Fill Out Your Sba 355 Form

The SBA Form 355 serves as a crucial document for small businesses seeking guidance and assistance from the Small Business Administration (SBA). It is primarily designed to gather necessary information for determining whether a business qualifies as 'small' under SBA criteria. Essential to this process is the requirement for the disclosing of various aspects of the business, including its ownership, financial status, and the nature of its operating activities. This form applies to entities organized for profit that operate within the United States or contribute significantly to the U.S. economy. The information collected is not only vital for securing assistance through SBA programs, but also plays a role in ensuring compliance with federal regulations regarding small business definitions. Applicants must adhere to strict guidelines when completing the form; failure to provide complete or accurate information can lead to delays in processing or result in adverse conclusions about the business's status. Furthermore, all affiliates— domestic or foreign— must be disclosed, emphasizing the importance of transparency in ownership structures. Key indicators used to evaluate a business's size include the average number of employees and annual receipts, both of which must be carefully calculated based on specific time frames. As such, providing a comprehensive understanding of these factors is essential for small entities aiming to leverage federal resources effectively.

Sba 355 Example

OMB Approval No:

Expiration Date: 12/31/2022

INFORMATION FOR SMALL BUSINESS SIZE DETERMINATION

General Instructions

CAREFULLY READ ALL OF THESE INSTRUCTIONS AND THE SBA SIZE REGULATIONS BEFORE COMPLETING THIS FORM.

Providing the information is required in order for you to obtain a size determination from SBA. Failure to submit the information or submitting incomplete information may affect the size determination.

1.The information provided in this form will be used by the Small Business Administration (SBA) for a size determination of a business applying for assistance available to small businesses under any program administered by this Agency, except for its Small Business Investment Companies (SBIC) Program, which uses SBA Form 480, or at the request of another Federal agency for purposes of its small business program. A small business is a concern which is independently owned and operated, not dominant in its field of operation, and does not exceed the size standard applicable to the procurement or program for which the business is seeking participation. SBA defines a concern to be a business entity organized for profit, with a place of business located in the United States, and which operates primarily within the United States or which makes a significant contribution to the U.S. economy through payment of taxes or use of American products, materials or labor. 13 CFR § 121.105.

2.SBA is authorized to make size determinations pursuant to the Small Business Act, 15 USC 637(a), and regulations thereunder for the purpose of deciding small business protests and to determine eligibility for program assistance. SBA's size regulations are found generally at Title 13 of the Code of Federal Regulations, Part 121. SBA may, at its discretion, request additional information not specifically identified on this form.

3.The applicant must return one copy of SBA Form 355, with additional sheets attached as needed, to the same SBA Government Contracting Area Office that provided the form. The person signing this form must be authorized to do so.

4.All affiliates of the applicant business, whether acknowledged or not, and whether foreign or domestic, must be disclosed. SBA's criteria for defining affiliates should be carefully reviewed. In 13 CFR § 121.103, SBA identifies various forms of affiliation. You can find this regulation on the size standards website at http://www.sba.gov/size. Separate affiliation rules apply to the SBA Business Loan, Disaster Loan, and Surety Bond Guarantee programs (13 CFR § 121.301) and to SBIR and STTR programs (13 CFR § 121.702). The website also provides some examples of affiliation in the “affiliation discussion” document. Dormant or inactive firms must be disclosed unless legally dissolved. Completion of Part V of this form does not constitute an admission or confirmation of affiliation.

5.Where the applicable size standard involves numbers of employees, SBA examines the applicant business's average number of employees on payroll for the 12 completed calendar months preceding the date of application or offer, including all employees who are hired on a

6.Where applicable size standards involve “average annual receipts,” the applicant business's annual receipts means total income (or gross income in the case of a sole proprietorship) plus cost of goods sold, as these terms are defined and reported on the business's Federal income tax return. For certifications on or before January 6, 2022, except for the Business Loan or Disaster Loan Programs, the applicant may choose to use a

SBA FORM 355

7.For certain assistance programs, SBA must determine the primary industry activity or the North American Industry Classification System (NAICS) code of a business as part of its size determination. For this, SBA considers the distribution of receipts, employees and costs of doing business among the different industries in which business operations occurred for the most recently completed fiscal year. SBA may also consider other factors, such as the distribution of patents, contract awards, and assets. See 13 CFR § 121.107.

8.For purposes of this form, consider principal stockholders as those persons or concerns which own 10 or more percent of the voting stock. In cases where no individual or concern owns at least 10 percent of the voting stock, the five largest stockholders and their percentages of stock must be listed.

9.Where certain financial assistance programs are involved, the business must state whether government funds (loans or grants) to be received will be used in a Labor Surplus Area. Labor Surplus Areas are defined in the Department of Labor publications "Area Trends in Employment and Unemployment." See 13 CFR § 121.301(e).

10.Certain industries require special information. Please review the Size Standards Table and any applicable footnote in 13 CFR § 121.201.

CRIMINAL PENALTIES FOR FALSE STATEMENTS:

Any intentional or negligent misrepresentation of the information contained in this form, or other documents submitted for purposes of the size determination, may result in criminal, civil or administrative sanctions including, but not limited to: 1) fines of up to $500,000, and imprisonment of up to 10 years, or both, as set forth in 15 U.S.C. § 645 and 18 U.S.C. § 1001, as well as any other applicable criminal laws; 2) treble damages and civil penalties under the False Claims Act; 3) double damages and civil penalties under the Program Fraud Civil Remedies Act; and 4) suspension and/or debarment from all Federal procurement and

__________________________________________________________________________________________________________________

CERTIFICATION:

I hereby certify that (1) I have made diligent efforts to obtain all information needed to complete this form; (2) I have reviewed all of the responses to the questions in this form, all exhibits and attachments submitted with this form, and all other documents and information that may be submitted subsequently; and (3) all information, exhibits, attachments, documents, and information that I submitted, or may be submitted subsequently, are true and correct to the best of my knowledge. I understand that the U.S. Small Business Administration (SBA) is relying on this information in order to make a size determination so that my business may receive assistance under the laws and regulations administered by SBA or so that my business can obtain a Federal contract.

_____________________________________________________

(name of sole proprietorship, partnership, limited liability company or corporation)

By:__________________________________________________

Signature

Name and Title:________________________________________

Date of signing: ________________________________________

PLEASE NOTE: The estimated burden hours for the completion of this form is 4 hours. You are not required to respond to this information collection if a valid OMB approval number is not displayed. If you have any questions or comment concerning this estimate or any other aspect of this information collection, please contact the U.S. Small Business Administration, Director, Records management Division, 409 3rd Street, S.W., Washington, DC 20416 and/or SBA Desk Officer, Office of Management

and Budget, New Executive Office Building, Room 10202, Washington, DC 20503. PLEASE DO NOT SEND

FORMS TO OMB.

SBA FORM 355

OMB Approval No:

Expiration Date: 12/31/2022

INFORMATION FOR SMALL BUSINESS SIZE DETERMINATION

____________________________________________________________________________________________________________________

Part I. Information relating to applicant business only:

____________________________________________________________________________________________________________________

1a. |

Name and address of applicant business |

1b. Name and title of person authorized to provide |

|

(Street, City, State & Zip Code) |

information: |

Telephone No.:

______________________________________

Fax No.:

______________________________________

______________________________________

DUNS No. of applicant: ____________________________

____________________________________________________________________________________________________________________

1c.

If determination is needed for a financial assistance program other than surety bond guarantee, will assistance funds be used in a labor surplus area?

yes _____ no _____

If yes, identify labor surplus area: _______________

____________________________________________________________________________________________________________________

1d. Date applicant was established or incorporated: _________________________________

Select type of business entity and provide as an attachment the corresponding information for the business entity chosen:

□ Partnership |

□ Corporation |

Attach a copy of |

Attach articles of |

partnership agreement. |

incorporation and a copy of |

|

latest annual report to |

|

stockholders, if any, and |

|

bylaws. |

□ LLC |

□ Other (including joint |

|

ventures) _______________ |

Attach a copy of its articles |

Identify business legal form |

of organization and |

and attach appropriate |

operating agreement. |

documents verifying |

|

ownership and structure. |

____________________________________________________________________________________________________________________

1e. Primary business activity by North American Industry Classification System (NAICS) code _______________

__________________________________________________________________________________________________________________

1f. Is applicant business organized for profit? Yes ___ No ___

If business is not organized for profit, stop and check with the SBA Government Contracting Office about whether to continue.

__________________________________________________________________________________________________________________

2.Has applicant previously been the subject of a formal SBA size determination? Yes ___ No ___

If yes, then what SBA Government Contracting Area Office? _______________________________

Date ______________________________

____________________________________________________________________________________________________________________

3.Does applicant operate under a franchise or license from another concern? yes _____ no _____

If yes, attach a copy of agreement.

4.Name and address of all owners, partners, principal stockholders, or members of business organization.

If the applicant is owned by one or more entities (i.e., not individuals), provide the names of all owners of the entities and their percentage of ownership. This information must be provided for owners of all entities until the applicant identifies the ultimate owners who are natural persons. Attach additional sheets if necessary.

Name |

% of ownership interest in the applicant |

5.Name of all officers of applicant. Attach additional sheets if necessary.

Name

Position held

6.Name the members of the Board of Directors, if a corporation. If an LLC, name the Manager(s) or members of the Board of Managers, and, if an LP, name the General Partner(s). Attach additional sheets if necessary.

Name |

Position held |

____________________________________________________________________________________________________________________

7a. Has the applicant issued any stock options (or is the issue of any pending)? ____ yes ____ no.

If yes, identify person or concern holding options and amount.

7b. Has the applicant pledged any stock as collateral? ____ yes ____ no.

If yes, provide details of arrangement.

7c. Is any of the applicant’s stock held by a trust, voting trust, or voted in accordance with a shareholder’s agreement?

___ yes ___ no.

If yes, provide relevant documents.

____________________________________________________________________________________________________________________

8.Are there any pending or recently completed mergers, or sale of the applicant by stock or assets? ____ yes ____ no. If yes, submit details and copies of relevant documents.

____________________________________________________________________________________________________________________

9a. Is the applicant or any person listed in questions 4, 5, or 6 (i.e., the owner, partner, director, officer, member, employee, or principal stockholder) an owner, officer, director, manager or employee of another business? ____ yes ____ no.

If yes, complete section 9b below.

____________________________________________________________________________________________________________________

9b. Attach additional sheets if necessary.

Name of person/business

Names of other businesses and addresses

Position held in other business

%of ownership interest in other business.

___________________________________________________________________________________________________________________

Part II. Information relating to

____________________________________________________________________________________________________________________

10.Provide the average number of employees of the applicant based upon numbers of employees

____________________________________________________________________________________________________________________

Part III. Information relating to

____________________________________________________________________________________________________________________

11.What is the ending date of the applicant’s fiscal year?

___________________________________________________________________________________________________________________

12.(a) For certifications made prior to January 6, 2022, select whether the applicant elects to use a

averaging period for average annual receipts (Business Loan or Disaster Loan applicants must select a

____ |

____ |

(b)Annual receipts/gross income of the applicant for each of its most recently completed five fiscal years as of the date that size is being determined. If selecting a

Year:______ |

$____________________________________ |

Year:______ |

$____________________________________ |

Year:______ |

$____________________________________ |

Year:______ |

$____________________________________ |

Year: ______ |

$____________________________________ |

Total: |

$____________________________________ |

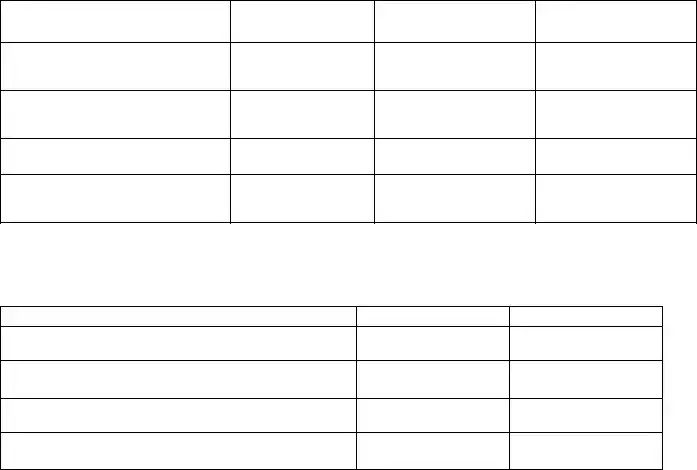

Part IV: Information about acknowledged affiliates.

13.Affiliates (domestic and foreign)

General Instruction #4 above provides guidance on determining whether a company is considered an “affiliate” of the applicant and whether information about the affiliate must be reported. Include as an affiliate any businesses that the applicant’s owner(s) include on a Schedule C or Schedule E of their personal tax returns in which the owner or immediate family member has a controlling interest.

Note: All documentary materials about affiliates, including recorded documents, operating documents, financial and tax information are to be submitted with this form.

____________________________________________________________________________________________________________________

13a. Acknowledged affiliates. Attach additional sheets if necessary. If acknowledged affiliation is on a basis other than ownership, provide explanation of basis for affiliation.

Name and address of acknowledged affiliate

%of ownership interest that applicant has in this affiliate

%of ownership that this affiliate has in the applicant

NAICS code of primary product or service

13 b. Name of all owners, partners, directors, members, and principal stockholders of each business in 13a.

If any owners are entities (i.e., not individuals) provide names of the owners of the entities. This information must be provided for owners of all entities until the applicant identifies the ultimate owners who are natural persons. Attach additional sheets if necessary.

Name of individual

Affiliated business

Position held

13c. Number of employees currently employed by each business listed in 13a, if applicant is being evaluated under an employee- based size standard. (Attach separate sheet if needed)

_________________________________________________________________________________________________________________

13d. |

Annual receipts/gross income of each business listed in 13a for each of the most recently completed five fiscal years prior to the date |

||

|

size is being determined, if applicant is being evaluated under a |

||

|

certifications prior to December 31, 2021, or for Business Loan or Disaster Loan applicants, only provide the most recently |

||

|

completed three fiscal years. Attach additional sheets if necessary. |

|

|

|

|

|

|

Year |

|

Business 1: |

Business 2: |

|

|

|

|

|

|

$: |

$: |

|

|

|

|

|

|

$: |

$: |

|

|

|

|

|

|

$: |

$: |

|

|

|

|

|

|

$: |

$: |

|

|

|

|

|

|

$: |

$: |

|

|

|

|

Total: |

|

Total: |

Total: |

|

|

|

|

____________________________________________________________________________________________________________________

14a. Are there any persons listed in question 13b who are also owners, partners, directors, members or principal stockholders in another company? ____ yes ____ no. If yes, complete section 14b below.

14b. Attach additional sheets if necessary.

Name of person/business

Name of other businesses and addresses

Position held in other business

%of ownership interest held other business

Part V. Information about alleged or possible affiliates of applicant.

In cases where you are contesting alleged or possible affiliation, you must complete questions 15 – 21. The term “contesting” means the firm filling out this form does not agree with the allegations that it is affiliated with a firm noted in the size protest or request for size determination. If you are not contesting an alleged or possible affiliation, include the affiliate as an acknowledged affiliate in Part IV and complete questions 15 – 21 only if requested by SBA. For size protests relating to a specific procurement, questions 22 – 26 must be answered. Attach a separate explanation for any question answered “yes.”

15.Have any owners, officers, directors, key employees or managing members of the applicant ever been employed by or performed similar work for any alleged affiliates? _____ yes ____ no

____________________________________________________________________________________________________________________

16.Have any services been performed by the applicant for any alleged affiliates, or vice versa? ____ yes ____ no

____________________________________________________________________________________________________________________

17.As of the date that applicant’s size is being determined, did the applicant share or lease any facilities, equipment, or personnel with, from, or to any of the alleged affiliates (vehicles, telephone lines, office space, receptionist, etc.)?

____ yes ____ no

____________________________________________________________________________________________________________________

18.Have there been or are there any current financial obligations between the applicant and the alleged affiliates?

____ yes ____ no

____________________________________________________________________________________________________________________

19.Are there any individuals who have signed or are expected to sign documents to facilitate the ability of the applicant to receive bonding, indemnifications or credit guarantees, who are not owners, officers, directors, employees, partners, members or stockholders? _____ yes ____ no

____________________________________________________________________________________________________________________

20.Is any family member of an individual identified in the response to #4a principal stockholder, partner, or member of any of the alleged affiliates or another business? ____yes ____ no

____________________________________________________________________________________________________________________

21.Has SBA ever determined the applicant to be affiliated with any of the alleged affiliates, or to the best of your knowledge, determined any of the alleged affiliates to be affiliated with each other?

____ yes ____ no

If yes, attach a copy of the determination(s) if available, or describe the determination(s) made by SBA.

____________________________________________________________________________________________________________________

22.Will any of the alleged affiliates, or any of their principals, provide an indemnity or guaranty to a surety to facilitate a contract award to the applicant? ____ yes ____ no

Has such an indemnity or guaranty been provided within the past two years? ____ yes ____ no

____________________________________________________________________________________________________________________

23.Have any of the alleged affiliates assisted in arranging for any of the subcontractors needed for performance of this contract or any contract awarded to the applicant within the last two years? ____ yes ____ no

____________________________________________________________________________________________________________________

24.Have there been or are there any actual or proposed subcontracts between the applicant and any of the alleged affiliates?

___ yes ____ no

____________________________________________________________________________________________________________________

25.Will any of the alleged affiliates perform as a subcontractor on this contract? ____ yes ____ no. Attach a copy of the agreement, if applicable.

____________________________________________________________________________________________________________________

26.In preparing the subject bid/proposal or request for assistance, was any assistance provided by an alleged affiliate?

____yes ____ no

____________________________________________________________________________________________________________________

Form Characteristics

| Fact | Description |

|---|---|

| 1. OMB Approval Number | The form is approved under OMB Approval No: 3245-0101. |

| 2. Expiration Date | The expiration date for this form is 12/31/2022. |

| 3. Purpose of the Form | This form is used by the Small Business Administration (SBA) to determine if a business qualifies as small for assistance programs. |

| 4. Size Definition | A small business must be independently owned and operated, not dominant in its field, and meet size standards set by the SBA. |

| 5. Authorized Signatory | The form must be signed by a person authorized to represent the business. Non-employees require written authorization. |

| 6. Disclosure of Affiliates | All affiliates, regardless of their status, must be disclosed to determine the business size accurately. |

| 7. Employee Count | Average number of employees is calculated based on the 12 months preceding the determination date. |

| 8. Financial Reporting | Annual receipts include total income plus cost of goods sold, as defined on the Federal income tax return. |

| 9. Criminal Penalties | False statements can lead to severe sanctions, including fines and imprisonment, as outlined in applicable laws. |

Guidelines on Utilizing Sba 355

Completing the SBA Form 355 requires careful attention to detail. It gathers essential information related to the size determination of your business, which is crucial for accessing assistance under Small Business Administration programs. To ensure accurate processing, follow these steps to fill out the form correctly.

- Begin with Part I of the form. Fill in the name and address of your business, including street, city, state, and zip code.

- Provide the name and title of the person authorized to provide information about the business. Include their telephone number, fax number, and email address.

- Input your DUNS Number, which is crucial for identifying your business.

- If seeking financial assistance, indicate if the funds will be used in a labor surplus area, responding with yes or no. If yes, identify the area.

- Enter the date the applicant was established or incorporated.

- Select the type of business entity and attach the necessary documents based on your choice, such as articles of incorporation or operating agreement.

- Provide your primary business activity by including the North American Industry Classification System (NAICS) code.

- Indicate whether your business is organized for profit. If it is not, consult with the SBA government contracting office.

- Answer if the applicant has previously undergone a formal SBA size determination. If yes, specify the office and date.

- State if your business operates under a franchise or license. Attach a copy of the agreement if applicable.

- List all owners, partners, principal stockholders, or members of your business organization. Include their percentage of ownership interest. Use additional sheets if necessary.

- Provide the name and position of all officers of the applicant. Additional sheets can be submitted if needed.

- For corporations, name the members of the Board of Directors or relevant positions for LLCs and LPs.

- Indicate any stock options issued. If applicable, identify who holds the options and how much.

- State if the applicant has pledged any stock as collateral and provide details if applicable.

- Respond whether any of the applicant's stock is held by a trust or similar arrangement. If yes, attach relevant documents.

- Answer if there are any pending or recently completed mergers or sales, providing details as necessary.

- Identify if the applicant or any listed individuals are associated with another business. Complete the additional section with names and positions if applicable.

If the business is being evaluated under employee-based size standards, complete Part II next. Provide the average number of employees for the preceding 12 months based on pay periods. If evaluating under receipts-based size standards, complete Part III. Note the ending date of the applicant's fiscal year, select a 3-year or 5-year average for receipts, and list the annual receipts for the most recently completed fiscal years. Ensure your total annual receipts are tallied correctly.

What You Should Know About This Form

What is the purpose of the SBA Form 355?

The SBA Form 355 is used to determine the size of a business for eligibility in small business assistance programs administered by the Small Business Administration (SBA). By completing this form, a business provides essential information that helps the SBA assess whether it meets the requirements to be classified as a small business, which impacts access to funding and contracts.

Who is required to fill out the SBA Form 355?

Any business seeking assistance from the SBA, except for its Small Business Investment Companies (SBIC) Program, must complete this form. It applies to various programs, including loans and federal contracts. Businesses must ensure that the information provided is accurate and complete to avoid delays or negative inferences regarding their eligibility.

What kind of information must be disclosed on the form?

The form requires detailed information about the applicant business, including its name, address, ownership structure, affiliate relationships, and financial data. Businesses must disclose all affiliates, whether domestic or foreign. Information about average number of employees and annual receipts is crucial for determining compliance with size standards set by the SBA.

What happens if inaccurate information is provided?

Providing false information on the SBA Form 355 can lead to serious consequences. These may include criminal charges, civil penalties, and administrative sanctions. Businesses could face fines of up to $500,000 or imprisonment, along with potential suspension from federal procurement opportunities. It is crucial to ensure all details submitted are true and correct to avoid these risks.

How does an applicant submit SBA Form 355?

After completing the SBA Form 355, the applicant must return one copy to the specific SBA Government Contracting Area Office that issued the form. If necessary, additional sheets can be attached. The form must be signed by someone who is authorized to do so, and any non-employee representatives must submit a proper authorization letter.

Common mistakes

Completing the SBA Form 355 can seem daunting, especially with the detailed information required for a small business size determination. Unfortunately, many people make mistakes that can delay their application or even affect their eligibility for important programs. Here are eight common pitfalls to avoid.

One major mistake is failing to read the instructions thoroughly. Before completing the form, it's vital to understand the specific requirements and regulations outlined by the SBA. Many applicants skip this step, assuming they can fill out the form based on a quick glance. This often leads to submitting incomplete or incorrect information that can result in unnecessary delays.

Another frequent error involves omitting details about affiliations. Whether acknowledged or not, every affiliate of the applicant must be disclosed. Many applicants overlook this important requirement, believing that only direct ownership matters. However, the SBA defines affiliates broadly, which may include various relationships. Neglecting to list all affiliates could raise questions about the business’s size status.

Some applicants also confuse the definition of average annual receipts and employee counts. For instance, failing to include all sources of income when calculating annual receipts can lead to an inaccurate portrayal of the business’s financial situation. Similarly, participants often forget to report all employees, including part-time and temporary staff, when asked to provide average employee counts for the past year.

Misunderstanding the necessary documentation can create confusion as well. For example, many people neglect to attach the required legal documents and agreements that substantiate their business structure, such as incorporation papers or partnership agreements. This can halt the review process until the missing information is provided.

Another common stumbling block is not providing complete contact information for authorized representatives. All contacts should have their phone numbers, emails, and titles listed accurately. Incomplete information can lead to communication gaps and delays in reaching a decision on the application.

Some applicants mistakenly believe that a partial disclosure of ownership is sufficient. The SBA requires complete transparency regarding stockholders and their ownership percentages. If the applicant fails to list all principal stockholders correctly, it may appear to the SBA that the business is trying to hide information.

Lastly, many businesses neglect the certification portion of the form, thinking it’s just a formality. This section is crucial; it confirms that all the provided information is accurate and that the SBA can rely on it for a size determination. Any mistake here could lead to the entire application being dismissed.

By being mindful of these common mistakes, applicants can improve their chances of submitting a successful SBA Form 355. Proper preparation and attention to detail will not only streamline the process but also foster trust with the SBA.

Documents used along the form

Completing the SBA 355 form is just one step in navigating the requirements set by the Small Business Administration (SBA) for size determination. It's essential to provide supporting documents to ensure that your application is complete. Here are some commonly used forms and documents you may encounter alongside the SBA 355 form:

- Articles of Incorporation: This document outlines the establishment and structure of a corporation, detailing its purpose, the number of shares authorized, and the rights of shareholders.

- Partnership Agreement: If applicable, this legal document details the relationships between partners, their respective rights, and responsibilities within the business.

- Operating Agreement: For LLCs, this document serves as a guideline for the management of the company and outlines member responsibilities and profit sharing.

- Franchise Agreement: If your business operates under a franchise model, this contract stipulates the terms and conditions between the franchisor and franchisee.

- Business Financial Statement: A vital document that provides an overview of a business’s financial standing, including assets, liabilities, and overall profitability.

- Tax Returns: Recent tax returns help verify income and business activities, crucial for establishing eligibility under income-based standards.

- SBA Form 480: Used specifically for applicants applying to the SBA's Small Business Investment Company (SBIC) Program, this form provides essential details for a different type of size determination.

- Government Assistance Plan: If applicable, this outlines any proposed use of SBA funds, especially if employed in labor surplus areas, guiding the determination of program eligibility.

These documents collectively enhance the credibility of your SBA 355 form submission. Preparing them thoroughly not only supports your application but also streamlines the size determination process, increasing your chances of a favorable outcome when seeking assistance. Ensuring all necessary information is at hand can greatly benefit your business's interaction with the SBA.

Similar forms

- SBA Form 480: This form is required for the Small Business Investment Companies (SBIC) program and shares similar functions in determining eligibility for financial assistance based on size standards.

- SBA Form 24: This form relates to the Guarantee of a Loan and assesses the size of a business in relation to its ability to secure funding, similar to how Form 355 evaluates size for other assistance programs.

- SBA Form 600: Used for the 8(a) Business Development program, this document gathers information to determine if a business qualifies based on size standards, comparable to Form 355's requirements.

- SBA Form 1624: This form pertains to the Agency's Surety Bond Guarantee Program, which also necessitates a size determination and is thus akin to the process outlined in Form 355.

- SBA Form 10: This is utilized for the Historically Underutilized Business Zone (HUBZone) program, focusing on small business size for eligibility, similar to Form 355’s emphasis on size assessments.

- SBA Form 918: This form applies to the administration of Small Business Innovation Research (SBIR) and Small Business Technology Transfer (STTR) programs, also concentrating on size standard evaluation.

- SBA Form 701: This document is for businesses applying for a set-aside contract program and requires a size determination, much like the requirements outlined in Form 355.

Dos and Don'ts

Things to Do When Filling Out the SBA 355 Form:

- Read all instructions carefully before starting the form.

- Ensure all information is complete and accurate to avoid delays.

- Disclose all affiliates of the business, including foreign and domestic entities.

- Attach necessary documents, such as organizational charts or agreements.

- Provide the average number of employees for the last 12 months if applicable.

- Have an authorized person sign the form, ensuring they have the authority to do so.

Things to Avoid When Filling Out the SBA 355 Form:

- Do not submit the form without reviewing all responses and necessary attachments.

- Do not omit any affiliates, even if they may not seem relevant.

- Avoid using vague language or terms that may not be easily understood.

- Do not forget to comply with specific requirements for different assistance programs.

- Do not underestimate the importance of accuracy; errors can lead to sanctions.

- Do not submit the form to the OMB; it should go to the SBA Government Contracting Area Office only.

Misconceptions

Here are seven common misconceptions about the SBA Form 355. Each one highlights a misunderstanding that can lead to confusion during the small business size determination process.

- Misconception 1: The SBA Form 355 only applies to new businesses.

- Misconception 2: Completing the form is optional.

- Misconception 3: Only financial information is required on the SBA Form 355.

- Misconception 4: All affiliates of a business must be disclosed if they are significant.

- Misconception 5: The number of employees is the only factor in size determination.

- Misconception 6: The SBA does not consider past size determinations.

- Misconception 7: Legal assistance is not needed in completing the form.

This form is relevant for both new and established businesses seeking a size determination for various SBA assistance programs, not limited to start-ups.

In fact, providing the required information is mandatory for businesses seeking to prove their eligibility for SBA programs. Not completing the form or submitting incomplete information can delay or adversely affect the determination.

Many overlook that the form also requires detailed information about ownership, business structure, and affiliations. Providing a complete picture of the business is essential.

Actually, all affiliates, regardless of their perceived significance, need to be disclosed. This includes both foreign and domestic affiliates to ensure accurate size determination.

While employee count is important, the SBA also evaluates average annual receipts and the business’s primary industry activity. All these elements play a role in the overall assessment.

Contrary to this belief, if a business has been subject to a formal size determination, that information is relevant and must be included in the current application process.

While some business owners may feel comfortable filling out the form themselves, seeking legal guidance can help ensure compliance with all requirements and can assist in obtaining necessary authorizations for representatives.

Key takeaways

Filling out and using the SBA Form 355 is essential for small businesses seeking size determination. Here are key takeaways to consider:

- Understand the purpose of the form: It helps the SBA determine whether your business qualifies as a small business for assistance programs.

- Complete all sections thoroughly. Incomplete forms can delay the determination process.

- All affiliates must be disclosed. Failing to do so can result in penalties.

- Provide accurate employee numbers. SBA counts all employees, including part-time and temporary staff, from the past 12 months.

- Be clear about your business entity type, whether it's a partnership, corporation, or LLC, and attach relevant documents.

- SBA uses both employee count and average annual receipts to determine size. Ensure your financial records reflect this accurately.

- Identify your primary NAICS code to classify your industry's main activity; this can affect eligibility.

- Only authorized individuals should sign the form. If someone else is signing, they need a letter of authorization.

- Stay informed about potential federal penalties. False statements on the form can lead to serious consequences.

- Submit the form to the correct SBA office. Always keep a copy for your records.

By following these takeaways, your completion of the SBA Form 355 can be smooth and efficient, putting your business on the right path to secure necessary assistance.

Browse Other Templates

South Carolina Title - Providing accurate details aids in preventing future legal issues with the vehicle's title.

How Long Does a Father Have to Sign a Birth Certificate in Texas - A sworn affidavit denying the husband’s role as the child's father.

Title Change - It must reflect the most current details regarding the owner and the vehicle.