Fill Out Your Sba Borrower Certification Form

The SBA Borrower Certification form is a crucial step in securing a loan backed by the U.S. Small Business Administration. This form comprises a series of statements that borrowers must certify prior to taking out a loan, ensuring that they understand and accept the responsibilities that come with the funding. Borrowers must indicate their agreement by initialing specific paragraphs that cover various aspects, such as affirming receipt of loan authorization, confirming financial stability, and acknowledging compliance with tax obligations. Key sections include confirmation of no adverse changes in financial conditions, adherence to environmental laws, and commitment to equitable employment practices. Furthermore, borrowers need to pledge that loan proceeds will not fund certain activities, like operating swimming pools or zoos, and agree to various occupancy requirements for their properties. It also contains provisions outlining restrictions on asset distribution, ownership changes, and limits on management compensation, which are designed to protect both lenders and the SBA. Completing this form accurately is imperative for moving forward in the loan process, as it lays the groundwork for a trustworthy financial relationship between the lender, borrower, and the SBA.

Sba Borrower Certification Example

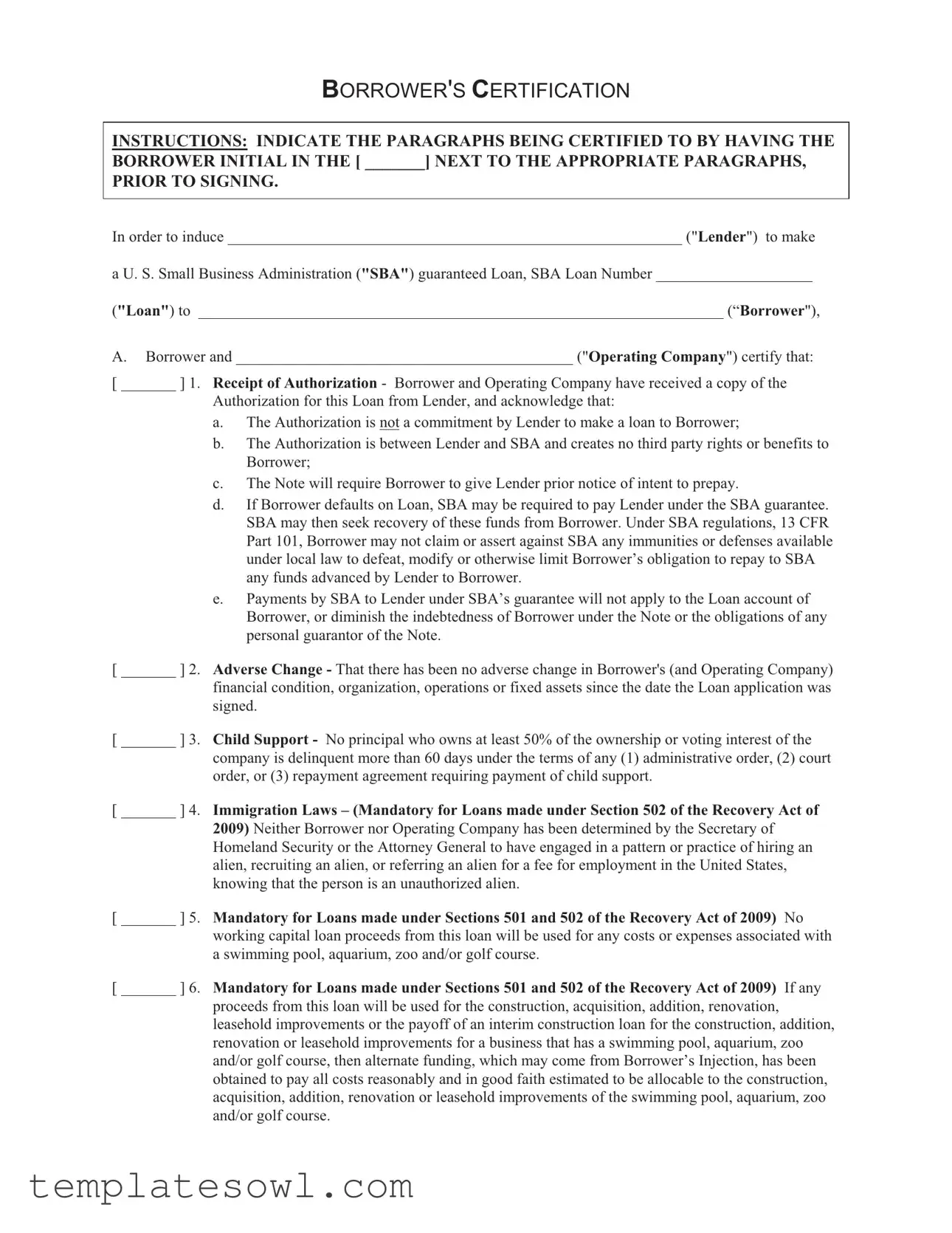

BORROWER'S CERTIFICATION

INSTRUCTIONS: INDICATE THE PARAGRAPHS BEING CERTIFIED TO BY HAVING THE BORROWER INITIAL IN THE [ _______] NEXT TO THE APPROPRIATE PARAGRAPHS,

PRIOR TO SIGNING.

In order to induce __________________________________________________________ ("Lender") to make

a U. S. Small Business Administration ("SBA") guaranteed Loan, SBA Loan Number ____________________

("Loan") to ___________________________________________________________________ (“Borrower"),

A.Borrower and ___________________________________________ ("Operating Company") certify that:

[ _______ ] 1. Receipt of Authorization - Borrower and Operating Company have received a copy of the

Authorization for this Loan from Lender, and acknowledge that:

a.The Authorization is not a commitment by Lender to make a loan to Borrower;

b.The Authorization is between Lender and SBA and creates no third party rights or benefits to Borrower;

c.The Note will require Borrower to give Lender prior notice of intent to prepay.

d.If Borrower defaults on Loan, SBA may be required to pay Lender under the SBA guarantee. SBA may then seek recovery of these funds from Borrower. Under SBA regulations, 13 CFR Part 101, Borrower may not claim or assert against SBA any immunities or defenses available under local law to defeat, modify or otherwise limit Borrower’s obligation to repay to SBA any funds advanced by Lender to Borrower.

e.Payments by SBA to Lender under SBA’s guarantee will not apply to the Loan account of Borrower, or diminish the indebtedness of Borrower under the Note or the obligations of any personal guarantor of the Note.

[ _______ ] 2. Adverse Change - That there has been no adverse change in Borrower's (and Operating Company)

financial condition, organization, operations or fixed assets since the date the Loan application was signed.

[ _______ ] 3. Child Support - No principal who owns at least 50% of the ownership or voting interest of the

company is delinquent more than 60 days under the terms of any (1) administrative order, (2) court order, or (3) repayment agreement requiring payment of child support.

[ _______ ] 4. Immigration Laws – (Mandatory for Loans made under Section 502 of the Recovery Act of

2009) Neither Borrower nor Operating Company has been determined by the Secretary of Homeland Security or the Attorney General to have engaged in a pattern or practice of hiring an alien, recruiting an alien, or referring an alien for a fee for employment in the United States, knowing that the person is an unauthorized alien.

[ _______ ] 5. Mandatory for Loans made under Sections 501 and 502 of the Recovery Act of 2009) No

working capital loan proceeds from this loan will be used for any costs or expenses associated with a swimming pool, aquarium, zoo and/or golf course.

[ _______ ] 6. Mandatory for Loans made under Sections 501 and 502 of the Recovery Act of 2009) If any

proceeds from this loan will be used for the construction, acquisition, addition, renovation, leasehold improvements or the payoff of an interim construction loan for the construction, addition, renovation or leasehold improvements for a business that has a swimming pool, aquarium, zoo and/or golf course, then alternate funding, which may come from Borrower’s Injection, has been obtained to pay all costs reasonably and in good faith estimated to be allocable to the construction, acquisition, addition, renovation or leasehold improvements of the swimming pool, aquarium, zoo and/or golf course.

[ _______ ] 7. Current Taxes - Borrower and Operating Company are current on all federal, state, and local taxes,

including but not limited to income taxes, payroll taxes, real estate taxes, and sales taxes.

[ _______ ] 8. Environmental — For any real estate pledged as collateral for the Loan or where the Borrower or

Operating Company is conducting business operations (collectively “the Property”):

(a)At the time Borrower and Operating Company submitted the Loan application, Borrower was in compliance with all local, state, and federal environmental laws and regulations pertaining to reporting or

(b)Borrower and Operating Company will continue to comply with these laws and regulations;

(c)Borrower and Operating Company, and all of its principals, have no knowledge of the actual or potential existence of any Contaminant that exists on, at, or under the Property , including groundwater under such Property other than what was disclosed in connection with the Environmental Investigation of the Property;

(d)Until full repayment of Loan, Borrower and Operating Company will promptly notify Lender if it knows or suspects that there has been, or may have been, a release of a Contaminant, in, at or under the Property, including groundwater, or if Borrower or Operating Company or such property are subject to any investigation or enforcement action by any federal, state or local environmental agency (Agency) pertaining to any Contaminant on, at, or under such Property, including groundwater.

(e)As to any Property owned by Borrower or Operating Company, Borrower or Operating Company indemnifies, and agrees to defend and hold harmless Lender and SBA, and any assigns or successors in interest which take title to the Property, from and against all liabilities, damages, fees, penalties or losses arising out of any demand, claim or suit by any Agency or any other party relating to any Contaminant found on, at or under the Property, including groundwater, regardless of whether such Contaminant resulted from Borrower’s or Operating Company's operations. (Lender or SBA may require Borrower or Operating Company to execute a separate indemnification agreement).

B.Borrower and Operating Company certify that they will:

[ _______ ] 1. Reimbursable Expenses- Reimburse Lender for expenses incurred in the making and

administration of the Loan.

[ _______ ] 2. Books, Records, and Reports-

a.Keep proper books of account in a manner satisfactory to Lender;

b.Furnish [ check one if appropriate: compiled - reviewed - audited ]

c.Furnish additional financial statements or reports whenever Lender requests them;

d.Allow Lender or SBA, at Borrower’s or Operating Company’s expense, to:

1)Inspect and audit books, records and papers relating to Borrower's and Operating Company’s financial or business condition; and

2)Inspect and appraise any of Borrower's and Operating Company’s assets; and

3)Allow all government authorities to furnish reports of examinations, or any records pertaining to Borrower and Operating Company, upon request by Lender or SBA.

[ _______ ] 3. |

Equal Opportunity - Post SBA Form 722, Equal Opportunity Poster, where it is clearly visible to |

|

employees, applicants for employment and the general public. |

[ _______ ] 4. |

|

|

and products with the proceeds of the Loan. |

[ _______ ] 5. |

Taxes - Pay all federal, state, and local taxes, including income, payroll, real estate and sales taxes |

|

of the business when they come due. |

[ _______ ] 6. |

Occupancy - Occupy, at all times during the term of the Loan, at least 51% of the total rentable |

|

property and 100% of the renovated rentable property. Borrower will not use Loan proceeds to |

|

improve or renovate any of the rentable property leased to third parties. |

[ _______ ] 7. |

Occupancy - Comply with the following provisions: (a) Borrower must lease 100% of the rentable |

|

property to Operating Company; (b) Operating Company may sublease up to 49% of the rentable |

|

property; (c) Borrower will not use Loan proceeds to improve or renovate any of the rentable |

|

property to be |

[ _______ ] 8. |

Occupancy - (a) Immediately occupy at least 60% of the rentable property; (b) Continue to occupy |

|

at least 60% of the rentable property for the term of the Loan; (c) Lease long term no more than |

|

20% of the rentable property to one or more tenants; (d) Plan to occupy within three years some of |

|

the remaining rentable property not immediately occupied or leased long term; (e) Plan to occupy |

|

within ten years all of the rentable property not leased long term. |

[ _______ ] 9. |

Occupancy - Comply with the following provisions: (a) Borrower must lease 100% of the rentable |

|

property to Operating Company; (b) Operating Company must immediately occupy at least 60% of |

|

the rentable property; (c) Operating Company will lease long term no more than 20% of the rentable |

|

property to one or more tenants; (d) Operating Company must plan to occupy within three years |

|

some of the remaining rentable property not immediately occupied or leased long term; (e) |

|

Operating Company must plan to occupy within ten years all of the rentable property not leased |

|

long term. |

C.Borrower and Operating Company certify that they will not, without Lender’s prior written consent:

[ _______ ] 1. Distributions- Make any distribution of company assets that will adversely affect the financial

condition of Borrower and/or Operating Company.

[ _______ ] 2. Ownership Changes - Change the ownership structure or interests in the business during the term

of the Loan.

[ _______ ] 3. Transfer of Assets - Sell, lease, pledge, encumber (except by purchase money liens on property

acquired after the date of the Note), or otherwise dispose of any of Borrower’s property or assets, except in the ordinary course of business.

[ _______ ] 4. Fixed Asset Limitation - Acquire by purchase or lease agreement any fixed assets

(totaling more than $_____________ in any year).

[ _______ ] 5. Location Limitation - Acquire by purchase or by lease, any additional locations.

[ _______ ] 6. Limitation on Compensation - Allow total annual salaries, withdrawals or other forms of

remuneration to officers or owners of Borrower and Operating Company, and their immediate family members, to exceed $_____________.

[ _______ ] 7. _____________________________________________________________________________

_____________________________________________________________________________

_____________________________________________________________________________

_____________________________________________________________________________

_____________________________________________________________________________

_____________________________________________________________________________

_____________________________________________________________________________

_____________________________________________________________________________

_____________________________________________________________________________

_____________________________________________________________________________

_____________________________________________________________________________

______________________________________________ |

______________________________________________ |

||

(Borrower) |

Date |

(Operating Company) |

Date |

By:___________________________________________ |

By: ___________________________________________ |

||

Form Characteristics

| Fact Name | Fact Description |

|---|---|

| Purpose | This form certifies that the borrower meets certain eligibility requirements for receiving an SBA guaranteed loan. |

| Initialing Sections | Borrowers must initial next to each paragraph they certify to. This indicates their acknowledgment of the statements made. |

| Loan Auth Confirmation | Borrowers confirm receipt of the loan authorization, which is not a guarantee of funding. |

| Adverse Changes Disclosure | Borrowers must certify that their financial situation has not changed adversely since loan application. |

| Child Support Status | Borrowers must verify that no principal owner is delinquent on child support payments exceeding 60 days. |

| Environmental Compliance | Borrowers certify compliance with environmental laws related to the property pledged as collateral for the loan. |

| Tax Compliance | Borrowers must ensure they are current on all federal, state, and local taxes to qualify for the loan. |

Guidelines on Utilizing Sba Borrower Certification

To proceed with your loan application, you'll need to fill out the SBA Borrower Certification form. Proper completion of the form ensures that both you and the lending institution are aligned on all necessary certifications. Follow these steps carefully to fill out the form accurately.

- Begin by entering the name of the lender where indicated.

- Input the SBA loan number in the designated space.

- Provide the name of the borrower in the appropriate section.

- Initial each certification paragraph (1-8) next to the statements that apply to your situation:

- Receipt of Authorization

- Adverse Change

- Child Support

- Immigration Laws

- Working Capital Loan Use

- Construction and Renovation Funding

- Current Taxes

- Environmental Certifications

- Certify the following items under section B by initialing:

- Reimbursable Expenses

- Books, Records, and Reports

- Equal Opportunity

- American-made Products

- Taxes

- Occupancy provisions

- Next, under section C, you need to confirm restrictions related to the loan by initialing the corresponding sections as required.

- Finally, sign and date the form in the areas provided for both the borrower and the operating company.

What You Should Know About This Form

What is the purpose of the SBA Borrower Certification form?

The SBA Borrower Certification form is designed to ensure that the borrower and the operating company understand and agree to specific terms and conditions laid out by the lender. By completing this form, borrowers affirm that they have received important information about their loan, have met certain qualifications, and agree to follow the regulations established by the Small Business Administration (SBA).

What should I do before signing the SBA Borrower Certification form?

Before signing, it is important for the borrower and the operating company to carefully read each paragraph in the certification form. Initialing next to the appropriate paragraphs allows the lender to know which parts of the certification are agreed upon. Ensure that all information provided is accurate and that you fully understand each section, as this document commits you to certain responsibilities and conditions.

What happens if a borrower does not meet the certification requirements?

If a borrower does not meet the certification requirements, they may risk losing the loan or facing legal consequences. The SBA may require repayment of the loan if any of the certifications are found to be inaccurate. It is crucial for borrowers to assess their current situation and ensure compliance with all requirements before submitting the form.

Can I make changes to my company ownership after signing the SBA Borrower Certification form?

No, significant changes in the ownership structure of the company are not allowed without the lender’s prior written consent. This ensures that the lender's investment remains secure and that the terms of the loan are not violated. If you are considering changes, discuss them with the lender first.

What are the penalties for not complying with the SBA Borrower Certification?

Non-compliance with the SBA Borrower Certification can lead to several consequences. Borrowers may face immediate repayment of the loan, loss of collateral, or legal action from the lender. Additionally, any misrepresentations made in the form could also result in serious legal repercussions, including penalties from the SBA.

Is it necessary to keep records after submitting the SBA Borrower Certification form?

Yes, maintaining proper books and records is essential even after submitting the form. The borrower must keep satisfactory financial records and is required to furnish year-end statements and other financial documentation upon request. This practice is part of the ongoing relationship with the lender and supports transparency throughout the loan period.

Common mistakes

Filling out the SBA Borrower Certification form can be daunting, and it's easy to make mistakes. One common error is failing to initial the correct paragraphs. Each section that requires certification needs your initials. Skipping this step could lead to delays or even denial of your loan application.

Another frequent mistake is overlooking the requirement to certify the current financial condition of the borrower. You must confirm that no adverse changes have occurred since your loan application. Not accurately representing your financial situation can raise red flags during the review process.

People often forget about the child support requirement. It's essential to ensure that no principal owning at least 50% of the company is delinquent in child support payments. This oversight can lead to loan disqualification, so taking a moment to check this is crucial.

When it comes to compliance with immigration laws, many applicants don't realize that they must affirm their adherence to these regulations. Not addressing this can lead to significant complications. It's vital to confirm that neither the borrower nor the operating company has violated any immigration laws related to employment practices.

A significant mistake involves misusing loan proceeds. If you plan to use funds for specific projects, such as a swimming pool or golf course, you must confirm that those expenses will not come from the loan. Misrepresentation can result in severe consequences, including full loan repayment demands.

Individuals sometimes underestimate the importance of tax compliance. The certification requires that all taxes, including federal, state, and local, be current. Being behind on taxes can not only jeopardize the loan but also lead to legal issues.

Environmental regulations are another area where mistakes can occur. Borrowers must certify that their business complies with all relevant environmental laws. Neglecting this can result in problems down the line, especially if any contamination issues arise.

Lastly, many people fail to accurately complete the sections regarding occupancy requirements. Ensuring that you meet all conditions related to property occupation is essential. Any inconsistencies in how you plan to use or occupy the property can cause misunderstandings or issues during the loan review process.

Documents used along the form

The SBA Borrower Certification form is a crucial document when applying for an SBA guaranteed loan. However, several other forms and documents may be required for a complete application. These documents help ensure compliance with various regulations, provide necessary financial information, and facilitate the loan process.

- Loan Application Form: This is the primary document that outlines the borrower's request for financial assistance, including the amount needed and the purpose of the loan.

- Personal Financial Statement: A detailed report of the borrower's personal assets, liabilities, income, and expenses. This helps lenders assess the borrower’s personal financial health.

- Business Plan: A comprehensive plan that describes the business model, goals, financing needs, and strategies for growth. It is crucial for demonstrating the viability of the business.

- Tax Returns: Personal and business tax returns for the past few years may be required. This provides insight into the financial history and tax compliance of the borrower.

- Credit Report: A report that summarizes the borrower’s credit history. This helps lenders evaluate the borrower's creditworthiness and risk level.

- Business License: Proof of any necessary licenses to operate the business legally. This ensures adherence to local regulations.

- Lease Agreements: If applicable, copies of leases for business premises are needed. These documents outline the terms of occupancy and any financial obligations.

- Environmental Assessment: For businesses handling potential contaminants, this document assesses compliance with environmental regulations and identifies any environmental liabilities.

- Insurance Documents: Proof of insurance coverage for the business. This protects both the borrower and the lender from potential risks associated with business operations.

Each of these documents serves a specific purpose in the loan application process. Providing them accurately can enhance the likelihood of approval and ensure that all legal and financial obligations are met.

Similar forms

-

Loan Application Form: Like the SBA Borrower Certification form, this document requires borrowers to disclose specific information about their financial status and business operations. Both forms emphasize transparency, ensuring that lenders have adequate insights to assess risk and make informed lending decisions.

-

Personal Financial Statement: This document captures personal assets, liabilities, income, and expenses of the borrower. Similar to the SBA form, it demands an honest representation of financial conditions, focusing on the borrower’s capacity to repay the loan.

-

Business Plan: A well-structured business plan outlines the strategic direction and expected financial performance of a business. Both documents focus on the feasibility of the business and its capacity to utilize borrowed funds effectively while ensuring the lender's investment is secure.

-

Credit Report Authorization: This form allows lenders to assess a borrower's creditworthiness. The emphasis on complete disclosure in both forms aims to create a complete financial picture, thereby aiding the lending decision.

-

Environmental Assessment Report: Required for properties involved in any financial transaction, it evaluates environmental risks. This report, like the SBA Borrower Certification, ensures compliance with environmental laws and highlights potential liabilities.

-

Lease Agreement: This document outlines the terms under which a borrower uses a property. Both agreements require borrowers to understand and commit to maintenance responsibilities and financial obligations, promoting a stable investment environment for the lender.

-

Business Credit Application: Similar to the SBA Borrower Certification, it collects essential information for evaluating creditworthiness and business legitimacy, emphasizing the need for borrowers to uphold their duties in managing credit responsibly.

-

Guarantee Agreement: This document may be required when a third party agrees to back a loan. It shares the focus of the SBA Borrower Certification on the financial responsibility of interested parties, ensuring all obligations are clear and understood.

-

Articles of Incorporation or Organization: This foundational document for businesses provides details on structure and ownership. Both it and the SBA form confirm the legitimacy and lawful operations of the borrower’s business entity.

-

Affidavit of Ownership: Borrowers may be required to affirm their ownership stakes in the business. Like the SBA Borrower Certification, this document underscores the importance of declaring true ownership to maintain integrity within the loan process.

Dos and Don'ts

Do's and Don'ts for Filling Out the SBA Borrower Certification Form

- Do: Read the instructions carefully. Ensure you understand each certification requirement before starting.

- Don't: Leave any sections blank. Every item requiring input should be addressed clearly to avoid delays.

- Do: Initial next to the certified statements accurately to indicate your acknowledgment and agreement.

- Don't: Provide false information. Misstatements can lead to serious penalties or disqualification from receiving a loan.

- Do: Keep a copy of the completed form for your records. It’s vital to have documentation on hand.

- Don't: Assume prior knowledge is enough. Refer back to the form almost as a checklist to verify all details.

- Do: Ensure that all parties involved have signed where required, especially the Borrower and Operating Company.

- Don't: Wait until the last minute to complete the form. Allow ample time for other involved parties to review and sign.

Misconceptions

Understanding the SBA Borrower Certification form can be challenging. Here are five common misconceptions that may create confusion:

- Misconception 1: The certification guarantees loan approval.

- Misconception 2: All loan terms are negotiable.

- Misconception 3: The certification is a formality without real consequences.

- Misconception 4: Only financial information is required.

- Misconception 5: It's fine to submit the form without thorough review.

Many believe that simply completing the certification form guarantees they will receive a loan. In reality, the certification is only part of the process, and approval depends on various factors, including creditworthiness and other underwriting criteria.

Some may think they can negotiate terms after submitting the certification. However, the terms of the loan are generally predefined, especially in government-guaranteed loans, making substantial changes unlikely.

While it may seem like just a formality, the certification contains legal affirmations. Misrepresenting information can lead to severe penalties, including potential loan default or legal repercussions.

Some borrowers might think the form only focuses on finances. In fact, the certification also addresses compliance with federal laws, operational changes, and current tax obligations, among other aspects.

Many assume they can submit the form without carefully reviewing it. In reality, borrowers should review all details meticulously to ensure accuracy and compliance, as errors can complicate the approval process or lead to denial.

Key takeaways

Filling out the SBA Borrower Certification form is a critical step in securing a loan backed by the U.S. Small Business Administration. Here are some key takeaways to keep in mind:

- Understand the Structure: Each section of the form contains various paragraphs that need to be certified. Make sure to read through all of them carefully and initial next to each one you are certifying.

- Accuracy Matters: Be honest about your financial condition, including any potential adverse changes. Misrepresentation can have serious consequences for both your application and future responsibilities.

- Child Support Obligations: Ensure that any principal who owns 50% or more of the company is not delinquent in child support payments. This is essential for compliance purposes.

- Current Tax Status: Confirm that you and your operating company are up-to-date on all federal, state, and local taxes. This requirement must be met to avoid complications in the loan process.

- Environmental Compliance: Understand your obligations regarding any real estate collateral. Be prepared to confirm compliance with local, state, and federal environmental laws. You may need to disclose any contaminants related to your property and be ready to address any issues should they arise.

- Future Obligations: Know that you will need to maintain specific records and provide financial information to the lender. This includes keeping proper accounting records and submitting year-end financial statements within the required timeframe.

Browse Other Templates

Personal Management - Scouts should reflect on family needs during financial planning discussions.

I Have Forgotten My Fcmb Account Number - Request additional features or services as necessary during activation.

Tax Waiver Form Nj - The form requires notarization by a qualified notary public.