Fill Out Your Sbi Retired Employees Medical Benefit Form

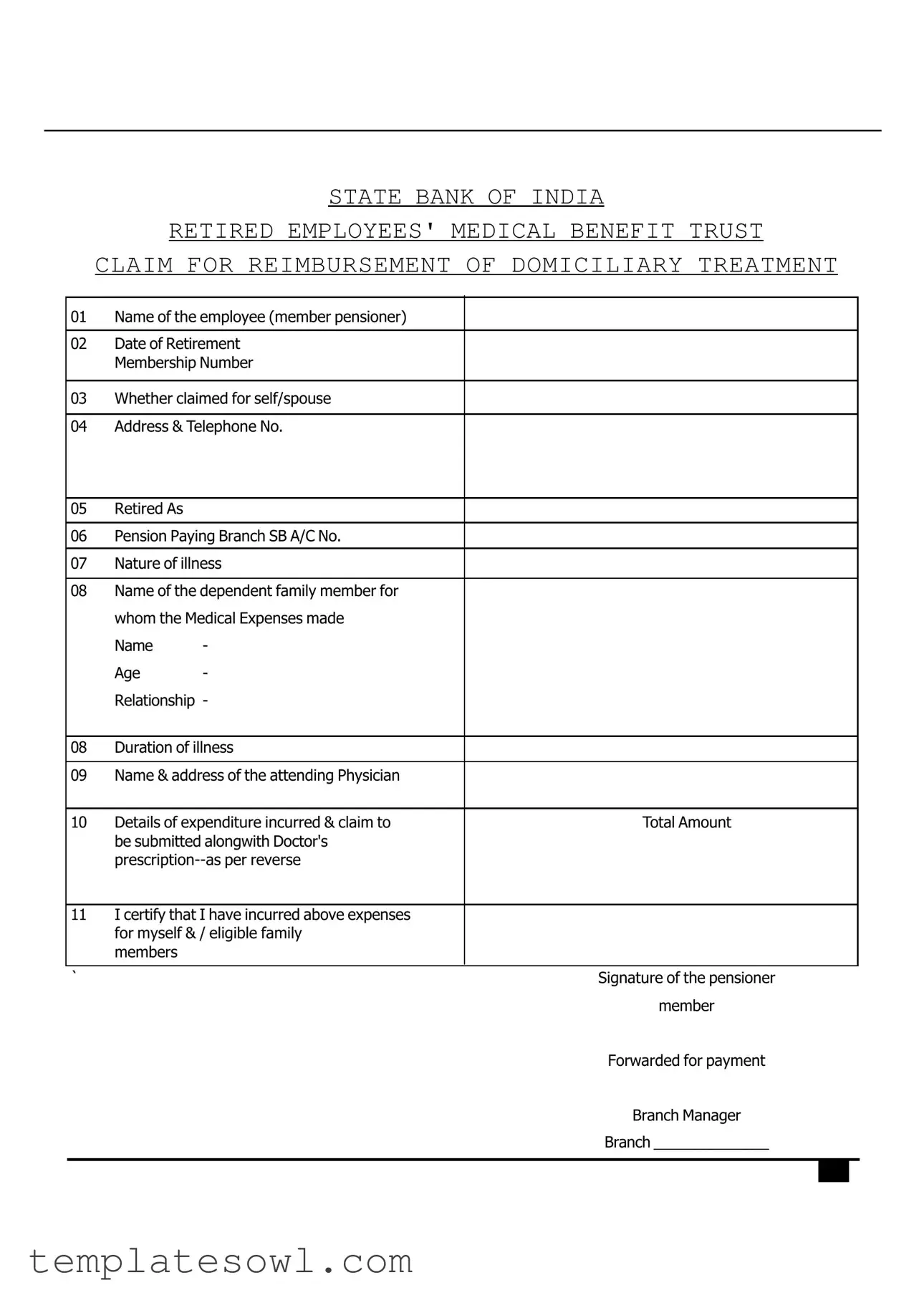

The SBI Retired Employees Medical Benefit Form serves as a vital tool for pensioners seeking reimbursement for domicile medical expenses incurred during retirement. This form encompasses various essential components that help streamline the claims process, ensuring that retirees receive the necessary financial support for their healthcare needs. Key elements include the personal information of the retiree, such as name, retirement date, and pension details, alongside specific data regarding the nature of the illness and the attending physician. The form also requires a detailed account of the expenditures incurred, which should be accompanied by relevant medical prescriptions. Additionally, retirees must provide information about dependent family members and indicate whether the claim is for themselves or their spouse. The thoroughness of this form is intended to facilitate proper processing of claims, allowing branch managers and administrative offices to assess and approve requests for payment. Understanding these sections can empower retirees to navigate their medical reimbursement claims effectively, ensuring they receive the benefits to which they are entitled.

Sbi Retired Employees Medical Benefit Example

STATE BANK OF INDIA

RETIRED EMPLOYEES' MEDICAL BENEFIT TRUST

|

CLAIM FOR REIMBURSEMENT OF DOMICILIARY TREATMENT |

||

|

|

|

|

01 |

Name of the employee (member pensioner) |

|

|

|

|

|

|

02 |

Date of Retirement |

|

|

|

Membership Number |

|

|

|

|

|

|

03 |

Whether claimed for self/spouse |

|

|

|

|

|

|

04 |

Address & Telephone No. |

|

|

|

|

|

|

05 |

Retired As |

|

|

|

|

|

|

06 |

Pension Paying Branch SB A/C No. |

|

|

|

|

|

|

07 |

Nature of illness |

|

|

|

|

|

|

08 |

Name of the dependent family member for |

|

|

|

whom the Medical Expenses made |

|

|

|

Name |

- |

|

|

Age |

- |

|

|

Relationship |

- |

|

|

|

|

|

08 |

Duration of illness |

|

|

|

|

|

|

09 |

Name & address of the attending Physician |

|

|

|

|

|

|

10 |

Details of expenditure incurred & claim to |

Total Amount |

|

|

be submitted alongwith Doctor's |

|

|

|

|

||

|

|

|

|

11 |

I certify that I have incurred above expenses |

|

|

|

for myself & / eligible family |

|

|

|

members |

|

|

|

|

|

|

` |

|

|

Signature of the pensioner |

member

Forwarded for payment

Branch Manager

Branch ______________

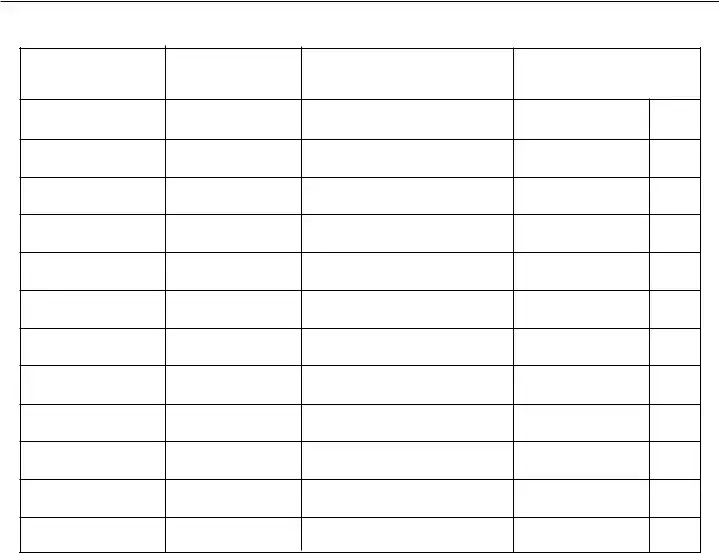

DETAILS OF THE BILLS

BILLNO.

DATE

PARTICULARS

OF THE BILL

AMOUNT

TOTAL

Signature of the pensioner member

AT ADMINISTRATIVE OFFICE

Amount of the expenditure claimed for Domiciliary treatment Rs.

Amount of expenditure for Domiciliary treatment |

Rs. |

|

|||

already claimed during the year |

|

|

|

||

Balance available for domiciliary treatment |

Rs. |

|

|||

sanctioned Rs. |

Towards Domiciliary treatment |

|

|

|

|

Chief Manager (HR) |

|

Assistant General Manager (ADMIN) |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

Form Characteristics

| Fact Name | Details |

|---|---|

| Form Purpose | The SBI Retired Employees Medical Benefit form is designed for retired employees to claim reimbursement for domiciliary treatment expenses. |

| Eligibility | This form is available to retired employees of the State Bank of India and their eligible family members. |

| Required Information | Applicants must provide personal information, including name, retirement date, and membership number, as well as details about the illness and expenditures incurred. |

| Documentation | Accompanying the claim, a doctor’s prescription is required, alongside detailed bills that substantiate the expenses claimed. |

| Submission Process | The completed form must be forwarded for payment through the relevant branch manager, ensuring signatures from both the pensioner and branch officials. |

| State-Specific Legal Framework | The governing laws associated with benefits for retired employees, including those specific to this form, may vary by state. It is advised to consult local regulations. |

| Maximum Claim Limits | There are prescribed limits on the amount that can be claimed for domiciliary treatment, which applicants should be aware of when submitting their claims. |

Guidelines on Utilizing Sbi Retired Employees Medical Benefit

Completing the SBI Retired Employees Medical Benefit form requires accurate information about your medical expenses and personal details. This guide will walk you through the necessary steps to ensure you fill out the form correctly, facilitating a smoother reimbursement process.

- Provide Personal Information: Start by entering your name as the employee and your membership number. Include the date of retirement and indicate if the claim is for yourself or your spouse.

- Contact Details: Enter your address and telephone number to ensure that communication can be established if necessary.

- Employment Information: State your designation at retirement and the relevant pension-paying branch, along with your savings bank account number.

- Medical Details: Describe the nature of the illness for which you are seeking reimbursement. Also, mention the name of the dependent family member for whom the medical expenses were incurred, including their age and relationship to you.

- Illness Duration: Indicate the duration of the illness clearly to provide context for the claimed expenses.

- Physician Information: Provide the name and address of the attending physician who treated you or your dependent.

- Expenditure Details: Detail the expenditure incurred and affirm that the total amount claimed will be submitted alongside the doctor’s prescription.

- Certification: Sign the certification portion of the form, confirming that the expenses were incurred for you or eligible family members.

- Forwarding for Payment: If applicable, have the Branch Manager or authorized personnel sign the form before submission.

- Bill Details: Complete the section for the bill details by listing the bill number, date, particulars of the bill, and amount involved.

- Administrative Information: Lastly, complete any necessary administrative details related to the already claimed amount and the balance available for domiciliary treatment.

After completing the form, double-check all entries for accuracy. This attention to detail will help ensure that your claim is processed quickly and without delays. Once satisfied, submit the form according to the procedures outlined by your administering branch.

What You Should Know About This Form

1. What is the SBI Retired Employees Medical Benefit form?

The SBI Retired Employees Medical Benefit form is a document that enables retired employees of the State Bank of India to claim reimbursement for medical expenses related to domiciliary treatment. It ensures that pensioners and their eligible family members can recover costs incurred for necessary medical care at home.

2. Who is eligible to fill out this form?

Eligibility to fill out the form generally includes SBI retired employees who are members of the SBI Retired Employees' Medical Benefit Trust. Additionally, their spouses and eligible dependent family members may also claim benefits on this form.

3. What information do I need to provide on the form?

When completing the form, you will need to provide your name, date of retirement, membership number, and details such as the nature of your illness and the attending physician's name and address. Information about your spouse or dependent family members, the duration of the illness, and total expenses incurred is also required.

4. How do I submit my medical expenses?

You can submit your medical expenses by completing the form and attaching necessary documents such as bills and a doctor's prescription. Be sure to include all relevant bills listed with their respective amounts, as well as a signed declaration certifying that expenses were incurred for yourself or eligible family members.

5. Is there a specific way to present my bills?

Yes, it's important to structure the details of your bills clearly. You should list each bill by its number, date, particulars of the bill, and the amount. This organized approach helps streamline the processing of your claim, making it easier for the branch manager and administrative offices to review your submission.

6. Can I claim for both self and spouse?

Yes, you can claim reimbursement for both yourself and your spouse. When filling out the form, just indicate who the treatment was for by selecting the appropriate option. Make sure to provide detailed information for each person, including their relationship to you and the specific medical expenses incurred.

7. What happens after I submit the form?

After submission, the branch manager will review the form and all accompanying documents. Once everything is in order, the claim will be forwarded for payment to the appropriate administrative office. They will determine the reimbursement amount based on the expenses claimed and any balance available for domiciliary treatment.

8. What if I experience issues with my claim?

If you encounter issues with your claim, it's best to directly contact the branch where you submitted the form. They can provide clarification on any missing information or the reasons for a delayed payment. It's important to maintain open communication to resolve any problems efficiently.

Common mistakes

Filling out the SBI Retired Employees Medical Benefit form requires careful attention to detail, but several common mistakes can hinder the processing of claims. One frequent error occurs in the section where individuals state their name and other personal information. Many applicants inadvertently provide incomplete or unclear information. Missing elements such as a full name or membership number can delay the claims process and cause unnecessary frustration.

Another mistake often seen is related to the nature of the illness. Providing vague descriptions or omitting details can lead to complications in the verification of claims. It is essential to be as specific as possible regarding the illness, as this information directly impacts the approval of the claim. Precise and comprehensive entries contribute to a smoother approval process.

Additionally, applicants may forget to include necessary documentation, such as the attending physician's details and the relevant bills. Claims submitted without supporting documents cannot be approved immediately. Every expense claimed should be accompanied by a doctor's prescription, and missing these documents can result in rejection of a claim. Patients must ensure that all required paperwork is collected and attached before submission.

Lastly, the certification section is often overlooked. Some retirees neglect to sign the form or fail to confirm that the claimed expenses were indeed incurred. This lack of certification can lead to automatic disqualification of the claim. Signing the form serves as a commitment to the accuracy of information provided and helps expedite the payment process. Meeting these basic requirements can significantly enhance the likelihood of a successful claim.

Documents used along the form

The SBI Retired Employees Medical Benefit form is essential for those seeking reimbursement for medical expenses incurred post-retirement. However, it is often accompanied by other forms and documents that provide necessary context or support for the claim. Below are some commonly used documents in conjunction with this form.

- Doctor's Prescription: This document serves as proof of the medical treatment received. It outlines the diagnosis and includes the prescribed medications, which are crucial for validating the need for the expenses claimed.

- Medical Bills: Receipts or statements from healthcare providers detailing the services rendered and costs incurred. These bills are vital for substantiating the claim amount and ensuring transparency in the reimbursement process.

- Hospital Discharge Summary: In cases of hospitalization, this summary provides a comprehensive overview of the patient's stay, including treatment outcomes and follow-up care. It aids in demonstrating the necessity for inpatient care.

- Identity Proof of Retiree: A copy of the retiree's identification, such as a driver’s license or pension card, helps confirm the individual's identity and retirement status, ensuring that only eligible individuals submit claims.

- Dependent Verification Document: Documentation that establishes the relationship of any dependents for whom expenses are claimed. This could be a marriage certificate or birth certificate, ensuring that claims made for family members are legitimate.

Each of these documents plays a supportive role in the claims process, helping to substantiate the request for reimbursement. Properly assembling these forms and documents can significantly impact the efficiency and success of the claim submission.

Similar forms

- Health Insurance Claim Form: This document allows policyholders to request reimbursement for medical expenses, similar to how the SBI form processes claims for retired employees' medical benefits. Both require details on the insured individual and the nature of the medical treatment received.

- Workers' Compensation Claim Form: This form is used by employees to seek compensation for work-related injuries. Like the SBI form, it demands information about the claimant, medical treatment details, and expenses incurred.

- Medicare Claim Form: Medicare claims are submitted by beneficiaries for health services received. Similar to the SBI document, it involves providing personal information, details of the treatment, and costs associated with that treatment.

- Veteran's Administration (VA) Claim Form: Veterans can use this form to claim benefits for medical services. It shares similarities with the SBI form, including sections for patient information, treatment descriptions, and expense documentation.

- Long-Term Care Insurance Claim Form: This document is for policyholders needing to access long-term care benefits. Both forms request information about the claimant and details about the healthcare services they utilized.

- Out-of-Pocket Medical Expense Reimbursement Form: This is used by individuals to reclaim costs incurred for medical treatments not covered by insurance. The required information overlaps with that needed for the SBI form, focusing on expenses related to specific treatments.

- Disability Insurance Claim Form: Individuals use this form to claim benefits when unable to work due to medical conditions. Similar to the SBI form, it collects details about the illness and the associated medical expenses.

- Flexible Spending Account (FSA) Claim Form: Employees can request reimbursement for eligible medical expenses under an FSA. This form also requires details on the medical service, dates of treatment, and costs, mirroring the SBI process.

- Dependent Care Expense Claim Form: Much like the SBI form, this document allows individuals to claim expenses related to dependent care. It gathers similar information regarding the individual and the services received.

- Health Savings Account (HSA) Claim Form: This form is used for withdrawing funds for medical expenses from an HSA. Similar to the SBI form, it necessitates detailed reporting of medical services and the related expenses.

Dos and Don'ts

When filling out the SBI Retired Employees Medical Benefit form, you must follow some essential guidelines to ensure a smooth process. Here is a list of things you should and shouldn't do:

- DO provide accurate personal information, including your name, date of retirement, and membership number.

- DO clearly specify whether the claim is for yourself or your spouse.

- DO include detailed information about the illness and the attending physician.

- DO attach all necessary bills and receipts to support your claim.

- DON'T leave any sections of the form blank; incomplete forms will delay processing.

- DON'T forget to sign the form; your signature certifies that the information is true.

Follow these guidelines to improve your chances of a successful reimbursement claim. Your attention to detail matters.

Misconceptions

Many misconceptions circulate regarding the SBI Retired Employees Medical Benefit form. Understanding the truth behind these myths can help retirees navigate the process with greater ease. Here are nine common misunderstandings:

- Only retirees can apply for benefits. Many assume that only the retired employees themselves are eligible to claim medical benefits. However, dependents such as spouses and children can also be covered under this scheme.

- Medical claims can only be made for hospitalization. This is incorrect. The SBI Medical Benefit Trust allows for claims related to domiciliary treatment, which means expenses incurred for treatment at home can also be reimbursed.

- Old forms are still valid. Some believe that outdated claim forms can still be used. It’s essential to use the latest version of the Medical Benefit form, as requirements and procedures may change.

- All medical expenses are covered without inspection. It's a misconception that all claimed expenses will automatically be reimbursed. The claims are subject to scrutiny and must adhere to the guidelines laid out in the benefits scheme.

- A single claim can cover multiple family members. Many think they can submit one claim for all family members. Each family member's expenses must be documented separately to ensure proper reimbursement.

- Only specific illnesses are eligible for claims. Some retirees are under the impression that only certain illnesses qualify for benefits. In reality, as long as the treatment is necessary and properly documented, most illnesses are eligible.

- Signature of the branch manager is not necessary. Some believe the manager's signature is optional. In fact, it's required as a part of the claims process for validation and approval.

- Retirement benefits are a one-time payment. This is a common misunderstanding. The SBI Medical Benefit Trust allows for multiple claims for domiciliary treatment, provided they comply with the annual limits and guidelines.

- All bills and documents can be submitted later. Many think they can complete the form and submit receipts at their convenience. However, documentation must be submitted together with the claim to ensure timely processing and reimbursement.

By clarifying these misconceptions, retirees can better utilize the medical benefits available to them and ensure they receive the support they deserve.

Key takeaways

Filling out and using the SBI Retired Employees Medical Benefit form can seem complex, but understanding the key points can simplify the process. Here are essential takeaways:

- Complete Personal Information: Make sure to fill in all required personal details, including your name, retirement date, and membership number. Accurate information ensures smooth processing.

- Claim for Yourself or Spouse: Specify whether the claim is for yourself or for your spouse. This distinction is crucial for proper processing of your medical expenses.

- Document Illness Details: Clearly describe the nature of the illness and include the duration. This helps the reviewing authority assess the validity of the claim.

- Physician Information: Provide the name and address of the attending physician. This information is essential for confirming the medical treatment provided.

- Attach Supporting Documents: Include all necessary bills and the doctor’s prescription along with the claim form. Incomplete submissions can delay reimbursement.

- Certification: Sign the certification statement at the end of the form. This confirms that the expenses claimed were indeed incurred for you or your eligible family members.

By following these guidelines, the process of submitting the SBI Retired Employees Medical Benefit form can be more efficient and effective.

Browse Other Templates

Hud 92006 - The HUD 92541 form is a Builder's Certification document required by the U.S. Department of Housing and Urban Development.

I20 Form - Students planning summer vacations or breaks should ensure their I-20 is properly endorsed before travel.

What Are Insurable Earnings - The form requires authorization for the insurer to access information regarding illness or pregnancy.