Fill Out Your Sc 220 Form

The SC-220 form, known as the "Request to Make Payments," is an essential tool for individuals facing small claims judgments in California. Designed to provide relief to those who may not be able to pay their judgment in a single, lump-sum payment, this form allows individuals to propose a payment plan instead. Upon filling out the SC-220, users will need to include their personal information, the total amount owed, and the name of the party to be paid. It’s important to explain why payment in installments is necessary, as this can influence the court's decision. The form also includes options for detailing specific payment terms, such as the amount of each payment and the schedule for these payments, which can be tailored to the individual's financial situation. There’s a built-in warning about the consequences of missed payments, emphasizing the seriousness of adhering to the agreed plan. Once the SC-220 is completed and filed with the small claims court clerk, the other involved parties will be notified and given an opportunity to respond within a specified timeframe. It's crucial for all parties to be aware of their rights and responsibilities in this process, especially when it comes to potential interest on judgments and the consequences of missed payments. Overall, understanding and accurately completing the SC-220 form can be a key step towards managing financial obligations under a small claims judgment.

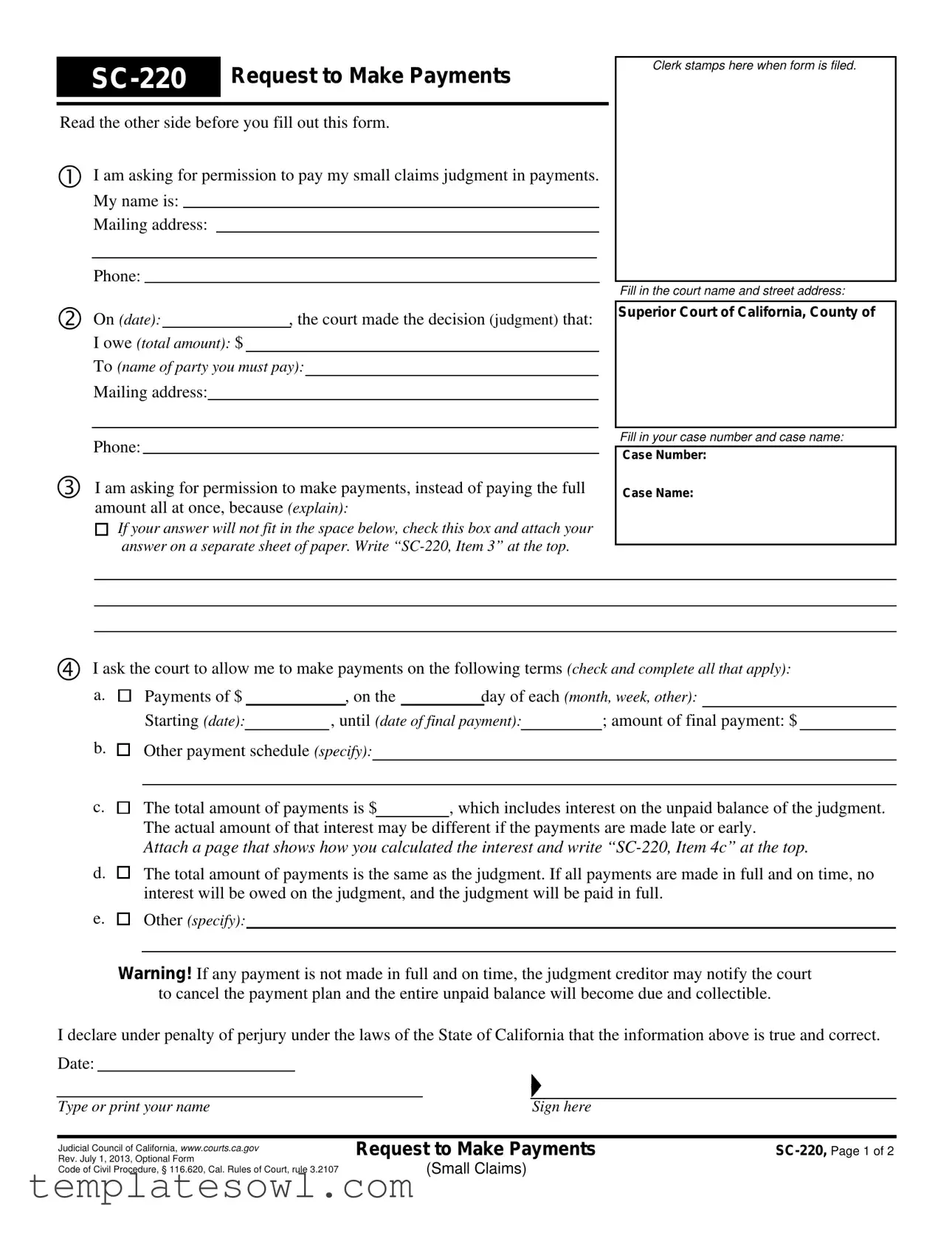

Sc 220 Example

Read the other side before you fill out this form.

I am asking for permission to pay my small claims judgment in payments. My name is:

Mailing address:

Phone:

Clerk stamps here when form is filed.

Fill in the court name and street address:

On (date):, the court made the decision (judgment) that:

I owe (total amount): $

To (name of party you must pay):

Mailing address:

Phone:

I am asking for permission to make payments, instead of paying the full amount all at once, because (explain):

If your answer will not fit in the space below, check this box and attach your answer on a separate sheet of paper. Write

Superior Court of California, County of

Fill in your case number and case name:

Case Number:

Case Name:

I ask the court to allow me to make payments on the following terms (check and complete all that apply):

a. |

Payments of $ |

|

, on the |

day of each (month, week, other): |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

Starting (date): |

|

, until (date of final payment): |

; amount of final payment: $ |

||||||

|

|

|

|

|

|

|

|

|

|

|

b.

Other payment schedule (specify):

c.

The total amount of payments is $, which includes interest on the unpaid balance of the judgment.

The actual amount of that interest may be different if the payments are made late or early.

Attach a page that shows how you calculated the interest and write

d.

The total amount of payments is the same as the judgment. If all payments are made in full and on time, no interest will be owed on the judgment, and the judgment will be paid in full.

e.

Other (specify):

Warning! If any payment is not made in full and on time, the judgment creditor may notify the court

to cancel the payment plan and the entire unpaid balance will become due and collectible.

I declare under penalty of perjury under the laws of the State of California that the information above is true and correct.

Date:

Type or print your name |

Sign here |

Judicial Council of California, www.courts.ca.gov Rev. July 1, 2013, Optional Form

Code of Civil Procedure, § 116.620, Cal. Rules of Court, rule 3.2107

Request to Make Payments |

(Small Claims)

Payments in Small Claims Cases

General Information

If the court ordered you to pay money, you can ask the court for permission to make payments. Here’s how:

•Read this form.

•Fill out Form

•Fill out Form

•File your completed forms with the small claims court clerk.

The court will mail all other plaintiffs and defendants in the case copies of your Request to Make Payments and Financial Statement, and a blank Form

The other parties will have 10 days to file a Response. Then, the court will mail all plaintiffs and defendants in the case:

•A decision on the Request to Make Payments or

•A notice to go to a hearing.

If the court ordered someone to pay you money,

and that person has filed a Request to Make Payments…

•Read this form and the Request.

•If you agree with the Request, you do not need to do anything.

•If you do not agree with the Request or you want to be paid interest, file a Response within 10 days after the court clerk mailed the Request to you. (This date is on the Clerk’s Certificate of Mailing.) If you do not do this, the court may allow the person who owes you money to make payments. And, you may lose your rights to collect interest on the judgment.

To file your Response:

•Fill out Form

•Have your Response served on all other plaintiffs and defendants in your case. (See Form

•File your Response and Proof of Service with the small claims court clerk.

Answers to Common Questions

When is the judgment due?

Unless the court orders otherwise, small claims judgments are due immediately. If the judgment is not paid in full within 30 days, the judgment creditor (person to whom the money is owed) can take legal steps to collect any unpaid amount. (Collection may be postponed if an appeal or a request to vacate (cancel) or correct the judgment is filed.)

Can the judgment debtor make payments?

A party who was ordered to pay a small claims judgment (the judgment debtor) can ask the court for permission to make payments. If the court agrees, the party who is owed money (the judgment creditor) cannot take any other steps to collect the money as long as the payments are made on time.

Is interest added after the judgment?

Interest (10 percent per year) is usually added to the unpaid amount of the judgment from the date the judgment is entered until it is paid in full. Interest can only be charged on the unpaid amount of the judgment (the principal); interest cannot be charged on any unpaid

interest. If a partial payment is received, the money is applied first to unpaid interest and then to unpaid principal.

When the court allows payments, the court often does not order any interest, as long as all payments are made in full and on time. Unless the creditor asks for interest to be included in the order allowing payments, the creditor may lose any claims for interest. But, if the debtor does not make full payments on time, interest on the missed payment or the entire unpaid balance might become due and collectible.

How do I calculate interest?

If you are proposing a payment schedule that includes interest, you need to itemize the principal and interest for each payment. To do this, you can search on the Internet for “free amortization calculator.” Enter the total amount of the judgment as the principal, the interest rate of 10 percent per year, the frequency of payments (monthly, weekly, etc.), and the number or length of payments. Print the results showing the payment amount and how each payment is divided between principal and interest. Attach this to your Request or Response.

Need help?

For free help, contact your county’s small claims advisor: [local info here]

Or go to

Rev. July 1, 2013

Request to Make Payments

(Small Claims)

Form Characteristics

| Fact Name | Fact Description |

|---|---|

| Purpose | The SC-220 form is used to request permission from the court to make payments on a small claims judgment rather than paying the full amount at once. |

| Governing Law | This form is governed by the California Code of Civil Procedure, Section 116.620, and California Rules of Court, Rule 3.2107. |

| Filing Process | The completed SC-220 form must be filed with the small claims court clerk, who will then notify all parties involved in the case. |

| Payment Schedule Options | Users can propose different payment schedules, including specific amounts, dates, and terms that best fit their financial situation. |

| Interest on Payments | Interest may be included in the total payments, but if payments are made in full and on time, no interest will be owed. |

| Consequences of Missed Payments | If any payment is late or incomplete, the judgment creditor may petition the court to cancel the payment plan, making the entire balance due. |

Guidelines on Utilizing Sc 220

Filling out the SC-220 form is an important step if you've been ordered to make payments on a small claims judgment but need some flexibility. After you complete this form, you’ll submit it to the court, which will then communicate with all relevant parties about your payment request.

- Read the form carefully. Before starting, ensure you understand what is required.

- Fill in your personal information. Write your name, mailing address, and phone number in the designated areas.

- Provide the court's details. Enter the name of the court and its street address.

- Note the judgment details. On the specified date, indicate the judgment that was made, and fill in the total amount you owe and the name and contact information of the party you must pay.

- Explain why you need a payment plan. Provide a short explanation of your circumstances that necessitate making payments instead of paying in full.

- Include case information. Enter your case number and case name in the appropriate fields.

- Outline your proposed payment terms. Check off the applicable options and fill in the details, such as payment amounts, frequency, start and end dates, and total amounts including interest, if applicable.

- Sign and date the form. Type or print your name and sign where indicated to declare that the information provided is true and correct.

Once you have completed this form, file it with the small claims court clerk. From there, the court will inform the other parties about your request and the process will continue from that point.

What You Should Know About This Form

What is the SC-220 form used for?

The SC-220 form, titled "Request to Make Payments," is used by individuals who have been ordered to pay a small claims judgment. This form allows them to request permission from the court to make payments over time rather than settling the entire amount at once. This flexibility can be beneficial for debtors who are experiencing financial difficulty.

Who should fill out the SC-220 form?

The form should be filled out by a person identified as the judgment debtor, which is the party required to pay the judgment amount. Each debtor must submit a separate SC-220 form for each creditor they owe money to, thus ensuring that the court manages each case individually.

What information is required on the SC-220 form?

Debtors will need to provide personal information, including their name, mailing address, and phone number. They must also include details about the court judgment, such as the date of the judgment, the total amount owed, and the name and contact information of the creditor. Additionally, they will outline their proposed payment plan and any calculations regarding interest that might apply.

How do I submit the SC-220 form?

Once you have completed the SC-220 form, you must file it with the small claims court clerk. Along with this form, be sure to complete Form EJ-165, the Financial Statement. The clerk will then mail copies of these forms to the other parties involved in the case. This process ensures transparency and gives those parties an opportunity to respond to your request.

What happens after I file the SC-220 form?

After submission, the court will review your request. The other parties involved will have ten days from the date on the Clerk’s Certificate of Mailing to respond. You may receive either a decision on your request or notice of a hearing if there are disputes regarding the proposed payment plan.

Can the creditor object to my payment request?

Yes, if the judgment creditor disagrees with your payment request or wishes to receive interest, they can file a response within ten days. Their response could lead to a court hearing where both parties can present their arguments. If you do not respond to their objection, the court may allow your request to make payments without any consideration of their concerns.

Is interest applied to the judgment amount if I make payments?

Interest at the rate of 10 percent per year is typically added to the unpaid judgment amount until it is fully paid. However, when a court allows a payment plan, it may not impose interest if the debtor makes all payments in full and on time. If any payments are late or insufficient, the court may reinstate accrued interest on the unpaid balance.

How is interest on the judgment calculated?

If your proposed payment plan includes interest, you should provide a clear breakdown of how the payments will be divided between principal and interest. Using an online amortization calculator can help you derive these figures. Include the details alongside your payment request for clarity and transparency.

Can I get help with completing the SC-220 form?

Absolutely! Many counties offer resources and small claims advisors who can assist you in completing this form correctly. You can find local assistance by visiting your county's court website or checking the resources available at www.courts.ca.gov/selfhelp-smallclaims.htm. Don’t hesitate to seek help if you have questions about the process.

Common mistakes

When filling out the SC-220 form, people often make mistakes that can delay the process or even lead to rejections. One common mistake is not reading the entire form carefully before starting. This can result in missing important instructions. It's essential to take the time to understand what is needed before writing down any information.

Another mistake is failing to provide complete contact information. Including your mailing address and phone number is vital. Without this information, the court may have trouble reaching you regarding your payment request. Always double-check your entries to ensure they are accurate.

Many people forget to specify the total amount they owe in the correct section. It's important to write the exact judgment amount clearly. If this critical detail is omitted, it can cause confusion during the processing of the request.

Improperly stating the reasons for the payment request is also a frequent error. Simply stating, “I cannot pay” may not be sufficient. The form requests a specific explanation of your situation. Providing clear and detailed reasons can help the court understand your financial circumstances better.

In addition to this, some individuals skip the part about providing a proposed payment schedule. Leaving this section blank can lead to delays. Be sure to check the applicable boxes, and provide the amounts and dates for each proposed payment.

Failing to calculate interest accurately is another misstep. If your plan includes interest, it’s essential to attach a clear breakdown of how you calculated it. A lack of proper documentation can raise questions and lead to issues with your request.

People often overlook signing the form. Skipping the signature means the request is incomplete. Remember, signing under penalty of perjury emphasizes the importance of honesty in all the provided information.

Omitting case details, such as the case name and number, is a mistake that can slow down your request. This information should be included prominently to ensure the court can quickly identify your case.

Additionally, miscommunication about whether you're making a payment proposal for one or multiple creditors can create complications. Always ensure you fill out a separate SC-220 form for each judgment creditor you need to pay.

Finally, not filing the form in a timely manner can jeopardize your plans. The court typically has specific deadlines. Make sure to check these dates to ensure your request is processed without unnecessary delays.

Documents used along the form

When dealing with small claims judgments and payment requests, it's important to have all the necessary documents ready. Along with the SC-220 form, some other forms and documents may come in handy. Here’s a brief explanation of a few commonly used ones.

- Form EJ-165, Financial Statement: This form provides detailed information about your financial situation. It includes your income, expenses, assets, and liabilities. The court uses this information to evaluate your ability to make payments on the judgment.

- Form SC-221, Response to Request to Make Payments: If you are a judgment creditor and disagree with the payment request, this form allows you to respond. You can express your objections or outline any conditions, such as wanting to collect interest on the judgment.

- Form SC-112A, Proof of Service By Mail: This form is used to confirm that you have sent documents to the other parties involved in the case. Proper service is essential to ensure all parties are informed and that the court process moves forward correctly.

- Court Hearing Notice: This is not a form but an important document that the court may issue. If a hearing is scheduled regarding the payment request, the notice will inform you of the time, date, and location to attend and present your case.

Being aware of these forms can simplify the process as you navigate small claims payments. Ensure you have these documents ready and understand their purpose to effectively manage your situation.

Similar forms

- SC-221 Response to Request to Make Payments: This form is used by parties who disagree with a payment request. It allows them to formally respond within ten days of being notified.

- EJ-165 Financial Statement: This document requires the judgment debtor to disclose their financial situation. It helps the court understand the ability to make payments.

- SC-112A Proof of Service By Mail: This form verifies that all parties have been properly notified about filings. It ensures that everyone involved is aware of any actions taken.

- SC-100 Plaintiff's Claim and ORDER to Go to Small Claims Court: This is the initial document to file in small claims cases. It outlines the claim being made against a party.

- SC-120 Defendant's Claim and ORDER to Go to Small Claims Court: This form allows a defendant to counterclaim. It serves as a response to the original plaintiff’s claim.

- SC-200 Small Claims Judgment: This document records the court's decision on the case. It specifies the amount owed by the judgment debtor to the creditor.

- SC-130 Request to Vacate Judgment: If a party wishes to contest the judgment made against them, this form can request its cancellation or amendment.

- SC-140 Request for Court Order: This form is used when a party seeks additional orders from the court regarding payment plans or other matters related to the judgment.

- SC-110 Notice of Hearing: This document informs parties of a hearing date. It is essential for ensuring transparency and communication regarding court proceedings.

Dos and Don'ts

When filling out the SC-220 form, attention to detail is essential. Consider the following tips on what to do and what to avoid to ensure a smooth process.

- Read the entire form carefully. Before starting, ensure you fully understand what information is needed.

- Provide accurate personal information. Include your name, mailing address, and phone number.

- Detail your payment proposal clearly. Specify how much and when you intend to make payments.

- Double-check the case number and case name. This information is critical for ensuring your request is linked to the correct case.

- Do not leave sections blank. Fill in all applicable areas so as not to delay your request.

- Avoid submitting multiple requests for the same payment arrangement. File only one form for each creditor.

- Do not forget to include an attachment if your explanation doesn't fit in the provided space.

- Refrain from providing vague payment terms. Make sure your payment schedule is specific to avoid confusion.

Misconceptions

Misconceptions about the SC-220 form can lead to confusion and uncertainty. Here are some key misunderstandings:

- It's only for large claims. Many believe the SC-220 form is applicable only to significant judgments, but it's available for any small claims judgment.

- All payments must be made immediately. Some think they need to pay the full judgment right away. The form actually allows for a payment plan.

- Filing the form guarantees approval. Just because you submit an SC-220 doesn't mean the court will automatically allow your payment request. The court will review it first.

- Interest is always waived with a payment plan. While many payment plans don't incur interest, if not agreed upon by the creditor, interest may still apply.

- The creditor can't dispute my payment plan. Creditors have the right to respond to your payment plan request, and they can object if they find it unacceptable.

- Not responding means agreeing automatically. If you receive a payment plan request and don’t respond, it's not automatically an agreement. You may lose rights if you don’t act.

- Late payments won’t affect the plan. If payments are late or incomplete, the entire balance could become due immediately, which can cause financial strain.

- I can change the payment amount after filing. Once you submit the SC-220, altering the agreed-upon terms isn’t straightforward. Approval for any changes typically requires further court input.

Understanding these points can help you navigate the payment request process more effectively.

Key takeaways

Filling out the SC-220 form can be a straightforward process if you keep a few essential points in mind. Here are some key takeaways to help guide you:

- Understand the Purpose: The SC-220 form allows you to request permission to pay a small claims judgment in installments rather than in one lump sum.

- Gather Necessary Information: Before filling out the form, make sure you have all relevant details handy, including the total amount owed, the name and address of the party to whom you owe money, and your case number.

- Explain Your Situation: In the space provided, clearly explain why you are seeking to make payments rather than paying the full amount at once.

- Outline Your Payment Plan: Specify the payment schedule you wish to propose. You can choose payment amounts and frequencies, like monthly or weekly, and include when you plan to start and complete payments.

- Interest Considerations: Be aware that interest typically accrues on unpaid judgments at a rate of 10 percent per year. You may need to include interest calculations if your plan involves payments over time.

- Follow Submission Guidelines: Complete the form and file it with the small claims court clerk. The court will notify the other parties involved, who then have ten days to respond.

- Know the Risks: If you miss any payment or fail to pay on time, the judgment creditor can alert the court, and the entire balance may become collectible immediately.

By keeping these points in mind, you increase your chances of successfully setting up a manageable payment plan that works for you.

Browse Other Templates

Identity Verification Form Template - Local laws may dictate specific requirements related to this form.

Pos-040 - This form allows for fax service only when there is prior agreement between the parties involved.