Fill Out Your Sbi Expres Credit Form

The SBI Express Credit Form plays an essential role for individuals seeking a loan from the State Bank of India. This detailed application gathers a variety of personal and financial information, enabling the bank to assess the applicant’s eligibility. It begins with personal details, including the applicant's name, addresses, date of birth, and sex, ensuring a comprehensive identity verification process. Occupational details follow, asking for information about employment status, income levels, and the nature of current liabilities and assets. The form also inquires about the purpose of the loan and proposes repayment terms, which are crucial for determining the feasibility of the loan request. To support the application, the submission of several documents is required, such as identification proof and income statements. Additionally, the form includes a declaration section, where applicants attest to the accuracy of their provided information and agree to comply with the bank’s requirements. This thorough approach helps the bank evaluate the creditworthiness of potential borrowers and ensures responsible lending practices.

Sbi Expres Credit Example

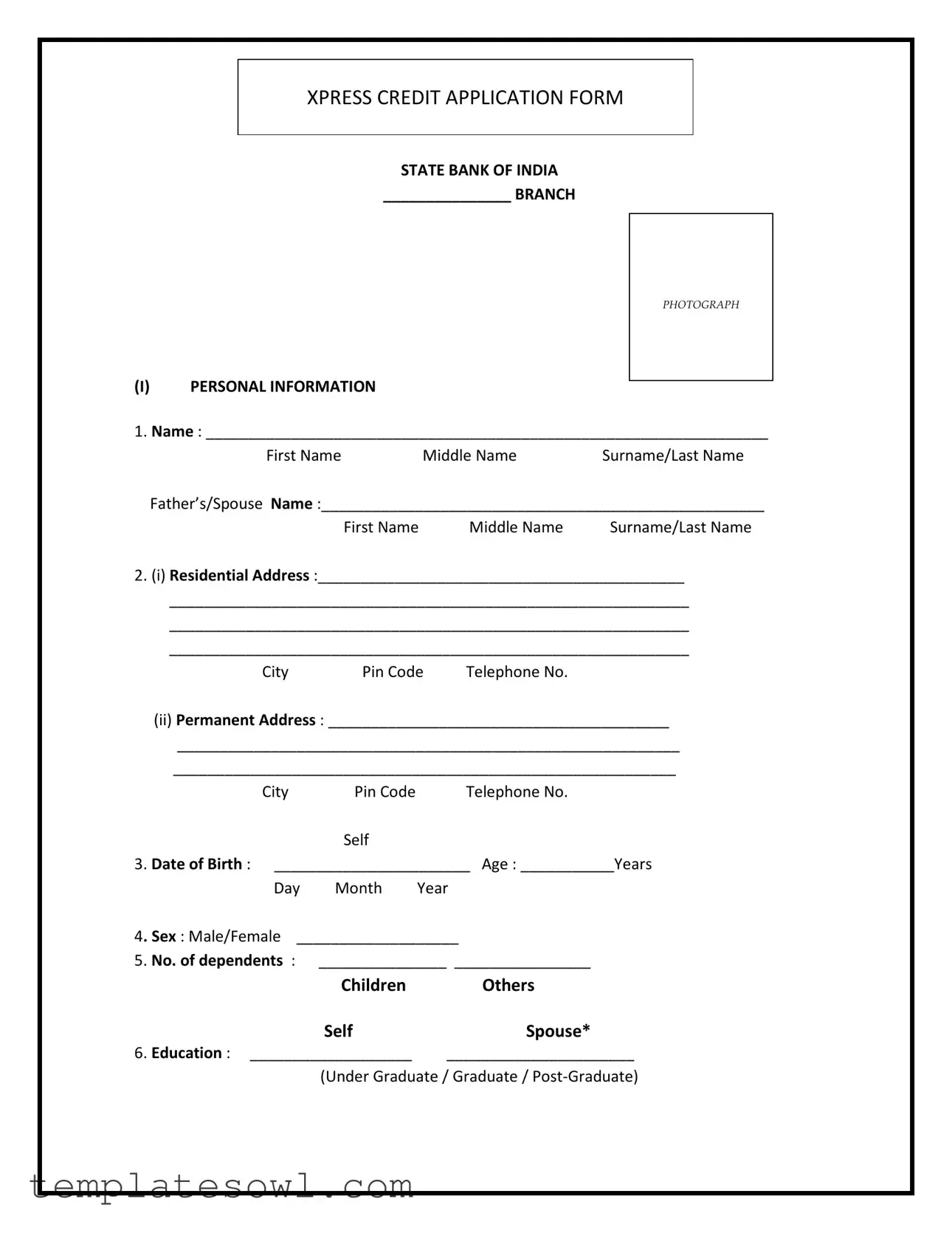

XPRESS CREDIT APPLICATION FORM

STATE BANK OF INDIA

_______________ BRANCH

(I)PERSONAL INFORMATION

1. Name : __________________________________________________________________

First Name |

Middle Name |

Surname/Last Name |

Father’s/Spouse Name :____________________________________________________ |

||

First Name |

Middle Name |

Surname/Last Name |

2.(i) Residential Address :___________________________________________

_____________________________________________________________

_____________________________________________________________

_____________________________________________________________

City Pin Code Telephone No.

(ii) Permanent Address : ________________________________________

___________________________________________________________

___________________________________________________________

City Pin Code Telephone No.

Self

3. Date of Birth : _______________________ Age : ___________Years

Day |

Month |

Year |

4. Sex : Male/Female ___________________ |

||

5. No. of dependents : |

_______________ ________________ |

|

|

Children |

Others |

|

Self |

Spouse* |

6. Education : ___________________ |

______________________ |

|

|

(Under Graduate / Graduate / |

|

7.Occupational Details :

a.Employees of : __________________

-Govt./Public Sector Undertaking / Public Ltd. Co. / Multi National Company / Reputed Institution

b.Self – Employed : _________________________________________

-MBA / Engineer /Doctor / Architect / C.A.

c.Pensioner of : _________________________________________

-PSU/State /Central Govt. /Public Sector Bank

(Voluntary Retirement taken on ________________as per copy of relieving letter

No………….. dated………………enclosed)

8.Name and Address of Employer/Establishment : _____________________________________

_______________________________________________________________________________

_______________________________________________________________________________

9.Designation : __________________________________________

10.Length of Service : ______Years ____ Months

11.Monthly /Annual Income : Self

Gross Rs. |

: __________________ |

|

|

Net Rs. |

: __________________ |

|

|

Other Regular Monthly |

|

|

|

Income Rs. |

: __________________ |

|

|

Please specify Source |

: __________________ |

|

|

12. Do you own a House : |

YES/NO |

|

(Tick whichever is applicable) |

If Yes, Is the house mortgaged : |

YES / NO |

(Tick whichever is applicable) |

|

Value of House ( At Cost) : Rs. _________________________________

13.Vehicle : Type of Vehicle : ________________ __: ___________________

Two Wheeler : __________________ : _____________________

Four Wheeler : __________________ : _____________________

Make _____ Age ____ : Make ______ Age _____

Owned / Company Provided / Hypothecated ____________ :

14.Present Liability : Rs. __________________ : _____________________

15.Other Assets owned by : Self

Property (other than House) : |

Rs. _____________ |

|

Bank/Post Office Deposits, NSC’s, LIC Policy, Gold, Shares, |

|

|

Debentures, Units of UTI /Mutual Funds: |

Rs. ____________ |

|

Others |

: |

Rs. _____________ |

Total |

: |

Rs. _____________ |

16.Other Liabilities in Brief :

Friends and Relatives : Rs. _____________

Employers |

: Rs. _____________ |

|

||

Banks/F.I.s |

: Rs. _____________ |

|

||

Others |

: Rs. _____________ |

|

||

Total |

: Rs. _____________ |

|

||

17. Purpose of Loan : _____________________________________________ |

||||

18. Loan Amount: |

|

|

: Rs. ________________________ |

|

Proposed Repayment Period |

: ___________________________ Months / Years |

|||

Proposed Monthly Repayment |

: Rs. ________________________ |

|||

(II) Details of Bank Account : |

Self |

|

|

|

19. Name of the Branch |

____________ |

|

||

Telephone No. : |

|

____________ |

|

|

Type of Account: |

|

____________ |

_____________ |

|

Account Number : |

|

____________ |

_____________ |

|

Year of Opening : |

|

____________ |

_____________ |

|

(III) |

Two Personal Reference : |

|

1) Name: ________________________ |

2) Name : ____________________ |

|

Address : ________________________ |

Address : _____________________ |

|

_________________________________ |

_____________________________ |

|

Tel. No. __________________ |

Tel. No. _______________________ |

|

(IV) Declaration :

I/We declare that all the particulars and information given in the application form are true, correct and complete and that they shall form the basis of any loan, State Bank of India may decide to grant me/us.

I/We undertake to inform State Bank of India regarding change in my/our occupation/employment /residential address and to provide any further information that the bank may require.

I/We confirm that I/we do not have any other credit facilities with any bank other thatn that mentioned above. I/We confirm that if I/we avail of any credit facilities with any other bank in future, I/ we will furnish the details to State Bank of India immediately. I/We further authorize the bank to credit all sums received by the bank or standing to the credit in my/our name jointly or severally to the loan account, if necessary. I/We confirm that the funds will be used for stated purpose and will not be used for speculative purpose. I/We confirm that we are resident Indians.

I also understand that the sanction of the loan is subject to the execution of documents as per the Bank’s requirements. I agree that the Bank has a right to make such enquiries about me as it/they think(s) fit.

|

___________________ |

Place :_______________ |

Signature of Applicant |

Date :_______________ |

|

(V)Documentation: Please submit the following documents along with your application. - Latest monthly salary slip showing deductions - of Self.

- Latest Form 16 from employer (for employees). - of Self

- Copy of IT return for last two years, duly acknowledged by ITO with Computation of income, for Professionals.

- Copy of Passport or Voters ID Card or Driving License for proof of Identity #

-Copy of ration card/Telephone Bill/Passport/Voters

-Latest Passport size Photograph - of Self

-Last six months Bank Statement of the account where salary is credited - of Self

-Verification of signature from the bank where salary is credited or any employers.

-Relieving Letters of Pensioner from the employer.

-Proof of official address (for other than employees)

-Proof of Professional Qualification: Copy of highest professional degree held.

Place: _____________ |

Signature of Applicant |

Date : _________________ |

|

FOR BANK’S USE

Appraisal / Recommended by : _____________________________________

Date : _________________

________________________________________________________________________________

________________________________________________________________________________

________________________________________________________________________________

____________________________

Sanctioned by : ____________________

Date : ____________________________

Form Characteristics

| Fact Name | Details |

|---|---|

| Application Purpose | The SBI Express Credit form is primarily used for applying for a loan from the State Bank of India. |

| Required Documentation | Applicants must submit various documents, including income proof, identity verification, and residence proof, to complete the loan application process. |

| Income Disclosure | The form requires applicants to provide details of different income sources, including gross and net monthly income along with any additional regular income. |

| Governing Law | The form operates under the laws of the state in which the application is submitted, primarily governed by banking regulations of the relevant state and federal laws. |

Guidelines on Utilizing Sbi Expres Credit

After you gather the necessary information, you can begin filling out the Sbi Expres Credit form. It's essential to provide accurate details to ensure a smooth application process. Follow the steps outlined below to complete the form effectively.

- Personal Information section:

- Enter your full name, including first, middle, and last names.

- Write the name of your father or spouse.

- Fill in your residential address, including city and pin code, along with your telephone number.

- Provide your permanent address, if different from the residential address.

- State your date of birth and age.

- Select your sex (Male/Female).

- Indicate the number of dependents you have.

- Specify your educational qualifications.

- Occupational Details section:

- Specify whether you are employed by a government agency, public sector, or reputed company.

- If self-employed, mention your profession (e.g., MBA, Engineer).

- If a pensioner, provide relevant details such as your previous employer.

- Enter the name and address of your employer or establishment.

- Provide your designation and length of service.

- Indicate your monthly or annual income, including gross and net amounts.

- Assets and Liabilities section:

- State whether you own a house and if it is mortgaged, along with its value.

- Specify details about any vehicles you own.

- List any present liabilities you have.

- Provide information on other assets owned, such as bank deposits or shares.

- Detail any other liabilities, including amounts owed to friends, banks, etc.

- State the purpose of the loan and the amount requested.

- Bank Account Details section:

- Fill out the name of your bank branch and its telephone number.

- Specify the type of your account and provide the account number.

- Indicate the year your account was opened.

- Personal References section:

- List two personal references along with their addresses and telephone numbers.

- Declaration section:

- Read the declaration carefully and sign where indicated, confirming all provided information is true.

- Documentation section:

- Gather and submit the required documents listed.

- This includes your salary slip, identity proof, residency proof, and any other specified documents.

Ensure all sections are filled out completely and accurately. Once you have completed the form and attached the necessary documentation, you can submit it to the relevant branch of the State Bank of India. After submission, the bank will process your application and reach out for any further information if needed.

What You Should Know About This Form

What is the SBI Expres Credit form used for?

The SBI Expres Credit form is an application for individuals seeking a personal loan from the State Bank of India. It gathers essential personal, financial, and employment information required for the bank to assess eligibility and determine the loan amount and terms.

What personal information do I need to provide on the form?

You will need to fill in basic personal details such as your name, residential and permanent addresses, date of birth, age, sex, number of dependents, and education level. Additionally, it requires information about your employment or business occupation.

Do I need to specify my income?

Yes, the form requires you to disclose both gross and net income, along with any other regular monthly income sources. This information is crucial for the bank to evaluate your ability to repay the loan.

What documentation do I need to submit with the application?

You must attach several supporting documents. These include your latest salary slip, Form 16 (if employed), IT returns for the past two years (for professionals), proof of identity, proof of residence, a recent passport-sized photograph, and bank statements. Specific documents may vary depending on your employment status or position.

Can I get a loan if I don't own a house?

Yes, homeownership is not a prerequisite for obtaining a loan. However, if you do own a house, you must specify if it is mortgaged and provide its estimated value. The bank examines all aspects of your financial background during the approval process.

How does the repayment process work?

The form asks you to propose a repayment period along with the monthly repayment amount you can afford. Based on the details you provide, the bank sets the repayment schedule, which will be communicated to you upon loan approval.

What are the eligibility criteria for a personal loan through this form?

Eligibility criteria vary but generally include a stable income source, a good credit score, and sufficient financial stability to manage the proposed loan repayments. Your age and the number of dependents may also play a role in determining eligibility.

Is there a fee associated with the application for Expres Credit?

Typically, banks may charge a processing fee when you apply for a loan. It’s advisable to check with the bank directly or review their official website to find exact details about fees applicable to the SBI Expres Credit application.

What happens next after submitting the application?

After submission, the bank will review your application and attached documentation. They may reach out for additional information. If everything checks out, you will receive a loan offer outlining the loan terms, interest rate, and repayment schedule.

Can I amend my application after submission?

Once submitted, changes to your application may be challenging but not impossible. Contact the bank promptly if you need to update any information. Be sure to clarify whether the changes will affect your application status as they might require additional documentation.

Common mistakes

Filling out the SBI Express Credit form can be straightforward, but many make mistakes that can delay processing. One common error is not providing complete personal information. Ensure that every section, from your name to your residential address, is filled out accurately. Missing details can lead to automatic rejection.

Another frequent mistake is the inconsistency in contact information. Double-check that your phone number is correct and matches the address provided. Inaccurate information can hinder the bank’s ability to reach you.

When it comes to age, individuals often forget to specify the correct date of birth. Always write it clearly to avoid any confusion. A simple oversight here can raise questions regarding your eligibility.

People sometimes overlook the importance of detailing their employment status. It’s crucial to specify if you are self-employed or a full-time employee. Be honest about your position and make sure the information aligns with your income statement to avoid discrepancies later on.

Not disclosing the number of dependents can also be an issue. This section helps assess your financial commitments. Leaving it blank may raise concerns and affect loan decisions.

In the income section, some fail to declare all sources of income. If you have a side job or investments, include them. Transparency here can improve your chances of loan approval. Similarly, ensure that the figures you provide are accurate and verifiable.

Another common error involves the property and asset declaration. Be clear about whether you own a house or vehicle and include accurate valuations. Information should be precise; rounding off could create misunderstandings about your financial standing.

Don’t forget to check the loan purpose and amount thoroughly. People sometimes write vague purposes which can lead to delays. Detail why you are seeking the loan and specify a clear amount.

Lastly, when it comes to signatures and declarations, candidates often rush through this step. Ensure that you sign correctly and confirm your understanding of the terms. An unclear or incorrect signature can invalidate your form.

Documents used along the form

When applying for a loan with the SBI Express Credit form, it's essential to gather several supporting documents. These additional forms and documents help the bank assess your application thoroughly. Below is a list of commonly required documents that you may need.

- Latest Monthly Salary Slip: This document shows your income and any deductions made. It helps the bank verify your employment status and financial stability.

- Form 16: Provided by your employer, this form certifies the amount of tax deducted from your salary and serves as proof of your earnings for tax purposes.

- IT Returns: Include copies of your income tax returns for the last two years. This documentation is crucial for professionals to confirm your income and tax compliance.

- Proof of Identity: Acceptable documents include a Passport, Voter ID Card, or Driving License. These help the bank verify who you are.

- Proof of Residence: You may provide a Ration Card, Telephone Bill, or any of the identity proofs mentioned earlier. This confirms your residential address.

- Bank Statements: Provide the last six months of bank statements for the account where your salary is credited. This offers insight into your financial behavior.

- Professional Qualification Proof: A copy of your highest professional degree will be necessary if you're self-employed or a professional, confirming your qualifications.

Having these documents ready will enhance your chances of a smooth application process with State Bank of India. Be sure to check the latest requirements beforehand, as they can sometimes change. Good luck with your application!

Similar forms

-

Personal Loan Application Form: Similar to the SBI Expres Credit form, a personal loan application form requires detailed personal information, income details, and the purpose of the loan. Both forms seek the applicant's financial background and relevant documentation to evaluate eligibility.

-

Home Loan Application Form: This document shares similarities with the SBI Expres Credit form in that it also delves into the applicant's personal and financial details. It includes asset information and specific details about the intended use of the loan, focusing on property-related purchases.

-

Business Loan Application Form: Like the SBI Expres Credit form, this application requires comprehensive personal and financial information. It emphasizes the applicant's business plan and financial projections, essential for assessing the viability of the loan request.

-

Education Loan Application Form: This form is similar as it gathers personal information, details about the applicant's education, and financial responsibilities. It aims to establish the applicant's need for funds, as well as their ability to repay the loan based on future earning potential.

Dos and Don'ts

Filling out the SBI Expres Credit form can be a straightforward process if you follow a few essential guidelines. Here are six important things to keep in mind:

- Do ensure all personal information is accurate. Mistakes can delay the processing of your application.

- Do provide clear contact details. This includes telephone numbers and addresses to facilitate communication from the bank.

- Do attach all required documents. Missing documentation could result in your application being returned.

- Do double-check your income details. Providing the correct amount helps the bank assess your repayment capacity effectively.

- Don't leave any sections blank. Every part of the form should be filled out to avoid unnecessary delays.

- Don't include false information. Misrepresentation can lead to rejection of your application and serious consequences.

Misconceptions

Misconceptions about the SBI Xpress Credit form can lead to confusion for applicants. Let’s clarify some common misunderstandings:

- Misconception 1: The SBI Xpress Credit form is only for existing customers.

- Misconception 2: Filling out the form guarantees loan approval.

- Misconception 3: Any income can be declared without verification.

- Misconception 4: The documentation required is minimal and can be submitted later.

- Misconception 5: The purpose of the loan does not need to be clearly defined.

- Misconception 6: Personal references are optional.

This is not true. Anyone can apply, whether they have an existing account or not. New customers are also welcome with the appropriate documentation.

Completing the form does not guarantee that a loan will be granted. Approval depends on the bank's assessment of your financial situation and creditworthiness.

This is misleading. The bank requires documented proof of income, such as salary slips or tax returns, to verify the information you provide in the form.

In fact, the application cannot proceed without the required documentation submitted at the time of application. It’s essential to gather all necessary documents beforehand.

This is incorrect. You must specify the purpose of the loan in the application. Clarity about the loan’s purpose helps the bank assess your needs and determine appropriate terms.

This is not accurate. Providing personal references is a mandatory requirement in the application process. These references help validate your identity and character during the assessment.

Key takeaways

Filling out the SBI Xpress Credit form requires attention to detail. Here's what you need to know:

- Provide your personal information accurately. This includes your name, address, and date of birth.

- Clearly state your occupational details. Specify whether you are employed, self-employed, or a pensioner.

- Keep your income details transparent. Include your gross and net income, along with any other regular income sources.

- List your assets and liabilities. Detail property values, bank deposits, and any loans you currently have.

- Indicate the purpose of the loan. Be specific about what you intend to use the funds for.

- Fill in your proposed loan amount and repayment terms accurately. Make sure these figures are realistic.

- Submit all required documentation with your application. Missing documents can delay processing.

- Make sure your personal references are informed. Their details will also be part of your application.

- Review the declaration section carefully. Ensure that all statements are true, as these form the basis of your loan application.

- Finally, sign and date the form. This shows your commitment and readiness to proceed with the application.

Browse Other Templates

Fairbanks Accident Report - Injured parties' contact information is required on the form.

How to Get Your College Transcript - This request form is essential for students needing proof of academic history.

Nz Arrival Card - Enquiries regarding the form can be made by calling the dedicated phone line.