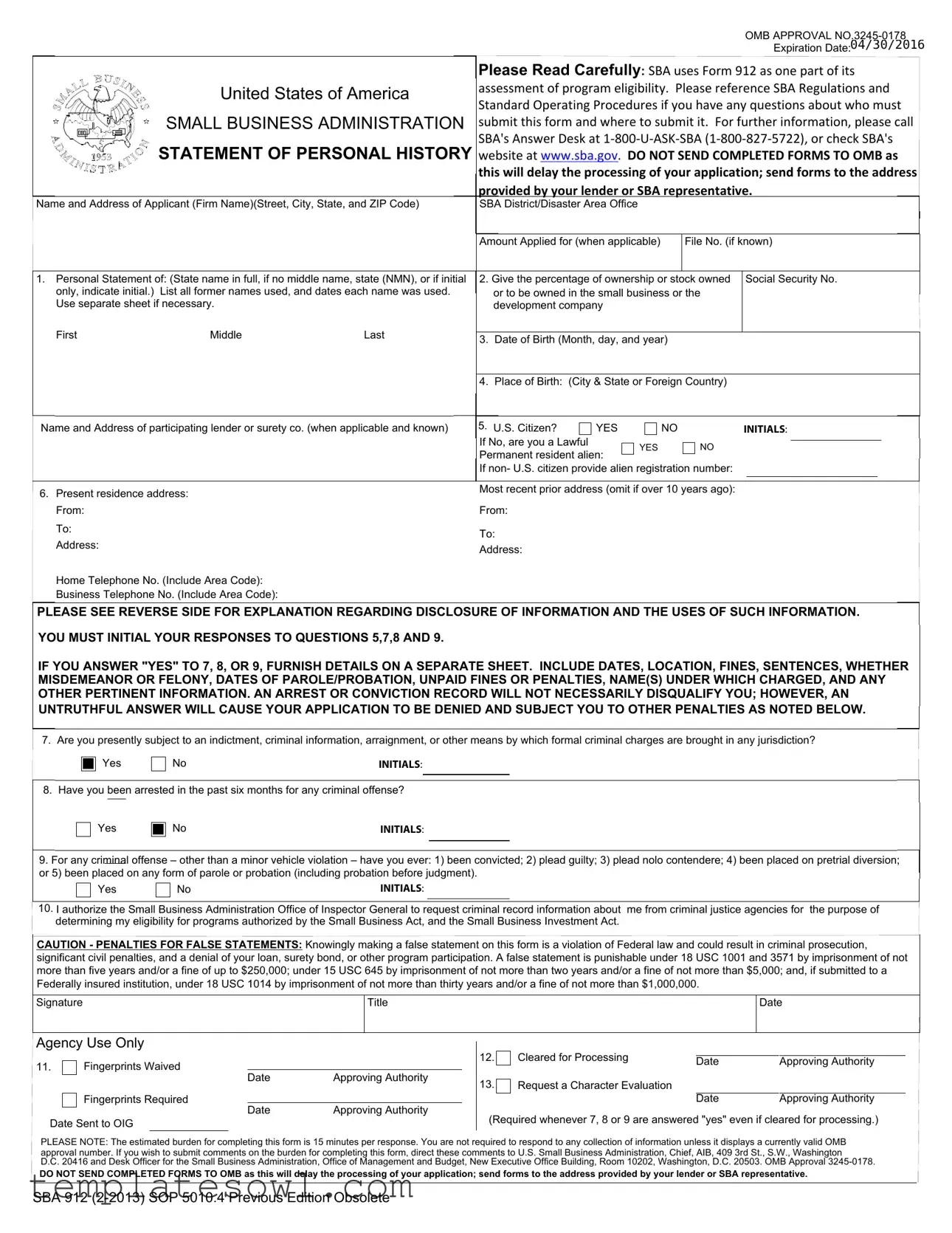

Fill Out Your Sba 912 Form

The SBA 912 form plays a significant role in the Small Business Administration's efforts to evaluate the eligibility of applicants for loans and other forms of assistance. This form collects essential personal and background information that helps paint a comprehensive picture of the applicant’s character. Individuals are required to provide details, including their names, addresses, Social Security numbers, and citizenship status. The form also delves into the applicant’s legal history, asking whether they have faced any criminal charges or convictions, thereby ensuring compliance with federal regulations. Applicants also authorize background checks for criminal history, with an understanding that truthful disclosure is crucial for maintaining eligibility. The SBA emphasizes the importance of honesty, noting that misrepresentation could lead to serious penalties, including prosecution. In addition, the form addresses privacy concerns, allowing individuals access to their personal information held by the SBA. This collection of data not only fulfills regulatory obligations but also serves as a means of protecting the integrity of the funding process, ensuring that assistance is granted to those who are fitting candidates.

Sba 912 Example

OMB APPROVAL

|

|

|

|

Expiration Date:04/30/2016 |

|

|

|

Please Read Carefully: SBA uses Form 912 as one part of its |

|

|

United States of America |

assessment of program eligibility. Please reference SBA Regulations and |

||

|

Standard Operating Procedures if you have any questions about who must |

|||

|

SMALL BUSINESS ADMINISTRATION |

|||

|

submit this form and where to submit it. For further information, please call |

|||

|

|

|

SBA's Answer Desk at |

|

|

STATEMENT OF PERSONAL HISTORY website at www.sba.gov. DO NOT SEND COMPLETED FORMS TO OMB as |

|||

|

|

|

this will delay the processing of your application; send forms to the address |

|

|

|

|

provided by your lender or SBA representative. |

|

Name and Address of Applicant (Firm Name)(Street, City, State, and ZIP Code) |

SBA District/Disaster Area Office |

|

||

|

|

|

Amount Applied for (when applicable) |

File No. (if known) |

1. Personal Statement of: (State name in full, if no middle name, state (NMN), or if initial |

2. Give the percentage of ownership or stock owned Social Security No. |

|||

only, indicate initial.) |

List all former names used, and dates each name was used. |

or to be owned in the small business or the |

||

Use separate sheet if necessary. |

|

development company |

|

|

First |

Middle |

Last |

3. Date of Birth (Month, day, and year) |

|

|

|

|

|

|

|

|

|

4. Place of Birth: (City & State or Foreign Country) |

|

Name and Address of participating lender or surety co. (when applicable and known)

6.Present residence address: From:

To:

Address:

Home Telephone No. (Include Area Code): Business Telephone No. (Include Area Code):

5. U.S. Citizen? |

YES |

NO |

INITIALS: |

|

If No, are you a Lawful |

|

YES |

NO |

|

Permanent resident alien: |

||||

|

|

|||

If non- U.S. citizen provide alien registration number:

Most recent prior address (omit if over 10 years ago): From:

To:

Address:

PLEASE SEE REVERSE SIDE FOR EXPLANATION REGARDING DISCLOSURE OF INFORMATION AND THE USES OF SUCH INFORMATION.

YOU MUST INITIAL YOUR RESPONSES TO QUESTIONS 5,7,8 AND 9.

IF YOU ANSWER "YES" TO 7, 8, OR 9, FURNISH DETAILS ON A SEPARATE SHEET. INCLUDE DATES, LOCATION, FINES, SENTENCES, WHETHER MISDEMEANOR OR FELONY, DATES OF PAROLE/PROBATION, UNPAID FINES OR PENALTIES, NAME(S) UNDER WHICH CHARGED, AND ANY OTHER PERTINENT INFORMATION. AN ARREST OR CONVICTION RECORD WILL NOT NECESSARILY DISQUALIFY YOU; HOWEVER, AN UNTRUTHFUL ANSWER WILL CAUSE YOUR APPLICATION TO BE DENIED AND SUBJECT YOU TO OTHER PENALTIES AS NOTED BELOW.

7. Are you presently subject to an indictment, criminal information, arraignment, or other means by which formal criminal charges are brought in any jurisdiction?

Yes

No |

INITIALS: |

8. Have you been arrested in the past six months for any criminal offense?

Yes

No |

INITIALS: |

9.For any criminal offense – other than a minor vehicle violation – have you ever: 1) been convicted; 2) plead guilty; 3) plead nolo contendere; 4) been placed on pretrial diversion; or 5) been placed on any form of parole or probation (including probation before judgment).

Yes

No |

INITIALS: |

10.I authorize the Small Business Administration Office of Inspector General to request criminal record information about me from criminal justice agencies for the purpose of determining my eligibility for programs authorized by the Small Business Act, and the Small Business Investment Act.

CAUTION - PENALTIES FOR FALSE STATEMENTS: Knowingly making a false statement on this form is a violation of Federal law and could result in criminal prosecution, significant civil penalties, and a denial of your loan, surety bond, or other program participation. A false statement is punishable under 18 USC 1001 and 3571 by imprisonment of not more than five years and/or a fine of up to $250,000; under 15 USC 645 by imprisonment of not more than two years and/or a fine of not more than $5,000; and, if submitted to a Federally insured institution, under 18 USC 1014 by imprisonment of not more than thirty years and/or a fine of not more than $1,000,000.

Signature

Title

Date

Agency Use Only

11. |

Fingerprints Waived |

|

|

|

Date |

Approving Authority |

|||

|

|

|||

|

Fingerprints Required |

|

|

|

|

Date |

Approving Authority |

||

|

|

Date Sent to OIG

12. |

Cleared for Processing |

|

|

|

|

Date |

Approving Authority |

||||

|

|

||||

13. |

Request a Character Evaluation |

|

|

|

|

|

|

Date |

|

Approving Authority |

|

(Required whenever 7, 8 or 9 are answered "yes" even if cleared for processing.)

PLEASE NOTE: The estimated burden for completing this form is 15 minutes per response. You are not required to respond to any collection of information unless it displays a currently valid OMB approval number. If you wish to submit comments on the burden for completing this form, direct these comments to U.S. Small Business Administration, Chief, AIB, 409 3rd St., S.W., Washington

D.C. 20416 and Desk Officer for the Small Business Administration, Office of Management and Budget, New Executive Office Building, Room 10202, Washington, D.C. 20503. OMB Approval

DO NOT SEND COMPLETED FORMS TO OMB as this will delay the processing of your application; send forms to the address provided by your lender or SBA representative.

SBA 912

NOTICES REQUIRED BY LAW

The following is a brief summary of the laws applicable to this solicitation of information.

Paperwork Reduction Act (44 U.S.C. Chapter 35)

SBA is collecting the information on this form to make a character and credit eligibility decision to fund or deny you a loan or other form of assistance. The information is required in order for SBA to have sufficient information to determine whether to provide you with the requested assistance. The information collected may be checked against criminal history indices of the Federal Bureau of Investigation.

Privacy Act (5 U.S.C. § 552a)

Any person can request to see or get copies of any personal information that SBA has in his or her file, when that file is retrieved by individual identifiers, such as name or social security numbers. Requests for information about another party may be denied unless SBA has the written permission of the individual to release the information to the requestor or unless the information is subject to disclosure under the Freedom of Information Act.

Under the provisions of the Privacy Act, you are not required to provide your social security number. Failure to provide your social security number may not affect any right, benefit or privilege to which you are entitled. Disclosures of name and other personal identifiers are, however, required for a benefit, as SBA requires an individual seeking assistance from SBA to provide it with sufficient information for it to make a character determination. In determining whether an individual is of good character, SBA considers the person's integrity, candor, and disposition toward criminal actions. In making loans pursuant to section 7(a)(6) the Small Business Act (the Act), 15 USC § 636 (a)(6), SBA is required to have reasonable assurance that the loan is of sound value and will be repaid or that it is in the best interest of the Government to grant the assistance requested. Additionally, SBA is specifically authorized to verify your criminal history, or lack thereof, pursuant to section 7(a)(1)(B), 15 USC § 636(a)(1)(B). Further, for all forms of assistance, SBA is authorized to make all investigations necessary to ensure that a person has not engaged in acts that violate or will violate the Act or the Small Business Investment Act,15 USC §§ 634(b)(11) and 687b(a). For these purposes, you are asked to voluntarily provide your social security number to assist SBA in making a character determination and to distinguish you from other individuals with the same or similar name or other personal identifier.

When the information collected on this form indicates a violation or potential violation of law, whether civil, criminal, or administrative in nature, SBA may refer it to the appropriate agency, whether Federal, State, local, or foreign, charged with responsibility for or otherwise involved in investigation, prosecution, enforcement or prevention of such violations. See 74 Fed. Reg. 14890 (2009) for other published routine uses.

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | SBA Form 912 is used to assess eligibility for various SBA programs. |

| Expiration Date | The current OMB expiration date for this form is April 30, 2016. |

| Submission Guidance | Completed forms should not be sent to OMB to avoid processing delays. |

| Ownership Disclosure | Applicants must list their percentage of ownership in the business. |

| Criminal History | Responses regarding criminal history must be initialed and detailed on a separate sheet if affirmative. |

| Privacy Act Compliance | In accordance with the Privacy Act, requests for personal information can be made by individuals regarding their files. |

| Punishment for False Statements | Knowingly providing false statements can lead to prosecution and denial of assistance. |

| Estimated Completion Time | It takes approximately 15 minutes to complete the form. |

| Applicable Laws | Uses of this form are governed by the Small Business Act (15 USC § 636) and the Privacy Act (5 U.S.C. § 552a). |

Guidelines on Utilizing Sba 912

Completing the SBA Form 912 is an important step in the application process for various SBA programs. Here’s a straightforward guide to ensure you fill it out correctly and gather the necessary information along the way. Follow these steps, and you’ll be on your way to submitting the form with confidence.

- Begin by entering the Name and Address of Applicant. Include your firm name, street address, city, state, and ZIP code.

- Fill in the SBA District/Disaster Area Office and the Amount Applied for (if applicable). Include the File No. if known.

- Provide your Personal Statement. State your full name and list any former names along with the dates each was used. Use a separate sheet if necessary.

- Enter your Date of Birth (Month, day, year) and your Place of Birth (City & State or Foreign Country).

- Identify the Name and Address of participating lender or surety company if this information is available to you.

- Fill in your Present residence address, along with the time frame you have lived there.

- Provide your home and business telephone numbers, including area codes.

- Indicate your citizenship status by checking either YES or NO. If you answer NO, indicate if you are a Lawful Permanent Resident Alien and provide your alien registration number.

- List your most recent prior address (omit if you have lived at your current address for over 10 years), including the duration.

- Respond to the questions regarding any criminal history by checking YES or NO. Initial your responses to questions 5, 7, 8, and 9.

- If you answered YES to questions 7, 8, or 9, you must provide the necessary details on a separate sheet.

- Sign and date the form. Add your title and ensure all other fields are completed.

Keep in mind the importance of honesty when providing your information. Misrepresentation can lead to serious consequences. After you’ve completed the form, submit it to the appropriate address provided by your lender or SBA representative, not to the OMB, to avoid delays. You’re one step closer to your goal!

What You Should Know About This Form

What is the SBA 912 form?

The SBA 912 form is used by the Small Business Administration (SBA) to assess eligibility for various programs. This includes loans, surety bonds, and other types of assistance. It collects personal history information from applicants and helps determine if they meet the required criteria.

Who needs to fill out the SBA 912 form?

Individuals applying for SBA loans or programs may need to submit the SBA 912 form. It is typically required for owners, partners, or anyone involved in business decisions. If you are unsure whether you need to fill out this form, consult with your lender or SBA representative.

How is the information on the SBA 912 form used?

The information collected on the SBA 912 form is used to evaluate an applicant's character and credit history. The SBA may verify this information by checking it against criminal history indices. This helps ensure that the programs are being provided to individuals who are eligible and trustworthy.

What if I have a criminal record?

Having a criminal record does not automatically disqualify you from receiving assistance. The SBA will look at the details, including the nature of the offenses and whether you have been honest in your disclosure. It’s important to provide accurate information, as dishonesty can lead to denial of your application.

How long does it take to fill out the SBA 912 form?

On average, it takes about 15 minutes to complete the SBA 912 form. However, the time may vary depending on how much information you need to provide. Take your time to ensure accuracy.

Where do I send the completed SBA 912 form?

You should not send the completed form to the Office of Management and Budget (OMB) as that may delay your application. Instead, submit the form to your lender or the address provided by your SBA representative.

What happens if I don’t provide my Social Security number?

You are not required to provide your Social Security number when completing the SBA 912 form. However, not providing it might limit your access to certain benefits. Your Social Security number helps the SBA verify your identity and make character assessments more easily.

Are there penalties for false information on the SBA 912?

Yes, providing false information is a serious offense. It may result in criminal prosecution, civil penalties, and the denial of your application. The SBA takes these matters very seriously, so always ensure your answers are truthful.

Can I check what personal information the SBA has on file about me?

Yes, under the Privacy Act, you can request to see or get copies of your personal information in SBA's records. You will need to provide identifiers like your name or Social Security number to retrieve your file.

Who can I contact for more information about the SBA 912 form?

You can call the SBA's Answer Desk at 1-800-U-ASK-SBA (1-800-827-5722) for more assistance. You may also want to check their website at www.sba.gov for additional resources and guidance.

Common mistakes

When filling out the SBA Form 912, people often make mistakes that can lead to delays or even denials in their application for assistance. One common error is providing incomplete information. It's vital to ensure that all required fields are filled out completely. Missing information, like a Social Security number or address details, can slow down the processing time. Taking a moment to double-check that all sections are complete saves time in the long run.

Another mistake is failing to read the form's instructions carefully. The SBA provides specific guidance on how to fill out each section, and overlooking these details can cause confusion. Sometimes, applicants assume they know what is required without fully reviewing the directions, which can lead to misunderstandings about what information needs to be provided.

Many applicants also neglect to initial their responses where required. This includes questions regarding citizenship status and any criminal history. Not initialing these responses can create red flags during the review process. It's essential to pay attention to these small details to avoid complications later on.

Some individuals mistakenly believe that they can leave out past names or aliases. This is a significant oversight. Not listing all former names, as required, can be viewed as an incomplete application. Transparency is crucial, and providing accurate historical information demonstrates honesty during the application review process.

Providing inaccurate or misleading information is another critical error. Some applicants might think that minimizing their past can help their case, but this approach can lead to more significant issues if it's discovered. The SBA emphasizes that untruthful answers can lead to application denials and potential legal consequences. Always provide accurate, truthful information to build trust with the reviewing agency.

Lastly, many people fail to check their contact information before submitting the form. If there are errors in vital details like phone numbers or email addresses, it can hinder communication. Ensure that your details are correct so the SBA can easily reach you if needed, promoting a smooth application process. By being mindful of these common mistakes, individuals can enhance their chances of successfully navigating the SBA loan application process.

Documents used along the form

The SBA 912 form is essential for applicants seeking assistance from the Small Business Administration. To ensure the process goes smoothly, several other documents may be required. Below is a list of commonly used forms alongside the SBA 912, each serving its unique purpose.

- SBA Form 4 - Loan Application: This form is used to formally apply for an SBA loan. It requires details about the business, financial information, and the purpose of the loan.

- SBA Form 2462 - Personal Financial Statement: This document provides a comprehensive overview of an individual's financial status, including assets, liabilities, and income. It's often needed to assess creditworthiness.

- SBA Form 159 - Fee Disclosure and Compensation Agreement: This form discloses any fees associated with the loan application and documents any compensation arrangements between the applicant and their representative.

- SBA Form 2301 - Business Plan: A well-structured business plan outlining the business's goals, operational strategy, and financial projections may be required for certain types of loans.

- SBA Form 601 - Request for Certificate of Competency: This form is used when a business is considered non-responsible or does not meet specific qualifications. It requests a review to determine if the business is capable of fulfilling contract obligations.

- IRS Form 4506-T - Request for Transcript of Tax Return: This form allows the SBA to verify income through past tax returns. It is crucial for assessing the financial background of the applicant.

Completing the SBA 912 form and accompanying documents accurately is critical for a timely review of your application. Ensure all information is current and relevant to avoid any setbacks in processing.

Similar forms

- Personal Financial Statement (SBA Form 413): This form collects your financial details, including liabilities and assets, similar to how Form 912 gathers personal history to assess eligibility.

- Business Loan Application (SBA Form 4): Like Form 912, this application requires information about the applicant’s background and ownership interests to evaluate the business's viability.

- Credit Report Authorization Form (SBA Form 2462): This document authorizes a credit check, which parallels the criminal history check required by Form 912 to clear eligibility.

- Personal Background Statement (SBA Form 843): This form seeks personal history details, akin to Form 912, ensuring a comprehensive review of the individual applying for funds.

- Affidavit of Individual Surety (SBA Form 990): Similar to Form 912, this affidavit requires personal qualifications and background to secure surety for loans.

- Letter of Intent to Apply for Assistance (SBA Form 2551): This document outlines the applicant’s intentions and background, resembling the disclosure requirements of Form 912.

- Small Business Investment Company (SBIC) Application (SBA Form 1031): Like Form 912, this form assesses the applicant's qualifications and ownership structure to support investment decisions.

- Ownership Disclosure Statement (SBA Form 122): This document demands clear ownership details, aligning with the ownership disclosures made in Form 912.

- Non-Disclosure Agreement: This agreement ensures that personal information is protected, much like the confidentiality of information provided in Form 912.

- Verification of Identity (e.g., Driver's License or Passport): These identity verification documents parallel the personal identification requirements outlined in Form 912.

Dos and Don'ts

When filling out the SBA 912 form, it's crucial to follow specific guidelines to ensure your application is processed smoothly. Here’s a list of dos and don’ts:

- Do read the instructions carefully before starting to fill out the form.

- Do provide accurate information. Incorrect details can lead to delays or denials.

- Do check your responses clearly and make necessary initials as required.

- Do submit your completed form to the correct address as specified by your lender or SBA representative.

- Don't skip any questions. All required fields must be completed to avoid processing issues.

- Don't falsify any information. Providing false statements can have serious legal consequences.

Carefully following these tips can help you avoid common pitfalls and improve your chances of a positive response from the SBA.

Misconceptions

Misconceptions about the SBA Form 912 can lead to confusion and misunderstanding regarding its purpose and requirements. Below are some common misconceptions explained.

- Misconception 1: The SBA Form 912 is only for businesses with criminal records.

- Misconception 2: Providing a Social Security number is mandatory for everyone.

- Misconception 3: All applicants with prior arrests will be automatically disqualified.

- Misconception 4: Application forms can be sent directly to the OMB for processing.

- Misconception 5: The processing time for Form 912 is quick and straightforward.

- Misconception 6: All information on the form is confidential and cannot be accessed by others.

This form is used to assess eligibility for various SBA programs, not solely for those with criminal histories. While the form does inquire about prior convictions, its primary goal is to evaluate overall character and creditworthiness.

While disclosing a Social Security number helps the SBA distinguish between applicants with similar names, it is not strictly required. Individuals can still apply without it, but it may complicate the processing of their application.

An arrest record does not necessarily lead to disqualification. The SBA takes into account the nature and details of the offense. Honesty in reporting such history is crucial, as untruthful answers can lead to denial or penalties.

Applications must not be sent to the Office of Management and Budget (OMB). Instead, they should be directed to the lender or SBA representative specified in the form instructions to avoid delays.

Completing the form may take about 15 minutes, but processing can take longer, depending on the applicant's circumstances and the detail required in the review process.

While personal information is protected under the Privacy Act, the SBA can release information in some circumstances, such as when legally required or with the individual's consent. Understanding this helps manage expectations regarding privacy.

Key takeaways

Here are key takeaways about filling out and using the SBA 912 form:

- Purpose: The SBA 912 form is required to assess eligibility for various SBA programs. Completing this form accurately is essential.

- Contact Information: If you have questions, contact SBA’s Answer Desk at 1-800-U-ASK-SBA or visit their website at www.sba.gov.

- Submission Guidelines: Do not send completed forms to OMB. Submit your form to your lender or the SBA representative instead.

- Identification and Personal History: Provide your full name, Social Security number, date of birth, and address. This helps establish your identity.

- Criminal History Disclosure: Be truthful when answering questions related to criminal history. Failure to do so could lead to significant penalties.

- Initials Required: You must initial responses for specific questions to confirm your answers are accurate and truthful.

- False Statements Consequences: Knowingly submitting false information can incur severe criminal and civil penalties, including imprisonment.

- Privacy Act: Your personal information is protected. You can request access to your information held by the SBA.

- Estimate of Completion Time: Completing this form is estimated to take around 15 minutes.

Browse Other Templates

How to Get Sf-50 Online - Familiarizing yourself with common mistakes can significantly improve your chances of success.

Af Form 422 Medical Clearance - The AF 1466 allows military departments to keep track of medical needs for assignment purposes.

How to Set Up Direct Deposit - Understand how to fill out the form for smoother processing.