who claims to be a successor or authorized individual concerning the decedent's property. |

Guidelines on Utilizing Sb 13100 Probate

Completing the SB 13100 Probate form is an important step in the process of claiming personal property when someone passes away. It requires careful attention to detail to ensure accuracy and compliance with California's probate laws. Follow these steps to fill out the form successfully.

- Write the decedent’s full name in the first blank space.

- Enter the date of death of the decedent in the next blank provided.

- Fill in the county and state where the death occurred.

- Confirm that at least 40 days have passed since the death. Attach a certified copy of the death certificate.

- Check the appropriate box to indicate whether any proceedings are ongoing for the estate or if the personal representative has given consent.

- Ensure the total gross fair market value of the decedent’s real and personal property does not exceed $166,250.

- Indicate whether an inventory and appraisal of any real property is attached or confirm that there is no real property in the estate.

- Clearly describe the property to be collected, ensuring enough detail is provided.

- Identify the successor(s) of the decedent.

- Check the box that accurately describes your status regarding the property: either as a successor or as an authorized representative.

- Acknowledge that no other person has a superior right to the property in question.

- Request that the property be paid, delivered, or transferred to you.

- Sign and date the form, including your printed name beneath your signature.

- Have the form notarized, ensuring the notary public completes the acknowledgment section appropriately.

What You Should Know About This Form

What is the SB 13100 Probate form?

The SB 13100 Probate form is an affidavit that allows individuals to collect personal property belonging to a deceased person without requiring full probate proceedings, provided that certain conditions are met. This form is governed by California Probate Code Sections 13100-13106 and is often used when the total value of the estate does not exceed $166,250.

Who can use the SB 13100 form?

The form can be used by the successors of the decedent, which includes heirs or beneficiaries who are entitled to the property. Alternatively, individuals who are legally authorized to act on behalf of a successor may also complete the form. It's essential to determine eligibility before proceeding.

What conditions must be met to use this form?

To qualify for using the SB 13100 form, at least 40 days must have passed since the decedent's death. There must also be no active probate proceedings, or the personal representative of the estate must consent in writing to the transfer of the property. Additionally, the total gross fair market value of the property in California must not exceed $166,250.

What information is required on the SB 13100 form?

The form requires several key pieces of information, including the decedent's name, date and place of death, details about the property to be transferred, and affirmation of successor status. It also needs signatures from the affiant or declarant, as well as a notarized acknowledgment.

Is a death certificate required for the SB 13100 form?

Yes, a certified copy of the decedent's death certificate must be attached to the affidavit. This serves as proof that the decedent has passed and that the necessary waiting period of 40 days has elapsed.

Can the form be used if there is real property in the estate?

The SB 13100 form can still be utilized if there is real property, but an inventory and appraisal of that property must be included. If there is no real property, the form allows for a simple declaration of that fact.

What happens after the SB 13100 form is submitted?

Once the SB 13100 form is completed and submitted, the affiant or declarant can request that specified personal property is transferred to them. Upon successful processing, the property will be paid, transferred, or delivered as requested. Ensure that all information is correct and complete to avoid delays.

Common mistakes

When filling out the SB 13100 Probate form, many people make mistakes that can delay the process or lead to complications. One common error is failing to attach a certified copy of the decedent's death certificate. This document is essential to prove that at least 40 days have passed since the decedent's passing. Without it, the form cannot be processed.

Another frequent oversight is not checking the appropriate box regarding the current status of the estate. Applicants either forget to mark that no administration is taking place or neglect to indicate if the personal representative has given consent for the transfer of property. This step is crucial and can make a significant difference in how the estate is handled.

People often underestimate the importance of correctly evaluating the gross fair market value of the decedent's property. If the value exceeds $166,250, the requirements change. Miscalculating this figure can result in ineligibility for filing this affidavit.

Some filers mistakenly assume they can skip the inventory and appraisal step for real property. Whether there is real property in the estate or not needs to be clearly indicated. Omitting this information or failing to attach the proper documentation may complicate things down the line.

The next mistake typically involves not fully identifying the property intended for transfer. The section requesting a description of the property must be filled out completely. Insufficient information can lead to confusion and delays, as courts require clear identification of the assets in question.

A lack of clarity about who the successors are is also an issue. Individuals filling out the form sometimes leave this section blank or provide vague answers. Clear identification of successors is vital for determining who has rights to the property.

Finally, some individuals hastily conclude the process without realizing that no one else claims a superior right to the decedent's interest in the property. This check is not just a formality; it's a critical statement that must be accurate to avoid future disputes. Ensuring all parts of the SB 13100 Probate form are completed carefully will help streamline the probate process and mitigate potential challenges.

Documents used along the form

The SB 13100 Probate form is frequently used in California to facilitate the collection of personal property after the death of an individual. When dealing with the probate process, several other forms and documents are often necessary to ensure compliance and proper handling of the estate. Below are five commonly associated documents.

- Death Certificate: This official document confirms the date and place of the decedent’s death. It is crucial for many legal processes, including the SB 13100 form, as it establishes that at least 40 days have passed since the decedent's death.

- Inventory and Appraisal Form: This document details the decedent's assets and their respective values. In cases where the estate includes real property, this form may be required to support the claim for property transfer under the SB 13100 provisions.

- Affidavit of Identity: This affidavit serves to confirm the identity of the affiant or declarant. It is often used to provide assurance that the right individual is making the claim, particularly when others may be involved in the estate.

- Letter of Consent from Personal Representative: If a personal representative has been appointed to manage the estate, a letter confirming their consent to transfer specific property may be necessary. This ensures all parties are in agreement regarding the distribution of assets.

- Notice of Death: This document is typically filed with local authorities or published in a community newspaper. It serves to inform potential claimants of the decedent’s passing and the ongoing probate proceedings, ensuring transparency and giving notice to interested parties.

Understanding these supporting documents is vital for navigating the probate process smoothly. Each plays a role in confirming details and facilitating estate administration, thus ensuring all legal requirements are met.

Similar forms

- Affidavit of Small Estate: This document allows individuals to claim assets of a deceased person under a certain value without a full probate process. Similar to SB 13100, it simplifies the process for transferring property when an estate does not require formal administration.

- Petition for Probate: This form initiates the probate process for an estate, providing details about the deceased's assets. While SB 13100 allows for quicker asset transfer, the petition serves to formally open the estate for administration.

- Small Estate Affidavit: Used in various states, this affidavit allows heirs to collect estate assets under a statutory limit, similar to how SB 13100 functions within California law.

- Declaration of Due Diligence: This document may accompany affidavits or estates to confirm efforts made to locate heirs or successors. It aids in establishing that proper steps have been taken, similar to asserting rights in the SB 13100 form.

- Transfer on Death Deed: This deed allows real property to transfer to beneficiaries upon the owner’s death. Both this deed and SB 13100 aim for efficient property transfer without the need for lengthy probate.

- Will: A will outlines how a person wishes to distribute their assets after death. While a will typically goes through probate, SB 13100 provides a means to access certain assets without needing to navigate the probate process.

- Order for Final Distribution: This document wraps up the probate process by detailing how assets are distributed among heirs. It serves the final step, while SB 13100 is a way to bypass longer procedures for immediate access to assets.

- Claim Against Estate: This form allows creditors to make claims on a deceased person's estate. While SB 13100 addresses the transfer of assets to successors, the claim process is a parallel action for addressing debts owed by the estate.

- Trust Certification: This document verifies the existence and terms of a trust. Like SB 13100, it helps facilitate the distribution of assets outside of the probate process, allowing for a smoother transition of assets to beneficiaries.

Dos and Don'ts

When filling out the SB 13100 Probate form, it is essential to understand the key actions to take and avoid. Here is a guide for you:

- Do ensure that the decedent’s name, date of death, and county of death are clearly and accurately filled in.

- Do attach a certified copy of the decedent’s death certificate as evidence that at least 40 days have passed since the decedent's death.

- Do indicate whether any proceedings are currently being conducted for the administration of the estate.

- Do confirm that the gross fair market value of the decedent's property does not exceed $166,250.

- Don't leave any section of the form blank unless it specifically states that the information is optional.

- Don't forget to sign and date the form once all required information is filled out.

Misconceptions

Misconceptions can often lead to misunderstandings when dealing with legal forms such as the Sb 13100 Probate form. Here are five common misconceptions, along with explanations to clarify each point.

- It can be used at any time after a person's death. The Sb 13100 form can only be applied 40 days after the death of the decedent. There must be proof of this timeframe through a certified death certificate.

- All estates can use this form. This form applies only to estates where the total value of personal and real property in California does not exceed $166,250. Estates exceeding this limit must follow more complex probate procedures.

- There must be a formal probate process ongoing. This is not true. The form can be used when no probate proceedings are currently taking place, or with written consent from the decedent's personal representative if such proceedings exist.

- This form allows access to any property belonging to the decedent. The form is limited to specific property claimed under the affidavit. The property must be clearly described within the affidavit to avoid confusion or disputes.

- Anyone can fill out the form. Only successors, as defined in California Probate Code Section 13006, or individuals authorized under Section 13051 to act on behalf of successors can fill out and submit this form.

Key takeaways

Here are some key takeaways to keep in mind when filling out and using the SB 13100 Probate form:

- The decedent must have passed away at least 40 days prior to submitting the form, and you will need to attach a certified copy of the death certificate.

- Determine if there is an ongoing probate proceeding. If not, you may proceed, but if there is, written consent from the personal representative is necessary.

- The total gross fair market value of the decedent’s real and personal property in California must not exceed $166,250 to qualify for this affidavit.

- Clarify whether an inventory and appraisal of real property is included. If there is no real property, be sure to indicate that on the form.

- You must affirm that no one else has a superior claim over the described property, ensuring you have the rightful authority to complete the transfer request.

Browse Other Templates

Work Application Form - Employers can use the data from the application to efficiently compare candidates.

Social Security Tax Form - Box 5 represents the net benefits for the year, calculated by subtracting Box 4 from Box 3.

Escrow Account Rules - It clearly states what portion of the monthly payment is dedicated to the escrow account.