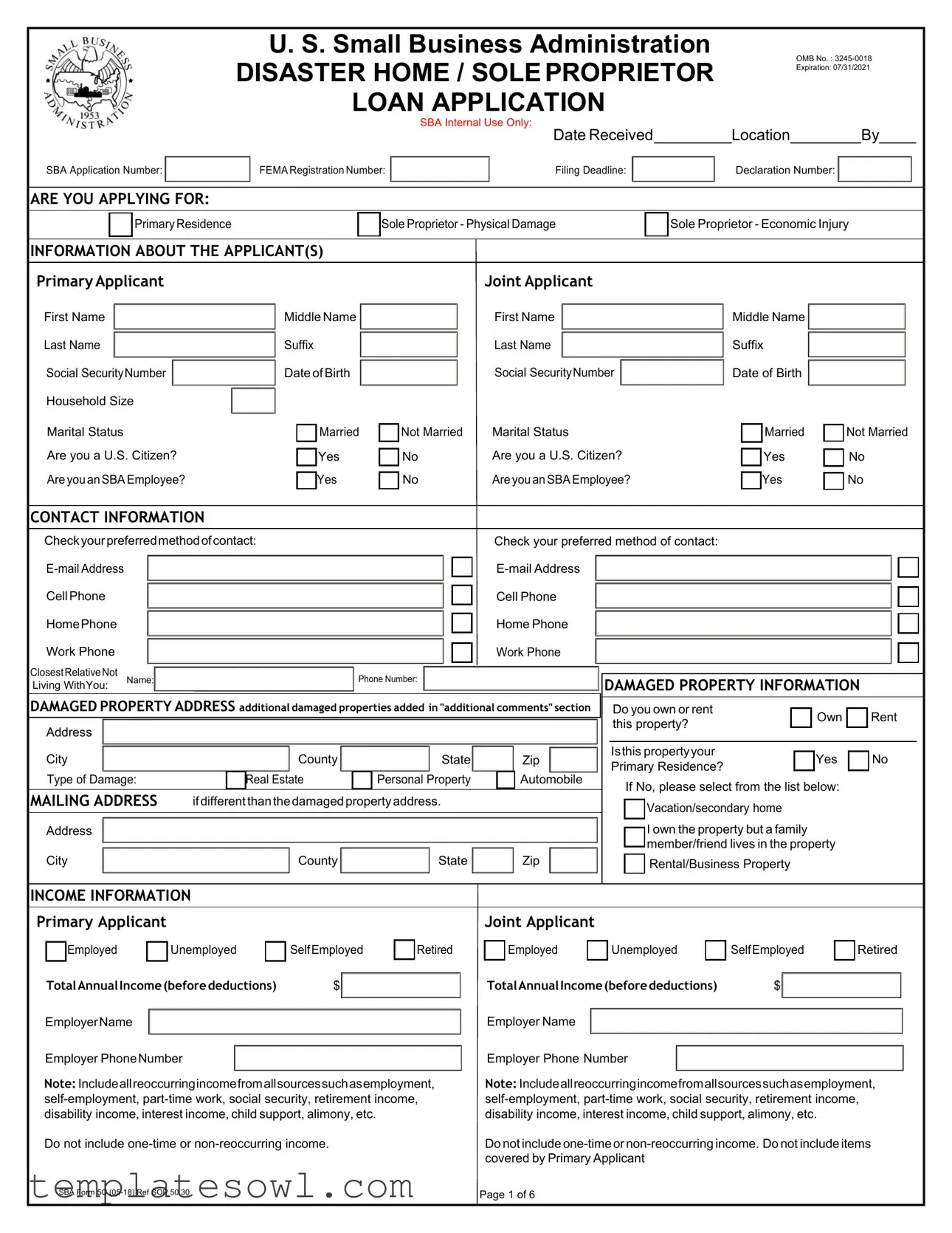

Fill Out Your Sba 5C Form

The SBA 5C form serves as a crucial gateway for individuals and sole proprietors seeking disaster assistance from the Small Business Administration (SBA). This application is particularly relevant for those affected by natural disasters, enabling them to apply for various types of loans designed to aid in recovery. The form collects comprehensive information about the applicant, including personal details, property damage assessments, income and debt disclosures, as well as insurance coverage. Applicants must clarify whether their request pertains to physical damage or economic injury, and they are required to outline all assets and liabilities. Other sections address the applicant's citizenship status and any federal tax delinquencies, ensuring that eligibility criteria are met. Moreover, consent for information sharing with relevant institutions must be provided, acknowledging that the SBA must review financial records for effective processing of the application. Instructions detail what documentation may be needed upon loan approval, reinforcing the importance of accurate and thorough submissions. Altogether, the SBA 5C form not only facilitates the financial assistance process but also underscores the program's commitment to comprehensive support for disaster recovery efforts.

Sba 5C Example

U. S. SMALL BUSINESS ADMINISTRATION DISASTER HOME / SOLEPROPRIETOR LOAN APPLICATION

OMB No. :

Expiration: 07/31/2021

|

|

|

|

|

|

|

|

|

SBA Internal Use Only: |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

Date Received |

|

|

Location |

|

|

By |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SBA Application Number: |

FEMA Registration Number: |

|

Filing Deadline: |

|

|

Declaration Number: |

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ARE YOU APPLYING FOR: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

Primary Residence |

|

|

|

|

|

Sole Proprietor - Physical Damage |

|

|

Sole Proprietor - Economic Injury |

||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

INFORMATION ABOUT THE APPLICANT(S) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Primary Applicant |

|

|

|

|

|

|

|

Joint Applicant |

|

|

|

|

|

|

|

|

|

|

|

|

|||

First Name |

Middle Name |

|

First Name |

|

|

Middle Name |

|

|

|

|

|||||||||||||

Last Name |

Suffix |

|

Last Name |

|

|

Suffix |

|

|

|

|

|||||||||||||

Social SecurityNumber |

Date of Birth |

|

Social SecurityNumber |

|

|

Date of Birth |

|

|

|

|

|||||||||||||

Household Size |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Marital Status |

|

|

Married |

|

Not Married |

Marital Status |

|

|

|

|

|

Married |

|

Not Married |

|||||||||

|

|

|

|

|

|

|

|

|

|

||||||||||||||

Are you a U.S. Citizen? |

|

|

|

|

|

|

|

Are you a U.S. Citizen? |

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

Yes |

|

|

No |

|

|

|

|

|

Yes |

|

No |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AreyouanSBA Employee? |

|

|

Yes |

|

|

No |

AreyouanSBA Employee? |

|

|

|

|

Yes |

|

No |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CONTACT INFORMATION

Checkyourpreferredmethodofcontact:

CellPhone

HomePhone

Work Phone

Check your preferred method of contact:

Cell Phone

Home Phone

Work Phone

ClosestRelativeNot |

Name: |

Phone Number: |

Living WithYou: |

|

|

DAMAGED PROPERTY ADDRESS additional damaged properties added in "additional comments" section

Address |

|

|

|

|

|

|

|

City |

|

|

County |

|

State |

|

Zip |

Type of Damage: |

|

|

Real Estate |

|

Personal Property |

|

Automobile |

|

|

|

|

||||

MAILING ADDRESS |

ifdifferentthanthedamagedpropertyaddress. |

|

|

||||

Address |

|

|

|

|

|

|

|

City |

|

|

County |

|

State |

|

Zip |

DAMAGED PROPERTY INFORMATION

Do you own or rent |

|

|

|

Own |

|

|

|

Rent |

|

|

|

|

|

|

|||

this property? |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Isthis propertyyour |

|

|

|

Yes |

|

|

|

No |

|

|

|

|

|

|

|||

Primary Residence? |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

If No, please select from the list below:

Vacation/secondary home

Vacation/secondary home

I own the property but a family member/friend lives in the property

Rental/Business Property

Rental/Business Property

INCOME INFORMATION

Primary Applicant |

Joint Applicant |

|

Employed |

|

Unemployed |

|

SelfEmployed |

|

Retired |

Total Annual Income (before deductions) |

$ |

|

|

||||

EmployerName

Employer PhoneNumber

Note: Includeallreoccurringincomefromallsourcessuchasemployment,

Do not include

|

Employed |

|

Unemployed |

|

SelfEmployed |

|

Retired |

Total Annual Income (before deductions) |

$ |

|

|

||||

Employer Name

Employer Phone Number

Note: Includeallreoccurringincomefromallsourcessuchasemployment,

Do not include

SBA Form 5C |

Page 1 of 6 |

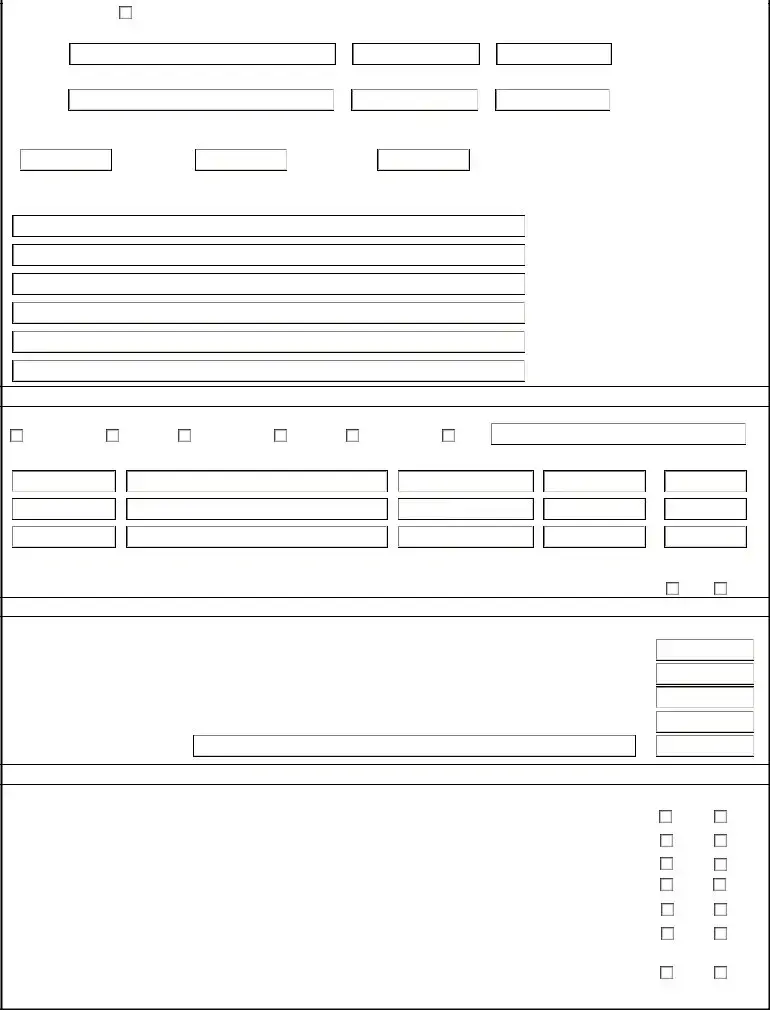

DEBTS |

|

I have no debts |

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mortgage Holder or Landlord's Name (Primary Residence) |

|

MonthlyPayment/Rent |

Current Balance |

|

|||||||

|

|

Name |

|

|

|

|

|

$ |

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

2nd MortgageHolderName(ifapplicable) |

|

|

MonthlyPayment/Rent |

Current Balance |

|

||||||

|

|

Name |

|

|

|

|

|

$ |

|

$ |

|

|

|

|

Note: Please complete the section below if the amounts are NOT included in your mortgage payment: |

|

|||||||||||

|

RealEstateTaxes |

|

|

Homeowner's Insurance |

|

|

|||||||

|

$ |

per year |

|

$ |

per year |

|

$ |

|

per year |

|

|||

|

OtherDebtincludingautopayments,creditcards,installmentloans,studentloans,etc. |

Note: Only include debts that will last longer than 10 months. |

|||||||||||

|

Nameof Creditor |

|

|

|

|

|

|

|

|

Monthly Payment |

Current Balance |

||

$ $

$ $

$ $

$ $

$ $

$

$ $

$ $

$ $

$ $

$ $

$

INSURANCE INFORMATION

|

Pleasecheckallinsuranceinforceforthedamagedproperty: |

|

|

|

|

|

(describe) |

|

|

|

|

|

||||||

|

|

Homeowner's |

|

Flood |

|

Automobile |

|

Renter's |

|

NoInsurance |

|

Other: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

PolicyType |

|

Insurance Company Name |

|

|

PolicyNumber |

PhoneNumber |

|

Amount Received |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OTHER DISASTER ASSISTANCE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other than FEMA, have you received any grant award (i.e. city grants, county grants, state grants, etc.): |

|

|

|

Yes |

|

No |

|||||||||||

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ASSETS

Cash, Bank Accounts and Marketable Securities (e.g. Stock & Bonds, CDs, etc.) (Not including retirement accounts) . . . . . . . . . . . . . . . . . . . ... . . .. . $ Retirement Accounts (e.g. IRAs, Keogh, TSP or other similar accounts). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. ... . .$ Personal Property (furniture, appliances, vehicles, RVs, etc.). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .$

Primary Residence |

$ |

All Other Real Estate (describe) |

$ |

DISCLOSURES

The responses below apply to the Applicant and Joint Applicant, if any. Please explain any "Yes" responses on the last page.

1. |

. . . . . .. .Are you delinquent on any Federal taxes, Federal loans, Federal grants, or 60 days past due on any child support obligation? |

|

Yes |

|

No |

||

|

|

|

|

||||

2. |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. .Are you currently a defendant in any lawsuits or have pending judgements against you? |

|

|

Yes |

|

No |

|

|

|

|

|

|

|

|

|

3. |

....................AreyoucurrentlysuspendedordebarredfromcontractingwithFederalgovernmentorreceivingFederalgrantsorloans? |

|

|

Yes |

|

No |

|

|

|

|

|

|

|||

4. |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ..Do you have federal loans, federally guaranteed loans, or previous SBA loans? |

|

|

Yes |

|

No |

|

5. Are you engaged in the productionor distribution of any product that has been determined to be obscene by a court of competent |

|

Yes |

|

No |

|||

|

|

|

|||||

|

jurisdiction? |

|

|

|

|

||

|

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

6. |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. .In the past year, have you been convicted of a felony committed in connection with a riot or civil disorder? |

|

|

Yes |

|

No |

|

7. |

Areyoupresently, a)subject toan indictment,criminal information, arraignment, orothermeans by whichformalcriminal charges arebrought inany |

|

|

|

|||

|

|

Yes |

|

No |

|||

|

|

|

|

||||

|

|

|

|

||||

|

. . . . . . . . . . . . .parole or probation (including probation before judgment)? |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

|

|

|

|

|

SBA Form 5C |

Page 2 of 6 |

|

REPRESENTATIVE INFORMATION

If you have paid a representative (packager, attorney, accountant, etc.) to assist you in completing the application, please complete the section below:

NameandAddressofRepresentative: |

Fee charged or agreed upon |

|

$ |

CONSENT

I authorize my insurance company, bank, financial institution, or other creditors to release to SBA all records and financial information necessary to process this application.

SBA has my permission, as required by the Privacy Act, to release any information collected in connection with this application to Federal, state, local, tribal or nonprofit organizations (e.g.RedCross,SalvationArmy, MennoniteDisasterServices,SBAResource Partners)forthepurposeof assistingme withmySBA application, evaluatingmyeligibilityforadditional disaster assistance, or notifying me of the availability of such assistance.

If my loan is approved, I may be eligible for additional funds to safeguard my property from damages similar to those caused by this disaster. Although it is not necessary for me to provide with my application, a description and cost estimate will be required prior to SBA approval of the mitigation measure.

I have received and read a copy of the "STATEMENTS REQUIRED BY LAWS AND EXECUTIVE ORDERS" which was attached to this application.

CERTIFICATIONASTOTRUTHFULINFORMATION:Bysigningthisapplication,youcertifythatallinformationin yourapplicationandsubmitted with yourapplicationistrueandcorrectto the best of your knowledge, and that you will submit truthful information in the future.

WARNING: Whoever wrongfully misapplies the proceeds of an SBA disaster loan shall be civilly liable to the Administrator in an amount equal to

Signature of Applicant |

Date |

Signature of Joint Applicant |

Date |

ADDITIONAL COMMENTS

SBA Form 5C

Page 3 of 6

U.S. Small Business Administration

DISASTER HOME LOAN APPLICATION

If you have questions about this application or problems providing the required information, please contact our Customer Service Center at

SBA will contact you by phone or Email to discuss your loan request.

FILING REQUIREMENTS

REQUIRED FOR ALL LOAN APPLICATIONS:

■Complete and sign this application form (SBA Form 5C)

■Complete and sign the Tax Information Authorization (IRS Form 4506T) enclosed with this application. This income information, obtained from the IRS, will help us determine your repayment ability. U.S. Territories that have their own taxing authority outside of the IRS may require additional form(s) in order to obtain copies of their transcripts. The exact form(s) required will be determined at the onset of the declared disaster. All other filing requirements remain the same.

WHILE NOT NECESSARY TO ACCEPT YOUR APPLICATION, YOU MAY BE REQUIRED TO SUPPLY THE FOLLOWING INFORMATION TO PROCESS THE APPLICATION. IF REQUESTED, PLEASE PROVIDE WITHIN 7 DAYS OF THE INFORMATION REQUEST:

■If any applicant has changed employment within the past two years, provide a copy of a current (within 1 month of the application date) pay stub for all applicants

■If we need additional income information, you may be asked to provide copies of your

Federal income tax returns, including all schedules

IF SBA APPROVES YOUR LOAN, WE MAY REQUIRE THE FOLLOWING ITEMS BEFORE LOAN CLOSING. WE WILL ADVISE YOU, IN WRITING, OF THE DOCUMENTS WE NEED.

■If you own your residence, a COMPLETE legible copy of the deed, including the legal description of the property

■If the damaged property is your primary residence, proof of residency at the damaged address

■If you had damage to a manufactured home, a copy of the title. If you own the lot where the home is located, a COMPLETE legible copy of the deed, including the legal description of the property

■If you have damage to an automobile or other vehicle, proof of ownership (a copy of the registration, title, bill of sale, etc.)

SBA Form 5C

Page 4 of 6

NOTE: PLEASE READ, DETACH AND KEEP FOR YOUR RECORDS

STATEMENTS REQUIRED BY LAWS AND EXECUTIVE ORDERS

TocomplywithlegislationpassedbytheCongressandExecutiveOrdersissuedbythePresident,Federalexecutiveagencies, includingtheSmallBusinessAdministration(SBA),mustnotifyyouofcertaininformation.Youcanfindtheregulationsandpolicies implementing these laws and Executive Orders in Title 13, Code of Federal Regulations (CFR), Chapter 1, or our Standard Operating Procedures(SOPs).Inordertoprovidetherequirednotices,thefollowingisabriefsummaryofthevariouslawsandExecutive Orders that affect SBA's Disaster Loan Programs. A glossary of terms can be found at Disasterloan.SBA.GOV

FREEDOM OF INFORMATION ACT (5 U.S.C. 552)

This law provides, with some exceptions, that we must make records or portions of records contained in our files available to persons requesting them. This generally includes aggregate statistical information on our disaster loan programs and other information suchasnames of borrowers (andtheirofficers,directors,stockholders orpartners),loanamounts at maturity,the collateral pledged, and the general purpose of loans.Wedo not routinely make available to third parties your proprietary data withoutfirstnotifyingyou,asrequiredbyExecutiveOrder#12600,orinformationthatwouldcausecompetitive harmorconstitute a clearly unwarranted invasion of personal privacy.

FreedomofInformationAct(FOIA)requestsmustdescribethespecificrecordsyouwant.ForinformationabouttheFOIA,contact the Chief, FOI/PA Office, 4093rd Street, SW, Suite 5900,Washington, DC 20416, or by

PRIVACY ACT (5 U.S.C. § 552a)

Anyonecanrequestto seeor getcopies of anypersonal informationthat wehavein your file.Anypersonal informationinyourfile that is retrieved by individual identifiers, such asname or social security number is protected bythe Privacy Act, which means requests for information about you may be denied unless we have your written permission to release the information to the requestor or unless the information is subject to disclosure under the Freedom of Information Act. The Agreements and Certifications section of this form contains written permission for us to disclose the information resulting from this collection to state, local or private disaster relief services.

ThePrivacyActauthorizesSBAtomakecertain"routineuses"ofinformationprotectedbythatAct.OnesuchroutineuseforSBA's loan system of records is that when this information indicates a violation or potential violation of law, whether civil, criminal, or administrative in nature, SBA may refer it to the appropriate agency, whether Federal, State, local or foreign, charged with responsibilityfororotherwiseinvolvedininvestigation,prosecution,enforcementorpreventionofsuchviolations.Anotherroutine use of personal information isto assist in obtaining credit bureau reports, on the Disaster Loan Applicants and guarantors for purposesoforiginating,servicing,andliquidatingDisasterloans.See,69F.R.58598,58617(andasamendedfromtimetotime)for additional background and other routine uses.

UndertheprovisionsofthePrivacyAct,youarenotrequiredtoprovidesocialsecuritynumbers.(Butseetheinformationunder DebtCollectionActbelow)Weusesocialsecuritynumberstodistinguish betweenpeoplewithasimilarorthesamenamefor credit decisions andfor debt collection purposes. Failure toprovide this number may not affectanyright, benefit or privilege to which you are entitled bylaw, but having the number makes it easier for us to more accurately identify to whom adverse credit information applies and to keep accurate loan records.

Note: Any person concerned with the collection, use and disclosure of information, under the Privacy Act may contact the Chief, FOI/PA Office, 409 3rd Street, SW, Suite 5900, Washington, DC 20416 or by

for information about the Agency's procedures relating to the Privacy Act and the Freedom of Information Act.

SBA Form 5C

Page 5 of 6

DEBT COLLECTION ACT OF 1982; DEFICIT REDUCTION ACT OF 1984; DEBT COLLECTION IMPROVEMENT ACT OF 1996 & other titles (31 U.S.C. 3701 et seq.)

These laws require us to aggressively collect any delinquent loan payments and to require you to give your taxpayer identification number to us when you apply for a loan. If you receive a loan and do not make payments when theybecome due, we may take one or more of the following actions (this list may not be exhaustive):

*Report the delinquency to credit reporting bureaus.

*Offset your income tax refunds or other amounts due to you from the Federal Government.

*Refer the account to a private collection agency or other agency operating a debt collection center. *Suspend or debar you from doing business with the Federal Government.

*Refer your loan to the Department of Justice.

*Foreclose on collateral or take other actions permitted in the loan instruments. *Garnish wages.

*Sell the debt.

*Litigate or foreclose.

RIGHT TO FINANCIAL PRIVACY ACT OF 1978 (12 U.S.C. § 3401 et seq.)

Thisnotifiesyou,asrequiredbytheRighttoFinancialPrivacyActof1978(Act),ofourrighttoaccessfinancialrecords heldbyfinancialinstitutionsthatwereoraredoingbusinesswithyouoryourbusiness.Thisincludesfinancialinstitutions participating in loans or loan guarantees.

ThelawprovidesthatwemayaccessyourfinancialrecordswhenconsideringoradministeringGovernmentloanorloan guarantyassistancetoyou.Wemustgiveafinancial institutionacertificate of ourcompliancewiththeActwhenwefirst requestaccesstoyourfinancialrecords.Noothercertificationisrequiredforlateraccess.Ouraccessrightscontinuefor the term of any approved loan or loan guaranty. We do not have to give you any additional notice of our access rights during the term of the loan or loan guaranty.

We may transfer to another Government authority any financial records included in a loan application or about an approvedloanorloanguarantyasnecessarytoprocess,service,liquidate,orforeclosealoanorloanguaranty.Wewill notpermitanytransferof your financial recordstoanother Governmentauthorityexceptasrequiredorpermitted bylaw.

CONSUMER CREDIT PROTECTION ACT (15 U.S.C. 1601 et seq.)

This legislation gives an applicant who is refused creditbecause of adverse information about the applicant's credit, reputation,characterormode oflivinganopportunitytorefuteorchallengetheaccuracyofsuchreports.Therefore,ifwe decline your loan in whole or in part because of adverse information in a credit report, you will be given the name and address of the reporting agency so you can seek to have that agency correct its report, if inaccurate. If we decline your loaninwholeorinpart becauseof adverseinformationreceivedfromasourceother thana creditreportingagency, you will be given information but not the source of the report.

Within3daysaftertheconsummation of thetransaction,anyrecipientof anSBAloanwhichissecuredinwholeorinpart byalienontherecipient'sresidenceorhouseholdcontentsmayrescindsuchaloaninaccordancewith"RegulationZ"of the Federal Reserve Board.

PLEASE NOTE: The estimated burden for completing this form is 1.25 hours. Your responses to the requested information are required in order to obtain a benefit under our Disaster Home Loan Program. However, you are not required to respondtoanycollectionofinformation unlessitdisplaysacurrentlyvalidOMBapprovalnumber.Ifyouhavequestions or comments concerning any aspects of this information collection, please contact the U.S. Small Business Administration InformationBranch,4093rdStreet,SW,Washington,DC20416andDeskOfficerforSBA,OfficeofManagementand Budget, Office ofInformation and Regulatory Affairs, 725 17th Street,NW,Washington, DC20503.

SBA Form 5C |

Page 6 of 6 |

Form Characteristics

| Fact Name | Details |

|---|---|

| Purpose of Form | The SBA Form 5C is used for applying for disaster loans related to homes and sole proprietorships affected by declared disasters. |

| Application Deadline | Each application has a specific filing deadline, typically related to the declaration of the disaster. Keep track of this date to ensure timely submission. |

| Key Information Required | Applicants must provide personal details such as Social Security number, income information, property damages, and insurance coverage. |

| Eligibility Criteria | Eligibility includes U.S. citizenship, no current federal debts in default, and compliance with SBA regulations. |

| Disclosure Requirements | Applicants must disclose any federal loans or grants they currently have and answer questions about past criminal convictions and debts. |

| Governance | This form is governed under the Small Business Act and related federal regulations. Specific state requirements may vary. |

| Final Certification | By signing the form, applicants certify that all information is accurate and agree to follow all stated rules and regulations. |

Guidelines on Utilizing Sba 5C

Filling out the SBA Form 5C requires attention to detail and accurate information. Follow these steps carefully to ensure you provide all necessary details for your disaster loan application. The process involves gathering personal information, income details, and property data.

- Obtain the SBA Form 5C and review it to understand all sections.

- Fill in your personal information in the "Applicant Information" section, including names, social security numbers, and date of birth. If applicable, also fill in the information for a joint applicant.

- Indicate your marital status and whether you are a U.S. citizen.

- Provide your household size and confirm if you are an SBA employee.

- Choose your preferred method of contact and provide the relevant contact details.

- List the contact information for a closest relative living with you.

- In the "Damaged Property Address" section, fill out the address of the damaged property. If there are multiple properties, mention them in the "additional comments" section.

- Indicate whether the damaged property is your primary residence and describe any type of damage to it.

- Complete the income information section for both the primary applicant and joint applicant, including total annual income and employer details.

- List any debts you may have, such as mortgages or loans. Include the mortgage holder's name, monthly payment, and current balance.

- Check all insurance policies in force for the damaged property and provide details including policy type and insurance company name.

- Detail any other disaster assistance received, specifying if you have obtained grants from other sources.

- In the assets section, provide the pre-disaster values of cash, retirement accounts, and personal property.

- Answer the disclosure questions to indicate any legal or financial issues that may apply to you or the joint applicant. Provide explanations for any "yes" responses on the last page.

- If applicable, complete the "Representative Information" section if you have a representative helping you with this application.

- Sign and date the application, ensuring all information is truthful and complete.

Once you have filled out the form, review it for accuracy and completeness. Keep a copy for your records. After you submit the form, the SBA will process your application and may contact you if additional information is needed.

What You Should Know About This Form

What is the SBA Form 5C?

The SBA Form 5C is a loan application used by individuals seeking disaster assistance from the U.S. Small Business Administration (SBA). Specifically, it is designed for homeowners and sole proprietors affected by disasters to apply for financial relief to address physical damage or economic injury resulting from disaster events.

Who can use the SBA Form 5C?

Individuals applying for disaster loans related to their primary residence or sole proprietorship can use this form. This includes homeowners affected by physical damage, as well as sole proprietors seeking assistance for economic injury caused by disasters. Applicants need to be U.S. citizens or qualified non-citizens.

What information must be provided on the form?

The application requires detailed personal information, including names, Social Security numbers, and contact information for both the primary and joint applicants. Additionally, applicants must provide information about the damaged property, debts, income, insurance coverage, and any other disaster assistance received. Full details about assets and liabilities must also be disclosed.

Is there a filing deadline for the SBA Form 5C?

Filing deadlines for the SBA Form 5C depend on the specific disaster declaration. Applicants should refer to the disaster declaration number provided in the application materials, as this will outline the timeframe within which they must submit their application to be considered for assistance.

What documents may be required along with the SBA Form 5C?

While completing the form is necessary, additional documentation may be required for processing. This can include a Tax Information Authorization form, proof of residency, documentation of damages, and financial statements. The SBA will inform applicants of any other necessary documents needed before final loan approval.

What happens after I submit SBA Form 5C?

Once submitted, the SBA will review the application and contact the applicant for any clarifications or additional information needed. If approved, the applicant may receive a loan offer, and further documentation will likely be requested before the loan can be disbursed. Approval timelines can vary based on the volume of applications being processed.

How can I get assistance if I have questions about the form?

Applicants who have questions or encounter difficulties while completing the SBA Form 5C can contact the SBA’s Customer Service Center. They can reach out via phone at 1-800-659-2955 or send an email to disastercustomerservice@sba.gov to receive support and guidance as needed.

Common mistakes

Applying for financial assistance through the SBA's Disaster Loan program can be a complex process. Mistakes in filling out the SBA Form 5C can lead to delays or even denial of your application. Here are ten common pitfalls that applicants should strive to avoid.

1. Incomplete Information: One of the biggest mistakes is leaving sections unanswered. Each part of the form is essential for the SBA to evaluate your application. Double-check that all relevant fields are filled out completely.

2. Mathematical Errors: Simple addition or subtraction errors can have significant consequences when reporting income or debts. Small miscalculations may lead to a misrepresentation of your financial situation, so it's crucial to review all figures meticulously.

3. Incorrect Contact Information: Ensure that the preferred method of communication is accurate and up-to-date. If the SBA cannot reach you due to incorrect contact details, it may delay the processing of your application.

4. Misclassifying Property: Applicants sometimes misidentify their property type, such as marking their primary residence incorrectly. It's vital to classify your property accurately to avoid issues with eligibility.

5. Failing to Disclose All Debts: Not being upfront about all debts can backfire. Whether it’s credit card debts, loans, or other obligations, complete transparency helps the SBA understand your financial obligations better.

6. Neglecting Insurance Information: Some applicants forget to check all applicable insurance policies affecting the damaged property. This oversight can lead to misunderstandings or delays in assistance decisions.

7. Ignoring Filing Deadlines: Familiarize yourself with the submission deadlines. Missing these deadlines can result in the SBA not considering your application for funding, even if it’s filled out perfectly.

8. Not Signing the Application: It may sound obvious, but forgetting to sign the application is a surprisingly common error. Without a signature, the SBA will not process your application.

9. Overlooking the Required Documents: Many applicants underestimate the documentation needed to support their application. Ensure you gather all necessary paperwork as per the listed requirements, such as income verification or proof of property ownership.

10. Misunderstanding Eligibility Criteria: Finally, not understanding the specific eligibility requirements can lead to wasted efforts. Applicants should review all SBA guidelines related to disaster loans to ensure they meet the necessary criteria before applying.

By avoiding these mistakes, you enhance your chances of a smooth application process and reduce the possibility of delays in receiving the assistance you need.

Documents used along the form

When applying for a disaster loan through the SBA, it's important to gather all necessary documentation to support your application. Along with SBA Form 5C, various other forms and documents may be required. These documents help provide a complete picture of your financial situation and the damages incurred. Below is a list of such documents.

- IRS Form 4506T: This form allows the SBA to obtain your tax return transcripts from the IRS, which will assist in verifying your income and repayment ability.

- Proof of Ownership: If you are requesting assistance for damage to property, you will need to provide evidence of ownership, such as a title or a copy of the deed to the property.

- Income Tax Returns: Your federal income tax returns, including all forms and schedules, may be required to further establish your financial condition.

- Pay Stubs: Recent pay stubs from employers can be necessary to confirm ongoing employment and income details.

- Insurance Documentation: Copies of any insurance policies related to the property can demonstrate coverage and potential payouts relevant to your claim.

- Repair Estimates: Any estimates for repairs to your damaged property should be included to outline the costs you will incur.

- Statements from Creditors: These statements can clarify your current debts and obligations, providing insight into your financial situation.

- Evidence of Other Assistance: Documentation showing any other disaster assistance received can help confirm the extent of support you have accessed.

- Disaster Declaration: A copy of the disaster declaration from FEMA or local authorities can substantiate your eligibility for loans.

- Joint Applicant Information: If there is a joint applicant on the loan, their information, including income and debts, should also be included.

Gathering these documents ensures that your application is thorough and increases the likelihood of a successful loan approval. Be diligent and organized when compiling your materials, as a complete application can lead to faster processing and assistance.

Similar forms

- IRS Form 4506T: This form allows the SBA to obtain your tax information from the IRS. Similar to the SBA 5C, it is necessary for verifying income, which is a crucial aspect of the application process.

- SBA Form 1368: This form is used to provide a detailed analysis of your economic injury. Just like the SBA 5C, it is focused on assessing financial impacts due to disasters and is vital for determining loan eligibility.

- FEMA Application for Disaster Assistance: This document is similar in that it is meant for individuals affected by disasters. Like the SBA 5C, it collects pertinent information to evaluate your situation and needs.

- SBA Form 912: This form is used for a Statement of Personal History. Like the SBA 5C, it aims to gather personal background information to assess eligibility for loans, ensuring that the applicant meets certain requirements.

Dos and Don'ts

- Do: Carefully read all instructions provided with the SBA 5C form.

- Do: Ensure that all information is accurate and complete before submitting the form.

- Do: Provide all necessary supporting documents, such as pay stubs or tax returns, if requested.

- Do: Include your preferred method of contact to facilitate communication.

- Don't: Rush through the application; incomplete forms can lead to delays.

- Don't: Forget to sign the application; missing signatures may result in rejection.

- Don't: Omit any debts or income sources; transparency is crucial.

- Don't: Ignore the deadline for submission; timely applications are essential for consideration.

Misconceptions

Misconceptions about the SBA Form 5C can lead to confusion when seeking disaster assistance. Here are seven myths clarified:

- Only homeowners can apply. Many believe that only homeowners are eligible for the SBA Form 5C. In reality, sole proprietors who have suffered physical damage or economic injury can also apply for assistance.

- Income eligibility is based solely on tax returns. While tax returns are important, the form requires information on all sources of steady income, such as social security, retirement, and alimony, providing a more comprehensive view of your financial situation.

- You must be an established business for years. Some think they need years of business operations to qualify. However, new sole proprietors who have encountered losses due to disasters also qualify for assistance.

- Filling out the form ensures automatic approval. There’s a common belief that completing the application guarantees funding. In reality, approval depends on various factors, including eligibility, financial assessments, and documentation.

- The SBA Form 5C is only for physical damages. Many people incorrectly assume this form is limited to physical damage claims. It can also be used to request assistance for economic injury due to disasters.

- Insurance coverage eliminates eligibility. A misconception exists that having insurance means you cannot apply for aid. In fact, the form allows applicants to seek additional assistance if their insurance does not cover all damages.

- Once submitted, there’s no further communication. Some applicants might think that after they submit the form, they won’t hear back. However, the SBA actively communicates with applicants regarding their status and any additional information needed.

Understanding these misconceptions can help streamline the application process and improve applicants' chances of receiving the assistance they need.

Key takeaways

Completing and submitting the SBA Form 5C requires careful attention to detail. Here are key takeaways for applicants:

- Primary Purpose: This form is designed for individuals applying for disaster loans for their primary residence or as sole proprietors, focusing on either physical damage or economic injury.

- Required Information: Applicants must provide personal details including names, Social Security numbers, and household size. Be prepared to answer questions concerning citizenship and employment status.

- Property Details: Clearly indicate whether you own or rent the property and specify if it is your primary residence. Additional properties can be noted in the comments section if necessary.

- Income Disclosure: Report all recurring income sources, including salaries, social security, and any other consistent financial support. Avoid one-time income figures.

- Debt Information: List all debts, including mortgages and loans, alongside their current balances and monthly payments. Only include debts lasting longer than ten months.

- Insurance Coverage: Identify any insurance policies on the damaged property, specifying types and amounts. This information can impact loan approval.

- Signature Requirement: By signing the form, you certify that all information provided is accurate and that any essential documents will be submitted as required.

Understanding these key points can help streamline the application process for disaster assistance through the SBA.

Browse Other Templates

Ucc Transcripts - Fill out your personal information clearly to avoid processing delays.

Venn Diagram Instructions - Useful for creating fresh perspectives on familiar subjects.