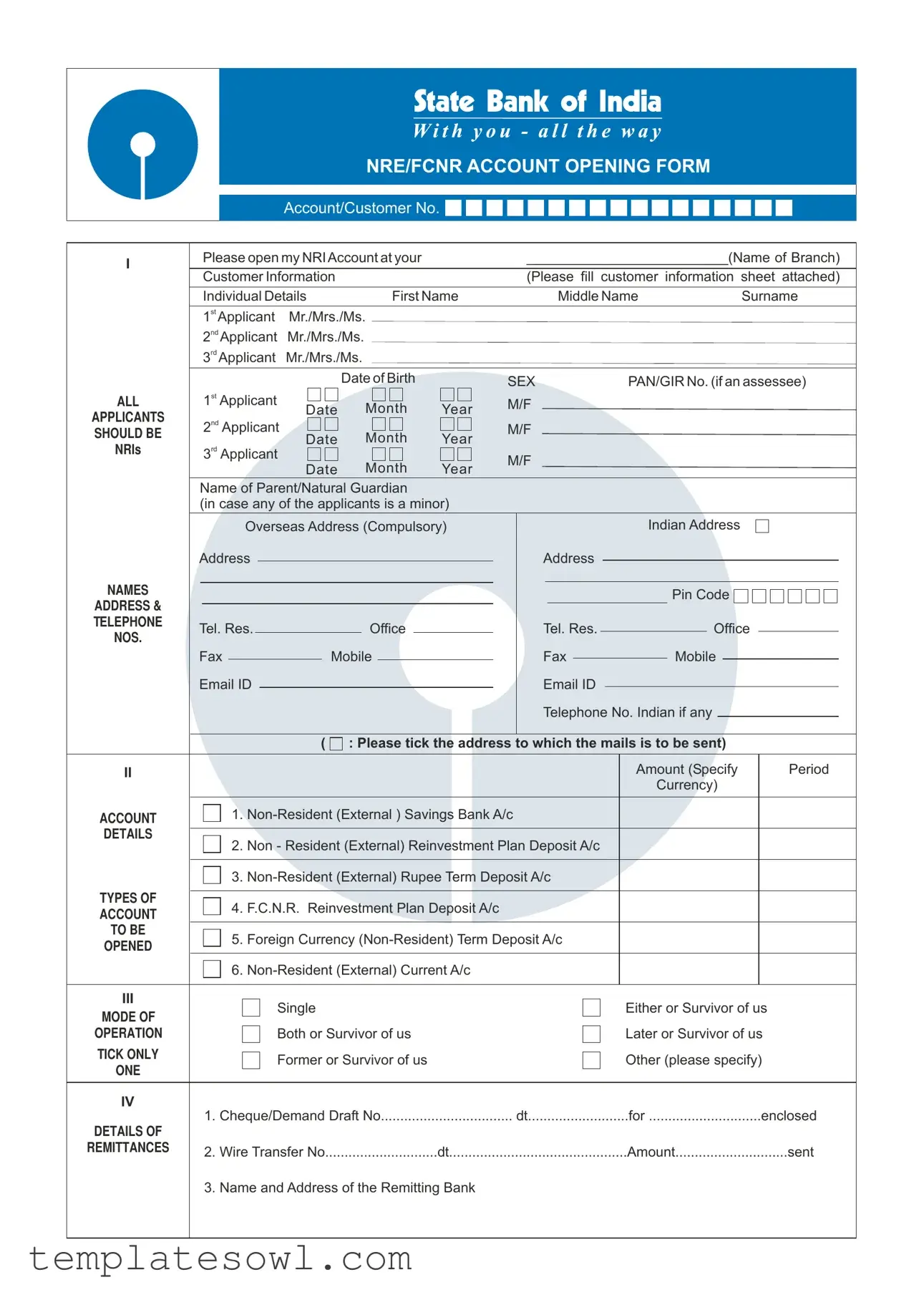

Fill Out Your Sbi Saving Account Opening Form

For individuals aspiring to open an SBI savings account, the SBI Saving Account Opening Form serves as a crucial gateway. This comprehensive document guides prospective account holders through a straightforward yet meticulous process. Within its pages, essential sections demand attention, starting with personal information like names, dates of birth, and genders. It requires detailed addresses to ensure proper communication, both overseas and within India, reflecting the global mobility of non-resident Indians (NRIs). Furthermore, applicants must provide information about the type of account they wish to establish—choices ranging from Non-Resident External (NRE) accounts to Foreign Currency Non-Resident (FCNR) accounts. Also included are provisions for operational modes, ensuring clarity on how applicants prefer to manage their accounts. Importantly, the form addresses the necessity for remittance methods and any additional facilities, such as ATM and internet banking options. The verification process, carefully outlined, ensures that all signatures and documents meet the bank’s regulatory requirements. Each section brings the applicant closer to financial integration, underscoring the form’s significance in establishing a robust banking relationship with SBI.

Sbi Saving Account Opening Example

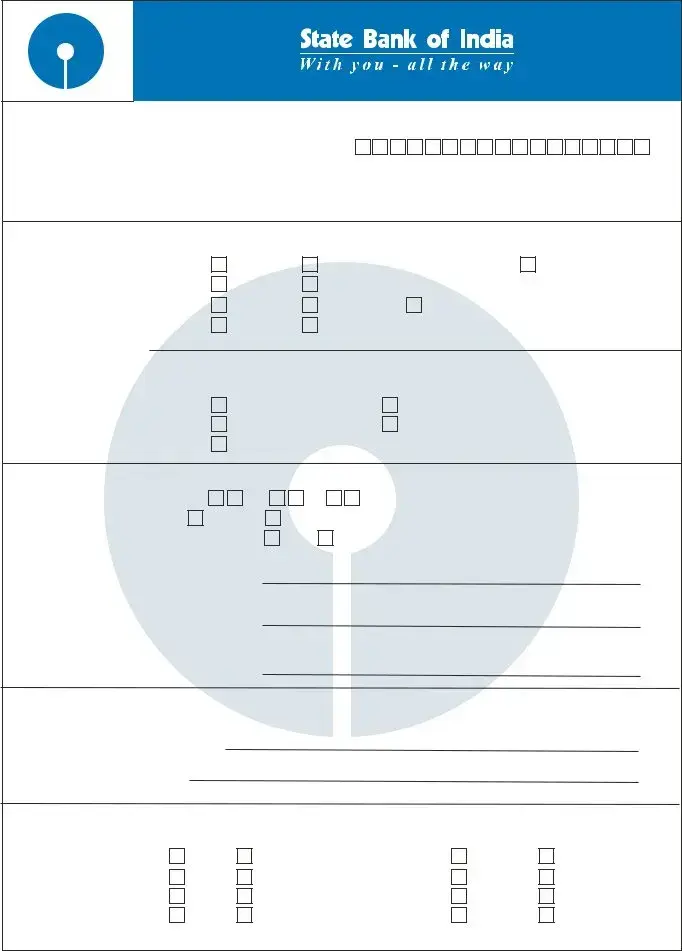

NRE/FCNR ACCOUNT OPENING FORM

Account/Customer No.

I |

|

|

Please open my NRIAccount at your |

|

|

|

__________________________(Name of Branch) |

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Customer Information |

|

|

|

|

|

|

(Please fill customer information sheet attached) |

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

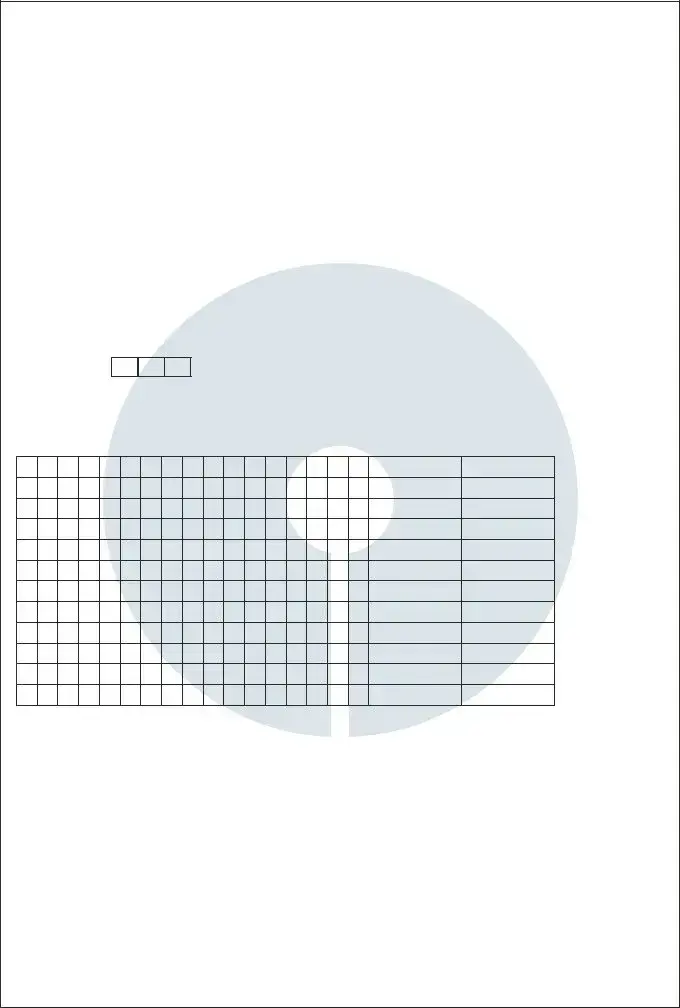

Individual Details |

|

First Name |

|

|

|

Middle Name |

Surname |

||||||||||||||||||||||||

|

|

|

1st Applicant |

Mr./Mrs./Ms. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

2nd Applicant |

Mr./Mrs./Ms. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

3rd Applicant |

Mr./Mrs./Ms. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date of Birth |

|

|

SEX |

PAN/GIR No. (if an assessee) |

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

ALL |

|

|

1st |

Applicant |

Date |

Month |

Year |

M/F |

|

|

|

|

|

|

|

|

|

|||||||||||||||||

APPLICANTS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

2nd Applicant |

|

|

|

|

|

|

|

|

M/F |

|

|

|

|

|

|

|

|

|

||||||||||||||

SHOULD BE |

|

|

Date |

Month |

Year |

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

NRIS |

|

|

|

rd |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

3 |

Applicant |

|

|

|

|

|

|

|

|

M/F |

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

Date |

Month |

Year |

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

Name of Parent/Natural Guardian |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

(in case any of the applicants is a minor) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

Overseas Address (Compulsory) |

|

|

|

|

|

|

|

|

Indian Address |

|

|

|

|

|||||||||||||||

NAMES |

Address |

|

|

|

|

|

|

|

|

|

|

|

Address |

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pin Code |

|

|

|

|

||||

ADDRESS & |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TELEPHONE |

Tel. Res. |

|

|

|

|

|

|

Office |

|

|

|

|

Tel. Res. |

|

|

|

|

|

Office |

|

|

|

||||||||||||

NOS. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fax |

|

|

|

Mobile |

|

|

|

|

Fax |

|

|

|

Mobile |

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

Email ID |

|

|

|

|

|

|

|

|

|

|

Email ID |

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Telephone No. Indian if any |

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

( : Please tick the address to which the mails is to be sent) |

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

II |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Amount (Specify |

|

Period |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Currency) |

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

ACCOUNT |

|

|

|

|

|

1. |

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DETAILS |

|

|

|

|

|

2. Non - Resident (External) Reinvestment Plan Deposit A/c |

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

3. |

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

TYPES OF |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4. F.C.N.R. Reinvestment Plan Deposit A/c |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

ACCOUNT |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TO BE |

|

|

|

|

|

5. Foreign Currency |

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

OPENED |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

III |

|

|

|

|

|

|

|

|

Single |

|

|

|

|

|

|

|

|

|

|

|

|

|

Either or Survivor of us |

|||||||||||

MODE OF |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OPERATION |

|

|

|

|

|

|

|

|

Both or Survivor of us |

|

|

|

|

|

|

|

|

|

|

Later or Survivor of us |

||||||||||||||

TICK ONLY |

|

|

|

|

|

|

|

|

Former or Survivor of us |

|

|

|

|

|

|

|

|

|

|

Other (please specify) |

||||||||||||||

ONE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

IV |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. Cheque/Demand Draft No.................................. dt..........................for .............................enclosed |

|||||||||||||||||||||||||||||||

DETAILS OF |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

REMITTANCES |

|

|

2. Wire Transfer No.............................dt..............................................Amount.............................sent |

|||||||||||||||||||||||||||||||

|

|

|

||||||||||||||||||||||||||||||||

|

|

|

3. Name and Address of the Remitting Bank |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

V |

Please transfer Interest to Savings/Current |

|

Do not renew and (please tick......) |

|||||||||||||

A/c.No.______________ |

|

|

|

● |

Mail transfer for maturity amt. in |

|||||||||||

PAYMENT / |

|

|

|

|||||||||||||

|

|

Renew Principal only. |

|

|

|

|

INR/USD/GBP/Euro |

|||||||||

RENEWAL |

|

|

|

|

|

|

||||||||||

|

|

|

|

|

● |

Transfer to Saving/Current |

||||||||||

|

|

|

|

|

|

|

|

|||||||||

INSTRUCTIONS |

|

|

Renew Principal Plus Interest. |

|

|

|

|

A/c.No.______________________ |

||||||||

(INTEREST / |

|

|

|

|

|

|

||||||||||

|

|

Please keep Term Deposits in safe custody |

|

|

|

|

|

|

|

|||||||

PRINCIPAL |

|

|

|

Any other instructions (Please specify) |

||||||||||||

|

|

and renew for similar period on maturity. |

|

|||||||||||||

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

VI NOMINATION |

|

Yes (Please attach separate Nomination Form) |

|

|

No |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

||||||

VII |

I intend to avail the ticked ( ) products/services also (to be applied for separately by each applicant) |

|||||||||||||||

OTHER FACILITIES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Internet Banking |

|

|

|

|

|||||||||

The facility is available for mode of operation: Single/Either or Survivor only |

||||||||||||||||

If you already have an SBI |

||||||||||||||||

CARD |

||||||||||||||||

which the account that you now wish to open is to be linked. |

|

|

|

|

||||||||||||

|

|

|

|

|

||||||||||||

|

Card No. of 1st Applicant |

|

|

|

|

|

|

|

|

|

|

|||||

|

Card No. of 2nd Applicant |

|

|

|

|

|

|

|

|

|

|

|||||

INTERNET BANKING |

Please tick below. In case you do not have an SBI |

|||||||||||||||

(INB) |

|

|

NRO Savings A/c. |

|

NRE Savings A/c. |

|||||||||||

|

|

|

|

|||||||||||||

|

The Bank offers online banking (at selected Branches) to allow you another option to access your |

|||||||||||||||

|

account. A PIN will be mailed to you to enable you to use online banking. (please fill in the online SBI |

|||||||||||||||

|

registration form in the enclosure) |

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

VIII |

|

|

|

Name |

|

|

Specimen Signature |

|

For Verification by Branch Officials |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SPECIMEN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

SIGNATURE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

Photo |

|

|

Photo |

|

|

|

|

Photo |

||||

PLEASE SIGN IN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

BLACK INK. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PHOTOGRAPHS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SHOULD BE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SIGNED ACROSS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BY THE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

APPLICANTS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

1st Applicant |

|

|

2nd Applicant |

|

|

3rd Applicant |

||||||

|

|

|

|

|

|

|

|

|

|

|||||||

IX |

1. |

Verification of Signature to be made by a |

|

|

|

|

|

|

||||||||

VERIFICATION OF |

|

Indian Embassy |

High Commissioner |

|

|

Bank |

||||||||||

SIGNATURE |

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

Consulate |

Notary Public |

|

|

Person known to the Bank |

||||||||||

SIGNATURE, |

2. |

Verification is not necessary if you have an account with this branch. |

||||||||||||||

NAME OF PERSON |

|

(Please give the Account No.) _______________________________________________________ |

||||||||||||||

VERIFYING WITH |

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

RUBBER STAMP |

|

Above signatures verified by (Name) _______________________________Designation__________ |

||||||||||||||

AND/ OR SEAL & |

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

ADDRESS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Signature_______________________________ |

|||||||||||

|

Place :_________ |

|

|

|

|

|

|

|

Date: ______________ |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

XIntroduction Details (any one)

XI

|

A/c. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Self (in case of |

No. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

an existing customer of the Bank)

In case of attestation by self please enclose (any 2 of the following)

1.Cheque drawn on bank A/c. abroad

2.Latest Overseas Bank Statement in original.

3.Copy of Telephone/Electricity Bill

4.Cancelled paid cheque of your Overseas Bank A/c.

5.Drawing Income/Employee ID/Labour Card

Passport & Residence Visa/ID Card Copies duly attested by Banker/Notary Public/Indian Embassy/A person Known to the Bank/Self

Passport Details

Applicant's Name

Passport No.

Date & Place of Issue

Nationality

Present Occupation

1)

2)

3)

Declarations:

I/We hereby declare that I am/we are

I/We agree that no claim will be made by me/us for any interest on the deposit/s for any period after the date/s of maturity of the deposit/s. I/We agree to abide by the provisions of the Foreign Currency

I/We agree that if the premature withdrawal is permitted at my/our request, the payment of interest on the deposit may be allowed in accordance with the prevailing stipulations, laid down by Reserve Bank of India in this regard.

I/We authorise the bank to automatically renew the deposit on the due date for an identical period unless the instruction to the contrary from me/us is received by the Bank before maturity. I /We understand that the renewal will be in accordance with the provisions of the Reserve Bank of India scheme in force at the time of renewal.

I/We further understand that the interest applicable on renewals will be at the applicable ruling rates on the date of maturity and that the renewal will be noted on the deposit receipt on my/our presenting the same on the maturity date or later for renewal/payment.

(________________________) |

(___________________) |

(___________________) |

Signature of 1st Applicant |

Signature of 2nd Applicant |

Signature of 3rd Applicant |

XII Format for Declaration Cum Undertaking of NRI

(Under Section 10(5), Chapter III of Foreign Exchange Management Act, 1999)

I/We hereby declare that the transaction(s) the details of which are specifically mentioned in the Schedule hereunder does not involve and is not designed for the purpose of any contravention or evasion of the provisions of the aforesaid Act or of any rule, regulation, notification, direction or order made thereunder. I/We also hereby agree and undertake to give such informations/documents, before the Bank undertakes the transaction(s) and as may be required from time to time as will reasonably satisfy you about the transaction(s) in terms of the above declaration

I/We also understand that if I/We refuse to comply with any such requirement or make unsatisfactory compliance therewith, the Bank shall refuse in writing to undertake the transaction and shall if it has reason to believe that any contravention/evasion is contemplated by me/us report the matter to Reserve Bank of India.

*I/We further declare that the undersigned has/have the authority to give this declaration and undertaking on behalf of the firm/company.

Place: |

Signature of the applicant |

Date: |

For Foreign Exchange |

*Applicable when the declaration/undertaking is signed on behalf of the firm/company.

FOR OFFICE USE

1.Applicant(s) interviewed and purpose ascertained (description)_______________

2.Application received by Post_________________________

3.Particulars of identification _________________________ (xerox copy of the documents obtained)

OPEN THE ACCOUNT

ACCOUNT No.

REJECT (GIVEN REASONS)

4.Account opened on (date) __________________________________

5. Value Date __________________ |

Signature of Branch Manager for Value Date_______________________ |

6.Account opened by computer operator (name) _____________________________________________________

Authorised person/Officer (name) _______________________________________________________________

7.Internet (INB)/Telebanking ID Despatched on ____________________________________

8.Customer particulars loaded on site on _________________________________________

9.ATM/Debit Card No.________________________ despatched on ___________________

10.INB services approved & INB customer flag set to "Y" in Bankmaster

11.Letter of thanks sent to customer on ___________________________________________

12.Acknowledgement received from customer on ___________________________________

13.Nomination form entered in register & its serial No. _______________________________

14.TDR/STDR No. ______________________ dt. _________________________________

15.Threshold Limit Rs.________________________

Branch Manager/Authorised Official

Account transferred to __________________________________/Branch on_________________________________

Account closed on _________________________

_________________

Signature of Officer

ONLINE SBI

INTERNET BANKING (INB)

REGISTRATION FORM

(to be signed and mailed to the branch where the account is maintained)

To

The Branch Manager

…………..................………..

…………..................………..

I wish to register as a user of 'OnlineSBI', SBI's Internet Banking Service.

Name of Customer |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(25 Characters) |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mailing Address: |

: |

Telephone No. : |

Mobile No. : |

Date of Birth DD MM YY

Single/ Joint* |

Transaction |

Accounts |

Rights |

|

(Y/N) |

My Account Numbers

* Mode of operation for Online SBI Service will be the same as that for your account at the branch (See Part III of the Account Opening Form)

I have read the provisions contained in the “Terms of service document” of “OnlineSBI” and accept them. I agree that the transactions executed over OnLineSBI under my Username and Password will be binding on me.

Customers' Signature |

Date: |

Branch Use

Signature verified

TERMS OF SERVICE: ONLINE SBI

General Information:

1.You should register for 'OnlineSBI' with the branch where you maintain the account.

2.If you maintain accounts at more than one branch, you need to register at each branch separately.

3.Normally OnlineSBI services will be open to the customer only after he acknowledges the receipt of password.

4.We invite you to visit your account on the site frequently for transacting business or viewing account balances. If you believe that any information relating to your account has a discrepancy, please bring it to the notice of the branch by

5.In a joint account, all account holders are entitled to register, as users of 'OnlineSBI', but transactions would be permitted based on the account operation rights recorded at the branch. (To begin with the services will be extended only to single or Joint “E or S” accounts only).

6.All accounts at the branch whether or not listed in the registration form, will be available on the 'OnlineSBI'. However the applicant has the option to selectively view the accounts on the 'OnlineSBI'.

Security:

1.The Branch where the customer maintains his account will assign:

a)

b)Password

2.The

3.Bank will make reasonable use of available technology to ensure security and to prevent unauthorised access to any of these services. The 'OnlineSBI service is VERISIGN certified which guarantees, that it is a secure site. It means that

●You are dealing with SBI at that moment.

●The

These together with access control methods designed on the site would afford a high level of security to the transactions you conduct.

SBI will soon be implementing PKI/Digital Signature.

4.You are welcome to access 'OnlineSBI' from anywhere anytime. However, as a matter of precaution, customers may avoid using PCs with public access.

5.There is no way to retrieve a password from the system. Therefore if a customer forgets his password, he must approach the branch for

Bank's terms:

6.All requests received from customers are logged for backend fulfilment and are effective from the time they are recorded at the branch.

7.Rules and regulations applicable to normal banking transactions in India will be applicable mutatis mutandis for the transactions executed through this site.

8.The OnlineSBI service cannot be claimed as a right. The bank may also convert this into a discretionary service anytime.

9.Dispute between the customer and the Bank in this service is subject to the jurisdiction of the courts in the Republic of India and governed by the laws prevailing in India.

10.The Bank reserves the right to modify the services offered or the Terms of service of 'OnlineSBI'. The changes will be notified to the customers through a notification on the Site.

Customer's obligations:

1.The customer has an obligation to maintain secrecy in regard to Username & Password registered with the Bank. The bank presupposes that login using valid Username and Password is a valid session initiated by none other than the customer.

2.Transaction executed through a valid session will be construed by SBI to have emanated from the registered customer and will be binding on him / her.

3.The customer will not attempt or permit others to attempt accessing the 'OnlineSBI' through any unlawful means.

Dos' & Don'ts':

1.The customer should keep his/her ID and password strictly confidential and should not divulge the same to any other person. Any loss sustained by the customer due to

2.The customer is free to choose a password of his own for OnlineSBI services.As a precaution a password that is generic in nature, guessable or inferable personal data such as name, address, telephone member, driving license, date of birth etc. is best avoided. Similarly it is a good practice to commit the password to memory rather than writing it down somewhere.

3.It may not be safe to leave the computer unattended during a valid session. This might give access to your account information to others.

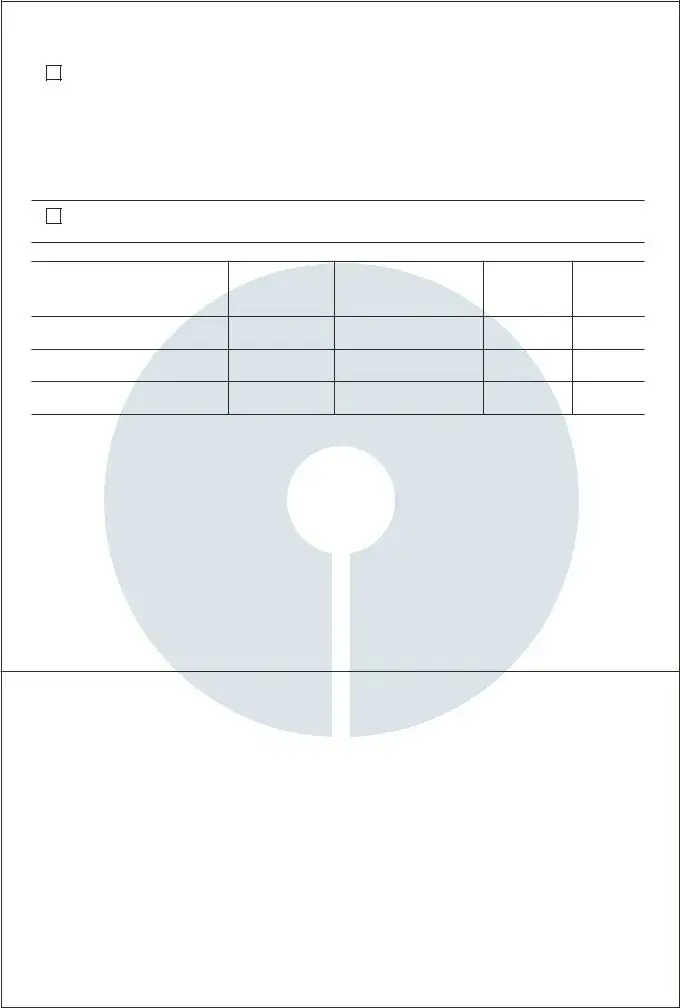

NOMINATION FORM DA1

Nomination under Sec. 45ZA of the Banking Regulation Act, 1949 and Rule 2(1) of the Banking Companies (Nomination) Rules, 1985 in respect of Bank deposits.

I/We

Name(s) &Address(es) of theAccount Holder(s)

Nominate the following person to whom in the event of my/our/minor's death the amount of deposit in the account, Particulars whereof are given below, may be returned by State Bank of India.

DEPOSIT

Nature of Deposit |

Distinguishing Number |

Additional Details, if any |

|

(Give Account Number) |

|

|

|

|

|

|

|

NOMINEE

Name and Address |

Relationship with |

Age |

If Nominee is a minor, |

(Only one nominee) |

Depositor, if any |

|

Give Date of Birth |

|

|

|

|

|

|

|

|

* As the nominee is a minor on this date. I/We appoint

(Name, Address & of the guardian) to receive the amount of the deposit in the account on behalf of the nominee in the event of my/our/minor’s death during the minority of the nominee.

Signature (Name & Address of witness)

Place :

Date :

* Strike out if nominee is not a minor.

Signature(s) of depositor(s)

Note: Where deposit is made in the name of a minor,

the nomination should be signed by a person lawfully

entitled to act on behalf of the minor.

* Nomination without witness is not valid & Cannot be registered.

FOR BRANCH USE ONLY

Particulars of Form DA1 (if received) entered in Nomination Register Sr.No. _______ |

Dt. ________________ |

|||||||

Customer advised on |

|

|

|

|

|

|

||

Acknowledgement received on |

|

|

|

|

|

|

||

|

|

|

|

|

|

|||

Open |

|

|

Account opened |

|

|

|

|

|

|

|

|

|

|

||||

Date |

|

|

|

19 |

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|||

No. of Cheque Book/ TDR issued |

|

|

|

|

|

(from) |

||

|

|

|

|

|||||

Branch Manager |

|

|

Ledg. Keeper |

|

|

(to) |

||

|

|

|

|

|||||

|

|

|||||||

|

|

|||||||

Officer |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Information Sheet |

|

(Annexure of A/c. opening form |

A/c./Customer No. |

to be obtained from each applicant |

Full Name _________________________________________________ |

separately) |

Father's/Husband's Name: ____________________________________ |

(Please tick the Appropriate Box) |

|

(A) Occupation:

1.Occupation:

2.If

Salaried

Student

Doctor

Business

Self Employed/Professional

Others (specify |

) |

Lawyer |

Engineer |

Others |

|

Business

3.Source of Funds

4.I. Monthly Income

II. Annual Turnover

, US$1000

US$

US $______________

US

(B) Personal: |

|

|

|

|

|

|

5. |

Date of Birth: |

DD |

|

MM |

|

YY |

6. |

Marital Status: |

|

Married |

Unmarried |

||

7. |

Any relative settled abroad |

|

|

Yes, |

No. If yes, please specify names and addresses. |

|

Name________________________ |

Address__________________________________________________ |

|||||

Name________________________

Name________________________

(C) Dealing with other Banks

If Yes

8.Name of the Bank and Branch

9.Type of A/cs./Facilities

(D) |

Existing Credit facilities if any; |

|

10. |

Car Loan |

Yes |

11. |

Credit Cards |

Yes |

12. |

Housing Loan |

Yes |

13. |

Education Loans |

Yes |

Address__________________________________________________

Address__________________________________________________

YesNo

No |

14. |

Consumer Loan |

Yes |

No |

No |

15. |

Business |

Yes |

No |

No |

16. |

Against security |

Yes |

No |

No |

17. |

Others (Specify) |

Yes |

No |

Additional Information (Optional)

Please fill in the following information in order to help us identify your requirement for better service:

1. |

Educational |

Graduate |

Post Graduate |

|

||

|

Qualification |

Professional (Pl.specify) |

|

|

|

|

2. |

Your Spouse's |

Graduate |

Post Graduate Qualification |

|||

3. |

Family Member: |

Upto 10 yrs |

Above 61 Total |

|||

|

No. of Males |

+ |

+ |

+ |

+ |

= |

|

No. of Females |

+ |

+ |

+ |

+ |

= |

4. |

How may times you have been to |

Never |

above 5 times |

|||

|

India in last 3 years |

|

|

|

|

|

5.Do you have a Credit Card

Yes

No

SBI Card

Non SBI Card

Assets |

Total |

US $ |

(Approx) |

6.Vehicles

7.House you live in

8.Life Policy for

9.Other Investments

Car

Own

< US$2000

< US$2000

Others

Rented

<US$5000

<US$5000

None

Employer's

> US $5000

> US $5000<10000

> US$ 50000

> US $

10. Any other Assets (Specify) __________________________________________________________________

Place : ________________ |

Signature of Customer ___________________________________ |

Date: ________________ |

|

Form Characteristics

| Fact Name | Details |

|---|---|

| Form Purpose | This is the SBI NRE/FCNR account opening form for non-resident Indians, allowing them to open various types of savings accounts. |

| Required Information | Applicants must provide personal details, including names, addresses, and identification information such as PAN/GIR numbers. |

| Account Types | Available accounts include Non-Resident External (NRE) Savings, FCNR Deposits, and standard NRIs Current Accounts. |

| Mode of Operation | Individuals can select from various modes, including single, either or survivor, and both or survivor options for account operation. |

| Remittance Details | Applicants need to specify details of the initial deposit, including cheque numbers and wire transfer information. |

| NRI Eligibility | Only non-resident Indians and persons of Indian origin may apply. Residents of jurisdictions where account opening is prohibited cannot apply. |

| Nomination Option | Applicants can opt for a nomination feature; a separate nomination form must be attached if chosen. |

| Signature Verification | Verification of signatures is required and may involve officials from government bodies or trusted persons recognized by the bank. |

| Governing Laws | This form is governed by the Foreign Exchange Management Act, 1999, and relevant banking regulations applicable in the U.S. |

Guidelines on Utilizing Sbi Saving Account Opening

Filling out the SBI Saving Account Opening form is a straightforward process. By providing the required information accurately, you can ensure a smooth account setup experience. Below are the necessary steps to help guide you through completing the form effectively.

- Start with Personal Information: Fill in your first name, middle name, and surname as the first applicant. Include the same for any additional applicants, if applicable.

- Input Date of Birth and Gender: Enter the date of birth for each applicant along with the gender (M/F).

- Provide Identification Details: If you are an assessee, fill in your PAN/GIR number for the first applicant and repeat for any additional applicants.

- Input Addresses: Fill in the overseas address as well as the Indian address. Ensure all details like the postal code are included.

- Complete Contact Information: List the telephone numbers (home and office), fax numbers, and email addresses for each applicant. Select the preferred mailing address.

- Select Account Type: Tick the appropriate boxes for the types of accounts you wish to open, such as NRE or FCNR accounts.

- Choose Mode of Operation: Indicate your preferred mode of operation: Single, Either or Survivor, or Both. Tick only one option.

- Record Remittance Details: Include the cheque/demand draft number or wire transfer number along with the amount and date associated with your remittance.

- Specify Payment Instructions: Indicate how you want the interest to be managed (for example, whether you want it renewed or transferred).

- Nomination Details: Decide if you want to make a nomination. If yes, attach a separate nomination form.

- Select Additional Facilities: Choose any additional services like an ATM card or internet banking that you'd like to apply for along with the account.

- Provide Signatures: Each applicant must sign in black ink. Make sure photographs are also submitted and signed across.

- Verification Section: Complete the verification section. You may need to provide someone known to the bank to verify signatures or identify yourself through a banking official.

- Make Declarations: Read through the declaration section and ensure that you understand and agree to the terms before providing your signatures.

After completing the form, review all the information for accuracy. If everything is correct, submit the form along with all necessary documents, such as identification and photographs, to the bank branch. Following this process will help facilitate the opening of your account seamlessly.

What You Should Know About This Form

1. What is the purpose of the SBI Saving Account Opening form?

The SBI Saving Account Opening form is used to gather the necessary information required to open a savings account for non-resident Indians (NRIs) or persons of Indian origin (PIOs) at SBI. It includes details such as personal information, account type, remittance details, and nomination preferences, enabling the bank to process the application effectively.

2. Who is eligible to fill out this form?

Non-resident Indians (NRIs) and persons of Indian origin (PIOs) are eligible to fill out the form. Individuals who reside in jurisdictions where opening or maintaining the account is prohibited by local laws cannot apply. It is important to provide accurate information, as false declarations may lead to account denial.

3. What personal information is required in the form?

The form requires detailed personal information, including the first name, middle name, surname, date of birth, and gender of all applicants. It also asks for addresses, phone numbers, email IDs, and PAN/GIR numbers where applicable. If an applicant is a minor, the name of a parent or guardian must be provided.

4. What types of accounts can be opened using this form?

This form allows applicants to select from various account options, including Non-Resident (External) Savings Bank Accounts, Non-Resident (External) Current Accounts, and different types of Foreign Currency accounts. Applicants should choose the account type that best suits their financial needs.

5. How can applicants submit the initial deposit for their account?

Applicants can submit their initial deposit through a cheque, demand draft, or wire transfer. They must provide the details of the chosen method along with the application. All financial transactions should align with the requirements specified by the bank to ensure proper processing.

6. Is it necessary to provide photographs?

Yes, applicants must include passport-sized photographs with their application. These photographs should be signed across by the applicants for verification purposes. The photograph submission ensures that the bank can identify account holders accurately.

7. What is the process for verifying signatures?

Signature verification may be required when the applicant does not already have an account with the branch. Verification can be done by an Indian Embassy, consulate, notary public, or someone known to the bank. This step is crucial to prevent fraudulent activities and to ensure the integrity of the application.

8. Can a nomination be made on the account?

Yes, applicants have the option to make a nomination for the account. If a nomination is desired, applicants should attach a separate nomination form to the application. This allows for the designation of a beneficiary who will receive the account assets in the event of the account holder's demise.

Common mistakes

When filling out the SBI Saving Account Opening form, there are several common mistakes that people often make. These errors can delay the application process and even lead to account opening denials. It's important to be aware of these issues to avoid complications.

One significant mistake is failing to provide complete and accurate personal information. The form requires your full name, date of birth, and addresses. Omitting any of this information can cause confusion and result in processing delays. Double-check that every section is filled out correctly.

Another frequent error is the selection of the mode of operation. Many applicants mistakenly assume they can choose multiple options. Instead, you must select only one mode. Misunderstanding this can lead to a delay in your application approval and account setup.

Providing the wrong documents is also a common issue. Applicants often forget to include essential verification documents, such as identity proof and address proof. Always ensure that you attach the required documents as requested on the form to avoid any delays.

Additionally, not signing the form properly can be problematic. It’s crucial to use black ink and make sure all signatures match the specimen signatures provided earlier in the application. Missing or inconsistent signatures may require you to resubmit the form.

Another mistake is not ticking the appropriate boxes when applying for additional services like Internet Banking or an ATM card. If you want these services but do not indicate so on the form, your request will not be processed. Make sure to carefully review all sections related to additional facilities.

Some people also forget to provide their overseas address. This information is compulsory for non-resident accounts and leaving it blank can lead to unnecessary complications. Always check that all compulsory fields are completed.

Another oversight is not indicating your preferred communication method for receiving bank statements and other notices. Clearly indicating your choices ensures you stay informed about your account activities.

Moreover, applicants often miscalculate the amount of money they want to deposit. Double-check the figures you provide, as any discrepancies can raise questions and potentially halt the processing of your application.

Lastly, many individuals miss the nomination section. This part is vital for ensuring that your account can be managed according to your wishes in case of unforeseen circumstances. Failing to complete this section may lead to complications down the line.

By being aware of these common mistakes, you can fill out the SBI Saving Account Opening form more accurately. Thoroughly reviewing your application before submission can save time and help you avoid unnecessary hurdles.

Documents used along the form

When opening an SBI Savings Account, submitting the account opening form is just one part of the process. A few additional documents and forms are commonly required. Below is a list of important forms and documents to consider.

- Identity Proof: A valid government-issued document such as a passport, driving license, or voter ID serves to verify the identity of the applicant.

- Address Proof: This may include utility bills, rental agreements, or bank statements that confirm the address provided in the application.

- PAN Card: For tax identification, a copy of the Permanent Account Number (PAN) card is crucial, especially for Indian residents.

- Photographs: Recent passport-sized photographs of the applicant(s) are authenticated by signing on the front for identity verification purposes.

- Nomination Form: A form that allows the account holder to nominate a beneficiary should something happen to them. This form needs to be duly signed.

- Foreign Address Proof: For Non-Resident Indians (NRIs), documents like a foreign bank statement or utility bill may be required to confirm the overseas address.

- Declaration Form: This document ensures compliance with the regulations under the Foreign Exchange Management Act (FEMA). It states that the applicant is not involved in any activity that contravenes the relevant regulations.

Gathering these documents in advance can help streamline the account opening process. Always ensure that each document is valid and correctly filled out to avoid any delays.

Similar forms

Bank Loan Application Form: Similar to the SBI Savings Account Opening form, this document collects personal information from applicants, such as name, address, and financial details, to assess eligibility for a loan.

Investment Account Opening Form: Both forms require detailed personal identification information, including names, addresses, and contact numbers, to comply with regulatory standards.

Credit Card Application Form: Like the SBI form, this application demands financial and personal information to determine creditworthiness, including income and employment status.

Retirement Account Application: This document also asks for personal data such as date of birth and contact details, focusing on the applicant's financial objectives for retirement savings.

Health Insurance Application: This form, similar to the SBI Savings form, requires personal information including name, age, and medical history to assess risk and eligibility for health coverage.

Utility Service Application: Similar to the SBI form, this document collects name, address, and identification details to establish service provisioning for utilities like water and electricity.

Membership Registration Form: This form often includes personal information such as name, address, and contact details to enroll individuals in organizations or clubs, much like opening a bank account.

Rental Application Form: This document similarly requires comprehensive personal details, including employment history and references, to evaluate potential tenants, mirroring the applicant information needed by banks.

Job Application Form: Just like the SBI form, it gathers detailed personal information about candidates, including contact details and work history, to assist in the hiring process.

Visa Application Form: This document shares similarities with the SBI form by requiring extensive personal information and identification documents to determine eligibility for travel and immigration.

Dos and Don'ts

When filling out the SBI Savings Account Opening form, it is essential to follow specific guidelines to ensure you complete the process accurately. Here’s what you should and shouldn’t do:

- Do: Provide accurate personal information. Double-check your name, address, and contact details.

- Do: Sign in black ink. This is typically required for verification purposes.

- Do: Include all necessary documents. Ensure you attach any required forms, like the Nomination Form, if applicable.

- Do: Use the correct branch name where you want to open the account. This avoids delays in processing.

- Do: Review all instructions carefully before submission. This can prevent misunderstandings later.

- Don’t: Skip fields that are marked as compulsory. Omitting information can result in rejection of your application.

- Don’t: Provide false information. Misrepresentation can lead to serious legal consequences.

Your diligence can save time and ensure a smooth account opening process. Pay attention to these guidelines as you proceed.

Misconceptions

When it comes to the SBI Saving Account Opening form, many people hold misconceptions that can lead to confusion during the application process. Here are seven common myths debunked:

- You can open the account without providing an overseas address. An overseas address is compulsory for non-resident accounts. Without it, your application may be rejected.

- There’s no need to provide identification if you have an existing SBI account. Verification of identification is still necessary, regardless of whether you are an existing customer.

- All applicants must be physically present to open a joint account. While it’s preferable, if one applicant is an NRI, the process can still proceed with proper documentation.

- You can ignore the nomination section of the form. It's essential to complete this section if you want to ensure that your funds are distributed according to your wishes, especially if something happens to you.

- The bank won’t check the accuracy of the provided information. The bank has processes in place to verify the details you provide. Any discrepancies can delay your application.

- Online banking services are automatically enabled upon account opening. Customers must specifically request internet banking services as indicated in the form.

- Fees will not apply to this account type. Some accounts may incur fees based on the services you choose. Always review the terms before opening your account.

Understanding these facts can save you time and help streamline your experience with opening an SBI saving account.

Key takeaways

Opening an SBI NRE/FCNR account involves a few important steps. Here are key takeaways regarding the process and form:

- Fill out the SBI Saving Account Opening Form completely.

- Provide accurate personal information, including first name, middle name, surname, and date of birth.

- Ensure that all applicants indicate their gender (M/F) clearly.

- Include both overseas and Indian addresses for all applicants.

- Specify the type of account to be opened, selecting from options like NRE Savings or FCNR Term Deposit.

- Clearly mark the mode of operation for the account, choosing options such as single or joint.

- Attach a recent photograph for each applicant. Sign across the photographs for verification.

- Verification of signatures may be required from a recognized authority, such as a bank or consulate.

- Read the declarations carefully and ensure all provided information is accurate to prevent future issues.

Following these guidelines will smooth the account opening procedure and ensure compliance with regulations.

Browse Other Templates

The Appraisal Foundation - The form ensures that appraisers do not have pending interests in properties assessed.

Truck Driving Loading Lumper - Signature of the payer provides a layer of authorization for the transaction.