Fill Out Your Sba 160 Form

The SBA Form 160 plays a crucial role in the loan application process for organizations seeking financial assistance through the U.S. Small Business Administration (SBA). This form is primarily a resolution of the board of directors, formally granting the authority to designated officers to act on behalf of the organization in all matters related to SBA loans. Key aspects of the form include the authorization for the officers to apply for loans, sign necessary agreements, and accept loan proceeds. Additionally, it empowers them to handle any renewals or extensions of existing loans. The form also stipulates that the organization may mortgage or pledge assets to secure the loans, ensuring that all actions taken by the officers are ratified and confirmed by the board. By centering on proper governance, the SBA Form 160 encourages accountability and transparency within the organization, thereby establishing a clear record that can be trusted by both the SBA and the organization itself. Completing this form is essential for any organization wishing to engage with the SBA's loan programs, reinforcing the importance of structured decision-making in acquiring vital funds.

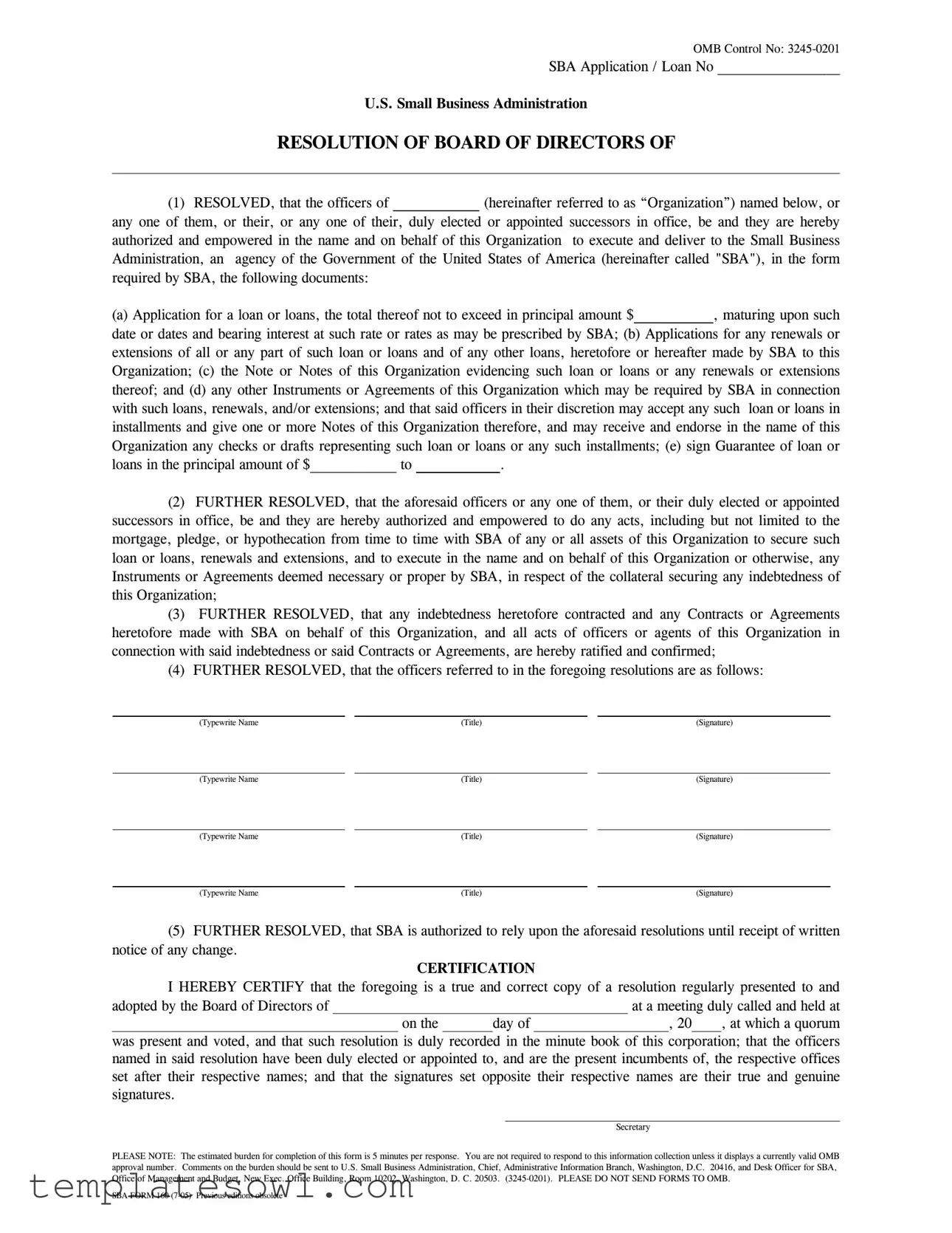

Sba 160 Example

OMB Control No:

SBA Application / Loan No _________________

U.S. Small Business Administration

RESOLUTION OF BOARD OF DIRECTORS OF

(1)RESOLVED, that the officers of ____________ (hereinafter referred to as “Organization”) named below, or any one of them, or their, or any one of their, duly elected or appointed successors in office, be and they are hereby authorized and empowered in the name and on behalf of this Organization to execute and deliver to the Small Business Administration, an agency of the Government of the United States of America (hereinafter called "SBA"), in the form required by SBA, the following documents:

(a)Application for a loan or loans, the total thereof not to exceed in principal amount $___________, maturing upon such date or dates and bearing interest at such rate or rates as may be prescribed by SBA; (b) Applications for any renewals or extensions of all or any part of such loan or loans and of any other loans, heretofore or hereafter made by SBA to this Organization; (c) the Note or Notes of this Organization evidencing such loan or loans or any renewals or extensions thereof; and (d) any other Instruments or Agreements of this Organization which may be required by SBA in connection with such loans, renewals, and/or extensions; and that said officers in their discretion may accept any such loan or loans in installments and give one or more Notes of this Organization therefore, and may receive and endorse in the name of this Organization any checks or drafts representing such loan or loans or any such installments; (e) sign Guarantee of loan or

loans in the principal amount of $____________ to |

|

. |

(2)FURTHER RESOLVED, that the aforesaid officers or any one of them, or their duly elected or appointed successors in office, be and they are hereby authorized and empowered to do any acts, including but not limited to the mortgage, pledge, or hypothecation from time to time with SBA of any or all assets of this Organization to secure such loan or loans, renewals and extensions, and to execute in the name and on behalf of this Organization or otherwise, any Instruments or Agreements deemed necessary or proper by SBA, in respect of the collateral securing any indebtedness of this Organization;

(3)FURTHER RESOLVED, that any indebtedness heretofore contracted and any Contracts or Agreements heretofore made with SBA on behalf of this Organization, and all acts of officers or agents of this Organization in connection with said indebtedness or said Contracts or Agreements, are hereby ratified and confirmed;

(4)FURTHER RESOLVED, that the officers referred to in the foregoing resolutions are as follows:

(Typewrite Name |

|

(Title) |

|

(Signature) |

|

|

|

|

|

(Typewrite Name |

|

(Title) |

|

(Signature) |

|

|

|

|

|

(Typewrite Name |

|

(Title) |

|

(Signature) |

|

|

|

|

|

(Typewrite Name |

|

(Title) |

|

(Signature) |

(5)FURTHER RESOLVED, that SBA is authorized to rely upon the aforesaid resolutions until receipt of written notice of any change.

CERTIFICATION

I HEREBY CERTIFY that the foregoing is a true and correct copy of a resolution regularly presented to and

adopted by the Board of Directors of |

|

|

|

at a meeting duly called and held at |

|||||

|

|

on the |

day of |

, 20 |

, at which a quorum |

||||

|

|

|

|

|

|

|

|

|

|

was present and voted, and that such resolution is duly recorded in the minute book of this corporation; that the officers named in said resolution have been duly elected or appointed to, and are the present incumbents of, the respective offices set after their respective names; and that the signatures set opposite their respective names are their true and genuine signatures.

Secretary

PLEASE NOTE: The estimated burden for completion of this form is 5 minutes per response. You are not required to respond to this information collection unless it displays a currently valid OMB approval number. Comments on the burden should be sent to U.S. Small Business Administration, Chief, Administrative Information Branch, Washington, D.C. 20416, and Desk Officer for SBA, Office of Management and Budget, New Exec. Office Building, Room 10202, Washington, D. C. 20503.

SBA FORM 160

Form Characteristics

| Fact Name | Description |

|---|---|

| OMB Control Number | The SBA 160 form is associated with OMB Control No: 3245-0201. |

| Purpose | This form serves as a resolution for the Board of Directors to authorize certain officers of an organization to execute loan documents for the U.S. Small Business Administration. |

| Loan Details | Organizations may apply for loans not exceeding a principal amount specified in the form. |

| Certification Requirement | The Secretary of the organization must certify that the resolution is accurate and properly recorded in the minute book. |

| Estimated Burden | The estimated time to complete the SBA 160 form is roughly 5 minutes. |

Guidelines on Utilizing Sba 160

Completing the SBA 160 form involves a series of straightforward steps. This form is required to authorize specific officers of an organization to act on its behalf regarding loan applications and other financial agreements with the Small Business Administration (SBA). Below are the steps to correctly fill out the form.

- Enter the SBA Application / Loan Number at the top of the form where indicated.

- In the section that begins with "RESOLVED," fill in the name of your organization in the first blank space.

- Specify the maximum principal amount for the loan in the blank provided in item (a).

- If applicable, fill in the details for any renewals or extensions in the subsequent sections (b through d) as required.

- Complete item (e) by entering the principal amount for any loan guarantees mentioned.

- In the next section, list the names, titles, and signatures of the authorized officers of your organization as specified.

- Verify that the information is accurate, and attach any additional documentation if necessary.

- Finally, have the Secretary of the organization certify the completed form by entering their name and the date of the board meeting.

Ensure all the entries are clearly written or typed, as this will help in the processing of your loan application. Double-check to confirm that no sections are left incomplete.

What You Should Know About This Form

What is the purpose of the SBA 160 form?

The SBA 160 form is a resolution of the board of directors for an organization applying for a loan through the U.S. Small Business Administration (SBA). It authorizes specific officers of the organization to act on behalf of the organization in executing necessary loan documents. This includes applications, notes, and agreements related to the loan. By completing this form, the organization formally designates its representatives and confirms their authority to secure financing.

Who needs to sign the SBA 160 form?

Typically, the form must be signed by the officers of the organization who have been authorized by the board of directors. This might include the president, vice president, and secretary. Each signatory must provide their name, title, and signature. The form serves to demonstrate that these individuals are allowed to make binding financial commitments for the organization.

How long does it take to complete the SBA 160 form?

The estimated time to complete the SBA 160 form is about five minutes. This estimate accounts for the time needed to read the form, gather required information, and obtain necessary signatures. It is important that the information provided is accurate and complete, as it supports the loan application process.

What should I do if there are changes to the board of directors?

If there are changes to the board of directors or the officers authorized to act on behalf of the organization, it is essential to notify the SBA in writing. The SBA 160 form remains valid until the organization submits a written notice of change. Keeping the SBA informed about such changes helps ensure that the correct individuals are authorized for future transactions.

Common mistakes

Many people encounter challenges when completing the SBA Form 160, leading to potential pitfalls. One common mistake is failing to include all necessary signatures. The form requires signatures from all authorized officers. Omitting even one can delay the process or cause the application to be rejected.

Another frequent error involves not providing accurate financial details. Ensuring that loan amounts, interest rates, and other financial figures are correctly recorded is essential. Any discrepancies can raise red flags and complicate or stall the application review.

Inaccurate representations of corporate resolutions also pose problems. The form asks for specific wording regarding the authority granted to officers. Using vague language or material alterations can lead to confusion and a lack of clarity. It is critical to adhere closely to the prescribed language required by the SBA.

Additionally, many applicants overlook the importance of a quorum. The meeting minutes documenting the resolution should reflect that a quorum was present during the decision-making process. Failing to do so not only risks invalidating the resolution but can also undermine the integrity of the entire application.

Another common oversight occurs in the certification section. Applicants sometimes mistakenly certify information inaccurately or fail to ensure proper documentation of meetings and decisions made. Inaccurate certifications can undermine credibility and lead to serious consequences for the organization.

Finally, it is essential to remain updated on SBA requirements. Regulations and forms may change, and applicants sometimes use outdated versions. Using the most current form, complete with the appropriate OMB approval number, is crucial to avoid unnecessary complications.

Documents used along the form

When applying for financing through the Small Business Administration (SBA), additional forms and documents complement the SBA 160 form. These documents help verify your organization's structure, financial status, and compliance with SBA requirements. Here’s a list of commonly used forms alongside the SBA 160:

- SBA Form 1919: This is the borrower information form. It gathers personal and business details about the applicant, which aids in assessing the eligibility for an SBA loan.

- SBA Form 413: This personal financial statement gives a detailed overview of the personal financial situation of the borrower, including assets, liabilities, and net worth. It plays a crucial role in evaluating loan applications.

- SBA Form 4506-T: This form allows the SBA to obtain a tax return transcript from the IRS, ensuring that the applicant's income and tax filings are accurate and up to date.

- Business Plan: A comprehensive business plan outlines business objectives, strategies, market analysis, and financial projections. This document helps the SBA assess the viability of the venture.

- Articles of Incorporation or Organization: This document confirms the legal existence of the business structure. It typically includes the company’s name, purpose, and registered address.

- Bylaws: Bylaws are the internal rules governing the operation of the company. They outline the responsibilities of officers, how meetings are conducted, and other essential operational procedures.

- Resumes of Key Management: Providing resumes for key management personnel highlights their qualifications and experience. This information can reassure lenders of the team’s capability to execute the business plan.

- Credit Report: A personal credit report provides insights into the creditworthiness of the borrower. It helps lenders gauge the risk involved in extending a loan.

- Bank Statements: Recent bank statements demonstrate the financial health of the business and provide insight into its cash flow. This information can influence financing decisions.

Understanding these documents and their purposes can streamline your loan application process and improve your chances of securing funding. Each document plays a vital role in supporting your application and meeting the requirements set by the SBA.

Similar forms

The SBA Form 160 is a significant document for organizations seeking loans from the Small Business Administration. Several other forms share similarities with it, in how they collect essential information and facilitate transactions. Here are nine documents that resemble the SBA Form 160:

- SBA Form 4: This form serves as the application for a loan guarantee. Much like the SBA Form 160, it requires details about the organization and the proposed loan, ensuring that necessary approvals are in place.

- SBA Form 912: This form involves a statement of personal history. Similar to the SBA Form 160, it captures information about key personnel, aiding the lender in assessing the organization’s character and reliability.

- SBA Form 2202: This form is used for listing all business debts. It parallels the SBA Form 160 by providing insights into the organization’s financial obligations, supporting creditworthiness evaluation.

- SBA Form 470: This documentation is vital for requesting a modification or extension of an existing loan. It is akin to the SBA Form 160, as it seeks approval for changes to loan terms, reflecting corporate decision-making.

- SBA Form 8(a): An application form for the 8(a) Business Development Program. Like the SBA Form 160, it requires thorough organizational details and governance information, ensuring compliance and appropriateness in funding considerations.

- SBA Form 10: This is the form for loan applications under the Disaster Loan Program. It shares similarities with the SBA Form 160 in that it outlines necessary financial and operational details to facilitate aid and recovery efforts.

- Business Loan Application: Many lenders have their own loan application forms which often require similar information as the SBA Form 160, including details about the organization’s operations and finances.

- Corporate Resolutions: These documents outline decisions made by a company’s board. They resemble the SBA Form 160 in that both types of documents authorize actions on behalf of the organization, ensuring transparent governance and compliance.

- Certificate of Incumbency: This document verifies the individuals authorized to act on behalf of the company. It complements the SBA Form 160 by confirming who within the organization has the authority to execute agreements and conduct business.

Understanding these documents can enhance comprehension of the loan application process and the importance of essential organizational governance.

Dos and Don'ts

When filling out the SBA Form 160, it is essential to approach the task with care. Here are five important dos and don’ts to keep in mind:

- Do provide accurate information about your organization, including the name and title of the officers involved.

- Do ensure that all signatures are genuine and correspond to the names printed on the form.

- Do clearly indicate the amount of the loan and any other relevant financial details accurately.

- Do keep a copy of the completed form for your records once it has been executed.

- Do read the instructions carefully, paying attention to any specific requirements from the SBA.

- Don't leave any sections of the form incomplete; missing information can delay your application.

- Don't make any alterations or changes to the document unless specifically permitted by the SBA.

- Don't forget to submit any additional documents or agreements referenced within the form.

- Don't send the form to the Office of Management and Budget; submit it only to the SBA as instructed.

- Don't assume previous forms or resolutions are acceptable; always verify that you're using the most current version.

By following these guidelines, you can help ensure a smoother and more efficient process as you complete the SBA Form 160.

Misconceptions

There are several misconceptions surrounding the SBA 160 form that can lead to confusion for those looking to secure funding. Here are six common misconceptions:

- Only Large Businesses Can Use This Form: Many believe that the SBA 160 form is only applicable to large corporations. In reality, it is designed for small businesses of all sizes seeking loans from the SBA.

- The Form Is Only for Initial Loan Requests: Some think the SBA 160 is exclusively for first-time loan applications. However, it can also be used for renewals and extensions of existing loans, allowing businesses to secure additional funding when needed.

- All Loans Require This Form: Another misconception is that every loan secured through the SBA requires the completion of the SBA 160. In fact, the form is typically used for loans that require board authorization. Not all loan types necessitate this step.

- Completion of the Form Guarantees Loan Approval: It's a common belief that filling out the SBA 160 will automatically lead to a loan approval. Rather, this form is part of the application process, and loan approval depends on various factors including creditworthiness and the business's financial situation.

- The Form Is Complex and Difficult to Complete: Some individuals worry that the SBA 160 is complicated and intimidating. In reality, the form is straightforward and can be completed in a few minutes, making it accessible to business owners.

- As a Business Owner, You Can Sign Without Board Approval: Many assume that as long as they are business owners, they can execute the form on their own. However, the SBA 160 specifically requires the resolution and signatures of the board of directors, ensuring that the decision has collective agreement.

Understanding these misconceptions can help small business owners navigate the loan process more effectively and improve their chances of securing the necessary funding.

Key takeaways

When filling out the SBA 160 form, also known as the Resolution of Board of Directors, it’s essential to keep the following key points in mind:

- Ensure that the form is completed by the Board of Directors, as their authorization is required for the organization to engage with the SBA.

- All officers listed must be duly elected or appointed, and their current positions should be clearly stated next to their names.

- The amount requested in the loan application must be clearly filled in to avoid any confusion during processing.

- Each officer’s signature is necessary; they must sign next to their printed name and title to validate the resolution.

- It is wise to keep a copy of this resolution in the organization’s official minute book, documenting the decision for future reference.

- The SBA relies on the information provided in the form; any changes should be communicated to the agency in writing swiftly.

- Be aware that the form includes a note regarding the estimated time for completion; this can provide helpful context for planning.

- Finally, remain mindful of the importance of each resolution as it pertains to securing loans, including potential mortgage or pledge of organization assets.

By adhering to these guidelines, organizations can effectively utilize the SBA 160 form to facilitate their borrowing needs.

Browse Other Templates

54244 640p - Employers should check the appropriate box if they are providing additional supporting documents with their protest.

What Is a Disclosure Statement - This form can help identify pre-existing issues before they become larger problems after a purchase.