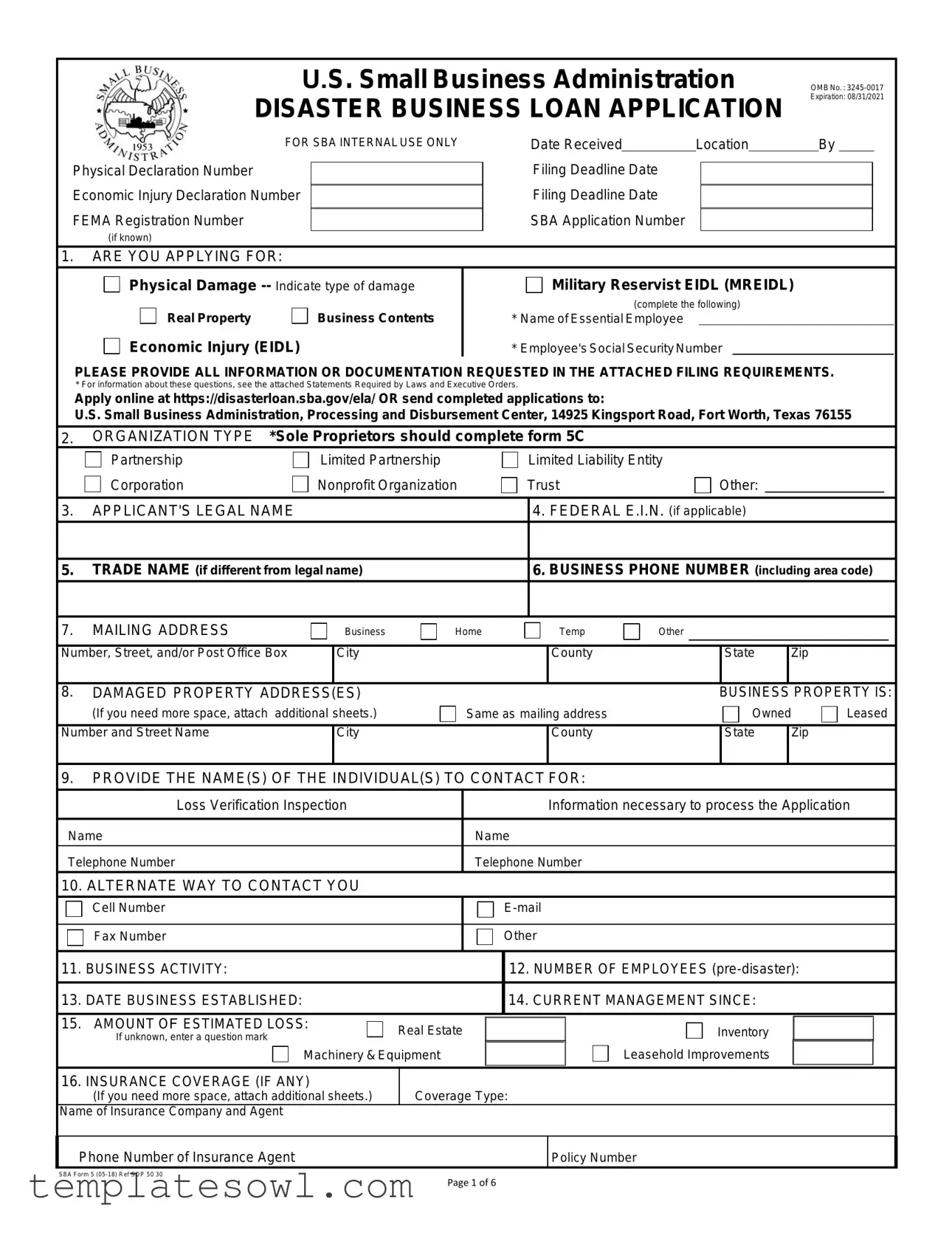

Fill Out Your Sba 5 Form

The SBA Form 5 is a critical document used for applying for disaster business loans through the U.S. Small Business Administration (SBA). Designed specifically for businesses affected by disasters, this form facilitates the process of obtaining financial support necessary for recovery. Key components of the form include sections for identifying the type of damages—be it physical or economic injury—as well as information about the business's legal structure and ownership. Applicants must provide details such as their business's federal Employer Identification Number (EIN), contact information, and the estimated financial losses incurred due to the disaster. Moreover, the form includes sections that require disclosures about insurance coverage, previous loan history, and any outstanding issues like bankruptcy or liens. To ensure all necessary details are captured, the SBA asks for supporting documents, such as tax returns and personal financial statements. Submitting a completed Form 5 is essential for businesses seeking to restore operations in the wake of a disaster, making it a cornerstone tool in their recovery efforts.

Sba 5 Example

~ |

u' |

U.S. Small Business Administration |

OMB No. : |

||||||||||||

* |

|

* |

DISASTER BUSINESS LOAN APPLICATION |

Expiration: 08/31/2021 |

|||||||||||

"' |

rJl |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

~ |

< |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4; |

,o |

FOR SBA INTERNAL USE ONLY |

|

Date Received |

Location |

|

By |

|

|

|

||||

|

~l1y I ST R |

|

|

- |

|

||||||||||

|

|

1953 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Filing Deadline Date |

|

|

|

|

|

|

|

|

||

Physical Declaration Number |

|

|

|

|

|

|

|

|

|

|

|

||||

Economic Injury Declaration Number |

|

|

Filing Deadline Date |

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

||||||

FEMA Registration Number |

|

|

|

SBA Application Number |

|

|

|

|

|

|

|

|

|||

|

I |

I |

|

I |

|

|

|

I |

|||||||

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

(if known)

1.ARE YOU APPLYING FOR:

|

Physical Damage |

|

Military Reservist EIDL (MREIDL) |

|

|||

Real Property |

Business Contents |

(complete the following) |

|

||||

|

* Name of Essential Employee |

|

|

|

|||

|

|

|

|

||||

Economic Injury (EIDL) |

* Employee's Social Security Number |

|

|

||||

|

|

||||||

|

|

|

|

|

|||

PLEASE PROVIDE ALL INFORMATION OR DOCUMENTATION REQUESTED IN THE ATTACHED FILING REQUIREMENTS.

* For information about these questions, see the attached Statements Required by Laws and Executive Orders.

Apply online at https://disasterloan.sba.gov/ela/ OR send completed applications to:

U.S. Small Business Administration, Processing and Disbursement Center, 14925 Kingsport Road, Fort Worth, Texas 76155

2.ORGANIZATION TYPE *Sole Proprietors should complete form 5C

Partnership |

Limited Partnership |

Limited Liability Entity |

Other: |

Corporation |

Nonprofit Organization |

Trust |

|

3. APPLICANT'S LEGAL NAME |

4. FEDERAL E.I.N. (if applicable) |

||

5.TRADE NAME (if different from legal name)

6. BUSINESS PHONE NUMBER (including area code)

7. |

MAILING ADDRESS |

Business |

Home |

Temp |

Other |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Number, Street, and/or Post Office Box |

ICity |

|

ICounty |

|

IState |

IZip |

|

|

|||

8. |

DAMAGED PROPERTY ADDRESS(ES) |

|

|

|

BUSINESS PROPERTY IS: |

||||||

|

(If you need more space, attach additional sheets.) |

Same as mailing address |

|

|

Owned |

|

|

Leased |

|||

|

|

|

|

|

|

||||||

Number and Street Name |

ICity |

|

ICounty |

|

IState |

IZip |

|

|

|||

9.PROVIDE THE NAME(S) OF THE INDIVIDUAL(S) TO CONTACT FOR:

|

Loss Verification Inspection |

|

|

|

|

|

Information necessary to process the Application |

|

|

|

|

|

|

|

|

|

|

Name |

|

|

Name |

|

|

|

||

|

|

|

|

|

|

|

|

|

Telephone Number |

|

|

Telephone Number |

|

||||

|

|

|

|

|

|

|

|

|

10. ALTERNATE WAY TO CONTACT YOU |

|

|

|

|

|

|

|

|

Cell Number |

|

|

|

|

|

|

||

Fax Number |

|

|

Other |

|

|

|

||

11. |

BUSINESS ACTIVITY: |

|

|

|

12. NUMBER OF EMPLOYEES |

|||

|

|

|

|

|

|

|

|

|

13. |

DATE BUSINESS ESTABLISHED: |

|

|

|

14. CURRENT MANAGEMENT SINCE: |

|||

|

|

|

|

|

|

|

|

|

15. |

AMOUNT OF ESTIMATED LOSS: |

|

Real Estate |

|

|

|

Inventory |

|

|

If unknown, enter a question mark |

|

|

|||||

|

|

|

B |

|

Leasehold Improvements B |

|||

|

Machinery & Equipment |

|

||||||

16. |

INSURANCE COVERAGE (IF ANY) |

|

I Coverage Type: |

|

|

|

||

|

(If you need more space, attach additional sheets.) |

|

|

|

||||

Name of Insurance Company and Agent |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Phone Number of Insurance Agent |

|

|

|

|

I |

|

||

|

|

|

|

|

Policy Number |

|

||

SBA Form 5

Page 1 of 6

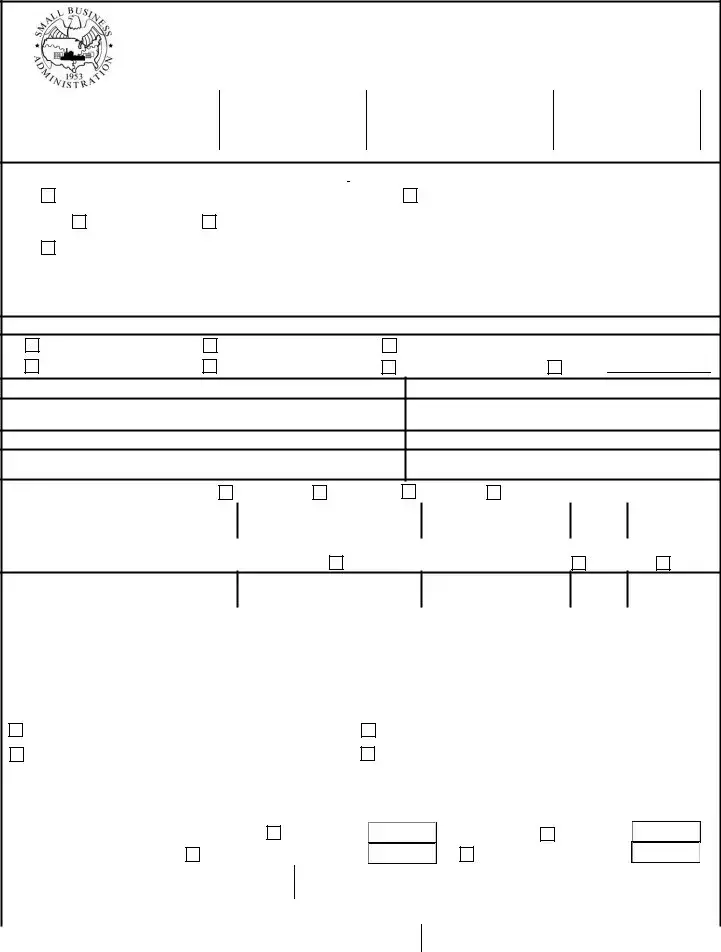

17. OWNERS |

(Individuals and businesses.) |

|

|

Complete for each: 1) proprietor, or 2) limited partner who owns 20% or more interest and each |

|||||||||||||||

|

(If you need more space attach additional sheets.) |

general partner, or 3) stockholder or entity owning 20% or more voting stock. |

|

|

|

|

|||||||||||||

Legal Name |

|

|

|

|

|

|

|

Title/Office |

% Owned |

|

|

|

|

||||||

SSN/EIN* |

Marital Status |

|

Date of Birth* |

|

Place of Birth* |

Telephone Number (area code) |

|

US Citizen |

|||||||||||

|

I |

|

I |

|

I |

|

|

|

|

IState |

|

Yes No |

|||||||

Mailing Address |

|

|

|

|

|

|

|

City |

|

|

|

|

|

Zip |

|

||||

Legal Name |

|

|

|

|

|

|

|

Title/Office |

% Owned |

Address |

|

|

|

|

|||||

SSN/EIN* |

Marital Status |

|

Date of Birth* |

|

Place of Birth* |

Telephone |

Number (area code) |

|

US Citizen |

||||||||||

|

I |

I |

|

I |

|

|

|

|

|

|

|

Yes No |

|||||||

Mailing Address |

|

|

|

|

|

|

|

City |

|

|

|

|

IState |

|

Zip |

|

|||

* For information about these questions, see the attached Statements Required by Laws and Executive Orders. |

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Business Entity Owner |

|

|

|

|

EIN |

Type of Business |

|

|

|

% Ownership |

|||||||||

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mailing Address |

|

|

|

|

|

City |

|

|

|

IState |

|

lZip |

Code |

|

|||||

|

|

|

|

|

|

|

|

IPhone |

|

|

|

|

|

|

|

||||

18. For the applicant business and each owner listed in item 17, please respond to the following |

questions, providing dates and details on any |

|

|||||||||||||||||

question answered YES (Attach an additional sheet for detailed responses). |

|

|

|

|

|

|

|

|

|

|

|||||||||

a. Has the business or a listed owner ever been involved in a bankruptcy or insolvency proceeding? . . |

. . . . . . . . . . . |

. |

. . |

. . . . . |

. |

Yes |

|

No |

|||||||||||

b. Does the business or a listed owner have any outstanding judgments, tax liens, or pending lawsuits against them? |

|

. . Yes |

No |

||||||||||||||||

c. In the past year, has the business or a listed owner been convicted of a criminal offense committed during and in |

|

|

|

|

|

||||||||||||||

connection with a riot or civil disorder or other declared disaster, or ever been engaged in the production or distribution of any |

|

|

No |

||||||||||||||||

product or service that has been determined to be obscene by a court of competent jurisdiction? . . . |

. . . . . . . . . . . . |

|

. . |

. . . . . |

. |

Yes |

|||||||||||||

d. Has the business or a listed owner ever had or guaranteed a Federal loan or a Federally guaranteed loan? |

. |

Yes |

|

No |

|||||||||||||||

e. Is the business or a listed owner delinquent on any Federal taxes, direct or guaranteed Federal loans (SBA, FHA, VA, |

|

|

|

||||||||||||||||

student, etc.), Federal contracts, Federal grants, or any child support payments? |

. . . . . . . . . . . |

|

. . |

. . . . . . |

. |

Yes |

|

No |

|||||||||||

f. Does any owner, owner's spouse, or household member work for SBA or serve as a member of SBA's SCORE, ACE, or |

|

|

|

||||||||||||||||

Advisory Council? |

. . . . . . . . . . . . . . . . . |

. . . |

. . . |

. . . . . . . . |

|

. . . . . . . . . . . |

. . . . |

. . . . . . . . . . . |

|

. . |

. . . . . . |

|

|

Yes |

|

No |

|||

g. Is the applicant or any listed owner currently suspended or debarred from contracting with the Federal government or receiving |

|

|

|

||||||||||||||||

Federal grants or loans? |

. |

. . . . . . . . . . . . . . . . . |

. . . |

. . . |

. . . . . . . |

. |

. . . . . . . . . . . |

. . . . |

. . . . . . . . . . . |

|

. . |

. . . . . . |

|

Yes |

No |

||||

19. Regarding you or any joint applicant listed in Item 17: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

a)are you presently subject to an indictment, criminal information, arraignment, or other means by which formal criminal charges are brought in any jurisdiction; b) have you been arrested in the past six months for any criminal offense; c) for any criminal offense - other than a minor vehicle violation - have you ever: 1) been convicted, 2) plead guilty, 3) plead nolo contendere, 4) been placed on pretrial diversion, or 5) been placed on

any form of parole or probation (including probation before judgement)?

Yes

Yes

No

No

20.PHYSICAL DAMAGE LOANS ONLY. If your application is approved, you may be eligible for additional funds to cover the cost of mitigating measures (real property improvements or devices to minimize or protect against future damage from the same type of disaster event).

It is not necessary for you to submit the description and cost estimates with the application. SBA must approve the mitigating measures

before any loan increase.By checking this box, I am interested in having SBA consider this increase.

21.If anyone assisted you in completing this application, whether you pay a fee for this service or not, that person must print and sign their name

in the space below.

Name and Address of Representative (please include the individual name and their company)

(Signature of Individual)

(Name of Company)

(Print Individual Name)

Phone Number (include Area Code)

Street Address, City, State, ZipFee Charged or Agreed Upon

Unless the NO box is checked, I give permission for SBA to discuss any portion of this application with the representative listed above. NO

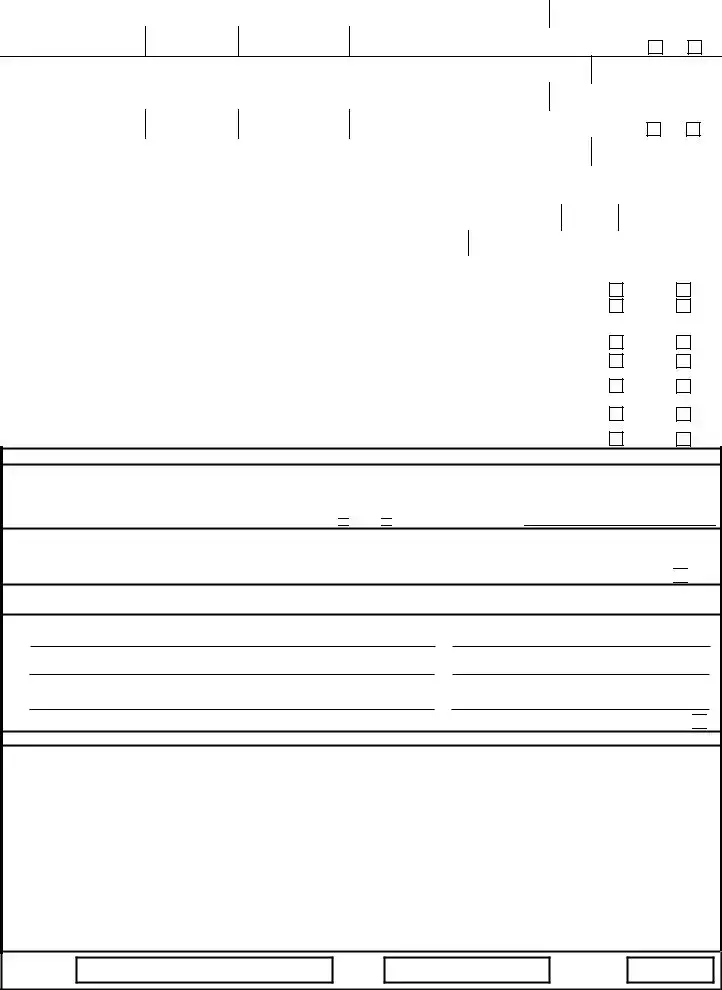

AGREEMENTS AND CERTIFICATIONS

On behalf of the undersigned individually and for the applicant business:

I/We authorize my/our insurance company, bank, financial institution, or other creditors to release to SBA all records and information necessary to process this application.

If my/our loan is approved, additional information may be required prior to loan closing. I/We will be advised in writing what information will be required to obtain my/our loan funds. I/We hereby authorize the SBA to verify my/our past and present employment information and salary history as needed to process and service a disaster loan.

I/We authorize SBA, as required by the Privacy Act, to release any information collected in connection with this application to Federal, state, local, tribal or nonprofit organizations (e.g. Red Cross Salvation Army, Mennonite Disaster Services, SBA Resource Partners) for the purpose of assisting me with my/our SBA application, evaluating eligibility for additional assistance, or notifying me of the availability of such assistance.

I/We will not exclude from participating in or deny the benefits of, or otherwise subject to discrimination under any program or activity for which I/we receive Federal financial assistance from SBA, any person on grounds of age, color, handicap, marital status, national origin, race, religion, or sex.

I/We will report to the SBA Office of the Inspector General, Washington, DC 20416, any Federal employee who offers, in return for compensation of any kind, to help get this loan approved. I/We have not paid anyone connected with the Federal government for help in getting this loan.

CERTIFICATION AS TO TRUTHFUL INFORMATION: By signing this application, you certify that all information in your application and submitted with your application is true and correct to the best of your knowledge, and that you will submit truthful information in the future.

WARNING: Whoever wrongfully misapplies the proceeds of an SBA disaster loan shall be civilly liable to the Administrator in an amount equal to

amount of the loan under 15 U.S.C. 636(b). In addition, any false statement or misrepresentation to SBA may result in criminal, civil or administrative sanctions including, but not limited to: 1) fines and imprisonment, or both, under 15 U.S.C. 645, 18 U.S.C. 1001, 18 U.S.C. 1014, 18 U.S.C. 1040, 18 U.S.C. 3571, and any other applicable laws; 2) treble damages and civil penalties under the False Claims Act, 31 U.S.C. 3729; 3) double damages and civil penalties under the Program Fraud Civil Remedies Act, 31 U.S.C. 3802; and 4) suspension and/or debarment from all Federal procurement and

SIGNATURE I

Sign in Ink

I TITLE I |

I DATE I |

111 |

SBA Form 5

Page 2 of 6

U. S. Small Business Administration

DISASTER BUSINESS LOAN APPLICATION

If you have questions about this application or problems providing the required information, please contact our Customer Service Center

at

If more space is needed for any section of this application, please attach additional sheets.

SBA will contact you by phone or

Filing Requirements

FOR ALL APPLICATIONS, EXCLUDING

This application (SBA Form 5), completed and signed

•Tax Information Authorization (IRS Form 4506T), completed and signed by each applicant, each principal owning

•20 percent or more of the applicant business, each general partner or managing member; and, for any owner who has greater than 50 percent ownership in an affiliate business. Affiliates include, but are not limited to, business parents, subsidiaries, and/or other businesses with common ownership or management

•

•

Complete copies, including all schedules, of the most recent Federal income tax returns for the applicant business; an explanation if not available

Personal Financial Statement (SBA Form 413) completed, signed, and dated by the applicant, each principal owning 20 percent or more of the applicant business, and each general partner or managing member

Schedule of Liabilities listing all fixed debts (SBA Form 2202 may be used)

ITEMS MUST BE SUBMITTED:

This application (SBA Form 5), completed and signed

|

A complete copy of the organization's most recent tax return OR a copy of the organizations's IRS |

|

|

||

• |

||

complete copies of the organization's three most recent years' "Statement of Activities" |

||

• |

Schedule of Liabilities. |

|

|

Tax Information Authorization (IRS Form |

•Affiliates include, but are not limited to, business parents, subsidiaries, and/or other businesses with common ownership or management.

ADDITIONAL REQUIREMENTS FOR MILITARY RESERVIST ECONOMIC INJURY (MREIDL);

•

•

A copy of the essential employee’s notice of expected

A written explanation and financial estimate of how the

• |

MREIDL Certification Form |

|

|

|

|

|

ADDITIONAL INFORMATION MAY BE NECESSARY TO PROCESS YOUR APPLICATION. IF REQUESTED, PLEASE PROVIDE WITHIN 7 DAYS OF THE INFORMATION REQUEST;

• |

Complete copy, including all schedules, of the most recent Federal income tax return for each principal owning |

|

20 percent or more, each general partner or managing member, and each affiliate when any owner has more than 50 percent |

|

ownership in the affiliate business. Affiliates include, but are not limited to, business parents, subsidiaries, and/or other businesses |

|

with common ownership or management |

•

•

•

If the most recent Federal income tax return has not been filed, a

A current

Additional Filing Requirements (SBA Form 1368) providing monthly sales figures for will generally be required when requesting an increase in the amount of economic injury.

SBA Form 5

Page 4 of 6

NOTE: PLEASE READ, DETACH AND KEEP FOR YOUR RECORDS

STATEMENTS REQUIRED BY LAWS AND EXECUTIVE ORDERS

To comply with legislation passed by the Congress and Executive Orders issued by the President, Federal executive agencies, including the Small Business Administration (SBA), must notify you of certain information. You can find the regulations and policies implementing these laws and Executive Orders in Title 13, Code of Federal Regulations (CFR), Chapter 1, or our Standard Operating Procedures (SOPs). In order to provide the required notices, the following is a brief summary of the various laws and Executive Orders that affect SBA's Disaster Loan Programs. A glossary of terms can be found at Disasterloan.sba.gov.

FREEDOM OF INFORMATION ACT (5 U.S.C. § 552)

This law provides, with some exceptions, that we must make records or portions of records contained in our files available to persons requesting them. This generally includes aggregate statistical information on our disaster loan programs and other information such as names of borrowers (and their officers, directors, stockholders or partners), loan amounts at maturity, the collateral pledged, and the general purpose of loans. We do not routinely make available to third parties your proprietary data without first notifying you, required by Executive Order 12600, or information that would cause competitive harm or constitute a clearly unwarranted invasion of personal privacy.

Freedom of Information Act (FOIA) requests must describe the specific records you want. For information about the FOIA, contact the Chief, FOI/PA Office, 409 3rd Street, SW, Suite 5900, Washington, DC 20416, or by

PRIVACY ACT (5 U.S.C. § 552a)

Anyone can request to see or get copies of any personal information that we have in your file. Any personal information in your file that is retrieved by individual identifiers, such as name or social security number is protected by the Privacy Act, which means requests for information about you may be denied unless we have your written permission to release the information to the requestor or unless the information is subject to disclosure under the Freedom of Information Act. The Agreements and Certifications section of this form contains written permission for us to disclose the information resulting from this collection to state, local or private disaster relief services.

The Privacy Act authorizes SBA to make certain "routine uses" of information protected by that Act. One such routine use for SBA's loan system of records is that when this information indicates a violation or potential violation of law, whether civil, criminal,

or administrative in nature, SBA may refer it to the appropriate agency, whether Federal, State, local or foreign, charged with responsibility for or otherwise involved in investigation, prosecution, enforcement or prevention of such violations. Another routine use of personal information is to assist in obtaining credit bureau reports, on the Disaster Loan Applicants and guarantors for purposes of originating, servicing, and liquidating Disaster loans. See, 69 F.R. 58598, 58617 (and as amended from time to time) for additional background and other routine uses.

Under the provisions of the Privacy Act, you are not required to provide social security numbers. (But see the information under Debt Collection Act below) We use social security numbers to distinguish between people with a similar or the same name for credit decisions and for debt collection purposes. Failure to provide this number may not affect any right, benefit or privilege to which you are entitled by law, but having the number makes it easier for us to more accurately identify to whom adverse credit information applies and to keep accurate loan records.

Note: Any person concerned with the collection, use and disclosure of information, under the Privacy Act may contact the Chief, FOI/ PA Office, 409 3rd Street, SW, Suite 5900, Washington, DC 20416 or by

DEBT COLLECTION ACT OF 1982; DEFICIT REDUCTION ACT OF 1984; DEBT COLLECTION IMPROVEMENT ACT OF 1996 & other titles (31 U.S.C. 3701 et seq.)

These laws require us to aggressively collect any delinquent loan payments and to require you to give your taxpayer identification number to us when you apply for a loan. If you receive a loan and do not make payments when they become due, we may take one or more of the following actions (this list may not be exhaustive):

*Report the delinquency to credit reporting bureaus.

*Offset your income tax refunds or other amounts due to you from the Federal Government. *Refer the account to a private collection agency or other agency operating a debt collection center. *Suspend or debar you from doing business with the Federal Government.

*Refer your loan to the Department of Justice.

*Foreclose on collateral or take other actions permitted in the loan instruments. *Garnish wages.

*Sell the debt. *Litigate or foreclose.

SBA Form 5

Page 5 of 6

RIGHT TO FINANCIAL PRIVACY ACT OF 1978 (12 U.S.C. § 3401 et seq.)

This notifies you, as required by the Right to Financial Privacy Act of 1978 (Act), of our right to access financial records held by financial institutions that were or are doing business with you or your business. This includes financial institutions participating in loans or loan guarantees.

The law provides that we may access your financial records when considering or administering Government loan or loan guaranty assistance to you. We must give a financial institution a certificate of our compliance with the Act when we first request access to your financial records. No other certification is required for later access. Our access rights continue for the term of any approved loan or loan guaranty. We do not have to give you any additional notice of our access rights during the term of the loan or loan guaranty.

We may transfer to another Government authority any financial records included in a loan application or about an approved loan or loan guaranty as necessary to process, service, liquidate, or foreclose a loan or loan guaranty. We will not permit any transfer of your financial records to another Government authority except as required or permitted by law.

Paperwork Reduction Act (44 U.S.C. Chapter 35)

We are collecting the information on this form in order to make disaster loans available to qualified small businesses. The form is designed to collect the information necessary for us to make eligibility and credit decisions in order to fund or deny loan requests. We will also use the information collected on this form to produce summary reports for program and management analysis, as required by law.

PLEASE NOTE: The estimated burden for completing this form is 2 hours. Your responses to the requested information are required in order to obtain a benefit under SBA's Disaster Business Loan Programs. However, you are not required to respond to any collection of information unless it displays a currently valid OMB approval number. If you have any questions or comments concerning any aspects of this information collection, please contact the U.S. Small Business Administration Information Branch, 409 3rd St., SW, Washington, DC 20416 and Desk Officer for SBA, Office of Management and Budget, Office of Information and Regulatory Affairs, 725 17th St., NW, Washington, DC 20503.

Policy Concerning Representatives and Their Fees

When you apply for an SBA loan, you may use an attorney, accountant, engineer, appraiser or other representative to help prepare and present the application to us. You are not required to have representation. If an application is approved, you may need an attorney to help prepare closing documents.

There are no "authorized representatives" of SBA, other than our regular salaried employees. Payment of a fee or gratuity to our employees is illegal and will subject those involved to prosecution.

SBA Regulations prohibit representatives from proposing or charging any fee for services performed in connection with your loan unless we consider the services necessary and the amount reasonable. The Regulations also prohibit charging you any commitment, bonus, broker, commission, referral or similar fee. We will not approve the payment of any bonus, brokerage fee or commission. Also, we will not approve placement or finder's fees for using or trying to use influence in the SBA loan application process.

Fees to representatives must be reasonable for services provided in connection with the application or the closing and based upon the time and effort required, the qualifications of the representative, and the nature and extent of work performed. Representatives must execute a compensation agreement.

In the appropriate section of the application, you must state the names of everyone employed by you or on your behalf. You must also notify the SBA disaster office in writing of the names and fees of any representative you employ after you file your application.

If you have any questions concerning payment of fees or reasonableness of fees, contact the Field Office where you filed or will file your application.

Occupational Safety and Health Act (29 U.S.C. 3651 et seq.)

This legislation authorizes the Occupational Safety and Health Administration (OSHA) in the Department of Labor to require businesses to modify facilities and procedures to protect employees when appropriate. If your business does not do so, you may be penalized, forced to close or prevented from starting operations in a new facility. Because of this, we may require information from you to determine whether your business complies with OSHA regulations and may continue operating after the loan is approved or disbursed. You must certify to us that OSHA requirements applying to your business have been determined and that you are, to the best of your knowledge, in compliance.

SBA Form 5

Page 6 of 6

Form Characteristics

| Fact | Description |

|---|---|

| Form Purpose | The SBA Form 5 is an application for disaster business loans provided by the U.S. Small Business Administration to assist businesses impacted by disasters. |

| OMB Number | This form is identified with OMB No. 3245-0017, reflecting the design and approval for public information collection. |

| Expiration Date | The current expiration date for this form is crucial for ensuring that applications remain valid and up-to-date, which was 08/31/2021. |

| Types of Aid | The form allows applicants to indicate their needs, including physical damage, economic injury, or military reservist assistance. |

| Eligibility Requirements | To apply, businesses must provide detailed information about ownership, legal status, business activity, estimated losses, and insurance coverage. |

| Submission Requirements | Applicants must submit the form along with additional documents, including tax returns and financial statements, to complete their application. |

| State-Specific Forms | Some states may have specific requirements that govern the application process for disaster loans; applicants should check their local SBA office. |

| Filing Deadline | Applicants must be aware of the filing deadline for applications to ensure timely processing and access to funds needed for recovery. |

| Contact Information | For questions or assistance, applicants can contact the SBA Customer Service Center at 1-800-659-2955 or via email. |

Guidelines on Utilizing Sba 5

Filling out the SBA 5 form is a straightforward process that requires careful attention to detail. Completing the form accurately helps ensure that your application for a disaster business loan is processed without unnecessary delays. Gather all the necessary information before starting to fill out the form.

- Basic Information: Begin by entering the date received, the location, and the name of the person processing your application.

- Check Loan Type: Indicate the type of disaster loan you are applying for (Physical Damage, Military Reservist EIDL, Economic Injury, etc.).

- Organization Type: Select your organization type from the provided options (Partnership, Corporation, Nonprofit, etc.).

- Legal Business Information: Fill in the applicant's legal name, Federal Employer Identification Number (if applicable), trade name (if different), business phone number, and mailing address.

- Damaged Property: Specify the address of the damaged property and its ownership status (owned or leased).

- Contact for Business: Provide contact names and phone numbers for loss verification and inspection information.

- Alternate Contact Method: Indicate how you can be reached (cell number, email, fax).

- Business Overview: Describe the business activity, number of employees before the disaster, date established, and current management since.

- Estimated Loss: Estimate your loss amount for various categories, such as real estate and inventory.

- Insurance Coverage: If applicable, provide details about your insurance coverage, including the insurance company’s name and the policy number.

- Owner Information: List all owners and provide relevant details including name, title, ownership percentage, contact information, and social security number.

- Eligibility Questions: Answer questions regarding bankruptcy, outstanding judgments, criminal offenses, federal loans, tax delinquencies, or employment with the SBA.

- Relation to Criminal Charges: Respond to questions about any pending criminal charges or past arrests.

- Physical Damage Loans: If applicable, express interest in additional funds for mitigating measures after loan approval.

- Assistance Acknowledgment: If someone assisted you in completing the form, provide their details, including name and contact.

- Agreements and Certifications: Review and sign the agreements and certifications section acknowledging the provided information is true.

- Signature: Sign the application in ink, including your title and date of signing.

Once you’ve carefully completed the form and collected any additional required documentation, you can submit it either online or by mailing it to the designated address. Properly following these steps can help ensure your application is processed efficiently.

What You Should Know About This Form

1. What is the SBA Form 5 used for?

The SBA Form 5 is an application for a Disaster Business Loan from the Small Business Administration (SBA). It is designed for businesses that have suffered physical damage or economic injury due to a disaster. By completing this form, you can apply for financial assistance to help recover from losses and get back on your feet.

2. Who needs to fill out the SBA Form 5?

Any business organization affected by a disaster, such as corporations, partnerships, limited liability entities, or sole proprietorships, can complete this form. Nonprofits and trusts also qualify. Each owner in the business with at least 20% ownership must be mentioned in the application.

3. What information is required to complete the form?

You will need to provide several key pieces of information, including the legal name of your business, contact details, the type of damages suffered, estimated loss amounts, insurance coverage, and certain personal details about business owners. Ensure all sections are thorough and complete to avoid delays.

4. How do I submit the SBA Form 5?

You can submit your completed SBA Form 5 online at the SBA's disaster loan application site or send a hard copy to the designated processing address: U.S. Small Business Administration, Processing and Disbursement Center, 14925 Kingsport Road, Fort Worth, Texas 76155.

5. What happens after I submit my application?

After submission, the SBA will review your application. They may contact you if they require any additional information. This review process is critical to determine your eligibility for a loan. Keep an eye on your email and phone for communication from the SBA.

6. What should I do if I need help completing the application?

If you require assistance filling out the SBA Form 5, you can seek help from legal or financial professionals, but you are not obliged to do so. Any representative who helps you must disclose their name and fees in the application. Keep in mind that the SBA does not authorize any representatives other than its employees.

7. Is there a deadline for applying for a disaster loan?

There is a filing deadline outlined in the disaster declaration. It’s important to check the specific date that applies to your situation. Submitting your application as soon as possible is recommended to ensure you don’t miss any critical deadlines.

Common mistakes

Completing the SBA 5 form accurately is essential for securing a disaster business loan. However, many applicants make mistakes that can delay the process or lead to denial of their application. One common error is failing to provide all required documentation. The form states that applicants must submit a variety of supporting documents along with their application. Missing tax returns, financial statements, or proof of ownership can result in a request for additional information, which can prolong the review process.

Another frequent mistake involves incorrect or incomplete information in the application fields themselves. Applicants must ensure that every relevant question is answered in full. Incomplete answers can lead to misunderstandings or assumptions that may negatively impact eligibility. For example, omitting the federal Employer Identification Number (EIN) or the business’s physical address can create barriers that complicate the review process.

Additionally, some applicants overlook the importance of organizational structure. Different types of business entities have specific requirements and implications for the application. Applicants must clearly indicate their type of organization, such as a sole proprietorship, partnership, or corporation. Misidentifying the business type can lead to delays or rejection, as the form is tailored for various business structures.

Finally, a critical mistake is not certifying the accuracy of the information provided. The form requires a certification statement confirming that all submitted data is true to the best of the applicant's knowledge. Failing to sign this declaration can result in the immediate dismissal of the application. This certification is crucial because it emphasizes the responsibility of the applicant to provide truthful information, which is a fundamental requirement of the SBA application process.

Documents used along the form

The SBA Form 5 is vital for businesses seeking loan assistance in the wake of disasters. However, several other documents may also be necessary to complete your application. Each of these forms serves an important purpose in ensuring that you meet the eligibility requirements and that your application is processed smoothly. Below is a list of commonly required forms that often accompany the SBA Form 5.

- IRS Form 4506T: This form is used to authorize the IRS to release tax information to the SBA. It must be signed by each applicant and any principal owners with a significant ownership percentage in the business.

- SBA Form 413: The Personal Financial Statement collects detailed financial information about the applicant and any significant owners, including assets, debts, and income. It must be signed and dated.

- SBA Form 2202: This form is a Schedule of Liabilities. It lists all fixed debts and liabilities of the business, helping the SBA understand the financial obligations of the borrower.

- Federal Income Tax Returns: Complete copies of recent federal tax returns must be provided. This helps the SBA evaluate the financial history and current standing of the business.

- Statement of Activities: For non-profit organizations, this document outlines the organization's financial activities over the last few years, providing an overview of its financial health.

- Business Plan or Financial Projection: This outlines your business strategy and financial plans, including projected income, expenses, and cash flow, helping the SBA assess future viability.

- Insurance Coverage Documentation: Proof of insurance coverage is essential to demonstrate the business’s protection against future risks, especially those similar to the disaster that prompted the loan application.

- Mitigation Measures Documentation: If you’re applying for funds to mitigate future damages, documentation detailing proposed improvements is necessary. This includes understanding how these enhancements will protect against similar disasters.

Gathering these documents ahead of time can streamline your application process and reduce delays. Each piece of paper adds a layer of clarity and understanding to your business’s situation. Being well-prepared increases your chances of receiving the assistance you need to recover and thrive.

Similar forms

- SBA Form 413 (Personal Financial Statement): Similar to the SBA Form 5, the SBA Form 413 requires detailed financial information about the applicant. Both forms aim to assess the financial health of the business and its owners, helping the SBA determine creditworthiness.

- SBA Form 2202 (Schedule of Liabilities): This document, like the SBA Form 5, provides a comprehensive overview of the applicant’s debts. Both forms require listing fixed debts to evaluate the applicant's financial obligations and assess repayment capacity.

- IRS Form 4506-T (Tax Information Authorization): This form allows the SBA to obtain verified tax information, similar to what is required in the Sba 5. Both forms request information that helps assess the financial status of the business and its owners.

- SBA Form 1368 (Monthly Sales Figures): Just as the SBA Form 5 collects vital business information for loan processing, SBA Form 1368 gathers monthly sales data. This information aids the SBA in evaluating the business's revenue and ongoing viability post-disaster.

- SBA Form 7 (Loan Application): This form is used for other types of SBA loans, much like the SBA Form 5 serves disaster loans. Both forms require extensive information about the business, its owners, and financial details for the SBA's decision-making process.

- FEMA Form 121 (Disaster Assistance Application): This document is similar to the SBA Form 5 in that it collects information to determine disaster assistance eligibility. Both forms aim to gather essential details for processing disaster-related loans or assistance.

Dos and Don'ts

- Provide complete and accurate information on all sections of the form.

- Check for any inconsistencies before submitting your application.

- Attach all required documentation, such as tax returns and financial statements.

- Contact the SBA for clarification if any questions are unclear.

- Include your legal name and business details exactly as they appear on official documents.

- Make sure to sign the application and provide your title and date.

- Submit your application on time to avoid delays in processing.

- Do not leave any sections blank; incomplete forms may be rejected.

- Avoid providing false or misleading information, which can result in legal penalties.

- Do not submit the application without proofreading for errors.

- Do not forget to include contact information for any representatives assisting you.

- Do not ignore any additional information requests from the SBA after submission.

- Never pay fees to anyone claiming to expedite the approval process.

- Do not procrastinate; ensure your documents are organized and ready for submission.

Misconceptions

Understanding the SBA Form 5 can be challenging. There are several misconceptions that often arise regarding this form. Here are four common misunderstandings, clarified.

- Misconception 1: The SBA Form 5 is only for businesses that have sustained significant physical damage.

- Misconception 2: You must be a corporation to qualify for a loan using this form.

- Misconception 3: All application information is confidential and will not be disclosed to any other parties.

- Misconception 4: Once you submit the form, there is no further communication required.

This is incorrect. While the form does cover physical damage, it also caters to businesses experiencing economic injury, even if their physical premises were not directly impacted by a disaster. Understanding the broader applications is crucial for potential applicants.

In reality, various business structures are eligible to apply. Sole proprietorships, partnerships, and limited liability entities can also use the SBA Form 5 to seek financial assistance. Make sure to identify your business type properly on the form.

Although some personal information is protected, the SBA may share certain details with other Federal, state, or local agencies for the sake of program evaluation or additional assistance. It's wise to understand how your information may be used.

This is misleading. After submitting the SBA Form 5, you might be contacted for additional information or clarification. Staying prompt and responsive can enhance your chances of approval.

Key takeaways

1. Understand Your Purpose for Filling Out the SBA Form 5: This form is primarily used for applying for disaster business loans from the U.S. Small Business Administration. It’s crucial to clearly identify whether you are seeking assistance for physical damage, economic injury, or other types of disaster-related losses.

2. Gather Required Documentation: Before starting the application, collect necessary documents such as your latest tax returns, a personal financial statement, and information about your business’s structure. Having all required paperwork ready will simplify the process.

3. Provide Accurate and Complete Information: Ensure that all sections of the form are filled out completely and accurately. Incomplete or incorrect information can lead to delays in processing or denial of your application. Double-check details like your legal business name, address, and Federal Employer Identification Number (EIN).

4. Note the Filing Deadline: Be aware of filing deadlines. Missing the deadline can disqualify you from receiving assistance. Keep track of any relevant dates regarding disaster declarations or application submission deadlines.

5. Identify Your Business Structure: You will need to specify your organization's type, whether it's a sole proprietorship, partnership, corporation, or another structure. Each type has different implications for ownership and liability.

6. Seek Help If Necessary: If you're unsure about any part of the application or feel overwhelmed, consider reaching out to a representative, such as an attorney or accountant. Just be cautious about any fees associated with their services, as payment policies are regulated.

7. Be Ready for Additional Information Requests: After submitting your application, you might be asked for more details or documentation. Promptly provide any requested information to keep the process moving forward.

8. Understand Your Rights and Responsibilities: By signing the application, you certify that the information provided is accurate. Misrepresentation can lead to serious legal consequences, including criminal penalties.

9. Reach Out for Support: If you have questions or need help during the application process, do not hesitate to contact the SBA Customer Service Center. They can assist you with any issues or clarifications you might need.

Browse Other Templates

Florida State College Jacksonville - Lease agreements with notarized signatures can serve as acceptable residency documentation.

Ciwa Precautions - This form enables healthcare professionals to systematically evaluate symptoms like nausea and agitation.

Mcsa-5871 - A follow-up appointment is indicated for those who wear contact lenses.