Fill Out Your Sbi Home Loan Application Form

Applying for a home loan with the State Bank of India (SBI) involves completing a detailed application form designed to gather important information from loan applicants. From personal details like names, addresses, and identification numbers to employment and financial details, this form requires individuals to provide a comprehensive overview of their financial standing and housing needs. The form is divided into distinct sections: one for personal details, one for employment and income, another for property and loan specifics, and finally, a declaration section where applicants attest to the accuracy of the information provided. Each segment demands precise data, including your employment status, monthly income, existing obligations, and even the specifics surrounding the property you wish to purchase. Additionally, it underscores the bank’s commitment to security by requesting guarantor and referee details. Completing this form accurately is crucial, as it lays the foundation for your loan application and potential approval. Understanding each part of this form can make the process smoother and increase the likelihood of a favorable response from SBI.

Sbi Home Loan Application Example

APPLICANT

CO – APPLICANT

GUARANTOR

Name Gender M F

Name Gender M F

Salutation Mr Mrs Ms Dr. Other Date of Birth d d

Marital Status Married Unmarried Other Name of Spouse

No. of Dependents No. of Children Name of Father

Mother’s Maiden Name Category SC ST OBC General Nationality Residential Status Resident NRI / PIO Religion

Attach your recent

passport size

photograph here

Place of Birth Photo Identification (ID) : Type |

|

|

|

|

||

|

|

|

|

|||

Photo Identification (ID): Number Photo ID: Valid Upto |

|

|

||||

d d m m |

y |

y y |

|

y |

|

|

- |

|

|

|

|

|

|

Driving Licence No. Driving Licence Valid Upto |

|

Please sign here |

||||

d d m m |

y |

y y |

y |

|

|

|

PAN No./GIR No. Passport No |

|

|

|

|

|

|

Passport Valid Upto |

|

|

|

|

|

|

d d m m y y y y |

|

|

|

|

|

|

Highest Qualification Attained Qualifying Year |

|

|||||

d d m m |

|

y y |

y |

y |

|

|

Present Address: Staying at the present address for the past ____ Years and ___Months. |

Residential Address |

|

House /Flat / Apartment No. or Name

Street Name & No. and Area/Location

Landmark |

|

City |

District Pin Code |

State |

Country |

Telephone (Landline) Mobile (Primary) Mobile (Secondary)

Email (Personal)

Permanent Address: Is permanent address same as present address? Yes No (To be filled if permanent address is different from present address)

Permanent Address: Is permanent address same as present address? Yes No (To be filled if permanent address is different from present address)

House /Flat / Apartment No. or Name

Street Name & No. and Area/Location

Landmark |

|

|

City |

District Pin Code |

|

State |

Country |

|

Telephone (Landline 1) |

Telephone (Landline 2) |

|

Office / Business Address: |

|

|

Office / Business Address |

||

|

||

|

|

Name of Org/Employer, Dept, & Floor

Street Name & No. and Area/Location

Landmark |

|

City |

District Pin Code |

State |

Country |

Telephone (Landline) |

Fax Mobile (Secondary) |

Email (Organizational)

Repayment Mode

Repayment Mode

Relationship with the Bank Less than 1 year 1 – 3 years More than 3 years

Relationship with the Bank Less than 1 year 1 – 3 years More than 3 years

References (Names and addresses of two referees who are not related to you):

References (Names and addresses of two referees who are not related to you):

State Bank of India |

|

Name: |

|

|

may make enquiries |

|

Address: |

|

|

from the referees if |

|

|

|

|

it deems necessary. |

|

Email: |

|

|

|

|

Tel: |

Mob: |

|

|

|

|

|

|

Name:

Address:

Email:

Tel:Mob:

|

APPLICANT |

|

|

||

|

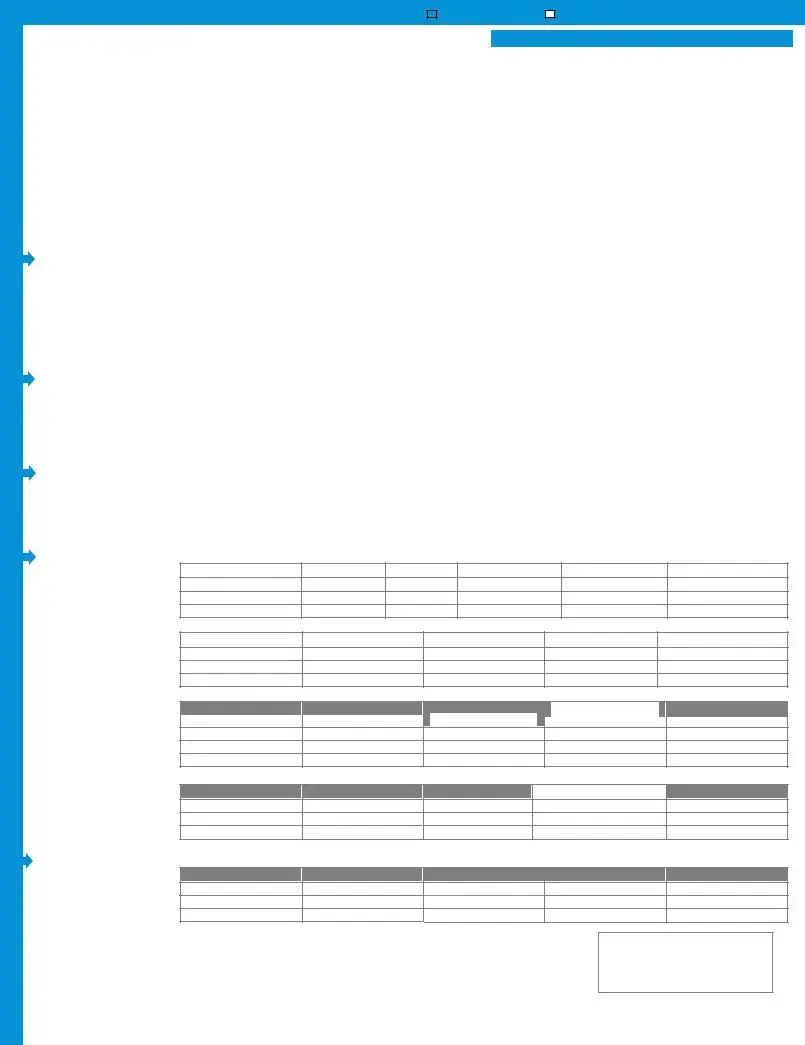

Nature of Occupation Salaried Businessmen / Self Employed Professional Pensioner

Nature of Occupation Salaried Businessmen / Self Employed Professional Pensioner

Employer Name Employment Status

CO – APPLICANT

GUARANTOR

GUARANTOR

Salaried Individual

Regular Probationary Contractual

Total Experience Yrs Months Years in Present Job Yrs Months Years in Previous Job (If Applicable) Yrs Months

Previous Employer’s Name Contact Number

Previous Employer’s Address Current Industry

Organization Type Public Sector Unit Listed Private Company Unlisted Private Company MNC Central/State Government Local Civic Body

Department Designation |

|

|

|||||||||

Employee No. |

Remaining Service Yrs Months |

|

|

|

|

||||||

Website |

|

||||||||||

|

|

|

|

|

|

||||||

Businessman/Self Employed |

|

|

Businessmen / Self Employed Professional |

|

|

||||||

Nature of Business Manufacturing Company |

Services Company Trading Company Trading Firm Other___________________________ |

||||||||||

Business Name |

Industry |

||||||||||

Trade License No. |

Trade License Expiry Date |

||||||||||

Name of POA Holder |

Type of Ownership Single Joint No. of Partners |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

Income / Financial Details |

|

|

|

|

|

|

Income / Financial Details |

|

|

|

|

Income Details |

|

|

|

|

|

|

|

|

|

|

|

|

|

Income Head |

|

Gross Income |

Net Income |

|

Frequency |

How are you paid ? |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Obligation / Deduction Details |

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Obligation Head |

|

Gross Obligations |

Net Obligations |

|

Frequency |

Remarks |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Existing Loans (If Any)

|

Bank / Financer |

Type of Loan |

EMI |

Tenure of the Loan |

No. of EMIs Paid |

|

|

Outstanding Balance |

|

|

|

|

|

|

|

|

|

Bank Accounts Held

Bank Accounts Held

|

Bank Name |

|

Branch |

|

Account Type |

Account Number |

Account held for (Years) |

|

|

|

|

|

|

|

|

Credit Cards

Credit Cards

Card Number |

|

Issuer Name |

|

Primary |

|

Outstanding Balance |

|

Remarks |

|

|

|

|

/Supplementary |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fixed Deposits

Fixed Deposits

FD Number

Amount

Rate

Maturity Date(dd/mm/yyyy)

Maturity Date(dd/mm/yyyy)

Bank Name

Other Current Assets (Bonds, Shares, Mutual Fund, Other Investments, Precious metals / Gold / Jewelry , Immovable Property etc)

Asset Type

Asset Description

Asset No.

Asset Value

Remarks

Name: Date:

Name: Date:

Scheme Name SBI Max Gain |

|

SBI Yuva Home Loan SBI |

SBI NRI Housing Loan |

||

SBI Realty Home Loan |

SBI Home Plus |

|

|||

Other Scheme |

|

|

|

||

______________________________________________________________________________________________________ |

|

Property Details |

|||

Builder |

Yes |

No |

If Yes, then please provide Builder Project |

||

|

Property Type |

Free Hold Lease Hold |

|

||

Builder Name |

Project Name |

|

|||

Building Name / Number Wing Name |

|

||||

Built up Area (Sq ft) |

Plot Area (Sq ft) Plinth Area (Sq ft) |

||||

Boundaries (Sq ft) |

Undivided share of land (for flats in %) Survey No. |

||||

Plot / Flat No. |

TCT/CCT No. Block No. |

||||

Name of Seller |

Registered Owner |

||||

Sellers Address 1 |

|

||||

Sellers Address 2 |

|

||||

Landline / Mobile Fair Market Value Guarantee Tenure (Months)

Guarantee Amount Guarantee End Date

Architect |

Contractor |

||

Address of Property |

|

||

Address of Property |

|||

|

|

||

|

|

|

|

Address of Property 1

Address of Property 2

Landmark |

|

City |

District Pin Code |

State |

Country |

|

|

Loan Details |

Loan Details |

|

Cost of property (Project Cost) Down payment (amount) Down payment %

Loan Amount |

Repayment Monthly |

|

Quarterly Annually Tenure (Months) |

|||||

Loan Purpose |

New House Construction |

Purchase of New House |

Purchase of Old House |

Purchase of Plot of Land |

||||

|

Purchase of New Flat |

Purchase of Resale Flat |

Purchase of New House |

Repairs and Renovation |

||||

|

Home Extension |

Balance Transfer from other Bank |

Reimbursement of expenditure incurred in past 12 months |

|||||

Interest Rate Option |

Fixed Rate |

Floating Rate |

Moratorium Period (Months) |

|||||

|

|

Whether Interest to be Capitalized during Moratorium Period |

Yes |

No |

||||

|

|

|

|

|

||||

Insurance |

|

|

|

Home Loan Linked Life Insurance Policy |

||||

For your benefit and convenience, the following group insurance plan underwritten by SBI Life Insurance Company Ltd is available for your consideration. If you opt for this cover, SBI would administer your enrolment for the chosen plan. Please note that this insurance cover is optional for the purpose of the loan application and may also be obtained from other providers.

SBI Life Rinn Raksha Policy – Rinn Raksha Policy (RRP) is a group mortgage reducing term life insurance policy underwritten by the SBI Life Insurance

Company Limited, which covers you against death and/or disability (as defined in the policy) to protect your dependants from the liability of the loan

outstanding. The policy covers the outstanding loan balance for the entire tenor of the loan for an upfront one time premium.

Do you wish to be covered by Home Loan Insurance (Life) Cover e.g. SBI Life?

Yes |

No |

If YES, Whether one time premium will be paid by you or you would like to add the premium to the home loan?

I will pay the premium Please add the premium to the home loan amount mentioned above

Signature of Applicant |

Signature of |

Signature of Guarantor |

DECLARATION

I/We certify that the information provided by me/us in this application form is true and correct in all respects and State Bank of India is entitled to verify this directly or through any third party agent. I/We confirm that the attached copies of financials/Bank Statements/Title/Legal documents etc. are submitted by me/us against my/our loan application and certify that these are true copies. I/We further acknowledge the Bank's right to seek any information from any other source in this regard. I/We understand that all of the

I/We further agree that any facility that may be provided to me/us shall be governed by the rules of the Bank that may be in force from time to time. I/We will be bound by the terms and conditions of the facility/ies that may be granted to me/us. I/We authorise the Bank to debit my home loan account with the Bank for any fees, charges, interest etc. as may be applicable.

I/We undertake and declare that I/we will comply with the Foreign Exchange Management Act, 1999 („FEMA‟) and the applicable rules, regulations, notifications, directions or orders made there under and any amendments thereof. I/We undertake to intimate the Bank before proceeding overseas on permanent employment and/or emigrating and/or changing my/our nationality.

I/We acknowledge that the Bank remains entitled to assign any activities to any third party agency at its sole discretion. I/We further acknowledge the right of the Bank to provide details of my/our account to third party agencies for the purpose of availing support services of any nature by the Bank, without any specific consent or authorisation from me/us.

I/We acknowledge that the existence of this account and details thereof (including details of transactions and any defaults committed by me), will be recorded with credit reference agencies and such information (including processed information) may be shared with banks/financial institutions and other credit grantors for the purposes of assessing further applications for credit by me/us and/or members of my/our household, and for occasional debt tracing and fraud prevention. I/We accordingly authorise the Bank to share information relating to my/our home loan account.

I/We understand that as a precondition, relating to grant of loans/advances/other

1.Accordingly, I/we hereby agree and give consent for the disclosure by the Bank of all or any such; (a) information and data relating to me/us (b) the information or data relating to any credit facility availed of/to be availed of by me/us and (c) default, if any, committed by me/us in discharge of my/our such obligation, as the Bank may deem appropriate and necessary, to Credit Information Bureau (India) Limited (CIBIL) and any other agency authorised in this behalf by Reserve bank of India / Government of India.

2.I/We undertake that (a) CIBIL and any other agency so authorised may use, process the said information and data disclosed by the Bank; and (b) CIBIL and any other agency so authorised may furnish for consideration, the processed information and data or products thereof prepared by them, to banks/financial institutions and other credit grantors, as may be specified by the Reserve Bank in this behalf.

I/We agree to receive SMS alerts related to my/our application status and account activity as well as product use messages that the Bank will send, from time to time, on my/our mobile phone number as mentioned in this application form. I/We undertake to intimate the Bank in the event of any change in my/our mobile phone number and residential address.

I/We further acknowledge that I / We have read, understood and agree with the Most Important Terms and Conditions governing the home loan product chosen by me/us.

Signature of Applicant |

Signature of |

Signature of Guarantor |

Place………………………………. |

Place………………………………. |

Place………………………………. |

Date……………………………….. |

Date……………………………….. |

Date……………………………….. |

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

ACKNOLEDGEMENT RECIEPT

Home Loan Application No:

Loan application received on

.

Request will be disposed of and acceptance/rejection notification would be mailed within 15 days from the date of receipt of completed application form with supporting documents. On behalf of State Bank of India.

Date and Place:_____________________ |

Authorised Signatory |

Form Characteristics

| Fact Name | Description |

|---|---|

| Application Components | The SBI Home Loan Application includes personal, employment, income, property, and declaration sections. |

| Identification Requirements | Applicants must provide various forms of ID, such as a passport or driving license. |

| Income Documentation | Income details must be supplied, including gross and net incomes along with obligations. |

| Property Specifics | Property details require information like project cost, loan amount, and type (freehold/leasehold). |

| Insurance Options | A group mortgage reducing term life insurance is available. Opting for this is optional. |

| State Regulations | Applications are governed by state laws, including those related to loan agreements and consumer protection. |

| Consent for Disclosure | Applicants must consent to the bank sharing information with credit bureaus for verification purposes. |

Guidelines on Utilizing Sbi Home Loan Application

Completing the SBI Home Loan Application form is an important step in securing funding for your property. By providing accurate and complete information, you set the stage for the review and approval of your loan application.

- Begin with FORM-A (PERSONAL DETAILS). Fill in your full name at the top, along with your gender, salutation, date of birth, and marital status. Don’t forget to add your spouse’s name and the number of children and dependents you have.

- Provide your Residential Address along with your telephone and email details. Make sure to indicate how long you have been living at your current address.

- If your permanent address is different from your current residence, complete the details in the Permanent Address section. Confirm if it’s the same by selecting ‘Yes’ or ‘No’.

- Next, move to your Office / Business Address. Fill in the name of your employer, the industry type, your position, and other relevant contact details.

- Complete FORM-B (EMPLOYMENT & INCOME DETAILS). Indicate whether you're salaried or self-employed, and provide details about your employment and income status.

- List your current income, obligations, and existing loans in the income section. Include details of any bank accounts, credit cards, and fixed deposits.

- Proceed to FORM-C (PROPERTY & LOAN DETAILS). Specify the scheme you are applying for and provide all necessary information regarding the property, including its type, area, and builder details.

- Fill out the loan information including the cost of property, down payment, desired loan amount, repayment option, and loan purpose.

- In FORM-D (DECLARATION), carefully read and acknowledge the declarations. Ensure that you sign as the applicant, co-applicant, or guarantor.

- Lastly, ensure all information is accurate. Attach necessary documents, including your recent photograph, and double-check for completeness before submitting the application.

After submitting your application, the bank will review your documents and notify you within 15 days. This ensures a smooth process moving forward and gives you an idea of the next steps.

What You Should Know About This Form

1. What is the SBI Home Loan Application form?

The SBI Home Loan Application form is a document required to apply for a home loan from the State Bank of India. It includes sections for personal details, employment information, property details, loan details, and a declaration. Filling out this form accurately is crucial for the loan approval process.

2. What personal details are required in the form?

Applicants need to provide various personal details. This includes your name, gender, date of birth, marital status, address, and contact information. You'll also need to include details about your spouse, dependents, and your parents.

3. How do I fill in my employment details?

In the employment section, you will specify your nature of occupation (salaried, self-employed, etc.), employer's name, employment status, and total experience. It's also important to indicate your current industry and designation accurately.

4. What property details should I include?

When entering property details, include information such as the property type, builder details, project name, and address. You'll also provide information regarding boundaries, fair market value, and the seller’s information. It’s essential to be specific here, as this helps in the appraisal of your loan application.

5. What types of loans can I apply for through this form?

The form allows you to choose from several loan options including new house construction, purchase of new or old houses, purchasing plots of land, and refinancing existing loans. There are various schemes available. Choose the one that best meets your needs.

6. Is insurance necessary when applying for a home loan?

While insurance is not mandatory, SBI offers home loan-linked life insurance as an optional benefit. This insurance covers the outstanding loan balance in the event of unforeseen circumstances, providing additional peace of mind to borrowers.

7. What happens after I submit the application?

After submitting the application, the bank will review it and notify you of the acceptance or rejection within 15 days. Make sure all documents are complete and accurate to avoid delays. Notifications will be sent through email or postal service.

8. Can I fill out the application form online?

Currently, the application process requires a physical form submission. However, it's a good idea to check the SBI website for any updates or improvements in their application processes that may allow for online submissions in the future.

Common mistakes

Completing the SBI Home Loan Application form can be a complex process, and it’s easy to make mistakes that can delay the approval of your loan. Here are five common errors that applicants often encounter when filling out the form that can be easily avoided.

One significant mistake is providing incomplete or inaccurate personal details. Each section of the application form, from names and addresses to contact information, must be filled out meticulously. Missing digits in your phone number or an incorrect email address can lead to communication breakdowns. Ensure all contact details are accurate to avoid delays in processing your loan application.

Another issue is failing to provide a complete and accurate employment history. It’s critical to clearly list your current employment status, length of employment, and your previous job details if applicable. Inconsistencies or lack of information may raise concerns during the verification process. If you have held multiple positions, be sure to include all relevant experiences to present a comprehensive employment profile.

Applicants frequently overlook the importance of financial disclosures. This includes specifying any existing loans, bank accounts, and monthly obligations. Providing clear and complete financial details helps the bank assess your financial health accurately. It’s advisable to double-check all financial entries, ensuring they reflect your current and true financial situation.

Additionally, neglecting to sign the application form correctly can lead to immediate rejection. Often, applicants forgo their signatures in various required places or sign without verifying that all necessary sections are completed. Always review your application to ensure signatures are present wherever indicated, as this confirms your agreement to the terms outlined.

Finally, many applicants forget to attach required documentation. Submitting the application without including necessary documents such as identification proof or income statements can cause significant delays. Before sending in your application, verify that all required documents are in order and securely attached. This proactive step can facilitate a smoother and faster approval process.

Documents used along the form

When applying for a home loan through the State Bank of India (SBI), several documents must typically accompany the application form. These documents help the bank assess the applicant's financial situation, qualifications, and the property details. Below is a list of commonly required forms and documents.

- Proof of Identity: This document verifies the identity of the applicant. Acceptable forms often include a government-issued photo ID, such as a passport, driver's license, or national identification card.

- Proof of Address: This document serves to establish the applicant's residential address. Common proofs include utility bills, lease agreements, or government correspondence that shows the current address.

- Income Proof: Income statements are essential for demonstrating the applicant's earning capability. These can include salary slips, employment letters, tax returns, or bank statements reflecting regular income.

- Property Documents: These documents outline the ownership and legal status of the property being financed. This can include the title deed, property registration papers, and occupancy certificates.

- Bank Statements: Recent bank statements offer insight into the applicant's financial habits and stability. Typically, banks require six months of bank statements from all relevant accounts.

- Tax Returns: Previous years' tax returns provide a comprehensive view of an applicant's financial health. They demonstrate income stability and tax compliance, important factors for lenders.

- Loan Repayment Agreement: This agreement outlines the terms and conditions for repaying the loan, including interest rates, repayment schedules, and any other related conditions.

Providing accurate and complete documentation is crucial for expediting the loan application process. Applicants should ensure all required documents are readily available, as deficiencies can lead to delays or rejections.

Similar forms

-

Mortgage Application Form: Similar to the SBI Home Loan Application, this form gathers personal details, financial stability, and property information needed for lenders to assess credit risk and process a mortgage application.

-

Bank Loan Application: This document serves a similar purpose in compiling personal data and financial background to evaluate eligibility for various types of loans, not just home loans.

-

Personal Loan Application: This form requests personal and income information, similar to the home loan application, enabling the lender to determine the applicant's capacity to repay a personal loan.

-

Auto Loan Application: Like the SBI Home Loan Application, this document requires personal and financial details, focusing specifically on the buyer's ability to finance a vehicle.

-

Loan Pre-Approval Form: This form aims to pre-qualify borrowers for loans based on their financial information and credit history, paralleling the pre-approval step in home loan applications.

-

Credit Card Application: This application requires similar personal and income information as the home loan application, as both assess an applicant's creditworthiness.

-

Investment Loan Application: This document requests details about the applicant’s finances to evaluate their capacity to take on debt for investment purposes, much like a home loan application.

-

Business Loan Application: Similar to the SBI Home Loan Application, this form gathers essential data about personal finances and business information to evaluate the risk of lending for business purposes.

-

Student Loan Application: This application often provides an overview of personal and financial circumstances to help lenders assess credit risk, much like a home loan process.

Dos and Don'ts

When filling out the SBI Home Loan Application form, it’s important to adhere to the following guidelines:

- Double-check all personal details for accuracy, including name, address, and contact information.

- Use a recent passport-sized photograph as specified in the application.

- Ensure that you complete all sections of the form. Incomplete forms may delay processing.

- Verify your employment and income details carefully; mistakes can lead to complications.

- Include the correct information regarding existing loans and obligations.

Avoid the following common mistakes:

- Do not leave any mandatory fields blank; this could lead to rejection.

- Avoid using unclear or illegible handwriting when filling out the form.

- Do not submit outdated or invalid identification documents.

- Refrain from providing inaccurate information regarding your financial history.

Misconceptions

There are numerous misconceptions surrounding the SBI Home Loan Application form. Understanding these can greatly assist applicants as they navigate the loan process. Here are eight common misconceptions:

- All applicants need a co-applicant. While having a co-applicant can improve your chances of getting a loan or increase the eligible amount, it is not mandatory. Individuals can apply alone.

- A higher income guarantees loan approval. While a stable and high income positively impacts the application, the bank considers several factors, including credit history and existing liabilities.

- You must have perfect credit to apply. Many people think they need pristine credit. In reality, banks often accept applicants with less-than-perfect credit, but this can affect the terms of the loan.

- The application process is the same for everyone. Each applicant is unique. The requirements may vary based on factors like income type, employment status, and residential status.

- Property value is the only factor in loan approval. The bank assesses multiple factors beyond property value, such as the applicant's income, job stability, and repayment capacity.

- Once you apply, you cannot make changes to your application. Applicants can often make amendments to their application before it is processed. It's best to contact the bank for guidance.

- The loan amount you apply for is the amount you will receive. Banks have specific criteria and may approve a lower amount than requested based on their evaluation process.

- Applying for multiple loans simultaneously will increase your chances. This misconception can actually hurt your credit score. It is advisable to focus on one application at a time.

Clarifying these misconceptions can help potential borrowers have a smoother experience with their home loan application process at SBI.

Key takeaways

The SBI Home Loan Application form is a crucial step for individuals seeking financing for their housing needs. Understanding the key aspects of this form can facilitate a smoother application process.

- Provide Accurate Information: Ensure that all details filled in the application are correct and truthful, as discrepancies could lead to delays or denials.

- Submit Required Documentation: Attach necessary documents like identity proof, income statements, and property details that support the application.

- Specify Employment Status: Clearly indicate your occupation, income details, and job stability, as this information is essential for the bank's assessment.

- Identify Loan Purpose: Clearly state the purpose of the loan, whether it is for purchasing a new home, construction, or other reasons to help the bank evaluate your request.

- Select Repayment Mode: Choose a repayment method that best suits your financial situation, such as check-off, ECS, or post-dated cheques.

- Consult About Insurance Options: Consider opting for the Home Loan Linked Life Insurance policy, which can provide security against unforeseen circumstances.

- Stay Informed About Processing Times: After submission, expect a response regarding the acceptance or rejection of your application within 15 days.

Browse Other Templates

2022 Tax Checklist - Costs for guide dogs and handicap access devices may be eligible for deduction under medical expenses.

Coventry Health - The proper identification of the claim number is essential in the review process.

Can You Get a Moving Permit Online - To receive a Moving Permit, you must provide evidence of ownership or consent from the owner.