Fill Out Your Sbi Card Dispute Form

The SBI Card Dispute Form serves as a crucial tool for cardholders to address and resolve issues related to unauthorized or erroneous transactions. When a customer encounters discrepancies in their card statements—be it fraudulent charges, duplicate billings, or undelivered goods—completing this form initiates the dispute process with the issuing bank. The form requires essential details such as the cardholder's name, card number, phone number, and email address, which ensure efficient communication throughout the dispute resolution journey. Additionally, cardholders can itemize the specific transactions in question, providing relevant dates, amounts, and merchant details. Mediating various types of disputes, the form allows customers to clearly indicate the reasons for their claims, ranging from unauthorized transactions to non-receipt of goods. Importantly, the form also includes a declaration statement, obligating users to provide truthful information while highlighting the potential consequences of submitting an invalid dispute. Understanding how to fill out this form accurately is essential for a timely resolution, highlighting the user's responsibility to supply any required supporting documentation, whether it be receipts, correspondence with merchants, or police reports in cases of theft. The structured process that follows submission underscores the commitment of SBI Card to ensure cardholder protection and satisfaction, reflecting a responsive banking service that values customer trust.

Sbi Card Dispute Example

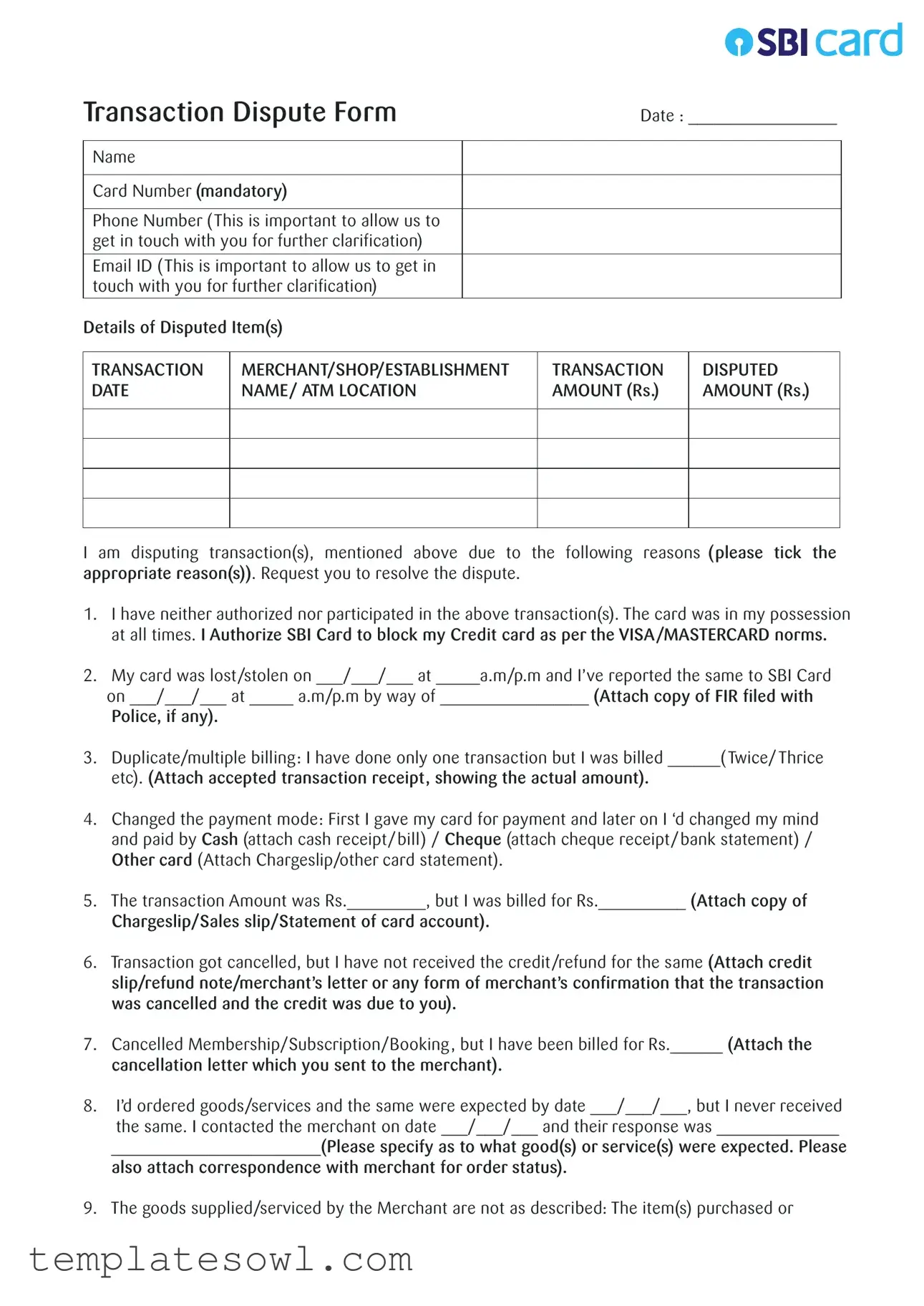

Transaction Dispute Form

Date : _________________

Name

Card Number (mandatory)

Phone Number (This is important to allow us to get in touch with you for further clarification)

Email ID (This is important to allow us to get in touch with you for further clarification)

Details of Disputed Item(s)

TRANSACTION DATE

MERCHANT/SHOP/ESTABLISHMENT NAME/ ATM LOCATION

TRANSACTION AMOUNT (Rs.)

DISPUTED AMOUNT (Rs.)

I am disputing transaction(s), mentioned above due to the following reasons (please tick the appropriate reason(s)). Request you to resolve the dispute.

1.I have neither authorized nor participated in the above transaction(s). The card was in my possession at all times. I Authorize SBI Card to block my Credit card as per the VISA/MASTERCARD norms.

2.My card was lost/stolen on ___/___/___ at _____a.m/p.m and I’ve reported the same to SBI Card on ___/___/___ at _____ a.m/p.m by way of _________________ (Attach copy of FIR filed with Police, if any).

3.Duplicate/multiple billing: I have done only one transaction but I was billed ______(Twice/Thrice etc). (Attach accepted transaction receipt, showing the actual amount).

4.Changed the payment mode: First I gave my card for payment and later on I ‘d changed my mind and paid by Cash (attach cash receipt/bill) / Cheque (attach cheque receipt/bank statement) / Other card (Attach Chargeslip/other card statement).

5.The transaction Amount was Rs._________, but I was billed for Rs.__________ (Attach copy of Chargeslip/Sales slip/Statement of card account).

6.Transaction got cancelled, but I have not received the credit/refund for the same (Attach credit slip/refund note/merchant’s letter or any form of merchant’s confirmation that the transaction was cancelled and the credit was due to you).

7.Cancelled Membership/Subscription/Booking, but I have been billed for Rs.______ (Attach the cancellation letter which you sent to the merchant).

8.I’d ordered goods/services and the same were expected by date ___/___/___, but I never received

the same. I contacted the merchant on date ___/___/___ and their response was ______________

________________________(Please specify as to what good(s) or service(s) were expected. Please

also attach correspondence with merchant for order status).

9. The goods supplied/serviced by the Merchant are not as described: The item(s) purchased or

service(s) paid for do not conform to what was agreed to have been supplied by the merchant or was/were defective. (Please specify as to what good(s) or service(s) were expected & what were actually delivered. Enclose any documentation that supports your claim. Please return the goods to the merchant & provide proof of returned goods, Copy of correspondence with merchant, Terms & Conditions of Contract/delivery and nature of defect etc).

10.Cash not dispensed in the ATM but I was billed for the amount of Rs._______ / Cash dispensed partially in the ATM for Rs.________ but I was billed for the entire amount of Rs. _______ (Attach copy of ATM slip).

11.Others (Please explain in detail. Please attach a separate letter, if necessary).

12.I do not remember the transaction. Kindly retrieve chargeslip / documents for my reference. I agree to pay charges specified by SBI Card in this regard.

Declaration :

I declare that above given information is true and correct to the best of my knowledge. I understand that I can be held liable for all charges incurred before the time of reporting of loss/theft and also, if dispute raised by me is found invalid. I agree to pay the charges levied by SBI Card for the same.

Any Additional Comments:

______________________________________________________________________________________

______________________________________________________________________________________

______________________________________________________________________________________

Primary Cardholder's Signature |

__________________________ |

IMPORTANT NOTES:-

(i)On receipt of the disputed claim along with the relevant supporting documentation requested within the stipulated time (30 days) from the date of disputed transaction, we will take up the matter with the member bank and request them to provide the details on the basis of which the disputed charge was processed to your card account.

(ii)On receipt of clarifications from member bank regarding the disputed charge we shall revert to you with the clarifications on the dispute, which takes normally around 45 to 60 days’ time in accordance with the VISA/ MASTERCARD Rules.

(iii)SBI Card may request the customer to provide a signed progressive feedback letter or further clarification on the dispute after review of the documentation provided by the member bank on the dispute, which is required to progress the dispute further with the member bank.

(iv)In case we do not hear from you by the stipulated revert date, the disputed transaction shall be construed to be in order, and we shall be constrained to close the matter at our end.

(v)Request to the Cardholder: Please attach copies of your correspondence with the Merchant,

The dispute form duly signed by you may be sent to us with the relevant supporting documents by post or email at the following address:

Chargeback Team, SBI Card,

DLF Infinity Towers, Tower C,

Bldg 3, DLF Cyber City, Gurgaon – 122002, Haryana, India

Email Address: Chargeback@sbicard.com

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | The SBI Card Dispute Form is used to report unauthorized or erroneous transactions. |

| Cardholder Information | Card number and personal contact details (phone and email) are mandatory for proper communication. |

| Disputed Amount | Cardholders must specify both the transaction amount and the disputed amount. |

| Authorization | Cardholders have the right to authorize SBI Card to block their card in case of an unauthorized transaction. |

| Time Frame | Disputes must be submitted within 30 days of the transaction date for timely resolution. |

| Document Requirements | Supporting documents such as transaction receipts, FIRs, and cancellation letters must be attached to the form. |

| Resolution Timeline | It usually takes around 45 to 60 days to resolve disputes once all documentation is received. |

| Invalid Disputes | If a dispute is determined to be invalid, the cardholder may be liable for all charges incurred. |

| Communication with Merchants | Cardholders are advised to maintain correspondence with merchants regarding disputed transactions. |

| Additional Comments | Cardholders can provide further explanations in the comments section for clarity on their dispute. |

Guidelines on Utilizing Sbi Card Dispute

Once you have completed the SBI Card Dispute Form, the next step involves submitting it along with any required documentation. The details you provide will help in processing your dispute effectively. Ensure all information is accurate to avoid delays. After submission, the team will review your claim and may reach out for further information if necessary. The overall process may take about 45 to 60 days, depending on the bank's response.

- Date: Write the date of filling out the form in the designated space.

- Name: Fill in your full name.

- Card Number: Enter your card number. This field is mandatory.

- Phone Number: Provide a phone number where you can be reached for clarification.

- Email ID: Fill in your email address for further communication.

- Details of Disputed Item(s): For each disputed transaction, provide the following details:

- Transaction Date

- Merchant/Shop/Establishment Name/ATM Location

- Transaction Amount (Rs.)

- Disputed Amount (Rs.)

- Reasons for Dispute: Tick the appropriate reasons for disputing the transactions listed. Select all that apply.

- Declaration: Read and sign the declaration stating that the information provided is accurate.

- Additional Comments: Include any further comments or information that may assist in your dispute.

- Signature: Sign the form as the primary cardholder.

Attach any supporting documents as requested based on the reasons for your dispute. Ensure everything is complete and send the form to the specified address or email for prompt processing.

What You Should Know About This Form

What is the SBI Card Dispute Form?

The SBI Card Dispute Form is a document used to report issues you may have with transactions on your SBI credit card. It allows you to detail the specific reasons for your dispute and includes spaces for necessary information like card number, transaction details, and your contact information. It's essential for initiating a formal dispute process.

How do I complete the SBI Card Dispute Form?

To complete the form, provide your name, card number, phone number, and email address at the top. Then, list the disputed transaction details: date, merchant, and amounts. Check the reason that applies to your dispute. Finally, add your signature to declare that the information is accurate and submit it with any required documentation.

What information do I need to provide?

You’ll need to include your personal details, such as your name and contact information. You should also list the transaction date, merchant name, transaction amounts, and the reason for the dispute. If relevant, attach supporting documents like receipts, bank statements, or cancellation letters.

How do I submit the form?

You can send the completed form and any supporting documents via post or email. If mailing, send it to the Chargeback Team at the address provided on the form. For email submissions, use the email address Chargeback@sbicard.com. Make sure to keep copies of everything you send.

What happens after I submit the dispute form?

After you submit your form, SBI Card will review your claim. They will contact the merchant bank for clarification about the disputed transaction. On average, this process can take between 45 to 60 days. They will keep you updated during this time.

Will I need to provide additional information during the review process?

Yes, SBI Card may contact you for more information after they receive feedback from the merchant bank. You might be asked to provide a signed feedback letter or further clarification to help resolve your dispute. Staying responsive to their requests is crucial for timely resolution.

What if I forget to include information or documents?

If you don’t provide enough information or the necessary documents with your dispute form, SBI Card may not be able to process your claim. Incomplete submissions could lead to the matter being closed, so it’s important to double-check everything before sending it in.

How long do I have to file a dispute?

You need to submit your dispute and the supporting documents within 30 days from the date of the disputed transaction. Missing this window might hinder your ability to have the transaction reviewed, so act quickly if you notice an issue.

Can I still be charged if my dispute is found invalid?

Yes, if your dispute is determined to be invalid, you will be liable for any charges incurred before reporting the loss or theft. Make sure to check your statements regularly to catch any fraudulent or incorrect charges as soon as possible.

Common mistakes

When filling out the SBI Card Dispute Form, individuals often make common mistakes that can delay the resolution of their claims. One frequent error is not providing adequate details about the transactions. Each disputed item must be clearly outlined, including transaction dates and amounts. Failing to specify these details makes it difficult for the SBI team to process the dispute effectively.

Another mistake is neglecting to include necessary documentation. Missing supporting documents, such as receipts or a copy of a police report, can hinder the dispute process. These documents are vital for substantiating the claim and without them, a dispute could be dismissed.

Many people also overlook the importance of providing correct contact information. The phone number and email address are crucial for follow-up communication. Incomplete or incorrect information can lead to delays or misunderstandings, prolonging the dispute resolution process.

Additionally, it's common for individuals to tick incorrect or multiple reasons for the dispute. Clarity is essential when choosing the reason for the dispute. Selecting several reasons without clear explanation may complicate the issue, as the card issuer needs to understand the exact nature of the complaint.

Some individuals might submit the form without reviewing it properly. Errors in the form, such as typos or missing signatures, can lead to complications. A thorough review ensures that all required sections are completed accurately, which helps streamline the processing time.

Lastly, many forget to be timely. Submitting the form and necessary documentation after the 30-day deadline can result in automatic denial of the dispute. Prompt action is critical to ensure that the claim is investigated and resolved in a satisfactory manner.

Documents used along the form

When addressing disputes related to your SBI Card, several other forms and documents may be required to support your case. Having these documents readily available will streamline the process and strengthen your claim. Below is a list of commonly used forms and their purposes.

- Authorization Form: This document allows you to authorize third parties to act on your behalf in relation to your card dispute. Properly filled out, it ensures that your representative can communicate directly with SBI Card.

- Fraudulent Transaction Report: Use this report to outline details of any unauthorized transaction. It assists in documenting your claim of fraud and is typically submitted alongside the dispute form.

- Merchant Communication History: Gather all correspondence with the merchant regarding the disputed transaction. This helps establish your case by providing context and evidence of your interactions and their responses.

- Police Report (if applicable): If your card was stolen or used fraudulently, a copy of the police report may strengthen your claim. It acts as official documentation of the incident.

- Transaction Receipts: Include any receipts related to the disputed transaction to demonstrate what was purchased and the amount charged. This helps clarify discrepancies in billing.

- Refund Confirmation Letter: If you have proof of a refund request that was not honored, this letter can substantiate your claim for a refund that was due but not received.

- Cancellation Notice: If you canceled a service or subscription but were still charged, a copy of the cancellation notice you sent to the merchant can be vital evidence.

- Proof of Returned Goods: For disputes regarding the condition of goods delivered, proof that items were returned to the merchant can support your claim and justify your request for a refund.

- Terms and Conditions Document: Submit any related terms or agreements that were provided at the time of purchase. This adds credibility to your claim if the goods or services did not meet the specified conditions.

Gathering these documents can significantly impact the outcome of your dispute. Ensure you keep copies for your records and submit any relevant materials along with your SBI Card Dispute Form to expedite your case.

Similar forms

- Credit Card Chargeback Form: Similar to the SBI Card Dispute Form, a chargeback form allows customers to dispute unauthorized transactions on their credit card. It includes personal details, transaction information, and reasons for the dispute, facilitating the resolution process.

- Fraud Report Form: This document is used to report fraudulent activities associated with a credit card. Like the SBI form, it requires the user to provide specific transaction details and explanations about the unauthorized charges.

- Transaction Error Form: This form helps users report mistakes in billing or transactions. It parallels the SBI Card Dispute Form in requiring transaction specifics and reasons for the error claim.

- Lost Card Report: When a credit card is lost or stolen, this form helps users report the incident. Similar to the SBI form, it requests details surrounding the loss and prompts users to confirm card misuse.

- Merchant Dispute Resolution Form: This document assists customers in resolving issues with merchants directly. It shares similarities with the SBI Card Dispute Form, particularly in collecting transaction details and correspondence with the merchant.

- Consumer Complaints Form: This form is designed for filing complaints against service providers. Much like the SBI form, it captures personal information and outlines the nature of the complaint, aiming for a resolution.

- Refund Request Form: Used when seeking a refund for an unsatisfactory product or service, this form is akin to the SBI Card Dispute Form in that it asks for documentation of the transaction and reasons for the refund request.

- Charge Dispute Letter: This letter is an alternative method for disputing a charge. Similar to the SBI Card Dispute Form, it details the disputed amount and reasons, although it can be less structured.

- Payment Dispute Notification: When disputing a payment made electronically, this notification serves a role similar to the SBI form, as it details the payment and the reason for dispute.

- Account Statement Dispute Form: This form focuses on discrepancies found in credit card statements. Like the SBI form, it requires users to specify the amounts in question and their reasoning for disputing specific transactions.

Dos and Don'ts

When filling out the SBI Card Dispute form, following these guidelines can ensure a smoother process:

- Provide complete information: Fill in all mandatory fields such as your name, card number, phone number, and email ID. This information is crucial for communication regarding your dispute.

- Attach relevant documents: Include copies of receipts, FIRs, or any correspondence that supports your claim. Documentation strengthens your dispute and can help expedite the resolution process.

- Be clear and concise: Clearly state the reason for your dispute. Use the options provided in the form and include additional details where necessary. This helps ensure that your issue is understood.

- Submit within the timeframe: Make sure to send your completed form and all supporting documents within the 30-day limit from the date of the disputed transaction. Timeliness is key in these matters.

- Keep a copy of everything: Retain copies of the dispute form and all documents you send. This can be useful for tracking progress and referencing in future communications.

Avoid these common pitfalls to ensure your dispute is handled effectively:

- Do not leave out important information. Omitting details can delay the process or lead to misunderstandings.

- Avoid submitting the form without documentation. Claims lacking evidence may not be taken seriously or could be rejected.

- Refrain from using informal language. This is a formal process, so keep your communication professional and to the point.

- Do not wait too long to file your dispute. Delayed submissions might result in losing the right to challenge the transaction.

- Do not forget to sign your form. An unsigned form may be deemed invalid, hindering your dispute.

Misconceptions

Understanding the SBI Card Dispute Form is essential for effective dispute resolution. Unfortunately, there are several misconceptions that can create confusion. Here’s a list to clarify these misunderstandings:

- Misconception 1: My dispute will be resolved immediately.

- Misconception 2: I can submit the form without any supporting documents.

- Misconception 3: I will not be charged any fees for raising a dispute.

- Misconception 4: Once I submit a dispute, I don’t need to follow up.

- Misconception 5: I have to fill out all reasons for disputing, even if only one applies.

- Misconception 6: My dispute is automatically considered valid if I provide the form.

- Misconception 7: The dispute will be resolved in favor of the cardholder regardless of evidence.

- Misconception 8: Any transaction can be disputed, regardless of the date.

- Misconception 9: I can dispute a transaction even if I’ve verified it with my merchant.

Resolution typically takes time. After submitting the form, the process can often take up to 60 days.

Supporting documents are crucial. They help validate your claim and must accompany your dispute form for a timely resolution.

There may be charges levied if the dispute is found invalid, so it’s important to be aware of this possibility.

It’s best to stay proactive. Follow up to see if additional information is needed or to check on the status of your claim.

You only need to provide the relevant reasons for your dispute. Tick the appropriate boxes that correspond to your issue.

Submit your information completely, but all claims will be reviewed carefully. Validity depends on the documentation and circumstances.

The outcome depends on both the documentation you provide and the merchant's response. Careful review of all information is necessary.

There are time limits for filing disputes. Be sure to submit your complaint within the specified time frame after the transaction occurs.

If the transaction has been verified as valid with the merchant, it may weaken your dispute claim. Always ensure the reason for the dispute is solid.

By understanding these common misconceptions, cardholders can better navigate the SBI Card Dispute Form process and increase their chances for a favorable outcome.

Key takeaways

When filling out and using the SBI Card Dispute Form, keep these key takeaways in mind:

- Complete Information: Ensure that you provide all mandatory details, including your name, card number, phone number, and email address. This information is essential for timely communication.

- Detail Your Dispute: Clearly specify the transaction details and the reason for your dispute. Accuracy is critical, as it helps expedite the resolution process.

- Attach Supporting Documents: Include relevant documentation that supports your dispute. This could range from receipts to correspondence with merchants, depending on the reason for the dispute.

- Follow Timelines: Submit the dispute form and documentation within 30 days of the disputed transaction date. Timeliness is key to ensuring your claim is processed.

- Understand Potential Liabilities: Be aware that you may remain liable for charges incurred prior to reporting a loss or theft. If your dispute is determined to be unfounded, you may also incur additional charges.

- Remain Available for Follow-Up: Be prepared to provide additional information if requested. SBI Card may contact you for a signed feedback letter or further clarifications, so stay accessible.

By paying attention to these pointers, you can navigate the dispute process more effectively and increase your chances of a satisfactory resolution.

Browse Other Templates

Workers Compensation Endorsements - The form was developed by the National Council on Compensation Insurance in 1983.

Form 1007 - Fair Rental Days are used to calculate the service months by dividing by 30.