Fill Out Your Sba 2202 Form

The SBA 2202 form plays a vital role in the Small Business Administration’s loan application process, particularly for businesses seeking financial assistance. This document aids applicants in detailing their current liabilities effectively. It includes essential information such as the applicant's name and a schedule that outlines their notes, mortgages, and accounts payable. Each entry requires critical details, including the name of the creditor, original amount, current balance, maturity date, and payment amount. Highlighting whether the payment is current or delinquent is also necessary. The SBA 2202 serves as a supplementary tool to ensure that the liabilities presented align with those on the applicant's balance sheet. By accurately completing this form, applicants can provide a clear financial picture that meets the SBA's filing requirements. Remember, using this form is optional; you may choose to submit your own format if preferred. Timely and precise completion of this document is crucial for a smooth application process.

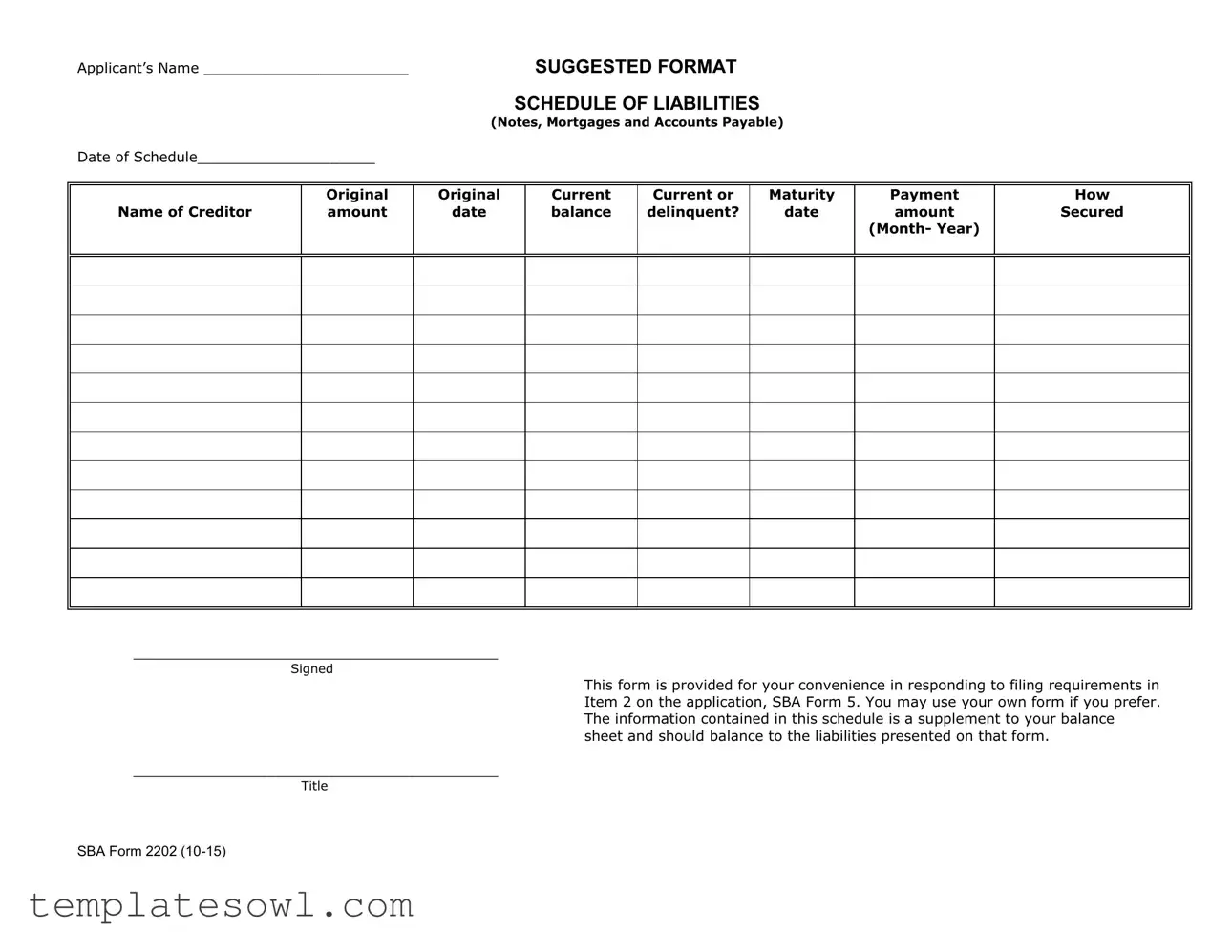

Sba 2202 Example

Applicant’s Name _______________________

SUGGESTED FORMAT SCHEDULE OF LIABILITIES

(Notes, Mortgages and Accounts Payable)

Date of Schedule____________________

Name of Creditor

Original amount

Original

date

Current balance

Current or

delinquent?

Maturity

date

Payment

amount

(Month- Year)

How

Secured

_________________________________________

Signed

This form is provided for your convenience in responding to filing requirements in Item 2 on the application, SBA Form 5. You may use your own form if you prefer. The information contained in this schedule is a supplement to your balance sheet and should balance to the liabilities presented on that form.

_________________________________________

Title

SBA Form 2202

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The SBA Form 2202 is designed to assist applicants in detailing their liabilities, including notes, mortgages, and accounts payable when applying for SBA loans. |

| Usage | This form serves as a supplementary document to the applicant's balance sheet, ensuring accuracy and clarity in financial reporting. |

| Required Information | Applicants must provide details about each liability, including the creditor's name, original amount, current balance, status (current or delinquent), and payment information. |

| Flexibility | While the form is provided by the SBA, applicants have the option to submit their own format if it resembles the requirements outlined in the form. |

| Signature Requirement | Each form must be signed by the applicant, indicating the information is accurate and truthful to the best of their knowledge. |

| Governing Law | The use of SBA Form 2202 is governed by federal laws and regulations pertaining to small business administration and lending practices. |

| Update Date | The current version of the SBA Form 2202 was last updated in October 2015, according to the most recent regulations. |

Guidelines on Utilizing Sba 2202

Once you have decided to complete the SBA Form 2202, gather the necessary financial documents that will help you fill it out accurately. The form requires information about your liabilities, including notes, mortgages, and accounts payable. Following the steps below will guide you through the process.

- Start by writing your name as the Applicant’s Name at the top of the form.

- On the line labeled Date of Schedule, enter the current date when you are filling out the form.

- In the section labeled Name of Creditor, list the names of all creditors to whom you owe money.

- For each creditor, fill in the Original amount of the loan or debt you initially took out.

- Next, indicate the Original date when the loan or debt was first taken out.

- Provide the Current balance owed to each creditor as of the date you filled in the form.

- Next to Current or delinquent?, mark whether your payments are up to date or if you are behind.

- In the Maturity date section, enter when the loan or debt is scheduled to be fully paid off.

- Fill in the Payment amount (Month-Year), indicating how much you are required to pay each month.

- In the section labeled How Secured, describe how the debt is secured, if applicable.

- Finally, sign and date the form in the designated area.

Once you have completed this form, it will serve as an important supplement to your balance sheet. Ensure all information is accurate and reflects your current financial obligations. This will help fulfill the necessary requirements for your application.

What You Should Know About This Form

What is the SBA 2202 form?

The SBA 2202 form is a schedule of liabilities used to list your outstanding financial obligations, including notes, mortgages, and accounts payable. This form is designed to help complete the application process for an SBA loan by providing detailed information about what you owe.

Who needs to fill out the SBA 2202 form?

Anyone applying for an SBA loan must fill out the SBA 2202 form. This information is necessary to assess your financial situation and understand your repayment obligations. A clear picture of your liabilities helps lenders make informed decisions.

What information do I need to provide on the SBA 2202 form?

You'll need to include the name of each creditor, original loan amounts, current balances, payment amounts, and maturity dates. Additionally, indicate whether the accounts are current or delinquent. This detailed breakdown is crucial for lenders reviewing your financial history.

Can I use a different format instead of the SBA 2202 form?

Yes, you can use your own format to present the required information about your liabilities. However, ensure that your document includes all necessary details specified in the SBA 2202 form. The goal is to provide clear and complete information for the lender.

How does the SBA 2202 form relate to my balance sheet?

The information on the SBA 2202 form is a supplement to your balance sheet. The total liabilities reported on this schedule should match the liabilities shown in your balance sheet. This consistency is important for accurate financial reporting.

Is there a deadline for submitting the SBA 2202 form?

The SBA 2202 form should be submitted along with your loan application. It is important to check the requirements for your specific loan application, as deadlines may vary based on the lender or program you are applying for.

What happens if I don’t provide the SBA 2202 form?

If you fail to provide the SBA 2202 form, your loan application may be incomplete, which could delay processing or result in denial. It is best to complete this form thoroughly and accurately to enhance your chances of loan approval.

Where can I obtain the SBA 2202 form?

The SBA 2202 form can be found online on the SBA website or may be provided by your lender. Ensure you have the most recent version to meet current requirements. Using outdated forms may cause confusion in your application process.

Common mistakes

Filling out the SBA 2202 form can present challenges, and several common misunderstandings may lead to mistakes. One significant error is failing to include all liabilities. When applicants overlook any debts, including notes, mortgages, or accounts payable, they risk misrepresenting their financial situation. It is crucial that the listed liabilities reflect the current fiscal responsibilities accurately to ensure a correct evaluation of the application.

Another frequent mistake occurs with the terminology used in the form, particularly in the "Current or delinquent?" section. Sometimes, applicants might assume that a single word indicates their financial status. However, distinguishing clearly between current and delinquent liabilities is essential. Mislabeling a liability can create the impression that a business is in a far worse situation than it actually is or vice versa.

Completing the “Maturity date” section often leads to confusion as well. Applicants sometimes either leave this section blank or input incorrect dates. This oversight can obscure the urgency of repayment and mislead those reviewing the application about the business’s financial viability. Providing accurate maturity dates allows lenders to assess the timing of significant upcoming obligations.

The section asking for the "Current balance" is frequently mismanaged. Mistakes include failing to update the figures or not clearly stating balances when they fluctuate. Regular financial changes can affect the accuracy of this information. If a liability has been recently settled or modified, reflecting that change is crucial to giving a true picture of the applicant's financial obligations.

Lastly, neglecting to sign the form is a common oversight that can delay the review process significantly. While this may seem minor, an unsigned form may lead to confusion or may render the application incomplete. Lenders need confirmation that the information provided is accurate and truthful, and a signature is a crucial part of that validation. Proper attention to detail during the completion of the SBA 2202 form can prevent these mistakes and facilitate a smoother application process.

Documents used along the form

The SBA Form 2202 is an essential document for small businesses applying for loans. It provides a schedule of liabilities that helps lenders understand the financial obligations of the applicant. Alongside this form, several other documents are often required to give a complete picture of the business’s financial health. Below is a list of those commonly used forms and documents.

- SBA Form 5: This form is the actual loan application for the Small Business Administration (SBA) loan. It collects basic information about the business, its owners, and the amount of financing requested.

- Personal Financial Statement (PFS): Often required for business owners, this document outlines personal assets and liabilities, including any debts and income sources that could impact business finances.

- Business Plan: A comprehensive outline of the business’s operations, management, finances, and market strategy. Lenders often require this to evaluate the business's viability and potential for success.

- Tax Returns: Providing both personal and business tax returns from the past few years helps lenders assess financial history, growth, and consistency.

- Balance Sheet: This financial statement provides a snapshot of the business's assets, liabilities, and equity at a specific point in time, essential for understanding financial stability.

- Profit and Loss Statement: Also known as an income statement, it summarizes revenues, costs, and expenses over a particular period, helping to show profitability trends.

- Cash Flow Statement: This document tracks the inflow and outflow of cash within the business, highlighting the ability to cover debts and other financial obligations.

- Lease Agreements: If the business operates from a rented location, providing lease agreements helps clarify financial commitments regarding property expenses.

- Business License: Having a valid business license indicates that the enterprise is legally recognized and authorized to operate in its region.

- Insurance Policies: Proof of general liability insurance or other relevant insurance policies demonstrates the business's risk management practices and financial preparedness for unforeseen events.

Having these documents ready in conjunction with the SBA Form 2202 will not only streamline the loan application process but also enhance the credibility of your financial profile. Preparation is key to presenting a strong case to potential lenders. With the right documentation, you will be better positioned to secure the funding that your business needs.

Similar forms

The SBA Form 2202 focuses on the schedule of liabilities for businesses seeking financial assistance. Other forms share similar functions, typically providing information about debts and obligations. Below are five documents that are comparable to the SBA Form 2202, each serving a unique purpose in financial reporting:

- SBA Form 5: This application form is utilized by small business owners to apply for various types of SBA assistance, including loans. Like the SBA 2202, it requires the applicant to disclose financial information, including liabilities, to facilitate the decision-making process regarding funding.

- Balance Sheet: This financial statement provides an overview of a company's assets, liabilities, and equity at a specific point in time. The SBA 2202 serves as a supplement to the balance sheet by offering detailed information on liabilities, ensuring that both documents are consistent and complete.

- SBA Form 413: This personal financial statement requires business owners to disclose their individual assets and liabilities. Similar to the SBA 2202, it helps lenders assess the overall financial health of the applicant by revealing personal financial obligations that may affect business operations.

- SBA Form 241: The form is requested when applying for microloans and details the applicant's business debts and outstanding loans. Like the SBA 2202, it focuses on liabilities, ensuring the lender has a clear understanding of the applicant's financial responsibilities.

- Credit Report: A credit report provides a comprehensive view of an individual or business's credit history, including outstanding debts. This document is similar to the SBA 2202 in that it helps assess financial viability by detailing current and delinquent obligations, which are essential for lending decisions.

Understanding these forms and how they relate to the SBA Form 2202 can significantly enhance the ability to provide accurate financial disclosures when seeking assistance.

Dos and Don'ts

When filling out the SBA Form 2202, there are important guidelines to follow for a successful submission. Here are six things you should and shouldn’t do.

- Do ensure accuracy: Double-check all numbers and dates to ensure they are correct.

- Do use the suggested format: Follow the structured layout provided in the form for clarity.

- Do disclose all liabilities: Include every liability to provide a complete picture of your financial obligations.

- Do indicate whether liabilities are current or delinquent: This information is essential for assessing your financial health.

- Don't omit creditor details: Make sure to include the name and original amounts to avoid confusion.

- Don't leave sections blank: Fill out every applicable section to prevent delays in processing your application.

Misconceptions

When it comes to the SBA Form 2202, several misconceptions can lead to confusion for applicants. Understanding the realities of this form can help ensure your application process runs smoothly. Below is a list of common misunderstandings:

- The SBA Form 2202 is mandatory for all applicants. - While it is recommended, you may use your own format to present the required information.

- Only major debts need to be reported. - All liabilities, including small business debts such as notes, mortgages, and accounts payable, should be included.

- The form only applies to current debts. - You must report both current and delinquent debts on the SBA Form 2202.

- You cannot make changes to the form. - Applicants are allowed to customize the format if they wish, as long as it contains the essential information.

- There's no need for the information to match other financial statements. - The totals on the SBA Form 2202 should balance with the liabilities on your business's balance sheet.

- The form is only required for large loans. - Regardless of the size of the loan, the SBA Form 2202 may still be necessary for your application.

- Completing the form is not essential if you have no debt. - Even if your business has no debt, a blank form may still be required to demonstrate your financial status.

Clear understanding of these points can help navigate the application process more effectively. Always check official resources or consult with experts if you are unsure about any requirements related to the SBA Form 2202.

Key takeaways

When filling out and using the SBA 2202 form, individuals and businesses should keep several key points in mind:

- Accuracy is essential. Ensure that all provided information, such as the original amount and current balance, is correct to avoid any potential issues.

- Include all liabilities. The form requires a comprehensive list of notes, mortgages, and accounts payable related to your business.

- Provide a clear schedule. Fill in each section methodically, including the date of the schedule and the name of each creditor.

- Understand the significance of details. Each column is important, from the maturity date to how each liability is secured. These details help lenders assess the financial health of your business.

- Use your own format if needed. While the SBA provides this form, you're allowed to use an alternative format as long as it contains the same information.

- Sign the form. Don’t forget to include a signature and title. This validates the information and shows that it has been reviewed.

- Balance your schedules. The total liabilities listed in the SBA 2202 should match the liabilities on your balance sheet. This creates consistency and helps with transparency.

Browse Other Templates

How to Make an Insurance Claim - Timely submission of the claim form is crucial for a smooth claims experience.

Maryland Handgun Registration - Revoke authorization anytime by submitting a written request before any actions are taken.