Fill Out Your Sba 147 Form

The SBA 147 form is an important document in the context of small business loans guaranteed by the Small Business Administration (SBA). This form captures essential details regarding the loan, including the loan number, name, amount, the interest rate, and specifics about the borrower and lender. A comprehensive section outlines the borrower's promise to pay back the loan, including all related interest and fees. The form defines critical terms such as "Collateral," which refers to any property pledged as security for the loan, and "Guarantor," meaning any individual or entity guaranteeing the loan. It establishes payment terms, and stipulates conditions under which the borrower could default on the loan, encompassing failure to make timely payments or misleading representations to either the lender or the SBA. In the event of a default, the lender reserves a range of rights, including the ability to demand immediate payment, collect owed amounts from guarantors, and take action to dispose of or preserve collateral. The SBA 147 form also emphasizes that federal law will govern any interpretations, reinforcing the primacy of federal regulations over state laws in matters concerning the loan. Additionally, it outlines the liabilities of individuals and entities signing the note and underscores the importance of maintaining written agreements while waiving certain defenses that might otherwise arise. Through these various sections, the SBA 147 form delineates the rights, responsibilities, and obligations of both the borrower and lender, thus serving as a critical component in the overall loan process.

Sba 147 Example

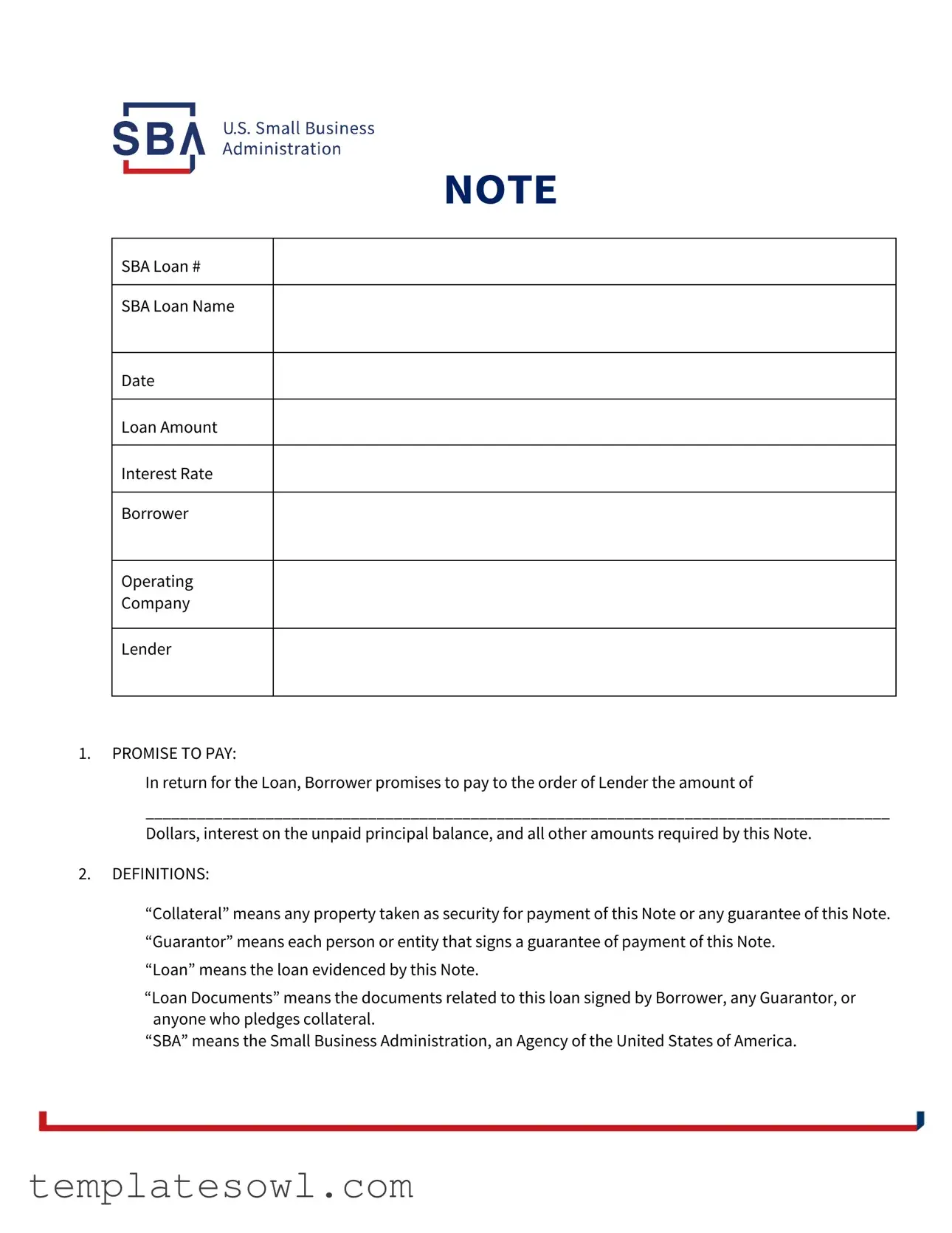

NOTE

SBA Loan #

SBA Loan Name

Date

Loan Amount

Interest Rate

Borrower

Operating

Company

Lender

1.PROMISE TO PAY:

In return for the Loan, Borrower promises to pay to the order of Lender the amount of

_______________________________________________________________________________________

Dollars, interest on the unpaid principal balance, and all other amounts required by this Note.

2.DEFINITIONS:

“Collateral” means any property taken as security for payment of this Note or any guarantee of this Note.

“Guarantor” means each person or entity that signs a guarantee of payment of this Note.

“Loan” means the loan evidenced by this Note.

“Loan Documents” means the documents related to this loan signed by Borrower, any Guarantor, or anyone who pledges collateral.

“SBA” means the Small Business Administration, an Agency of the United States of America.

3.PAYMENT TERMS:

Borrower must make all payments at the place Lender designates. The payment terms for this Note are:

2 of 6

SBA FORM 147 (06/03/02) VERSION 4.1

4.DEFAULT:

Borrower is in default under this Note if Borrower does not make a payment when due under this Note, or if Borrower or Operating Company:

A.Fails to do anything required by this Note and other Loan Documents;

B.Defaults on any other loan with Lender;

C.Does not preserve, or account to Lender’s satisfaction for, any of the Collateral or its proceeds;

D.Does not disclose, or anyone acting on their behalf does not disclose, any material fact to Lender or SBA;

E.Makes, or anyone acting on their behalf makes, a materially false or misleading representation to Lender or SBA;

F.Defaults on any loan or agreement with another creditor, if Lender believes the default may materially affect Borrower’s ability to pay this Note;

G.Fails to pay any taxes when due;

H.Becomes the subject of a proceeding under any bankruptcy or insolvency law;

I.Has a receiver or liquidator appointed for any part of their business or property;

J.Makes an assignment for the benefit of creditors;

K.Has any adverse change in financial condition or business operation that Lender believes may materially affect Borrower’s ability to pay this Note;

L.Reorganizes, merges, consolidates, or otherwise changes ownership or business structure without Lender’s prior written consent; or

M.Becomes the subject of a civil or criminal action that Lender believes may materially affect Borrower’s ability to pay this Note.

5.LENDER’S RIGHTS IF THERE IS A DEFAULT:

Without notice or demand and without giving up any of its rights, Lender may:

A.Require immediate payment of all amounts owing under this Note;

B.Collect all amounts owing from any Borrower or Guarantor;

C.File suit and obtain judgment;

D.Take possession of any Collateral; or

E.Sell, lease, or otherwise dispose of, any Collateral at public or private sale, with or without advertisement.

6.LENDER’S GENERAL POWERS:

Without notice and without Borrower’s consent, Lender may:

3 of 6

SBA FORM 147 (06/03/02) VERSION 4.1

A.Bid on or buy the Collateral at its sale or the sale of another lienholder, at any price it chooses;

B.Incur expenses to collect amounts due under this Note, enforce the terms of this Note or any other Loan Document, and preserve or dispose of the Collateral. Among other things, the expenses may include payments for property taxes, prior liens, insurance, appraisals, environmental remediation costs, and reasonable attorney’s fees and costs. If Lender incurs such expenses, it may demand immediate repayment from Borrower or add the expenses to the principal balance;

C.Release anyone obligated to pay this Note;

D.Compromise, release, renew, extend or substitute any of the Collateral; and

E.Take any action necessary to protect the Collateral or collect amounts owing on this Note.

7.WHEN FEDERAL LAW APPLIES:

When SBA is the holder, this Note will be interpreted and enforced under federal law, including SBA regulations. Lender or SBA may use state or local procedures for filing papers, recording documents, giving notice, foreclosing liens, and other purposes. By using such procedures, SBA does not waive any federal immunity from state or local control, penalty, tax, or liability. As to this Note, Borrower may not claim or assert against SBA any local or state law to deny any obligation, defeat any claim of SBA, or preempt federal law.

8.SUCCESSORS AND ASSIGNS:

Under this Note, Borrower and Operating Company include the successors of each, and Lender includes its successors and assigns.

9.GENERAL PROVISIONS:

A.All individuals and entities signing this Note are jointly and severally liable.

B.Borrower waives all suretyship defenses.

C.Borrower must sign all documents necessary at any time to comply with the Loan Documents and to enable Lender to acquire, perfect, or maintain Lender’s liens on Collateral.

D.Lender may exercise any of its rights separately or together, as many times and in any order it chooses. Lender may delay or forgo enforcing any of its rights without giving up any of them.

E.Borrower may not use an oral statement of Lender or SBA to contradict or alter the written terms of this Note.

F.If any part of this Note is unenforceable, all other parts remain in effect.

G.To the extent allowed by law, Borrower waives all demands and notices in connection with this Note, including presentment, demand, protest, and notice of dishonor. Borrower also waives any defenses based upon any claim that Lender did not obtain any guarantee; did not obtain, perfect, or maintain a lien upon Collateral; impaired Collateral; or did not obtain the fair market value of Collateral at a sale.

4 of 6

SBA FORM 147 (06/03/02) VERSION 4.1

10.

5 of 6

SBA FORM 147 (06/03/02) VERSION 4.1

11.BORROWER’S NAME(S) AND SIGNATURE(S):

By signing below, each individual or entity becomes obligated under this Note as Borrower.

BORROWER’S NAME AND SIGNATURE:

BORROWER’S NAME AND SIGNATURE:

BORROWER’S NAME AND SIGNATURE:

6 of 6

SBA FORM 147 (06/03/02) VERSION 4.1

Form Characteristics

| Fact Name | Detail |

|---|---|

| SBA Loan Purpose | The SBA Form 147 is primarily used for documenting loans provided under the Small Business Administration programs to support small businesses. |

| Payment Agreement | Borrowers agree to repay the loan amount, along with any applicable interest, according to the terms outlined in the note. |

| Default Conditions | A borrower may be considered in default for various reasons, including failing to make timely payments, not complying with loan requirements, or undergoing bankruptcy. |

| Lender's Rights | In case of default, lenders have the right to require immediate repayment, collect amounts due, and take possession of collateral without prior notice. |

| Federal Law Applicability | This form is governed by federal law when the SBA is involved, which may supersede state laws in certain instances. |

Guidelines on Utilizing Sba 147

Completing the SBA Form 147 is a key step in securing a loan through the Small Business Administration. This process involves accurately providing information pertaining to the loan agreement, payment obligations, collateral, and other relevant terms. Follow these steps to ensure the form is filled out correctly.

- Begin by entering the SBA Loan Number in the designated space.

- Fill in the SBA Loan Name as stated in your loan documentation.

- Write the Date when you are completing the form.

- In the Loan Amount section, write the total dollar amount of the loan.

- Indicate the Interest Rate that applies to your loan.

- Identify the Borrower, listing the full name as it appears in loan documents.

- Enter the name of the Operating Company if applicable.

- Provide the name of the Lender as designated in your loan agreement.

- In the section for PROMISE TO PAY, confirm the amount you have noted and ensure it matches your approved loan amount.

- Refer to the Definitions section, ensuring you understand terms like "Collateral" and "Guarantor" before proceeding.

- Review the PAYMENT TERMS making note of where payments will be made and ensure you understand the schedule.

- Check the DEFAULT provisions, understanding what conditions may lead to a default.

- Read through LENDER’S RIGHTS IF THERE IS A DEFAULT to know the lender’s options in case of non-payment.

- Understand LENDER’S GENERAL POWERS, noting the rights related to the collateral and other relevant obligations.

- Familiarize yourself with WHEN FEDERAL LAW APPLIES, especially if SBA is the holder of your note.

- Make sure to include any STATE-SPECIFIC PROVISIONS that may apply based on your location.

- Sign and date the form at the bottom where required.

What You Should Know About This Form

What is the SBA Form 147?

SBA Form 147 is a loan document used in transactions involving loans backed by the Small Business Administration (SBA). It outlines the terms of the loan, including the loan amount, interest rate, and repayment obligations. The borrower agrees to repay the lender based on the conditions set in this document.

Who are the parties involved in the SBA Form 147?

The primary parties involved in SBA Form 147 are the borrower, operating company, lender, and any guarantors. The borrower is the entity receiving the loan, while the operating company operates the business. The lender is the institution providing the loan, and guarantors may provide a guarantee for repayment.

What happens if the borrower defaults on the loan?

Default occurs if the borrower fails to make payments or meets other obligations outlined in the document. If default occurs, the lender has various rights, including requiring immediate payment of the entire loan, taking possession of collateral, and pursuing legal action to collect the debt.

What are the collateral requirements?

Collateral refers to any property pledged as security for the loan. The borrower must provide adequate collateral to the lender to secure the loan's repayment. The specifics of the collateral will be defined in the loan documents.

Can the lender take action without notice?

Yes, the lender can take certain actions without prior notice to the borrower. This includes collecting amounts owed, selling collateral, or taking legal action to protect its rights. Such actions can occur if the borrower is in default under the terms of the note.

What are some obligations of the borrower?

The borrower must adhere to the payment schedule, maintain collateral, and provide accurate disclosures to the lender. Other obligations include paying taxes on time and securing lender approval for any significant changes to the business structure.

How is the SBA Form 147 enforced?

This form is enforced under federal law when the SBA holds the note. While state or local procedures may apply in specific instances, federal regulations take precedence, and the borrower cannot use state laws to contest obligations under this form.

What does "successors and assigns" mean in the context of this loan?

"Successors and assigns" refers to the legal ability of the rights and responsibilities under the SBA Form 147 to be transferred. This means that any successors of the borrower or lender can be held to the same responsibilities as the original parties involved in the loan.

Common mistakes

Completing the SBA Form 147 requires careful attention to detail. Common mistakes can lead to delays or even denials of loan applications. Understanding these errors can improve the accuracy and efficiency of the application process. Here are several mistakes people often make when filling out the form.

First, many individuals neglect to accurately fill in the loan amount. This detail must be precise, as it defines the financial obligation. Entering the wrong amount can raise concerns for the lender, potentially ending in the application being rejected.

Second, borrowers frequently skip the borrower's name or operating company section. Lenders need clear identification of the borrower to process the application. Leaving this section blank can create confusion and delays, as the lender may struggle to link the loan request with the correct applicant.

Third, not providing sufficient information about the collateral is another common oversight. It's crucial to define the collateral in detail, as this acts as security for the loan. Vague descriptions or incomplete information can lead to the lender doubting the value or availability of the collateral.

Fourth, applicants sometimes mistakenly assume that verbal confirmations or discussions with the lender suffice instead of written documentation. All terms, conditions, and agreements should be securely established in writing to avoid any misunderstandings later in the process.

Fifth, some individuals may fail to disclose relevant financial issues, such as pending lawsuits or debts. Full transparency is essential for working with lenders. Concealing such information can categorize the applicant as untrustworthy, jeopardizing the loan application.

Sixth, various applicants overlook the importance of signing all necessary sections of the SBA Form 147. Each required signature confirms acceptance of the terms. Missing a signature, even by a co-borrower or guarantor, can render the application invalid.

Seventh, many people forget to provide up-to-date information. It is essential to ensure that the details on the form reflect current circumstances and financial statuses. Outdated information can create inconsistencies that may lead to questions and delays in processing.

Finally, failure to consult with a financial advisor or a professional during the completion of this form can result in errors. Seeking guidance can clarify any complicated aspects of the application that may require insight beyond the applicant's expertise.

Documents used along the form

The SBA 147 form serves as a critical document in the loan application process, particularly when dealing with the Small Business Administration (SBA). Alongside this form, several other documents are commonly required to ensure a comprehensive understanding of the loan agreement and its stipulations. Each of these documents plays a significant role in organizing the terms of the loan, protecting the interests of both the borrower and the lender, and clarifying obligations. Below is a list of related documents often utilized in conjunction with the SBA 147 form.

- SBA 504 Loan Application: This document details the specifics of the loan being requested, including financial projections, management qualifications, and the purpose for which the loan will be used. It’s essential for evaluating eligibility.

- Business Plan: A comprehensive business plan outlines the business model, market analysis, and operational plan. Lenders review this to assess the viability of the business and the borrower's ability to repay the loan.

- Personal Financial Statement: This statement provides an overview of the individual's financial position, including assets, liabilities, income, and expenses. It helps the lender evaluate the creditworthiness of the borrower.

- Tax Returns: Typically requested for the previous three years, tax returns offer a view into the business’s financial history, supporting claims made in the application and financial statements.

- Loan Agreement: This legally binding document outlines the terms and conditions agreed upon by both lender and borrower, detailing the obligations of each party regarding the loan.

- Collateral Documents: If the loan includes any collateral, this documentation establishes the asset being used as security for the loan. This could include titles, appraisals, or agreements verifying ownership and condition.

- Guarantee Agreement: If a third party guarantees the loan, this agreement details the guarantor's commitment to fulfill loan obligations if the borrower defaults.

- Disclosure Statement: This document outlines any potential risks associated with the loan. It is essential for ensuring that borrowers fully understand the terms and implications of the loan agreement.

Each of these documents works to create a clearer picture of the financial situation and obligations involved in a loan through the SBA. Together with the SBA 147 form, they establish a framework that promotes transparency and accountability, ultimately benefiting all parties involved in the lending process.

Similar forms

Promissory Note: Similar to the SBA 147 form, a promissory note outlines the borrower's commitment to repay a loan. Both documents contain essential terms such as the loan amount, interest rate, and repayment schedule. However, the promissory note typically focuses mainly on the borrower's promise to repay without additional guarantees or collateral specifications.

Loan Agreement: This is a broader document that includes the terms of the loan, related covenants, and obligations of both the borrower and lender. Like the SBA 147, a loan agreement provides detailed provisions regarding default and the rights of the lender if repayment does not occur.

Collateral Agreement: A collateral agreement specifies the assets pledged as security for the loan. Similar to the references to "Collateral" in the SBA 147, this document makes it clear what physical or personal property backs the loan, thus protecting the lender in the event of default.

Guarantee Agreement: In this document, a third party agrees to take responsibility for the borrower's debt if the borrower defaults. The SBA 147, while primarily focused on the borrower, also addresses the role of guarantors, establishing a link between these two forms.

Default Notice: This document is issued when a borrower fails to meet their obligations. Much like the default terms in the SBA 147, a default notice outlines the nature of the default and the potential actions the lender may take, ensuring that both parties understand the consequences of missed payments.

Dos and Don'ts

When filling out the SBA 147 form, it is important to ensure accuracy and compliance with all requirements. Below is a list of dos and don'ts to consider.

- Do provide complete and accurate information for each required field.

- Do review the form thoroughly before signing to ensure everything is correctly filled out.

- Do keep a copy of the completed form for your records.

- Do seek assistance if you encounter any difficulties or have questions about the form.

- Don't leave any fields blank; omissions may lead to processing delays.

- Don't use white-out or any correction fluid to alter the form.

- Don't sign the document without reviewing the terms, as this may result in unintentional obligations.

- Don't submit the form without ensuring that all required documentation is attached.

Misconceptions

Understanding the SBA Form 147 is essential for anyone involved in small business loans, yet several misconceptions often arise. Here are four common misunderstandings, clarified:

- Misconception 1: The SBA Form 147 is only for certain types of loans.

- Misconception 2: Completing the SBA Form 147 guarantees loan approval.

- Misconception 3: The terms of the SBA Form 147 are set in stone.

- Misconception 4: If I default, the lender can immediately take my collateral.

This form is actually designed for a range of SBA loan programs. It serves as a standard promissory note for borrowers, regardless of the specific loan type or purpose.

Completing this form is just one part of the loan application process. Approval hinges on various factors like creditworthiness, the business's financial health, and other documentation.

While the form outlines essential terms, these are often negotiable. Borrowers can discuss terms such as payment schedules or interest rates with lenders before finalizing the agreement.

Defaulting on a loan is serious, but lenders typically must follow specific procedures before taking action. They can't just seize collateral without proper evaluation and compliance with the terms stated in the loan documents.

Recognizing these misconceptions can help you navigate the SBA loan process with greater confidence. Knowledge is power, and informed decisions paves the way to successful loan management.

Key takeaways

The SBA 147 form is a loan agreement that outlines the terms and conditions governing the loan provided by the lender, backed by the Small Business Administration.

When filling out the form, it is essential to provide accurate information, including the loan amount, interest rate, borrower details, and the lender's name.

Understand the payment terms specified in the agreement; borrowers must make all payments on time and at the designated place specified by the lender.

The form includes a section on default, detailing various actions that could lead to default, such as failing to make timely payments or ignoring tax obligations.

Upon default, the lender has the right to take measures such as demanding immediate payment, collecting amounts from guarantors, or taking possession of the collateral.

Borrowers should be aware that the lender holds significant rights, including the power to bid on collateral or incur expenses necessary for enforcing the terms of the agreement.

This agreement is enforced under federal law when the SBA is the holder, ensuring that federal regulations apply regardless of state or local laws.

Lastly, all individuals and entities signing the form are jointly and severally liable, meaning that any one of them can be held responsible for the entire loan amount.

Browse Other Templates

Ciwa Precautions - Effective communication about symptom experiences enhances the accuracy of the assessments.

Kitten:opriuem-o0u= Tabby:uc4odmp4wrg= Cat - The AQS 278 form helps facilitate the health and safety of pets during importation.